- Home

- »

- Medical Devices

- »

-

Healthcare Third-party Logistics market Size Report, 2030GVR Report cover

![Healthcare Third-party Logistics Market Size, Share & Trends Report]()

Healthcare Third-party Logistics Market Size, Share & Trends Analysis Report By Industry (Biopharmaceutical, Pharmaceutical, Medical Device), By Supply Chain, By Service Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-974-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

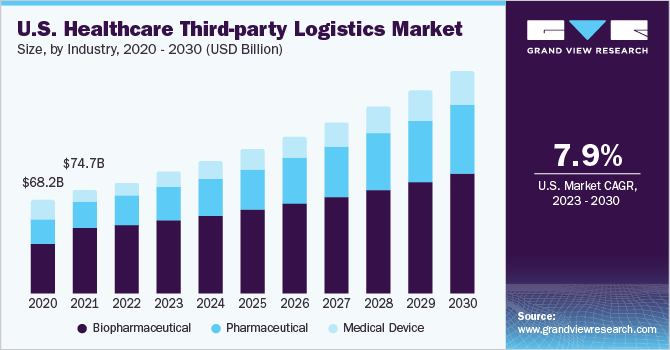

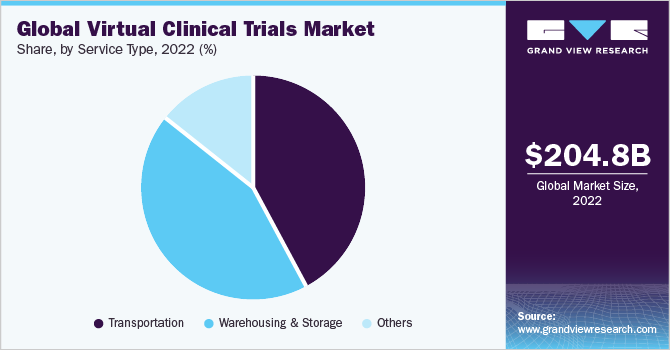

The global healthcare third-party logistics market size was valued at USD 204.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The rising trend of outsourcing logistics and the increasing use of advanced technology by integrating information between manufacturers, suppliers, retailers, and wholesalers have led to the growth of the industry. Additionally, pharmaceutical logistics companies are increasingly adopting retrieval systems and automated storage solutions, which are garnering substantial attention.

U.S. healthcare third-party logistics market size, by industry, 2020-2030 (USD Billion)

(CAGR - 7.9%)

Moreover, the industry is poised to experience strong expansion throughout the assessment period, fueled by the increasing trend of collaborations between healthcare companies and third-party logistics (3PL) providers. This is complemented by the heightened emphasis of 3PL providers on extending their offerings into niche therapeutics. For instance, in June 2023, DHL Group announced a new partnership with Vizient Inc., a leading member-directed healthcare performance enhancement organization in the U.S., to establish DHL Supply Chain as an authorized provider of third-party logistics services for supply chain operations.

Through this agreement, members of Vizient, which includes healthcare suppliers and hospital systems, will gain enhanced opportunities to utilize the top-tier service logistics offerings provided by DHL Supply Chain. Also, in April 2023, AmerisourceBergen Corporation announced the launch of its Cell and Gene Therapy (CGT) Integration Hub, designed to seamlessly integrate with provider-oriented platforms or biopharmaceuticals. Its purpose is to enable the instantaneous exchange of data and assist in coordinating services throughout the entirety of treatment development and the patient's healthcare journey.

The COVID-19 pandemic has also boosted the demand for third-party logistics (3PL). During the pandemic, 3PL companies were able to handle the growing demand for healthcare supplies to prevent the pandemic by minimizing supply chain disruptions. They also formed close partnerships with suppliers and added specialized value-based services that helped them generate a good profit. They also collaborated with COVID-19 vaccine providers to supply them across the globe.

3PL services mainly help lower a company's operating costs through two methods. First, 3PL firms usually provide their customers with comprehensive warehousing and transportation services. Therefore, for the companies that use 3PL services, the capital and operational costs such as employee training costs, salaries of logistics personnel, and purchases of transportation trucks and warehouse construction get saved. Second, third-party logistics providers can significantly reduce information asymmetry and transaction costs by eliminating unnecessary distributors from the circulation link.

