- Home

- »

- Advanced Interior Materials

- »

-

EMI Shielding Material Market Size, Industry Report, 2030GVR Report cover

![EMI Shielding Material Market Size, Share & Trends Report]()

EMI Shielding Material Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Conductive Coatings & Paints), By End-use (Consumer Electronics, Telecommunications & Information Technology), By Region And Segment Forecasts

- Report ID: GVR-4-68040-530-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EMI Shielding Material Market Summary

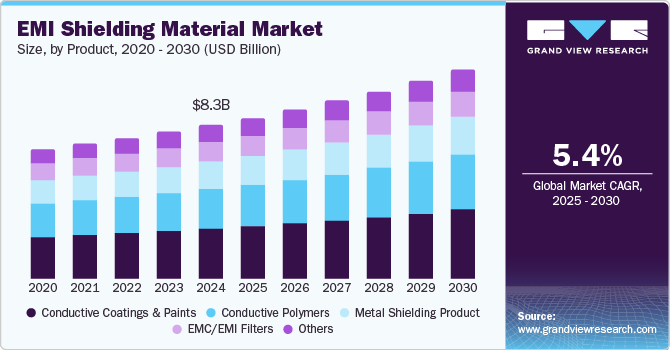

The global EMI shielding material market size was estimated at USD 8.3 billion in 2024 and is projected to reach USD 11.4 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030, driven by the increasing demand for electronic devices and advancements in communication technologies.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 41.4% in 2024.

- Based on product, the conductive coatings & paints segment led the market and accounted for the largest revenue share of 32.7% in 2024.

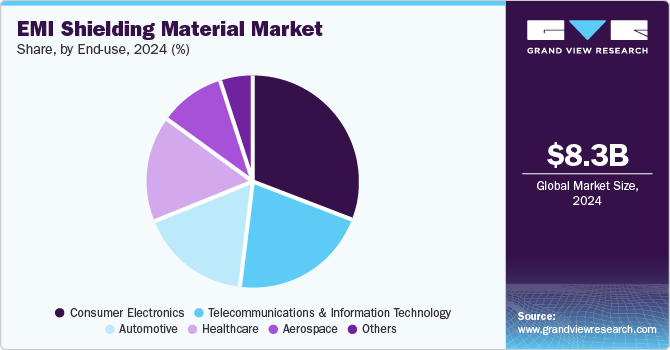

- Based on end use, the consumer electronics segment dominated the market and accounted for the largest revenue share of 31.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.3 Billion

- 2030 Projected Market Size: USD 11.4 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

The proliferation of consumer electronics, such as smartphones, laptops, and wearables, has led to a rising need for effective electromagnetic interference (EMI) shielding solutions to prevent signal interference and ensure device performance. Additionally, as the adoption of 5G technology accelerates, the demand for shielding materials is growing, as these networks operate at higher frequencies, making electronic components more susceptible to electromagnetic interference.

The growing adoption of EMI shielding materials in healthcare and medical devices is also propelling market growth. With the rapid advancement of medical technologies, including MRI machines, pacemakers, and wireless medical devices, the need for shielding solutions to minimize electromagnetic interference has become paramount. EMI shielding ensures the accurate functioning of sensitive medical equipment and prevents potential disruptions that could compromise patient safety. As the healthcare sector continues to embrace digitalization and connectivity, the demand for shielding materials in medical applications is expected to increase further.

Another key driver of the EMI shielding material industry is the expansion of the automotive and aerospace industries, where electronic components play a crucial role in vehicle safety, navigation, and communication systems. The increasing integration of advanced driver-assistance systems (ADAS), electric vehicle (EV) components, and in-flight communication technologies has heightened the need for robust EMI shielding solutions. In the automotive sector, shielding materials such as conductive plastics, coated fabrics, and metal enclosures are essential to prevent interference that could affect critical vehicle systems. Similarly, in aerospace applications, EMI shielding is vital to protect avionics and ensure the smooth operation of aircraft communication and control systems.

