- Home

- »

- Renewable Energy

- »

-

Europe Waste to Energy Market Size & Share Report, 2030GVR Report cover

![Europe Waste To Energy Market Size, Share & Trends Report]()

Europe Waste To Energy Market Size, Share & Trends Analysis Report By Technology (Technology, Thermal), By Country, and Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-080-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Market Size & Trends

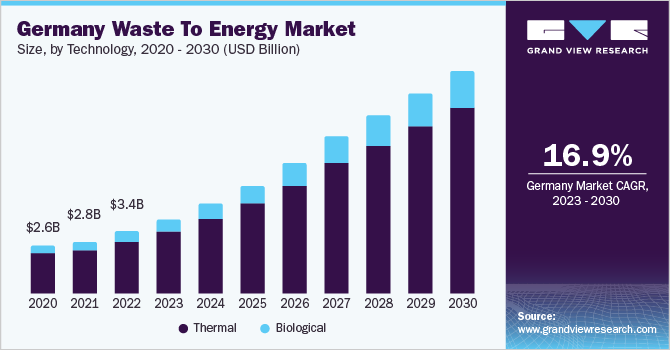

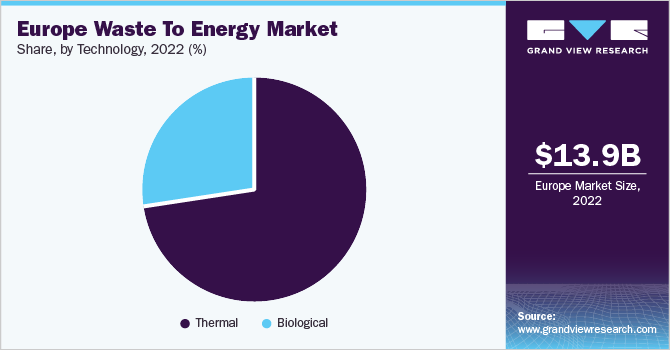

The Europe waste to energy market size was estimated at USD 13.88 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 14.4% from 2023 to 2030. The market is projected to grow significantly owing to the growing distress about GHG emissions and new EU regulations to decrease carbon footprint. Growing environmental concerns and climate change have led various countries around the world to take steps to reduce their carbon footprint from the industrial sector and opt for waste to energy technology.

As per the EU - Central Asia Cooperation on water environment and climate change, the share of waste disposal in the EU has increased from more than 16% in 2000 to 27% in 2020. A growing share of waste disposal in Europe is expected to drive the European waste to energy (WTE) market over the forecast period.

Due to the Russia-Ukraine conflict, prices of natural gas inflated in the region which fueled the government to enact other sources of energy generation. Favorable regulations like the windfall tax which was implemented in November 2022 consist of an additional 45% levy on generators. This tax covers electricity generated by anaerobic digestion plants or waste to energy facilities. Hence, this supports additional energy from waste facilities which are expected to augment the growth of the market in the region.

Fossil fuels account for over 60% share in the electricity generation sector around the world. However, with the rise in environmental concerns, there has been an increase in the adoption of renewable energy. The presence of stringent environmental regulations and policies in majority of the European countries has also provided a major boost for renewable energy.

The power generation market has been witnessing a surge in the installed capacity of renewable power sources on account of growing environmental concerns coupled with the aim to reduce the harmful effects of greenhouse gasses in majority of the countries. This has been a major factor in the expansion of waste to energy in Europe.

Germany’s economy is led by the industrial manufacturing sector, including fabricated parts and metal components. East Germany is marked with significant metal forging, stamping, and bending processors & facilities. The food & beverage processing sector also has a major presence, contributing to a considerable amount of organic and non-hazardous waste generated across the country.

Thermal technology dominated the waste-to-energy market in 2022 and is expected to maintain its dominance owing to the increasing development in gasification and incineration technologies in Germany.

In November 2016, Climate Action Plan 2050 was adopted by the government of Germany. Germany became the first among the Paris Agreement participants to submit a low GHG emission development strategy to the United Nations. The plan was designed to achieve the country's goals and targets pledged in the Paris Agreement, intending to achieve global greenhouse gas neutrality by 2050. One of Germany's major long-term goals is to become a neutral nation in terms of greenhouse gas emissions by 2025.

Hence, favorable government policies and low emission goals are expected to foster a waste to energy market in the country over the forecast period.

