- Home

- »

- Biotechnology

- »

-

DNA Polymerase Market Size, Share & Trends Report, 2030GVR Report cover

![DNA Polymerase Market Size, Share & Trends Report]()

DNA Polymerase Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Taq Polymerase, Pfu Polymerase, Proprietary Enzyme Blends), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-059-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA Polymerases Market Summary

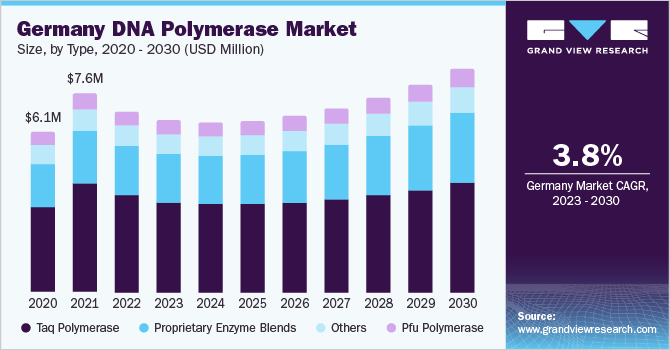

The global DNA polymerase market size was valued at USD 132.6 million in 2022 and is expected to reach USD 136.5 million by 2030, growing at a compound annual growth rate (CAGR) of 1.30% from 2023 to 2030. The market is expected to grow in the coming years, due to the increasing demand for DNA polymerases for sequencing applications and development of precision medicine.

Key Market Trends & Insights

- North America held a dominant market share of 47.25% in 2022.

- By type, the Taq polymerase segment accounted for the largest revenue share of 53.99% in 2022.

- By application, the polymerase chain reaction segment dominated the market with a share of 74.85% in 2022.

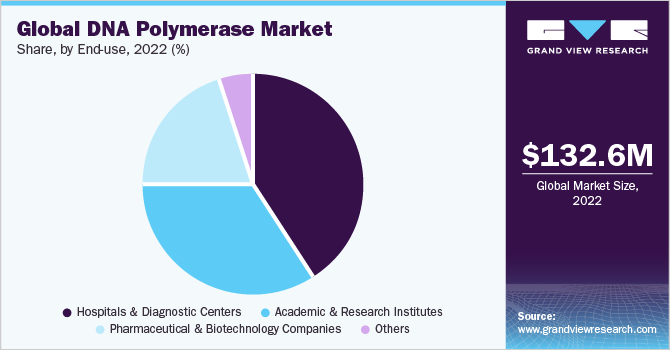

- By end-use, the hospitals and diagnostic centers segment accounted for the largest market share of 41.65% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 132.6 Million

- 2030 Projected Market Size: USD 136.5 Million

- CAGR (2023-2030): 1.30%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Furthermore, key players are developing new and improved DNA polymerases that can enhance the accuracy and speed of these applications and can boost the market over the forecast period.

The COVID-19 pandemic had a significant impact on the growth of the market as DNA polymerases are vital enzymes used in the Polymerase Chain Reaction (PCR) process. PCR has been instrumental in detecting and diagnosing COVID-19 infections, and as a result, there was a positive impact on the market in 2020 and 2021 due to the increasing use of this process.Most life sciences companies are focusing their R&D departments to identify new molecules or leads for the treatment of COVID-19 and DNA polymerases play an important role in such studies. For instance, in May 2021, Cipla Limited partnered with Ubio Biotechnology Systems Pvt. Ltd to launch 'ViraGen,' a real-time detection kit for COVID-19 based on multiplex PCR technology in India. Thus, the use of PCR in diagnosing COVID-19 infections is expected to propel the growth of the market.

The growing demand for molecular diagnostics, particularly for the early detection and monitoring of diseases, is expected to drive the growth of market. DNA polymerase are an important tool in molecular diagnostics for detecting and amplifying target DNA sequences. As the prevalence of infectious diseases and genetic disorders continues to rise, the adoption of such polymerases and polymerase-based diagnostic tests is expected to grow, which is can propel the market growth. For instance, according to estimates published by the American Cancer Society, 1.9 million new cancer cases are expected to be diagnosed in the U.S. alone in 2022, resulting in 609,360 cancer deaths. Thus, the rising prevalence of diseases is expected to increase the demand for molecular diagnostic tests during the forecast period.

