- Home

- »

- Animal Health

- »

-

Veterinary 3D Printing Market Size, Industry Report, 2030GVR Report cover

![Veterinary 3D Printing Market Size, Share & Trends Report]()

Veterinary 3D Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Implants, Prosthetics & Orthotics), By Animal (Dogs, Cats), By Application (Orthopedics), By Material (Metals, Ceramics, Polymers), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary 3D Printing Market Summary

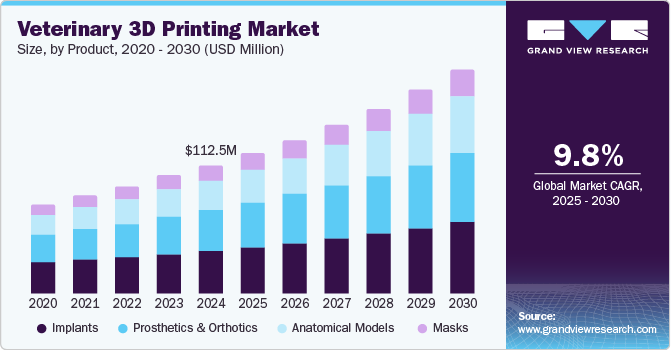

The global veterinary 3D printing market size was estimated at USD 112.5 million in 2024 and is projected to reach USD 196.2 million by 2030, growing at a CAGR of 9.82% from 2025 to 2030. Rising adoption of 3D printing in veterinary sciences, R&D initiatives, increasing application of 3D printing in veterinary surgical planning, and the emergence of novel applications are some of the major factors driving this market.

Key Market Trends & Insights

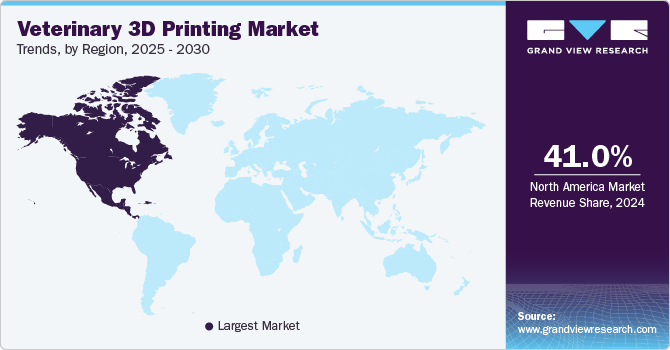

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Sweden is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, implants accounted for a revenue of USD 40.9 million in 2024.

- Anatomical Models is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 112.5 Million

- 2030 Projected Market Size: USD 196.2 Million

- CAGR (2025-2030): 9.82%

- North America: Largest market in 2024

This technology has existed since the 1980s in various sectors, including healthcare. However, this technology's entry into the veterinary space has been recent. Using this technology, animal care has enabled personalized solutions, such as custom prosthetics and surgical guides tailored to individual anatomical needs. This enhances the quality of care, reduces costs and production time, and improves surgical outcomes. Additionally, it facilitates surgical planning and education by creating precise anatomical models, ultimately leading to better animal health outcomes.

The most crucial factor proving to be disruptive in driving the market forward is the acceleration in the adoption of 3D printing into the veterinary practice by veterinarians across the globe. This rise in adoption can be seen across multiple species, including companion animals like dogs, cats, turtles, etc. For instance, in March 2024, veterinarians from the Royal (Dick) School of Veterinary Studies, UK, successfully utilized a 3D-printed spinal guide for stabilizing a vertebral complication in a dog. This custom-designed guide allowed them to locate precise drilling and screw locations before the actual surgery.

Furthermore, in December 2024, a team from Mystic Aquarium, U.S., developed a custom 3D-printed harness for a green sea turtle. The turtle was suffering from a complication known as Bubble Butt Syndrome, which affects its ability to swim due to trapped air in the shell. The experts utilized 3D scanning and computational design to create an adjustable harness that allowed the turtle to swim normally again.

Additionally, in October 2024, veterinarians from Colorado State University utilized a 3D-printed model of a horse's skull as an assistive tool in a complex surgical procedure. This innovative approach allowed the surgical team to better plan and execute the surgery, ultimately improving the horse's surgical outcome. Such creative approaches highlight the potential of this technology in enhancing surgical outcomes for complex health conditions in various animals.

