- Home

- »

- IT Services & Applications

- »

-

Higher Education Technology Market Size Report, 2030GVR Report cover

![Higher Education Technology Market Size, Share & Trends Report]()

Higher Education Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Services), By Deployment (Cloud, On-premise), By Solution, By Services, By Learning Mode, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-152-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Higher Education Technology Market Summary

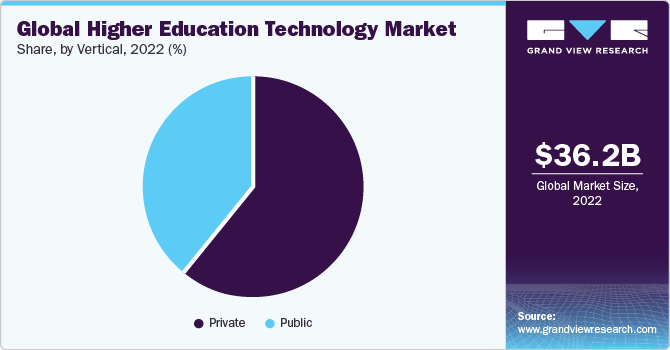

The global higher education technology market size was estimated at USD 36.24 billion in 2022 and is projected to reach USD 140.40 billion by 2030, growing at a CAGR of 18.6% from 2023 to 2030. The market growth can be attributed to the rising adoption of competency-based education, allowing students to advance based on their mastery of specific skill sets rather than the traditional credit-hour method.

Key Market Trends & Insights

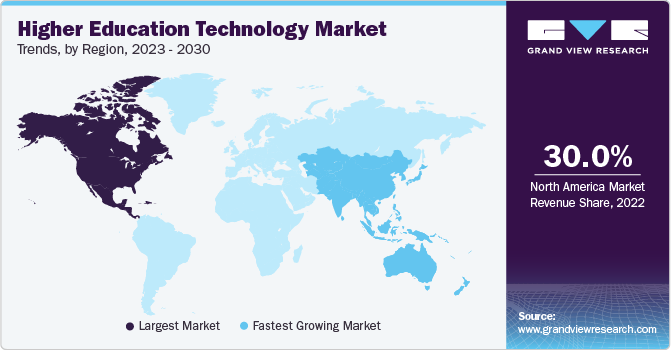

- The North America region dominated the market with a share of around 30% in 2022.

- The higher education technology market in the U.S. is expected to register significant CAGR over the forecast period.

- Based on vertical, the private segment held a market share of around 60% in 2022.

- Based on component, the hardware segment held a market share of around 28% in 2022.

- Based on solution, the student information management system segment held the largest share of 25% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 36.24 Billion

- 2030 Projected Market Size: USD 140.40 Billion

- CAGR (2023-2030): 18.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Moreover, the increasing shift towards personalized and adaptive learning is gaining traction. Institutions are using technology to personalize educational content based on individual student needs, preferences, and learning methods, thereby improving the overall learning experience, which is creating robust opportunities for the growth of the market. Governments are allocating funds to assist higher education institutions with operating costs, infrastructural development, and research. Adequate funding is essential for preserving quality education and encouraging innovation.

The growing integration of advanced technologies such as Artificial Intelligence (AI), virtual reality, and augmented reality is reshaping the market landscape, thereby propelling the growth of the market. Institutions are rapidly adopting online learning platforms, employing data analytics for student insights, and experimenting with novel approaches to improve the digital learning experience. For instance, in May 2023, Ellucian, an enterprise software provider for higher education, launched a new partner network to combine its capabilities with other educational technology applications on college campuses across the world. Through its network of 150 member organizations, the newly formed Ellucian Partner Network will collaborate on technology development, sales, and marketing. Institutions will be able to use data from departments across the university in all of their various technological systems due to the Ellucian SaaS platform and the company’s partner program and connections.

Integrated campus management systems have gained prominence, providing complete solutions to streamline several administrative operations. These systems frequently integrate modules for student information, finance, human resources, and facilities management, resulting in a cohesive platform for effective campus operations. Furthermore, the major driving factor behind the market is the rising adoption of cloud-based campus management solutions. This development enables institutions to securely access and manage data from anywhere, increasing flexibility and scalability. Cloud solutions also encourage collaboration among various divisions within an institution. Institutions are recognizing the significance of employing cloud solutions to satisfy students' changing requirements and improve overall campus experiences.

Online learning platforms are integrating enhanced collaborative tools and social learning capabilities. This enables students to collaborate on projects, participate in conversations, and establish a sense of community in a virtual setting, simulating features of the traditional classroom experience. Online learning platforms emphasize accessibility, ensuring that information is intended to suit various learners, including those with disabilities. This emphasis on inclusivity strives to make education more accessible to a broader spectrum of pupils. As the market evolves, online learning is projected to play an increasingly significant role in serving the various educational demands of students globally, which is further expected to drive market growth.

