- Home

- »

- Advanced Interior Materials

- »

-

Graphite Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Graphite Market Size, Share & Trends Report]()

Graphite Market (2026 - 2033) Size, Share & Trends Analysis Report By Form (Natural Graphite, Synthetic Graphite), By End Use (Electrodes, Refractories, Lubricants, Battery Production), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-142-0

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphite Market Summary

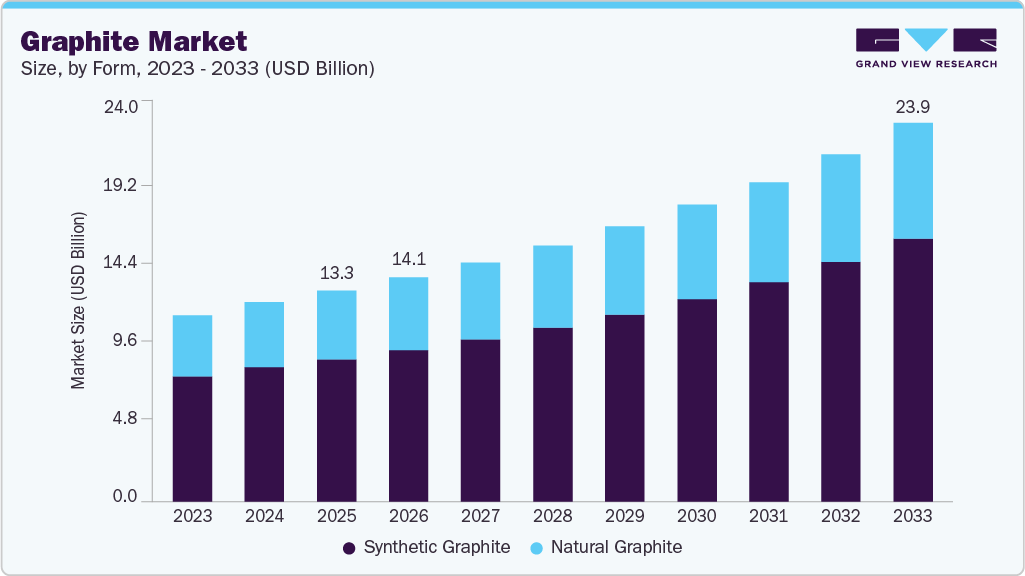

The global graphite market size was estimated at USD 13.29 billion in 2025 and is projected to reach USD 23.87 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. Increasing investments in expanding petrochemical production and growth in the detergents industry are anticipated to drive market growth over the forecast period.

Key Market Trends & Insights

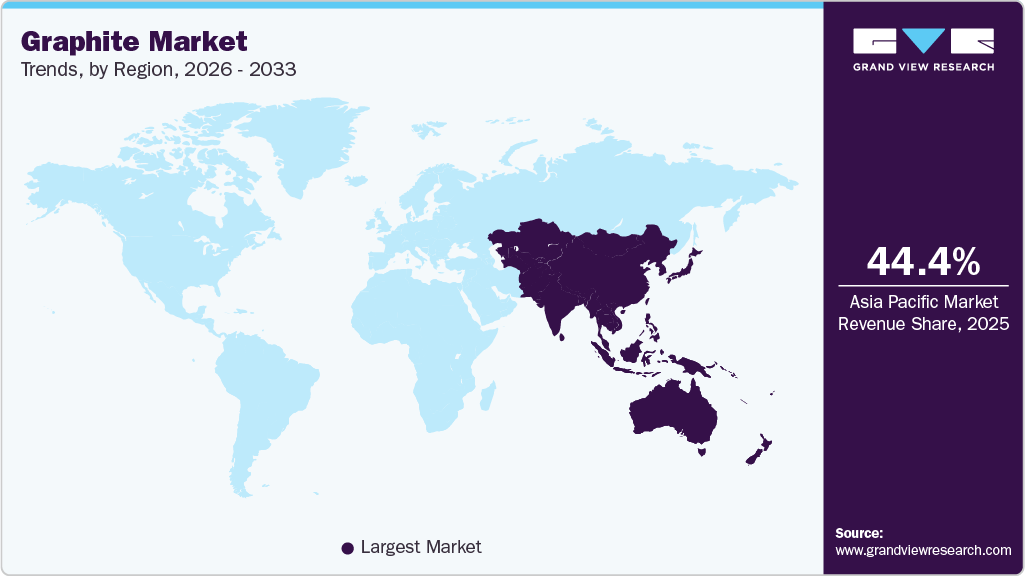

- Asia Pacific dominated the graphite market with the largest revenue share of 44.4% in 2025.