As a result, they can help businesses lower their operational costs. However, a company gives up some control over the delivery when they choose a 3PL provider. When a company chooses to work with a third-party logistics provider (3PL), they are placing a great deal of faith in 3PL to adhere to the agreed-upon rules for operations that may significantly impact customer satisfaction. Critical data exchanges might not go well. Furthermore, disclosing confidential data to a third party (such as sourcing or order details) may make businesses feel exposed in the event of a data breach.

Industry Insights

The biopharmaceutical segment accounted for the largest revenue share of 62.0% in 2022. The growth of the biopharmaceutical third-party logistics (3PL) market is being driven by factors such as the increasing demand for temperature-controlled logistics services to expanding distribution networks of biopharmaceutical companies to increase their sales and transport biologics in various geographical areas. Furthermore, several service providers are focusing on partnerships with biopharmaceutical companies to support their logistical concerns regarding newly approved biologics.

For instance, in September 2022, Outlook Therapeutics, Inc., a biopharmaceutical company, announced a strategic alliance with AmerisourceBergen Corporation. Per the agreement, AmerisourceBergen will provide third-party distribution and logistics services, as well as pharmacovigilance and medical information services, for Outlook Therapeutics, Inc. in the U.S.

The medical devices segment is anticipated to register the fastest CAGR of 10.7% during the forecast period in the healthcare third-party logistics market. The rising use of homecare medical devices for the growing geriatric population, increasing focus on personalized medicine by using health trackers and remote patient monitoring devices, and rising supply chain resilience and agility to overcome medical device shortages are the major driving factors.

For instance, in July 2021, the FDA announced a budget of USD 21.6 million for its new Resilient Supply Chain and Shortages Prevention Program (RSCSPP). The main aim of the program is to strengthen the supply chain. Moreover, increasing government initiatives for developing the medical devices industry by building MedTech parks for manufacturers to develop their base for R&D are further expected to drive industry growth.

Supply Chain Insights

The non-cold chain segment held the largest revenue share of 79.7% in 2022. This is due to greater scalability, improved visibility, and lower operating expenses, all of which contribute to the growth of a more robust logistics network with higher returns and lower risks. As a result, 3PL has become a crucial component of pharmaceutical companies' business strategies. The growth in the number of SKUs per distributor that do not require temperature-controlled transportation, unlike biologics, is another factor that has fueled the expansion of the non-cold chain segment.

The cold chain segment, on the other hand, is expected to register the fastest CAGR of 10.5% during the forecast period. This is mainly due to the meteoric rise in demand for biologics, a brand-new class of pharmaceuticals that has grown quickly in recent years. Aside from biologics, the healthcare 3PL market has witnessed the emergence of various types of precision medicine, such as blood products, biomarker testing, specific vaccines, cellular therapies, and regenerative medicine in the form of stem cells, which require both temperature- and time-controlled distribution.

Furthermore, biopharmaceutical logistics providers are upgrading their systems to include cold chain logistics for cell and gene therapies. For instance, in September 2022, Cryoport, a company specializing in temperature-controlled cold chain supply services, entered into a collaboration with BioLife Plasma Services, which is a part of Takeda Pharmaceutical Company Limited dedicated to plasma donation and collection. This partnership aims to provide uniform services for collecting, processing, and storing cell therapy products throughout the U.S. and Europe.

Service Type Insights

The warehousing and storage segment led the market with the largest revenue share of 43.6% in 2022. The healthcare industry is using 3PL services to lower overhead operating costs and expenditures. Due to an increase in demand, service providers have introduced several value-added services to their portfolios, such as packaging and warehousing. Additionally, suppliers have installed barcode scanners and robots for picking and aligning products from far-off areas to lessen the burden and speed up turnover.

The other services segment is anticipated to register the fastest CAGR of 8.4% during the forecast period. This segment includes packaging, custom & duty management, procurement services, and other value-added services. Packaging is one of the crucial elements of healthcare logistics since the transportation of healthcare products depends not only on the storage facilities but also on the packaging of the product.

