- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe Digestive Health Products Market, Industry Report, 2030GVR Report cover

![Europe Digestive Health Products Market Size, Share & Trends Report]()

Europe Digestive Health Products Market Size, Share & Trends Analysis Report By Product (Dairy Products, Bakery & Cereals), By Ingredient (Prebiotics, Probiotics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

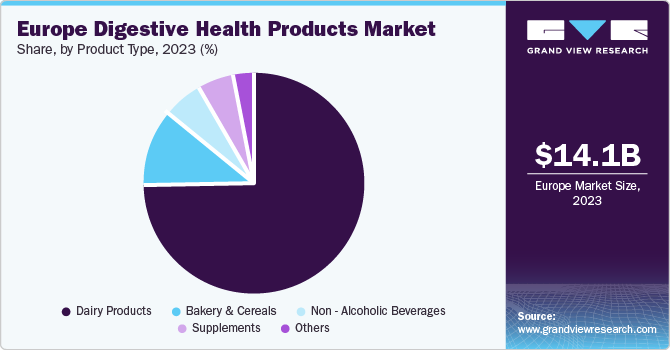

The Europe digestive health products market size was estimated at USD 14.11 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The market growth is driven by growing consumer awareness about the link between gut health and overall well-being. Another key factors driving the growth of the European market is the high rates of pancreatitis reported in countries such as Finland, Poland, Scotland, and Spain. This is due in part to the aging European population, which is more susceptible to gastrointestinal diseases and disorders. As a result, European consumers are increasingly seeking natural and effective solutions to support their digestive health. This has led to an increased demand for dietary supplements, functional foods, and other products containing natural ingredients, such as probiotics, prebiotics, fiber, and enzymes.

Europe digestive health products market accounted for the share of 27.34% of the global digestive health products market in 2023.

Growing technological innovations in the sector also offers lucrative opportunities for the players operating in the digestive health products market. The Federation of European Nutrition Societies (FENS) and the European Society for Clinical Nutrition and Metabolism (ESPEN) fund and invest in various nutritional foods and nutraceutical businesses, and govern and grant for business in the nutrition sector, respectively.

These initiatives have encouraged participants in the digestive health products market to develop highly beneficial and new innovative products, which drives the growth of the market. For instance, technological advancements in the development of probiotics, prebiotics, and other digestive health supplements have made it easier to formulate more effective products that can provide targeted support to specific digestive issues.

Market players are adopting various strategies to gain a competitive edge in the growing Canadian market. For instance, in May 2022, BioGaia, a Swedish biotechnology company, announced that it would be starting its distribution channel for probiotics in Germany. BioGaia's decision to sell probiotics under its own management in Germany is a strategic move in line with its overall goal of increasing B2C sales and strengthening its position in the probiotics market

Market Concentration & Characteristics

The Europe digestive health products market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Product innovations and technological advancements are expected to be major factors attributable to the expansion of the market over the forecast period. Probiotics now have diverse applications, such as probiotic drinks, probiotic dairy products, probiotic supplements, and probiotic cosmetics, as well as in animal agriculture, especially aquaculture.

Market players are adopting various strategies, such as collaborations and product portfolio expansion, to gain a competitive edge in the growing market. For instance, in August 2022, Yeo Valley Organic introduced kefir drinks to its 'Love Your Gut' yogurt line in the U.K. The range of kefir drinks is available in three flavors: natural, cherry, and mango & passionfruit. It contains a blend of 14 distinct culture strains. Similarly, in February 2022, Remedy, a kombucha brand based in the U.K., introduced a new flavor variant called Remedy Kombucha Wild Berry.

The European Commission has stated the terms prebiotic probiotic and wellbeing and health claims require approval to be utilized, which has not been allowed in any event, following many applications. In this way, the use of these terms on product labels was banned. Since prebiotics and probiotics constitute an important part of digestive health products, its ban impacted the sales of several prebiotics and probiotics manufacturers. On the contrary,the support of authoritative bodies such as the European Commission and the EPA toward the production and consumption of naturally-derived ingredients is likely to act in favor of the digestive health products market. This scenario has pushed manufacturers to use naturally-derived ingredients.

