- Home

- »

- Animal Health

- »

-

Europe Veterinary 3D Printing Market, Industry Report, 2030GVR Report cover

![Europe Veterinary 3D Printing Market Size, Share & Trends Report]()

Europe Veterinary 3D Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Implants, Masks), By Animal (Dogs, Cats), By Application (Orthopedics, Surgical Planning), By Material (Metals, Ceramics), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-543-9

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Veterinary 3D Printing Market Trends

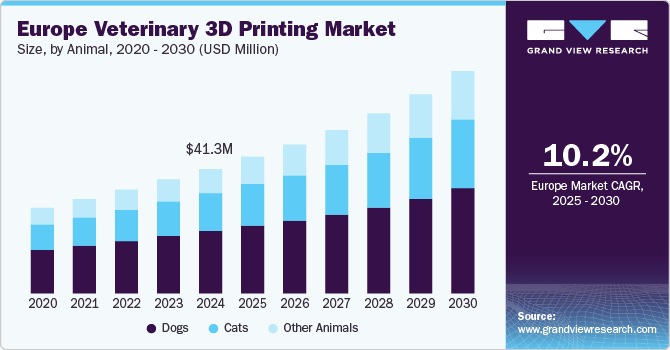

The Europe veterinary 3D printing market size was valued at USD 41.3 million in 2024 and is projected to grow at a CAGR of 10.2% from 2025 to 2030. Rising integration of 3D printing in veterinary practice, initiatives by veterinary institutions to promote the use of advanced technologies, emerging applications in veterinary education & drug development, and increasing penetration of 3D printing technology into multiple species are some of the major factors driving the growth of the Europe veterinary 3D printing industry.

3D printing is increasingly integrated into veterinary practice due to its ability to create customized, animal-specific solutions using CAD software. It is currently utilized to manufacture prosthetics, orthotics, and anatomical models for surgical planning. It is also being increasingly integrated for veterinary educational purposes. It enhances learning by providing realistic anatomical models for training. Additionally, 3D printing aids recovery with tools like masks for wound healing and fracture support. In the last few years, the adoption of this technology has been rising exponentially, especially in regions like the U.S. and Europe, where pet expenditures are very high compared to others. This factor facilitates the sector's growth by prompting pet owners to increasingly opt for this technology to solve their pet's health complications.

For instance, as per March 2025, reports from the UK's Royal (Dick) School of Veterinary Sciences, veterinary neurosurgeons from the hospital removed a rare brain tumor from an eight-year-old cocker spaniel named Lordy. Lordy had developed Cushing's syndrome due to a tumor on his pituitary gland. An MRI and CT scan revealed the tumor's growth and potential to invade other brain areas. A 3D-printed model of Lordy's brain and tumor was created using CT images to assist in the surgery planning. This model was used to guide the surgeons during the procedure to locate the optimal access point, allowing them to drill a precise hole through the dog’s soft palate to remove the tumor. The utilization of 3D printing enhanced the surgical precision of veterinary professionals.

In another March 2025 report from Grove Veterinary Hospital in the UK, a 3-year-old Labrador named Floyd regained mobility after pioneering 3D-printed surgery to correct a severe congenital limb deformity. The dog was born with carpal valgus, resulting in misaligned radius and ulna bones, causing its paws to turn outward. Collaborating with Vet3D, the hospital used CT scans to design a 3D-printed surgical guide for precise bone realignment. Specialist surgeons performed staged surgeries on the front legs, referred the guides to reposition bones, and secured them with plates and screws. Post-surgery, the dog walked comfortably within days and fully recovered in three months. The veterinary experts at the hospital highlighted how 3D printing enhanced surgical accuracy, calling it “revolutionary” for treating limb deformities.

Such instances highlight the increasing integration of 3D printing into veterinary practice and its transformative potential in improving surgical precision and patient outcomes. This technology enables the creation of customized surgical guides, anatomical models, and implants tailored to individual cases, facilitating complex procedures with enhanced accuracy. By bridging diagnostic imaging and surgical execution, 3D printing supports innovative approaches to treating challenging conditions, such as congenital deformities and tumors. As adoption grows globally, it is set to revolutionize the veterinary practice by advancing treatment quality and animal recovery.

Applications

Challenges

3D printed masks for assistance in surgical wounds.

Limited availability of some materials.

Custom designed implants.

3D image generation for printing challenging in small animals and complex cases.

Creating complex implants like prosthetics & orthotics.

Compliance issues from animal owner and veterinarians.

3D models for surgical planning .

Long term biocompatibility testing crucial in some materials

3D models for academic training purposes.

Complications related to regulatory approvals

Application under research in veterinary drug development.

