- Home

- »

- Plastics, Polymers & Resins

- »

-

Electronic Packaging Market Size, Industry Report, 2030GVR Report cover

![Electronic Packaging Market Size, Share & Trends Report]()

Electronic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Glass), By End-use (Consumer Electronics, Automotive, Aerospace & Defence, Healthcare), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-527-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electronic Packaging Market Summary

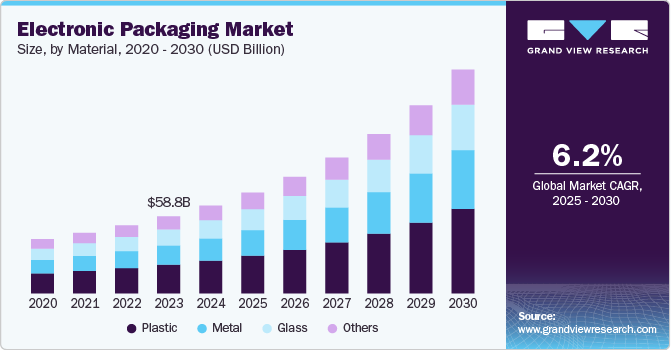

The global electronic packaging market size was estimated at USD 62.51 billion in 2024 and is expected to grow at a CAGR of 6.2% from 2025 to 2030. The growing adoption of electric vehicles (EVs) is driving demand for advanced electronic packaging, as EVs require high-performance power electronics, battery management systems, and reliable thermal solutions.

Key Market Trends & Insights

- Asia Pacific dominated the global electronic packaging market and accounted for the largest revenue share of 42.37% in 2024.

- By material, plastic dominated the electronic packaging market across the product segmentation in terms of revenue, accounting for a market share of 37.28% in 2024.

- By end use, consumer electronics dominated accounting to a market share of 36.39% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62.51 Billion

- 2030 Projected Market Size: USD 89.67 Billion

- CAGR (2025-2030):6.2%

- Asia Pacific: Largest market in 2024

The electronic packaging market is witnessing a strong shift towards miniaturization as consumer electronics, automotive electronics, and industrial devices demand compact, lightweight, and high-performance solutions. With the rise of IoT, 5G, and AI-driven applications, advanced packaging techniques such as system-in-package (SiP), fan-out wafer-level packaging (FOWLP), and embedded die packaging are gaining traction. These innovations enhance device efficiency, reduce power consumption, and improve thermal management—critical factors for next-generation electronic components. As manufacturers strive to integrate more functionality into smaller form factors, high-density interconnects (HDI) and advanced substrates are becoming essential, driving continuous advancements in packaging technology.

Drivers, Opportunities & Restraints

The rapid expansion of semiconductor manufacturing, coupled with the transition to advanced process nodes (such as 7nm, 5nm, and below), is a key driver for the electronic packaging market. Leading semiconductor foundries and integrated device manufacturers (IDMs) are investing heavily in advanced packaging solutions to enhance chip performance while managing thermal and power constraints. As AI, cloud computing, and edge devices demand higher processing speeds and efficiency, packaging technologies such as 2.5D and 3D stacking, chiplets, and heterogeneous integration are becoming industry standards. In addition, government incentives and private investments in semiconductor fabrication across the U.S., China, and Europe are reinforcing demand for cutting-edge packaging materials, substrates, and interconnect technologies.

Sustainability is emerging as a major opportunity in electronic packaging as regulatory bodies and major corporations push for environmentally friendly solutions. Traditional packaging materials, such as epoxy resins and lead-based interconnects, are facing scrutiny due to their environmental impact. In response, the industry is exploring bio-based polymers, recyclable substrates, and lead-free solder alternatives to reduce e-waste and improve circular economy practices. Companies investing in green packaging technologies, including biodegradable encapsulants and solvent-free processing techniques, can gain a competitive edge while aligning with global sustainability goals. As regulatory frameworks tighten, eco-friendly packaging innovations will become a key differentiator for market leaders.

