- Home

- »

- Distribution & Utilities

- »

-

Dry Type Transformer Market Size, Industry Report, 2033GVR Report cover

![Dry Type Transformer Market Size, Share & Trends Report]()

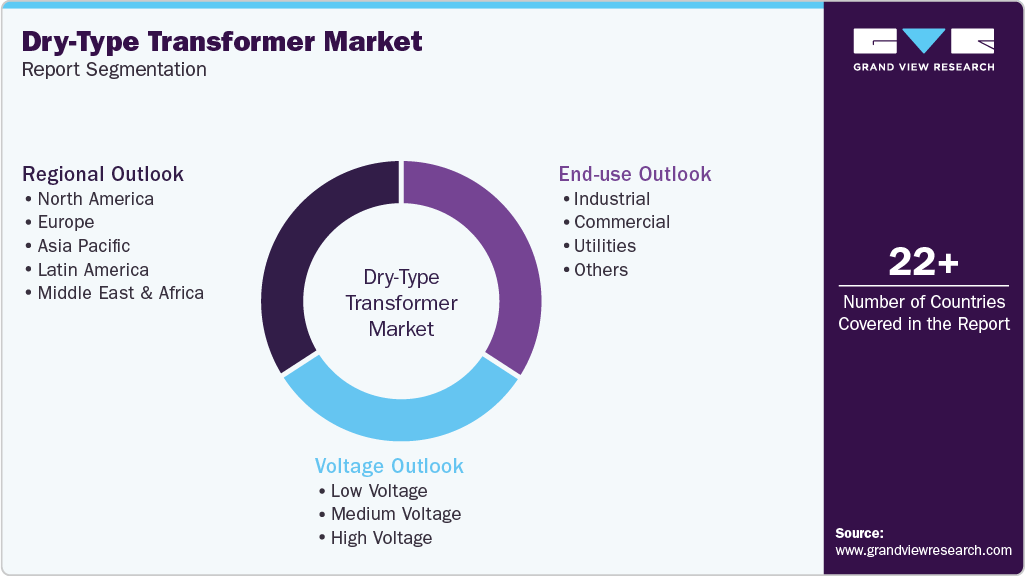

Dry Type Transformer Market (2026 - 2033) Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By End-use (Industrial, Commercial, Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-394-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dry Type Transformer Market Summary

The global dry type transformer market size was estimated at USD 7.12 billion in 2025 and is projected to reach USD 11.87 billion by 2033, growing at a CAGR of 6.7% from 2026 to 2033. A dry-type transformer operates using air or solid insulation instead of liquid dielectric fluids, offering enhanced fire safety, lower environmental risk, and reduced maintenance requirements compared to oil-filled transformers.

