- Home

- »

- IT Services & Applications

- »

-

Facility Management Software Market, Industry Report, 2033GVR Report cover

![Facility Management Software Market Size, Share & Trends Report]()

Facility Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment Mode (On-premises, Cloud, Hybrid), By Solution Type, By Enterprise Size, By End-use (Commercial, Industrial, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-701-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Facility Management Software Market Summary

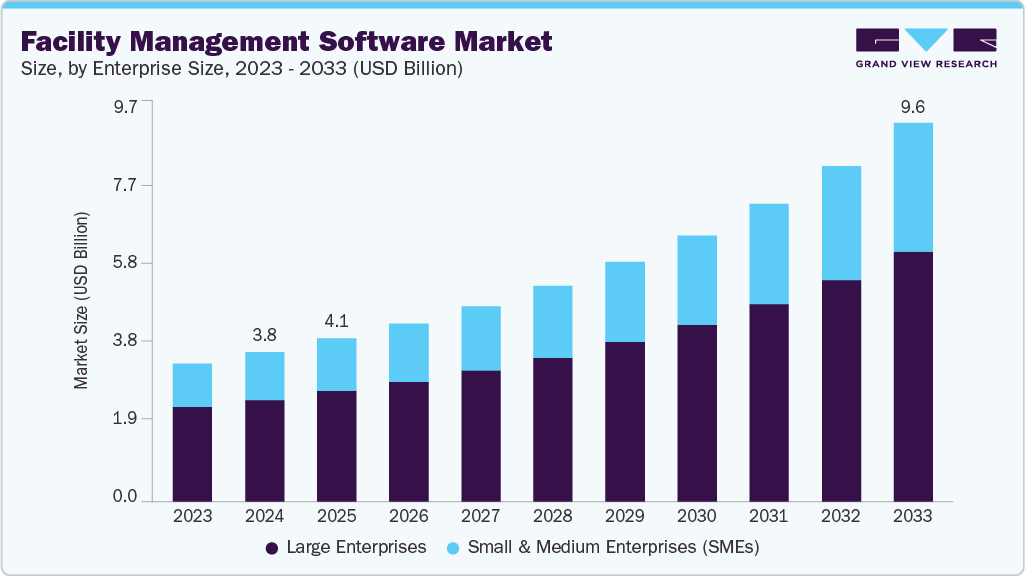

The global facility management software market size was estimated at USD 3.79 billion in 2024 and is projected to reach USD 9.60 billion by 2033, growing at a CAGR of 11.1% from 2025 to 2033. The market is driven by the accelerated digital transformation initiatives among organizations shifting from traditional manual facility operations to automated, data-driven management systems.