Despite strong market growth, supply chain disruptions and fluctuating raw material prices pose significant challenges to the electronic packaging industry. The sector relies on high-purity metals (such as copper and gold), advanced polymers, and semiconductor-grade ceramics, all of which are susceptible to geopolitical tensions, trade restrictions, and production bottlenecks. Shortages in critical materials, such as advanced substrates and high-performance adhesives, have led to extended lead times and increased costs, affecting production efficiency and profitability. In addition, semiconductor packaging processes require precise equipment and specialized chemicals, making the industry highly vulnerable to global supply chain instabilities. Companies must adopt resilient sourcing strategies and invest in localized production to mitigate these risks.

Material Insights

Plastic dominated the electronic packaging market across the product segmentation in terms of revenue, accounting for a market share of 37.28% in 2024. The increasing need for lightweight and cost-effective electronic packaging is driving the demand for plastic materials, particularly in consumer electronics, telecommunications, and industrial applications. Plastics such as polycarbonate (PC), polyethylene terephthalate (PET), and polyphenylene sulfide (PPS) offer excellent electrical insulation, chemical resistance, and design flexibility, making them ideal for housing sensitive electronic components. With sustainability becoming a priority, companies are investing in bio-based and recyclable plastic packaging solutions to reduce environmental impact while maintaining performance standards. The shift toward miniaturized and portable electronics is further accelerating the use of high-performance engineered plastics that provide durability without adding significant weight or cost.

The metal packaging segment is expanding due to the growing need for durable and thermally efficient materials in high-power electronics, aerospace, and industrial automation. Advanced metal alloys such as aluminum, copper, and stainless steel are widely used in heat sinks, enclosures, and shielding applications to enhance thermal management and electromagnetic interference (EMI) protection. With the rise of 5G infrastructure and power-intensive semiconductor devices, manufacturers are adopting precision metal stamping and die-casting techniques to improve reliability and longevity. In addition, the push for sustainability is driving innovations in recyclable metal packaging solutions, balancing performance with environmental considerations.

End-use Insights

Consumer electronics dominated the electronic packaging market across the technology segmentation in terms of revenue, accounting to a market share of 36.39% in 2024. The rapid expansion of the consumer electronics industry, driven by the growing adoption of smartphones, wearables, and smart home devices, is significantly boosting demand for advanced electronic packaging. Consumers expect thinner, more energy-efficient, and high-performance devices, necessitating innovations in chip-scale packaging (CSP), system-in-package (SiP), and fan-out wafer-level packaging (FOWLP). As leading tech companies focus on integrating AI and IoT capabilities into their products, the need for compact, multi-functional electronic packaging solutions is increasing. In addition, sustainability concerns are prompting the development of eco-friendly, biodegradable, and low-carbon footprint packaging materials to align with global environmental goals.

The automotive industry's transition toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is fueling demand for specialized electronic packaging solutions that offer superior durability, thermal efficiency, and high reliability. Modern vehicles rely heavily on electronic control units (ECUs), sensors, and power modules, all of which require robust packaging to withstand extreme temperatures, vibrations, and electrical stresses. The push for higher power densities in EV batteries and fast-charging systems is also driving the adoption of advanced semiconductor packaging technologies, such as power-integrated modules (PIMs) and silicon carbide (SiC)-based solutions. Automakers and tier-1 suppliers are increasingly collaborating with semiconductor packaging firms to enhance vehicle performance, safety, and energy efficiency.

Regional Insights

North America is experiencing strong growth in the electronic packaging market due to increasing investments in semiconductor manufacturing and advanced packaging technologies. Government initiatives, such as the U.S. CHIPS and Science Act and Canada’s push to strengthen domestic semiconductor supply chains, are encouraging the development of local packaging facilities to reduce reliance on imports. Leading chip manufacturers and outsourced semiconductor assembly and test (OSAT) companies are expanding their presence in the region, investing in advanced packaging techniques like 3D stacking, system-in-package (SiP), and heterogeneous integration to support AI, 5G, and high-performance computing (HPC) applications. As the demand for data centers, IoT devices, and automotive electronics rises, the need for highly efficient and thermally optimized electronic packaging solutions is expected to grow.

