- Home

- »

- Next Generation Technologies

- »

-

Electric Mining Equipment Market Size, Industry Report 2033GVR Report cover

![Electric Mining Equipment Market Size, Share & Trends Report]()

Electric Mining Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Electric Truck, Electric Drills), By Power Source (Battery Powered, Trolley Assisted), By Mining, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-747-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Mining Equipment Market Summary

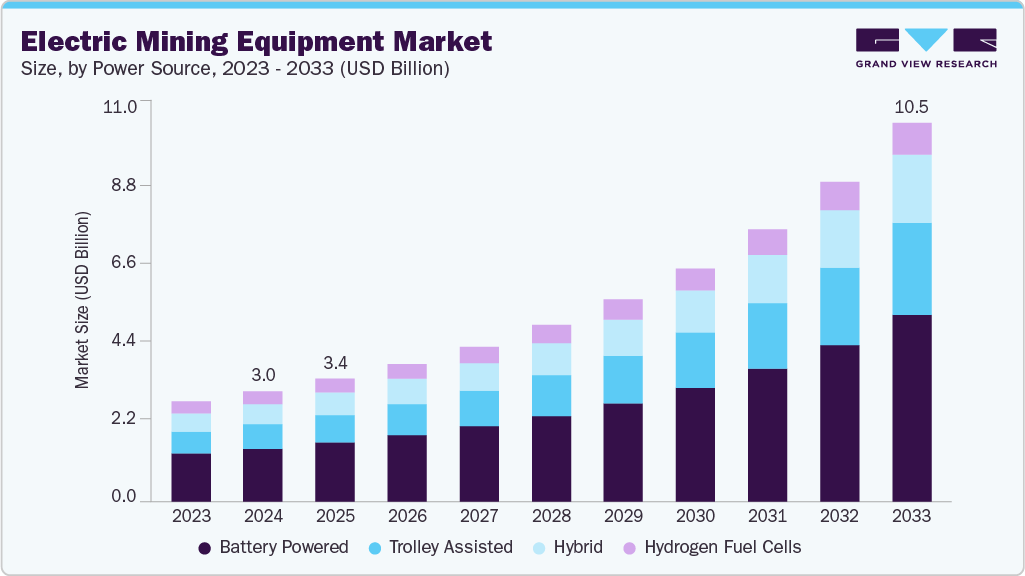

The global electric mining equipment market size was estimated at USD 3.05 billion in 2024, and is projected to reach USD 10.51 billion by 2033, growing at a CAGR of 15.2% from 2025 to 2033. This steady growth is attributed to the rising enforcement of stringent emission regulations, accelerating technological advancements in battery and powertrain systems, increasing integration of automation and digital mining solutions, growing emphasis on lowering the total cost of ownership through reduced ventilation and fuel costs, and the surge in strategic partnerships supported by government decarbonization policies.

