- Home

- »

- Plastics, Polymers & Resins

- »

-

Eco-friendly Food Packaging Market, Industry Report, 2030GVR Report cover

![Eco-friendly Food Packaging Market Size, Share & Trends Report]()

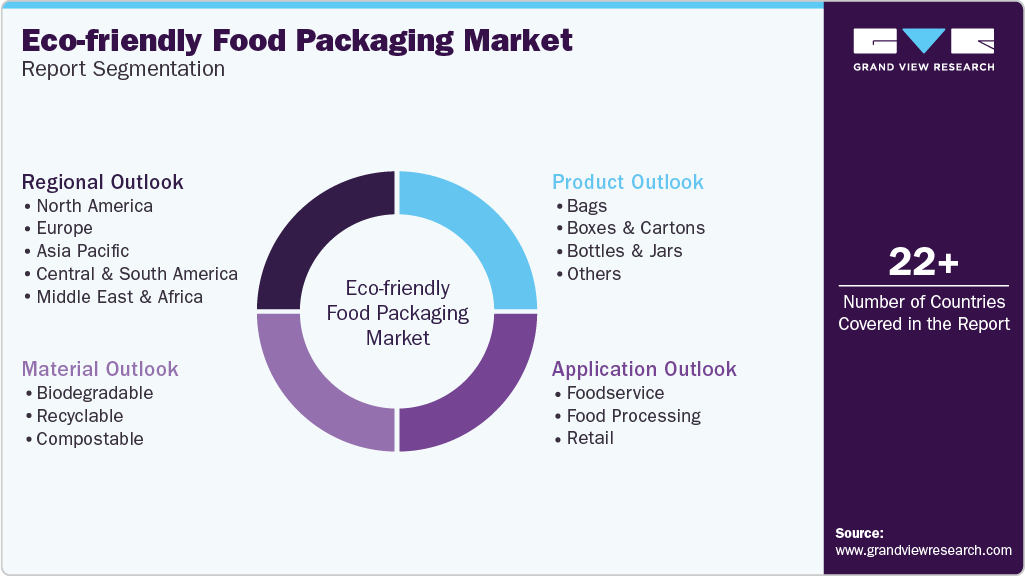

Eco-friendly Food Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Biodegradable, Recyclable, Compostable), By Product (Bags, Boxes & Cartons, Bottles & Jars), By Application (Foodservice), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-578-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eco-friendly Food Packaging Market Summary

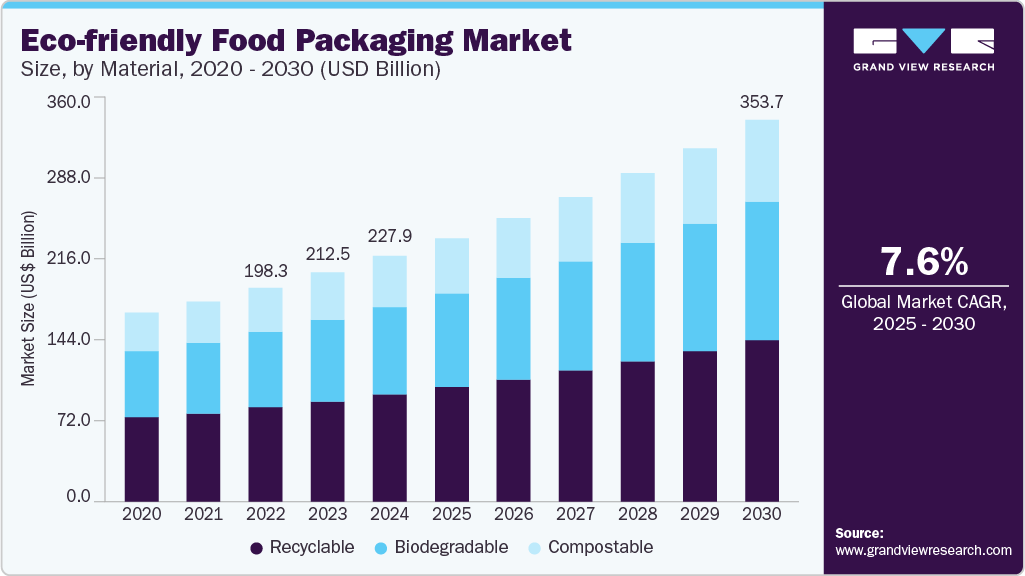

The global eco-friendly food packaging market size was estimated at USD 227.96 billion in 2024 and is projected to reach USD 353.78 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. Rising consumer awareness of environmental issues and growing demand for sustainable alternatives are driving the eco-friendly food packaging industry.

