- Home

- »

- Petrochemicals

- »

-

Fischer-Tropsch Wax Market Size, Industry Report, 2033GVR Report cover

![Fischer-Tropsch Wax Market Size, Share & Trends Report]()

Fischer-Tropsch Wax Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (FT Hard Wax, FT Medium Wax, FT Soft Wax), By Application (Adhesives & Sealants, Paints & Coatings, Plastics & Rubber Processing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-821-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fischer-Tropsch Wax Market Summary

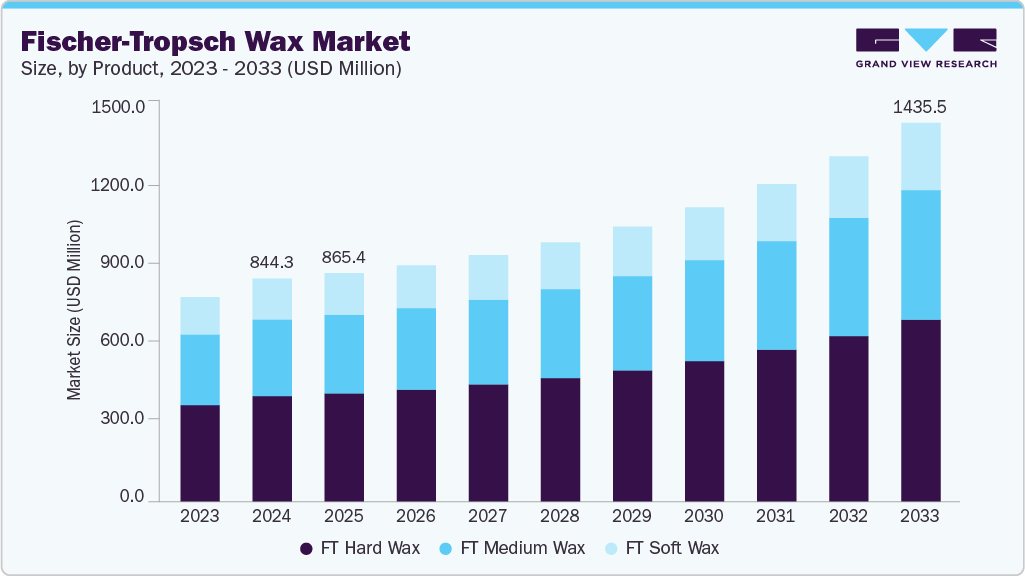

The global fischer-tropsch wax market size was estimated at USD 844.3 million in 2024 and is projected to reach USD 1435.5 million by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The market is primarily driven by rising demand for high-performance synthetic waxes across adhesives & sealants, coatings, printing inks, and plastics processing, where superior thermal stability, narrow molecular weight distribution, and low oil content deliver enhanced product performance.