Key Market Trends & Insights

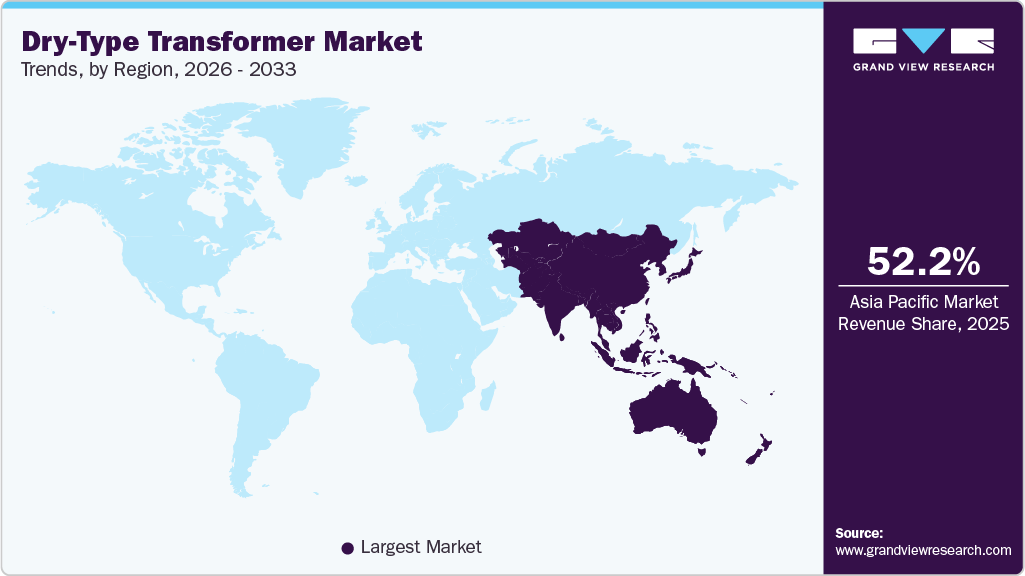

- The Asia Pacific Dry-Type transformer market held the largest global revenue share of 52.2% in 2025.

- The Dry-Type transformer industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By voltage, the medium voltage segment held the highest market share of 47.2% in 2025.

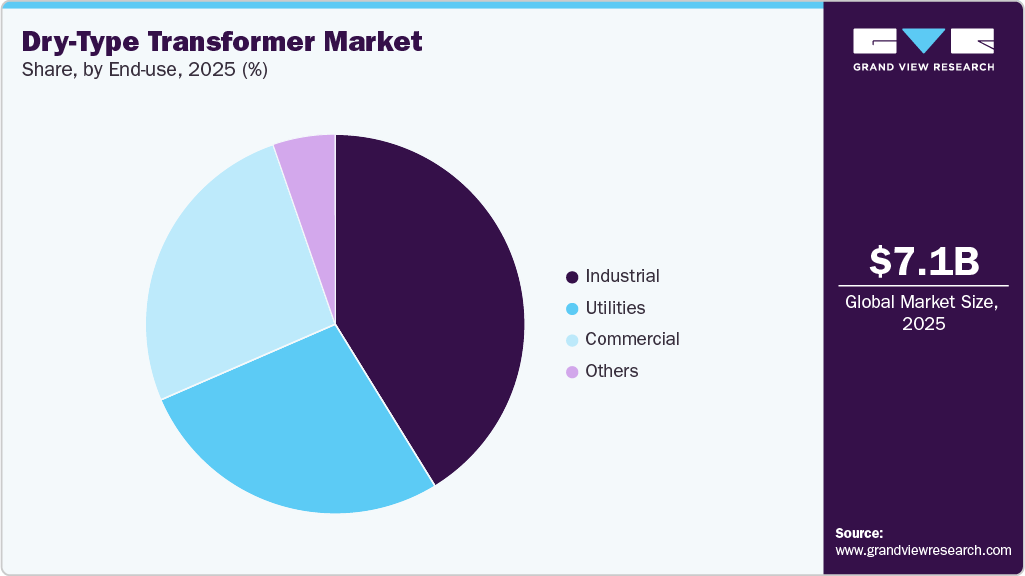

- By end use, the industrial segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.12 Billion

- 2033 Projected Market Size: USD 11.87 Billion

- CAGR (2026-2033): 6.7%

- Asia Pacific: Largest Market in 2025

Ongoing technological advancements in insulation materials, thermal management systems, and compact transformer designs, along with the rising deployment of energy-efficient power distribution infrastructure, are key factors driving market growth. Increasing investments in urban infrastructure development, commercial buildings, and industrial facilities, supported by government initiatives focused on energy efficiency and safety regulations, are further strengthening demand across the global Dry-Type transformer industry.

The global market continues to evolve amid growing demand for safe, reliable, and low-maintenance power distribution solutions, particularly in densely populated urban areas and environmentally sensitive applications. Utilities, commercial developers, and industrial users are increasingly adopting dry-type transformers to support grid modernization, renewable energy integration, and electrification initiatives. The expanding use of dry-type transformers in renewable energy systems, data centers, metro rail networks, and commercial real estate projects plays a significant role in sustaining market momentum. Continuous innovations in insulation technology, noise reduction, digital monitoring, and high-capacity dry-type designs further enhance the market outlook globally.