Key Market Trends & Insights

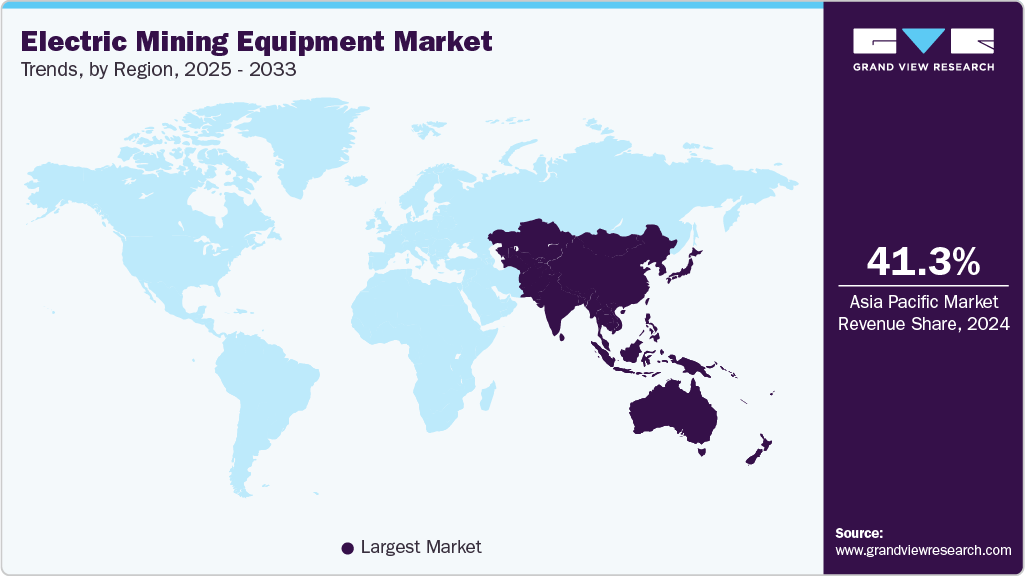

- The Asia Pacific electric mining equipment industry accounted for a 41.27% share of the overall market in 2024.

- The electric mining equipment industry in China held a dominant position in 2024.

- By type, the electric trucks segment accounted for the largest share of 34.2% in 2024.

- By power source, the battery powered segment held the largest market share in 2024.

- By mining, the surface mining segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.05 Billion

- 2033 Projected Market Size: USD 10.51 Billion

- CAGR (2025-2033): 15.2%

- Asia Pacific: Largest Market in 2024

Tightening global emissions regulations are propelling market growth in the electric mining equipment sector. Regulatory initiatives such as the European Union’s Green Deal and the U.S. Environmental Protection Agency (EPA) Tier 4 standards are urging mining operators to shift from diesel-powered to electric-powered fleets. The U.S. Department of Energy (DOE) emphasizes the mining sector’s role in reducing Scope 1 emissions as part of national decarbonization pathways. Furthermore, government-backed bodies like the International Council on Mining and Metals (ICMM) have introduced guidelines urging net-zero commitments across the mining value chain, significantly boosting the demand for zero-emission mining vehicles like electric trucks and LHDs.Rapid progress in battery storage systems is significantly boosting the market for electric mining equipment. Innovations in lithium-iron phosphate (LFP) and solid-state batteries are improving energy density and reducing charging time, making electric equipment more suitable for continuous operations in remote mining environments. The U.S. DOE has invested heavily in next-generation battery R&D through initiatives like the Advanced Battery Materials Research (BMR) program. These advancements have enabled companies such as Sandvik and Epiroc to introduce battery-electric underground loaders and haul trucks with longer operational ranges and reduced downtime, accelerating commercial adoption and driving industry transformation.

Government-backed programs focused on worker safety and digital transformation are propelling the integration of automation and electric mobility. For instance, Canada’s Natural Resources Department and the U.S. NIOSH (National Institute for Occupational Safety and Health) have supported R&D into autonomous and remotely operated electric mining vehicles to reduce human exposure to hazardous environments. This convergence of electrification with AI and telematics enables predictive maintenance, operational analytics, and remote operation, key pillars of the modern “smart mine.” Such innovations are boosting the market by reducing labor costs, increasing uptime, and enhancing overall productivity.

The falling total cost of ownership is another factor significantly boosting the market for electric mining equipment. While electric mining machines require higher upfront investment, they offer reduced operational costs through savings on diesel, lubricants, and maintenance. More importantly, electric equipment drastically reduces underground ventilation expenses, one of the largest cost centers in deep mines. According to the U.S. Department of Energy, mining operators can save up to 40% on ventilation when transitioning to battery-electric fleets. This favorable economic profile is persuading both large and mid-sized operators to increasingly electrify their equipment.

Collaborations between mining operators, equipment manufacturers, and government agencies are creating strong momentum across the electric mining landscape. Public-private partnerships supported by policy incentives and national green mining strategies are accelerating large-scale deployments. For instance, Australia’s government-backed Modern Manufacturing Initiative and Canada’s Zero-Emission Vehicle Infrastructure Program (ZEVIP) have enabled mining giants to trial and scale electric fleets. Fortescue Metals, for example, has partnered with Liebherr to deploy electric haul trucks and excavators under a USD 2.8 billion electrification program, demonstrating the catalytic role of policy-backed investments in boosting the electric mining equipment industry globally.

