- Home

- »

- Next Generation Technologies

- »

-

Gaming Simulator Market Size, Share & Growth Report, 2030GVR Report cover

![Gaming Simulator Market Size, Share & Trends Report]()

Gaming Simulator Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Gaming Type (Shooting, Fighting, Racing, Golf), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-227-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gaming Simulator Market Summary

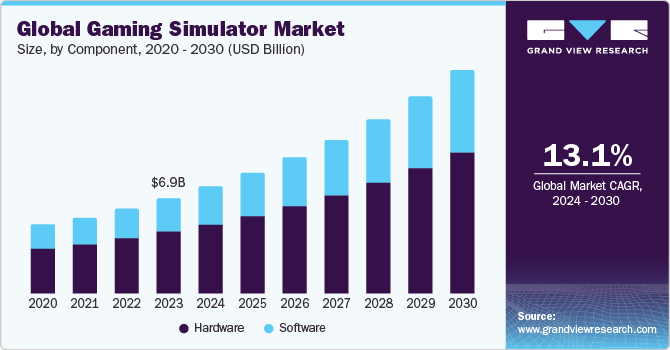

The global gaming simulator market size was estimated at USD 6.87 billion in 2023 and is projected to reach USD 16.17 billion by 2030, growing at a CAGR of 13.1% from 2024 to 2030. The market is anticipated to grow owing to increased demand for realistic gaming experiences, technological advancements, and the rising popularity of eSports.

Key Market Trends & Insights

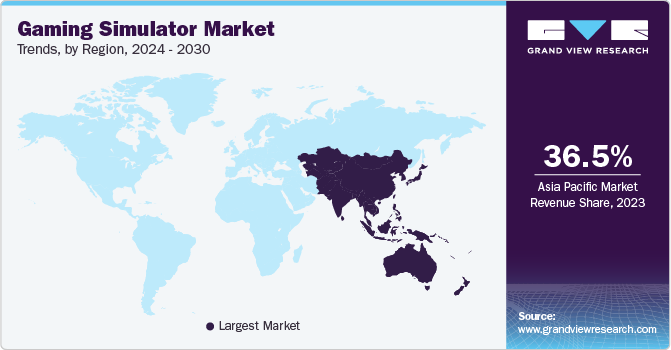

- Asia Pacific dominated the gaming simulator market with the largest revenue share of 36.5% in 2023.

- The gaming simulator market in the U.S. accounted for the largest revenue share of 64.1% in North America in 2023.

- Based on component, the hardware segment led the market with the largest revenue share of 64.7% in 2023.

- In terms of game type, the racing segment led the market with the largest revenue share of 51.7% in 2023.

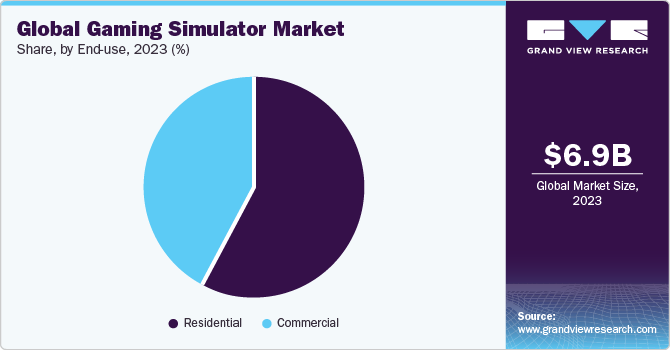

- On the basis of end use, the residential segment led the market with the largest revenue share of 57.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.87 billion

- 2030 Projected Market Size: USD 16.17 billion

- CAGR (2024-2030): 13.1%

- Asia Pacific: Largest market in 2023

Modern gamers are seeking more than just traditional gameplay; they want experiences that are as close to reality as possible.

Simulators excel at providing these experiences by replicating real-world scenarios with high fidelity. Whether it’s simulating a racing car, flying an aircraft, or managing a farm, simulators offer detailed and accurate representations of these activities. This realism is appealing to both casual gamers looking for new experiences and serious enthusiasts who want to hone their skills.

Simulators are not confined to home use, they are also becoming a popular attraction in various entertainment venues. Theme parks, arcades, and family entertainment centers are incorporating gaming simulators to attract visitors and provide unique experiences. These venues are leveraging the appeal of cutting-edge technology to offer attractions like VR roller coasters, flight simulators, and racing simulators. The broadening application of gaming simulators in the entertainment industry is contributing to market growth by reaching a wider audience.