Technology Insights

Based on technology, the Europe waste-to-energy market has been segmented into biological and thermal. The thermal type segment is further sub-segmented into incineration, gasification, and pyrolysis. Thermal technology accounted for the largest revenue market share of 72.89% which includes waste that is subjected to high temperatures but with different oxygen concentrations. Biological includes anaerobic digestion. Biological treatments are used with wet waste such as food waste and farm slurry.

Biological includes anaerobic digestion. Biological treatments are used with wet waste such as food waste and farm slurry. The growth of biological waste-to-energy technology is attributed to the gradual development of anaerobic decomposition technology. Governing authorities of various developed nations indulge in several research & development activities to improve the economic feasibility of anaerobic digestion facilities. Advancements in reactor design and genetic engineering of organisms are among the vital factors that are critical to the enhancement of biological conversion of gases to fuels and other co-products. Concerns related to the environment and the rising demand for clean fuels such as biogas in the transportation sector are anticipated to boost the segment growth.

Country Insights

Germany accounted for 24.21% of the revenue market share in the market in 2022 owing to the increasing waste generation and growing focus on non-fossil fuel sources. The rising population coupled with increasing demand for energy-efficient and clean energy is expected to propel the market for waste to the country’s energy market. Germany is being very active in the R&D efforts related to clean and energy-efficient power generation sources. The availability of funding in the European Union for energy conservation and energy efficiency projects has been one of the major factors driving the country’s market growth.

France accounted for the second largest share of waste to energy (WTE) market owing to the presence of a large number of waste-to-energy plants and government inclination towards the adoption of clean energy. Technological advancements in energy recovery to improve the output efficiency of WtE plants are projected to augment market growth in the coming years. For instance, France-based company, Suez, developed the CHP+ high-performance co-generation technology to allow the recovery of residual heat produced through waste combustion and concurrently generate captive energy for use in local activities.

Market participants are focusing on R&D activities to decrease the technology cost associated with WTE power generation plants. Few market participants in France have vertically integrated to strengthen their services. Other market participants are involved in the expansion of their facilities to diversify their waste solution capability offerings.

Key Companies & Market Share Insights

The market is competitive owing to the involvement of market players in business expansion activities through collaborations and partnerships across the value chain. For instance, in April 2023, Hitachi Zosen Inova AG announced the construction of waste to energy project with a capacity of 75 MW located in Moscow, Russia. The project is expected to be commissioned in 2023. Some prominent players in the Europe waste to energy market include:

-

EEW Energy from Waste

-

Hitachi Zosen Inova AG

-

Martin GmbH

-

Mitsubishi Heavy Industries Ltd

-

Ramboll Group A/S

-

STEAG energy services Gmbh

-

SUEZ

-

Tana Oy

-

Veolia

-

Wheelabrator Technologies

Europe Waste To Energy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.26 billion

Revenue forecast in 2030

USD 41.75 billion

Growth rate

CAGR of 14.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in GWh, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, country

Region scope

Europe

Country scope

Germany; Russia; U.K.; Spain; Italy; France; Sweden; Austria; Netherlands

Key companies profiled

SUEZ;Hitachi Zosen Inova AG; Veolia; Martin GmbH; Mitsubishi Heavy Industries Ltd; Ramboll Group A/S; STEAG energy services Gmbh; Wheelabrator Technologies; EEW Energy from Waste; Tana Oy

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Waste To Energy Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe waste to energy market report based on technology, and country:

-

Technology Outlook (Revenue, USD Million; Volume, GWh, 2018 - 2030)

-

Biological

-

Thermal

-

Incineration

-

Pyrolysis

-

Gasification

-

-

-

Country Outlook (Revenue, USD Million; Volume, GWh, 2018 - 2030)

-

Germany

-

Russia

-

U.K.

-

Spain

-

Italy

-

France

-

Sweden

-

Austria

-

Netherlands

-

Frequently Asked Questions About This Report

b. The Europe waste to energy market was estimated at USD 13.88 billion in 2022 and is projected to reach USD 16.26 billion in 2023.

b. The Europe waste to energy market is expected to witness a compound annual growth rate of 14.4% from 2023 to 2030 to reach USD 41.75 billion by 2030.

b. Thermal technology emerged as the largest technology segment and accounted for 72.89% of the market in 2022 owing to the increasing development in gasification and incineration technologies in Germany.

b. Some key players operating in the Europe waste to energy market include SUEZ, Hitachi Zosen Inova AG, Veolia, Martin GmbH, Mitsubishi Heavy Industries Ltd, Ramboll Group A/S, Steag Energy Services GmbH, and others.

b. Factors such as growing distress about GHG emissions and new EU regulations to decrease carbon footprint are the major drivers of Europe waste to energy market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."