Type Insights

The electric trucks segment accounted for the largest share of 34.20% in 2024. Electric trucks are witnessing rising demand as mining operators shift toward low-emission haulage alternatives to comply with global decarbonization mandates. Their adoption is particularly strong in surface mines where haulage accounts for a major share of fuel consumption. Recent initiatives, such as Fortescue’s deployment of electric haul trucks under its USD 2.8 billion partnership with Liebherr, are setting benchmarks for fleet electrification. As payload capacity, battery range, and fast-charging capabilities improve, electric trucks are increasingly replacing traditional diesel fleets across major mining regions, propelling this segment forward.

The Electric LHDs (Load-Haul-Dump) segment is expected to grow at a significant CAGR during the forecast period. Electric LHDs are emerging as a cornerstone of underground mining modernization, driven by the need to reduce ventilation costs and improve air quality. These machines eliminate diesel particulates and heat, addressing both operational expenses and worker safety concerns. Leading OEMs like Epiroc and Sandvik have introduced battery-electric LHDs with rapid battery-swapping systems and autonomous capabilities. Governments in Canada and the EU are supporting pilot projects to electrify underground fleets, making electric LHDs one of the fastest-growing segments in confined mine environments.

Power Source Insights

The battery powered segment held the largest market share in 2024 and is growing at the fastest CAGR during the forecast period. Battery-powered electric mining equipment is driving the industry’s transition to clean energy, thanks to advancements in lithium-ion and LFP (lithium iron phosphate) technology. The appeal lies in operational flexibility, zero tailpipe emissions, and independence from overhead infrastructure. As battery costs decline and energy density improves, mining companies are integrating battery-powered loaders, trucks, and drills into both surface and underground operations. Regulatory support from national energy transition frameworks is further accelerating this shift, making battery power the dominant propulsion type across new fleet investments.

The trolley assisted segment is expected to grow at the fastest CAGR during the forecast period. Trolley-assisted systems are gaining momentum in high-production surface mines where ultra-class haul trucks operate. This power source allows vehicles to draw electricity from overhead lines, drastically cutting diesel consumption while enabling higher speeds on gradients. Countries like Sweden and South Africa are testing trolley-electric corridors in partnership with government bodies and energy providers. Though infrastructure-intensive, the long-term fuel savings and emission reductions are boosting the trolley-assisted segment as a strategic complement to fully battery-powered solutions.

Mining Insights

The surface mining segment dominated the market in 2024, driven by the sheer scale of operations and available space for charging or trolley infrastructure. Mining giants are electrifying large fleets of trucks and excavators to meet ESG targets and reduce reliance on diesel. Government-backed infrastructure programs in Australia and Europe are helping surface mines adopt grid-connected or solar-supported charging networks, making this segment a critical growth area for high-tonnage electric equipment.

The underground mining segment is projected to grow at the fastest CAGR over the forecast period. In underground mining, the transition to electric equipment is being primarily driven by the potential to reduce costly ventilation systems required for diesel-powered fleets. Electric drills, LHDs, and utility vehicles reduce heat and emissions, resulting in safer and more efficient work environments. Governments in Canada, Germany, and Chile are funding electrification pilot projects in underground mines to demonstrate health and cost benefits. As these case studies scale, underground mining is expected to witness significant investment in battery-electric machinery.