Another factor driving the market growth is the growing R&D initiatives to expand the boundaries of 3D printing beyond orthopedics and routine veterinary surgeries. This innovative spirit can be highlighted by the initiative taken by veterinary experts at Kansas State University (KSU) in March 2024. KSU partnered with the Technology Development Institute (TDI) to create 3D-printed animal eye models for veterinary education and training. These models are specifically designed to replicate the eyes of dogs, cats, horses, and rabbits, allowing students to practice using eye exam equipment without needing live animals. Such initiatives are aimed at improving the learning experience for veterinary medicine students. These proxy eyes are realistic training aids to improve coordination and skill development.

Leading Under-Research Biowaste Materials for use in Veterinary 3D Printing

Type of Sources

Composition of the bioink for 3D printing

Potential Application

Chicken bones

Chicken bone derived HA+ Polyvinyl alcohol + polyethylene glycol

Repair of smaller orthopedic defects but may not suitable for load bearing applications.

Bovine bones

Deproteinized bovine bone + collagen

Maybe useful in assisting bone regeneration as this compound rapidly releases calcium.

Swine Bones

Porcine bone derived HA powder + PCL

May prove to be helpful in supporting angiogenesis & osteogenesis

Alginate + methacrylated-dECM (decellularized extra cellular matrix)

Eggshells

Eggshell powder + PCL

To increase in strength of the printed product.

Eggshell powder + PLA

Eggshell or Fish Waste

Eggshell/cuttle bone/mussel shell derived biogenic HA (15 % wt.) + PCL (85 % wt.)

Fish scales

Fish scales + alginate dialdehyde + gelatin

Promotes hydroxyapatite formation and collagen secretion, therefore increase strength and may prove to be useful in load bearing applications.

Fish Skin

Shark skin derived collagen + alginate + human Adipose Stem cells (hASCs)

Shark skin derived collagen + alginate + L929 fibroblasts

Eel fish

Eel fish derived collagen + alginate

Market Concentration & Characteristics

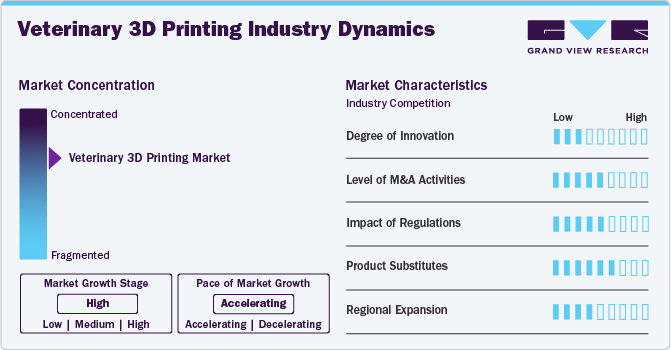

The degree of innovation in this market is very high. This can be attributed to the ongoing and continuously upcoming research activities to incorporate 3D printing into veterinary care for multiple species, such as horses, livestock animals, wildlife animals, and exotic animals beyond the currently largely penetrated market, like dogs and cats.

The market also features low merger and acquisition (M&A) activities. On the contrary, it is booming, with multiple startup companies entering this industry and established players in the more significant 3D printing industry entering the veterinary industry.

The regulatory landscape in this industry currently requires an approval or clearance process, which mandates clinical data collection and post-market surveillance. Additionally, owing to unclear guidelines, there is a need for international harmonization of regulations, as well as clear labeling and instructions for use. These factors contribute to the complexity of bringing 3D-printed products to clinical settings, necessitating a deep understanding of animal anatomy and compliance with regulatory standards to address the unique anatomical challenges presented by various species.

The impact of product substitutes in this industry is estimated to be on the lower side. Despite some emerging companies, on a broader scale, a limited number of companies provide these products specifically for veterinary use.

The regional expansion can be anticipated to be moderate. The market is largely concentrated in North America and Europe. Despite veterinary institutions from regions like Asia Pacific beginning to take initiatives to increase adoption, it will take a much longer time period for them to show a significant impact on the industry as a whole.