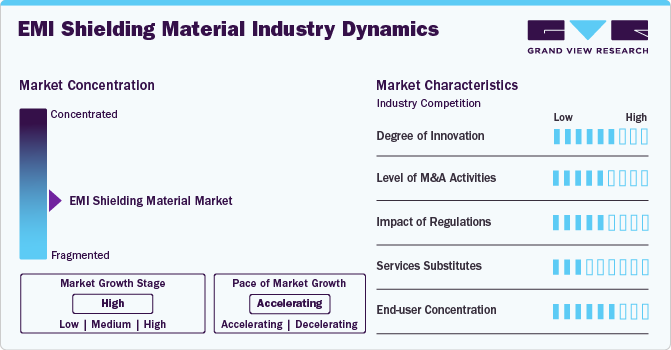

Market Concentration & Characteristics

The global EMI (Electromagnetic Interference) shielding materials market is characterized by a moderate to high level of market concentration, with key players focusing on technological advancements and product innovations to gain a competitive edge. The degree of innovation in this market is significant, driven by the increasing demand for high-performance shielding materials in consumer electronics, automotive, aerospace, and telecommunications industries. Companies are investing in the development of lightweight, flexible, and high-conductivity materials, such as conductive coatings, metalized fabrics, and advanced polymer composites, to enhance shielding effectiveness while meeting stringent industry requirements. The integration of nanotechnology and advanced conductive fillers, including graphene and carbon nanotubes, has further expanded the market’s innovation landscape, offering enhanced EMI shielding capabilities with minimal impact on weight and form factors.

Regulatory frameworks and environmental standards play a crucial role in shaping the EMI shielding material industry. Stringent regulations by agencies such as the Federal Communications Commission (FCC) in the U.S., the European Union’s EMC Directive, and other global regulatory bodies mandate strict electromagnetic compatibility (EMC) requirements for electronic devices and automotive components. Compliance with these regulations has driven manufacturers to adopt sustainable and RoHS-compliant materials that minimize environmental impact while maintaining superior shielding performance. Although there are limited service substitutes for EMI shielding materials, emerging alternatives such as software-based shielding techniques and embedded shielding solutions within electronic circuits pose potential competition. However, the end-user concentration remains strong in the consumer electronics and automotive sectors, where the rising demand for high-speed connectivity, autonomous vehicles, and miniaturized electronic components continues to fuel the adoption of EMI shielding solutions worldwide.

Product Insights

The conductive coatings & paints segment led the market and accounted for the largest revenue share of 32.7% in 2024, driven by the increasing demand for effective electromagnetic interference (EMI) shielding solutions across various industries. With the rapid expansion of consumer electronics, telecommunications, and automotive sectors, there is a growing need to protect sensitive electronic components from EMI, which can disrupt performance and reliability. Conductive coatings and paints, formulated with materials such as silver, copper, and nickel, provide efficient shielding by creating a conductive layer on electronic enclosures, circuit boards, and other critical components.

The conductive polymers segment is expected to grow at the fastest CAGR of 5.7% over the forecast period, driven by the increasing demand for lightweight, flexible, and cost-effective shielding solutions across various industries. Unlike traditional metal-based shielding materials, conductive polymers offer superior design flexibility, corrosion resistance, and ease of processing, making them highly suitable for modern electronic applications. With the rapid miniaturization of electronic devices and the growing complexity of circuit designs, the need for efficient EMI shielding solutions that can be integrated into compact and lightweight electronic components is rising. Conductive polymers, with their excellent electrical conductivity and adaptability, are becoming a preferred choice for manufacturers looking to enhance the electromagnetic compatibility (EMC) of their devices while maintaining design versatility.

End-use Insights

The consumer electronics segment dominated the market and accounted for the largest revenue share of 31.5% in 2024, as the increasing adoption of smart devices, wearables, and advanced computing systems necessitates effective electromagnetic interference (EMI) protection. The rapid expansion of the Internet of Things (IoT) and 5G-enabled devices has led to a significant rise in electronic components operating at higher frequencies, making them more susceptible to EMI-related performance issues. As a result, manufacturers are investing in advanced shielding materials, such as conductive coatings, metal enclosures, and composite-based solutions, to enhance device performance, reduce signal disruption, and comply with stringent electromagnetic compatibility (EMC) regulations.

Automotive segment is expected to grow at the fastest CAGR of 6.2% over the forecast period, driven by the rapid advancement of electronic components in modern vehicles. With the increasing adoption of electric vehicles (EVs), autonomous driving technologies, and advanced infotainment systems, the need for effective electromagnetic interference (EMI) shielding has become critical. Automotive manufacturers are integrating complex electronic control units (ECUs), sensors, and wireless communication systems into vehicles, which generate high levels of electromagnetic radiation. To ensure seamless operation and prevent signal disruptions, EMI shielding materials such as conductive coatings, metal enclosures, and shielding gaskets are being widely used in vehicle design, driving demand in the market.