- By form, the synthetic graphite segment led the market with the largest revenue share of 67.5% in 2025.

- By end use, the electrode segment led the market with the largest revenue share of 36.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.29 billion

- 2033 Projected Market Size: USD 23.87 billion

- CAGR (2026-2033): 7.8%

- Asia Pacific: Largest market in 2025

Due to their stability, superior activity, and selectivity in conversion processes, zeolites are widely used in the petrochemical industry as catalysts for accelerating chemical reactions.Sustainability initiatives and recycling are increasingly important in shaping the market's future. Graphite recovery from spent lithium-ion batteries is gaining momentum as part of a broader effort to promote circular economic practices. In addition, industry players invest in R&D to develop greener production technologies and secure stable, low-emission supply chains. Graphite will remain at the forefront of material innovation and strategic resource planning for years as the world moves toward electrification and carbon neutrality.

Graphite is becoming increasingly vital in the global transition toward clean energy, sustainable mobility, and advanced industrial processes. Its unique properties, such as high electrical and thermal conductivity, excellent lubricity, and chemical inertness, make it essential across various applications. The material is pivotal in energy storage, particularly in lithium-ion batteries, where it serves as the primary anode material. As electric vehicle (EV) adoption accelerates and renewable energy deployment scales up, the demand for graphite continues to rise significantly.

Drivers, Opportunities & Restraints

The graphite industry is experiencing robust expansion, primarily driven by the exponential growth of the electric vehicle (EV) industry and the corresponding surge in lithium-ion battery production. Graphite is an indispensable component of lithium-ion batteries, comprising over 90% of the anode material due to its excellent conductivity, stability, and performance characteristics. With each EV battery pack containing between 50 and 100 kilograms of graphite, the global boom in EV adoption is translating directly into soaring graphite demand. In 2023, global EV sales exceeded 14 million units, and this figure is expected to continue rising sharply as automakers electrify their fleets and consumers shift toward cleaner transportation options.

The graphite industry is significantly constrained by the high cost of producing battery-grade graphite, particularly coated spherical purified graphite (CSPG). CSPG is the most critical raw material used in lithium-ion battery anodes, and its production involves multiple high-cost processes: purification, shaping, micronizing, and surface treatment. The base natural graphite feedstock typically costs around USD 400-600 per ton; however, processing this material into battery-grade CSPG can increase costs to USD 1,800-2,600 per ton.

The global shift toward electric mobility drives unprecedented demand for lithium-ion batteries, with graphite accounting for nearly 95% of the anode material. The demand for natural and synthetic graphite will surge as EV production scales, especially in China, Europe, and North America. With the rise of renewable energy sources, utility-scale and residential energy storage systems are gaining traction. These systems utilize lithium-ion batteries, generating long-term demand for high-purity graphite as a core material in batteries, extending beyond the EV sector.

Form Insights

The synthetic graphite segment is led the market with the largest revenue share of 67.5% in 2025, fueled by its critical role in lithium-ion battery anodes, electric arc furnace (EAF) electrodes, and thermal applications. As demand for electric vehicles (EVs) and advanced energy storage systems accelerates, they are favored for their exceptional purity, uniform structure, and ability to deliver consistent performance in high-temperature and high-load environments. Its engineering properties make it well-suited for applications requiring precision and reliability. EAFs depend heavily on electrodes in the steel sector due to their durability and conductivity, which are essential for efficient steel production.

The natural graphite segment is anticipated to grow at the fastest CAGR during the forecast period, fueled mainly by its indispensable role in producing lithium-ion battery anodes. As the global adoption of electric vehicles (EVs), energy storage systems, and portable electronics continues to expand, demand for flake graphite, which is processed into spherical graphite for battery applications, has risen sharply. Countries are actively working to diversify supply chains and reduce reliance on China, which currently dominates global graphite refining. Its lower cost of production and reduced environmental impact compared to synthetic alternatives make it increasingly attractive for manufacturers prioritizing sustainability and cost efficiency.