Key Market Trends & Insights

- North America eco-friendly food packaging market dominated the global industry and accounted for the largest revenue share of over 33.0% in 2024.

- The eco-friendly food packaging market in the U.S. is driven by consumer preferences, corporate sustainability pledges, and state-level plastic bans.

- By material, the recyclable material segment recorded the largest revenue share of over 43.0% in 2024.

- By product, the boxes & cartons segment recorded the largest revenue share of over 30.0% in 2024.

- By application, the foodservice segment recorded the largest revenue share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 227.96 Billion

- 2030 Projected Market Size: USD 353.78 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Government regulations banning single-use plastics further accelerate the adoption of biodegradable and recyclable packaging solutions. Government regulations and policy initiatives have become powerful catalysts for market transformation. The European Union's Single-Use Plastics Directive, which banned multiple single-use plastic items in July 2021, has been expanded in 2024 to include additional packaging categories, creating immediate demand for alternatives. Similarly, California's SB 54 legislation requires all packaging to be recyclable or compostable by 2032, forcing food companies to accelerate their transition. These regulatory pressures have sparked innovation in materials science, with breakthroughs in PHA (polyhydroxyalkanoate) bioplastics and cellulose-based films for biodegradable food packaging.

Modern consumers associate sustainability with brand credibility, driving companies to adopt eco-packaging as a market differentiator. Consumers are willing to pay a premium for sustainably packaged food. Brands such as Beyond Meat leverage this by using PCR (post-consumer recycled) plastic for their plant-based products. Additionally, McDonald’s phased out polystyrene foam cups in favor of fiber-based alternatives in Europe, responding to vocal consumer activism.

Breakthroughs in biopolymers and waste-derived materials are reducing costs and improving functionality, making eco-packaging viable at scale. For instance, Notpla is a London-based company that has developed an innovative seaweed-based coating designed to replace conventional plastic coatings used in grease-resistant fast-food packaging. This seaweed coating is applied to paperboard to create takeaway boxes and other food packaging that are greaseproof, water-resistant, and fully biodegradable.

Major retailers and food giants are setting aggressive ESG targets, forcing suppliers to adopt sustainable packaging or risk losing contracts. Walmart’s Project Gigaton pressures vendors to eliminate plastic waste, leading to partnerships with Loop Industries for circular packaging solutions. Similarly, Nestlé targets 100% recyclable or reusable packaging by 2025 and plans to reduce virgin polymer use by one-third, investing USD 30.0 million in recycled plastics supply in the U.S.