Drivers, Opportunities & Restraints

The Dry-Type transformer market continues to advance on the back of rising demand for safe, reliable, and low-maintenance power distribution solutions, particularly in urban, commercial, and industrial environments where fire safety and environmental protection are critical. Utilities, real estate developers, and industrial operators are increasingly shifting from conventional oil-filled transformers toward dry-type alternatives to comply with stricter safety norms, sustainability targets, and space constraints. The absence of liquid insulation, reduced risk of fire and leakage, and suitability for indoor installations make dry-type transformers essential for modern power distribution networks, metro rail systems, data centers, hospitals, and high-rise buildings. Continuous improvements in insulation materials, thermal performance, and compact transformer designs are further accelerating adoption across both utility and non-utility end use applications.

Emerging opportunities arise from rapid urbanization, the expansion of commercial infrastructure, and the increasing integration of renewable energy sources into distribution grids. Increasing investments in smart cities, electric vehicle charging infrastructure, and distributed energy systems are driving demand for medium-voltage dry-type transformers that can support dynamic load profiles and decentralized power generation. Advancements in digital monitoring, condition-based maintenance, and noise-reduction technologies are also enhancing operational efficiency and lowering total lifecycle costs. Additionally, rising electrification in developing economies and the replacement of aging distribution infrastructure in mature markets present significant growth potential. However, the market faces restraints, including higher initial costs compared to oil-filled transformers, limitations in high-capacity and high-voltage applications, and thermal management challenges under heavy load conditions. Supply chain volatility for copper, aluminum, and insulation materials, along with cost sensitivity in price-driven markets, remains an additional constraint on widespread adoption.

Voltage Insights

The medium voltage segment dominated the global Dry-Type transformer industry, accounting for over 47% of total revenue in 2025, making it the leading voltage category globally. This dominance is primarily attributed to the widespread use of medium-voltage dry-type transformers across commercial buildings, industrial facilities, metro rail networks, data centers, and renewable energy installations. Their superior fire safety, compact design, and suitability for indoor and urban environments have accelerated their adoption, particularly in regions that enforce strict safety and environmental regulations. Continuous advancements in insulation systems, higher thermal class materials, and noise-reduction technologies are further strengthening the position of the Medium Voltage segment across utility and non-utility distribution networks.

The medium voltage segment is also projected to register the fastest CAGR of 7.9% over the forecast period, supported by rising urbanization, grid modernization initiatives, and increasing investments in distributed and renewable energy systems. The expanding deployment of electric vehicle charging infrastructure, smart buildings, and decentralized power generation is driving sustained demand for medium-voltage dry-type transformers that can support dynamic load profiles. Additionally, large-scale replacement of aging distribution infrastructure and growing emphasis on energy efficiency and operational safety are expected to fuel further growth. Technological advancements in digital monitoring, condition-based maintenance, and compact modular designs continue to enhance reliability and lifecycle performance, reinforcing strong growth momentum for the Medium Voltage segment.

End-use Insights

The industrial segment led the Dry-Type transformer market, accounting for approximately 41.2% of total revenue share in 2025. Strong demand from manufacturing facilities, process industries, refineries, mining operations, and large industrial campuses continues to support the widespread adoption of dry-type transformers, driven by their enhanced fire safety, low maintenance requirements, and reliable performance in harsh operating environments. Increasing electrification of industrial processes, rising deployment of automation systems, and the integration of captive renewable energy sources are further strengthening demand. Additionally, stringent safety and environmental regulations across developed and emerging economies are encouraging industrial users to replace oil-filled transformers with dry-type alternatives, reinforcing the segment’s leading market position.

