- Home

- »

- Next Generation Technologies

- »

-

Fiber Optic Test Equipment Market, Industry Report, 2030GVR Report cover

![Fiber Optic Test Equipment Market Size, Share & Trends Report]()

Fiber Optic Test Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment, By End-use (Telecommunication Companies, Data Centers, Cable TV Operators, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-518-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Optic Test Equipment Market & Trends

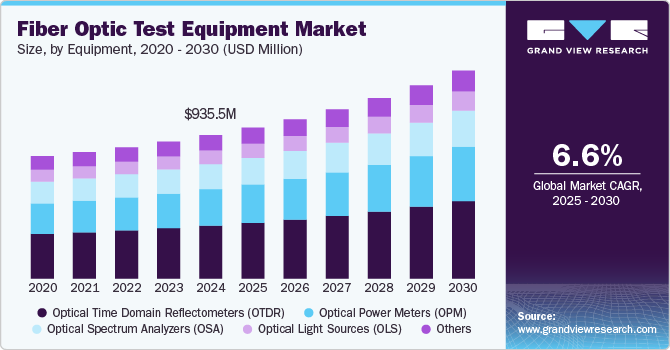

The global fiber optic test equipment market size was estimated at USD 935.5 million in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The growth is driven by the rapid expansion of 5G networks, data centers, and high-speed broadband deployments, increasing demand for efficient fiber optic infrastructure. Growth in telecommunications, aerospace, healthcare, and industrial automation further fuels the demand for precise testing solutions. Additionally, advancements in optical sensing and IoT applications are driving adoption in smart grids, automotive, and oil & gas industries. The need for high-speed, low-latency connectivity and stringent network performance standards continues to propel market growth worldwide.

The rapid expansion of 5G networks, data centers, and high-speed broadband deployments is driving demand for fiber optic test equipment to ensure network reliability, efficiency, and minimal downtime. As 5G infrastructure requires dense fiber optic networks for ultra-low latency and high-speed data transmission, precise testing tools are essential for installation and maintenance. Similarly, the growth of hyperscale data centers and fiber-to-the-home (FTTH) broadband necessitates advanced testing solutions for seamless connectivity. This increasing reliance on fiber optics accelerates market growth for specialized test equipment.

The demand for high-speed, low-latency connectivity and stringent network performance standards is driving the growth of the fiber optic test equipment industry as industries require error-free, high-bandwidth communication. With increasing reliance on 5G, cloud computing, and AI-driven applications, precise fiber optic testing ensures optimal network performance and minimal downtime. Additionally, regulatory requirements and service-level agreements (SLAs) push telecom providers and data centers to adopt advanced testing solutions for quality assurance. This growing need for reliability and efficiency continues to fuel market expansion.

The global fiber optic test equipment industry is witnessing advancements such as AI-powered testing, automated OTDR analysis, and real-time remote monitoring, enhancing network efficiency and fault detection. 5G and next-gen Passive Optical Networks (PON) are driving demand for high-precision test tools with wider wavelength support. Additionally, the integration of cloud-based analytics and IoT-enabled fiber monitoring systems is improving predictive maintenance. These innovations are enabling faster, more accurate testing, reducing downtime, and ensuring superior network performance.

The expansion in emerging markets presents a significant growth opportunity for the fiber optic test equipment industry, driven by rapid telecom infrastructure development and increasing demand for high-speed broadband. Countries in Asia-Pacific, Latin America, and Africa are heavily investing in 5G networks, FTTH deployments, and smart city projects, requiring advanced fiber testing solutions. Additionally, the rise of industrial automation and cloud services in these regions is fueling demand for reliable fiber optic networks. This growing need for network quality assurance is accelerating the adoption of fiber optic test equipment.

Equipment Insights

The Optical Time Domain Reflectometers (OTDR) segment accounted for the largest share of 36.9% in 2024. The segment's growth is driven by increasing demand for fiber network reliability, 5G expansion, and high-speed broadband deployments. OTDRs are essential for fault detection, performance monitoring, and network troubleshooting, ensuring minimal downtime in telecom, data centers, and industrial networks. Additionally, advancements in AI-powered OTDR analysis and real-time remote testing are enhancing efficiency and accuracy.

The Optical Power Meters (OPM) segment is expected to grow at the highest CAGR from 2025 to 2030. The segment's growth is driven by the increasing deployment of 5G networks, fiber-to-the-home (FTTH), and high-speed data centers. OPMs are essential for measuring optical signal strength and ensuring efficient power transmission, making them critical for network performance optimization. Additionally, advancements in compact, handheld, and automated OPMs are enhancing testing efficiency for field technicians. As global demand for high-bandwidth, low-latency communication rises, the adoption of OPMs continues to accelerate.