Key Market Trends & Insights

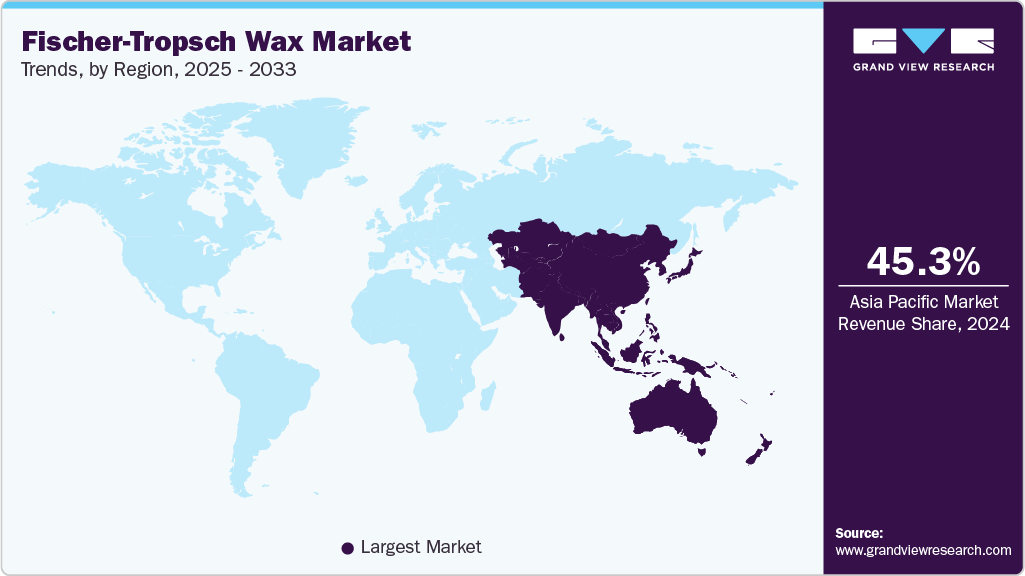

- Asia Pacific dominated the fischer-tropsch wax industry with the largest revenue share of 45.3% in 2024.

- The market in China is expected to grow at the fastest CAGR of 7.0% from 2025 to 2033.

- By product, the FT hard wax segment held the largest revenue share of 47.3% in 2024 in terms of value.

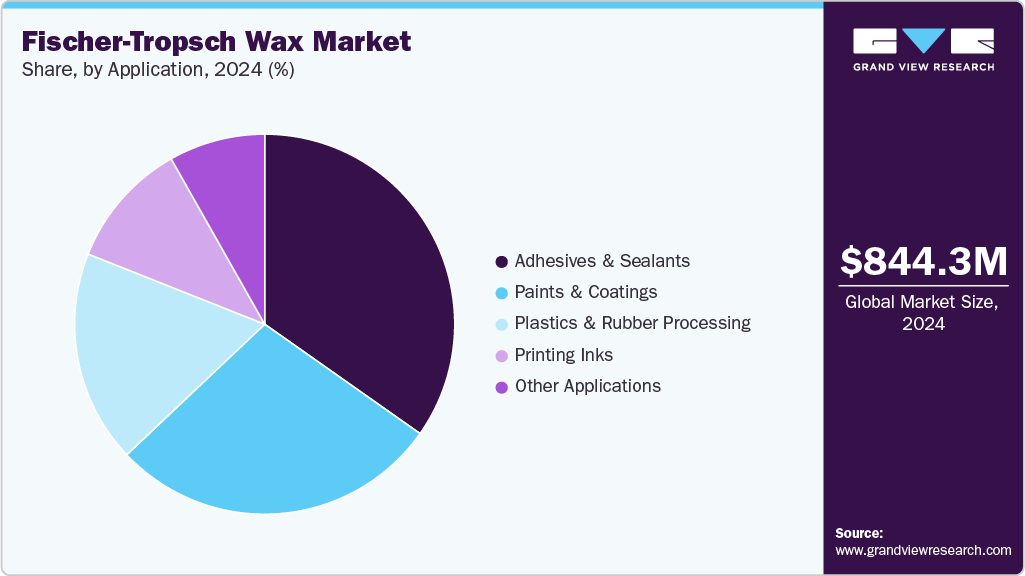

- By application, the adhesives & sealants segment held the largest revenue share of 34.8% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 844.3 Million

- 2033 Projected Market Size: USD 1,435.5 Million

- CAGR (2025-2033): 6.5%

- Asia Pacific: Largest market in 2024

The expanding gas-to-liquids (GTL) and coal-to-liquids (CTL) capacity, particularly in the Asia Pacific and the Middle East, is ensuring a stable supply while improving cost competitiveness. Growth in infrastructure development, packaging, and automotive manufacturing, coupled with increasing substitution of conventional petroleum waxes with cleaner, more consistent fischer-tropsch (FT) wax solutions, further reinforces sustained market expansion.Significant opportunities are emerging from the growing shift toward specialty and premium-grade wax formulations for advanced applications such as high-end coatings, hot-melt adhesives, 3D printing materials, and engineered plastics. The increasing focus on sustainability and process efficiency is also accelerating demand for FT waxes with low VOC emissions and improved recyclability profiles. Furthermore, investments in hydrogen-based FT technologies and renewable feedstock integration present long-term potential for bio-based and low-carbon FT wax production, opening new pathways for differentiation and premium pricing, particularly in regulated markets across Europe and North America.

