- Home

- »

- Next Generation Technologies

- »

-

Drone Software Market Size & Share, Industry Report, 2030GVR Report cover

![Drone Software Market Size, Share & Trends Report]()

Drone Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (System, Application), By Architecture (Open Source, Closed Source), By Deployment, By Application, By Industry Vertical, By Drone Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-113-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drone Software Market Summary

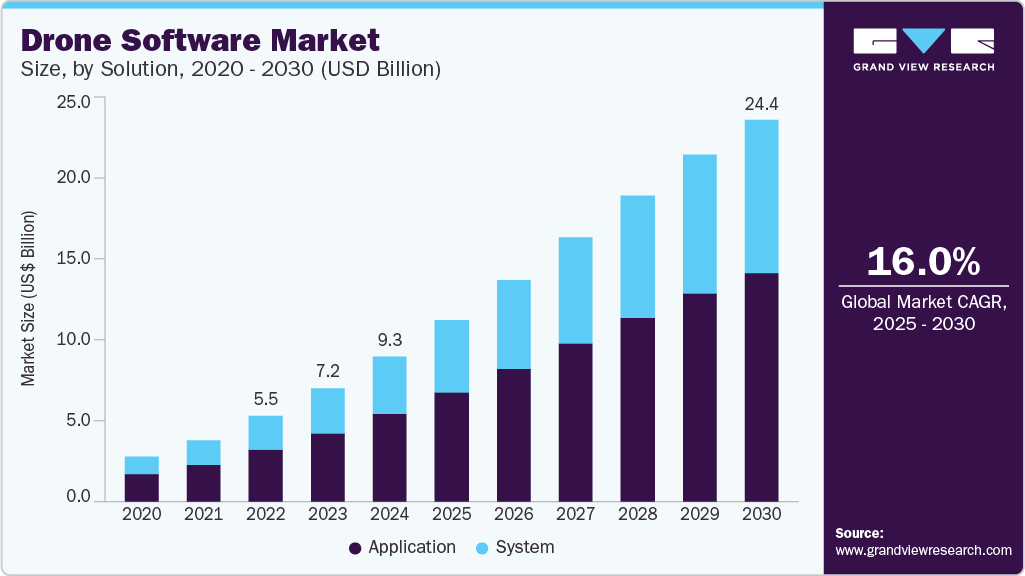

The global drone software market size was estimated at USD 9.27 billion in 2024 and is projected to reach USD 24.39 billion by 2030, growing at a CAGR of 16.0% from 2025 to 2030. This growth is driven by the increasing adoption of drones across sectors such as agriculture, construction, logistics, and defense, where advanced software solutions are essential for mission planning, data analysis, and autonomous navigation.

Key Market Trends & Insights

- North America drone software market accounted for the highest share of over 34% in 2024.

- The drone software market in Asia Pacific is expected to grow at the fastest CAGR of over 19% from 2025 to 2030.

- Based on solution, the application segment dominated the market with a share of over 60% in 2024.

- Based on drone type, the rotary blade segment accounted for the largest market share in 2024.

- Based on industry vertical, the media and entertainment segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.27 Billion

- 2030 Projected Market Size: USD 24.39 Billion

- CAGR (2025-2030): 16.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising demand for real-time data processing, improved flight control, and enhanced user interfaces is pushing software developers to innovate rapidly. Furthermore, the integration of AI, machine learning, and cloud-based analytics into drone software is enabling more precise and efficient operations. Regulatory support and growing investments in unmanned aerial systems also contribute to the market’s robust expansion.

The industry is expanding its capabilities to support high-resolution 3D mapping and advanced geospatial analytics. These features are crucial for applications in construction, mining, and environmental monitoring, where precision is non-negotiable. Sophisticated mapping tools are replacing traditional survey methods, cutting project timelines and reducing human error. This trend is positioning the drone software industry as a critical enabler of digital transformation in field operations.

The integration of drone software with IoT sensors and edge computing is driving smarter and faster decision-making in real-world scenarios. Edge devices enable on-site data processing, reducing latency and bandwidth usage. This is particularly beneficial in remote operations like pipeline monitoring and offshore inspections. By uniting drones with IoT ecosystems, the drone software market is becoming a central hub for intelligent field automation.

