- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Flow Wrap Packaging Market Size, Industry Report, 2030GVR Report cover

![Flow Wrap Packaging Market Size, Share & Trends Report]()

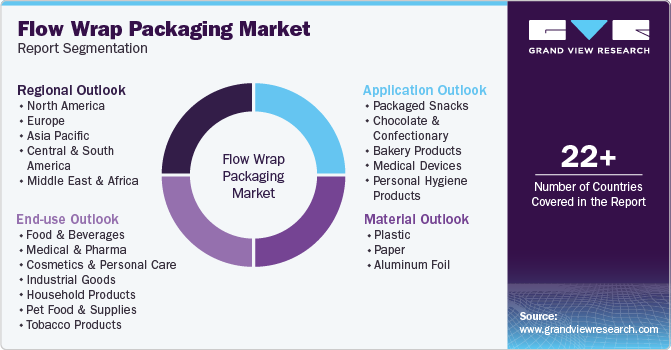

Flow Wrap Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper, Aluminum Foil), By Application (Packaged Snacks, Chocolate & Confectionary, Bakery Products), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-8

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Wrap Packaging Market Size & Trends

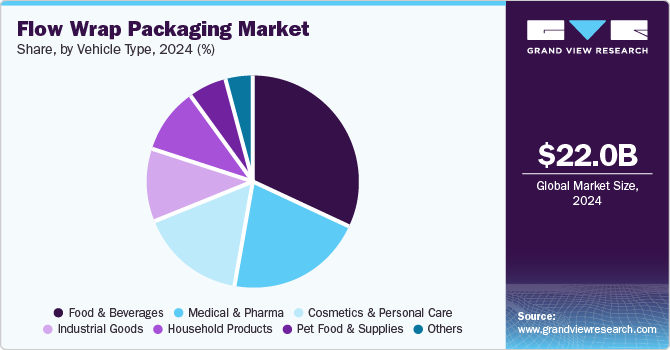

The global flow wrap packaging market size was estimated at USD 22.0 billion in 2024 and expected to grow at a CAGR of 7.77% from 2025 to 2030. As industries seek to enhance their operational efficiency, there is a growing demand for packaging solutions that can streamline production processes. Flow wrap packaging offers high-speed wrapping capabilities, which significantly reduces labor costs and increases productivity.

The flow wrap packaging industry is witnessing a significant trend toward sustainable materials, driven by consumer and regulatory pressures for eco-friendly solutions. Manufacturers are increasingly incorporating biodegradable films, recycled materials, and compostable polymers in their product offerings. This shift aligns with global efforts to reduce plastic waste and carbon emissions. Additionally, brands are adopting "green" flow wrap packaging to appeal to environmentally conscious consumers, a factor that is reshaping purchasing decisions and marketing strategies across multiple sectors, including food, beverages, and personal care products.

Drivers, Opportunities & Restraints

The rapid expansion of e-commerce and modern retail chains is a key driver for the flow wrap packaging market. With increased consumer reliance on online shopping, there is a growing demand for secure, durable, and visually appealing packaging that can protect goods during transit. Flow wrap packaging provides excellent flexibility, barrier protection, and cost efficiency, making it an ideal choice for industries such as snacks, confectionery, bakery, and Medical & Pharma. The shift toward convenience-oriented lifestyles has further boosted the need for single-serve and portion-controlled products, bolstering demand for flow wrap solutions.

Technological advancements in high-speed flow wrapping machines present lucrative opportunities for market players. Innovations such as automated systems with enhanced precision, improved sealing techniques, and capabilities for handling a wide range of materials allow manufacturers to increase efficiency and reduce production costs. These advancements cater to the rising need for high-volume production in industries like food and beverage, healthcare, and consumer goods, enabling companies to address growing demand while optimizing operational workflows. Additionally, integrating digital printing technologies into flow wrap packaging offers customization opportunities, enhancing brand differentiation.

The flow wrap packaging industry faces a significant restraint due to fluctuations in the prices of raw materials, particularly petroleum-based plastics such as polypropylene and polyethylene. Supply chain disruptions, geopolitical tensions, and varying crude oil prices contribute to price volatility, creating cost pressures for manufacturers. This challenge is compounded by the rising costs of sustainable alternatives, which, although environmentally friendly, often carry higher production expenses. These factors limit profit margins and make it difficult for smaller players to compete effectively, thereby impacting market growth.