Key Market Trends & Insights

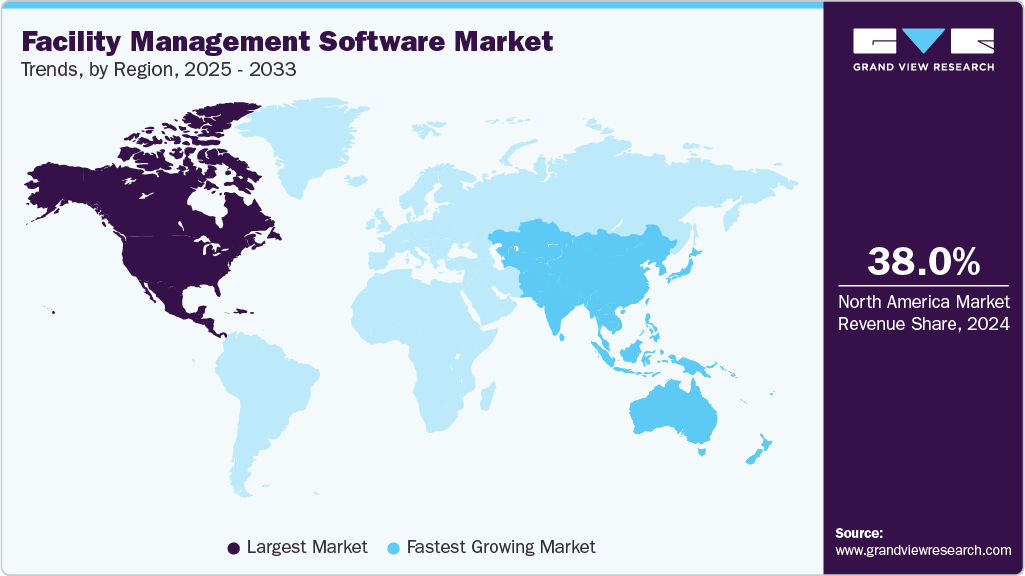

- North America held a 38.0% revenue share of the global facility management software market in 2024.

- In the U.S., the market is driven by increasing adoption of smart building technologies, advanced energy management solutions, and AI-driven predictive maintenance systems tailored to meet the country’s evolving regulatory landscape.

- By deployment mode, the cloud segment held the largest revenue share of 60.34% in 2024.

- By solution type, the Computerized Maintenance Management System (CMMS) segment held the largest revenue share in 2024.

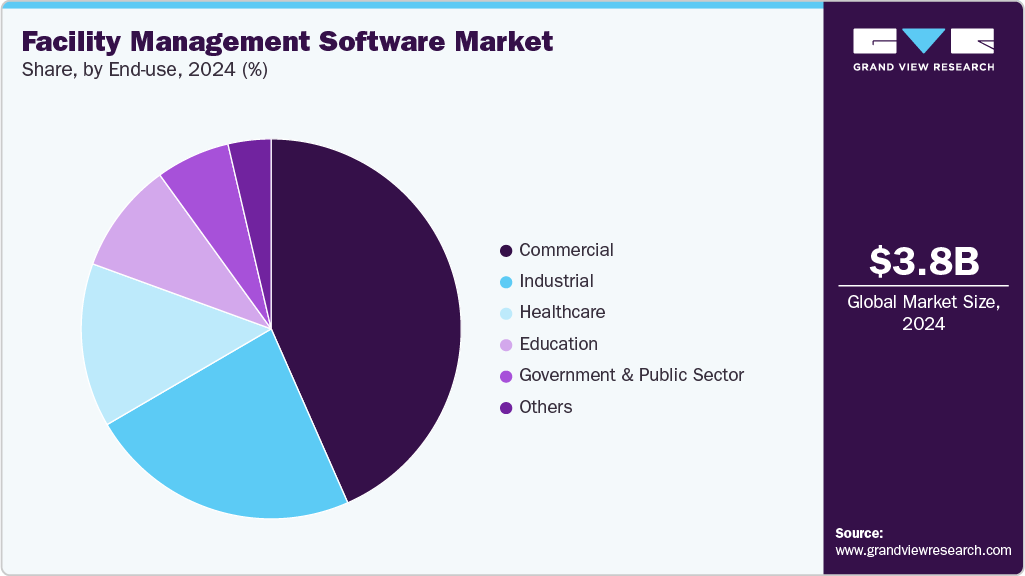

- By end-use, the commercial segment accounted for the largest market share of 43.40% in 2024 in the global facilities management software market.

Market Size & Forecast

- 2024 Market Size: USD 3.79 Billion

- 2033 Projected Market Size: USD 9.60 Billion

- CAGR (2025-2033): 11.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises across sectors such as commercial real estate, healthcare, education, and industrial manufacturing are transitioning toward integrated, cloud-native FM software environments that enable centralized control, real-time analytics, and predictive maintenance. This demand is fueled by the growing reliance on Computerized Maintenance Management Systems (CMMS), Integrated Workplace Management Systems (IWMS), and cloud-based CAFM solutions, which facilitate operational agility, cost efficiency, and enhanced occupant experiences. For instance, commercial property managers are increasingly deploying IWMS platforms to optimize space utilization, monitor energy consumption, and streamline vendor management through real-time dashboards and mobile-enabled workflows.The market is further intersecting with emerging advancements in artificial intelligence (AI), Internet of Things (IoT), and smart building technologies, as organizations prioritize intelligent, connected facilities to meet sustainability and operational efficiency goals. Businesses are integrating AI-driven predictive maintenance, IoT sensor-based occupancy tracking, and automated energy optimization features within their FM software ecosystems to reduce downtime, enhance asset longevity, and achieve ESG targets. Additionally, the adoption of AI-powered security management, smart cleaning schedules, and automated compliance reporting is expanding the scope of FM software from pure asset management to holistic facility intelligence.

