- Home

- »

- Pharmaceuticals

- »

-

Germany Legal Cannabis Market Size, Industry Report 2030GVR Report cover

![Germany Legal Cannabis Market Size, Share & Trends Report]()

Germany Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Hemp, Marijuana), By Derivatives (CBD, THC), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-284-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Germany Legal Cannabis Market Trends

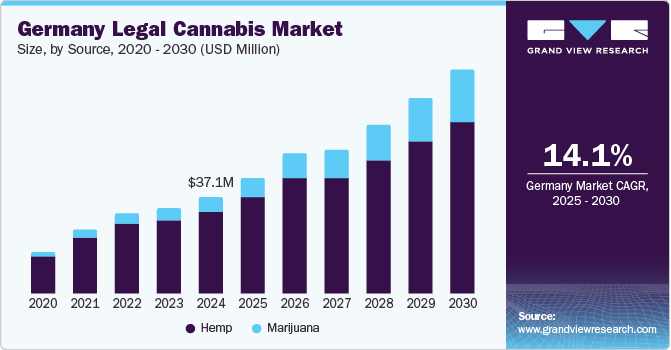

The Germany legal cannabis market size was estimated at USD 32.8 million in 2023 and is expected to grow at a CAGR of 14.9% from 2024 to 2030. The market is driven by factors such as increasing adoption of cannabis for treating chronic diseases, positive legal developments, growing research on cannabis use, and increasing adoption & launch of CBD-infused cosmetic products. For instance, in September 2023, The Cronos Group launched a medical brand, PEACE NATURALS (bulk cannabis), in Germany. In July 2023, the company signed a distribution agreement with Cansativa GmbH, a distributor of medical cannabis in Germany.

Furthermore, favorable government initiatives and rising demand for CBD-infused products in Germany fuel the market growth. For instance, general European Union (EU) position has been adopted by Germany, which allows the sale of non-food CBD products as long as they contain less than 0.2% Delta-9 Tetrahydrocannabinol (THC). Moreover, Küsten CBD, a German CBD cosmetics company, offers CBD cosmetics, including cooling gel for accompanying symptoms of muscle tension, osteoarthritis, & bruises, warming gel for joint pain & back pain, tattoo/body lotion for dry skin prone to acne & neurodermatitis, body oil/massage oil (like Rose Dream) for daily body care, and facial fluid (antiaging in function) for dry & sensitive skin.

Moreover, rising prevalence of chronic conditions such as diabetes, cancer, & neurological illnesses and growing research activities & clinical trials in Germany propel the market growth. For instance, in October 2023, Avextra Pharma GmbH, a biopharmaceutical company, initiated a double-blind phase 2 clinical trial for the use of Belcanto (a cannabis-based medicine) in treating cancer patients in palliative care. This medicine has been approved by The German Federal Institute for Drugs and Medical Devices (BfArM) and the relevant ethics committees, and the first patient was expected to receive the dose in December 2023.

Presence of several insurance companies in the German healthcare system drives market growth. Individuals can choose between public insurance (GKV) or private insurance (PKV) in Germany. Since January 2017, public health insurers have been mandated to provide coverage for cannabis medication up to 5 ounces, which is more than the legal limit of 3.5 ounces or 100 grams per month, making Germany one of the potentially lucrative markets in Europe. The insurance scheme covers all cannabis treatments without specifying particular medical conditions, thus boosting market growth in the country.

There is a high demand for various CBD-infused products, such as oil, beauty products, and cannabis extracts, driving the market growth. For instance, in September 2021, Alternative Medical Products Inc., a supplier of cosmetic CBD products to German pharmacies, launched the CBD brand CANAVEX. It is a CBD cosmetic product sold by pharmacists without a doctor's prescription. This formulation contains high-quality CBD sourced from EU-GMP compliant and German organic hemp seed oil, as well as vitamin E.

Market Concentration & Characteristics

In October 2022, Health Minister of Germany, Karl Lauterbach, unveiled plans to legalize the possession of cannabis up to 30 grams. However, those plans were later scaled back following opposition from the European Union’s executive commission. In February 2024, the lower house of parliament (Bundestag) in Germany approved new legislation to legalize the limited recreational use of cannabis. As per the new rules, adults can possess a small quantity of cannabis for personal use, though the drug remains prohibited for individuals under the age of 18. The bill was passed with 407 lawmakers voting in favor, 226 voting against, and 4 lawmakers abstaining from voting. This decision came after a contentious national debate regarding the pros and cons of increasing access to the drug.

