- Home

- »

- Next Generation Technologies

- »

-

Europe Drone (UAV) Market Size, Industry Report, 2033GVR Report cover

![Europe Drone (UAV) Market Size, Share & Trends Report]()

Europe Drone (UAV) Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Product, By Technology, By Payload Capacity, By Power Source, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-655-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Drone (UAV) Market Size & Trends

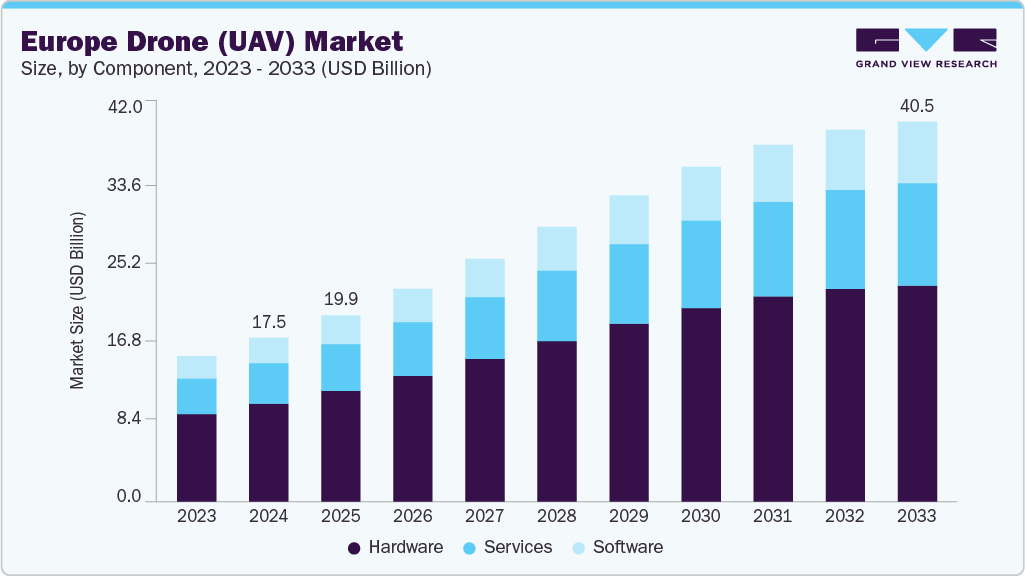

The Europe drone (UAV) market size was estimated at 17,478.4 million in 2024 and is projected to reach USD 40,486.7 million by 2033, growing at a CAGR of 9.3% from 2025 to 2033. This growth includes the rapid adoption of drones across agriculture, infrastructure inspection, and logistics sectors. Advancements in battery technology and lightweight materials enable longer flight durations and greater payload capacities. The rise of smart city initiatives and increased investment in 5G infrastructure further enhance drone connectivity and real-time data transmission. Supportive regulatory frameworks and growing funding for drone startups across Europe are accelerating innovation and adoption in both commercial and government applications.

Stringent regulatory frameworks across the European Union for UAV safety, licensing, and airspace integration are major growth drivers for the Europe drone (Unmanned Aerial Vehicle ) industry. These regulations aim to ensure safe and responsible drone operations while enabling commercial applications. Harmonized policies such as the EU Drone Strategy 2.0 encourage the development of unified drone traffic management systems (UTM) and cross-border drone operations, fueling innovation and adoption across the continent.

Additionally, the increasing use of drones in industries such as agriculture, energy, construction, and logistics is expanding the demand for both commercial UAV platforms and supporting services. In agriculture, drones (UAV) are being deployed for crop monitoring, precision spraying, and yield estimation, while the energy and utilities sector is using them for infrastructure inspections and maintenance. These applications are significantly improving operational efficiency and reducing costs, accelerating market penetration across Western and Eastern Europe.