The growing demand for drone-based last-mile delivery is driving the development of logistics-optimized drone software platforms. These solutions include route optimization, dynamic scheduling, payload tracking, and real-time delivery status updates. E-commerce, healthcare, and food service sectors are investing heavily in drone delivery trials, increasing reliance on sophisticated software orchestration. As delivery drone usage scales, demand for specialized logistics software is expected to surge.

Subscription-based models are transforming how drone software is purchased and deployed. SaaS offerings are lowering entry barriers, making professional-grade tools accessible to startups, SMEs, and independent operators. This approach also supports faster innovation cycles with frequent updates and feature releases. As the drone software industry matures, flexible licensing is becoming a strategic lever for market expansion.

The growing demand for real-time analytics is pushing the drone software industry to offer faster and more actionable insights during field operations. Real-time processing empowers users to make critical decisions instantly, reducing delays in inspections, surveillance, and logistics. Industries such as agriculture and construction benefit from live feedback to optimize on-the-spot actions. This trend is accelerating the adoption of high-performance computing frameworks and edge analytics in drone software solutions.

Solution Insights

The application segment dominated the market with a share of over 60% in 2024, driven by the need for rapid situational awareness in emergency and disaster response. Public safety agencies are turning to drone software for real-time data visualization and incident management. Applications include fire mapping, search-and-rescue coordination, and crowd monitoring, where software plays a critical role in processing aerial data instantly. These solutions enhance operational speed and improve decision-making under high-stress conditions. As climate-related events and security concerns increase, public sector demand for drone software is expected to rise.

The system segment is expected to witness the fastest CAGR of over 16% from 2025 to 2030, owing to the rising need for seamless mission planning and automation. The flight planning and control system segment is experiencing rapid growth in the drone software industry. These systems enable precise route configuration, waypoint navigation, and real-time adaptation to environmental changes. Industries like logistics, defense, and agriculture rely heavily on this software to execute safe and efficient missions. As demand for autonomous operations increases, the value of intelligent flight control systems continues to expand.

Architecture Insights

The open source segment accounted for the highest market share in 2024, owing to the increasing demand for flexible and cost-effective drone software solutions. The open source segment is gaining strong momentum across various industries. Open source platforms provide developers with the freedom to customize flight control, data processing, and analytics features to meet specific operational needs. This has spurred innovation, particularly among startups, research institutions, and hobbyists seeking scalable and collaborative software ecosystems. As the drone ecosystem matures, the open source segment is expected to play a pivotal role in driving technological advancement and market accessibility.

The closed source segment is expected to witness significant CAGR from 2025 to 2030, owing to the growing demand for secure, reliable, and enterprise-grade drone software solutions. The closed source segment is experiencing robust growth. Proprietary platforms offer end-to-end support, regular updates, and advanced features tailored for industries with stringent compliance and data privacy requirements, such as defense, energy, and government. These solutions often come with dedicated customer service and integration capabilities that ensure seamless deployment in complex operational environments. As businesses prioritize security and scalability, closed source drone software remains a critical component of the market’s expansion.

Deployment Insights

The onboard segment accounted for the largest market share in 2024. The rising demand for enhanced autonomy and real-time data processing is driving rapid growth in the onboard segment of the drone software industry. Onboard software empowers drones to analyze sensor data and make critical decisions instantly without relying on external communication links. This capability is especially vital in industries such as defense, agriculture, and disaster management, where immediate response is crucial. As operational environments become more complex, the onboard segment will continue to be a major growth driver.

The ground-based segment is expected to witness the fastest CAGR from 2025 to 2030, primarily driven by the need for centralized control and comprehensive data management. The ground-based segment of drone software is witnessing significant growth. Ground control software enables operators to monitor, command, and analyze multiple drones simultaneously, enhancing mission coordination and operational safety. This is especially critical in sectors like public safety, infrastructure inspection, and logistics, where real-time oversight is essential. As drone fleets expand and missions grow more complex, the demand for advanced ground-based software solutions continues to accelerate.

Application Insights

The filming & photography segment accounted for the largest market share in 2024. The rising demand for high-quality aerial imagery and innovative visual content is driving significant growth in the filming and photography segment of the drone software market. Advanced drone software offers features such as automated flight paths, real-time video stabilization, and intelligent tracking to capture cinematic shots with precision and ease. This is fueling adoption in industries including film production, advertising, real estate, and media. As content creators seek more creative freedom and cost-effective solutions, drone software tailored for filming and photography is becoming increasingly indispensable.

