- Home

- »

- Pharmaceuticals

- »

-

Healthcare Cold Chain Third Party Logistics Market Report 2033GVR Report cover

![Healthcare Cold Chain Third Party Logistics Market Size, Share & Trends Report]()

Healthcare Cold Chain Third Party Logistics Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Warehousing & Storage, Packaging Solutions), By Product (Biopharmaceuticals), By Temperature Range, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-525-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Cold Chain Third Party Logistics Market Summary

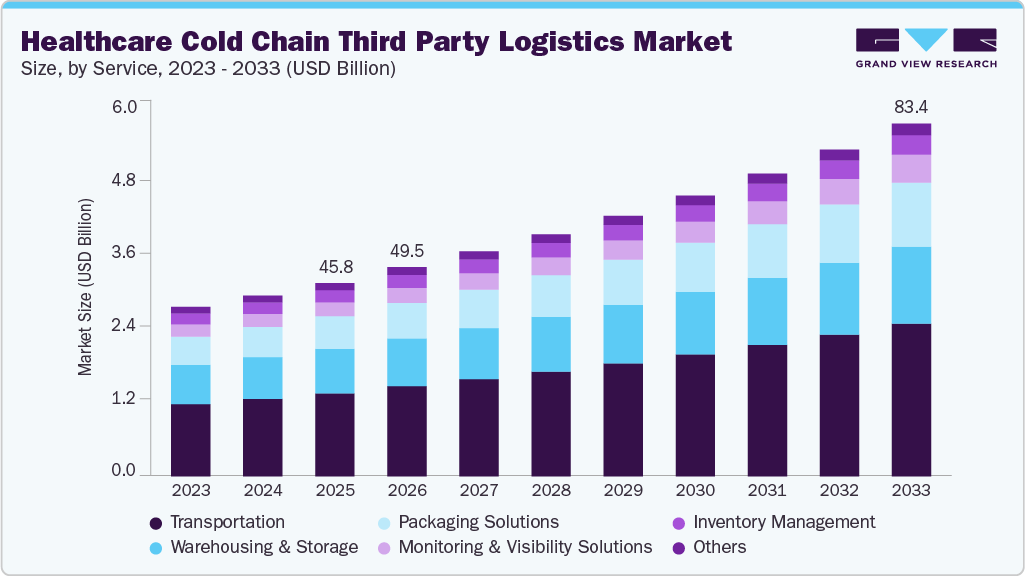

The global healthcare cold chain third party logistics market size was valued at USD 45.76 billion in 2025 and is projected to reach USD 83.40 billion by 2033, growing at a CAGR of 7.74% from 2026 to 2033. The rising demand for temperature-sensitive pharmaceutical products, stringent global regulations for pharmaceutical storage and distribution and expansion of global pharmaceutical distribution networks.