Furthermore, the rise of autonomous and AI-powered unmanned aerial vehicles (UAVs) is revolutionizing the capabilities of drone systems. The integration of machine learning and computer vision is enabling drones to conduct complex tasks such as real-time object detection, autonomous navigation, and predictive maintenance. These advancements are particularly useful in sectors like search and rescue, environmental monitoring, and border surveillance, where intelligent UAV systems reduce human intervention and enhance accuracy.

Moreover, the continuous R&D investments by leading aerospace companies and startups are driving technological breakthroughs in battery life, lightweight materials, swarm intelligence, and hybrid propulsion systems. For example, in March 2025, Airbus UTM partnered with Thales to develop a next-generation U-Space air traffic control system to support real-time UAV traffic management across Europe. Such initiatives are laying the foundation for a fully scalable and secure drone ecosystem, pushing the market toward sustained growth in the coming years.

Component Insights

The hardware segment accounted for the largest market share of over 59% in 2024, driven by the surge in demand for high-performance drone platforms, payloads, and flight-critical components across both commercial and defense sectors. In Europe, the emphasis on robust, mission-specific UAV hardware such as propulsion systems, navigation modules, and payload delivery systems is being propelled by increasing adoption in sectors like border surveillance and precision agriculture. Stringent EU regulations on drone safety and airworthiness are compelling OEMs to invest in durable, scalable, and regulation-compliant hardware systems, solidifying the dominance of this segment in the Europe drone industry.

The services segment is expected to witness the fastest CAGR of over 10% from 2025 to 2033, owing to the growing demand for drone-as-a-service (DaaS) models across Europe. These services enable organizations to access drone capabilities for surveying, inspection, surveillance, and delivery without investing in hardware or pilot training. Europe's increasing focus on urban air mobility (UAM), emergency response support, and smart city infrastructure is driving the need for managed drone services, fleet maintenance, real-time data analysis, and compliance management. The rise of specialized service providers offering end-to-end drone (unmanned aerial vehicle) operations is expected to significantly fuel growth in this segment.

Product Insights

The multi-rotor segment accounted for the largest market share in 2024. This growth can be attributed to its superior maneuverability, vertical takeoff and landing (VTOL) capabilities, and ease of deployment in confined or complex environments. In Europe, multi-rotor UAVs are widely used for applications such as infrastructure inspection, law enforcement surveillance, agricultural monitoring, and emergency response due to their stability and precision in hovering. Their cost-effectiveness and compatibility with high-resolution imaging systems make them ideal for both commercial and public sector use. The growing demand for real-time data collection in urban areas and the expansion of drone-as-a-service providers have further reinforced the dominance of the multi-rotor segment in the Europe UAV (unmanned aerial vehicle) market.

The hybrid segment is expected to register the fastest CAGR from 2025 to 2033, owing to its unique ability to combine the long-range endurance of fixed-wing UAVs with the vertical takeoff and landing (VTOL) capabilities of rotary drones. In Europe, this versatility is increasingly valued across both defense and commercial sectors for missions requiring efficient deployment in confined or remote areas such as infrastructure inspection, border surveillance, and emergency response. The growth is further fueled by advancements in battery efficiency, lightweight composite materials, and AI-powered navigation systems, making Europe unmanned aerial vehicle industry more reliable and cost-effective.

Technology Insights

The remotely operated segment dominated the market with the largest share in 2024, owing to its high adaptability across both commercial and government applications where manual control and real-time decision-making are crucial. This segment is particularly favored in missions requiring human oversight, such as law enforcement surveillance, border patrol, and industrial inspections, where unpredictable conditions demand precise operator intervention. The lower cost and regulatory simplicity of remotely operated drones make them more accessible for enterprises and public agencies. The widespread use of these drones is expected to drive segmental growth in the coming years.