Regional Insights

The healthcare sector in North America is another key driver for the EMI shielding material market. With the growing prevalence of medical devices that utilize advanced electronics, including diagnostic equipment, pacemakers, and imaging systems, the demand for EMI shielding has become crucial. Electromagnetic interference can compromise the performance and reliability of medical devices, which is particularly concerning in critical healthcare applications. As a result, the industry relies on high-quality EMI shielding materials to prevent interference and ensure the accuracy and safety of medical equipment. With the ongoing development of next-generation medical devices, the demand for specialized EMI shielding solutions is anticipated to increase, further boosting market growth.

U.S. EMI Shielding Material Market Trends

The aerospace and defense industries are also driving the demand for EMI shielding materials in the U.S. These industries require highly reliable, high-performance shielding materials to protect sensitive electronic components and ensure the safety and efficiency of their systems. In aerospace applications, EMI shielding is essential to prevent interference with avionics, communication systems, and radar equipment, which could have severe consequences in mission-critical operations. Likewise, in the defense sector, advanced military technologies, including communication systems, missile guidance, and electronic warfare equipment, all require effective EMI shielding to ensure operational reliability in complex electromagnetic environments. The U.S. government’s ongoing investments in defense and aerospace innovation continue to support the growth of the EMI shielding material market in these sectors.

Asia Pacific EMI Shielding Material Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 41.4% in 2024, driven by the rapid expansion of the region’s electronics and telecommunications industries. Countries such as China, Japan, South Korea, and India are key manufacturing hubs for consumer electronics, including smartphones, laptops, tablets, and wearable devices. As these electronic products become more advanced and compact, the risk of electromagnetic interference (EMI) increases, necessitating the use of high-performance EMI shielding materials. The growing production of consumer electronics in the region is a primary factor fueling the demand for EMI shielding solutions.

The EMI shielding material market in China is experiencing significant growth, driven by the rapid expansion of the country's electronics and telecommunications industries. As China continues to solidify its position as a global leader in consumer electronics manufacturing, the demand for high-performance electromagnetic interference (EMI) shielding solutions has surged. The increasing complexity of electronic devices, including smartphones, laptops, and smart home appliances, necessitates robust EMI shielding materials to ensure device functionality, minimize signal disruptions, and comply with stringent electromagnetic compatibility (EMC) regulations. This trend is expected to continue as China remains at the forefront of technological advancements in the electronics sector.

Europe EMI Shielding Material Market Trends

The Europe EMI shielding material market is experiencing significant growth, driven by the increasing demand for advanced electronics across various industries, particularly in automotive, telecommunications, and consumer electronics. The region's strong presence of automobile manufacturers adopting electric and autonomous vehicles has been a key factor contributing to the need for electromagnetic interference (EMI) shielding solutions. With the integration of complex electronic systems, including battery management systems, inverters, sensors, and communication modules, automotive companies in Europe are adopting sophisticated EMI shielding materials to ensure optimal performance and safety. The growing trend towards electric vehicles (EVs) and hybrid models is further boosting demand, as these vehicles incorporate numerous electronic components that require protection from electromagnetic interference.

The automotive sector in Germany plays a crucial role in driving the demand for EMI shielding materials. As a global leader in automotive manufacturing, the country is witnessing a significant rise in the integration of electronic systems in vehicles, including advanced driver-assistance systems (ADAS), infotainment systems, and electric powertrains. With the shift toward electric vehicles (EVs) and the development of autonomous driving technologies, there is an increasing need for shielding solutions to prevent electromagnetic interference. High-voltage components, such as battery management systems and inverters in EVs, require effective shielding to ensure their optimal performance. Furthermore, the increasing deployment of wireless technologies such as 5G and V2X communication in automobiles has amplified the need for reliable EMI shielding solutions, positioning the automotive sector as a key driver of market growth in Germany.

Latin America EMI Shielding Material Market Trends

The Latin American EMI shielding material market is being driven by the region's rapidly expanding automotive industry. With increasing investments in electric vehicles (EVs) and the integration of advanced electronic systems in traditional internal combustion engine vehicles, the demand for effective EMI shielding solutions has grown. Modern vehicles are equipped with various electronic components, such as sensors, control units, infotainment systems, and communication modules, all of which generate electromagnetic interference (EMI). To ensure the proper functioning of these components and compliance with regional electromagnetic compatibility (EMC) standards, automotive manufacturers in Latin America are increasingly adopting EMI shielding materials, driving growth in the market.