Product Type Insights

The dairy products segment accounted for a revenue share of around 74.3% in 2023.Digestive health ingredients are often used in dairy products because these ingredients improve digestibility and nutritional value and provide a range of health benefits. For instance, dairy products such as yogurt and kefir are often fortified with probiotics to improve digestive health and strengthen the immune system. These probiotics balance the bacteria in the gut, improve digestion, and alleviate symptoms of certain digestive disorders such as irritable bowel syndrome (IBS). In addition, other digestive health ingredients, such as enzymes and fibers, are added to dairy products to improve their nutritional value and digestibility. For instance, lactase enzyme may be added to lactose-free milk products to help individuals who are lactose intolerant digest lactose more easily.

The supplements segment is expected to grow at a CAGR of 8.1% over the forecast period. Growing number of aging population coupled with rising consumer spending on products that improve the health is expected to boost segment’s growth. Ingredient suppliers and supplement manufacturers are increasingly focusing on product innovation and collaborations to expand their product portfolio according to consumers’ nutritional needs. In September 2022, Garden of Life, a Nestle Health Science's probiotics brand, expanded its product line by launching two probiotics specifically formulated to promote kids' growth and immunity. These products were introduced in China's offline retail market. Furthermore, in June 2021, Probi, a probiotic supplier, partnered with Oriflame to launch a global probiotic supplement that promotes general gut health. The supplement will feature a scientifically-proven probiotic strain and a custom formulation based on Probi's Probi Digestis concept, which aims to support healthy digestion.

Ingredient Insights

The probiotics segment accounted for a revenue share of 87.3% in 2023. The popularity of probiotic ingredients in healthy food and nutritional supplements is attributed to the growing consumer awareness of their potential health benefits, such as supporting immune function, improving digestive health, reducing inflammation, and promoting mental health. This trend is driven in part by a growing concern about health and wellness, as well as an increasing desire for natural and healthy dietary options. Furthermore, probiotic ingredients are believed to have a positive impact on a range of health issues, including allergies, autoimmune disorders, and mental health. As such, they are increasingly being incorporated into a wide range of products, including yogurts, kefir, and other fermented foods, as well as dietary supplements and other health products.

The food enzymes segment is projected to grow at a CAGR of 8.3% from 2024 to 2030. The multi-functionality of food enzymes and the growing demand for enzyme cultures from the food & beverage industry are expected to drive the segment growth over the forecast period. Food enzymes are mainly used in dairy product manufacturing and processing. They are used extensively across the food industry to enhance the quality, texture, and flavor of various products. The application areas in the food industry include traditional ones like baking, brewing, and cheese making, as well as newer areas such as modification of fat and development of new sweeteners.

Country Insights

In 2023, the Europe digestive health products market accounted for a revenue share of 27.34% in global digestive health products market. Increasing consumer awareness and aging population are the key factors to boost regional growth over the forecast period.

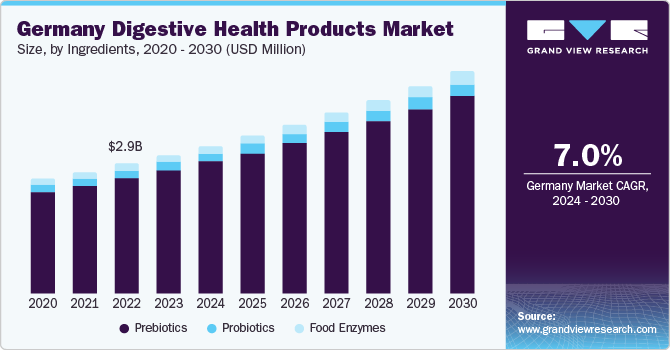

Germany Digestive Health Products Market Trends

The digestive health products market in Germany is expected to grow at a CAGR of 7.0% over the forecast period. Growing demand for natural, specialty, and organic food items in Germany, particularly among high-income consumers. These consumers are willing to pay a premium price for products that are perceived as healthier or more environmentally friendly. As a result, food items containing digestive health ingredients like probiotics, prebiotics, and food enzymes have become increasingly popular among consumers looking for natural and organic alternatives to conventional products. Additionally, Germany's well-established supply network for daily consumable and commercial food items has made it a stable market for businesses entering the digestive health products market. The increasing population in Germany has also led to a flourishing food and beverages retail sector, creating opportunities for market growth.