Key Market Trends & Insights

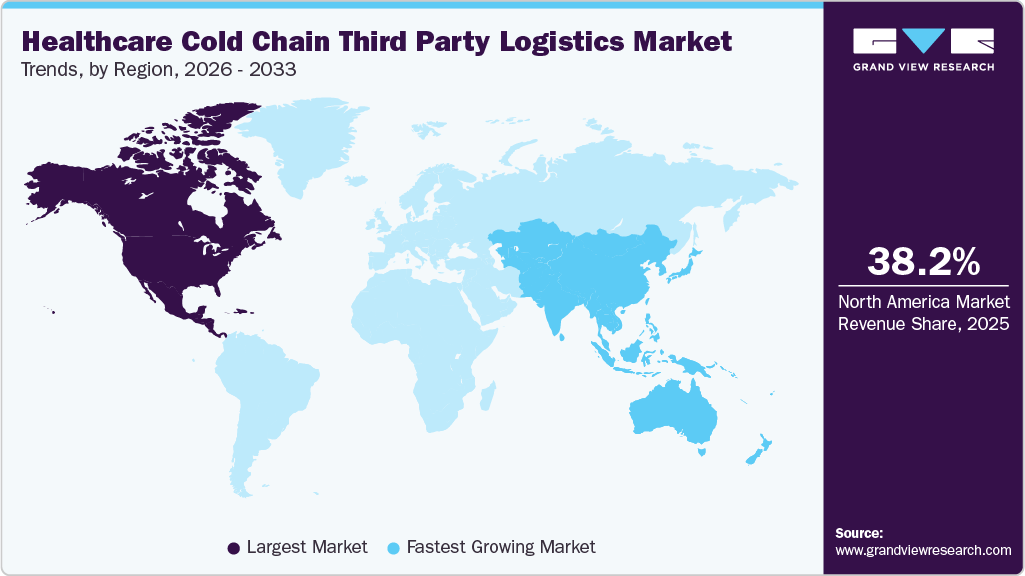

- North America healthcare cold chain third-party logistics market held the largest share of 38.20% of the global market in 2025.

- The healthcare cold chain third party logistics in the U.S. is expected to grow significantly over the forecast period.

- Based on service, the transportation segment held the largest market share of 42.98% in 2025.

- Based on product, biopharmaceuticals held the largest market share in 2025.

- Based on temperature range, the frozen segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 45.76 Billion

- 2033 Projected Market Size: USD 83.40 Billion

- CAGR (2026-2033): 7.74%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing global demand for vaccines, biologics, cell and gene therapies, and specialty drugs is significantly increasing reliance on cold chain logistics. Biologics, including monoclonal antibodies, gene therapies, and recombinant proteins, require stringent temperature control-typically between 2°C and 8°C, with some requiring ultra-low storage at -70°C or lower-to maintain their efficacy. As more temperature-sensitive products enter the market, pharmaceutical companies require highly specialized storage, packaging, and distribution systems to maintain product efficacy. This rise in biologics and high-value therapies directly drives the need for advanced 3PL providers capable of offering end-to-end temperature control, real-time monitoring, and regulatory compliance. As a result, healthcare companies outsource logistics to experienced cold chain specialists to reduce risk, ensure product quality, and meet global distribution timelines, thereby accelerating the expansion of the healthcare cold chain 3PL market.In addition, strict guidelines from government bodies such as FDA, EMA, and WHO require exact temperature management, verified transportation protocols, and thorough documentation for the distribution of pharmaceuticals. These regulatory demands create difficulties and expenses for manufacturers attempting to handle logistics on their own. As a result, companies rely on third-party logistics providers that have validated equipment, comply with GDP standards, and utilize advanced monitoring technologies. This transition ensures ongoing compliance with regulations, minimizes the risk of product loss or recalls, and strengthens the integrity of the supply chain.

Furthermore, as pharmaceutical companies expand their presence in emerging markets, the demand for dependable temperature-controlled distribution increases. These areas frequently face challenges such as insufficient cold storage facilities, fragmentated transportation systems, and inconsistent regulatory frameworks. The growth of cell and gene therapies is driving demand for ultra-low and cryogenic cold chain capacity. For instance, Cencora will expand its services in 500,000-sq-ft Texas 3PL facility will greatly expand controlled, refrigerated, frozen, and cryogenic storage capabilities. Thus, pharmaceutical manufacturers are turning to specialized third-party logistics (3PL) providers that possess well-established global networks, validated cold chain processes, and insights into local markets. This trend towards outsourcing helps minimize operational risks, guarantee consistent delivery, and preserve product integrity over long distances and varying climates. The expanding geographic distribution of healthcare products directly enhances the need for sophisticated 3PL cold chain services, thereby driving market growth.

Opportunity Analysis

The market for healthcare cold chain third-party logistics (3PL) is poised for substantial growth, fueled by the increasing demand for pharmaceuticals, biologics, vaccines, and developing cell and gene therapies that are sensitive to temperature. The expansion of global vaccination initiatives, growth of biotech development pipelines, and rising production of high-value therapeutics necessitate trustworthy, comprehensive cold chain solutions. Besides this, rapid adoption of advanced technologies such as IoT-based monitoring, AI-fueled predictive analytics, automation, and blockchain offers 3PL providers the chance to stand out through improved visibility, efficiency, and adherence to regulations.