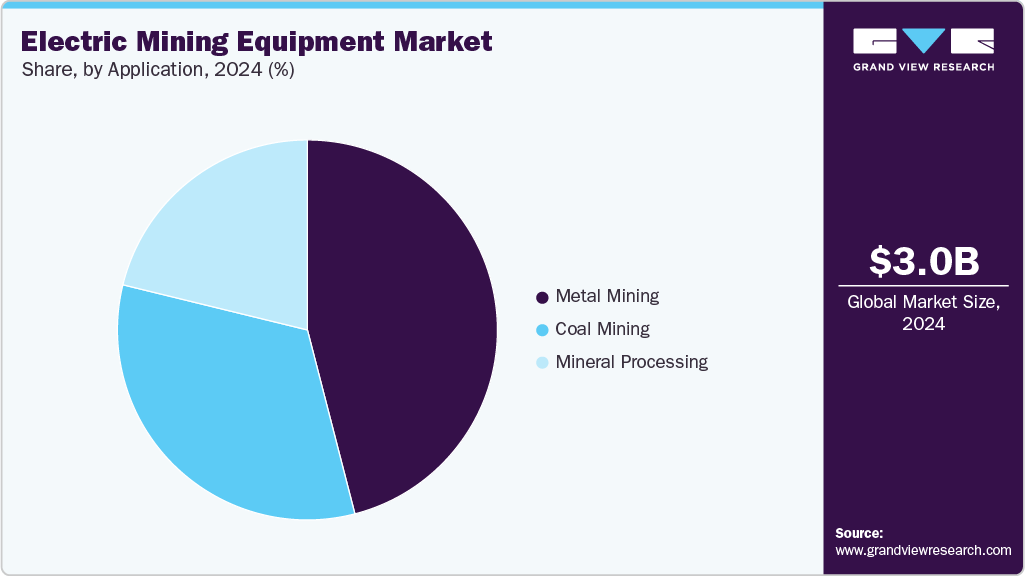

Application Insights

The metal segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period, due to rising demand for copper, nickel, and lithium, critical inputs for renewable energy and electric vehicle industries. Governments across the U.S., Australia, and the EU are prioritizing sustainable sourcing of these strategic minerals, encouraging mining companies to adopt electric equipment to meet “green extraction” standards. This regulatory push, combined with public pressure for ethical supply chains, is accelerating the deployment of electric mining equipment in metal-rich regions such as Chile, Peru, and Australia.

The mineral segment is projected to grow at the fastest CAGR over the forecast period. In the mineral mining segment, covering operations such as phosphate, limestone, and gypsum, electric mining equipment adoption is being driven by environmental compliance and operational efficiency. While traditionally overlooked, this segment is now facing regulatory scrutiny in regions like the EU, where stricter emission limits apply even to non-metallic mining operations. As a result, mid-sized mining companies are increasingly investing in electric drills, loaders, and support equipment to align with sustainability norms and community expectations.

Regional Insights

The North America electric mining equipment industry accounted for a 24.57% share of the overall market in 2024 and is projected to grow at a significant CAGR over the forecast period. North America is experiencing a shift in mining equipment procurement as electric solutions become integral to national supply chain resilience strategies. Both Canada and the U.S. are prioritizing domestic extraction of lithium, cobalt, and rare earths to reduce dependence on imports. As part of this push, mining operators are incorporating electric fleets to align with environmental and social governance (ESG) goals. The region is witnessing a rise in pilot programs co-funded by federal agencies to test battery-powered trucks and LHDs in harsh terrains, signaling long-term market expansion.

U.S. Electric Mining Equipment Market Trends

The U.S. electric mining equipment industry held a dominant position in 2024 in the North American region. In the U.S., the Department of Energy (DOE) and Department of Defense (DOD) are actively supporting electrification through R&D funding and strategic procurement under clean energy mandates. The U.S. Infrastructure Investment and Jobs Act has funneled billions into clean technology, part of which includes support for sustainable mining operations. Mining companies in Nevada and Arizona, regions rich in copper and lithium, have begun deploying battery-electric drills and haul trucks with support from government-funded demonstration programs. These initiatives are directly boosting domestic demand for electric mining equipment.