The others segment is projected to register the fastest CAGR of 7.9% over the forecast period, driven by growing adoption across commercial buildings, data centers, healthcare facilities, transportation infrastructure, and residential complexes. Rapid urbanization, the expansion of smart cities, and increasing investments in metro rail, airports, and electric vehicle charging infrastructure are creating strong demand for dry-type transformers, which are suited for indoor and space-constrained applications. Moreover, rising digitalization, growing emphasis on energy efficiency, and the need for reliable power distribution in critical facilities are accelerating growth in this segment. Continuous advancements in compact designs, noise reduction, and digital monitoring capabilities are further enhancing adoption, supporting robust growth momentum across a diverse range of non-industrial end use applications.

Regional Insights

Asia Pacific accounted for 52.2% of the global Dry-Type transformer market revenue in 2025, driven by rapid urbanization, large-scale power distribution expansion, and rising investments in industrial and commercial infrastructure across major economies in the region. Strong demand from countries such as China, India, and Southeast Asian nations is being driven by grid modernization programs, the integration of renewable energy at the distribution level, and stricter safety regulations favoring dry-type transformers over oil-filled alternatives. The region is also projected to register a CAGR of 7.6%, supported by expanding smart city projects, metro rail development, data center construction, and the growing adoption of energy-efficient power equipment. These factors collectively reinforce Asia Pacific’s position as the largest and fastest-growing regional market.

North America Dry Type Transformer Market Trends

The growth of the North America Dry-Type transformer industry is driven by ongoing grid modernization initiatives and increasing investments in commercial and industrial electrification. Utilities and private developers are adopting dry-type transformers to meet stringent fire safety, environmental, and efficiency standards, particularly in indoor and urban applications. Rising deployment of data centers, renewable energy systems, and electric vehicle charging infrastructure continues to support steady market growth. The replacement of aging distribution assets and the growing emphasis on resilient and sustainable power networks further strengthen demand across the region.

U.S. Dry Type Transformer Market Trends

The U.S. Dry-Type transformer industry is expanding due to strong growth in commercial construction, industrial automation, and the integration of renewable energy. Increasing investments in data centers, healthcare facilities, transportation infrastructure, and EV charging networks are driving demand for safe and low-maintenance power distribution solutions. Federal energy efficiency standards, sustainability mandates, and the need to upgrade aging electrical infrastructure are encouraging the adoption of dry-type transformers across utilities and end users. Continued focus on grid reliability and fire-risk mitigation further supports long-term market expansion.

Europe Dry Type Transformer Market Trends

Strict environmental regulations, high safety standards, and ambitious decarbonization targets across the region support the market growth. Widespread adoption of renewable energy, particularly wind and solar, is driving demand for efficient and reliable distribution transformers in both utility and non-utility applications. Investments in smart grids, rail electrification, and urban infrastructure are accelerating the shift toward dry-type transformers. Europe’s strong regulatory framework and focus on energy efficiency continue to position the region as a key market for advanced transformer technologies.

Latin America Dry Type Transformer Market Trends

The Latin America Dry-Type transformer industry is gaining momentum due to rising electricity demand, urban expansion, and the gradual modernization of power distribution networks. Increasing investments in commercial buildings, industrial facilities, and renewable energy projects are driving the adoption of dry-type transformers, particularly in indoor and environmentally sensitive applications. Government-led infrastructure development initiatives and efforts to improve grid reliability are further supporting market growth across key countries in the region.

Middle East & Africa Dry Type Transformer Market Trends

The Middle East and Africa Dry-Type transformer industry is expanding as countries focus on diversifying energy portfolios, improving grid reliability, and supporting large-scale infrastructure development. Growing investments in renewable energy, commercial real estate, and industrial projects are increasing demand for safe and low-maintenance transformer solutions. Urban development programs, smart city initiatives, and rising electricity consumption continue to create opportunities for dry-type transformer deployment, particularly in fire-sensitive and high-temperature operating environments.

Key Dry Type Transformer Company Insights

Some of the key players operating in the global Dry-Type Transformer industry include Hitachi Energy and Siemens Energy AG, among others.