Product Insights

The implants segment held the highest market share of 33.61% in 2024. This segment comprises 3D printed veterinary implants like TPLO, TPLA, etc. Key factors contributing to this dominance include the ability of these implants to be customized for various animal anatomies, which enhances surgical outcomes, and advancements in technology that allow for biocompatible materials, improving integration and reducing rejection rates. Additionally, the durability of these implants makes them suitable for high-stress applications in veterinary surgeries. At the same time, the rising incidence of orthopedic procedures further fuels the demand for these innovative solutions.

The anatomical models segment is expected to grow most over the forecast period. This can be attributed to the growing usage of artificial models in veterinary education and training. Prior to the initiation of practical training on live animals, veterinary students are increasingly trained in various skills like surgery, anatomy, physiology, etc., to refine them. Another critical emerging use of these anatomical models is in pre-surgical planning.

Animal Insights

By animal, the dogs segment held the highest market share in 2024. Dogs are the most adopted pets in the world and also lead other animals in terms of healthcare expenditure. This naturally prompts a higher adoption of any new technology that enters the veterinary space. Worldwide, 3D printing is actively used in various canine complications. For instance, in June 2024, a paralyzed dog regained the ability to walk through a 3D-printed spine to stabilize the affected area at the Chestergates Veterinary Hospital in the UK.

The other animals segment, including horses, turtles, birds, livestock animals, etc., is projected to expand at the fastest rate of over 12.2% in the forecast period, owing to the growing adoption of 3D printing in the treatment of various ailments and also the emergence of specialized companies focusing on developing 3D printed products for a specific species. For example, r3volutionD AG, a European company, is dedicated to manufacturing 3D printed products like dental implants, titanium implants, anatomical models, nosebands, chin & neck pads, etc., specifically for horses.

Application Insights

The orthopedics segment held the highest market share by application in 2024. This is due to the technology's ability to create customized implants and surgical guides tailored to the unique anatomies of various animals. This technology enhances surgical precision, reduces recovery times, and improves outcomes for complex orthopedic procedures, such as joint replacements and limb deformities. Additionally, the capacity to produce accurate 3D anatomical models aids in preoperative planning, allowing veterinarians to better understand and address specific conditions in pets.

The surgical planning segment is estimated to grow at the highest rate over the forecast period. This can be due to 3D printing, which creates patient-specific anatomical models and enhances the visualization of complex structures. It enables the creation of customized surgical instruments, patient-specific models, and surgical guides, leading to more efficient and less invasive procedures. With 3D printing, veterinarians can study complex fractures or deformities in detail, pre-contour implants, and practice surgical steps in advance, reducing the risk of complications during the surgery. The technology also facilitates better communication between veterinarians and pet owners, enhancing understanding of the animal's condition and the planned treatment. 3D printing can shorten the operation and anesthesia times, minimize risks, and increase the success of surgical treatments.

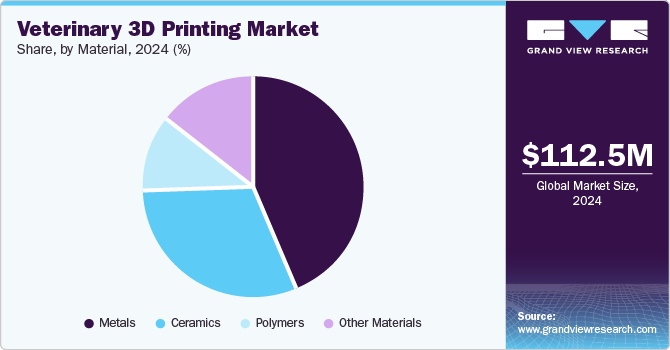

Material Insights

By materials, the metals segment held the highest market share in 2024. This can be attributed to their exceptional mechanical properties, strength, and durability, vital for creating reliable implants and prosthetics. Metals like titanium, stainless steel, and cobalt chromium are biocompatible and corrosion-resistant, making them suitable for long-term animal use. The precision of metal printing processes enables the production of complex geometries that can enhance surgical outcomes.

The other materials segment, including bone cement (PMMA, calcium carbonate) and biological and experimental materials like biowaste, is estimated to show the highest CAGR over 2025-2030. This can be attributed to these materials’ biocompatibility and ability to support bone healing and regeneration. These materials may potentially enhance the integration of implants with surrounding tissues, improving surgical outcomes. Additionally, utilizing biowaste and other sustainable materials reduces environmental impact and promotes cost-effective solutions in veterinary practices.

