- Home

- »

- Next Generation Technologies

- »

-

Enterprise IoT Market Size, Share & Growth Report, 2030GVR Report cover

![Enterprise IoT Market Size, Share & Trends Report]()

Enterprise IoT Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software & Solutions, Services), By Enterprise Type (SMEs, Large Enterprise), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-012-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise IoT Market Size & Trends

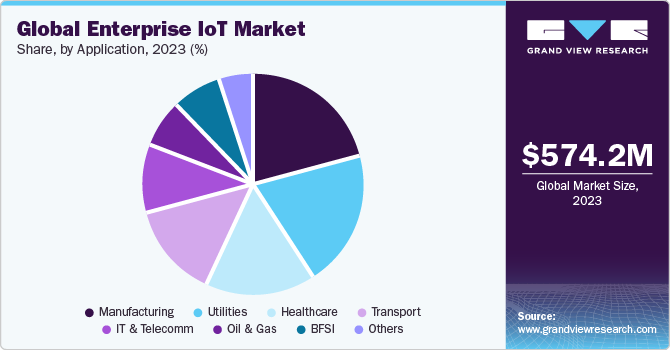

The global enterprise IoT market size was estimated at USD 574.2 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.1% from 2024 to 2030. The growth of the market is anticipated to be propelled by the evolution of technologies like Bluetooth, Wi-Fi, Insteon, ZigBee, and others. These technologies serve as the foundational infrastructure for IoT implementations, enabling seamless connectivity and communication between devices. As businesses increasingly recognize the value of real-time data insights and operational efficiency, they are embracing IoT solutions to enhance their processes and decision-making.

Major industry participants, including Cisco, PTC, and Amazon Web Services, play a pivotal role in propelling the growth of the market. These companies are at the forefront of innovation, consistently introducing innovative IoT solutions that cater to the evolving needs of businesses. Their strategic emphasis on developing advanced technologies and platforms contributes significantly to creating a robust ecosystem for IoT adoption. The competitive landscape stimulated by these key players fosters an environment of innovation and pushes the boundaries of what is achievable in the realm of enterprise IoT.

The demand for IoT solutions is further accentuated by the growing awareness among businesses about the potential benefits of digital transformation. Companies are increasingly recognizing the need to harness the power of connected devices to optimize their operations, improve efficiency, and gain a competitive edge. This awareness is translating into a surge in investments in IoT infrastructure and solutions across various industry verticals. From manufacturing and healthcare to logistics and smart cities, enterprises are integrating IoT to drive productivity, reduce costs, and enhance overall business performance.

The strategic partnerships and collaborations between telecom giants and technology companies are also instrumental in fostering the growth of the market. For instance, in February 2022, AT&T collaborated with IBM Corporation to explore the transformative possibilities of 5G, wireless networking, and edge computing. Such partnerships aim to leverage the strengths of each entity to create synergies that accelerate the development and deployment of IoT solutions. These collaborative efforts not only advance the technological capabilities of IoT but also expand the reach of these solutions to a broader market.

Moreover, the increasing prevalence of edge computing is significantly influencing the growth trajectory of the market. Edge computing brings computation and data storage closer to the source of data generation, reducing latency and enabling real-time processing. This paradigm shift is particularly crucial for applications that demand low latency, such as industrial automation and autonomous vehicles. The integration of edge computing with IoT enhances the overall efficiency of connected systems and opens new possibilities for innovative use cases.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to advancements in connectivity technologies like Bluetooth, Wi-Fi, and others. Major industry players consistently introduce leading-edge solutions, fostering a competitive landscape. Ongoing collaborations, increased awareness of digital transformation benefits, and the integration of edge computing contribute to a dynamic environment, sustaining a high level of innovation.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Companies are strategically aligning to strengthen their IoT capabilities, broaden service offerings, and capitalize on emerging opportunities. This trend underscores the ongoing consolidation and collaboration shaping the competitive landscape of enterprise IoT.