Consequently, these technological advancements are positioning FM software platforms not only as operational tools but also as strategic enablers of digital, sustainable, and resilient workplace environments. Furthermore, to support evolving needs, major vendors are embedding AI analytics, digital twin modeling, and cloud-native Solution Type capabilities into their FM offerings, enabling organizations to drive efficiency, adaptability, and sustainability at scale. For instance, in January 2021, IBM launched an upgraded TRIRIGA AI-powered IWMS platform featuring digital twin integrations and sustainability analytics, helping enterprises achieve smart building objectives while complying with tightening global sustainability regulations. These innovations are establishing FM software as a central component of enterprise digital transformation roadmaps across sectors.

Deployment Mode Insights

The cloud segment accounted for the largest revenue share of 60.34% in the global facility management software market in 2024, driven by increasing enterprise demand for centralized, flexible, and scalable facility management solutions that can be rapidly deployed across diverse property portfolios. Cloud-based platforms enable real-time visibility, streamlined operations, and reduced administrative overhead by consolidating multiple facility management functions into a single digital ecosystem. This growth is further supported by the rising preference for SaaS delivery models, which offer faster implementation, seamless updates, and lower total cost of ownership compared to legacy on-premises systems. For instance, in December 2024, Lessen launched Digital FM, a cloud-native solution designed to reduce operational risk and centralize facilities management for distributed enterprises by offering real-time asset tracking, preventive maintenance scheduling, automated workflows, and data-driven performance reporting. Therefore, such innovations highlight the dominant role of cloud deployment in driving operational efficiency, scalability, and improved risk management within the facilities management software market.

The hybrid segment is expected to register the fastest CAGR of 10.6% during the forecast period, driven by the rising demand for flexible deployment models that combine on-premises data security with the scalability and remote accessibility of cloud-based solutions. Organizations with stringent data governance requirements, such as healthcare, government, and financial services, are adopting hybrid FM software to maintain sensitive operational data on-premises while leveraging cloud capabilities for real-time analytics, mobile accessibility, and seamless system updates. This trend is further supported by the rapid evolution of hybrid workplace environments, where facility managers require integrated tools to manage fluctuating occupancy and optimize workspace utilization. For instance, in March 2023, Planon introduced its enhanced Workplace App, a mobile-first solution designed to connect building users with facility services through interactive floor plans, enabling real-time desk and meeting room booking, service requests, and occupancy insights within a hybrid IWMS framework. Consequently, hybrid deployment models are emerging as a strategic option for enterprises aiming to achieve operational resilience, user-centric facility experiences, and seamless digital transformation.

Solution Type Insights

The Computerized Maintenance Management System (CMMS) segment accounted for the largest market share of 32.03% in 2024, reflecting its essential role in streamlining maintenance workflows, strengthening asset performance, and minimizing unplanned downtime. CMMS platforms centralize maintenance operations, automate preventive schedules, and deliver real-time alerts through unified dashboards, a functionality increasingly enhanced by data-driven and IoT-enabled capabilities. Additionally, the segment growth is also driven by its alignment with predictive maintenance strategies, where AI and sensor data converge to forecast equipment failures before they cause disruptions. For instance, in February 2025, FlowPath Corporation, Inc. introduced its AI Assistant for CMMS, embedding intelligent automation directly within the platform to generate and assign work orders via mobile or voice commands, predict asset failure and repair needs, and offer dynamic dashboards for asset lifecycle and maintenance insights. Consequently, the aforementioned factors are contributing significantly to boosting the growth of the CMMS segment in the global facilities management software market.

