- Home

- »

- Advanced Interior Materials

- »

-

Germanium Market Size And Share, Industry Report, 2033GVR Report cover

![Germanium Market Size, Share & Trends Report]()

Germanium Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Germanium Ingot, Germanium Tetrachloride, High Purity GeO2), By Application (PET, Electronics & Solar, Fiber Optics, IR Optics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-463-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germanium Market Summary

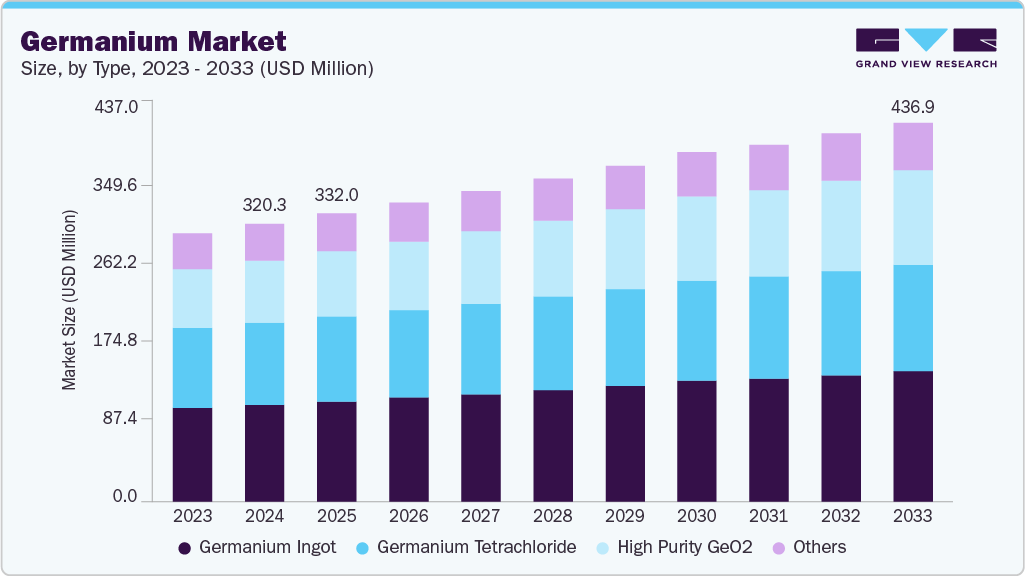

The global germanium market size was estimated at USD 320.3 million in 2024 and is projected to reach USD 436.9 million by 2033, growing at a CAGR of 3.5% from 2025 to 2033. The primary driving factor for germanium demand is its critical role in high-tech applications such as fiber optics, IR optics, and solar cells.

Key Market Trends & Insights

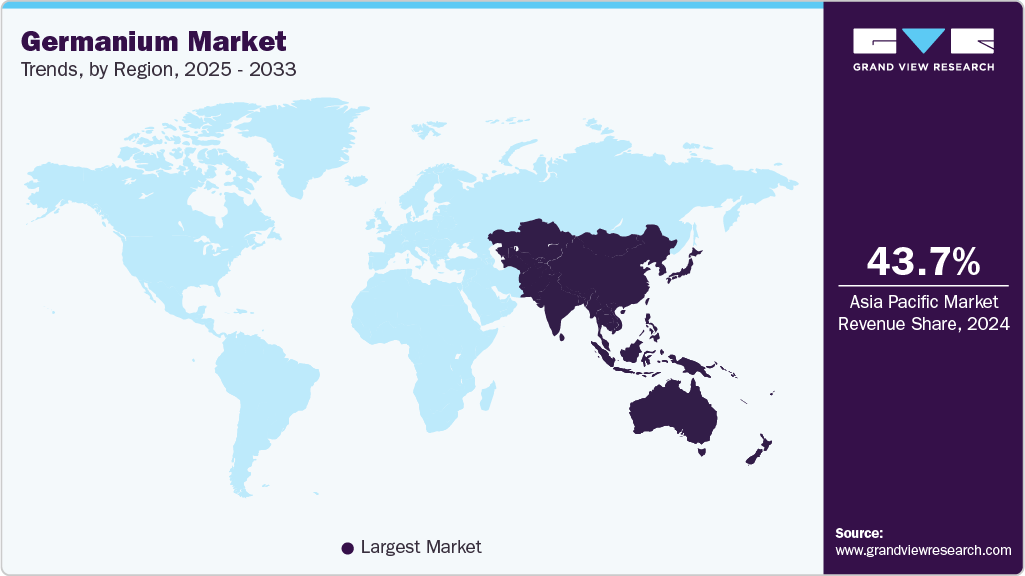

- Asia Pacific dominated the germanium market with a revenue share of 43.7% in 2024.