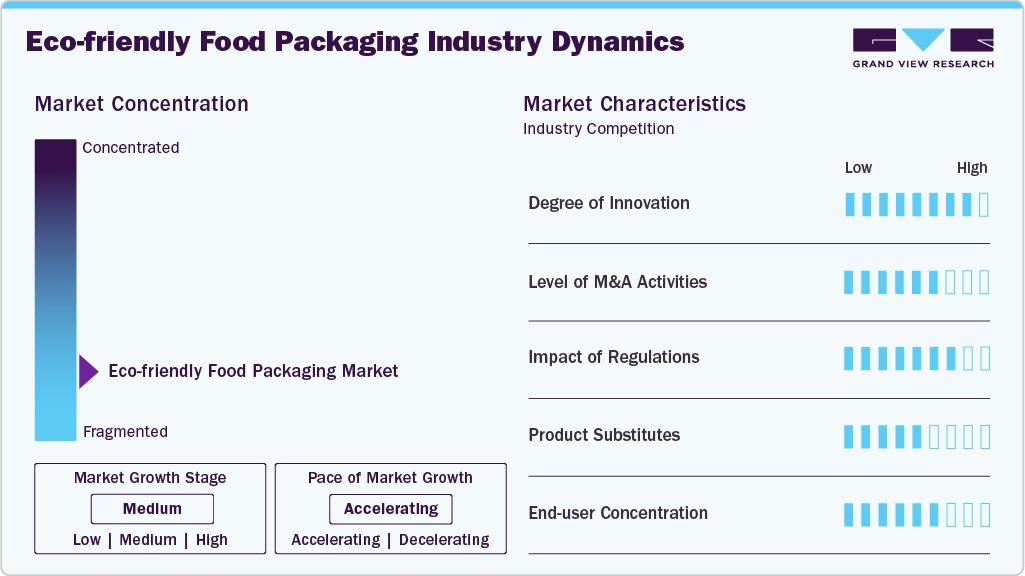

Market Concentration & Characteristics

Prominent eco-friendly food packaging solutions companies operating in the industry include Amcor plc, Berry Global Inc., Crown Holdings, Inc., DS Smith, Graphic Packaging International, LLC, Huhtamaki, International Paper, Mayr-Melnhof Karton AG, Sealed Air, Silgan Holdings Inc., Sonoco Products Company, TOPPAN Inc., Tetra Pak, Pappco Greenware, and Greendot Biopak Pvt. Ltd.

The industry is characterized by rapid innovation, driven by increasing consumer demand for sustainable alternatives and stringent environmental regulations. It is transitioning from traditional petroleum-based materials to biodegradable, compostable, and recyclable solutions such as molded fiber, paperboard, PLA bioplastics, and emerging materials such as seaweed or mycelium.

In March 2024, Duni Group, a provider of sustainable dining and food packaging solutions, entered a new collaboration with Notpla, a London-based sustainable packaging company, to launch an innovative plastic-free food packaging range called Alga. It features a unique seaweed-based coating developed by Notpla. This packaging combines cardboard with a renewable seaweed coating that acts as a moisture- and oil-resistant barrier, making it suitable for a variety of hot and cold foods while offering improved environmental performance.

Dutch authorities officially recognize the seaweed coating as the first truly plastic-free coating compliant with the EU Single-Use Plastics Directive. The Alga series includes four products, such as meal boxes and trays, designed for the foodservice sector, and is fully recyclable within existing paper/card waste streams.

Material Insights

The recyclable material segment recorded the largest revenue share of over 43.0% in 2024. Recyclable food packaging involves materials that can be processed and reused in the manufacturing cycle, such as paper, cardboard, glass, aluminum, and specific plastics such as PET and HDPE. This type of packaging maintains its structural integrity during the recycling process and is favored in both retail and takeaway formats due to its durability and cost-effectiveness. Growing infrastructure for waste collection and recycling, especially in urban areas, is a major enabler of this segment.

The compostable material segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. Compostable packaging is designed to break down under composting conditions into carbon dioxide, water, and biomass within a specified timeframe. Unlike biodegradable materials, compostable packaging must meet specific standards (e.g., ASTM D6400, EN 13432) to ensure it degrades in industrial or home compost settings. It’s often made from PLA, bagasse, or kraft paper, and is used for food containers, trays, and bags.

Product Insights

The boxes & cartons segment recorded the largest revenue share of over 30.0% in 2024. Eco-friendly boxes and cartons are typically manufactured from recycled paperboard or virgin paper sourced from sustainably managed forests. These packaging solutions are widely used for ready-to-eat meals, bakery items, frozen foods, and takeaway containers. Many of these cartons come with water-based or compostable coatings to improve moisture resistance. The growing popularity of food delivery and takeout services is driving demand for sustainable, sturdy packaging.

The bags segment is expected to grow at the fastest CAGR of 8.2% during the forecast period. Eco-friendly food packaging bags are primarily made from biodegradable, compostable, or recyclable materials such as kraft paper, bioplastics (PLA), or fabric-based alternatives. These bags are commonly used in grocery stores, bakeries, cafes, and fast-food outlets for packaging snacks, bread, produce, or takeaway meals. They are lightweight, cost-effective, and often customizable for branding purposes. The increasing bans and regulations on single-use plastic bags by governments worldwide are major drivers of this segment.