The fully autonomous segment is expected to register the fastest CAGR from 2025 to 2033. This growth is primarily driven by Europe’s increasing emphasis on automation, safety, and operational efficiency across both civilian and defense sectors. Fully autonomous UAVs are being adopted for missions that require minimal human intervention, such as long-range border surveillance, critical infrastructure monitoring, and emergency response in hazardous environments. European regulations are evolving to support beyond visual line of sight (BVLOS) operations, further encouraging the deployment of fully autonomous systems for scalable, high-efficiency UAV applications.

Payload Capacity Insights

The up-to-2KG segment dominated the market with the largest share in 2024, primarily due to its widespread use across commercial, governmental, and recreational applications. These lightweight drones offer greater operational flexibility, ease of deployment, and are compliant with less stringent regulatory restrictions, making them more accessible to users. Advancements in miniaturized sensors and high-resolution cameras have enabled even small drones to deliver professional-grade performance, further reinforcing the dominance of the up-to-2KG payload capacity segment in the Europe drone (UAV) industry.

The 2KG to 19KG segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by its optimal balance between payload capacity and operational flexibility. Drones in this weight range are widely adopted for applications such as industrial inspections and defense surveillance where moderate payloads like high-resolution cameras and thermal sensors are essential. European regulatory frameworks support drones under 25KG, making the 2KG to 19KG category a practical choice for both commercial and government operators, reinforcing its high growth potential across diverse European climates and use cases.

Power Source Insights

The battery-powered segment dominated the market with the largest share in 2024, owing to its lightweight design, operational simplicity, and suitability for various commercial and defense applications. In Europe, growing environmental concerns and regulations favor low-emission technologies, making electric-powered UAVs more attractive than other countries. The rapid advancement in lithium-ion and solid-state battery technologies has extended drone flight times and payload capacities, enhancing operational efficiency. The lower maintenance requirements and ease of deployment associated with battery-powered drones are driving their widespread adoption in regional sectors.

The hydrogen fuel cell segment is expected to register the fastest CAGR from 2025 to 2033. Growing demand for long-endurance UAVs across defense, infrastructure inspection, and environmental monitoring applications is driving interest in hydrogen-powered drones. Hydrogen fuel cells offer significantly longer flight times and faster refueling compared to traditional lithium-ion batteries, making them ideal for extended missions without increasing payload weight. Europe’s commitment to green energy and carbon neutrality aligns with the zero-emission profile of hydrogen fuel cells, encouraging adoption through regulatory support and funding. These factors are expected to boost the deployment of hydrogen-powered UAVs across European markets over the coming years.

End Use Insights

The military segment dominated the market with the largest market share in 2024, driven by the growing demand for advanced surveillance, intelligence, and tactical capabilities across European defense forces. Heightened geopolitical tensions, rising investments in defense modernization programs, and growing cross-border security concerns have accelerated the adoption of unmanned aerial vehicles (UAVs) for reconnaissance. Collaborations between leading defense manufacturers and government agencies and the development of indigenous UAV platforms under European defense initiatives reinforce the military segment’s leadership in the regional market.

The consumer segment is projected to grow at the fastest CAGR from 2025 to 2033, driven by increasing demand for recreational drones, aerial photography, and consumer-grade surveillance. Growth is being fueled by wider availability of affordable, user-friendly drones equipped with high-resolution cameras and GPS-based flight stabilization. Government initiatives promoting responsible drone use such as digital registration systems and geofencing regulations are improving public confidence and enabling broader adoption. Technological advancements in battery life and autonomous flying features are further enhancing the consumer drone experience and accelerating market expansion across Europe.

Country Insights

UK Drone (UAV) Market Trends

The UK drone (UAV) market accounted for the largest market share of over 24% in 2024. In the UK, rapid adoption of drones across industries such as infrastructure inspection, public safety, and agriculture has significantly driven market growth. Government-backed initiatives like the Future Flight Challenge and the establishment of drone corridors for advanced air mobility have created a strong, regulatory, and innovative friendly environment. Major investments in drone logistics trials, such as medical delivery projects in remote areas, demonstrate growing public sector engagement. The rise of domestic drone tech startups and collaborations with academic institutions are further fueling R&D and commercial deployment across the country. These factors are expected to propel the UK drone (UAV) market in the coming years.