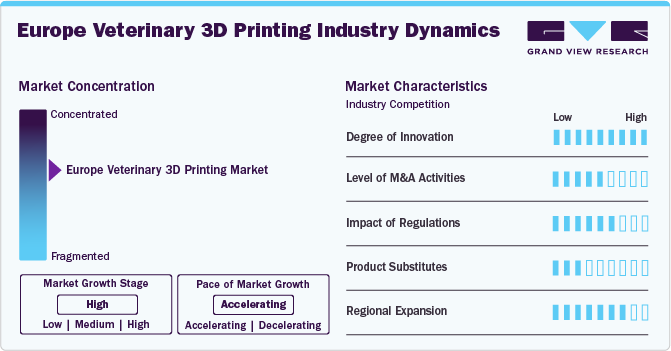

Market Concentration & Characteristics

The level of innovation in this market is exceptionally high, driven by ongoing research aimed at integrating 3D printing into veterinary care for a broader range of species, including horses, livestock, wildlife, and exotic animals, beyond the currently well-established market for dogs and cats.

The market is characterized by low merger and acquisition (M&A) activity; however, it is experiencing significant growth, with numerous startups entering the industry and established 3D printing companies expanding into the veterinary sector.

The regulatory environment requires approval or clearance processes involving clinical data collection and post-market surveillance. Due to ambiguous guidelines, there is a crucial need for international regulatory harmonization and clear labeling and usage instructions. These factors add complexity to introducing 3D-printed products in clinical settings, requiring a thorough understanding of animal anatomy and adherence to regulatory standards to address the specific anatomical challenges posed by various species.

The influence of product substitutes in the veterinary industry is anticipated to be minimal due to the limited number of companies offering specialized veterinary products. However, ongoing research and development are expected to increase market competition as more companies gradually enter the sector. This growth in competition is likely to occur in the near future, driven by emerging companies and innovative research projects.

The regional expansion can be anticipated to be moderate. The Europe veterinary 3D printing industry is largely concentrated in developed European countries. However, with factors like increasing pet health expenditures and the penetration of health insurance, this scenario is set to change in the near future, with the usage of this technology penetrating smaller countries.

Product Insights

The implants segment held the highest market share of 31.96% in 2024. This segment includes 3D-printed veterinary implants such as TPLO and TPLA, which are increasingly popular due to their ability to be customized for diverse animal anatomies, improving surgical precision and outcomes. Technological advancements allow the use of biocompatible materials, enhancing implant integration and reducing rejection risks. These implants are also highly durable, making them suitable for high-stress applications in veterinary surgeries. Additionally, the rising prevalence of orthopedic procedures has further driven the demand for these innovative solutions, solidifying their role in modern veterinary medicine.

The anatomical models segment will experience the most significant growth during the forecast period. This growth is driven by the increasing adoption of artificial models in veterinary education and training, allowing students to hone skills such as surgery, anatomy, and physiology before working with live animals. Additionally, these models are gaining importance in pre-surgical planning and drug development, further enhancing their utility and demand in the veterinary field. For example, the Fraunhofer Institute for Interfacial Engineering and Biotechnology IGB from Germany manufactures 3D skin models. These models are applicable in human research and play a crucial role in veterinary pharmacy. They facilitate the accelerated development of animal drugs and formulations by providing a reliable, species-specific platform for assessing toxicity, skin penetration, and immune responses.

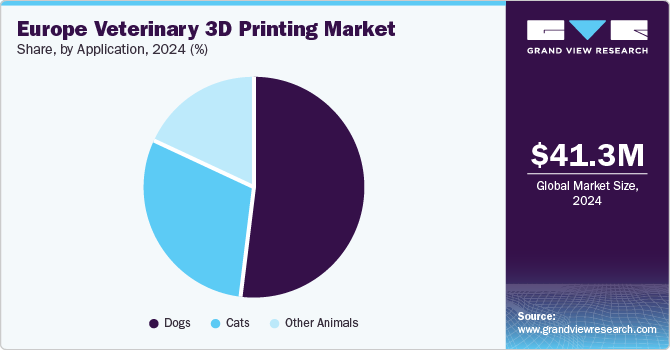

Animal Insights

In 2024, the dog segment accounted for the largest market share, as dogs are the most commonly adopted pets in the region and lead in healthcare spending. This trend encourages the adoption of new technologies in the veterinary field. For example, in October 2024, Lola, a 12-year-old labrador-spaniel, could walk again after receiving innovative surgery that utilized a 3D-printed plate to treat severe carpal instability.