The precision agriculture segment is expected to witness the fastest CAGR from 2025 to 2030, owing to the increasing need for optimized crop management and resource efficiency. The precision agriculture segment is rapidly advancing within the drone software industry. Drone software enables detailed crop health monitoring, soil analysis, and targeted application of fertilizers and pesticides through advanced data analytics and imaging technologies. These capabilities help farmers increase yields, reduce costs, and promote sustainable farming practices. As agricultural stakeholders adopt digital transformation, demand for specialized drone software in precision agriculture continues to grow significantly.

Industry Vertical Insights

The media and entertainment segment accounted for the largest market share in 2024. The growing demand for innovative content creation and immersive experiences is fueling expansion in the segment. Advanced drone software enables seamless aerial cinematography, live event coverage, and real-time streaming with enhanced control and creative flexibility. This technology is transforming how filmmakers, broadcasters, and event organizers capture and deliver dynamic visual content to global audiences. As consumer appetite for high-quality, engaging media rises, drone software tailored for entertainment applications is becoming increasingly vital.

The logistics and transportation segment is expected to witness the fastest CAGR from 2025 to 2030. The increasing need for seamless data integration across logistics networks is fueling demand for drone software that connects with enterprise resource planning (ERP) and warehouse management systems (WMS). Such integration enables real-time inventory tracking, automated dispatching, and enhanced visibility across supply chains. Businesses are leveraging these capabilities to improve coordination between aerial deliveries and ground logistics, reducing delays and errors. As logistics ecosystems become more complex, the demand for interoperable drone software solutions is set to grow substantially.

Drone Type Insights

The rotary blade segment accounted for the largest market share in 2024. The expanding use of rotary blade drones for aerial surveying and mapping is encouraging the development of advanced geospatial software integrations. High-resolution sensors and LIDAR systems require sophisticated data processing algorithms to generate accurate 3D models and terrain maps. Software advancements in this area allow for real-time data collection and processing onboard, reducing the need for post-flight analysis. As industries like construction, mining, and environmental monitoring adopt these technologies, the rotary blade software segment is poised for sustained growth.

The hybrid segment is expected to witness the fastest CAGR from 2025 to 2030. The rising demand for extended flight endurance and versatile operational capabilities is propelling growth in the hybrid drone software segment. Hybrid drones combine the vertical takeoff and landing (VTOL) benefits of rotary blades with the longer range and efficiency of fixed-wing designs, requiring advanced software to seamlessly manage complex flight dynamics. Industries such as agriculture, surveillance, and delivery services are adopting hybrid drones to cover larger areas with improved energy efficiency. As the market seeks solutions that balance flexibility and endurance, software tailored to hybrid drones is becoming a critical growth driver.

End-use Insights

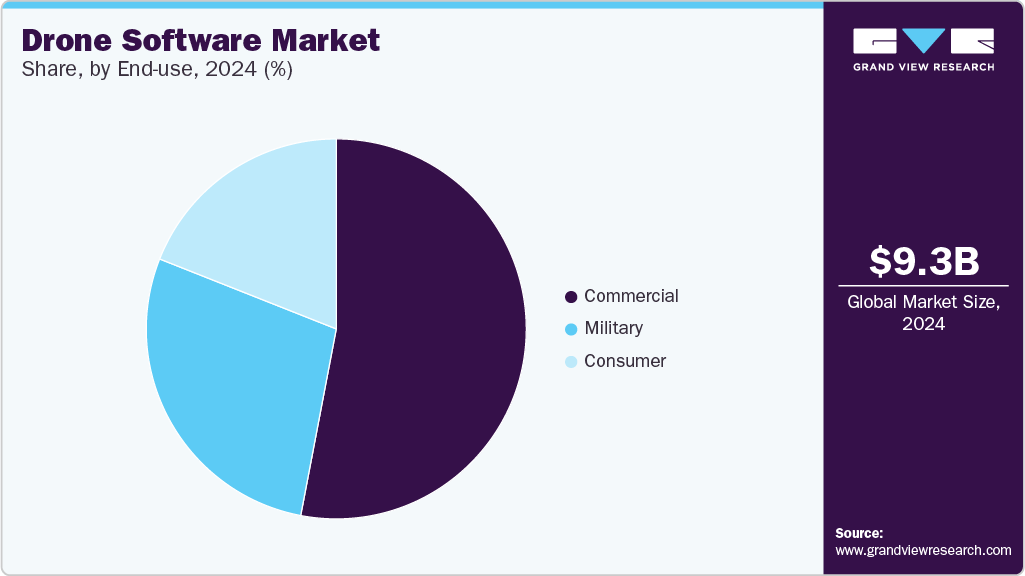

The commercial segment accounted for the largest market share in 2024, owing to rapid digital transformation across industries. Commercial drone software is becoming a key enabler of automation and workflow optimization. Real estate firms, energy companies, and urban planners are adopting drone solutions for accurate mapping, inspection, and surveying needs. Software that supports high-resolution imaging, 3D modeling, and cloud-based collaboration is increasingly in demand. This trend is reshaping operational models and fostering innovation in commercial drone applications.

