- Home

- »

- Electronic Devices

- »

-

Passive Optical Network Market Size & Share Report, 2030GVR Report cover

![Passive Optical Network Market Size, Share & Trends Report]()

Passive Optical Network Market (2024 - 2030) Size, Share & Trends Analysis Report By Structure, By Component, By Application (FTTx, Mobile Backhaul), By Region, And Segment Forecasts

- Report ID: 978-1-68038-853-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Passive Optical Network Market Summary

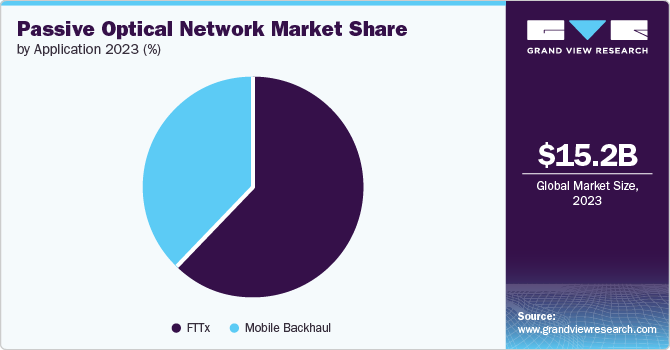

The global passive optical network market size was estimated at USD 15.12 billion in 2023 and is projected to reach USD 37.1 billion by 2030, growing at a CAGR of 13.9% from 2024 to 2030. With the proliferation of bandwidth-intensive applications, such as streaming services, online gaming, and cloud computing, consumers and businesses require faster and more reliable broadband connections.

Key Market Trends & Insights

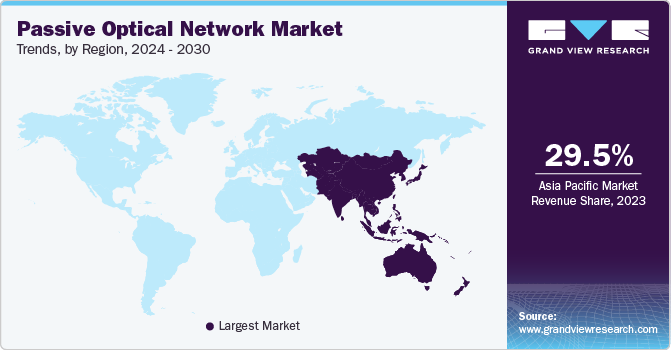

- Asia Pacific passive optical network market accounted for the largest market revenue share of 29.5% in 2023.

- The U.S. passive optical network market accounted for the largest market revenue share in North America.

- By structure, gigabyte passive optical network (GPON) dominated the market and accounted for a share of 44.2% in 2023.

- By component, optical cables accounted for the largest market revenue share in 2023.

- By application, the FTTx segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.12 Billion

- 2030 Projected Market Size: USD 37.1 Billion

- CAGR (2024-2030): 13.9%

- Asia Pacific: Largest market in 2023

- Middle East & Africa: Fastest growing market

With their ability to deliver high data rates and low latency, PON technologies are well-positioned to meet this growing need for seamless connectivity. As cities and communities expand, there is a greater need for robust and scalable broadband networks that can support high data transfer rates and future growth. PON systems are well-suited for these applications because they can support multiple users through a single optical fiber. The global shift towards fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) deployments is driving investments in PON infrastructure, as these solutions provide an efficient means to extend high-speed internet access to underserved areas and support the digital transformation of various sectors.

Innovations such as Gigabit Passive Optical Networks (GPON), XG-PON (10-Gigabit PON), and NG-PON2 (Next-Generation PON2) have significantly enhanced the capabilities of PON systems. These advanced technologies offer higher bandwidth, increased efficiency, and better performance than previous generations. The development of these next-generation PON solutions is encouraging ISPs and telecommunications companies to invest in PON technology as they seek to offer higher-speed services and meet their customers' evolving needs.

Structure Insights

Gigabyte Passive Optical Network (GPON) dominated the market and accounted for a share of 44.2% in 2023. As consumers and businesses increasingly rely on high-definition video streaming, online gaming, and cloud-based applications, there is a pressing need for network solutions to deliver higher bandwidth and faster speeds. GPON technology effectively addresses this demand with its capability to provide gigabit speeds to end-users. It offers a scalable solution that supports up to 2.5 Gbps downstream and 1.25 Gbps upstream, enhancing the service offerings and accommodating the ever-growing data needs of its customers.