The market is also subject to increasing regulatory scrutiny. This is due to concerns about the potential negative impacts of IoT, such as cyber-attacks, privacy violations, and interoperability issues. As a result, governments around the world are developing regulations for the safety of end users and the protection of their data privacy. These regulations could have a significant impact on the market, affecting the development and adoption of IoT technologies.

The threat of substitutes is low as there are a limited number of direct product substitutes for IoT technology. However, advancements in cloud computing, edge computing, or artificial intelligence may offer organizations alternative ways to achieve connectivity, data processing, and analytics, potentially reducing the perceived necessity of implementing resolute IoT solutions thereby posing a limited threat to the market growth.

End-user concentration in market is diverse and widespread, reflecting the broad applicability of IoT solutions across various industries such as manufacturing, healthcare, energy, and transportation among others. While large enterprises with expansive operations constitute a significant portion of the end-user base, smaller businesses are increasingly adopting tailored IoT solutions.

Application Insights

The manufacturing sector accounted for the largest revenue share in 2023. The rise of the concept of Industry 4.0 has propelled manufacturers to embrace IoT technologies, fostering a paradigm shift in production processes. Manufacturers can achieve unprecedented levels of efficiency, real-time monitoring, and predictive maintenance through the integration of smart sensors, connected devices, and data analytics. IoT applications in manufacturing extend across the entire value chain, from supply chain optimization and predictive maintenance to quality control and inventory management. This comprehensive approach enhances productivity, reduces downtime, and minimizes operational costs. The adoption of IoT in manufacturing facilitates the creation of smart factories where machines communicate seamlessly, leading to agile and responsive production environments.

The transport sector is expected to witness significant growth in the market. This surge can be attributed to the increasing integration of IoT technologies to revolutionize transportation and logistics. The deployment of IoT solutions in the transport sector facilitates real-time tracking, predictive maintenance, and operational optimization. Fleet management systems, connected vehicles, and smart logistics are becoming integral components, enhancing efficiency and safety. Enterprises in the transport sector are increasingly recognizing the transformative potential of IoT with a focus on improving supply chain visibility, reducing transit times, and minimizing costs. The adoption of IoT in transportation not only enhances asset utilization but also contributes to sustainability efforts through fuel efficiency and emissions monitoring.

Regional Insights

North America dominated the market and accounted for a 33.42% share in 2023. The early adoption of new technologies, including big data, IoT, ML, AI, cloud computing, and mobility in the region is poised to propel market expansion. North America's dominance is supported by the presence of well-established technology firms, advanced infrastructure, and a strong focus on innovation. This dominance is further amplified by the escalating demand for connected devices, intelligent solutions, and data analytics applications across various sectors like manufacturing, healthcare, and transportation. Moreover, businesses in the region are actively integrating IoT technologies into their operations to enhance operational efficiency. The concerted efforts of the US government to promote the adoption of immersive technologies are contributing to the region's increasing market share in enterprise IoT.

Asia Pacific is anticipated to witness significant growth in the market. The rapid expansion is fueled by the burgeoning industrial sector, rising adoption of digital technologies, and increasing investments in IoT infrastructure. Countries such as China, India and Japan are leading in terms of IoT deployments in industries such as retail, energy, and manufacturing with an increased adoption of automation and modern technology across various sectors to combat growing labor costs. The region's IoT market receives a boost from increased government initiatives promoting the use of connected devices, substantial investments from major players in the IoT market as well as the increasing use of mobile 5G services, which will be aided by rising need for smart city platforms.

Component Insights

Hardware component led the market and accounted for 45.64% of the global revenue in 2023 and is likely to dominate the market over the forecast period. The hardware segment encompasses a wide array of devices such as sensors, switches, routers, gateways, embedded ICs, etc. crucial for the seamless integration of IoT solutions into existing infrastructure. The demand for robust and efficient hardware has surged across various industries, such as manufacturing, logistics, and healthcare, where sensors and connected devices play a pivotal role in data acquisition and transmission. As businesses recognize the transformative potential of IoT, investments in high-quality hardware have become imperative to ensure reliable connectivity, real-time monitoring, and accurate data analytics.