The integration of artificial intelligence (AI) in gaming simulators significantly enhances both realism and interactivity. AI-driven non-player characters (NPCs) exhibit sophisticated behaviors that closely mimic real-life actions. For instance, in a flight simulator AI can control other aircraft with realistic flight patterns, thus creating an authentic experience for the player. In addition, AI-powered NPCs adapt to the player’s actions, which provides a dynamic and challenging environment. In a racing simulator, AI opponents can analyze and respond to the player's driving style, maintaining an engaging level of competition.

The customization and personalization are becoming central to the appeal of gaming simulators, enabling players to modify their experiences to suit individual preferences. In terms of vehicle and equipment customization, players have the option to tune performance characteristics such as engine settings, suspension, and aerodynamics in racing and flight simulators. Aesthetic modifications also play a key role, allowing players to alter the appearance of their vehicles, avatars, and environments through paint jobs, decals, and clothing, which enhances the visual appeal and personal connection to the game.

Market Concentration & Characteristics

The growth stage is medium. The integration of motion-sensing and haptic feedback technologies in simulators has contributed to the market's growth. Motion-sensing technologies, such as accelerometers and gyroscopes, detect the movement and orientation of the player, allowing for a more immersive game play experience. These technologies enable players to control the in-game actions by physically moving their bodies, enhancing the realism and engagement of the gameplay.

The haptic feedback technologies provide tactile sensations to the player through vibrations or movements. This adds a sense of touch to the gaming experience, allowing players to feel the impact of their actions within the game. For example, when driving a racing simulator and hitting a wall, haptic feedback can simulate the feeling of a collision, providing a more realistic and immersive experience. By integrating motion-sensing and haptic feedback technologies, simulators can offer a more engaging and interactive experience for players. This has attracted a larger consumer base, leading to the market growth.

The market growth can also be attributed to the rising disposable incomes of consumers. As individuals have more disposable income, they are increasingly seeking immersive gaming experiences that offer a higher level of realism and interactivity. In addition, the gaming industry has seen significant growth in recent years, with a larger number of people engaging in gaming as a form of entertainment. This increased demand for gaming experiences has created a market for gaming simulators as individuals look for ways to elevate their gaming sessions.

High development and product costs can act as a major challenge for the adoption of gaming simulators. Creating a high-quality simulator requires significant investment in advanced technologies such as virtual reality (VR), augmented reality (AR), artificial intelligence (AI), and sophisticated hardware components. These investments can be prohibitive, especially for smaller companies or startups. In addition, the ongoing costs of research and development to keep up with technological advancements add to the financial burden.

The market is diverse, with significant variations in demand and requirements across different End-use segments. The demand in the global market is evolving rapidly, influenced by technological advancements, changing consumer preferences, and new applications. The emphasis on realism, immersion, customization, social interaction, and accessibility is reshaping the market landscape. In addition, the growth of eSports and the adoption of new business models like subscription and streaming services are driving further changes.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 64.7% in 2023. Simulators rely on specialized hardware to replicate real-world environments and activities accurately. This includes VR headsets, motion platforms, haptic feedback devices, steering wheels, pedals, flight yokes, and other input devices. Such equipment is designed to provide a tactile and immersive experience, allowing users to interact with the simulation realistically. For instance, a racing simulator's steering wheel and pedals mimic the feel of driving a real car, while a flight simulator's yoke and throttle controls replicate the cockpit of an aircraft. This specialized hardware is crucial for delivering the authenticity that users expect from simulators.

The software segment is expected to register at a considerable CAGR over the forecast period. Advancements in software development have led to more sophisticated and capable simulation software. Modern simulators rely heavily on complex algorithms and high-quality graphics engines to create realistic environments and scenarios. These improvements in software capabilities enable more detailed and immersive experiences, which attract both casual gamers and professionals. Enhanced physics engines, realistic weather modeling, and intricate AI behaviors all contribute to the growing demand for advanced simulation software. In addition, the adoption of Software-as-a-Service (SaaS) models is revolutionizing the target market. SaaS allows users to access and use simulation software through subscription-based services rather than one-time purchases. This model provides several advantages, including regular updates, access to a wide range of content, and lower upfront costs.

Game Type Insights

Based on game type, the racing segment led the market with the largest revenue share of 51.7% in 2023. Racing games appeal to a broad audience due to their high-speed action and competitive nature. The excitement of racing against time or other players, combined with the adrenaline rush of high-speed driving, creates an engaging and addictive experience. Players are drawn to the challenge of mastering various tracks and vehicles, striving to improve their lap times and compete against others. This competitive aspect is a significant driver of demand in the racing game segment.