The sustainability & energy management segment is expected to grow at the fastest CAGR of 13.4% over the forecast period, driven by rising organizational focus on decarbonization strategies, energy cost reduction, and proactive ESG performance management. Enterprises are increasingly adopting integrated FM software solutions that enable real-time energy performance tracking, predictive analytics, and automated sustainability reporting to comply with evolving environmental regulations and meet corporate net-zero targets. For instance, in January 2025, JLL expanded its sustainability services by launching a new dedicated energy practice designed to provide clients with strategic energy management solutions, incorporating real-time building performance analytics, AI-powered optimization tools, and centralized ESG reporting. These services are designed to help organizations accelerate progress towards their carbon reduction and operational efficiency objectives. Therefore, sustainability and energy management solutions are emerging as drivers of operational excellence and responsible business transformation in the facilities management software landscape.

Enterprise Size Insights

Large size enterprises accounted for the largest market share of 67.80% in 2024 in the facility management software market, driven by the need for integrated solutions capable of managing complex facility portfolios, stringent compliance requirements, and large-scale maintenance operations. These organizations require software platforms that offer real-time visibility into assets, predictive maintenance scheduling, automated workflows, and enhanced emergency response capabilities. In addition, the demand for intelligent features such as AI-based search functions, mobile accessibility, and instant data retrieval has further accelerated adoption among large enterprises seeking operational efficiency and risk mitigation. For instance, in March 2025, ARC Facilities launched a suite of enhanced platform features, including AI-powered intelligent search that anticipates user queries, customizable widgets for personalized dashboards, QR code integration for immediate asset access, and dynamic campus mapping designed to improve productivity and responsiveness of fields operating across large, distributed facilities. Subsequently, the above-mentioned factors are contributing substantially to bolstering the growth of the large enterprises segment.

The Small and Medium-Sized Enterprise (SMEs) segment is expected to grow at the highest CAGR of 11.9% during the forecast period, driven by the growing need for affordable, easy-to-deploy, and scalable facilities management solutions that can address operational challenges. SMEs are increasingly seeking digital tools that simplify maintenance operations, reduce downtime, and offer essential functionalities like preventive maintenance scheduling, work order automation, and real-time asset visibility within a cost-efficient framework. Additionally, this growing demand is further supported by the rising availability of cloud-based, self-service FM software platforms designed specifically for smaller businesses with limited technical resources. For instance, in May 2025, EcoTrak introduced its self-service CMMS platform, offering small businesses a user-friendly solution to independently manage facilities operations, automate maintenance tasks, track assets, and access actionable insights via an intuitive interface. In conclusion, the aforementioned factors are contributing remarkably to spurring the growth of Small and Medium-Sized Enterprises (SMEs) during the upcoming years in the global facilities management software market.

End-use Insights

The commercial segment accounted for the largest market share of 43.40% in 2024 in the global facility management software market, driven by rapid digital transformation across office buildings, retail spaces, and hospitality chains. Key trends include the integration of AI-powered analytics to predict equipment failures and optimize maintenance schedules, along with smart building automation systems that enable centralized control over HVAC, lighting, and security systems. Additionally, the shift toward hybrid workplace models has further accelerated demand for space utilization tools, including occupancy monitoring, desk and meeting room booking, and flexible space management solutions to maximize real estate efficiency. Moreover, with rising sustainability targets and stricter ESG compliance mandates, commercial facility operators are adopting advanced energy management modules, automated sustainability reporting, and IoT-enabled energy monitoring to track and reduce consumption. Mobile-first FM platforms are also gaining traction, providing maintenance teams with real-time access to asset data and work order management, ultimately reducing operational downtime. Therefore, the commercial sector is expected to remain the largest and most dynamic end-use segment, driving continued innovation and technology adoption in the global facility management software market.