Despite growth dynamics, the market faces notable challenges, including high capital requirements for GTL and FT synthesis facilities, which restrict new capacity creation and concentrate supply among a few large producers. Volatility in natural gas and coal feedstock prices, coupled with geopolitical risks affecting energy supply chains, can impact production economics and pricing stability. The competition from lower-cost petroleum-based wax alternatives, regulatory scrutiny on carbon-intensive production routes, and limited end-user awareness in developing regions pose structural barriers to faster market penetration.

Market Concentration & Characteristics

The fischer-tropsch (FT) wax industry exhibits a concentrated yet differentiated competitive landscape, dominated by large integrated players such as Shell, Evonik, Clariant, Mitsui Chemicals, and Honeywell International, which benefit from strong upstream integration, advanced R&D capabilities, and global distribution networks. These companies focus on supplying high-purity FT waxes for large-scale industrial applications, leveraging product consistency, technical performance, and long-term supply contracts to secure market leadership. In contrast, specialist and regional players including Hywax GmbH, Nippon Seiro, King Honor International, Carmel Industries, and Bio Greenware compete through niche formulations, customized grades, and flexible customer servicing, targeting specific application segments and regional markets.

Competitive intensity is shaped by performance-based differentiation, sustainability positioning, and supply reliability. While pricing competition persists from petroleum-based alternatives, FT wax producers defend margins through superior functional properties and compliance with stringent environmental standards. High capital investment requirements and limited feedstock access create significant entry barriers, reinforcing market concentration, while strategic partnerships, capacity expansions, and innovation in low-carbon and bio-based FT waxes are emerging as key levers for long-term competitiveness.

Product Insights

The FT hard wax segment dominated the market with the largest revenue share of 47.3% in 2024, primarily due to its superior thermal stability, high melting point, and excellent hardness, which make it ideal for demanding industrial applications such as hot-melt adhesives, high-performance coatings, and polishing compounds. Its robust functional properties, including low oil content and narrow molecular weight distribution, allow manufacturers to achieve consistent quality and enhanced product performance, driving strong adoption across adhesives, coatings, and polymer processing industries. The segment’s dominance is further supported by rising industrialization in Asia Pacific, where high-volume consumption and GTL/CTL-based FT wax production underpin steady supply and competitive pricing.

In comparison, the FT medium wax and FT soft wax occupy smaller market shares due to their comparatively moderate functional properties and specialized applications. FT Medium Wax, with a balance of hardness and flexibility, is widely used in printing inks, plastics, and rubber processing, contributing a significant but secondary revenue share. FT Soft Wax, characterized by lower melting points, finds niche applications in candles, cosmetics, and low-temperature coatings, limiting its scale. While both segments are expected to grow steadily, the FT Hard Wax segment remains the fastest-growing and primary revenue driver, benefiting from broad industrial demand, premium pricing potential, and increasing penetration in high-value manufacturing applications.

Application Insights

The adhesives & sealants segment captured the largest revenue share of 34.8% in 2024, driven by the growing demand for high-performance bonding solutions across packaging, construction, automotive, and consumer goods industries. FT waxes are widely used in hot-melt adhesives and pressure-sensitive tapes due to their superior thermal stability, low oil content, and consistent melting properties, which enhance bonding efficiency, processing reliability, and product durability. Increasing industrialization in the Asia Pacific and North America, along with the rising adoption of eco-friendly and high-performance adhesives, further fuels the dominance of this application segment.

Other key application segments, paints & coatings, plastics & rubber processing, printing inks, and other applications, collectively account for the remaining market share. Paints & Coatings benefit from FT waxes’ ability to improve scratch resistance, gloss retention, and surface smoothness. In plastics & rubber processing, FT waxes act as lubricants, anti-blocking agents, and release agents, enhancing product quality and processing efficiency. Printing Inks rely on medium and soft waxes to optimize flow, prevent smudging, and improve adhesion. Niche applications, including candles, cosmetics, and specialty industrial formulations, form the Other Applications category. While these segments continue to grow steadily, Adhesives & Sealants remain the primary revenue driver, driven by broad industrial adoption and high-volume consumption.

Regional Insights

Asia Pacific FT wax industry dominated the global market in 2024, accounting for a 45.3% of total revenue, driven by robust industrialization, rapid urbanization, and a strong manufacturing base in adhesives, coatings, plastics, and packaging. The region benefits from abundant GTL and CTL production capacity, particularly in China, which ensures a stable supply and competitive pricing. Rising demand in automotive, electronics, and construction sectors, coupled with increasing adoption of high-performance synthetic waxes, underpins APAC’s leading market position.