Ethernet Passive Optical Network (EPON) is expected to register the fastest CAGR of 15.1% during the forecast period. EPON leverages standard Ethernet protocols and passive optical components, which helps reduce initial deployment and long-term operational costs compared to alternative optical networking technologies. The simplicity of the EPON architecture, which uses passive optical splitters to distribute the optical signal, further contributes to its cost efficiency. EPON’s ability to support many users with minimal additional infrastructure investments makes it a scalable solution for expanding existing networks and deploying new ones.

Component Insights

Optical cables accounted for the largest market revenue share in 2023. The expansion of 5G networks and the ongoing evolution of wireless technologies have amplified the need for robust and high capacity backhaul networks. Optical cables are pivotal in providing the bandwidth and low latency required to support the seamless connectivity and data transfer demands of 5G infrastructure. As the deployment of 5G continues to gain momentum globally, the demand for optical cables within the PON market is expected to experience significant growth.

The Optical Network Terminal (ONT) is expected to register the fastest CAGR during the forecast period. Applications such as 4K video streaming, online gaming, virtual reality (VR), and telecommuting require high bandwidth and low latency. ONTs are crucial components in PON networks that deliver high-speed internet to end-users. They convert the optical signal from the fiber network into an electrical signal that can be used by end-user devices.

Application Insights

The FTTx segment accounted for the largest market revenue share in 2023. FTTx solutions offer a scalable and future-proof infrastructure as businesses and service providers seek to build resilient networks that support future growth and technological advancements. FTTx networks are designed to accommodate increased data traffic and integrate new technologies as they become available, providing a long-term solution for high-speed internet connectivity. Furthermore, FTTx technologies provide the necessary infrastructure to support smart city initiatives and IoT applications, offering high-bandwidth and low-latency connections.

The mobile backhaul segment is anticipated to grow at the fastest CAGR over the forecast period. As fiber optic networks extend to new locations, there is an increasing need for mobile backhaul solutions to leverage this expanding infrastructure. PON technology provides a cost-effective and scalable solution for mobile backhaul, allowing service providers to utilize existing fiber optic networks to connect mobile base stations and improve network coverage.

Regional Insights

North America passive optical network market held a substantial market share in 2023. Government initiatives and funding programs aimed at expanding broadband access drive the market in North America. Programs such as the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund (RDOF) and the Infrastructure Investment and Jobs Act (IIJA) provide financial support for the deployment of high-speed internet infrastructure, especially in underserved and rural areas. These initiatives focus on improving broadband accessibility and bridging the digital divide by funding the installation of fiber optic networks.

U.S. Passive Optical Network Market Trends

The U.S. passive optical network market accounted for the largest market revenue share in North America. Advancements in fiber optic technology have been instrumental in fueling the growth of the PON market in the U.S. Wavelength Division Multiplexing (WDM) and passive optical splitters have enhanced the efficiency and performance of PON systems, enabling higher data transmission rates over longer distances. These technological advancements have made PON networks more reliable, scalable, and cost-effective, driving their adoption across various industry verticals.

Europe Passive Optical Network Market Trends

Europe passive optical market was identified as a lucrative region in 2023. As European consumers and businesses continue to embrace data-intensive applications such as ultra-high-definition video streaming, online gaming, and remote work, the demand for faster and more reliable internet connections is growing. PON technologies, including GPON (Gigabit Passive Optical Network) and XG-PON (10-Gigabit Passive Optical Network), offer the high-speed, high-bandwidth solutions necessary to meet these evolving demands.

The UK passive optical market is anticipated to grow significantly over the forecast period. The UK telecommunications sector is increasingly focused on expanding FTTH networks to improve broadband service quality and compete in the market. The shift towards FTTH as a preferred broadband solution reflects a broader trend towards investing in fiber optic infrastructure to provide future-proof internet services. This growing emphasis on FTTH deployments supports the expansion of the PON market in the UK.

Asia Pacific Passive Optical Network Market Trends

Asia Pacific passive optical network market accounted for the largest market revenue share of 29.5% in 2023. The rapid urbanization and increasing population density in the Asia Pacific are contributing to the expansion of PON networks. As urban areas become more densely populated, the demand for high-speed internet and advanced communication services escalates, creating a favorable environment for adopting PON technology. In addition, the growing number of residential and commercial construction projects in urban areas is driving the deployment of fiber-based PON solutions to meet the escalating connectivity needs.