In addition, entering emerging markets with developing healthcare systems presents additional opportunities, particularly in the Asia Pacific and Latin America, where there is a rising need for vaccines and biologics. Furthermore, collaborating with pharmaceutical companies, investing in facilities for ultra-low-temperature storage, and incorporating sustainable, energy-efficient practices enhance market presence. Moreover, regulatory demands to maintain product integrity and comply with Good Distribution Practices (GDP) generate opportunities for specialized services, enabling 3PL providers to secure long-term contracts and establish trusted connections with healthcare stakeholders worldwide.

Impact of U.S. Tariffs on Healthcare Cold Chain Third Party Logistics Market

U.S. tariffs are playing significant strain on the healthcare cold chain third-party logistics market, as pharmaceutical firms encounter increased expenses for imported packaging materials, refrigeration systems, and technology vital for transporting medicines that require specific temperature conditions. The rise in operational costs is pushing pharmaceutical operators to depend more on 3PL providers to maintain efficiency, adhere to regulations, and scale their operations without incurring substantial capital costs.

However, coordinating with multiple 3PL partners in presence of tariffs adds logistical complexity, especially when handling high-value medicines and medical devices across various markets. In addition, retaliatory tariffs may further limit market access, raise costs, and lead to stockpiling or realignment of the supply chain. Similarly, 3PL providers with international networks can help alleviate these challenges by ensuring timely and compliant deliveries. Moreover, emerging trends, such as personalized and precision medicine, increase the need for specialized, temperature-sensitive logistics, emphasizing the crucial role of 3PLs and the operational risks presented by tariffs in the global pharmaceutical cold chain market.