The military segment is expected to witness the fastest CAGR from 2025 to 2030. Owing to the increasing emphasis on electronic warfare and counter-drone measures, military forces are integrating advanced software solutions to detect, neutralize, or intercept hostile drones. Modern military drone software is equipped with threat classification, geofencing, and autonomous evasion capabilities. These functionalities are becoming essential for tactical operations in both conventional and asymmetric warfare. As threats become more technologically advanced, so does the software backing military UAVs.

Regional Insights

North America drone software market accounted for the highest share of over 34% in 2024, driven by the increasing need for cost-effective solutions. Drone-as-a-Service (DaaS) models are expanding rapidly in North America’s drone software market. These models allow businesses to access advanced drone capabilities, including hardware, software, and operational support, on a subscription basis. By removing the need for large capital investments, organizations can scale their drone operations with greater flexibility, particularly in sectors such as logistics, agriculture, and infrastructure.

U.S. Drone Software Market Trends

The drone software market in the U.S. dominated the region with a share of over 75% in 2024. Owing to the rising focus on sustainability and conservation efforts, drone software is becoming integral to environmental monitoring and wildlife protection. Drones equipped with advanced sensors and AI-based analytics are used to track ecosystems, monitor wildlife, and assess the impacts of climate change. This growing application in environmental management is helping governmental and non-governmental organizations make more accurate, data-driven decisions.

Europe Drone Software Market Trends

The drone software market in Europe is expected to grow at a CAGR of over 15% from 2025 to 2030, primarily driven by Europe’s ambitious renewable energy goals. Drone software is playing a critical role in inspecting wind turbines, solar panels, and other renewable infrastructure. Drones are equipped with advanced imaging and AI analytics, which help reduce maintenance costs and improve operational efficiency. As more renewable energy projects are launched, the demand for drone-based inspection software is expected to rise sharply.

The UK drone software market is expected to grow at a significant rate in the coming years, owing to the need for faster response times and improved public safety. The UK is increasingly developing custom drone software for emergency services. These specialized solutions integrate live-streaming, thermal imaging, and real-time mapping to assist in fire, search-and-rescue, and police operations. The ability to remotely assess dangerous situations is enhancing the efficiency of emergency responders while improving overall public safety.

The drone software market in Germany is driven by the rising demand for eco-conscious solutions, primarily driven by Germany’s strong engineering and construction sectors. There is a growing demand for drone software that supports high-precision surveying and the creation of digital twin models. This software enables the real-time mapping of construction sites, improving project visibility and reducing risks associated with inaccurate planning. As digital transformation accelerates in construction, drone technology is becoming a vital tool for project managers and engineers.

Asia Pacific Drone Software Market Trends

The drone software market in Asia Pacific is expected to grow at the fastest CAGR of over 19% from 2025 to 2030, owing to the explosive growth of e-commerce across Asia Pacific. Drone software is increasingly being utilized for last-mile delivery solutions and warehouse management. Companies are deploying drone fleets to streamline inventory processes, optimize delivery routes, and cut down on shipping times. This rise in demand for more efficient logistics is driving the market forward, particularly in countries like China, India, and Japan.

China drone software market is gaining traction, and the rising demand for more efficient agricultural practices in China is fueling the integration of drone software into autonomous agricultural platforms for tasks such as crop monitoring, spraying, and yield prediction. Powered by AI and machine learning, these technologies analyze data gathered from drones to improve farming efficiency and reduce labor costs. As precision farming gains traction, China’s agricultural sector is accelerating its adoption of these advanced drone solutions.

The drone software market in Japan is rapidly expanding, and the growing demand for industrial automation in Japan is leading to the development of advanced drone software designed for autonomous navigation within indoor environments like factories and warehouses. These platforms leverage sophisticated sensors and AI to navigate confined spaces, allowing drones to perform inspections, deliver goods, and monitor systems. As industrial sectors continue to adopt automation, the demand for specialized drone software in these settings is expected to expand rapidly.