The shooting segment is expected to grow at the fastest CAGR of 15.6% over the forecast period. Shooting games, also known as first-person shooters (FPS) or tactical shooters, have become immensely popular among gamers worldwide. Games like Call of Duty, Battlefield, and Counterstrike have amassed large and dedicated fan bases, driving demand for shooting game simulators. The fast-paced action, strategic gameplay, and multiplayer modes offer players exciting and engaging experiences that keep them coming back for more. In addition, realistic weapon handling, authentic sound effects, and dynamic environments create a sense of immersion that draws players into the action. Simulation technology enables developers to recreate various scenarios, from urban warfare to military operations, with unparalleled detail and accuracy. This realism enhances player engagement and contributes to the segment's growth.

End-use Insights

Based on end-use, the residential segment led the market with the largest revenue share of 57.9% in 2023. Residential gaming simulators are often more cost-effective than their commercial counterparts, making them an attractive option for budget-conscious consumers. While commercial gaming centers may charge hourly fees or require memberships, residential simulators offer a one-time investment with no recurring costs. In addition, the affordability of gaming consoles, PCs, and peripherals further lowers the barrier to entry for residential users, making gaming simulators accessible to a wider audience. Moreover, many residential gaming simulators feature social and multiplayer capabilities, enabling users to connect and play with friends and family members online. Through multiplayer modes, voice chat, or online communities, users can engage in social interactions and collaborative gameplay experiences from the comfort of their homes.

The commercial segment is expected to witness at a considerable CAGR over the forecast period. There's a rising demand for immersive gaming experiences among consumers, which extends beyond individual gamers to commercial entities like amusement parks, arcades, and entertainment centers. These businesses are investing in simulators to attract customers and enhance their offerings. In addition, various sports event organizations and eSports providers are investing in gaming zones or centers to cater to the rising demand for game simulators. For instance, in May 2024, True Gamers, a UAE-based eSports network, announced its plan to establish 150 gaming centers in the Kingdom of Saudi Arabia (KSA). It would be investing about USD 45 million to develop a strong eSports infrastructure in KSA.

Regional Insights

The gaming simulator market in North America is anticipated to grow at the fastest CAGR of 14.4% over the forecast period. This rapid growth is attributed to increasing demand for lightweight and compact racing simulators in the region. Manufacturers have responded to evolving gamer preferences by developing simulators that enhance immersion. This trend reflects a shift towards more realistic and engaging gaming experiences, driving significant market expansion.

U.S. Gaming Simulator Market Trends

The gaming simulator marketin theU.S.accounted for the largest revenue share of 64.1%, in North America in 2023. And it is anticipated to grow at a significant CAGR from 2024 to 2030. The U.S. is home to some of the major market players in the gaming simulator industry, such as D-BOX TECHNOLOGIES INC., Razer Inc., CXC Simulations, and Razer Inc. These companies contribute significantly to the growth and development of the target market in the U.S.

Asia Pacific Gaming Simulator Market Trends

Asia Pacific dominated the gaming simulator market with the largest revenue share of 36.5% in 2023. This dominance can be attributed to the large population, strong gaming culture, technological prowess, government support, and the popularity of mobile gaming. The increasing prominence of eSports has significantly influenced the demand for simulators in the Asia-Pacific region. Countries like India and South Korea have been at the forefront of competitive gaming for an extended period. As eSports tournaments and leagues continue to gain popularity throughout the region, there is a rising requirement for simulators that offer realistic training environments for both professional players and enthusiasts.

The gaming simulator market in China is experiencing significant growth due to the country's technological advancements, manufacturing capabilities, and the increasing demand for immersive gaming experiences. The convergence of these factors fuels significant growth, reflecting its position as a key player in delivering cutting-edge gaming experiences to its tech-savvy population.

Europe Gaming Simulator Market Trends

The gaming simulator market in Europe is experiencing significant growth and is projected to continue expanding in the coming years. Major European countries like the UK, Germany, France, Italy, and Spain are significant contributors to the target market, with factors like increasing accessibility, eSports popularity, and gaming conventions fueling the market growth. In addition, the number of gaming zones and e-sports championships offering enhanced gaming experiences through simulators is increasing across Europe. This trend is driving market participants to provide innovative gaming simulators to meet the rising demand from these venues and events.

The UK gaming simulator market growth can be attributed to a combination of factors. There is a growing demand for portable gaming simulators in the UK, especially among younger audiences. According to EX CORP, a developer of technological solutions for esports and competitive gaming, there are about 10 million competitive gamers.

Key Gaming Simulator Company Insights

Some of the key companies operating in the global market include Razer Inc. and Logitech among others.