The software & solution segment is expected to register the fastest CAGR during the forecast period. The growth can be attributed to the increasing recognition of the pivotal role software plays in maximizing the potential of IoT deployments. As organizations strive for greater operational efficiency, the demand for sophisticated software solutions facilitating seamless device connectivity, data analytics, and real-time monitoring is escalating. The software segment encompasses diverse offerings, including IoT platforms, analytics tools, and security solutions, all contributing to the integration and management of IoT ecosystems.

Conversely, significant growth is anticipated in the services segment in the future, driven by managed service providers facilitating the widespread adoption of IoT technology through service-oriented solutions. These solutions play a pivotal role in managing manufacturing operations, deploying front-end solutions, and identifying optimal components tailored to specific business requirements.

Enterprise Type Insights

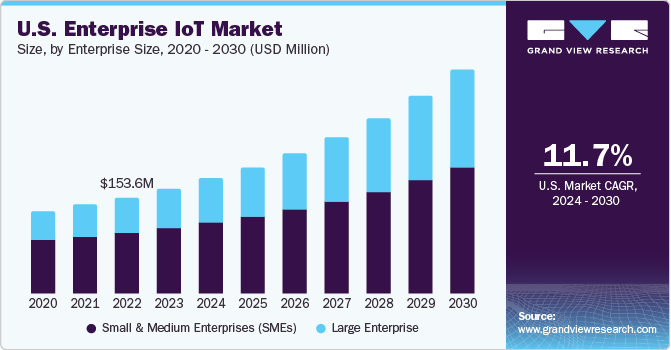

The small and medium sized enterprises (SMEs) segment accounted for the largest the market share in 2023 and is predicted to lead the market from 2024 to 2030. This robust adoption of SMEs can be attributed to the growing accessibility of cost-effective IoT solutions, tailored to the specific needs and budget constraints of smaller enterprises. The ability of IoT to offer real-time data insights, facilitate process automation, and improve decision-making resonates particularly well with the resource optimization needs of SMEs. Additionally, the rise in government initiatives aimed at fostering the digital growth of small and medium-sized businesses is contributing to the market's expansion. Governments are making substantial investments in IoT for innovative projects across diverse sectors, including infrastructure and defense.

The large enterprise segment is expected to register the fastest CAGR during the forecast period. This growth is attributed to the extensive resources, capabilities, and organizational complexities of large enterprises, enabling them to invest significantly in IoT adoption. These organizations leverage IoT technologies to enhance operational efficiency, optimize supply chains, and improve overall business processes. The scalability and flexibility of IoT solutions make them particularly attractive to large enterprises seeking comprehensive digital transformations. As these organizations prioritize innovation and digital integration across various departments, the demand for sophisticated IoT applications, including advanced analytics and real-time monitoring, is expected to surge.

Key Companies & Market Share Insights

Some of the key players operating in the market include Intel Corporation; Cisco Systems Inc.; and Advantech Co. Ltd.

-

Intel Corporation operates in the semiconductor industry, specializing in microprocessors and hardware components. Its processors power various industry verticals including personal computing, data centers, cloud computing, and IoT devices.

-

Cisco Systems Inc. operates in the networking and communications equipment industry, offering solutions for networking, security, cloud and collaboration. It also caters to diverse industry verticals such as telecommunication, IT, healthcare, finance, and more.

-

Advantech Co. Ltd., Laird Connectivity, and PTC Inc. are some of the emerging market participants in the enterprise IoT market.