End Use Insights

The hospitals & clinics segment led the market in 2024. This dominance can be because they have the infrastructure and financial resources to invest in 3D printing technology or procure such products immediately as per requirements, which is crucial for developing tailored treatment plans that improve animal recovery times. In contrast, academic institutions often prioritize research and education over immediate clinical applications, while animal rescue centers may lack the necessary funding and expertise to implement such advanced technologies effectively. This combination of factors positions veterinary clinics and hospitals as leaders in adopting and applying 3D printing innovations in veterinary medicine.

Academic & research institutions are estimated to register the highest CAGR due to their growing utility in education and training. 3D-printed models offer veterinary students hands-on experience with complex anatomical structures and surgical techniques before working with live animals. This approach enhances their skills, allowing students to understand anatomical intricacies better through tactile learning. Moreover, these institutions often use 3D printing for research, creating models of damaged target areas to improve understanding and early decision-making in veterinary care and develop novel products. The cost-effectiveness of producing models, especially within university settings, further facilitates its integration into educational programs, preparing students for advanced veterinary practices.

Regional Insights

North America veterinary 3D printing marketheld the largest share of more than 41.0% and is expected to grow at the fastest CAGR of 10.30% over the forecast period. Countries from this region, like the U.S., Canada, and Mexico, are continuously involved in activities to increase and expand the adoption of 3D printed products across the veterinary space. These activities range from research, product developments, veterinary surgery using 3D printed products, and the launch of laboratories with 3D printing abilities. For instance, in May 2024, a research project from École de Technologie supérieure University (ETSMTL) aimed to create a 3D-printed anatomical model of a bird's head for veterinary students. This model allowed students to practice their skills without risking harm to live birds, enhancing their training in avian anatomy and veterinary techniques.

U.S. Veterinary 3D Printing Market Trends

The veterinary 3D printing market in the U.S. is among the fastest growing due to the innovative techniques used by research scientists and veterinarians to enhance the adoption of 3D printing into veterinary medicine. For instance, in September 2024, researchers from UC Davis developed 3D-printed silicone models to train caregivers in tube-feeding vulnerable kittens. These models aim to improve training opportunities and training of veterinary students and caregivers in tube feeding techniques.

Europe Veterinary 3D Printing Market Trends

Europe veterinary 3D printing market accounted for the second-largest share in 2024. The region's lucrative growth is primarily attributed to the emergence of leading companies focusing on veterinary 3D printing and their market expansion activities. For instance, WIMBA, a company from Poland, opened a new in-house 3D printing facility at its headquarters in October 2024. This facility is built to create advanced custom orthotics and prosthetics for pets.

UK Veterinary 3D Printing Market Trends

The veterinary 3D printing market in UK is growing lucratively due to the increasing employment of advanced 3D printing techniques to address animal orthopedic complications. For instance, in October 2024, a labrador-spaniel dog from the UK suffering from a foot deformity was treated by experts at Cave Veterinary Specialists, who inserted a 3D-printed plate into the carpus to stabilize it.

Italy Veterinary 3D Printing Market Trends

The veterinary 3D printing market in Italy is expanding owing to active initiatives by the country’s key players with established companies to develop novel products. For example, in May 2024, Intrauma S.p.A partnered with WIMBA to utilize HP’s 3D printing technology to produce custom orthotics & prosthetics for pets.

Asia Pacific Veterinary 3D Printing Market Trends

The Asia Pacific veterinary 3D printing market is showing lucrative growth owing to the emergence of market participants in the veterinary 3D printing sector that produces products like prosthetics, orthotics, anatomical bone models, etc., for exotic animals. For example, in November 2021, researchers from the National University of Singapore completed the installation of 3D-printed protective shoes against conditions like callouses, tissue swelling pressure sores, etc., for birds of prey in wildlife sanctuaries.

India Veterinary 3D Printing Market Trends

Leading veterinary hospital chains in the country are actively seeking to develop 3D printing infrastructure to enhance patient care. For example, a leading veterinary hospital in India, MaxPetz, launched 3D printing capabilities for reconstructive veterinary surgeries in April 2024.

