- Home

- »

- Next Generation Technologies

- »

-

Environmental Technology Market Size & Share Report, 2030GVR Report cover

![Environmental Technology Market Size, Share & Trends Report]()

Environmental Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Application, By Technological Solutions (Greentech/Renewable Energy, Carbon Capture), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-111-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Environmental Technology Market Summary

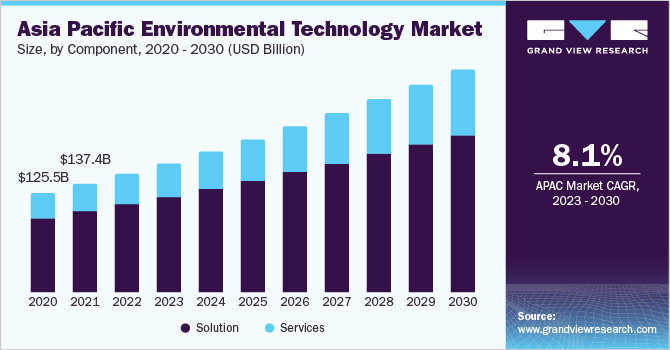

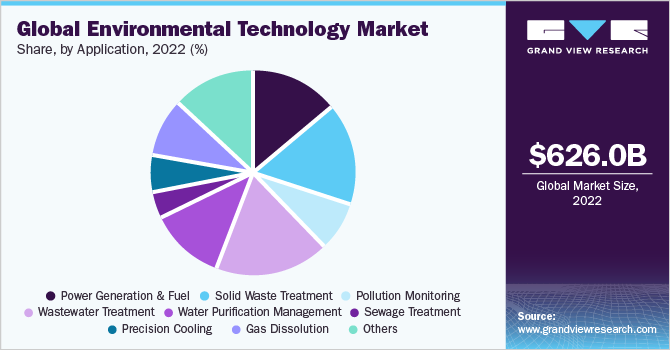

The global environmental technology market size was estimated at USD 626.02 billion in 2022 and is projected to reach USD 955.84 billion by 2030, growing at a CAGR of 5.3% from 2023 to 2030. Environmental technology refers to the use of scientific and engineering principles to develop technologies that can aid in addressing environmental concerns and encourage sustainable development.

Key Market Trends & Insights

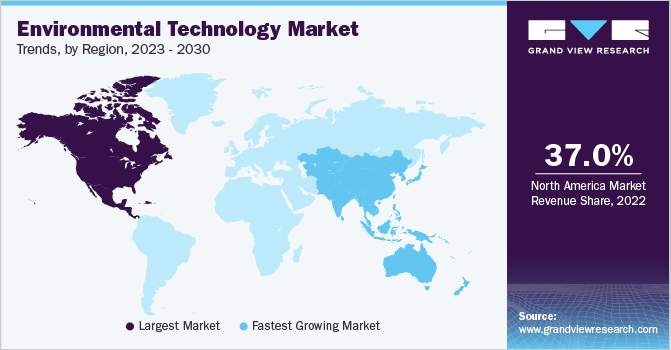

- North America dominated the market in 2022, accounting for over 37% share.

- By component, the solution segment led the environmental technology market in 2022, accounting for over 72% share.

- By application, The wastewater treatment segment led the market in 2022, accounting for over 17% share.

- By technology solugtions, the waste valorization/recycling & compositing segment held the largest revenue share of over 11% in 2022.

- By vertical, the energy & utilities segment held the largest revenue share of over 14% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 626.02 Billion

- 2030 Projected Market Size: USD 955.84 Billion

- CAGR (2023-2030): 5.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

These technologies can take many forms, such as pollution control devices, renewable energy systems, water treatment processes, and waste management techniques. Environmental technology aims to decrease the negative impact of human activity on the earth and build a healthier, cleaner, and more sustainable environment. It is an interdisciplinary field that blends skills and knowledge from various fields, such as chemistry, biology, engineering, physics, and environmental science. Overall, environmental technology is a vital tool in the battle against pollution, climate change, and other environmental challenges.

The cost savings presented by environmental technologies is a significant driver of growth in the market. Enterprises and customers can lower energy costs by implementing energy-efficient practices and embracing renewable energy sources. Additionally, waste reduction and enhanced efficiency can lead to cost savings in the long period. As renewable energy prices continue to decrease, more companies are expected to implement clean environmental technologies, further driving the growth of the market.