U.S. Electronic Packaging Market Trends

The U.S. electronic packaging market is being driven by the increasing demand for military-grade and high-reliability packaging solutions, particularly for defense, aerospace, and critical infrastructure applications. The country’s strategic focus on securing its semiconductor supply chain has led to major investments in advanced packaging technologies for applications such as radar systems, secure communication networks, and space exploration. Defense contractors and semiconductor companies are working on ruggedized and radiation-hardened packaging solutions that can withstand extreme conditions while ensuring high performance.

Asia Pacific Electronic Packaging Market Trends

Asia Pacific dominated the global electronic packaging market and accounted for largest revenue share of 42.37% in 2024 due to its rapidly growing semiconductor manufacturing and consumer electronics industries. Countries such as Taiwan, South Korea, and Japan are leading the development of advanced packaging techniques, including wafer-level packaging (WLP), chiplets, and fan-out packaging, to support high-performance computing, 5G, and AI-driven applications.

Europe Electronic Packaging Market Trends

Europe’s electronic packaging market is seeing significant momentum due to the region’s stringent environmental regulations and commitment to sustainability. The European Union’s directives on reducing e-waste and promoting circular economy practices are pushing manufacturers to develop eco-friendly packaging solutions that minimize carbon footprints and improve recyclability. Companies are investing in biodegradable encapsulants, solvent-free packaging processes, and lead-free soldering materials to comply with sustainability mandates while maintaining high-performance standards.

China’s electronic packaging market is expanding rapidly due to the government’s aggressive push for semiconductor localization and self-sufficiency. The country’s policies, such as the Made in China 2025 initiative and the National IC Industry Investment Fund, are driving large-scale investments in domestic packaging facilities to reduce reliance on foreign technologies. Chinese companies are developing advanced packaging solutions, such as flip-chip, fan-out, and 3D integration, to support the nation’s growing semiconductor industry.

Key Electronic Packaging Company Insights

The Electronic Packaging Market is highly competitive, with several key players dominating the landscape. Major companies include UFP Technologies, Inc, Sealed Air Corporation, DuPont de Nemours, Inc., SCHOTT AG, Sonoco Products Company, Amkor Technology, ASE Group, Jabil, Mondi plc, and DS Smith plc. The electronic packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Electronic Packaging Companies:

The following are the leading companies in the electronic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- UFP Technologies, Inc

- Sealed Air Corporation

- DuPont de Nemours, Inc.

- SCHOTT AG

- Sonoco Products Company

- Amkor Technology

- ASE Group

- Jabil

- Mondi plc

- DS Smith plc

Recent Developments

-

In September 2024, Scrona AG and Electroninks announced a partnership to develop materials and processes for advanced semiconductor packaging. Electroninks will provide its materials to Scrona for use with Scrona's EHD printhead technology. The collaboration aims to drive innovation in semiconductor manufacturing, focusing on applications such as RDL repair, fine line metalization, via filling, and 3D interconnects. Joint R&D efforts will take place in Zurich and Taiwan.

-

In February 2025, Siemens Digital Industries Software introduced an automated workflow certified for TSMC's InFO packaging technology. This workflow utilizes Siemens' Innovator3D IC, Xpedition Package Designer, HyperLynx DRC, and Calibre nmDRC software.

Electronic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.40 billion

Revenue forecast in 2030

USD 89.67 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

UFP Technologies, Inc; Sealed Air Corporation; DuPont de Nemours, Inc.; SCHOTT AG; Sonoco Products Company; Amkor Technology; ASE Group; Jabil; Mondi plc; DS Smith plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented electronic packaging market report on the basis of material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Glass

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Aerospace and Defence

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.