-

Hitachi Energy is a global leader in the Dry-Type Transformer market, offering a broad portfolio of low-voltage and medium-voltage dry-type transformers designed for applications across commercial buildings, industrial facilities, renewable energy projects, railways, and data centers. The company is recognized for its advanced insulation systems, high thermal performance, and strong focus on fire safety and environmental compliance. Hitachi Energy’s dry-type transformers support modern grid requirements through digital monitoring capabilities, high-efficiency designs, and compatibility with renewable energy integration. Its strong global manufacturing footprint and long-standing relationships with utilities and industrial customers contribute significantly to its leading market position.

-

Siemens Energy AG is a major global supplier in the Dry-Type Transformer market, providing energy-efficient and compact transformer solutions for infrastructure, industrial, and utility applications. The company’s dry-type transformers are widely deployed in urban substations, commercial buildings, transportation networks, and renewable energy installations where safety, low maintenance, and reduced environmental impact are critical. Siemens Energy emphasizes high efficiency, robust thermal design, and compliance with international standards, enabling reliable operation under demanding conditions. Strong R&D capabilities, digital integration features, and a global service network support Siemens Energy’s competitive position in the market.

Key Dry Type Transformer Companies:

The following are the leading companies in the dry type transformer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Eaton Corporation PLC

- Gujarat Transformers Private Limited

- Hammond Power Solutions Inc.

- Hitachi Energy Ltd.

- Hyundai Electric & Energy Systems Co. Ltd

- Kirloskar Electric Company Ltd.

- Schneider Electric SE

- Siemens Energy

- TBEA Co. Ltd.

Recent Developments

- In January 2025, Hitachi Energy Ltd. announced a major development in the dry-type transformer market by committing €30 million (approx. USD 32 million) to relocate and expand its dry-type transformer manufacturing facility in Zaragoza, Spain, moving to a state-of-the-art 22,000 m² complex at the Zaragoza Logistics Platform (Plaza). The project aims to significantly increase production capacity, create new jobs, and promote quality, innovation, and sustainability in transformer manufacturing, with an expected completion date by the end of 2026.

Dry Type Transformer Market Report Scope

Report Attribute

Details

Market Definition

The Dry-Type Transformer market represents the global revenue generated from the manufacturing, installation, and servicing of air-cooled and resin-cast transformers used for voltage conversion and power distribution across commercial, industrial, utility, and renewable energy applications.

Market size value in 2026

USD 7.54 billion

Revenue forecast in 2033

USD 11.87 billion

Growth rate

CAGR of 6.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in units, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; Eaton Corporation PLC; Gujarat Transformers Private Limited; Hammond Power Solutions Inc.; Hitachi Energy Ltd.; Hyundai Electric & Energy Systems Co. Ltd; Kirloskar Electric Company Ltd.; Schneider Electric SE; Siemens Energy; TBEA Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dry Type Transformer Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dry-type Transformer market report based on voltage, end-use, and region:

-

Voltage Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Utilities

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dry type transformer market size was estimated at USD 7.12 billion in 2025 and is expected to reach USD 7.54 billion in 2026.

b. The global dry type transformer market is expected to grow at a compound annual growth rate of 6.7% from 2026 to 2033 to reach USD 11.87 billion by 2033.

b. Based on the voltage segment, medium voltage held the largest revenue share of more than 47% in 2025.

b. Some of the key vendors operating in the global dry type transformer market include Hitachi Energy, Siemens Energy AG, ABB Ltd., Schneider Electric SE, Eaton Corporation PLC, General Electric (GE Grid Solutions), Mitsubishi Electric Corporation, Hammond Power Solutions Inc., Kirloskar Electric Company Ltd., and Hyundai Electric & Energy Systems Co. Ltd., among others.

b. The key factors driving the dry type transformer market include the growing focus on fire-safe and environmentally friendly power distribution solutions, rising demand from commercial and industrial infrastructure, and the increasing deployment of renewable energy and urban electrification projects requiring reliable, low-maintenance, and space-efficient transformers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.