Furthermore, rising demand for personalized medicine, and increasing adoption of cloning tools is expected to rise over the forecast period. For instance, in November 2021, Genes2Me's launched its molecular product range, which includes next-generation technology, enzyme technology, cloning, and other product categories. The product range features the Fantom High-Fidelity DNA polymerase, which can enhance the sensitivity of PCR tests, making it an essential component of cloning technology. Hence, the growing demand for personalized medicine is expected to increase the adoption of DNA polymerases for a variety of applications.

Furthermore, strategic initiatives undertaken by key market players are expected to boost the market growth over the forecast period. For instance, in June 2021, Ampliqon A/S introduced its AQ97 High Fidelity DNA Polymerase. The product offers a high fidelity enzyme that surpasses the fidelity of Taq polymerases by 60x, as well as provides a high elongation rate of 10 seconds/kb and a long-range capacity of 18 kb. Such product launches can positively affect the market growth in the coming years.

Type Insights

The Taq polymerase segment accounted for the largest revenue share of 53.99% in 2022. Taq polymerases are a type of DNA polymerases that is commonly used in the PCR techniques. The technique amplifies a specific DNA sequence, making it easier to study and analyze. Taq polymerases have several advantages that make them particularly useful for PCR, including their ability to withstand high temperatures and their high processivity, due to which, such DNA polymerases can extend DNA strands rapidly and efficiently. As the COVID-19 pandemic fueled several research prospects in genetics and molecular biology, demand for these DNA polymerases witnessed a rapid growth during the pandemic.

The proprietary enzyme blendssegment is expected to exhibit the fastest CAGR of 3.03% during the forecast period. The use of proprietary enzymes, such as Q5 high-fidelity polymerases and Phusion DNA polymerases, which incorporate high-performance polymerases is expected to grow as the demand for accurate, reliable, and cost-effective amplification solutions increases across various fields. Furthermore, with the increasing availability of specialized polymerases and enzyme blends and the rising demand for specific applications in emerging domains, such as DNA sequencing, the segment is expected to grow in the coming years.

Application Insights

The polymerase chain reaction segment dominated the market with a share of 74.85% in 2022, due to the widespread use of this amplification technology in several molecular biology techniques. The PCR technology has now become indispensable in various fields, including biotechnology, medical diagnostics, and forensic sciences, where it can be used for DNA-based research and new product development. Similarly, the technique also played an important role in the COVID-19 testing and surveillance programs across the globe. As DNA polymerases form a crucial aspect of the reagents involved in PCR techniques, the segment held a majority share in 2022.

The DNA sequencing segment is anticipated to witness the fastest CAGR of 12.46% during the forecast period. Rapid advancements in sequencing technology have enabled the identification of DNA variations associated with an increased risk of disease. Next-generation Sequencing (NGS) is widely used due to its ability to test multiple genes in a single diagnostic platform, expanding the utility of the technique in clinical diagnosis applications. These methods have now reached a point where they can provide high-quality results in research labs and clinical diagnostic laboratories with the help of DNA polymerases. As a result, increasing applications of sequencing in drug discovery and rising involvement of DNA polymerases in this domain are expected to drive segment growth.

End-use Insights

The hospitals and diagnostic centers segment accounted for the largest market share of 41.65% in 2022, due to the increasing prevalence of genetic disorders and infectious diseases like COVID-19 that led to a surge in the adoption of PCR testing by these facilities for diagnosis. For instance, in 2020, more than 1,000 laboratories in the U.S., including hospitals and diagnostic centers, conducted COVID-19 PCR tests. Hence, the high demand for PCR testing and use of polymerases for various diagnostic applications contributed to the majority share of the segment in 2022.

Academic and research institutes segment is expected to witness the fastest CAGR of 5.43% during the forecast period in the market, due to an increase in funding and investment programs from government agencies and private organizations. These programs aim to support research in this field. For instance, in May 2020, the University of California, Irvine received a USD 2.5 million grant from the John and Mary Tu Foundation to conduct research, testing, and discoveries to aid COVID-19 patient care. Such funding provides support for the development of new technologies and is expected to fuel the segment growth.

