- Home

- »

- Plastics, Polymers & Resins

- »

-

Flame Retardants For Aerospace Plastics Market Size ReportGVR Report cover

![Flame Retardants For Aerospace Plastics Market Size, Share & Trends Report]()

Flame Retardants For Aerospace Plastics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Antimony Oxide, Aluminum Trihydrate, Organophosphates, Boron Compounds), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-761-2

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flame Retardants for Aerospace Plastics Market Summary

The global flame retardants for aerospace plastics market size was estimated at USD 29.11 million in 2022 and is projected to reach USD 50.18 million by 2030, growing at a CAGR of 7.0% from 2023 to 2030. The industry is characterized by rising safety concerns over the flammability of plastic materials and their rapidly increasing usage in the aircraft sector.

Key Market Trends & Insights

- Europe dominated the market with a revenue share of 46.8% in 2022.

- In Asia Pacific, the use of flame retardants for plastics used in the production of aircraft is rising steadily.

- Based on product, the aluminum trihydrates segment dominated the global flame retardants for aerospace plastics market with a revenue share of more than 42% in 2022.

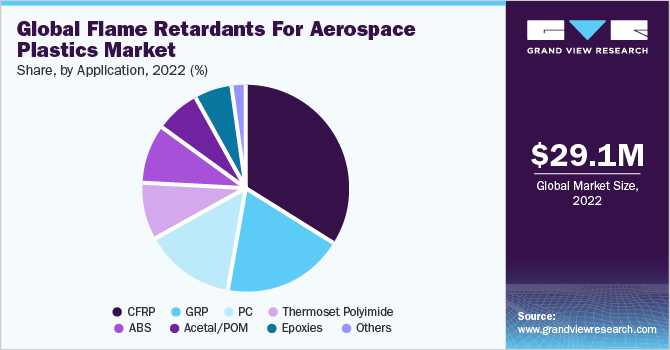

- Based on application, the carbon fiber reinforced plastic (CFRP) application segment dominated the market with a revenue share of 33.84% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 29.11 Million

- 2030 Projected Market Size: USD 50.18 Million

- CAGR (2023-2030): 7.0%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

By incorporating flame retardants into plastics that are quickly replacing most conventional materials in the aerospace industry, it becomes easier to reduce the risk of fire hazards and improve passenger and cargo safety due to the confined spaces in airplanes. Non-halogenated retardants like alumina trihydrate, antimony oxides, and organophosphates have made it possible to expand even in developed markets that are constrained by restrictions. With these composites being used in a variety of airplane parts, from the cockpit to the empennage, carbon fiber reinforced polymers (CFRP) have been a major user of flame retardants.

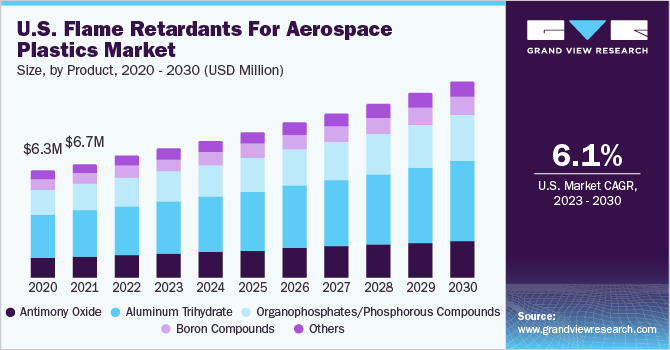

The U.S. is the largest consumer of the product in North America with a revenue share of more than 75% in 2022. High demand from the automotive & packaging industries is expected to drive market advancement in North America. Furthermore, the continuous strengthening of food, environmental, and medical regulations by regulatory bodies, including the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA), is expected to further contribute to high market demand in the coming years.

The rising awareness regarding the protection of combustible materials from fire hazards is another factor driving product demand. Decks, airframes, wings, cabins, cushion foams, rotor blades, and other interior parts of aeronautical vehicles frequently employ plastic. Because of their lightweight, adaptability, flexibility, low maintenance requirements, high resistance to chemicals and pressure, and versatility, high-performance engineered products such as polyimides, polycarbonates, glass-reinforced plastics (GRP), and even epoxies are overtaking traditional materials like metal and wood in terms of importance.

Product Insights

The aluminum trihydrates segment dominated the global flame retardants for aerospace plastics market with a revenue share of more than 42% in 2022. The significant demand for this product is attributed to the fact that aluminum trihydrate is an inexpensive substance that is frequently used in polymers for aerospace purposes since it is abundant in nature.

The increased demand for intumescent coatings, polyamides, and other aerospace plastic applications, has meant that red phosphorous, ammonium polyphosphate and other organophosphates have become the products with the fastest growth rates. Ammonium polyphosphate (APP) is primarily employed in intumescent systems, such as paints and coatings, to protect materials like steel and combustible plastics.

For aerospace plastic applications, antimony oxides are mostly employed as synergists with phosphorous- or nitrogen-based chemicals. The substance aids in fire prevention and control by delaying the decomposition process and preventing the release of flammable gases. Over the projection period, there will likely be a steady rise in the need for plastics and items that are fire-safe on airplanes to prevent mistakes and accidents.