China passive optical network market is anticipated to grow significantly over the forecast period. The increasing adoption of cloud services and data-intensive applications drives the need for higher bandwidth capacities in China. PON technology offers bandwidth efficiency and scalability advantages compared to traditional copper-based networks. As businesses and consumers continue embracing cloud computing and streaming services, the demand for PON solutions is expected to grow.

Middle East & Africa Passive Optical Network Market Trends

Middle East & Africa passive optical network market is anticipated to register the fastest CAGR over the forecast period. Government initiatives and national broadband strategies drive the growth of the PON market in the Middle East and Africa. Many countries in the region have launched plans to improve their telecommunications infrastructure. For instance, Saudi Arabia’s Vision 2030 includes expanding fiber-optic networks as a critical component of its digital transformation goals. Similarly, South Africa’s National Broadband Policy aims to enhance internet coverage and access through increased investment in broadband infrastructure.

Key Passive Optical Network Company Insights

Some of the key companies in the passive optical network market include Adtran, Calix, Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Mitsubishi Electric Corporation, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

ZTE Corporation offers a range of products to meet different requirements in a PON system. This involves smart OLTs managing data flow at the central office, ONTs at customer premises with Wi-Fi and VoIP capabilities, and passive splitters effectively dividing the signal for multiple users.

-

Adtran provides various passive optical network (PON) solutions specifically designed for the core network equipment. The company offers software-defined optical line terminals (SDX 6000 Series), which are flexible and open devices. These OLTs provide options for different PON standards, such as GPON, XGS-PON, and Combo PON (GPON and XGS-PON).

Key Passive Optical Network Companies:

The following are the leading companies in the passive optical network market. These companies collectively hold the largest market share and dictate industry trends.

- Adtran

- Calix, Inc.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- ZTE Corporation

- Fujitsu

- NXP Semiconductors

- TP-LINK CORPORATION PTE. LTD.

- Luna Innovations Incorporated

- Silixa Ltd

Recent Developments

-

In October 2023, ZTE Corporation launched the industry’s first Tbit all-optical access platform, ZXA10 C600E. This platform is designed to meet the increasing demand for high-bandwidth and low-latency services in the era of 5G and cloud computing.

Passive Optical Network Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.0 billion

Revenue forecast in 2030

USD 37.1 billion

Growth Rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Structure, component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; South Africa; UAE; South Africa

Key companies profiled

Adtran; Calix, Inc.; Huawei Technologies Co., Ltd.; Mitsubishi Electric Corporation; ZTE Corporation; Fujitsu; NXP Semiconductors; TP-LINK CORPORATION PTE. LTD.; Luna Innovations Incorporated; Silixa Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passive Optical Network Market Report Segmentation

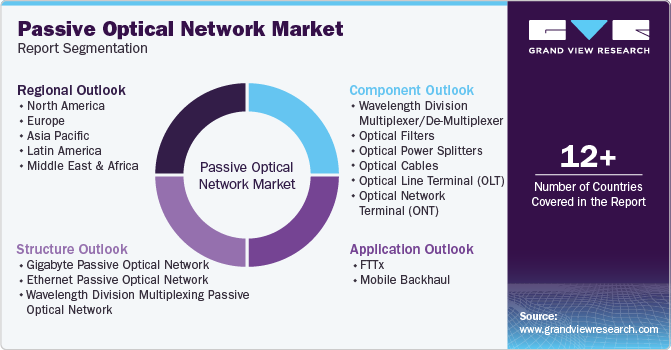

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global passive optical network market report based on structure, component, application, and region:

-

Structure Outlook (Revenue, USD Million, 2017 - 2030)

-

Gigabyte Passive Optical Network (GPON)

-

Ethernet Passive Optical Network (EPON)

-

Wavelength Division Multiplexing Passive Optical Network (WDM-PON)

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Wavelength Division Multiplexer/De-Multiplexer

-

Optical Filters

-

Optical Power Splitters

-

Optical Cables

-

Optical Line Terminal (OLT)

-

Optical Network Terminal (ONT)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

FTTx

-

Mobile Backhaul

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.