Europe Electric Mining Equipment Market Trends

Europe’s electric mining equipment industry growth is driven by the European Green Deal, the Fit for 55 initiative, and carbon neutrality targets set for 2050. Stringent carbon pricing and sustainability reporting requirements are pushing mining firms to modernize their fleets with electric machinery. The continent also benefits from a strong OEM ecosystem, with players like Epiroc and Liebherr, who are introducing a range of zero-emission products tailored to both surface and underground operations. Pan-European projects like EIT RawMaterials are accelerating market penetration through innovation funding and cross-border technology pilots.

Germany electric mining equipment industry is positioning itself as a leader in electric mining solutions through state-backed pilot mines focused on autonomous and electric machinery. The Federal Ministry for Economic Affairs and Climate Action (BMWK) is funding research into hybrid and battery-powered systems through programs like "Smart Mining 4.0". These pilot sites, primarily located in Saxony and North Rhine-Westphalia, serve as testing grounds for next-generation electric haul trucks and LHDs developed by domestic OEMs. Such initiatives are not only driving domestic adoption but setting technology benchmarks globally.

The UK electric mining equipment industry is promoting electrification in mining through policy mechanisms like clean air zones and low-emission fleet requirements. While the country does not have large-scale mining operations compared to others, its focus lies in aggregate, industrial mineral, and specialty mining. The British Geological Survey is advising operators on integrating battery-electric machinery in limestone and chalk quarries. The government is also funding research into modular electric retrofitting systems, allowing older diesel equipment to be upgraded, thereby driving demand in a cost-effective way.

Asia Pacific Electric Mining Equipment Market Trends

The Asia Pacific electric mining equipment industry accounted for a 41.27% share in 2024 and is growing at the fastest CAGR during the forecast period. The APAC region leads in the absolute number of electric mining vehicles deployed, particularly in high-volume markets such as China, Australia, and India. The region’s rapid resource extraction pace, especially in coal, copper, and rare earths, is fueling the switch to electric machinery. However, inconsistent regulatory frameworks and infrastructure limitations in some countries are challenging standardization. Despite this, APAC remains a high-opportunity region, especially as ESG awareness and clean energy financing improve.

China electric mining equipment industry is spearheading electric fleet deployment in the mining sector through aggressive industrial policy and support for state-owned mining enterprises. The Ministry of Industry and Information Technology (MIIT) has integrated electric equipment into its "Made in China 2025" plan, especially targeting coal and rare earth mines in Inner Mongolia and Shanxi. Domestic OEMs like XCMG and SANY are supplying electric loaders, shovels, and trucks in bulk, integrated with 5G and AI systems for autonomous operation. Local governments are subsidizing charging infrastructure near key mining hubs, dramatically boosting adoption.

Japan’s electric mining equipment industry trend is characterized by precision, compact design, and smart integration. With limited domestic mining activity, Japanese companies like Hitachi and Komatsu are focused on exporting compact, battery-powered equipment for tunnel construction, rare mineral sampling, and urban excavation. The Ministry of Economy, Trade and Industry (METI) is promoting Japan’s role in global decarbonization by supporting innovation in modular battery tech and AI-enabled mining automation. These developments are indirectly boosting global adoption through high-tech exports.

The electric mining equipment industry in India is witnessing early-stage adoption of electric mining equipment, primarily driven by public sector mining giants like Coal India Limited (CIL) and Hindustan Zinc. The Ministry of Coal’s initiatives under the “Sustainable Development Plan” include trial runs of battery-electric dumpers and tippers. Indian states like Odisha and Jharkhand have introduced incentives for mines using low-emission machinery. However, high upfront costs and infrastructure challenges still limit widespread deployment. Nonetheless, the government’s focus on domestic lithium and critical mineral exploration is expected to boost long-term electrification.

Key Electric Mining Equipment Company Insights

Some of the major players in the electric mining equipment industry include Caterpillar, Komatsu, Sandvik AB, Epiroc AB, Hitachi Construction Machinery Co., Ltd., among others. This is due to their strong commitment to sustainable mining solutions, extensive R&D investments in electrification, strategic collaborations with mining operators, and proven expertise in developing battery-electric and hybrid mining machinery. These companies are also leveraging their global distribution networks, technological leadership, and dedicated green product lines to meet the rising demand for emission-reducing equipment across both surface and underground mining operations.