-

Razer Inc. is an American multinational technology company that specializes in the design, development, and sale of consumer electronics, financial services, and gaming hardware. They provide laptops, mobile gaming console controllers, and monitors. Razer's software platform includes Razer Synapse, Razer Chroma RGB, and Razer Cortex. The company's hardware lineup also includes mice, headsets, keyboards, controllers, and audio devices. It serves its customers globally with 19 offices worldwide

-

Logitech offers a wide range of products that cater to various needs, including computer peripherals, gaming gear, audio devices, and video collaboration solutions. Some of the brands under Logitech include Logitech, Logitech G, ASTRO Gaming, Ultimate Ears, Jaybird, Blue Microphones, and Streamlabs. The company's gaming division, Logitech G, offers gaming wheels and gear that are compatible with simulators and racing games. Their gaming wheels, such as the G29 and G920, are designed to provide realistic force feedback and enhance the immersion of driving simulations

D-BOX TECHNOLOGIES INC. and GIANTS Software GmbH are some of the emerging market companies in the target market.

-

D-BOX Technologies Inc. is a Canadian company known for its innovative motion technology, used to create immersive and realistic experiences in the entertainment industry, including gaming. The company manufactures and designs motion and haptic systems for the entertainment, simulation, and training industries. D-BOX Technologies Inc. had formed strategic partnerships with leading game companies like Ubisoft to license its cutting-edge haptic technology for integration into video games, including the Assassin's Creed Valhalla. In addition, it had collaborated with prominent manufacturers of haptic gaming chairs, such as Cooler Master, to incorporate their technology into innovative gaming chair designs. The company operates through its offices in Montreal, Los Angeles, and Beijing

-

GIANTS Software GmbH is an international video game developer and publisher based in Switzerland. The company offers a range of products and software. The farming simulator series allows players to experience the life of a farmer and offers a wide range of agricultural machinery and tools from over 100 real agricultural brands. With offices in Switzerland, Germany, the USA, and the Czech Republic, GIANTS Software is committed to maintaining close contact with the agricultural industry and engaging with the gamer’s community

Key Gaming Simulator Companies:

The following are the leading companies in the gaming simulator market. These companies collectively hold the largest market share and dictate industry trends.

- 3D perception

- CKAS Mechatronics Pty Ltd.

- CXC Simulations

- D-BOX Technologies Inc.

- Eleetus, LLC.

- Microsoft

- Playseat

- FRANCE SIMULATEUR SARL/RSEAT

- Vesaro

- Sony Interactive Entertainment Inc.

Recent Developments

-

In March 2024, CXC Simulations introduced the Motion Pro Truck, a high-end racing simulator designed to provide a realistic and immersive off-road racing experience. The Motion Pro Truck offers an embodied experience of off-road racing. It offers visuals with wrap-around screens, a cutting-edge audio system for realistic sounds, and a full-motion system

-

In June 2023, D-BOX Technologies Inc. announced that it had renewed its partnership with Advanced SimRacing (ASR), a Canada-based digital motorsport equipment retailer and racing simulation chassis manufacturer. Through this renewed partnership, D-BOX Technologies aims to provide a more realistic and immersive experience to the simulation industry by integrating its cutting-edge motion technology with Advanced SimRacing's state-of-the-art simulators

-

In November 2023, Sony Interactive Entertainment Inc. announced its strategic partnership with NCSOFT Corporation, an online multiplayer game developer based in South Korea. This partnership aims to leverage both companies' strengths to enhance the realism and immersive experience of simulations across various applications, including gaming

Gaming Simulator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.73 billion

Revenue forecast in 2030

USD 16.17 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, game type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

3D perception; CKAS Mechatronics Pty Ltd.; CXC Simulations; D-BOX Technologies Inc.; Eleetus, LLC.; Microsoft; Playseat; FRANCE SIMULATEUR SARL/RSEAT; Vesaro; Sony Interactive Entertainment Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gaming Simulator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global gaming simulator market report based on component, game type, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Game Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Shooting

-

Fighting

-

Racing

-

Golf

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gaming simulator market size was estimated at USD 6.87 billion in 2023 and is expected to reach USD 7.73 billion in 2024.

b. The global gaming simulator market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 16.17 billion by 2030.

b. The hardware segment dominated the gaming simulator market with a share of 64.7% in 2023, driven by its crucial role in enhancing the gaming experience, the popularity of virtual reality headsets, the development of advanced and cost-effective hardware components, and the transition to new technologies.

b. Some key players operating in the gaming simulator market include 3D perception, CKAS Mechatronics Pty Ltd., CXC Simulations, D-BOX Technologies Inc., Eleetus, LLC., Microsoft, Playseat, FRANCE SIMULATEUR SARL/RSEAT, Vesaro, Sony Interactive Entertainment Inc.

b. Key factors driving the gaming simulator market growth include gaming solution providers adopting virtual reality technology to enhance real-life gaming experiences and the rising popularity of eSports & competitive gaming.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.