China FT wax industry accounted for 56.2% of Asia Pacific’s FT wax demand in 2024, reflecting its role as the region’s manufacturing powerhouse. Strong domestic consumption in adhesives, coatings, plastics, and rubber processing, combined with locally produced CTL-based FT wax, supports high-volume adoption. Government-backed infrastructure development, growing industrial output, and expanding export-oriented manufacturing contribute to China’s market dominance, making it the largest single-country market globally.

North America Fischer-Tropsch Wax Market Trends

North America FT wax industry captured 25.3% of the global FT wax market in 2024, led primarily by the United States. The region’s growth is driven by mature industrial sectors such as adhesives, coatings, and printing inks, which rely on high-purity FT waxes for consistent performance. Steady industrial demand, technological advancements in specialty waxes, and strong regulatory compliance standards further consolidate North America’s position as a key regional market.

U.S. Fischer-Tropsch Wax Market Trends

The U.S. FT wax industry represented 82.8% of North American FT wax consumption in 2024, reflecting its dominant industrial base and high adoption of premium, application-specific waxes. FT waxes are extensively used in adhesives, coatings, and plastics, benefiting from advanced manufacturing practices and stringent quality requirements. The country’s focus on sustainability and low-VOC wax grades, along with stable domestic GTL and import supply, reinforces its leadership within the North American market.

Europe Fischer-Tropsch Wax Market Trends

Europe FT wax industry held 20.7% of the global market in 2024, supported by strong demand in high-value industrial applications, including adhesives, coatings, printing inks, and specialty plastics. The region’s growth is driven by regulatory emphasis on product consistency, environmental compliance, and the adoption of low-carbon and specialty-grade FT waxes. Key industrial hubs in Germany, France, and the UK act as demand centers for both commodity and high-performance wax products.

Germany FT wax industry is Europe’s largest FT wax market, accounting for a significant share of regional demand due to its advanced manufacturing, automotive, and chemical sectors. High adoption of FT waxes in coatings, adhesives, and plastics is driven by stringent quality standards and industrial automation. Germany also serves as a strategic export hub for European wax producers, supplying specialty-grade FT waxes to neighboring countries.

Middle East & Africa Fischer-Tropsch (FT) Wax Market Trends

The Middle East & Africa FT wax industry is a growing market, supported by rising GTL production in countries such as Qatar, UAE, and Saudi Arabia. The region serves both domestic industrial needs and exports to Europe and Asia, leveraging abundant natural gas feedstocks for cost-effective FT wax production. Rising construction, packaging, and industrial activity, alongside planned GTL expansions, present growth opportunities for the region.

Latin America Fischer-Tropsch (FT) Wax Market Trends

Latin America FT wax industry is experiencing substantial growth, driven by industrial applications in adhesives, coatings, and plastics. Market growth is moderate due to smaller industrial bases and limited local FT wax production, making the region dependent on imports from APAC, North America, and Europe. Brazil and Mexico are the largest markets, with steady expansion expected from the packaging, construction, and automotive sectors.

Key Fischer-Tropsch (FT) Wax Company Insights

Key players, such as Hywax GmbH, Shell plc, Evonik Industries AG, CLARIANT, Carmel Industries , and King Honor International Ltd. are dominating the market.

Hywax GmbH

-

Hywax GmbH is a leading German wax specialist that, as of March 2022, operates under AWAX Group following the acquisition of Sasol Wax GmbH. Hywax maintains two production plants in Hamburg, plus sites in Linz (Austria) and Birkenhead (UK), and offers a broad portfolio including Fischer‑Tropsch synthetic waxes, paraffin and microcrystalline waxes, petroleum jellies, and tailor‑made emulsions. Their FT wax business is backed by proprietary hydrogenation (“hydrofinishing”) capabilities, giving them technological leadership in high‑purity, high‑performance waxes. The company serves a wide industrial base, adhesives, coatings, inks, polymers, cosmetics, candles, construction, and more, while emphasizing sustainability via zero‑waste production and upcycling by‑products.