The other animal segment, encompassing animals such as horses, turtles, birds, and livestock, is expected to grow at a rate exceeding 12% during the forecast period. This rapid expansion is driven by the increasing use of 3D printing in treating various conditions and the emergence of specialized companies that develop 3D-printed products tailored to specific species. For instance, an October 2023 article from the Vulture Conservation Foundation discussed using 3D printing by the Green Balkans, a Bulgarian NGO, in addressing various complications in various types of birds. The NGO partnered with Trakia University to use 3D printing to design and test multiple leg and beak prostheses in birds. In 2022, they released their first leg prostheses for white storks, with more currently in the pipeline. One prominent feature of this prosthesis is the GPS, showcasing the potential of technologically advanced prosthetics. They currently have beak prosthetics in the pipeline, and the project aims to expand to other species, highlighting the need for further funding to refine techniques and ensure broader applicability.

Application Insights

In 2024, the orthopedics segment accounted for the largest market share by application, driven by the technology's ability to create customized implants, orthotics, prosthetics, and surgical guides tailored to the unique anatomies of various animals. This innovation enhances surgical precision, shortens recovery times, and improves outcomes in complex orthopedic procedures, including joint replacements and limb deformities. Moreover, producing accurate 3D anatomical models supports better preoperative planning for orthopedic procedures, enabling veterinarians to address specific conditions in pets effectively. Other applications, such as surgical planning, dental implants, education, training, research, and masks, are gaining traction as they are relatively new to the market.

The surgical planning segment is projected to experience the fastest CAGR over the forecast period, due to the benefits of 3D printing. This technology allows for creating patient-specific anatomical models, enhances the visualization of complex structures, and enables customized surgical instruments and guides. Veterinarians can thoroughly study fractures or deformities, pre-contour implants, and rehearse surgical steps, reducing complications and improving outcomes. Additionally, 3D printing facilitates better communication between veterinarians and pet owners, shortens operation times, minimizes risks, and increases the success of surgical treatments.

Material Insights

In 2024, the metals segment held the largest market share, primarily due to their outstanding mechanical properties, strength, and durability, essential for producing reliable implants and prosthetics. Metals such as titanium, stainless steel, and cobalt chromium are biocompatible and corrosion-resistant, making them ideal for long-term animal use. The precision offered by metal 3D printing processes allows for creating complex geometries, which can significantly improve surgical outcomes. They are preferred over other materials due to their resilience for weight-bearing applications while ensuring biocompatibility for safe integration into the animal's body. Additionally, their ability to withstand the mechanical stresses of daily activity makes them well-suited for custom implants and prosthetics.

The other materials segment, which includes bone cement (such as PMMA and calcium carbonate) and experimental materials like biowaste, is expected to experience the fastest CAGR from 2025 to 2030. This growth is driven by these materials' biocompatibility and ability to aid in bone healing and regeneration. They may also improve the integration of implants with surrounding tissues, leading to better surgical outcomes. Furthermore, using these materials helps reduce environmental impact by providing cost-effective options for veterinary practices and animal owners. These materials offer a more natural, biologically compatible option for complex procedures, such as bone repairs and regenerative therapies, while supporting sustainable practices in the industry. Bone cement is also increasingly used to create custom implants and stabilize bone defects, offering more precise surgery solutions. It also plays a vital role in reducing post-surgery complications, enhancing the overall success of treatments.

End-use Insights

The hospitals and clinics segment dominated the veterinary 3D printing market in 2024, primarily due to their robust infrastructure and financial capacity to invest in or procure advanced 3D printing technologies. This enables them to develop tailored treatment plans that enhance animal recovery times and improve surgical outcomes. In contrast, academic institutions focus more on research and education, while animal rescue centers often lack the funding and expertise to adopt such innovations effectively. These factors contribute to the segment's leadership in leveraging 3D printing for personalized care and advanced veterinary solutions.

Academic and research institutions are expected to register the fastest CAGR due to the increasing use of 3D printing in education and training. 3D-printed models provide veterinary students with hands-on experience working with complex anatomical structures and surgical techniques before engaging with live animals. This method enhances skill by offering a better learning experience that helps them better understand anatomical details. Additionally, these institutions utilize 3D printing for research, creating models of damaged areas to improve decision-making and enhance early diagnosis in veterinary care while developing innovative products. The cost-effectiveness of producing models, particularly in university settings, further supports the integration of 3D printing into educational programs, equipping students for advanced veterinary practices.