Comparative Regional Matrix, by Technology

Region

Adoption of IoT & AI

Blockchain integration

Automated Warehousing

North America

High

Moderate

High

Europe

High

High

Moderate

Asia Pacific

Moderate

Emerging

Moderate

Latin America

Low

Emerging

Moderate

Middle East & Africa

Moderate

Low

Emerging

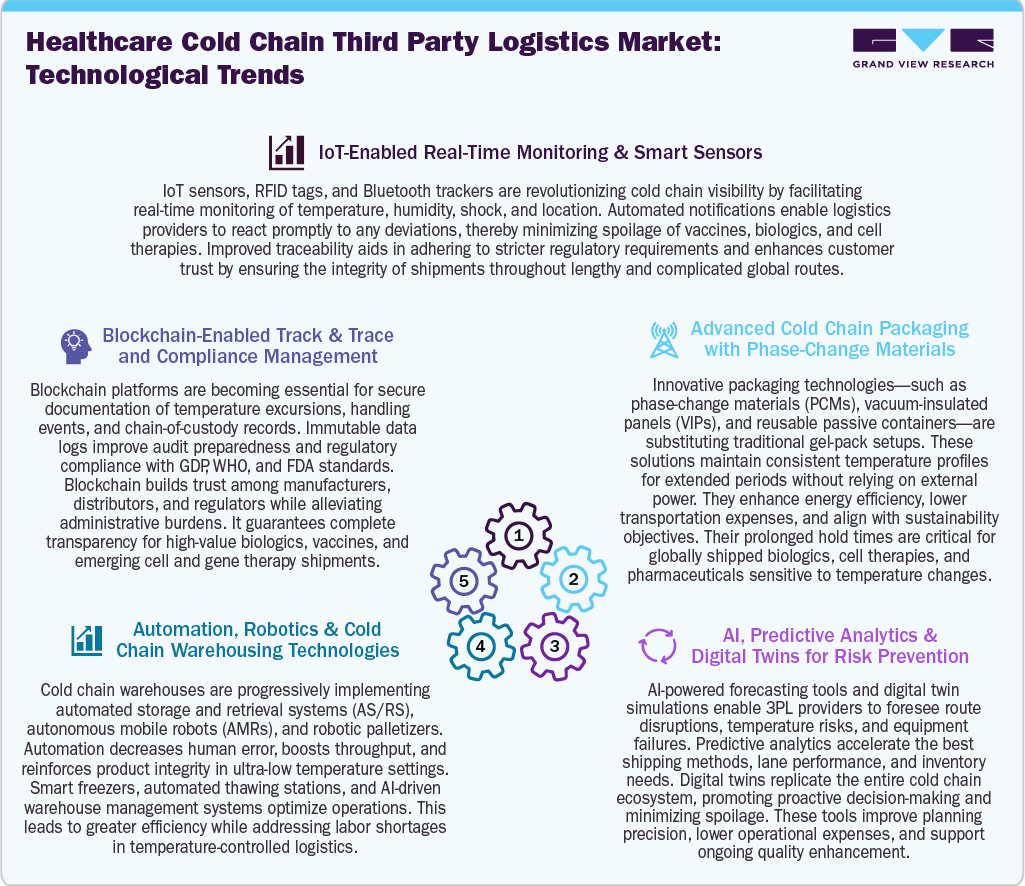

The healthcare cold chain third-party logistics market is rapidly advancing with technologies that enhance visibility, efficiency, and compliance measures. Internet of Things (IoT) devices and smart sensors facilitate real-time monitoring of temperature, humidity, and location, that mitigates risks of spoilage and enhances traceability. In addition, innovative packaging solutions, such as phase-change materials and vacuum-insulated panels, provide extended temperature stability while also promoting sustainability. Furthermore, artificial intelligence, predictive analytics, and digital twins are utilized to optimize delivery routes, avert disruptions, and refine planning precision.

In addition, automation technologies including automated storage and retrieval systems (AS/RS), autonomous robots, and intelligent freezers improve warehouse efficiency and minimize human errors in ultra-low-temperature settings. Moreover, use of blockchain technology is growing to secure chain-of-custody records, streamline audits, and guarantee regulatory compliance for high-value biologics as well as cell and gene therapies. Thus, these advancements bolster product integrity, enhance operational performance, and cater to the increasing global demand for temperature-sensitive healthcare products.

Pricing Model Analysis

In the 3PL market for healthcare cold chain logistics, pricing structures are designed to correspond with the complexity of services and the value provided to clients. Milestone-based pricing links costs to the successful completion of shipments or regulatory achievements, motivating high performance. In addition, value-based pricing establishes charges based on outcomes, such as minimized spoilage and improved compliance rates. Besides this, fixed-fee pricing models deliver predictable expenses for standardized logistics services, assisting with budgeting and ensuring reliability. Moreover, subscription or retainer pricing models provide continuous, recurring access to temperature-sensitive logistics, monitoring, and compliance assistance, encouraging long-term collaborations. Thus, these pricing strategies allow 3PL providers to enhance service delivery while enabling pharmaceutical companies to effectively control costs, risks, and operational efficiency.

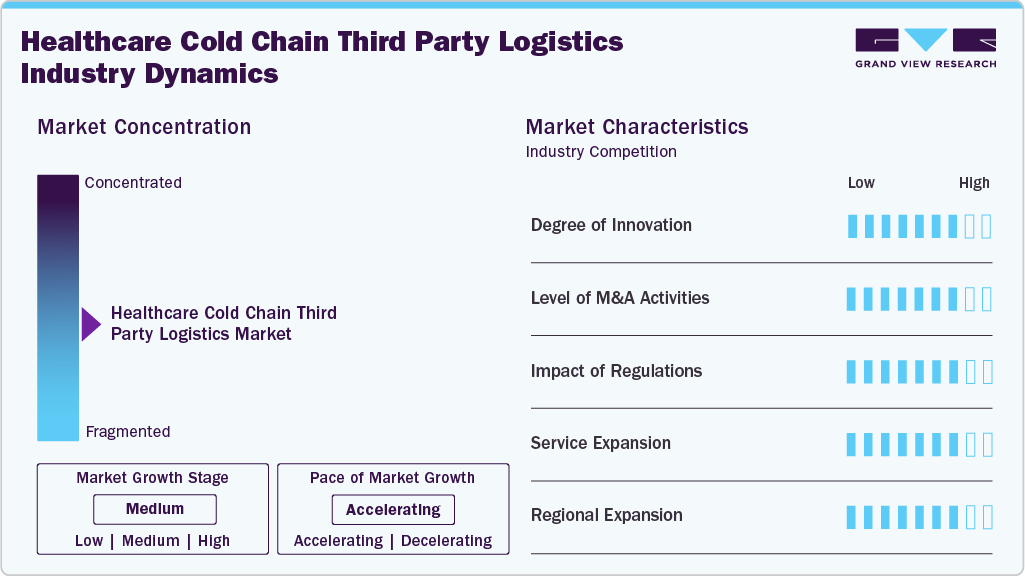

Market Concentration & Characteristics

The healthcare cold chain third party logistics market growth stage is medium, and growth is accelerating. The market is characterized by the level of merger & acquisitions activities, degree of innovation, regulatory impact, product expansion, and regional expansions.