Researchers are employing machine learning models to predict the qualities of new materials based on existing datasets. This has the potential to significantly speed up the discovery of materials with specified properties, such as increased conductivity or strength, which has an array of future opportunities for market growth. For instance, in April 2023,Imperial College London announced a partnership with Cornell University to collaborate on the use of artificial intelligence to advance scientific discoveries and future technologies. Imperial College London and Cornell University will work together to investigate how the technology may be used for better analysis, increase automation, and ultimately lead to speedier scientific discoveries. The Transatlantic AI in Science Network will connect Imperial's I-X and Cornell's AI for Science Institute's AI in Science programs through AI exchanges and partnerships.

Vertical Insights

The private segment held a market share of around 60% in 2022 and is expected to dominate the market by 2030. Private universities are increasingly integrating their educational offerings with the demands of the industry. This includes working with employers, conducting regular skill gap evaluations, and revising curricula to ensure graduates have skills relevant to the changing employment market. Private educational institutions are leveraging technology to provide personalized learning routes. Adaptive learning systems, data analytics, and artificial intelligence are being utilized to personalize educational experiences for individual students, increasing engagement and success rates. The scenario is likely to drive the adoption of higher education by private institutions over the forecast period.

The public segment is anticipated to grow at a CAGR of around 21% over the forecast period. The segment growth is attributed to the increasing adoption of data analytics. For decision-making, public colleges are increasingly relying on data analytics. This includes analyzing student performance statistics, enrolment trends, and other metrics to guide strategic decisions about resource allocation, student support, and academic programs. To promote entrepreneurship and the commercialization of research, public institutions are constructing innovation hubs, incubators, and technology transfer offices. This fosters collaboration between academia and industry, hence boosting economic progress.

Regional Insights

The North America region dominated the market with a share of around 30% in 2022. The growth of North American global higher education can be attributed to the growing popularity of adaptive learning systems in North American educational institutions. These technologies personalize the learning experience by catering to specific student needs and boosting engagement and outcomes using data analytics and artificial intelligence. In addition, institutions in North America are investing in online learning delivery innovations. This includes creating immersive and engaging online educational experiences through the use of VR, AR, and interactive simulations.

Asia Pacific is anticipated to register the fastest CAGR of 23.4% over the forecast period. The Asia Pacific region is experiencing growth in transnational education programs. Institutions are partnering with foreign counterparts to provide joint degree programs, branch campuses, and other forms of cross-border education. For instance, in May 2023, Ritsumeikan University (RU) partnered with the Australian National University (ANU) to create a dual degree program - Bachelor of Global Liberal Arts and Bachelor of Asia Pacific Affairs - to provide a fully international learning experience. Students who complete this dual degree program will be able to graduate with two degrees, one from RU and one from ANU. Students in Japan will study liberal arts with the goal of becoming involved members of global society in the 21st century. In Australia, participants will personally experience the dynamism of globalization and enhance their understanding of the Asia-Pacific region.

Component Insights

The hardware segment held a market share of around 28% in 2022. The segment growth can be attributed to the increased demand for online learning and the implementation of digital technologies. There is a focus on modernizing campus networks. Institutions are improving network infrastructure to provide students and faculty with high-speed and dependable connectivity. Higher education institutions are rapidly investing in high-performance computing systems to assist complicated research projects in areas such as scientific research, engineering simulations, and artificial intelligence. All these factors are expected to drive the hardware segment growth in the market.

The solution segment is anticipated to grow at a CAGR of around 19% over the forecast period. The segment growth can be attributed to the emergence of Learning Management Systems, with a focus on user-friendly interfaces, mobile compatibility, and advanced capabilities such as analytics and AI-driven personalized learning routes. Furthermore, as educational resources and data become more digital, there is a greater emphasis on cybersecurity solutions. To protect sensitive student and institutional data, educational institutions are investing in advanced cybersecurity solutions. Integrated Student Information Systems (SIS) is growing more complex, providing comprehensive solutions for handling student data, registration, grades, and other administrative chores. These systems frequently work in conjunction with other educational technology to provide a unified platform.

Solution Insights

The student information management system segment held the largest market share of over 25% in 2022. The segment growth is attributed to the growing traction of decentralized identity systems, which are gaining popularity. These solutions, which are frequently based on blockchain or other distributed ledger technology, provide students more authority over their personal information, enabling secure and privacy-preserving identity management. Moreover, student information management system solutions that use API-driven approaches to interoperability are being prioritized by institutions. This facilitates seamless interaction with other institutional systems, third-party applications, and new technologies, resulting in a more connected and efficient environment. All these factors are expected to drive the segment growth in the market.

The campus management segment is expected to grow at a CAGR of over 25% over the forecast period. The segment growth is attributed to the growing traction of the smart campuses concept, leveraging Internet of Things (IoT) technology. Sensors and linked devices are used on smart campuses to improve security, optimize resource utilization, and give data-driven insights for enhanced decision-making. In addition, the development and use of mobile applications for campus administration have grown. These applications provide students, instructors, and staff with easy access to information, services, and communication tools through their cell phones, resulting in a more connected and efficient campus environment. All these factors are expected to drive the campus management segment growth.