Middle East & Africa EMI Shielding Material Market Trends

The telecommunications industry in the Middle East & Africa is a key driver for the EMI shielding material market. With the expansion of 5G networks and the increasing number of mobile and internet-connected devices, the need for EMI shielding has become more pronounced. 5G infrastructure, which involves high-frequency signals, can cause electromagnetic interference, making EMI shielding essential for maintaining signal integrity and preventing disruptions. As telecom companies upgrade their networks and deploy new wireless communication technologies, the demand for EMI shielding solutions to protect communication equipment, base stations, and consumer devices is anticipated to rise.

Key EMI Shielding Material Company Insights

Some of the key players operating in the market include 3M, Parker Chomerics

-

3M Company is a global operator in innovative technologies, offering a broad range of products, including materials for the EMI shielding market. Known for its strong commitment to research and development, 3M provides high-performance shielding solutions for automotive, telecommunications, consumer electronics, and healthcare industries. Their product offerings include conductive adhesives, shielding films, metal foils, and tapes designed to prevent electromagnetic interference in electronic devices.

-

Parker Chomerics, a division of Parker Hannifin, specializes in the development of electromagnetic interference (EMI) shielding and thermal management solutions. They offer a comprehensive portfolio of materials designed to protect electronic devices and systems from EMI, including conductive elastomers, metal-filled gaskets, conductive fabrics, and EMI shielding coatings. Their products are widely used across industries such as automotive, aerospace, telecommunications, and industrial electronics.

Dow, ETS-Lindgren are some of the emerging market participants in EMI shielding material market.

-

Dow Inc is a multinational corporation known for its diverse product offerings, including advanced materials for EMI shielding. Their portfolio includes silicone-based EMI shielding materials, conductive elastomers, and specialized adhesives designed for use in automotive, telecommunications, consumer electronics, and other high-tech industries. Dow’s materials are engineered to deliver excellent shielding performance while maintaining flexibility and ease of use in complex designs.

-

ETS-Lindgren, a subsidiary of ESCO Technologies, is a global leader in the field of electromagnetic interference (EMI) shielding and testing solutions. Their product offerings include high-performance shielding materials, anechoic chambers, and test equipment for a variety of industries. ETS-Lindgren’s shielding solutions are specifically designed for telecommunications, aerospace, automotive, and healthcare sectors. They offer conductive coatings, shielding enclosures, and EMI gaskets to protect sensitive electronics from electromagnetic interference. With decades of experience, ETS-Lindgren is known for its expertise in providing customized solutions that meet the stringent regulatory and performance requirements of the EMI shielding market.

Key EMI Shielding Material Companies:

The following are the leading companies in the EMI shielding material market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Parker Chomerics

- Dow Inc

- ETS-Lindgren

- Henkel AG & Co. KGaA

- Kitagawa Industries

- Laird Technologies Inc.

- Leader Tech Inc.

Recent Developments

-

In February 2025, Molex introduced a new range of ruggedized EMI-filtered interconnects and RF components designed to address the growing demand for reliable electromagnetic interference (EMI) shielding in harsh environments. These innovative solutions are specifically engineered to provide enhanced protection against EMI while maintaining high performance in critical applications such as automotive, aerospace, telecommunications, and industrial electronics.

EMI Shielding Material Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.7 billion

Revenue forecast in 2030

USD 11.4 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil

Key companies profiled

3M Company; Parker Chomerics; Dow Inc; ETS-Lindgren; Henkel AG & Co. KGaA; Kitagawa Industries; Laird Technologies Inc.; Leader Tech Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global EMI Shielding Material Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global EMI shielding material market report based on product, end-use and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Conductive Coatings & Paints

-

Conductive Polymers

-

Metal Shielding Product

-

EMC/EMI Filters

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Telecommunications & Information Technology

-

Healthcare

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global EMI shielding material market size was estimated at USD 8.3 billion in 2024 and is expected to reach USD 8.7 billion in 2025.

b. The global EMI shielding material market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 11.4 billion by 2030.

b. The consumer electronics segment dominated the market and accounted for the largest revenue share of 31.5% in 2024, as the increasing adoption of smart devices, wearables, and advanced computing systems necessitates effective electromagnetic interference (EMI) protection.

b. Some of the key players operating in the EMI Shielding Material market include 3M Company, Parker Chomerics, Dow Inc, ETS-Lindgren, Henkel AG & Co. KGaA, Kitagawa Industries, Laird Technologies Inc., and Leader Tech Inc.

b. The key factors that are driving the EMI Shielding Material market include the increasing demand for electronic devices, the rise in wireless communication technologies, regulatory standards for electronic safety, and the growing need for automotive and industrial applications with advanced shielding solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.