-

Caterpillar Inc. is one of the world's largest manufacturers of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. The company has a broad product portfolio that serves various sectors, including mining, construction, energy, and transportation. Known for its commitment to innovation and durability, Caterpillar emphasizes sustainable solutions and advanced technologies across its machinery lineup. In the mining industry, Caterpillar offers a comprehensive range of equipment for surface and underground operations, including trucks, loaders, dozers, and drills. The company operates globally with a strong dealer network and customer support infrastructure, ensuring high availability and reliability of its equipment across diverse operating environments.

-

Komatsu Ltd. is a Japanese multinational corporation that manufactures equipment for construction, mining, forestry, and industrial applications. It is recognized for its technological advancements, product quality, and emphasis on operational efficiency. Komatsu offers a wide array of mining machinery, including haul trucks, excavators, wheel loaders, and dozers, catering to both surface and underground mining activities. The company integrates cutting-edge technologies such as automation, remote monitoring, and hybrid systems into its product development to enhance safety and productivity. With manufacturing and service operations across the globe, Komatsu maintains a strong presence in key mining markets, supported by a robust distribution and service network.

Key Electric Mining Equipment Companies:

The following are the leading companies in the electric mining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Komatsu

- Sandvik AB

- Epiroc AB

- Hitachi Construction Machinery Co., Ltd.

- AB Volvo

- ABB

- Siemens

- Liebherr Group

- XCMG Group

- SANY Group

Recent Developments

-

On September 17, 2024, Caterpillar unveiled its Cat Dynamic Energy Transfer (DET) system, capable of charging both diesel-electric and battery-electric haul trucks while in motion via an energy rail system, boosting operational uptime and reducing emissions.

-

On February 18, 2025, at Bauma 2025 in Düsseldorf, Komatsu showcased the PC7000‑11E electric hydraulic mining excavator, boasting up to 95% lower Scope 1 emissions and up to 47% lower total cost of ownership when paired with trolley assist.

Electric Mining Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.39 billion

Revenue forecast in 2033

USD 10.51 billion

Growth rate

CAGR of 15.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power source, mining, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Caterpillar; Komatsu; Sandvik AB; Epiroc AB; Hitachi Construction Machinery Co., Ltd.; AB Volvo; ABB; Siemens; Liebherr Group; XCMG Group; SANY Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Mining Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric mining equipment market report based on type, power source, mining, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric Trucks

-

Electric Drills

-

Electric LHDs (Load-Haul-Dump),

-

Electric Excavators

-

Electric Shovels

-

Others

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Battery Powered

-

Trolley Assisted

-

Hybrid

-

Hydrogen fuel cells

-

-

Mining Outlook (Revenue, USD Million, 2021 - 2033)

-

Surface Mining

-

Underground Mining

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal Mining

-

Coal Mining

-

Mineral Processing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric mining equipment market size was estimated at USD 3.05 billion in 2024 and is expected to reach USD 3.39 billion in 2025.

b. The global electric mining equipment market size is expected to grow at a significant CAGR of 15.2% to reach USD 10.51 billion in 2030.

b. The surface mining segment is dominating, accounting for the largest share of 63.2% in 2024, driven by high demand for open-pit extraction methods, lower operational costs, and the increasing adoption of advanced mining equipment and technologies.

b. Some of the major players in the electric mining equipment market include Caterpillar; Komatsu; Sandvik AB; Epiroc AB; Hitachi Construction Machinery Co., Ltd.; AB Volvo; ABB; Siemens; Liebherr Group; XCMG Group; SANY Group.

b. The electric mining equipment market is primarily driven by stringent environmental regulations, rising sustainability goals, and the need to reduce greenhouse gas emissions. Advancements in battery technology, automation, and IoT integration enhance operational efficiency while lowering maintenance costs. Additionally, electric equipment improves worker safety by reducing exposure to diesel fumes and noise, and government incentives further encourage adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.