Regional Insights

North America held a dominant market share of 47.25% in 2022, which can be attributed to the high demand for biotechnology techniques. The region is home to numerous prominent biotech and pharmaceutical companies that invest heavily in research and development of new drugs and therapies. These companies rely on DNA polymerases for various applications such as PCR, sequencing, and genetic engineering, which drive the demand for DNA polymerases. For instance, in November 2022, Cepheid launched its Xpert Xpress MVP. This multiplexed PCR test can identify DNA from organisms associated with bacterial trichomoniasis, vaginosis, and vulvovaginal candidiasis from a single sample.

The Asia Pacific market is expected to expand at the fastest CAGR of 1.73% during the forecast period. This growth can be attributed to the high incidence of target diseases, increasing funding for genomic research, and rising awareness about genetic testing in the region. Additionally, local and international market players are investing heavily in the development of novel DNA polymerases, which is expected to further propel the region’s growth in the coming years.

Key Companies & Market Share Insights

Leading market players are implementing a range of strategies such as expansions, partnerships, collaborations, novel product launches, and mergers and acquisitions to strengthen their market position. In March 2021, PCR Biosystems introduced the IsoFast Bst Polymerase reagents, which aid in the fast, robust, and sensitive amplification of RNA and DNA. Additionally, in January 2020, Meridian Bioscience, Inc. launched the High-Specificity Pfu HS Mix, allowing for high-fidelity amplification and amplification for clinical testing and companion diagnostics (CDx). Some of the key players in the global DNA polymerase market include:

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies

-

Merck KGaA

-

Danaher

-

QIAGEN

-

Hoffmann-La Roche Ltd

-

Bio-Rad Laboratories, Inc.

-

Takara Bio, Inc.

-

Promega Corporation

-

New England Biolabs

DNA Polymerase Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 124.7 million

Revenue forecast in 2030

USD 136.5 million

Growth rate

CAGR of 1.30% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Agilent Technologies; Merck KGaA; Danaher; QIAGEN; Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Promega Corporation; New England Biolabs

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

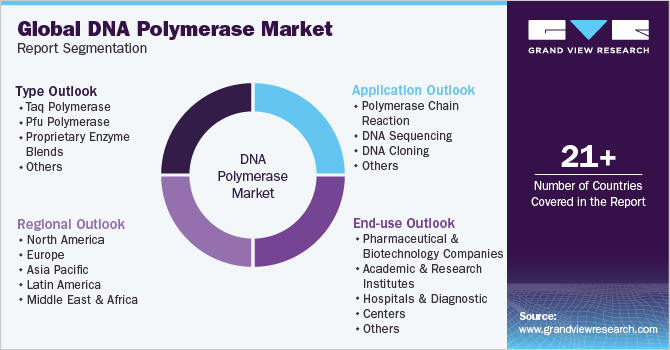

Global DNA Polymerase Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global DNA polymerase market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Taq Polymerase

-

Pfu Polymerase

-

Proprietary Enzyme Blends

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction

-

DNA Sequencing

-

DNA Cloning

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Academic and Research Institutes

-

Hospitals & Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA polymerases market size was estimated at USD 132.6 million in 2022 and is expected to reach USD 124.7 million in 2023.

b. The global DNA polymerase market is expected to grow at a compound annual growth rate of 1.30% from 2023 to 2030 to reach USD 136.5 million by 2030.

b. North America dominated the DNA polymerases market with a share of 47.25% in 2022. This is attributable to the increasing adoption of polymerase chain reaction and next-generation DNA sequencing technologies as well as high extent of research and development initiatives in the region.

b. Some key players operating in the DNA polymerases market include Thermo Fisher Scientific, Inc.; Agilent Technologies; Merck KGaA; Danaher; QIAGEN; Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Takara Bio, Inc.; Promega Corporation; and New England Biolabs.

b. Key factors that are driving the market growth include the increasing demand for DNA polymerases for sequencing applications and development of precision medicine as well as increasing availability of high speed and high accuracy polymerases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.