Material Insights

Plastic dominated the market across the product segmentation in terms of revenue, accounting for a market share of 60.46% in 2024. Plastic flow wrap packaging is driven by its unmatched versatility and cost efficiency, making it a preferred material for a wide range of applications. Advanced plastic films like biaxially oriented polypropylene (BOPP) offer superior barrier properties, durability, and transparency, ensuring product freshness and visibility. Ongoing innovations in recyclable and bio-based plastics align with sustainability goals, allowing manufacturers to address environmental concerns without compromising performance. The ability to customize plastic wraps for branding further strengthens its appeal in competitive consumer markets, particularly in food and personal care industries.

The increasing preference for paper flow wrap packaging is a key driver in this segment, fueled by consumer demand for biodegradable and recyclable materials. Paper-based wraps cater to industries seeking to reduce their environmental impact while maintaining effective product protection. Recent advancements in coated and laminated paper materials enhance moisture resistance and durability, making them viable for packaging snacks, baked goods, and confectionery.

Application Insights

Packaged snacks dominated the market across the application segmentation in terms of revenue, accounting to a market share of 33.40% in 2024. This segment benefits from the surge in on-the-go consumption, driven by changing lifestyles and busy schedules. Flow wrap packaging offers a convenient and efficient way to package single-serve portions, ensuring product freshness and portability. Its ability to provide air-tight seals and tamper-proof designs is essential for maintaining snack quality. Furthermore, the rise of healthy snack options like protein bars and fruit-based products has expanded the demand for attractive and functional flow wrap solutions tailored to meet the needs of health-conscious consumers.

In the chocolate and confectionery market, flow wrap packaging is propelled by the growing emphasis on premium and aesthetic packaging. High-end chocolates and artisanal confections rely on attractive flow wraps with glossy finishes, metallic tones, and intricate designs to enhance shelf appeal and convey luxury. The need for effective moisture and temperature barriers to preserve the texture and taste of products drives innovation in this segment. Seasonal and festive packaging for chocolates and confectionery further amplifies the demand for customizable flow wrap solutions.

End-use Insights

Food & beverages dominated the flow wrap packaging market across the application segmentation in terms of revenue, accounting for a market share of 31.97% in 2024. Aircraft tyres are made from conductive elastomer, which consists of natural rubber, and are subjected to extreme conditions. They are reinforced with strong and flexible materials such as Kevlar to absorb more of the shock of landing and support the natural rubber. Natural rubber exhibits excellent abrasion resistance, tear resistance, and excellent green strength & tack, which allows it to stick to other materials.

In the pharmaceutical industry, flow wrap packaging is driven by the need for stringent safety standards and regulatory compliance. The ability of flow wraps to provide tamper-evident seals and protect medicines from moisture, light, and contamination makes them essential for drug packaging. Increasing demand for unit-dose and single-use medical products further fuels growth, as flow wrap solutions offer convenient and secure packaging for syringes, tablets, and medical devices.

Regional Insights

In North America, the increasing adoption of sustainable packaging technologies is a key driver for the flow wrap packaging industry. Companies are investing in innovative materials such as recyclable films and compostable polymers to meet stringent environmental regulations and consumer expectations for eco-friendly solutions. The region’s robust research and development ecosystem supports advancements in barrier properties and lightweight materials, making flow wrap packaging suitable for a broad range of applications, including snacks, beverages, and Medical & Pharma.

U.S. Flow Wrap Packaging Market Trends

The U.S. flow wrap packaging industry is propelled by the rising demand for convenience and customization in packaging. Consumers are seeking single-serve and portion-controlled options across food and beverage categories, driving the need for versatile flow wrap solutions. At the same time, brands are focusing on unique packaging designs and high-quality printing to differentiate their products in a competitive retail environment. Technological innovations, such as digital printing and high-speed flow wrap machines, support these customization needs, further fueling market growth.

Asia Pacific Flow Wrap Packaging Market Trends

Asia Pacific dominated the global flow wrap packaging industry and accounted for largest revenue share of 40.40% in 2024, which is attributable to the rapid growth of the packaged food industry and e-commerce platforms in the region. Rising disposable incomes, urbanization, and the growing demand for convenient, ready-to-eat meals have increased the need for efficient and cost-effective packaging solutions. The surge in online grocery shopping and home delivery services has also boosted the demand for durable flow wrap packaging that ensures product protection during transit. Countries like India and Indonesia are witnessing substantial investments in packaging infrastructure, further accelerating market growth.