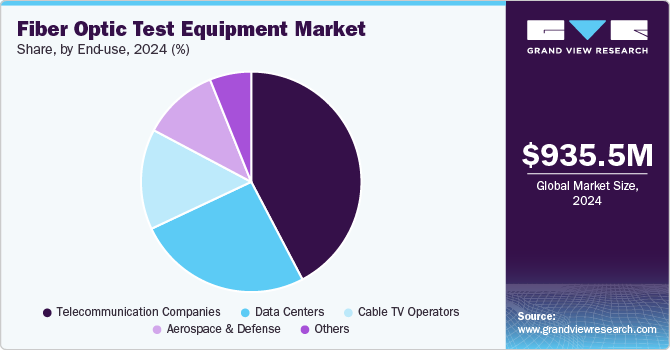

End-use Insights

The telecommunication companies segment dominated the market in 2024. Telecom providers rely on fiber optic test equipment for network installation, maintenance, and performance optimization, ensuring minimal downtime and superior connectivity. Additionally, increasing data consumption, cloud services, and IoT adoption are pushing telecom companies to invest in advanced testing solutions. This growing demand for high-speed, low-latency communication is fueling the adoption of fiber optic test equipment in the telecom sector.

The data centers segment is anticipated to grow significantly during the forecast period. The segment's growth is driven by the rising demand for high-speed, low-latency connectivity to support cloud computing, AI, and big data applications. As hyperscale and edge data centers expand, fiber optic networks are essential for handling massive data traffic, requiring advanced testing solutions for reliability and efficiency. The demand for seamless, high-bandwidth connectivity is accelerating the adoption of fiber optic test equipment in data centers.

Regional Insights

The North America fiber optic test equipment market is expected to grow at a significant CAGR from 2025 to 2030. The market in the region is driven by large-scale 5G rollouts, rising demand for hyperscale data centers, and stringent regulatory standards ensuring high network performance. The region's early adoption of next-gen optical technologies, along with significant investments in smart city and defense communications infrastructure, further accelerates market growth. Additionally, high broadband penetration and government funding for rural fiber deployments create sustained demand for advanced fiber testing solutions.

U.S. Fiber Optic Test Equipment Market Trends

The U.S. fiber optic test equipment industry is expected to grow at a significant CAGR from 2025 to 2030. The growth is driven by massive 5G infrastructure investments, rapid cloud service expansion, and the growth of AI-driven data centers. Federal initiatives like the Broadband Equity, Access, and Deployment (BEAD) program are accelerating rural fiber expansion. Additionally, strict Federal Communications Commission (FCC) regulations on network performance and the increasing adoption of quantum and edge computing are fueling demand for advanced fiber testing solutions.

Europe Fiber Optic Test Equipment Market Trends

The fiber optic test equipment industry in Europe is expected to grow at a significant CAGR from 2025 to 2030. The growth is driven by stringent EU regulations on network quality, large-scale fiber-to-the-home (FTTH) deployments, and the European Commission’s Digital Decade targets. Increasing investments in green data centers and 5G private networks for industrial automation further boost demand. Additionally, cross-border fiber connectivity projects and smart city initiatives are accelerating the adoption of advanced fiber testing solutions.

The growth of the fiber optic test equipment market in the UK is driven by the nationwide full-fiber broadband rollout, aggressive 5G network expansion, and government-backed rural connectivity programs. Rising investments in hyperscale data centers and fiber infrastructure for smart transportation systems further fuel demand. Additionally, Ofcom’s strict network performance standards push telecom operators to adopt advanced testing solutions.

The Germany fiber optic test equipment market’s growth is driven by the country’s focus on digital transformation, particularly in manufacturing (Industry 4.0) and automotive sector connectivity. The government’s funding for broadband expansion and accelerated 5G rollout for industrial automation further boosts market demand.

Asia Pacific Fiber Optic Test Equipment Market Trends

Asia Pacific dominated the global fiber optic test equipment industry in 2024 with a share of over 32.8%. The growth is driven by rapid 5G deployments, urbanization, and the expansion of smart cities. Key factors include large-scale broadband infrastructure investments in countries like China and India and increasing demand for fiber optics in telecom and industrial automation across emerging economies.

The fiber optic test equipment market in Japan is driven by advancements in 5G network infrastructure, high demand for optical networks in robotics and automation for industrial sectors, and Japan's focus on next-gen data centers. Additionally, government initiatives for smart city projects and IoT integration further fuel market growth.