Application Insights

The foodservice segment recorded the largest revenue share of over 41.0% in 2024 and is projected to grow at the fastest CAGR during the forecast period. This segment includes restaurants, cafes, food trucks, catering services, and quick-service restaurants (QSRs). These establishments increasingly rely on disposable packaging for takeout and delivery. Eco-friendly food packaging in this segment includes compostable plates, biodegradable containers, plant-based cutlery, and recyclable paper wraps. The rapid growth of the online food delivery ecosystem and third-party platforms, such as Uber Eats, Zomato, Swiggy, Zepto, and DoorDash, also encourages the use of sustainable packaging to reduce carbon footprints and enhance brand image.

The food processing segment involves manufacturers using eco-friendly packaging for processed foods such as snacks, dairy products, frozen foods, and ready-to-eat meals. Sustainable packaging solutions include plant-based films, edible coatings, and recyclable materials that extend shelf life while minimizing waste. Key drivers include stringent food safety regulations requiring sustainable yet hygienic packaging, as well as consumer demand for minimally processed and eco-friendly products. Food brands are also under pressure from retailers and investors to adopt greener packaging to meet ESG (Environmental, Social, and Governance) goals.

The retail segment covers supermarkets, grocery stores, and e-commerce platforms that use eco-friendly packaging for fresh produce, beverages, and packaged goods. Options include paper-based wraps, reusable containers, bags, and plant-based plastics that reduce landfill waste. Retailers are also encouraging customers to bring reusable bags and containers to minimize packaging waste. Additionally, e-commerce growth has led to demand for sustainable shipping materials, as companies aim to reduce carbon footprints and enhance brand reputation.

Regional Insights

North America eco-friendly food packaging market dominated the global industry and accounted for the largest revenue share of over 33.0% in 2024. This positive outlook is due to consumer demand for sustainability, corporate sustainability goals, and government policies. The U.S. and Canada have seen a surge in bans on single-use plastics, with cities such as San Francisco and Seattle leading the initiative. Major food chains, including McDonald’s and Starbucks, have committed to phasing out plastic straws and switching to paper or PLA (polylactic acid) alternatives. The rise of the zero-waste movement and increasing preference for plant-based diets also contribute to the demand for eco-friendly food packaging. Furthermore, the U.S. Inflation Reduction Act includes incentives for sustainable packaging innovations, boosting investments in biodegradable and recyclable solutions.

U.S. Eco-friendly Food Packaging Market Trends

The eco-friendly food packaging market in the U.S. is driven by consumer preferences, corporate sustainability pledges, and state-level plastic bans. California and New York have implemented strict regulations against single-use plastics, pushing brands to adopt alternatives such as molded fiber and bagasse. The Plant Based Products Council advocates bio-based packaging solutions.

Europe Eco-friendly Food Packaging Market Trends

The eco-friendly food packaging market in Europe is growing due to strict regulatory frameworks such as the EU Single-Use Plastics Directive and extended producer responsibility (EPR) laws. Countries, including Germany, France, and the UK, are at the forefront, with policies mandating compostable packaging for takeaway food. The Circular Economy Action Plan encourages companies to adopt reusable and recyclable materials. Supermarkets such as Tesco and Lidl have eliminated plastic packaging for fruits and vegetables, replacing it with biodegradable nets and paper-based solutions.

Germany eco-friendly food packaging market is growing due to its advanced waste management policies, high environmental awareness, and strong industrial base. The country’s Packaging Act (Verpackungsgesetz) mandates packaging recyclability and requires producers to register with a central packaging register, pushing companies to adopt sustainable materials. As a result, German supermarkets and food companies are increasingly using paper-based, compostable, and reusable packaging. Retail giants, namely Aldi and Lidl, have committed to reducing plastic packaging by up to 50% by 2025, aligning with national and EU-wide sustainability goals.