If the country's federal council or upper house of parliament (Bundesrat) approves the law, it would legalize smoking cannabis in public places, with a few exceptions, such as schools & sporting venues. The law would allow adults over 18 years old to possess up to 25 grams in public places and 50 grams in private settings. Moreover, the law is scheduled to take effect on April 1, 2024, if approved by the council. It prohibits children and teenagers under 18 from consuming cannabis and restricts individuals aged 18 to 21 from purchasing more than 30 grams. The proposed law would allow the sale of marijuana through "cannabis social clubs." However, members of these clubs would not be permitted to consume cannabis on the premises or within a 200-meter radius of the clubs. These clubs would be limited to 500 members and would not be allowed within 200 meters of any daycare center or school. In addition, the law would permit adults to cultivate up to three cannabis plants in their homes.

The global legal cannabis Market growth stage is high, and the pace of growth is accelerating. The Germany legal cannabis market is characterized by a high degree of innovation due to rising R&D activities on the use of cannabis & its medicinal properties, recent legalization activities of cannabis, and growing demand for cannabis-infused products. For instance, in August 2023, researchers from the Friedrich Schiller University Jena collaborated with colleagues from Austria, Italy, & the U.S. and identified anti-inflammatory effects shown by CBD.

Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. For instance, in August 2023, SynBiotic SE, a Munich-based cannabis company, acquired CannaCare Health GmbH and its popular CBD brand, Canobo, to expand its product portfolio.

The cannabis market in Germany is growing due to recent changes in regulations and the legalization of cannabis by lower house parliament. The legalization framework in Germany prioritizes public health objectives and permits commercial production & distribution of cannabis, which contributes to the market growth in the country. The Federal Institute for Drugs and Medical Devices oversees the production and importation of cannabis in Germany.

Market players are adopting various strategies, such as new product launches, partnerships & collaborations, and distribution agreements, to strengthen their market position. For instance, in January 2023, Ambari Brands Inc., a cannabis and CBD product manufacturer, expanded its European distribution by selling its cannabis products in almost every European country. The company is expected to expand into France, Germany, Portugal, and Nordic Countries.

The popularity of CBD-infused foods is rapidly rising due to the various health benefits associated with CBD. Some market players are expanding their market presence in different geographical areas. For instance, in May 2022, Aurora Cannabis announced that its medical cannabis manufacturing units had received EU-GMP certification, allowing the company to distribute highest-quality and premium medical cannabis in Germany.

Source Insights

The hemp segment dominated the market with the highest revenue share of 85.8% in 2023. Hemp covers an extensive range of products, including supplements, nutritional powders, beverages, protein & nutrition bars, animal feed, and pet food. Improving lifestyle and increasing product launches drive the demand for hemp products. For instance, in April 2021, PepsiCo, a food & beverage company, launched Rockstar Energy (a hemp-infused beverage) in Germany. This drink contains hemp seed extract with guarana, ginseng, caffeine, B vitamins, taurine, and sugar.

Hemp has many uses in commercial products, such as animal feed, food, paper, textiles, biodegradable plastics, clothing, insulation, paint, and construction material. Its stems are used for several purposes - larger pieces are utilized for fibers, while smaller pieces (hurds or shives) are used in products ranging from insulation to pet bedding. The seeds are mainly used to extract oils, animal feed, flour, protein powder, and food ingredients. The leaves and flowers have various uses, including making tea, creating compost, and serving as animal bedding.

The marijuana segment held the second-highest revenue share in 2023. The demand for marijuana in Germany is expected to increase due to rising awareness about its therapeutic benefits and recent changes in legalization. It has been used in treating Alzheimer’s, multiple sclerosis, rheumatism, cancer, and AIDS, among other diseases. In February 2024, the lower house of parliament passed a bill to legalize the recreational use of marijuana. According to this bill, if approved by the upper house of parliament, Germans can possess and cultivate marijuana from April 1, 2024. Thus, such factors contribute to segment growth.

Derivatives Insights

The CBD segment dominated the market with the largest revenue share of 64.9% in 2023. CBD is the nonpsychoactive compound found in the cannabis plant, and its use is increasing for several health benefits. Ongoing studies indicate the potential benefits of CBD for certain health conditions, further driving market growth. For instance, a study published in the Journal of British Journal of Cancer in March 2022, funded by the German Research Foundation, reported that CBD acts as an antimetastatic & antiangiogenic tumor therapy and also boosts the immune system's defense against tumors.

The others segment held a significant market share in 2023 and is expected to grow at fastest CAGR over the forecast period. The others segment includes derivatives or components of the cannabis plant, such as flavonoids, terpenes, and other minor cannabinoids. Factors such as growing adoption of minor cannabinoids, product launches, and adoption of various strategies for its distribution are anticipated to propel the segment growth. For instance, in August 2020, Avicanna Inc. advanced its supply chain business with commercial exports of CBD & CBG in Germany and the U.S.