Germany Drone (UAV) Market Trends

The Germany drone (UAV) market is expected to witness steady growth at a CAGR of over 9% from 2025 to 2033, driven by strong government support, advanced manufacturing capabilities, and robust industrial demand. Germany’s strategic focus on integrating drones into Industry 4.0 has spurred adoption across sectors like agriculture, construction, logistics, and infrastructure inspection. The country’s emphasis on safety regulations and pilot training programs is fostering a structured and scalable drone ecosystem. Ongoing investments in UAV traffic management systems and public-private collaborations are positioning Germany as a leading hub for commercial and industrial drone (UAV) innovation in Europe.

France Drone (UAV) Market Trends

The France drone (UAV) market is expected to witness steady growth at a CAGR of over 10% from 2025 to 2033, driven by increasing adoption across commercial sectors such as agriculture, infrastructure inspection, logistics, and public safety. Government initiatives supporting drone innovation, coupled with evolving regulations that streamline drone operations, are further propelling market expansion. Additionally, advancements in autonomous flight technologies, AI-based analytics, and battery efficiency are enhancing the capabilities of drones, encouraging broader enterprise and municipal usage. The rise in demand for aerial data collection and surveillance in both urban and rural applications also contributes to the market’s sustained growth trajectory.

Key Europe Drone (UAV) Company Insights

Some of the key players operating in the market include AIRBUS and Leonardo S.p.A., among others.

-

AIRBUS is a dominant force in the Europe drone (UAV) industry, known for its advanced unmanned systems for both defense and commercial applications. The company’s portfolio includes the Zephyr high-altitude pseudo-satellite (HAPS) and its role in the Eurodrone MALE (Medium Altitude Long Endurance) program, a joint European initiative. Airbus is also actively developing urban air mobility solutions and drone traffic management systems, solidifying its leadership in both surveillance and future aerial logistics.

-

Leonardo S.p.A. is a leading player in the Europe drone (UAV) market, offering a range of tactical and surveillance drones tailored for military and border control operations. Its Falco drone family has been widely deployed for ISR (Intelligence, Surveillance, Reconnaissance) missions across Europe and internationally. Leonardo’s focus on autonomous capabilities, sensor integration, and interoperability with defense systems has positioned it as a key UAV provider for European governments and NATO operations.

QUANTUM-SYSTEMS GMBH and Elistair are some of the emerging participants in the Europe drone (UAV) market.

-

QUANTUM-SYSTEMS GMBH is an emerging player in the European UAV market, specializing in vertical take-off and landing (VTOL) drones with extended range and endurance. Its flagship product, the Trinity Pro, is widely used for mapping, defense surveillance, and environmental monitoring. With a hybrid fixed-wing design and AI-enabled data processing, Quantum-Systems is gaining traction among defense and commercial clients across Europe.

-

Elistair is an innovative drone technology company gaining prominence for its tethered UAV solutions. These drones offer extended flight duration and secure, stable surveillance ideal for law enforcement, military, and critical infrastructure monitoring. Elistair’s flagship products, such as the Orion and Safe-T series, are deployed across multiple European countries, making it a fast-rising player in the perimeter security and persistent surveillance segments.

Key Europe Drone (UAV) Companies:

- AIRBUS

- Parrot Drones SAS.

- Leonardo S.p.A.

- Thales Group

- BAE Systems

- Safran Electronics & Defense

- Dronevolt

- QUANTUM-SYSTEMS GMBH

- Elistair

- Delair

Recent Developments

-

In June 2025, Parrot Drones SAS. launched the ANAFI UKR GOV, a lightweight ISR micro-UAV developed specifically for the defense and public safety sectors in Europe. Weighing under 1 kg, the drone is equipped with advanced features such as 35× optical zoom, 4K HDR video capture, thermal imaging, and autonomous tracking capabilities. Designed for tactical surveillance and rapid deployment, this new UAV model addresses the growing need for compact, high-performance aerial intelligence tools across European security forces, reinforcing Parrot's position as a key innovator in the Europe unmanned aerial vehicle (UAV) industry.