Europe Flow Wrap Packaging Market Trends

The flow wrap packaging industry in Europe is driven by stringent environmental regulations and the region’s commitment to circular economy practices. Governments and industry players are working to reduce plastic waste by promoting recyclable and bio-based flow wrap materials. Additionally, consumer demand for sustainable packaging in categories such as organic food, premium snacks, and confectionery has spurred innovation in eco-friendly solutions. The integration of renewable energy in packaging production processes also contributes to the region’s focus on sustainability, enhancing the appeal of flow wrap packaging.

The China flow wrap packaging market is fueled by the rapid expansion of the retail and food service industries. The rise of convenience stores, supermarkets, and online grocery platforms has created a strong demand for reliable and visually appealing packaging. Furthermore, China’s dynamic food service sector, including takeaway and delivery services, relies heavily on flow wrap solutions to ensure freshness and hygiene. Government initiatives promoting advanced manufacturing technologies and eco-friendly materials are also encouraging domestic companies to adopt innovative flow wrap packaging solutions.

Key Flow Wrap Packaging Market Company Insights

The market for flow wrap packaging is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Flow Wrap Packaging Companies:

The following are the leading companies in the flow wrap packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Constantia Flexibles Group

- Sealed Air Corporation

- Huhtamäki OYJ

- Billerud AB

- MONDI PLC

- Sonoco Products Company

- Glenroy, Inc

- Coveris Holdings S.A

- Winpak LTD.

- KM Packaging Services Ltd.

- Polysack Flexible Packaging Ltd.

- ePac Holdings, LLC.

- Asteria Group (Packaging PrintCo NV)

- aps Ltd

Recent Developments

-

In April 2024, Cox & Co, a single origin chocolate brand, introduced a new paper flow wrap packaging for its chocolates, aiming to eliminate all plastic from its products. This innovative packaging is designed to be kerbside recyclable, addressing consumer demand for sustainable options. The new paper wraps have a minimum shelf life of 12 months and will replace the company's previous compostable plastic packaging, helping to reduce chocolate packaging waste in landfills. Additionally, due to rising cocoa prices, this shift in packaging is expected to lower their packaging costs by 35%.

-

In November 2022, Innovia Films introduced a new ultra-low density film designed for ice cream flow wrap packaging. Developed at their facility in Płock, Poland, this film is resilient to various climatic conditions, although it should not be stored above 104°F (40°C). It can last up to six months without deterioration under proper storage. The film boasts high puncture resistance, which helps minimize food waste.

Flow Wrap Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.49 billion

Revenue forecast in 2030

USD 34.16 billion

Growth rate

CAGR of 7.77% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amcor plc; Constantia Flexibles Group; Sealed Air Corporation; Huhtamäki OYJ; Billerud AB; Mondi plc; Sonoco Products Company; Glenroy, Inc; Coveris Holdings S.A; Winpak LTD.; KM Packaging Services Ltd.; Polysack Flexible Packaging Ltd.; ePac Holdings, LLC.; Asteria Group (Packaging PrintCo NV); aps Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Wrap Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented Flow Wrap Packaging market report on the basis of material, application, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Paper

-

Aluminum Foil

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaged Snacks

-

Chocolate & Confectionary

-

Bakery Products

-

Medical Devices

-

Personal Hygiene Products

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Medical & Pharma

-

Cosmetics & Personal Care

-

Industrial Goods

-

Household Products

-

Pet Food & Supplies

-

Tobacco Products

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flow wrap packaging market size was estimated at USD 22.0 billion in 2024 and is expected to reach USD 23.49 billion in 2025.

b. The global flow wrap packaging market is expected to grow at a compound annual growth rate of 7.77% from 2024 to 2030 to reach USD 34.16 billion by 2030.

b. Packaged snacks dominated the flow wrap packaging market across the application segmentation in terms of revenue, accounting to a market share of 33.40% in 2024. This segment benefits from the surge in on-the-go consumption, driven by changing lifestyles and busy schedules.

b. Some key players operating in the flow wrap packaging market include Amcor plc; Constantia Flexibles Group; Sealed Air Corporation; Huhtamäki OYJ; Billerud AB; Mondi plc; Sonoco Products Company; Glenroy, Inc; Coveris Holdings S.A; Winpak LTD.; and KM Packaging Services Ltd.

b. The rapid expansion of e-commerce and modern retail chains is a key driver for the flow wrap packaging market. With increased consumer reliance on online shopping, there is a growing demand for secure, durable, and visually appealing packaging that can protect goods during transit.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.