The healthcare segment is expected to register the fastest growth of 12.4% during the forecast period in the global facilities management software market, driven by escalating demands for operational efficiency, patient safety, and stringent regulatory compliance within hospitals, clinics, and long-term care facilities. These organizations are adopting digital FM platforms to automate preventive maintenance, enable real-time asset and HVAC system monitoring, and streamline compliance workflows ensuring continuous uptime of critical medical equipment and safe clinical environments. Moreover, the increasing focus on infection controls post-pandemic, combined with the complexity of medical facility infrastructure, has accelerated the deployment of software tools that support sanitation tracking, indoor air quality monitoring, and dynamic space management. For instance, more than 400 U.S. hospital systems are leveraging FM:Systems’ cloud-based integrated workplace management system, which consolidates facility and real estate data to optimize underutilized space, enhance patient experience, and achieve compliance through centralized analytics dashboards and SaaS delivery. Consequently, as patient-centric care becomes increasingly data-driven, facilities management (FM) software is expected to emerge as a vital infrastructure tool, thereby positioning the healthcare segment as the fastest-growing in the market.

Regional Insights

North America facility management software market accounted for the largest share of 38% in 2024, driven by the combination of regulations, technological innovation, and shifting workplace norms specific to the region. AI and machine learning integration remains a dominant trend, with predictive maintenance, energy optimization, and real‑time building performance analytics becoming standard features in North American FM solutions. Additionally, sustainability and ESG compliance have rapidly gained traction as FM platforms include carbon‑tracking dashboards, energy benchmarking, and systems for managing green cleaning and waste protocols. Moreover, the widespread adoption of hybrid work models across the U.S. and Canada has spurred demand for flexible FM tools that support occupancy tracking, touchless service requests, indoor air quality monitoring, and space optimization to handle dynamic office utilization. Consequently, these region-specific drivers are reinforcing North America’s leadership position by pushing FM vendors to deliver advanced, scalable, and resilient solutions tailored to local operational, compliance, and workplace transformation needs.

U.S. Facility Management Software Market Trends

The facility management software market in the U.S. is witnessing strong growth driven by increasing adoption of smart building technologies, advanced energy management solutions, and AI-driven predictive maintenance systems tailored to meet the country’s evolving regulatory landscape. A key trend is the rapid digitalization of commercial and healthcare facilities, with organizations increasingly prioritizing real-time asset tracking, mobile maintenance platforms, and integrated workplace management systems (IWMS) to streamline multi-site operations. Additionally, the surge in hybrid work models has also led to rising demand for occupancy monitoring, space optimization, and touchless service management features. Moreover, stringent sustainability mandates at the federal and state levels are pushing U.S. enterprises to integrate ESG reporting, carbon footprint tracking, and energy benchmarking tools within their FM platforms. Furthermore, the growing focus on infrastructure modernization, particularly in government and education sectors, is accelerating investments in comprehensive FM software to enhance operational efficiency, ensure regulatory compliance, and support long-term asset lifecycle management.

Europe Facility Management Software Market Trends

The facility management software market in Europe is anticipated to register significant growth from 2025 to 2033, driven by a combination of regulatory pressures, sustainability objectives, and digital transformation initiatives unique to the region. The implementation of stringent environmental regulations, such as the EU Green Deal and Energy Performance of Buildings Directive, is compelling facility operators to adopt advanced software solutions with integrated energy management, carbon footprint tracking, and automated sustainability reporting capabilities. Additionally, the expansion of smart city projects across major European countries, including Germany, the United Kingdom, and France, is accelerating the deployment of predictive maintenance tools, IoT-enabled asset monitoring, and digital twin technologies to optimize building performance and reduce operational costs. Moreover, the growing trend of outsourcing non-core facility management services, particularly among small and medium-sized enterprises, is driving the adoption of cloud-based FM platforms that offer scalability, cost efficiency, and streamlined service delivery. Collectively, these factors are positioning Europe as a high-growth region, with facilities management software playing a critical role in supporting sustainability goals, enhancing operational efficiency, and enabling data-driven facility operations.

The UK facility management software market is poised for accelerated growth from 2025 to 2033 due to the widespread adoption of AI-driven predictive maintenance, real-time energy analytics, and smart building automation in urban centers like London, Manchester, and Birmingham, driven by rising energy costs and sustainability mandates. Additionally, economic pressures such as post-Brexit supply chain disruptions, inflation, and rising living costs are pushing organizations toward cloud-based, outsourced FM models to reduce capital expenditure and stabilize operational budgets. Furthermore, growth in hybrid work arrangements is catalyzing investments in mobile-first FM solutions that support desk booking, occupancy tracking, and touchless service requests, reflecting evolving workplace expectations across the region. These combined dynamics highlight the U.K.’s drive toward smart and cost-effective facility operations, positioning it as a pioneering market within the broader European FM software landscape.