- The germanium industry in Asia Pacific is expected to grow at a substantial CAGR of 3.7% from 2025 to 2033.

- By type, the germanium ingot segment dominated the market with a revenue share of over 34.0% in 2024.

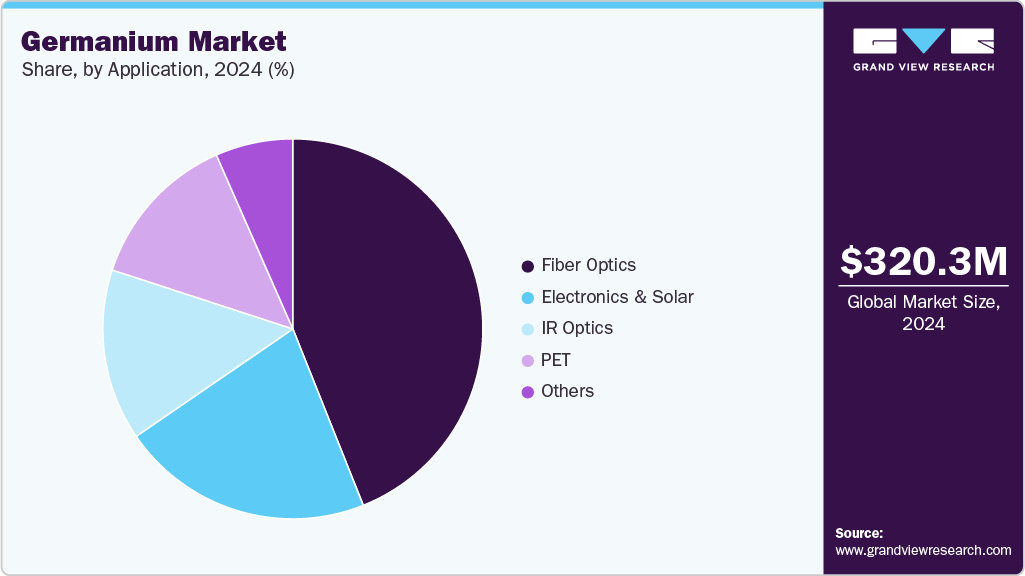

- By application, the fiber optics segment held the largest revenue share of over 44.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 320.3 million

- 2033 Projected Market Size: USD 436.9 million

- CAGR (2025-2033): 3.5%

- North America: Largest market in 2024

- Asia Pacific: Largest market in 2024

Rising investments in 5G networks, renewable energy, and defense technologies further boost its market growth. Germanium components account for a significant share of the advanced materials market due to their superior semiconductor properties, infrared transparency, and critical role in high-performance technologies. Their unique ability to enable high-speed data transmission, precision optics, and solar energy conversion makes them indispensable across multiple industries. Whether used in satellite solar cells, thermal imaging systems, or fiber optic cables, germanium-based materials are favored in defense, aerospace, telecommunications, and renewable energy sectors, where precision, efficiency, and reliability are non-negotiable. As a key enabler of cutting-edge innovation, it continues to solidify its presence in applications where conventional materials fall short.

The increasing global focus on digital infrastructure, energy transition, and national security is accelerating the demand for germanium. Its use in high-frequency electronics, 5G network deployment, and infrared surveillance technologies is rising with the growth of smart cities, space programs, and border security systems. Germanium’s high efficiency in multi-junction solar cells has also made it a staple for space-based energy systems, contributing to its widespread adoption in satellite missions and aerospace applications. In a market driven by technological advancement and strategic resource planning, it stands out as a critical raw material, offering high performance and long-term value in next-generation industrial ecosystems.

Drivers, Opportunities & Restraints

The germanium market is experiencing strong growth, primarily fueled by rising demand in high-tech sectors such as fiber optics, infrared optics, and solar cells. With the global rollout of 5G infrastructure, the deployment of fiber optic networks has accelerated, significantly boosting the need for germanium tetrachloride in optical fiber production. Additionally, germanium's role in high-efficiency solar panels, especially for space and satellite applications, is becoming increasingly important as investments in space technology expand. According to the International Renewable Energy Agency (IRENA), global solar photovoltaic (PV) capacity is projected to reach 5,000 GW by 2030, further supporting demand for germanium-based solar cell technologies. Demand from the defense sector is also strong due to the metal's application in infrared imaging systems, night vision devices, and thermal optics.

Amid the push for global decarbonization, particularly with the EU targeting carbon neutrality by 2050, investments in renewable energy projects are expected to grow substantially, creating a favorable environment for germanium demand. The expansion of high-efficiency solar energy systems and innovations in fiber optic and infrared technologies, such as those used in autonomous vehicles, AI sensors, and advanced medical imaging, present significant growth avenues. Additionally, opportunities are emerging through recycling initiatives to recover germanium from end-of-life electronics and fiber optic waste. Such efforts can provide a more stable and sustainable supply chain. Exploration of untapped reserves and development of processing capabilities outside the dominant regions can diversify global supply and reduce dependency on a few countries.