The industry is witnessing rapid innovation driven by advancements in healthcare cold chain monitoring market, blockchain-based supply chain security, and AI-driven predictive analytics. IoT-enabled temperature sensors are enhancing shipment tracking, while automated cold storage facilities are improving efficiency.

Stringent regulations imposed by the FDA, EMA, and WHO mandate strict adherence to temperature-controlled storage and transportation of pharmaceuticals. Compliance with Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) are important, which is also one of the factors driving logistics providers to invest in validated cold chain infrastructure, digital compliance tracking, and risk mitigation strategies.

Mergers and acquisitions (M&A) are reshaping the industry, with large logistics providers acquiring specialized cold chain firms to enhance their capabilities. Pharmaceutical companies are also entering strategic partnerships with 3PL providers to strengthen their distribution networks. For instance, in September 2025, DHL acquired SDS Rx enhancing its healthcare logistics, adding final-mile services, specialty pharmacy delivery, and same-day capabilities, strengthening end-to-end life sciences supply chains and patient-focused solutions.

The rising demand for specialized cold chain logistics services has led companies to expand their offerings, including end-to-end temperature-controlled transportation, real-time shipment monitoring, and last-mile delivery optimization.

Emerging markets in Asia Pacific, Latin America, and the Middle East are becoming hotspots for healthcare logistics expansion. Rising pharmaceutical demand, increased vaccine distribution, and improved infrastructure investments are driving growth in these regions. North America and Europe remain dominant due to their advanced regulatory frameworks, high adoption of cold chain technologies, and well-established logistics networks. For instance, in June 2025, Aenova expanded facility in Italy for cold chain warehouse with 1,300 pallet capacity, maintaining 2-8 °C and supporting packing, shipping, and end-to-end temperature-sensitive supply chains.

Service Insights

On the basis of service segment, the transportation segment captured the highest market share of 42.98% in 2025. The growth is mainly due to the rising global trade of temperature-sensitive pharmaceuticals, including biologics and vaccines, which require stringent cold chain logistics. Furthermore, the expansion of cross-border pharmaceutical distribution coupled with increasing outsourcing of logistics by pharmaceutical companies is growing investments in specialized refrigerated transport fleets.

The monitoring & visibility solutions segment is projected to experience the fastest growth due to the increasing need for real-time tracking, compliance, and risk mitigation in healthcare cold chain monitoring market. The adoption of advanced technologies ensures product integrity, minimizes spoilage, and enhances supply chain transparency

Product Insights

On the basis of the product segment, the biopharmaceuticals segment dominated the industry in 2025. The segment’s growth is mainly driven by increasing global demand for biologics, including monoclonal antibodies, recombinant proteins, and gene therapies, which require precise temperature control to maintain efficacy. The surge in chronic disease treatments, personalized medicine, and cell & gene therapy advancements has boosted the need for specialized cold chain solutions, including ultra-low temperature storage and secure transportation.

The pharmaceuticals segment is expected to experience a considerable growth rate during the forecast period. The growth is due to an increasing production and distribution of temperature-sensitive drugs, such as insulin, vaccines, and specialty medications for chronic conditions. The rise in demand for generics and biosimilars, coupled with the expansion of pharmaceutical exports to emerging markets, is creating a strong need for efficient cold chain logistics solutions.

Temperature Range Insights

On the basis of temperature range, the frozen segment dominated the industry in 2025. The segment’s growth is due to the high volume of biologics, vaccines, and specialty pharmaceuticals that require storage temperatures between -20°C and -80°C. The increasing adoption of frozen storage for cell-based therapies, blood plasma, and insulin has further strengthened the demand for reliable cold chain solutions.