Asia Pacific Eco-friendly Food Packaging Market Trends

The eco-friendly food packaging market in Asia Pacific is projected to grow at the fastest CAGR of 8.0% during the forecast period. The Asia Pacific region is a major driver of the eco-friendly food packaging market due to rapid urbanization, increasing environmental awareness, and stringent government regulations. Countries such as China, India, and Japan are implementing bans on single-use plastics, pushing businesses to adopt biodegradable and compostable alternatives. The growing middle-class population, coupled with rising demand for sustainable packaged food, is accelerating market growth. For example, Thailand has enforced a ban on plastic bags in major retailers. Additionally, food delivery platforms such as Zomato and Swiggy in India are transitioning to sustainable packaging to reduce plastic waste.

China eco-friendly food packaging market is growing due to its plastic ban policies and rapid adoption of sustainable alternatives. The government’s 2020 ban on non-degradable bags in major cities has pushed companies to switch to biodegradable options such as PLA and starch-based materials. Food delivery giants such as Meituan and Ele.me use plant-based packaging, while Alibaba’s Hema supermarkets promote reusable containers. Moreover, the 14th Five-Year Plan emphasizes a circular economy, encouraging innovations in compostable and recyclable food packaging.

Key Eco-friendly Food Packaging Company Insights

Key players operating in the eco-friendly food packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Eco-friendly Food Packaging Companies:

The following are the leading companies in the eco-friendly food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Berry Global Inc

- Crown Holdings, Inc.

- DS Smith

- Graphic Packaging International, LLC

- Huhtamaki

- International Paper

- Mayr-Melnhof Karton AG

- Sealed Air

- Silgan Holdings Inc.

- Sonoco Products Company

- TOPPAN Inc.

- Tetra Pak

- Pappco Greenware

- Greendot Biopak Pvt. Ltd.

Recent Developments

-

In February 2025, International Paper and DS Smith officially combined, creating a new global leader in sustainable packaging solutions with a strong focus on the North American and EMEA (Europe, Middle East, and Africa) regions. The USD 7.2 billion all-share deal merges two of the leading producers of sustainable packaging, containerboard, and pulp products, enhancing their offerings, innovation, and geographic reach.

-

In February 2025, Tetra Pak became the first company in India’s food and beverage packaging industry to introduce carton packaging that incorporates 5% certified recycled polymers, in compliance with the Plastic Waste Management (Amendment) Rules 2022. The recycled polymers used are ISCC PLUS certified, ensuring they meet global sustainability and food contact standards.

-

In May 2024, Anchor Packaging LLC collaborated with Cyclyx International to enhance the recovery and recyclability of food-grade plastics. This partnership aims to address sustainability challenges within the food service packaging industry by developing innovative recycling solutions for various types of post-use plastics.

Global Eco-friendly Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 244.71 billion

Revenue forecast in 2030

USD 353.78 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor plc; Berry Global Inc; Crown Holdings, Inc.; DS Smith; Graphic Packaging International, LLC; Huhtamaki; International Paper; Mayr-Melnhof Karton AG; Sealed Air; Silgan Holdings Inc.; Sonoco Products Company; TOPPAN Inc.; Tetra Pak; Pappco Greenware; Greendot Biopak Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eco-friendly Food Packaging Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eco-friendly food packaging market report based on material, product, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Recyclable

-

Compostable

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bags

-

Boxes & Cartons

-

Bottles & Jars

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Food Processing

-

Retail

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global eco-friendly food packaging market was estimated at around USD 227.96 billion in the year 2024 and is expected to reach around USD 244.71 billion in 2025.

b. The global eco-friendly food packaging market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach around USD 353.78 billion by 2030.

b. The food service application segment dominated the eco-friendly food packaging market in 2024 with 41.0% value share due to growing demand for sustainable packaging solutions from quick-service restaurants (QSRs), cafes, and delivery services.

b. The key players in the eco-friendly food packaging market include Amcor plc; Berry Global Inc; Crown Holdings, Inc.; DS Smith; Graphic Packaging International, LLC; Huhtamaki; International Paper; Mayr-Melnhof Karton AG; Sealed Air; Silgan Holdings Inc.; Sonoco Products Company; TOPPAN Inc.; Tetra Pak; Pappco Greenware; and Greendot Biopak Pvt. Ltd.

b. The eco-friendly food packaging market is driven by rising consumer awareness of environmental issues and increasing government regulations restricting single-use plastics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.