The facility management software market in Germany is witnessing strong momentum, driven by stringent regulatory frameworks focused on energy efficiency, sustainability, and building performance optimization. Policies such as the Building Energy Act are compelling facility operators to adopt advanced FM software equipped with real-time energy monitoring, automated compliance reporting, and carbon footprint tracking. Additionally, the country’s rapid smart building transformation is fostering the integration of IoT-enabled asset management, predictive maintenance tools, and digital twin technologies to improve operational transparency and reduce facility downtime. Moreover, German enterprises are also increasingly shifting from fragmented service models to integrated facility management approaches, leading to rising demand for cloud-based, modular FM platforms that consolidate maintenance, space management, and energy efficiency into a unified digital solution. Furthermore, the growing adoption of workplace flexibility and hybrid working arrangements is driving interest in space optimization and occupancy monitoring tools, positioning Germany as a leader in sustainable and technologically advanced facilities management practices in Europe.

Asia Pacific Facility Management Software Market Trends

The facility management software market in Asia Pacific is expected to register the fastest CAGR of 11.8% from 2025 to 2033, driven by a unique convergence of regional trends that emphasize sustainability, urbanization, and digital infrastructure innovation. Governments and municipalities across China, India, Southeast Asia, and Australia are actively investing in smart city projects and large-scale infrastructure development, creating demand for FM platforms that support real-time monitoring, predictive maintenance, and digital twin capabilities. Additionally, Asia Pacific is witnessing rapid adoption of IoT-enabled FM tools and predictive analytics, with the number of such implementations doubling between 2020 and 2024, particularly in markets like China, India, and Australia, while hybrid and cloud-based FM solutions are gaining traction among SMEs and government clients.These dynamics are complemented by emerging trends in edge computing, private AI, and cybersecurity infrastructure, thereby propelling APAC facilities management software toward intelligent, resilient, and future-ready operations.

Japan facility management software market is poised for robust growth from 2025 to 2033, propelled by its strong emphasis on smart building technologies, regulatory compliance, and digital integration. Urban centers are leading the charge, retrofitting aging infrastructure with IoT sensors, predictive maintenance platforms, and digital twin systems to enhance asset reliability and operational control. In addition, the government’s “Society 5.0” initiative is also a key catalyst, encouraging the convergence of real estate digitization, energy efficiency, and automation across both public and private sectors. Moreover, resilient investment in energy standards and seismic safety is elevating demand for FM platforms capable of integrated compliance reporting and automated performance monitoring.

The facility management software market in China is projected to expand significantly from 2025 to 2033, supported by significant investments in smart building infrastructure and a strong focus on sustainability and compliance. In major urban centers like Beijing, Shanghai, and Guangzhou, commercial and institutional facilities are integrating IoT sensor networks and predictive maintenance systems into FM platforms, reducing equipment failures by up to 30% and cutting energy usage by around 20%. Additionally, China’s predictive maintenance market is rapidly expanding, highlighting a broader shift toward AI-powered analytics and real-time facility monitoring.Collectively, these initiatives position China as a dynamically advancing market where facilities management software is central to operational efficiency, sustainability efforts, and urban resilience.

India facility management software market is poised for rapid expansion from 2025 to 2033, propelled by region-specific drivers shaping its digital transformation journey. Smart city initiatives are rapidly accelerating the deployment of IoT-enabled smart buildings across metros like Mumbai, Delhi, Bangalore, and Hyderabad, enabling real-time monitoring of energy use, indoor air quality, and HVAC performance. This has led to deeper integration of AI-powered predictive maintenance and advanced data analytics, helping FM teams identify anomalies and optimize asset performance, which in turn, significantly reduces operational downtime and costs. Furthermore, with growing emphasis on sustainability driven by both corporate and government policies, FM platforms increasingly incorporate energy optimization, waste management, and ESG reporting modules to support cleaner, greener infrastructure. Collectively, these trends are positioning India as a dynamic market where facility management software is central to smart, efficient, and scalable infrastructure management.