Furthermore, the growing awareness of environmental issues plays a vital role in driving the expansion of the market. As people become more aware of the negative consequences of human activities on the environment, there has been a rising demand for innovative solutions that can mitigate these impacts and promote sustainable practices. Additionally, as governments and businesses recognize the benefits of investing in sustainable solutions, they will likely continue supporting and driving innovation in the environmental sector. For instance, in July 2023, The United Nations Environment Programme (UNEP) partnered with Massive Earth Foundation (MEF) to launch LowCarbon. Earth (LCE) 2023, a climate tech accelerator. By focusing on climate change and pollution reduction, the LCE 2023 accelerator could provide a platform for passionate startup founders to access resources, mentorship, and funding to develop and scale their projects.

Component Insights

The solution segment led the environmental technology market in 2022, accounting for over 72% share of the global revenue owing to the increasing demand for technologies that can address environmental challenges effectively. Environmental technology encompasses a wide range of solutions to mitigate human activities impact on the environment and promote sustainable development. These technologies may include waste management systems, renewable energy sources, energy-efficient products, and water and air pollution control technologies. As the environment continues to degrade, there is a growing recognition of the need to find innovative solutions to repair and mitigate the damage caused by human activities. This recognition has sparked increased research and development efforts in the environmental sector.

The services segment is estimated to grow significantly over the forecast period. The market study services include water, waste management, energy, and industrial services. As businesses and governments become more conscious of the significance of environmental protection and sustainable development, they are turning to environmental technology providers to assist them in attaining their objectives. This has led to increased demand for these services, which help identify areas where they can reduce their environmental impact and improve their sustainability practices.

Application Insights

The wastewater treatment segment led the market in 2022, accounting for over 17% share of the global revenue. This high share can be attributed to the growing importance of addressing water pollution and managing wastewater. Wastewater treatment involves removing contaminants and pollutants from industrial, domestic, and agricultural wastewater before being discharged into the environment. As industrial activities expand, populations grow, and urbanization increases, the generation of wastewater has surged, making appropriate treatment necessary for safeguarding water resources and public health.

The water purification management segment is estimated to grow significantly over the forecast period. The increasing awareness of water scarcity and the need for clean and safe water has driven the demand for water purification technologies and solutions. Contamination of water sources from agricultural runoff, industrial discharge, and improper waste disposal poses significant environmental and health risks. Water purification management becomes crucial to remove pollutants and ensure water safety.

Technological Solutions Insights

The waste valorization/recycling & compositing segment held the largest revenue share of over 11% in 2022. The waste valorization/recycling & composting segment encompasses various technologies and processes that aim to extract value from waste materials through recycling, composting, and other resource recovery methods. This process helps divert waste from landfills, contributes to resource conservation, and reduces the overall environmental impact of waste disposal. Increased investments and advancements in recycling and composting technologies are likely to drive the segment's expansion and donate to more reliable and sustainable waste management practices globally.

The Greentech/renewable energy segment is predicted to foresee significant growth in the forecast period. The Greentech/renewable energy segment encompasses various technologies and practices, including wind, solar, geothermal, hydropower, bioenergy, and more. The increasing global emphasis on sustainable development, the need to address climate change, and lower reliance on fossil fuels have driven the demand for renewable energy technologies and green solutions. Furthermore, enterprises and industries are increasingly adopting renewable energy to meet their sustainability goals and reduce their carbon footprint, driving demand for Greentech solutions.

Vertical Insights

The energy & utilities segment held the largest revenue share of over 14% in 2022. The global shift towards renewable energy sources, such as wind, solar, and hydro, has driven investments in renewable energy infrastructure and technologies. The energy & utilities segment encompasses various technologies and solutions to optimize energy production, distribution, and consumption while minimizing environmental footprint. Key areas within this segment include smart grid solutions, renewable energy integration, energy-efficient technologies, and sustainable water and wastewater management.

The food & beverages segment is predicted to foresee significant growth in the forecast period. Sustainability is now crucial in the food and beverage (F&B) industry. Climate change effects, crop failure, logistics issues, and drought are all factors in rising global food insecurity. The F&B industry needs greater efficiency in transporting food from surplus points to places of shortage or famine. Products in the F&B sector have a very short life span, meaning product recycling and disposal options are a significant part of eco-friendly purchase decisions. Enterprises are vigorously promoting their recyclable packaging.