-

In February 2025, Delair introduced the hybrid-electric DT46 UAV platform in partnership with Ascendance, significantly advancing endurance capabilities in the Europe UAV market. Unveiled at the Paris Air Show, the DT46 offers over 5.5 hours of VTOL flight time, catering to long-duration missions in sectors such as infrastructure monitoring, defense, and environmental surveying. Delair revealed the DT61, a long-range fixed-wing drone with a 7-hour flight time and a range exceeding 100 kilometers, underscoring its commitment to high-performance UAV solutions for European industrial and governmental applications.

-

In January 2025, Leonardo S.p.A. announced a strategic partnership with Turkey's Baykar to integrate its advanced radars, jammers, and infrared systems into Baykar’s TB2 drones. This cross-border collaboration enhances the technological capabilities of UAVs used in defense applications and reflects Europe’s growing emphasis on sensor-rich, interoperable drone platforms. The partnership marks a significant step in strengthening Europe’s presence in the Europe drone (UAV) industry.

Europe Drone (UAV) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19,865.8 million

Revenue forecast in 2033

USD 40,486.7 million

Growth Rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, technology, payload capacity, power source, end use, country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

AIRBUS; Parrot Drones SAS.; Leonardo S.p.A.; Thales Group; BAE Systems.; Safran Electronics & Defense; Dronevolt; QUANTUM-SYSTEMS GMBH; Elistair; Delair

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Drone (UAV) Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe drone (UAV) market report based on component, product, technology, payload capacity, power source, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Frames

-

Control System

-

Power & Product System

-

Camera System

-

Navigation System

-

Transmitter

-

Wings

-

Others

-

-

Software

-

Services

-

Integration & Engineering

-

Maintenance & Support

-

Training & Education

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed-Wing

-

Multi-rotor

-

Single-Rotor

-

Hybrid

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Remotely Operated

-

Semi-autonomous

-

Fully Autonomous

-

-

Payload Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 2KG

-

2KG to 19KG

-

20KG to 200KG

-

Over 200KG

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Battery-Powered

-

Gasoline-Powered

-

Hydrogen Fuel Cell

-

Solar

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer

-

Prosumer

-

Toy/Hobbyist

-

Photogrammetry

-

-

Commercial

-

Inspection/Maintenance

-

Mapping & Surveying

-

Photography/Filming

-

Surveillance & Monitoring

-

Localization/Detection

-

Spraying/Seeding

-

Others

-

-

Military

-

Intelligence, Surveillance, Target Acquisition, And Reconnaissance (ISTAR)

-

Communication

-

Combat Operations

-

Military Cargo Transport

-

Precision Strikes

-

Others

-

-

Government & law enforcement

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe drone (UAV) market size was valued at USD 17,478.4 million in 2024 and is expected to reach USD 19,865.8 million in 2025.

b. The Europe drone (UAV) market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2033 to reach USD 40,486.7 million by 2033.

b. The hardware segment accounted for the largest market share of over 59% in 2024, driven by the surge in demand for high-performance drone platforms, payloads, and flight-critical components across both commercial and defense sectors.

b. Some key players operating in the Europe drone (UAV) market include AIRBUS, Parrot Drones SAS., Leonardo S.p.A., Thales Group, BAE Systems., Safran Electronics & Defense, Dronevolt, QUANTUM-SYSTEMS GMBH, Elistair, Delair.

b. The rapid adoption of drones across sectors such as agriculture, infrastructure inspection, and logistics, growing advancements in battery technology and lightweight materials and the rise of smart city initiatives and increased investment in 5G infrastructure are the key factors driving the Europe drone (UAV) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.