Despite its promising outlook, the germanium industry faces several constraints. One major challenge is its limited availability; germanium is primarily obtained as a byproduct of zinc ore processing, making its supply highly dependent on the fluctuating output of the zinc industry. Production is geographically concentrated in countries like China, Canada, and Russia, which increases the risk of supply chain disruptions due to geopolitical instability. Additionally, the extraction and refinement of germanium are capital- and energy-intensive, contributing to high production costs. These factors and the lack of viable substitutes for high-purity applications create supply risks and price volatility, potentially deterring investment and limiting wider adoption in cost-sensitive applications.

Type Insights

Germanium ingot dominated the market with a revenue share of over 34.0% in 2024. The growth of the germanium ingot segment is primarily driven by its extensive use in producing semiconductor wafers and IR optics. These ingots are the foundational material for manufacturing infrared optical lenses, which are widely used in thermal imaging systems for military, automotive, and industrial applications. The rising use of thermal imaging in security and defense has boosted the demand for germanium ingots, driven by the U.S. Department of Defense's growing investment in infrared technologies, thus emphasizing the importance of germanium-based IR optics.

High-purity germanium dioxide (GeO2) is the fastest-growing sub-segment due to its increasing use in optical fibers and solar energy applications. Its high transparency to infrared light makes it critical in producing optical lenses and fiber optic systems. The global demand for broadband communication, spurred by 5G growth, is boosting the need for optical fibers and, consequently, high-purity GeO2. This substance is also increasingly used in high-efficiency solar cells for space and renewable energy, aligning with the shift towards cleaner energy and large-scale solar projects in the U.S. and China. Consequently, the demand for high-purity GeO2 is set to surge.

Application Insights

The fiber optics segment held over 44.0% of germanium revenue in 2024. The fiber optics segment’s growth is fueled by the rapid expansion of 5G networks and increasing demand for high-speed data transmission. Germanium tetrachloride, a critical material used in fiber optic cables, plays a key role in enhancing the transmission capabilities of optical fibers. Market demand has surged with telecom companies globally, such as China Telecom and AT&T, investing heavily in expanding their fiber optic networks. Furthermore, governments are also supporting this growth; for instance, the U.S. Federal Communications Commission (FCC) has rolled out initiatives to extend broadband coverage, further driving the development of the germanium market.

The electronics and solar energy segments are emerging as the fastest-growing application areas in the global germanium industry, propelled by escalating demand for high-performance semiconductors and next-generation solar technologies. It is prized for its exceptional electron mobility and thermal conductivity in electronics, making it a critical material for high-frequency, high-speed, and radiation-resistant semiconductors. These properties are fundamental in advanced applications such as aerospace electronics, satellite systems, and military-grade communication devices, where conventional silicon-based components often fall short. As global demand grows for faster and more efficient devices, including 5G infrastructure, quantum computing, and autonomous technologies, its role in chip development is becoming increasingly strategic.

In parallel, the solar energy segment is witnessing a significant uptick in its consumption, particularly for multi-junction solar cells used in space and satellite power systems. Unlike conventional silicon solar panels, germanium-based cells offer superior efficiency and durability in extreme conditions, making them indispensable for aerospace missions and high-efficiency concentrated solar power (CSP) systems. Countries such as China, the U.S., and members of the EU are heavily investing in space programs and renewable energy infrastructure, directly boosting demand for germanium. Notably, China's aggressive push in solar R&D and space exploration has positioned it as a major consumer and producer of germanium technologies.

Regional Insights

The growth of the germanium industry in North America is driven by the region’s strong demand for infrared optics, primarily in the defense and aerospace sectors. The U.S., in particular, is a significant consumer due to its investments in military applications and high-performance electronics. Government initiatives supporting the growth of renewable energy, including solar power projects, further propel its demand. Additionally, the presence of major defense contractors and space agencies like NASA fuels consistent demand for germanium-based infrared and solar technologies. Ongoing R&D efforts in semiconductor innovation and thermal imaging contribute to the region’s growing consumption.

U.S. Germanium Market Trends

The U.S. dominates the North America germanium industry, with high consumption in both the military and space sectors. The U.S. Department of Defense and NASA are key drivers, using germanium in thermal imaging and solar panels for satellites. Growing investments in 5G infrastructure also support demand for it in fiber optics. The country’s emphasis on maintaining technological superiority in defense and aerospace fuels also sustained R&D in germanium-based applications. Strategic reserves and government-backed initiatives to secure critical minerals further reinforce the U.S.’s leading position in the regional market.