Key Facility Management Software Company Insights

Key players operating in the facility management software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Facility Management Software Companies:

The following are the leading companies in the facility management software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Planon

- Archibus

- Spacewell

- Bentley Systems

- MaintainX

- AkitaBox

- SafetyCulture

- Limble

- Corrigo

- Brightly Asset Essentials

- ServiceChannel

- FMS: Workplace

- eMaint

- Asset Panda

Recent Developments

-

In June 2025, FM and the Luxembourg Institute of Science and Technology (LIST) partnered to develop advanced digital twins and AI-driven tools that simulate and predict climate and cyber risks, helping facilities management software improve risk anticipation and operational resilience. This collaboration aims to provide real-time insights and visual dashboards for proactive management of business interruptions caused by extreme weather and cyber threats.

-

In April 2025, ServiceChannel launched an online Partner Ecosystem designed specifically for the facilities management industry, providing multi-site customers and service providers access to a curated network of innovative tools, services, and solution providers. This ecosystem includes vetted partners specializing in areas like IoT remote monitoring, field service management, asset collection, consulting, payment solutions, and technology implementation.

-

In April 2025, AVEVA partnered with ServiceNow to accelerate industrial transformation by integrating AVEVA’s CONNECT industrial intelligence platform with ServiceNow’s AI-driven Operational Technology Management solutions. This collaboration enables unified data and workflows across teams, locations, and applications, leveraging AI and automation to improve operational efficiency, reduce unplanned downtime, and optimize asset performance.

-

In July 2024, Accruent and Pentagon Solutions expanded their partnership to enhance facility and asset management offerings across the UK and Ireland by integrating Accruent’s EMS and Observe Energy Management solutions. This collaboration enables improved energy efficiency, room scheduling, and asset lifecycle management, helping customers achieve greater operational efficiencies and cost savings amid economic pressures.

Facility Management Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 4.12 billion

Revenue forecast in 2033

USD 9.60 billion

Growth rate

CAGR of 11.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, solution type, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

IBM; Planon; Archibus; Spacewell; Bentley Systems; MaintainX; AkitaBox; SafetyCulture; Limble; Corrigo; Brightly Asset Essentials; ServiceChannel; FMS: Workplace; eMaint; Asset Panda

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Enterprise Size and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facility Management Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global facility management software market report based on deployment mode, solution type, enterprise size, end-use, and region:

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud

-

Hybrid

-

-

Solution Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Integrated Workplace Management System (IWMS)

-

Computer-Aided Facilities Management (CAFM)

-

Computerized Maintenance Management System (CMMS)

-

Enterprise Asset Management (EAM)

-

Facility Operations & Security Management

-

Space & Move Management

-

Sustainability & Energy Management

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Size Enterprise

-

Small and Medium Sized Enterprise (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Industrial

-

Healthcare

-

Education

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global facilities management software market size was estimated at USD 3.79 billion in 2024 and is expected to reach USD 4.12 billion in 2025.

b. The global facilities management software market is expected to grow at a compound annual growth rate of 11.1% from 2025 to 2033 to reach USD 9.60 billion by 2033.

b. The cloud segment accounted for the largest revenue share of 60.34% in the global facilities management software market in 2024, driven by increasing enterprise demand for centralized, flexible, and scalable facility management solutions that can be rapidly deployed across diverse property portfolios. Cloud-based platforms enable real-time visibility, streamlined operations, and reduced administrative overhead by consolidating multiple facility management functions into a single digital ecosystem.

b. Some key players operating in the market include IBM, Planon, Archibus, Spacewell, Bentley Systems, MaintainX, AkitaBox, SafetyCulture, Limble, Corrigo, Brightly Asset Essentials, ServiceChannel, FMS: Workplace, eMaint, Asset Pandaand, and Others.

b. Factors such as the accelerated digital transformation initiatives among organizations shifting from traditional manual facility operations to automated, data-driven management systems plays a key role in accelerating the facilities management software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.