Latin America Veterinary 3D Printing Market Trends

The Latin America veterinary 3D printing market is driven by several factors, including the increasing pet ownership and awareness of animal welfare, the rise in animal procedures, and advancements in technology that enhance customization and efficiency in treatments. Additionally, the growing prevalence of pet injuries and the need for personalized solutions further contribute to this demand.

Brazil Veterinary 3D Printing Market Trends

The veterinary 3D printing market in Brazil is growing owing to technological advancements, a growing pet population, and the need for customized treatments. Regulatory support, educational programs, and collaborations with tech companies further enhance its adoption. Additionally, the cost-effectiveness of producing custom prosthetics and implants compared to traditional methods attracts more veterinary professionals to this technology.

MEA Veterinary 3D Printing Market Trends

The demand for 3D printing in veterinary medicine in the Middle East is fueled by increased infrastructure investments and a rise in animal surgeries, alongside the need for specialized care solutions. Government initiatives and educational programs are promoting innovation and developing a skilled workforce. Additionally, collaborations between veterinary clinics and tech companies enhance the accessibility and cost-effectiveness of 3D printing technologies.

South Africa Veterinary 3D Printing Market Trends

The veterinary 3D printing market in South Africa is showing lucrative growth owing to its efforts to adopt this technology for less-explored animal species like exotic birds. For instance, researchers and veterinarians from the University of Pretoria fitted a macaw bird with a new 3D-printed beak. The bird had lost its beak due to an accident.

Key Veterinary 3D Printing Company Insights

The market is relatively less competitive due to many key manufacturers. However, competition is expected to increase in the future due to a variety of activities undertaken by industry participants, such as product research and development, capacity expansion, partnerships, sales and marketing activities, mergers and acquisitions, product expansion, and product launches.

Key Veterinary 3D Printing Companies:

The following are the leading companies in the veterinary 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- bio3Dvet

- WIMBA

- Vimian

- 3D Pets (DiveDesign LLC)

- 3D Systems Inc.

- OrthoDesigns

- Ortho Vet 3D

- r3volutionD AG

- Novus Life Sciences

- WhiteClouds

- Med Dimensions LLC

- CABIOMEDE Vet

Recent Developments

-

In December 2024, researchers from Cornell College of Veterinary Medicine utilized 3D printed guides to correct the deformed leg of a beagle.

-

In October 2024, VCA Animal Hospitals launched a specialized 3D printing laboratory dedicated to pet orthopedic surgeries.

Veterinary 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 122.8 million

Revenue Forecast in 2030

USD 196.2 million

Growth rate

CAGR of 9.82% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal, application, materials, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

US; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

bio3Dvet; WIMBA; Vimian; 3D Pets (DiveDesign LLC); 3D Systems Inc.; OrthoDesigns; Ortho Vet 3D; r3volutionD AG; Novus Life Sciences; WhiteClouds; Med Dimensions LLC; CABIOMEDE Vet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary 3D printing market report based on product, animal, application, materials, end use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Implants

-

Prosthetics & Orthotics

-

Anatomical Models

-

Masks

-

-

Animal Outlook (Revenue, USD Million; 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Orthopedics

-

Surgical Planning

-

Other Applications

-

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Metals

-

Ceramics

-

Polymers

-

Other Materials

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals & Clinics

-

Academic & Research Institutions

-

Other End use

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary 3D printing market size was estimated at USD 112.51 million in 2024 and is expected to reach USD 122.8 million in 2025.

b. The global veterinary 3D printing market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 196.2 million by 2030.

b. By materials, the other materials segment, including bone cement (PMMA, calcium carbonate) and biological and experimental materials like biowaste, is estimated to show the highest CAGR over 2025-2030. This can be attributed to these materials’ biocompatibility and ability to support bone healing and regeneration. These materials may potentially enhance the integration of implants with surrounding tissues, improving surgical outcomes.

b. Some key players operating in the veterinary 3D printing market include bio3Dvet, WIMBA, Vimian, 3D Pets (DiveDesign LLC), 3D Systems Inc., OrthoDesigns, Ortho Vet 3D, r3volutionD AG, Novus Life Sciences, WhiteClouds, Med Dimensions LLC, and CABIOMEDE Vet

b. Key factors that are driving the market growth include rising adoption of 3D printing in veterinary sciences, R&D initiatives, increasing application of 3D printing in veterinary surgical planning, and the emergence of novel applications

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.