Asia Pacific Germanium Market Trends

Asia Pacific dominated the germanium market with a revenue share of 43.7% in 2024. Asia Pacific is the largest industry for germanium, led by China, which stands as the world’s biggest producer and consumer. The region’s dominance is fueled by its expansive electronics manufacturing base, booming fiber optics industry, and rapidly growing solar energy projects. China's control over its production significantly impacts global supply chains, giving it strategic leverage in the worldwide tech and energy sectors. Additionally, strong government support for renewable energy and high-tech industries, particularly in China, South Korea, and Japan, drives regional demand and innovation in germanium applications.

Europe Germanium Market Trends

Europe’s germanium industry is shaped by its strong focus on renewable energy and advanced technology sectors. Countries like Germany and France invest heavily in solar energy projects as part of their broader decarbonization goals, boosting demand for germanium-based solar cells. At the same time, the region’s well-established defense and aerospace industries drive consistent use of it in infrared optics and high-performance electronics. Europe is also actively working to diversify the global germanium supply chain by supporting domestic refining capabilities and exploring alternative sourcing to reduce import dependency, particularly from China.

Key Germanium Company Insights

Some of the key players operating in the market include Teck Resources Limited and China Germanium Co., Ltd.

-

Yunnan Chihong Zinc & Germanium Co., Ltd., based in China, is one of the world’s leading germanium producers, leveraging its position as a key player in the global market. The company’s operations span germanium extraction, refining, and production of germanium-based products like ingots, tetrachloride, and high-purity GeO2. It supplies materials to various industries, including fiber optics, infrared optics, and solar energy. Its strategic location in China, where most of the world’s germanium reserves are found, strengthens its supply chain, enabling it to meet domestic and international demand.

-

Umicore, a Belgium-based company, is a major player in the germanium market, with a strong presence in the global supply of high-purity germanium products. The company focuses on refining and recycling germanium, offering products for advanced applications in fiber optics, solar cells, and infrared optics. Umicore's expertise in material technology allows it to supply germanium for high-efficiency solar panels, especially for the aerospace and renewable energy sectors. Additionally,

Key Germanium Companies:

The following are the leading companies in the germanium market. These companies collectively hold the largest market share and dictate industry trends.

- Yunnan Chihong Zinc & Germanium Co., Ltd.

- Umicore

- Teck Resources Limited

- JSC Germanium

- PPM Pure Metals GmbH

- Indium Corporation

- China Germanium Co., Ltd.

- AXT, Inc.

- 5N Plus

- Noah Chemicals

Recent Developments

-

In May 2024, Umicore entered into a strategic partnership with STL, a subsidiary of Chemaf Resources, to advance germanium recycling from mining waste in the Democratic Republic of Congo (DRC). The initiative centers on extracting germanium from tailings at STL’s Lubumbashi site, reinforcing Umicore’s position as a frontrunner in sustainable materials recovery and circular economy practices.

-

In September 2023, Umicore partnered with RENA Technologies to co-develop next-generation germanium wafers aimed at enhancing semiconductor performance. This collaboration is focused on improving wafer quality for applications in high-efficiency solar cells and advanced electronics, combining RENA’s semiconductor processing expertise with Umicore’s leadership in the germanium value chain.

Germanium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 332.0 million

Revenue forecast in 2033

USD 436.9 million

Growth rate

CAGR of 3.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; China; India; Japan; South Korea; Brazil; UAE

Key companies profiled

Teck Resources Limited; Yunnan Chihong Zinc & Germanium Co., Ltd.; Umicore; JSC Germanium; China Germanium Co., Ltd.; 5N Plus; Noah Chemicals; AXT, Inc.; PPM Pure Metals GmbH; Indium Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Germanium Market Report Segmentation

This report forecasts revenue and volume growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global germanium market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Germanium Ingot

-

Germanium Tetrachloride

-

High Purity GeO2

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PET

-

Electronics & Solar

-

Fiber Optics

-

IR Optics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global germanium market size was estimated at USD 320.3 million in 2024 and is expected to reach USD 332.0 million in 2025.

b. The global germanium market is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2033 to reach USD 436.9 million by 2033.

b. By type, germanium ingot dominated the market with a revenue share of over 34.0% in 2024.

b. Some of the key vendors in the global germanium market are Teck Resources Limited, Yunnan Chihong Zinc & Germanium Co., Ltd., Umicore, JSC Germanium, China Germanium Co., Ltd., 5N Plus, Noah Chemicals, AXT, Inc., PPM Pure Metals GmbH, and Indium Corporation.

b. The germanium market is experiencing strong growth, primarily fueled by rising demand in high-tech sectors such as fiber optics, infrared optics, and solar cells.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.