-

Advantech Co. Ltd. is a Taiwan based embedded and automation products and solutions provider. The company serves various industry verticals, such as manufacturing, healthcare, transportation, and retail. Advantech offers solutions, including embedded systems, industrial automation, networking, and intelligent systems.

-

Laird Connectivity streamlines wireless connections through innovative RF modules, System-On-Modules, internal antennas, IoT devices, and tailored wireless solutions. Their clientele spans diverse industry sectors, including manufacturing, healthcare, transportation, and agriculture.

Key Enterprise IoT Companies:

- Advantech Co. Ltd.

- Aeris Communications, Inc.

- Amazon.com, Inc

- Cisco Systems, Inc.

- Intel Corporation

- Laird Connectivity

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Qualcomm Technologies, Inc.

- Robert Bosch, Inc.

- Siemens AG

Recent Developments

-

In June 2023, Advantech Co. Ltd. launched IoTMart International, an innovative cross-border digital commerce platform. IoTMart is a newly created online business service aimed at meeting the diverse needs of different customer groups with a primary focus on small and medium-sized customers.

-

In March 2023, Aeris Communications, Inc. announced the closing of the purchase of IoT Connected Vehicle Cloud (CVC) and Accelerator (IoT-A) businesses from Ericsson. The company aims to offer a unified IoT connectivity management service platform to customers worldwide.

-

In February 2023, Qualcomm Technologies, Inc. launched a new platform called Aware to provide a new standard for the IoT and assist businesses in enhancing operational efficiencies. As per the Aware cloud platform, large enterprises deploying IoT sensors can now connect globally and access real-time connection and data analytics.

Enterprise IoT Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 642.3 million

Revenue forecast in 2030

USD 1.42 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; UAE; South Africa

Key companies profiled

Advantech Co. Ltd.; Aeris Communications, Inc; Amazon.com, Inc; Cisco Systems, Inc.; Intel Corporation; Laird Connectivity; Microsoft Corporation; Oracle Corporation, PTC Inc.; Qualcomm Technologies, Inc.; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise IoT Market Report Segmentation

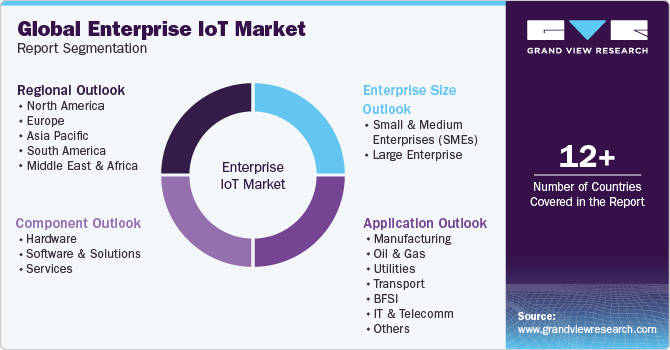

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise IoT market report based on component, enterprise size, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Solutions

-

Surveillance & Security

-

Network & Connectivity Management

-

Data Management

-

Application Management

-

Device Management

-

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Oil & Gas

-

Utilities

-

Transport

-

BFSI

-

IT & Telecomm

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise IoT market size was estimated at USD 574.2 million in 2023 and is expected to reach USD 642.3 million in 2024.

b. The global enterprise IoT market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 1.42 billion by 2030.

b. North America dominated the enterprise IoT market with a share of 33.42% in 2023. This is attributable to the early adoption of IoT technologies across various industry verticals in the region in order to improve proficiency in operation and better outputs.

b. Some key players operating in the enterprise IoT market include Amazon.com, Inc., Cisco Systems, Inc., IBM Corporation, Intel Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Siemens AG, PTC Inc., among others.

b. The adoption of enterprise IoT for applications such as remote management services, producing operational intelligence, among others drives the market growth. In addition, the advancement of Enterprise IoT solutions enhances the collaboration between humans and machines to improve operational productivity, safety, and efficiency, thereby creating demand for enterprise IoT solutions among end users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.