The cryogenic segment is expected to experience the fastest growth rate during the forecast period. The growth is due to rising demand for cell & gene therapies, regenerative medicines, and mRNA-based vaccines, which require ultra-low temperatures below -150°C. The increasing investments in cryogenic storage tanks, liquid nitrogen-based transport systems, and ultra-low temperature freezers are supporting this segment’s expansion.

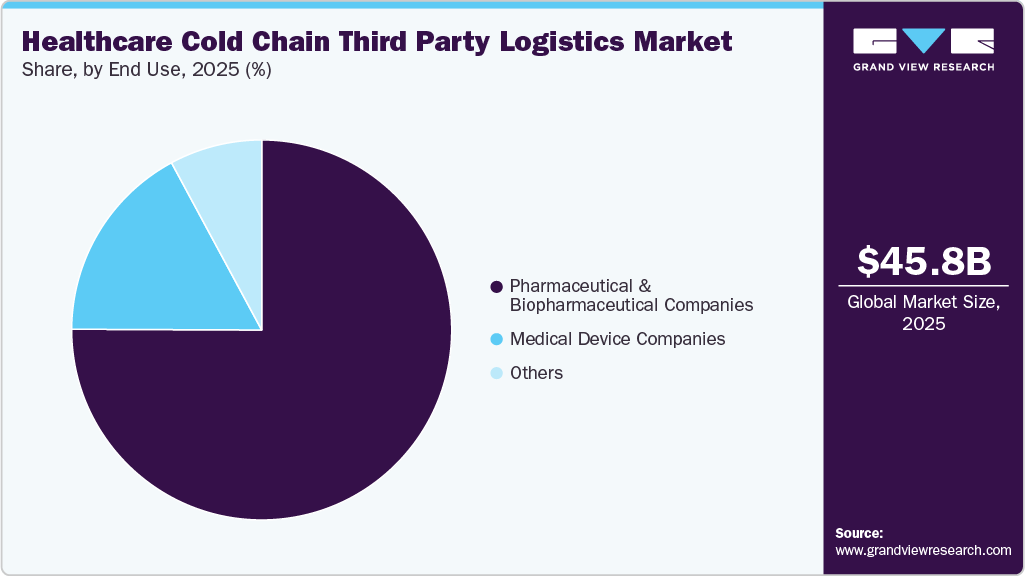

End Use Insights

On the basis of the end use, the pharmaceutical and biopharmaceutical companies segment dominated the industry in 2025. These are the primary users of cold chain logistics services for transporting temperature-sensitive drugs, vaccines, and biologics. Increasing R&D investments, expansion of biologics production facilities, and stringent regulatory compliance requirements are driving the demand for secure and efficient cold chain logistics solutions.

The medical device companies segment is expected to witness the fastest growth in the coming years due to the increasing need for temperature-controlled transportation of diagnostic kits, implants, and sensitive electronic medical equipment. The rising adoption of in-vitro diagnostics (IVD), blood storage solutions, and temperature-sensitive surgical products is fueling demand for specialized cold chain logistics services.

Regional Insights

North America Healthcare Cold Chain Third Party Logistics Market Trends

North America market held the largest market share of 38.20% in 2025. This growth can be attributed to its advanced pharmaceutical industry and well regulatory framework. The region is witnessing significant investments in temperature-controlled warehouses, AI-driven route optimization and growing strategic initiatives by key players. For instance, in November 2025, UPS acquired Andlauer Healthcare Group strengthened global cold chain capacity, expanding specialized 3PL services and enhanced temperature-controlled distribution accelerating growth and competitiveness in the Healthcare Cold Chain Third-Party Logistics market.

U.S. Healthcare Cold Chain Third Party Logistics Market Trends

The healthcare cold chain third party logistics market in the U.S. held the largest share in 2025 owing to country’s highly developed regulatory landscape (FDA, GDP, GMP) that mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized 3PL providers are further accelerating the market growth. For instance, in April 2025, EVERSANA expanded its major 3PL service, adding cold chain capacity, advanced warehouse management system (WMS) technology, and AI-driven robotics boosting operational efficiency, regulatory compliance, and scalable temperature-controlled distribution.