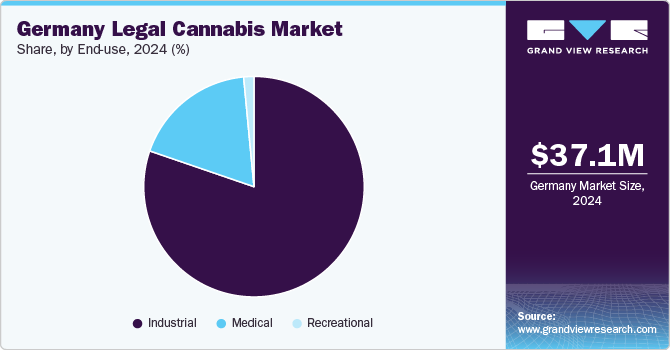

End-use Insights

The industrial use segment dominated the market in 2023 with a revenue share of 81.8%. In Germany, hemp is used for various commercial products, including animal feed, food, textiles, clothing, paper, paint, insulation, and biodegradable plastics. For instance, Biostoffe, a fabric manufacturer in Germany, offers fabrics made from hemp, cotton, linen, and wool. Furthermore, in January 2022, VPF GmbH & Co. KG, an adhesive materials specialist in Germany, launched a label stock entirely made from hemp fibers.

The recreational use segment is expected to grow at the fastest CAGR over the forecast period. This segment primarily involves the use of cannabis for smoking or consuming it in the form of foods & beverages. In addition, the legalization of cannabis for recreational purposes is contributing to the segment growth. For instance, in February 2024, the German parliament approved a draft law proposed by the government regarding the limited distribution of cannabis to adults for personal consumption. German citizens are allowed to grow up to three cannabis plants at home and possess a maximum of 25 grams for personal use under this law.

Key Germany Legal Cannabis Company Insights

More companies are expected to enter the cannabis market due to increasing demand for cannabis-infused food items and cosmetics as people become more aware of its medical benefits. Existing market players are expanding their presence through collaborations, mergers & acquisitions, partnerships, and product launches. For instance, in May 2023, Village Farms International Inc. launched cannabis products in Germany in partnership with IUVO Therapeutics GmbH, a distributor of medical cannabis in the German market.

Key Germany Legal Cannabis Companies:

- The Cronos Group

- Organigram Holding, Inc

- Tilray Brands, Inc.

- Canopy Growth Corporation

- Aurora Cannabis

- SynBiotic

- Cansativa GmbH

- DEMECAN

- Four 20 Pharma

- Avextra Pharma GmbH

Recent Developments

-

In June 2023, Cake & Caviar, a renowned cannabis brand from British Columbia, geared up for a major global expansion. The brand was expected to launch its products at the International Cannabis Business Conference (ICBC) in Berlin, Germany.

-

In May 2023, Stenocare A/S, a Danish company, expanded into Germany by launching medical cannabis oils in collaboration with ADREX Pharma, which specializes in developing, producing, and marketing medical cannabis products.

Germany Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.2 Million

Revenue forecast in 2030

USD 85.6 Million

Growth rate

CAGR of 14.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, end-use

Country scope

Germany

Key companies profiled

The Cronos Group; Organigram Holding, Inc; Tilray Brands, Inc.; Canopy Growth Corporation; Aurora Cannabis; SynBiotic; Cansativa GmbH; DEMECAN; Four 20 Pharma; Avextra Pharma GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Legal Cannabis Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Germany legal cannabis market report based on source, derivatives, and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp oil

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post-traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s

-

Diabetes

-

Parkinson's

-

Glaucoma

-

Others

-

-

Recreational Use

-

Frequently Asked Questions About This Report

b. The Germany legal cannabis market size was estimated at USD 32.8 million in 2023 and is expected to reach USD 37.2 million in 2024.

b. The Germany legal cannabis market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 85.6 million by 2030.

b. The hemp segment dominated the market with the highest revenue share of 85.8% in 2023. Hemp covers an extensive range of products, including supplements, nutritional powders, beverages, protein & nutrition bars, animal feed, and pet food.

b. Some key players operating in the Germany legal cannabis market include The Cronos Group; Organigram Holding, Inc; Tilray Brands; Canopy Growth Corporation; Aurora Cannabis; SynBiotic; Cansativa GmbH; DEMECAN; Four 20 Pharma; Avextra Pharma GmbH

b. Factors such as the growing adoption of cannabis for the treatment of chronic diseases, affirmative legal advancements in the country, increasing research activities on the use of cannabis, and growing adoption and launches of cosmetics CBD products drive market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."