End Use Insights

The electrodes segment led the market with the largest revenue share of 36.2% in 2025, which is expected to continue throughout the forecast period. Graphite electrodes play a pivotal role in the electric arc furnace (EAF) steelmaking segment, which is rapidly gaining momentum due to its lower carbon emissions and energy efficiency compared to traditional blast furnaces.

As countries, especially North America and Europe, pursue net-zero emission targets and industry decarbonization, the demand for EAFs and graphite electrodes surges. According to a media report, nearly 93% of new steelmaking capacity underway in 2024 is EAF-based, highlighting the sector’s transition toward greener technologies. This shift, driven by environmental regulations and growing infrastructure needs, is fueling consistent demand for electrodes.

Refractories are primarily used in high-temperature industrial applications, including the production of steel, cement, and non-ferrous metals. These applications demand materials with high thermal conductivity, chemical inertness, and structural stability under extreme temperatures, properties that it delivers consistently. For instance, in February 2025, Sovereign Metals announced that coarse flake graphite from its Kasiya project in Malawi met stringent specifications for refractory-grade graphite. This development enhances the project’s potential to serve the second-largest end-use segment for natural graphite, emphasizing the importance of secure, high-quality raw material sources for refractory applications.

Regional Insights

Asia Pacific dominated the graphite market with a revenue share of 44.4% in 2025. The graphite market in North America is anticipated to grow at a moderate CAGR during the forecast period, influenced by economic pressures and sector-specific developments. Canada and Mexico face high interest rates and industrial slowdowns, impacting construction and steel production. However, demand from EAF-based steelmaking remains stable, with Mexico’s public infrastructure and automotive manufacturing hubs supporting refractory and foundry applications.

U.S. Graphite Market Trends

The graphite market in the U.S. is anticipated to grow at a substantial CAGR during the forecast period, supported by a resilient industrial base and favorable economic indicators. According to the International Monetary Fund (IMF), the U.S. economy is expected to grow by 2.1% in 2025, driven by increased industrial production, investments in clean energy, and the reshoring of critical mineral supply chains. As energy storage, electric vehicles, and low-carbon steel demand accelerate, they have become essential inputs across key U.S. industries. This shift is further amplified by federal support for domestic mineral processing and sustainable manufacturing.

Asia Pacific Graphite Market Trends

Asia Pacific dominated the global graphite market with the largest revenue share of 44.4% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period, driven by the expansion of industrial output and a rapid transition to clean energy technologies. China, India, South Korea, and economies in Southeast Asia continue to prioritize infrastructure, automotive manufacturing, and renewable energy deployment, all of which heavily rely on graphite-based materials. Countries like India are experiencing an increasing demand for graphite in foundry and metallurgical applications, driven by the growth of their manufacturing and construction sectors.

Europe Graphite Market Trends

The graphite market in Europe is anticipated to grow at a steady CAGR during the forecast period, underpinned by the region’s strong policy commitment to decarbonization and resource security. Industrial momentum, particularly within the automotive, infrastructure, and advanced manufacturing sectors, continues to support graphite consumption. The transition to electric arc furnace (EAF) steelmaking drives consistent demand for graphite electrodes, while the broader push toward electrification and clean energy systems reinforces its role in energy storage and mobility-related applications across leading economies such as Germany, France, and Sweden.

Key Graphite Company Insights

Some of the key players operating in the market include Asbury Carbons, BTR New Material Group Co., and Eagle Graphite.

-

Asbury Carbons has over 120 years of experience as a family-led global supplier of carbon and graphite materials. The company maintains robust R&D and technical services, supported by certified ISO 9001 & ISO 14001 facilities across North America, Europe, and Asia.

-

BTR New Material Group Co., Ltd. is a subsidiary of China Baoan Group and a recognized state-level high-tech enterprise. The company is a global leader in developing and producing advanced materials for lithium-ion batteries. BTR integrates R&D, manufacturing, and sales, focusing on continuous innovation to meet the evolving needs of the electric vehicle (EV) and energy storage industries. Its client base includes major global battery manufacturers, such as CATL, Samsung SDI, and Panasonic.