Europe Healthcare Cold Chain Third Party Logistics Market Trends

The healthcare cold chain third party logistics market in Europe is anticipated to experience significant growth due to surge in investments in GDP-compliant cold storage facilities, rising expansion initiatives by major companies and last-mile delivery solutions. Besides this, European Medicines Agency (EMA) enforces strict guidelines, compelling logistics providers to adopt real-time temperature monitoring and risk mitigation strategies. For instance, in December 2025, Cencora expanded in Europe 3PL infrastructure, adding cold chain capacity, and cryogenic capabilities strengthening global specialty logistics.

Germany's healthcare cold chain third party logistics market held the largest share in 2025. This market is primarily driven by increasingly adopting automation, AI-driven supply chain analytics, and IoT-based monitoring to enhance efficiency. For instance, in May 2025, DHL expanded its health logistics campus, with advanced cold-storage zones and specialized biopharma services in Germany, boosting Europe’s temperature-controlled capacity. Besides this, sustainability is a major focus, with investments in hydrogen-powered refrigerated trucks and green warehousing solutions.

The UK's healthcare cold chain third party logistics market is anticipated to grow over the forecast period. The country’s market growth is due to its robust pharmaceutical supply chain, with high demand for cold chain logistics due to its strong biotech and vaccine production industry. The impact of Brexit has led to increased complexities in cross-border pharmaceutical trade, making efficient cold chain management essential.

Asia Pacific Healthcare Cold Chain Third Party Logistics Market Trends

The healthcare cold chain third party logistics market in Asia Pacific is projected to grow at the highest CAGR over the forecast period. The growth of the market is due to rising pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics. The region is witnessing massive investments in temperature-controlled warehouses, IoT-based tracking systems, and express cold chain transportation.

China's healthcare cold chain third party logistics market held the largest share in 2025. The country is rapidly expanding its cold storage and refrigerated transport infrastructure to meet rising demand. Government regulations on pharmaceutical cold chain compliance are becoming stricter further driving the investments in GDP-certified logistics solutions.

Japan is the Asia Pacific region's second-largest healthcare cold chain third party logistics market. The country has advanced regulatory compliance, high-tech logistics solutions, and an increasing demand for regenerative medicine. The country has one of the most sophisticated cold chain infrastructures, with extensive use of robotic cold storage, AI-driven logistics management, and RFID-based tracking.

The healthcare cold chain third party logistics market in India is expected to experience significant growth at a significant CAGR during the forecast period. The country is witnessing considerable growth due to increasing government support. For instance, in May 2025, Celcius Logistics accelerated India’s cold chain capacity, strengthening tech-enabled, temperature-controlled transport. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure. Besides this, growth of online pharmacy platforms and e-commerce-driven drug deliveries is increasing the need for last-mile cold chain solutions.

Latin America Healthcare Cold Chain Third Party Logistics Market Trends

The healthcare cold chain third party logistics market in Latin America is projected to grow over the forecast period. The growth in the region is due to rising vaccine distribution, increasing pharmaceutical imports, and expanding healthcare access. Countries like Brazil and Mexico are leading investments in cold storage and refrigerated transportation. Challenges such as infrastructure gaps, regulatory variations, and high logistics costs are pushing providers to adopt cost-effective, region-specific cold chain strategies.

The healthcare cold chain third party logistics market in Brazil is expected to grow over the forecast period. The country has a rapidly expanding biologics and vaccine distribution network, necessitating better cold chain storage and compliance-driven logistics solutions. Regulatory reforms and increased pharmaceutical trade agreements are enhancing international logistics operations.

Middle East And Africa Healthcare Cold Chain Third Party Logistics Market Trends

The Middle East & Africa are emerging as competitive regions in the healthcare cold chain third party logistics market, driven by rising vaccine demand, expansion of biopharma manufacturing, and government investments in temperature-controlled logistics infrastructure. The regulatory frameworks are strengthening, with GCC, Saudi FDA, and South Africa’s SAHPRA enforcing GDP-compliant storage, traceability, and cross-border transport standards. Besides this, competition intensifies as global players such as DHL, UPS, and Cencora expand regional capabilities, while local logistics firms improve cold storage networks.