The China fiber optic test equipment market’s growth is driven by massive 5G network rollouts, urban infrastructure development, and government-backed smart city projects. Additionally, China’s leadership in manufacturing and industrial automation generates high demand for reliable fiber optic networks and testing solutions.

Key Fiber Optic Test Equipment Company Insights

Some of the key companies in the fiber optic test equipment industry include EXFO Inc., Anritsu, Keysight Technologies, Fluke Corporation, and others. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

Keysight Technologies is a provider of fiber optic test equipment, offering advanced solutions such as OTDRs, optical power meters, and signal analyzers. Known for innovation, Keysight supports industries with high-performance testing tools, enabling efficient network deployment, maintenance, and optimization.

-

VIAVI Solutions Inc. is a prominent player in the fiber optic test equipment market, offering a comprehensive range of products, including OTDRs, optical power meters, and network analyzers. The company specializes in fiber network testing, troubleshooting, and optimization, supporting telecom and data center industries.

Key Fiber Optic Test Equipment Companies:

The following are the leading companies in the fiber optic test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Landa Corporation Ltd.

- EXFO Inc.

- Anritsu

- Keysight Technologies

- Fluke Corporation

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

- TEKTRONIX, INC.

- AFL

- Photon Kinetics, Inc

- OZ Optics Ltd.

Recent Developments

-

In September 2024, Keysight Technologies introduced the N7718C Optical Reference Transmitter. This solution supports high-speed optical communication by enabling compliance with emerging standards, such as IEEE 802.3dj, and offers versatile features, including clean and stressed signal generation, flexible optical input options, and compatibility with various modulation formats. It ensures precise testing and validation of optical receivers, improving performance and reducing noise and jitter for next-generation data transmission.

-

In July 2024, VIAVI Solutions Inc. launched NITRO Fiber Sensing, a real-time asset monitoring and analytics solution for critical infrastructure such as pipelines, power transmission, and data centers. It enables operators to detect, localize, and prevent threats to minimize downtime and reduce Total Cost of Ownership (TCO). By utilizing remote Fiber Test Heads for continuous monitoring, NITRO ensures proactive maintenance and enhances infrastructure security across industries.

Fiber Optic Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 983.9 million

Revenue forecast in 2030

USD 1,356.1 million

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

EXFO Inc.; Anritsu; Keysight Technologies; Fluke Corporation; VIAVI Solutions Inc.; Yokogawa Electric Corporation; TEKTRONIX, INC.; AFL; Photon Kinetics, Inc.; OZ Optics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

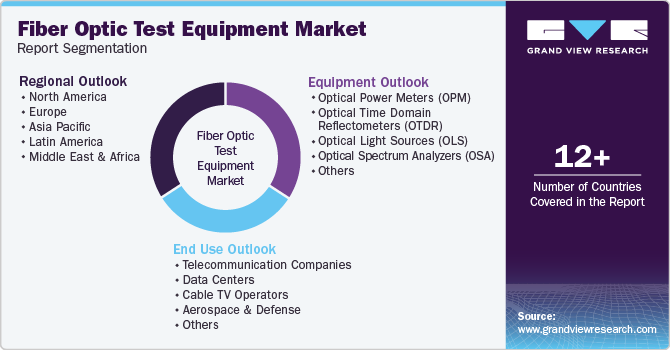

Global Fiber Optic Test Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fiber optic test equipment market report based on equipment, end-use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Power Meters (OPM)

-

Optical Time Domain Reflectometers (OTDR)

-

Optical Light Sources (OLS)

-

Optical Spectrum Analyzers (OSA)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunication Companies

-

Data Centers

-

Cable TV Operators

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber optic test equipment market size was estimated at USD 935.5 million in 2024 and is expected to reach USD 983.9 million in 2025.

b. The global fiber optic test equipment market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 1,356.1 million by 2030.

b. Asia Pacific dominated the fiber optic test equipment market with a share of 32.80% in 2024. The growth is attributed to driven by rapid 5G deployments, urbanization, and the expansion of smart cities.

b. Some key players operating in the virtual cards market include Landa Corporation Ltd., EXFO Inc., Anritsu, Keysight Technologies, Fluke Corporation, VIAVI Solutions Inc., Yokogawa Electric Corporation, TEKTRONIX, INC., AFL, Photon Kinetics, Inc, and OZ Optics Ltd.

b. The market is driven by the rapid expansion of 5G networks, data centers, and high-speed broadband deployments, increasing demand for efficient fiber optic infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.