-

Eagle Graphite, a small Canadian public company, has operated the Black Crystal Quarry near Nelson since 1981. It emphasizes high-purity natural flake graphite and maintains a streamlined R&D and operational structure for quality control. Although no ISO certifications are listed, the company emphasizes traceability and localized expertise for the North American market.

-

Graphite India Ltd. is one of India’s oldest and most prominent graphite electrode manufacturers. The company has pioneered the development of industrial graphite solutions in India and enjoys a strong presence in domestic and international markets. With manufacturing facilities across India and in Germany (through its subsidiary), Graphite India serves clients in the steel, metallurgy, automotive, and energy sectors. Its global reach and quality consistency make it a trusted name in the carbon industry.

Key Graphite Companies:

The following are the leading companies in the graphite market. These companies collectively hold the largest Market share and dictate industry trends.

- Asbury Carbons

- ENERGOPROM Group (EPM)

- BTR New Material Group

- HEG Ltd.

- Syrah Resource Limited

- AMG

- Eagle Graphite

- Imerys

- GrafTech International

- Graphite India Ltd.

- SGL Carbon

- Tokai Carbon Co., Ltd.

- Qingdao Tennry Carbon Co. Ltd.

- Nippon Graphite Industries Co., Ltd.

- Showa Denko K.K.

- Northern Graphite Corporation

Recent Developments

-

During its Q1 earnings call in April, GrafTech announced an upcoming rollout of an 800‑millimeter graphite electrode, which completed qualification trials and will be introduced in 2025. This larger diameter electrode is designed to improve Electric Arc Furnace (EAF) steelmaking efficiency by enabling higher power usage and reduced electrode consumption per ton of steel.

-

In May, Graphite India invested INR 50 crore for a 31% stake in Godi India Pvt. Ltd., a startup developing advanced battery technologies like aqueous electrode processing, active dry coating, pranic binders, as well as sodium-ion and solid-state battery materials. This strategic move deepens its footprint in next‑generation energy storage tech.

-

In April 2025, Imerys introduced SU‑NERGY, a catalyst-free sustainable graphite product for battery and industrial markets, ensuring higher purity and better environmental credentials without compromising performance. This launch underscores Imerys’s push for greener, high‑value graphite materials.

Graphite Market Report Scope

Report Attribute

Details

Market definition

The market size reflects the annual value of graphite consumed across end-use industries.

Market size value in 2026

USD 14.13 billion

Revenue forecast in 2033

USD 23.87 billion

Growth rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Ukraine; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Asbury Carbons; BTR New Material Group; Eagle Graphite; ENERGOPROM Group (EPM); GrafTech International; Graphite India Ltd.; HEG Ltd.; Imerys; Nippon Graphite Industries Co., Ltd.; Northern Graphite Corporation; SGL Carbon; Tokai Carbon Co., Ltd.; AMG; Showa Denko K.K.; Qingdao Tennery Carbon Co. Ltd.; AMG; Syrah Resource Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphite Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global graphite market report based on the form, end use, and region.

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural Graphite

-

Synthetic Graphite

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrodes

-

Refractories

-

Lubricants

-

Foundries

-

Battery Production

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Ukraine

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global graphite market size was estimated at USD 13.29 billion in 2025 and is projected to reach USD 14.13 billion by 2026.

b. The global graphite market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 to reach USD 23.87 billion by 2033.

b. By form, synthetic graphite dominated the market, accounting for a revenue share of over 67.0% in 2025.

b. Some of the key vendors of the global graphite market are Asbury Carbons, BTR New Material Group, Eagle Graphite, ENERGOPROM Group (EPM), GrafTech International, Graphite India Ltd., HEG Ltd., Imerys, Nippon Graphite Industries Co., Ltd., Northern Graphite Corporation, SGL Carbon, Tokai Carbon Co., Ltd.

b. The key factor driving the growth of the global graphite market is the surge in demand for electric vehicles and energy storage systems has been a significant driver for the graphite market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.