Regional Insights

North America dominated the market in 2022, accounting for over 37% share of the global revenue owing to a strong emphasis on environmental protection and sustainable development. The region has a high awareness among companies and consumers regarding environmental issues, which has driven the implementation of new environmental technologies. Additionally, the government in the region has invested significantly in the research and development of new environmental technologies and demonstrated robust support for environmental conservation. For instance, in January 2023, Honda Motor Co., Ltd., a Japanese public multinational conglomerate manufacturer of motorcycles, automobiles, and power equipment, announced sales targets of electrified vehicles in North America, intending to make fuel-cell electric and battery-electric vehicles demonstrate 100% of its vehicle sales by 2040. This initiative is a part of the company’s continued commitment to advances in safety and environmental technology.

Asia Pacific is anticipated to register the fastest CAGR over the forecast period owing to factors such as population growth, rapid industrialization, and increasing environmental awareness. The region has a large and expanding renewable energy sector, particularly in countries such as India and China. The region has a strong focus on renewable energy and energy-efficient buildings that have propelled the implementation of environmental technologies in the region. The region's strong economic growth has resulted in increased consumption, industrial activities, and urban development, leading to a rise in environmental challenges that need to be addressed.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in January 2023, Flipkart launched Flipkart Green, a dedicated e-store for sustainable products. Including 30,000 sustainable products on the platform is a significant step towards promoting environmentally friendly consumer choices and supporting global sustainability efforts. The company aims to provide its customers easy access to a wide range of globally certified sustainable items. This move will likely increase awareness about the importance of choosing eco-friendly products and encourage more people to make environmentally responsible purchasing decisions. Some of the prominent players in the global environmental technology market include:

-

AECOM

-

Lennox International Inc.

-

Teledyne Technologies Incorporated

-

Thermo Fisher Scientific Inc.

-

Abatement Technologies

-

Waste Connections

-

Biffa ltd

-

Svante Technologies Inc.

-

Carbon Clean Solutions Limited

-

Veolia Environment SA

Environmental Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 664.02 billion

Revenue forecast in 2030

USD 955.84 billion

Growth rate

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, technological solutions, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

AECOM; Lennox International Inc.; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc.; Abatement Technologies; Waste Connections; Biffa ltd; Svante Technologies Inc.; Carbon Clean Solutions Limited; Veolia Environnement SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global environmental technology market report based on component, application, technological solutions, vertical, and region.

-

Environmental Technology Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

Water Services

-

Waste Management Services

-

Energy Services

-

Industrial Services

-

-

-

Environmental Technology Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Power Generation & Fuel

-

Solid Waste Treatment

-

Pollution Monitoring

-

Wastewater Treatment

-

Water Purification Management

-

Sewage Treatment

-

Precision Cooling

-

Gas Dissolution

-

Others

-

-

Environmental Technology Technological Solutions Outlook (Revenue, USD Billion, 2017 - 2030)

-

Waste Valorization/Recycling & Compositing

-

Nuclear Energy

-

Data Center Cooling

-

Desalination

-

Greentech/Renewable Energy

-

Photovoltaic

-

Wind Energy

-

Geothermal Power

-

Carbon Capture (CCUS)

-

Bioremediation

-

Others

-

-

Environmental Technology Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential/Municipal

-

Industrial

-

Energy & Utilities

-

Transportation & Logistics

-

Oil & gas

-

Food & Beverages

-

Construction & Building Materials

-

Retail & Consumer goods

-

Government

-

Others

-

-

Environmental Technology Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental technology market size was estimated at USD 626.02 billion in 2022 and is expected to reach USD 664.02 billion in 2023.

b. The global environmental technology market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 955.84 billion by 2030.

b. North America dominated the environmental technology market with a share of 38.3% in 2022. This is attributable to a strong emphasis on environmental protection and sustainable development. The region has a high awareness among companies and consumers regarding environmental issues, which has driven the implementation of new environmental technologies.

b. Some key players operating in the environmental technology market include AECOM; Lennox International Inc.; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc.; Abatement Technologies; Waste Connections; Biffa ltd; Svante Technologies Inc.; Carbon Clean Solutions Limited; Veolia Environnement SA

b. Key factors that are driving the environmental technology market growth include the growing awareness of environmental issues and the cost savings offered by environmental technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.