There is a sizable market demand for other flame retardants made from materials like nitrogen, magnesium hydroxide, and molybdenum. Molybdenum compounds are most frequently utilized as smoke suppressants in cellulosic materials, although they recently became more common in many polymers as condensed-phase flame retardants. Due to its inherent stability at temperatures above 300 °C, magnesium hydroxide is a very acceptable alternative to ATH. The substance is also adaptable to processing across a variety of polymers, which encourages its use in aircraft plastics.

Application Insights

The carbon fiber reinforced plastic (CFRP) application segment dominated the market with a revenue share of 33.84% in 2022. This growth is attributed to the fact that CFRP contributes to a significant reduction in the weight of an aircraft and, as a result, a 20-30% reduction in fuel costs. Due to the material's strong impact resistance, defense jets are using it more and more frequently, mostly in armor shields to prevent unintentional damage to engine pylons. Due to these improved product qualities, Boeing, Airbus, and other international airlines are creating carbon fiber commercial aircraft more frequently.

Glass Reinforced Plastic (GRP) PA 66 is frequently used to create engine intake manifolds. Benefits include a decrease in weight of up to 60%, increased aerodynamics due to better surface quality, and general product flexibility. These fibers can be molded as single units and employed as reinforcement against high stress, thus enhancing aircraft safety and durability. Up to 12% GRP is used in the European "Eurofighter" to lighten, boost strength, and prolong the durability of this aircraft.

With regards to North America, the use of various types of plastics and advanced composite materials by NASA, NORAD, and other aerospace agencies to improve the efficiency of military, stealth, and space exploration vehicles is predicted to increase product demand in the U.S. and Canada. Increasing industrialization and rising consumer disposable income in Mexico are two additional important elements fostering the expansion of the regional market.

Regional Insights

Europe dominated the market with a revenue share of 46.8% in 2022. This growth is attributed to the presence of notable airline firms such as Airbus and Boeing, as well as others like the Safran Group and Rolls Royce Holding, in the region. The rigorous regulation of the manufacturing and aviation sectors in Europe has slowed the construction of halogenated retardants and made it difficult for other additives to expand.

The development of the aviation business in India, China, Thailand, and other emerging nations has been aided by the rising consumer disposable income in these countries and a sharp growth in interest in travel and tourism activities. In Asia Pacific, the use of flame retardants for plastics used in the production of aircraft is rising steadily.

Key Companies & Market Share Insights

Multinational firms that are integrated along the value chain from producing chemicals to delivering flame retardants define the global flame retardants industry for aerospace plastics. Players are merging and forming alliances to solidify their positions in the market. For instance, GF Piping Systems introduced its HEAT-FIT flame-retardant pipe jacket technology in March 2022. Applications for this solution include cruise ships, offshore rigs, and commercial ships.

Two thermoplastic polyurethane (TPU) layers make up this system, and they provide exceptional temperature resistance. In the same vein, Clariant, a specialty chemical company focusing on sustainability and innovation, revealed in December 2021 that it intended to construct a production facility in China for its highly regarded Exolit OP flame retardant range. Building up local production capacity would enable Clariant to significantly increase the speed at which it can deliver solutions to clients in the country. Some of the prominent players in the global flame retardants for aerospace plastics market include:

-

Huber Engineered Materials

-

Clariant Corporation

-

RTP Company

-

Vantage Specialty Chemicals

-

Italmatch Chemicals

-

Chemtura

-

Albemarle

-

Ciba

-

DIC Corporation

-

Rio Tinto

-

Solvay

-

Royal DSM

-

Israel Chemicals

-

BASF SE

-

Sinochem

Flame Retardants for Aerospace Plastics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 31.13 million

Revenue forecast in 2030

USD 50.18 million

Growth Rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; South Korea; India; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Huber Engineered Materials; Clariant Corporation; RTP Company; Italmatch Chemicals; Vantage Specialty Chemicals; Chemtura; Albemarle; Ciba; DIC Corporation; Rio Tinto; Solvay; Royal DSM; Israel Chemicals; BASF SE; Sinochem

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flame Retardants For Aerospace Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flame retardants for aerospace plastics market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Antimony Oxide

-

Aluminum Trihydrate

-

Organophosphates/Phosphorous Compounds

-

Boron Compounds

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber Reinforced Plastic (CFRP)

-

Glass Reinforced Plastic (GRP)

-

Polycarbonate

-

Thermoset Polyimide

-

Acrylonitrile Butadiene Styrene (ABS)

-

Acetal/Polyoxymethylene (POM)

-

Epoxies

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flame retardants for aerospace plastics market size was estimated at USD 29.11 million in 2022 and is expected to reach USD 31.13 million in 2023.

b. The global flame retardants for aerospace plastics market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 50.18 million by 2030.

b. Carbon fiber reinforced plastics (CFRP) segment dominated the flame retardants for aerospace plastics market with a share of 33.84% in 2022. This is attributable to the rising demand in defense jets application on account of its high impact resistance property.

b. Some key players operating in the flame retardants for aerospace plastics market include Huber Engineered Materials, Clariant Corporation, RTP Company, Italmatch, Chemtura, Albemarle, Ciba, DIC Corporation, Rio Tinto, Solvay, Royal DSM, Israel Chemicals, and BASF SE.

b. Key factors that are driving the market growth include growing plastics demand owing to lower airframe weight & fuel savings and increasing air passenger traffic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.