Key Drone Software Company Insights

Key players operating in the drone software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Drone Software Companies:

The following are the leading companies in the drone software market. These companies collectively hold the largest market share and dictate industry trends.

- AirMap Inc. (DroneUp, LLC)

- DELAIR SAS

- SZ DJI Technology Co., Ltd.

- DroneDeploy, Inc.

- Esri

- Pix4D SA

- PrecisionHawk, Inc.

- AgEagle Aerial Systems Inc.

- Skycatch, Inc.

- Skydio, Inc.

- Skyward IO, Inc.

- Yuneec International Co., Ltd.

Recent Developments

-

In May 2025, DJI introduced the Mavic 4 Pro, featuring a revolutionary software-integrated triple-camera system with a 360° rotating Infinity Gimbal. Central to the system is advanced imaging software supporting a 100MP Hasselblad sensor and dual telephoto lenses, enabling dynamic aerial image processing across multiple ranges. Coupled with enhanced low-light algorithms and optimized flight control software, the launch is set to boost demand for intelligent drone imaging software in professional cinematography and surveying workflows.

-

In May 2025, ZenaTech Inc. expanded its presence in the European drone software market by opening a new regional headquarters in Dublin, Ireland. The facility supports the company’s growing Drone-as-a-Service (DaaS) platform, which integrates AI-powered sensor analytics for precision agriculture and industrial monitoring. Positioned strategically near Dublin Airport, the hub will serve as a center for developing and deploying cloud-based drone software solutions across agriculture, construction, and renewable energy sectors in the UK and Europe.

-

In December 2024, Rheinmetall partnered with Auterion to co-develop a unified software operating environment for unmanned systems. The integration of AuterionOS into Rheinmetall’s drone and sensor platforms, including Luna NG and Aladin, addresses the need for standardized software across air, land, and sea systems. This collaboration is expected to accelerate the evolution of interoperable drone software architectures for NATO-aligned defense operations, enabling seamless command and control across multi-domain missions.

Drone Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.59 billion

Revenue forecast in 2030

USD 24.39 billion

Growth rate

CAGR of 16.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, architecture, deployment, application, industry vertical, drone type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; U.A.E.

Key companies profiled

AirMap Inc. (DroneUp, LLC); DELAIR SAS; SZ DJI Technology Co., Ltd.; DroneDeploy, Inc.; Esri; Pix4D SA; PrecisionHawk, Inc.; AgEagle Aerial Systems Inc.; Skycatch, Inc.; Skydio, Inc.; Skyward IO, Inc.; Yuneec International Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Drone Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drone software market report based on solution, architecture, deployment, application, industry vertical, drone type, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

System

-

Application

-

Flight Planning, Operations & Management

-

Data Capture

-

Data Processing & Analytics

-

Others

-

-

-

Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Source

-

Closed Source

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Onboard drones

-

Ground-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Search & Rescue

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Construction and Mining

-

Defense and Government

-

Energy and Utilities

-

Media and Entertainment

-

Logistics and Transportation

-

Others

-

-

Drone Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Wing

-

Rotary Blade

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Consumer

-

Military

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global drone software market size was estimated at USD 9.27 billion in 2024 and is expected to reach USD 11.59 billion in 2025.

b. The global drone software market is expected to grow at a compound annual growth rate of 16.0% from 2025 to 2030 to reach USD 24.39 billion by 2030.

b. The North America region accounted for the largest share of more than 34.0% in the drone software market in 2024 and is expected to continue its dominance over the forecast period, driven by advancements in AI-powered analytics, real-time data processing, and increasing demand for autonomous flight capabilities across industries such as agriculture, defense, and logistics.

b. Some key players operating in the drone software market include AirMap Inc. (DroneUp, LLC), Delair SAS, SZ DJI Technology Co., Ltd., DroneDeploy, Inc., ESRI, Pix4D SA, PrecisionHawk, Inc., AgEagle Aerial Systems Inc., Skycatch, Inc., Skydio, Inc., SkyWard IO, Inc., Yuneec International Co., Ltd.

b. Key factors that are driving the drone software market growth include the integration of AI and ML algorithms, increasing deployment of drones in both commercial and military applications, and the growing retail sales and widespread adoption of e-commerce platforms worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.