U.K. Digestive Health Products Market Trends

The digestive health products market in the U.K. is expected to grow at a CAGR of 7.8% over the forecast period. the rising demand for nutritional supplements, pet food, and functional food & beverages in the country. Digestive health products offer several benefits such as prevention of intestinal diseases, weight management, and mitigation of digestion issues, which consumers are increasingly recognizing in the country. A significant population of lactose-intolerant consumers in the U.K. is also a key reason for the growth of the probiotic market in the country. Companies such as Nestlé SA, Danone, and Yakult are key players operating in the probiotic market segment in the U.K.

Key Europe Digestive Health Products Company Insights

Some of the key players operating in the market include BASF SE, Chr. Hansen Holding A/S, andArla Foods amba

-

BASF SE manufactures chemicals, functionalmaterials, and agricultural products.BASF operates through the following segments: Chemicals, Industrial Solutions, Materials, Surface Technologies, Nutrition & Care, and Agricultural Solutions.

-

Chr. Hansen Holding A/Sis a bioscience company engaged in manufacturing probiotics strains and enzymes, cultures, and natural color-based products. The company was founded in 1874 and is located in Hørsholm, Denmark. The probiotics products of the company are used in dietary supplements, infant formulas, and fermented milk products.

Nestle SA, Bayer AG, andSanofi are some of the other participants in the Europe digestive health products market,

-

Nestle S.A. is a food and drinks manufacturing company. It was formed as a result of the merger between the Anglo-Swiss Condensed Milk Company and Henri Nestlé, both founded in 1866. The company is headquartered in Vaud, Switzerland.

-

Sanofi is a multinational pharmaceutical company. The company specializes in the research, development, manufacturing, and marketing of pharmaceutical products, vaccines, and healthcare solutions. The firm’s consumer healthcare unit is responsible for over-the-counter products, dietary supplements, and medical devices.

Europe Digestive Health Products Companies:

- BASF SE

- Chr. Hansen Holding A/S

- Arla Foods amba

- Nestle SA

- Bayer AG

- Sanofi

- Danone

- ADM

- Evonik

- General Mills

- Amway

Recent Developments

-

In February 2023, ADM, a company renowned for its science-based nutrition solutions, opened a cutting-edge production facility in Valencia, Spain, worth more than USD 30 million. The new facility has been established to cater to the increasing demand for probiotics, postbiotics, and other products that promote health and wellness.

-

In February 2023, Evonik completed the modernization and expansion of its probiotics production facilities in León, Spain. This upgrade will allow the company to meet the growing demand for its probiotic products, including Fecinor, Ecobiol, and GutCare.

Europe Digestive Health Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.11 billion

Revenue forecast in 2030

USD 23.02 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, ingredient, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

BASF SE; Chr. Hansen Holding A/S; Arla Foods amba; Nestle SA; Bayer AG; Sanofi; Danone; ADM; Evonik; General Mills; Amway

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Digestive Health Products Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe digestive health products market report based on product, ingredient, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy Products

-

Bakery & Cereals

-

Non - Alcoholic Beverages

-

Supplements

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotics

-

Probiotics

-

Food Enzymes

-

Animal Based

-

Plant Based

-

Microbial Based

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The Europe digestive health products market size was estimated at USD 14.11 billion in 2023 and is expected to reach USD 15.11 billion in 2024.

b. The Europe digestive health products market is expected to grow at a compounded growth rate of 7.3% from 2024 to 2030 to reach USD 23.03 billion by 2030.

b. The dairy products segment accounted for a revenue share of around 74.3% in 2023. Digestive health ingredients are often used in dairy products because these ingredients improve digestibility and nutritional value and provide a range of health benefits. For instance, dairy products such as yogurt and kefir are often fortified with probiotics to improve digestive health and strengthen the immune system.

b. Some key players operating in the Europe digestive health products market include BASF SE; Chr. Hansen Holding A/S; Arla Foods amba; Nestle SA; Bayer AG; Sanofi; Danone; ADM; Evonik; General Mills; Amway

b. Key factors that are driving the Europe digestive health products market growth include growing consumer awareness about the link between gut health and overall well-being. Another key factors driving the growth of the European market is the high rates of pancreatitis reported in countries such as Finland, Poland, Scotland, and Spain.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."