The South Africa healthcare cold chain third party logistics market is witnessing growth rising healthcare spending, expansion of public immunization programs, and increasing adoption of chronic disease therapies strengthen the need for reliable 2-8°C and deep-freeze solutions. For instance in October 2025, Maersk investment of USD 100M+ cold chain in Cape Town strengthens South Africa’s temperature-controlled logistics ecosystem, expanding capacity.

Saudi Arabia is emerging as a competitive hub in the Healthcare Cold Chain Third Party Logistics market, driven by strong government investments under vision 2030, regulatory tightening by sfda and rising imports of high-value specialty medicines. For instance, in October 2025, AJEX’s GMP-GxP compliant depot in Saudi Arabia expanded high-quality temperature-controlled capacity, strengthening regulatory-aligned distribution, and enhances last-mile reliability.

Key Companies Healthcare Cold Chain Third Party Logistics Insights

Key players in the market are actively enhancing their service offerings to meet the growing demand for temperature-sensitive pharmaceutical products. Companies such as Cardinal Health, DHL Group, Agility, are investing in advanced technologies such as IoT-enabled tracking systems, real-time temperature monitoring, and automated warehousing solutions. These innovations aim to ensure the integrity and safety of healthcare products during transit. For instance, in March 2025, DHL acquired CRYOPDP expanding its capabilities in clinical trial, biopharma, and cell and gene therapy logistics, accelerating global cold chain capacity.

Key Healthcare Cold Chain Third Party Logistics Companies:

The following are the leading companies in the healthcare cold chain third party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- DHL

- Agility

- SF Express

- Kinesis

- UPS

- Barrett Distribution Centers

- AmerisourceBergen

- DB Schenker

- FedEx

- KUEHNE + NAGEL

Recent Developments

-

In October 2025, Röhlig collaborated with SkyCell boosting advanced temperature-controlled air freight reliability, reduces spoilage risk, and enhances regulatory-compliant handling of sensitive pharma shipments, strengthening demand for high-quality cold chain 3PL solutions globally.

-

In September 2025, DHL acquired SDS Rx, expanding DHL’s end-to-end healthcare logistics, adding final-mile, specialty pharmacy, and radiopharmacy delivery, increasing integrated service capabilities and accelerating Healthcare Cold Chain 3PL market growth.

-

In August 2025, DHL Expanded its Asia Pacific Cold Chain Facility. This new GxP- and CEIV-certified cold chain facility improves regional temperature-controlled storage, boosts regulatory-compliant pharma handling, and strengthens DHL’s APAC network, driving greater adoption of outsourced cold chain 3PL services.

Healthcare Cold Chain Third Party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 49.49 billion

Revenue forecast in 2033

USD 83.40 billion

Growth rate

CAGR of 7.74% from 2026 to 2033

Historical year

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, product, temperature range, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Cardinal Health; DHL; Agility; SF Express; Kinesis; UPS; Barrett Distribution Centers; AmerisourceBergen; DB Schenker; FedEx; KUEHNE + NAGEL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Cold Chain Third Party Logistics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare cold chain third party logistics market based on service, product, temperature range, end use, and region.

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing & Storage

-

Packaging Solutions

-

Monitoring & Visibility Solutions

-

Inventory Management

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceuticals

-

Pharmaceuticals

-

Medical Device

-

Others

-

-

Temperature Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Frozen

-

Ultra-frozen/Deep-Frozen

-

Cryogenic

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global healthcare cold chain third party logistics market size was estimated at USD 45.76 billion in 2025 and is expected to reach USD 49.49 billion in 2026.

b. The global healthcare cold chain third party logistics market is expected to grow at a compound annual growth rate of 7.74% from 2026 to 2033 to reach USD 83.40 billion by 2033.

b. North America dominated the healthcare cold chain third party logistics market with a share of 38.20% in 2025. This is due to its advanced pharmaceutical industry and well regulatory framework.

b. Some key players operating in the healthcare cold chain third party logistics market include Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., UPS, Barrett Distribution, AmerisourceBergen Corporation, DB Schenker, FedEx, KUEHNE + NAGEL

b. Key factors that are driving the market growth are rising demand for temperature-sensitive pharmaceuticals, stringent regulatory requirements for drug storage and transportation, and the expansion of biologics and vaccine distribution worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.