Regional Insights

North America led the market with a revenue share of 42.6% in 2022. This high revenue share is mostly due to the region's dominance in pharmaceutical and biologic medications as well as a surge in exports and imports of biopharmaceuticals. The adoption of new technologies is relatively high in the region due to the high cost of healthcare. As a result, healthcare businesses with operations in North America are increasingly dependent on 3PL service providers to optimize warehousing and transportation, which is fueling regional growth. The presence of prominent firms in this area is another factor contributing to the dominance of this region.

Asia Pacific is expected to register a CAGR of 9.1% during the forecast period owing to the rising demand for cold storage facilities, increasing adoption rate of technologically advanced facilities, and rise in merger & acquisition activities by industry players in the region. For instance, in August 2023, CEVA Logistics announced an agreement to purchase 96% of Stellar Value Chain Solutions, a Mumbai-based company specializing in cold chain logistics. The acquisition of the company will enable CEVA to expand its footprint in India, enhancing its local workforce, customer base, and competencies.

Key Companies & Market Share Insights

Major players focus on expanding their facilities as well as undertaking collaborations, partnerships, and mergers and acquisitions. These are the key strategic initiatives influencing the industry dynamics. For instance, in February 2022, DHL Supply Chain allocated approximately USD 400 million to expand its pharmaceutical and medical device distribution network within the U.S. This investment by DHL Supply Chain entails the establishment of six new sites across the U.S. Some of the prominent players in the global healthcare third-party logistics market include:

-

Cardinal Health

-

DHL Group

-

Agility

-

SF Express

-

Kinesis Medical B.V.

-

United Parcel Service of America, Inc.

-

Barrett Distribution

-

AmerisourceBergen Corporation

-

DB Schenker

-

FedEx

-

KUEHNE + NAGEL

-

Kerry Logistics Network Ltd.

-

Freight Logistics Solutions

Healthcare Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 220.1 billion

Revenue Forecast in 2030

USD 368.2 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Industry, supply chain, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Cardinal Health; DHL International GmbH; Agility; SF Express; Kinesis Medical B.V.; United Parcel Service of America, Inc.; Barrett Distribution; AmerisourceBergen Corporation; DB Schenker; FedEx; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Freight Logistics Solutions

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

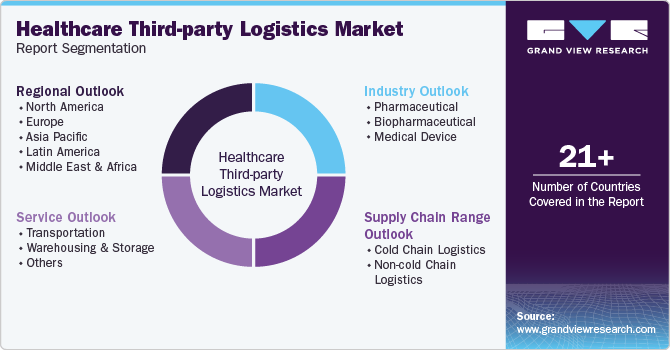

Global Healthcare Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare third-party logistics market report on the basis of industry, supply chain, service type, and region:

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical

-

Vaccines

-

Plasma Derived Products

-

Others

-

-

Medical Device

-

Class I

-

Class II

-

Class III

-

-

Pharmaceutical

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland Transportation

-

-

Warehousing and Storage

-

Others

-

-

Supply Chain Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cold Chain

-

Non-Cold Chain

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare third-party logistics market size was estimated at USD 204.8 billion in 2022 and is expected to reach USD 220.1 billion in 2023.

b. The global healthcare third-party logistics market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 368.2 billion by 2030.

b. North America dominated the healthcare 3PL market with a share of 42.6% in 2022. This is attributable to the rising demand for temperature-controlled logistic services to transport biologics in various regions.

b. Some key players operating in the healthcare third-party logistics market include DHL International GmbH., SF Express, United Parcel Service of America, Inc, AmerisourceBergen Corporation, DB Schenker, Kuehne and Nagel, Kerry logistics network limited, and Agility.

b. Key factors that are driving the healthcare third-party logistics market growth include growing distribution networks of biopharmaceutical companies to improve their sales. Rising adoption of automated storage and retrieval systems in emerging countries, and the trend of shifting from small molecule drugs to biopharmaceuticals, mainly vaccines, and biologics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."