Key Fischer-Tropsch (FT) Wax Companies:

The following are the leading companies in the fischer-tropsch (FT) wax market. These companies collectively hold the largest market share and dictate industry trends.

- Hywax GmbH

- Shell plc

- Evonik Industries AG

- CLARIANT

- Carmel Industries

- King Honor International Ltd.

- NIPPON SEIRO CO., LTD.

- Mitsui Chemicals, Inc.

- Honeywell International Inc.

- Bio Greenware Ltd

Fischer-Tropsch (FT) Wax Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 865.4 million

Revenue forecast in 2033

USD 1,435.5 million

Growth Rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

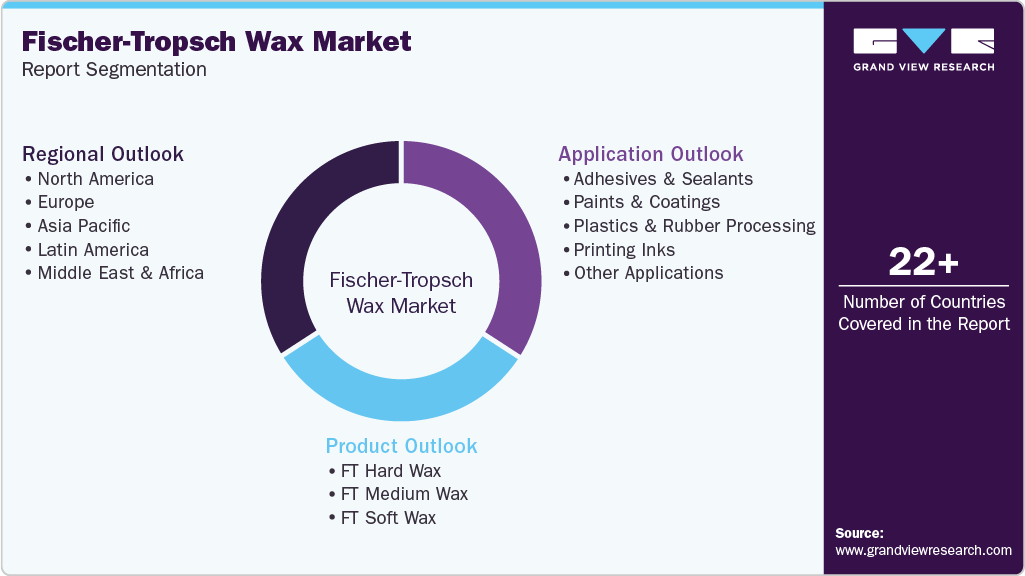

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Hywax GmbH; Shell plc; Evonik Industries AG; CLARIANT; Carmel Industries; King Honor International Ltd.; NIPPON SEIRO CO., LTD.; Mitsui Chemicals, Inc.; Honeywell International Inc.; Bio Greenware Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fischer-Tropsch (FT) Wax Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global Fischer-Tropsch (FT) wax market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

FT Hard Wax

-

FT Medium Wax

-

FT Soft Wax

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Adhesives & Sealants

-

Paints & Coatings

-

Plastics & Rubber Processing

-

Printing Inks

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global fischer-tropsch wax market size was estimated at USD 844.3 million in 2024 and is expected to reach USD 865.4 million in 2025.

b. The global fischer-tropsch wax market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach USD 1,435.5 million by 2033.

b. The adhesives & sealants segment dominated the FT wax market in 2024, capturing the largest revenue share due to strong industrial demand for high-performance bonding solutions in packaging, construction, automotive, and consumer goods, where FT waxes enhance thermal stability, processing consistency, and product durability.

b. Some of the key players operating in the fischer-tropsch (FT) wax market include Hywax GmbH, Shell plc, Evonik Industries AG, CLARIANT, Carmel Industries, King Honor International Ltd., NIPPON SEIRO CO., LTD., Mitsui Chemicals, Inc., Honeywell International Inc., and Bio Greenware Ltd

b. The FT wax market is primarily driven by rising industrial demand across adhesives, coatings, plastics, and printing inks, coupled with expanding GTL/CTL production capacity in Asia Pacific and the Middle East, which ensures consistent supply and competitive pricing. The superior thermal stability, low oil content, and narrow molecular weight distribution of FT waxes support high-performance applications, further fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.