Country Insights

The UK veterinary 3D printing market held the largest share of the Europe veterinary 3D printing industry, with more than 24% in 2024. The country's dominance can be attributed to factors such as the active involvement of veterinary practices in utilizing 3D printing technology to help resolve animal health problems and researchers fostering an innovative spirit to help improve upon the existing products. One such example is the January 2025 research project conducted by specialists from Manchester Veterinary Specialists. This research project evaluated using a 3D-printed guide for treating distal tibial varus deformity in the Dachshund dog breed. The study showed that 3D-printed, patient-specific osteotomy and reduction guides, with excellent clinical outcomes, enabled precise deformity correction. The approach allowed effective tibial alignment without needing bone grafts, promoting fast bone healing. The study highlights the potential of 3D printing in enhancing surgical accuracy and improving veterinary care.

Germany Veterinary 3D Printing Market Trends

The veterinary 3D printing market in Germany is estimated to show lucrative growth over the forecast period owing to growing competition in the country's competitive landscape with the emerging integration of advanced technologies. Furthermore, another subsequent market driver is the ongoing partnerships between key companies in the sector to develop advanced 3D-printed products for animals. For example, 3D Systems and Rita Leibinger Medical have jointly developed TTA RAPID, a 3D-printed titanium orthopedic knee implant for dogs with cruciate ligament issues since 2012. They have implanted these in nearly 10,000 dogs, enabling them to walk, run, and play within weeks.

Spain Veterinary 3D Printing Market Trends

The growth of the Spain veterinary 3D printing market is driven by initiatives taken by veterinary students in the country to assess the effectiveness of 3D printed models in veterinary education and training. For instance, according to the March 2025 published MDPI, researchers from multiple veterinary institutions across Spain jointly conducted a research project for evaluating veterinary students' perspectives on using 3D anatomical prints as educational tools in practical anatomy classes. The study received positive feedback, highlighting the benefits of practical learning and the ability to understand complex anatomical structures better. 3D prints enhanced engagement and provided a more interactive, hands-on experience than traditional methods. The study suggests that 3D prints can significantly improve veterinary education, offering a more dynamic and effective way to learn anatomy.

Key Europe Veterinary 3D Printing Company Insights

The market is currently less competitive due to the limited number of key manufacturers. However, competition is anticipated to grow rapidly as industry players engage in various activities, including product research and development, capacity expansion, partnerships, sales and marketing efforts, mergers and acquisitions, and introducing new products.

Key Europe Veterinary 3D Printing Companies:

- bio3Dvet

- WIMBA

- Vimian

- 3D Systems Inc.

- OrthoDesigns

- Ortho Vet 3D

- r3volutionD AG

- CABIOMEDE Vet

- Vet 3D

- Materialise

- Formlabs

Recent Developments

-

In March 2025, A Pittie pup received a custom 3D-printed prosthetic leg, enabling it to regain mobility after an amputation. The prosthesis was created using 3D scanning and printing technology, offering a personalized solution that helps the dog walk, run, and play again.

-

In February 2023, veterinarians at Highcroft Veterinary Referrals in Bristol, UK, developed a 3D-printed guide to assist with brain surgery for treating Cushing's disease in dogs. The guide, created from CT images, helps locate the pituitary gland for removal during hypophysectomy, offering a safer and more precise surgical approach.

Europe Veterinary 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.5 million

Revenue forecast in 2030

USD 73.9 million

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, application, material, end-use, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

bio3Dvet; WIMBA; Vimian; 3D Systems Inc.; OrthoDesigns; Ortho Vet 3D; r3volutionD AG; CABIOMEDE Vet; Vet 3D; Materialise; Formlabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Veterinary 3D Printing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe veterinary 3D printing market report based on product, animal, application, material, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Prosthetics & Orthotics

-

Anatomical Models

-

Masks

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Surgical Planning

-

Other Applications

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Ceramics

-

Polymers

-

Other Materials

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Academic & Research Institutions

-

Other End use

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

Frequently Asked Questions About This Report

b. The Europe veterinary 3D printing market size was estimated at USD 41.3 million in 2024 and is expected to reach USD 45.5 million in 2025.

b. The Europe veterinary 3D printing market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 73.9 million by 2030.

b. The UK held the largest market share of more than 24% in 2024. The country's dominance can be attributed to factors such as the active involvement of veterinary practices in utilizing 3D printing technology to help resolve animal health problems and researchers fostering an innovative spirit to help improve upon the existing products.

b. Some key players operating in the Europe veterinary 3D printing market include rising integration of 3D printing in veterinary practice, initiatives by veterinary institutions to promote the use of advanced technologies, emerging applications in veterinary education & drug development, and increasing penetration of 3D printing technology into multiple species.

b. Key factors that are driving the market growth include bio3Dvet, WIMBA, Vimian, 3D Systems Inc., OrthoDesigns, Ortho Vet 3D, r3volutionD AG, CABIOMEDE Vet, Vet 3D, Materialise, and Formlabs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.