Service Insights

The professional services segment held a market share of around 59% in 2022 and is expected to dominate the market by 2030. Strategic technology consulting is becoming increasingly popular in higher education professional services. Expert guidance on the adoption and integration of emerging technologies, such as artificial intelligence, data analytics, and cybersecurity solutions, is sought by institutions. Furthermore, professional services provide customized learning and curriculum design skills, which is driving market growth. Consultants are aiding institutions in building flexible and personalized learning paths that correspond with industry needs, with an emphasis on competency-based education.

The managed services segment is anticipated to register the fastest CAGR of around 20% over the forecast period. Institutions are increasingly outsourcing IT services to managed service companies, which is expected to drive the segment growth. This encompasses cloud computing, cybersecurity, network administration, and helpdesk support. Outsourcing allows universities to gain access to specialized expertise while reducing the pressure on in-house IT teams. Considering the evolving cyber threat landscape, cybersecurity-managed services are becoming increasingly important for higher education institutions. Managed security services comprise threat detection, incident response, vulnerability management, and continual monitoring to protect sensitive data.

Deployment Insights

The on-premise segment held a market share of over 54% in 2022 and is expected to dominate the market by 2030. The segment growth is attributed to the rising concerns about data sovereignty and privacy regulations. Several institutions choose on-premise solutions to have more control over their security architecture, which includes firewalls, access restrictions, and encryption techniques. Institutions have greater control over regulatory compliance and auditing processes with on-premise deployments. This is particularly significant for universities that must comply with stringent legal frameworks in areas such as finance, research, and student data management.

The cloud segment is anticipated to register the fastest CAGR of over 20% over the forecast period. The segment growth is attributed to the increasing implementation of hybrid and multi-cloud techniques by universities. This entails utilizing both public and private cloud solutions to build a flexible and scalable IT infrastructure capable of meeting a wide range of institutional needs. Moreover, edge computing is becoming more popular, particularly for applications that demand low-latency processing. Cloud deployment at the edge offers faster data processing, which is critical for developing technologies in education, such as Augmented Reality (AR) and Virtual Reality (VR).

Learning Mode Insights

The offline learning segment held a market share of around 53% in 2022 and is expected to dominate the market by 2030. Offline learning facilitates cultural and social engagement among students. The value of the campus environment in developing a sense of community, cultural diversity, and social participation is being emphasized by institutions. Offline learning makes it easier to establish practical skill development centers. To ensure that students obtain hands-on training in fields such as healthcare, engineering, and vocational studies, institutions are constructing dedicated facilities outfitted with industry-grade tools and equipment. All these factors are expected to drive the offline learning segment growth.

The online learning segment is anticipated to register the fastest CAGR over 19% over the forecast period. Universities are increasingly implementing hybrid and multi-cloud techniques. This entails utilizing both public and private cloud solutions to build a flexible and scalable IT infrastructure capable of meeting a wide range of institutional needs. Moreover, edge computing is becoming more popular, particularly for applications that demand low-latency processing. Cloud deployment at the edge offers faster data processing, which is critical for developing technologies in education, such as Augmented Reality (AR) and Virtual Reality (VR).

Key Companies & Market Share Insights

The key players in the market are investing resources in research & development activities to support growth and enhance their internal business operations. The report will include company analysis based on their financial performances, product benchmarking, key business strategies, and recent strategic alliances. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development and enhancement of existing products to acquire new customers and capture more market shares. For instance, in July 2023, UNCF (United Negro College Fund), a minority education organization, announced a partnership with Axim Collaborative and Harvard University to advance the development of HBCUv (HBCU Virtual). This project exemplifies UNCF's and its nine collaborating HBCUs' dedication to revolutionizing higher education through revolutionary education technology, collaboration, and legitimate ownership by and for HBCUs.

Key Higher Education Technology Companies:

- Blackboard Inc.

- BYJU’S

- California Institute of Technology

- CIVITAS LEARNING

- Coursera Inc.

- Dell Inc.

- Harvard University

- Imperial College London

- Massachusetts Institute of Technology

- Oracle

- SAP SE

- Stanford University

- University of Cambridge

- University of Oxford

- VMWare

Higher Education Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 42.60 billion

Revenue forecast in 2030

USD 140.40 billion

Growth rate

CAGR of 18.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, services, deployment, learning mode, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; and South Africa

Key companies profiled

Blackboard Inc.; BYJU’S; California Institute of Technology; CIVITAS LEARNING; Coursera Inc.; Dell Inc.; Harvard University; Imperial College London; Massachusetts Institute of Technology; Oracle; SAP SE; Stanford University; University of Cambridge; University of Oxford; VMWare.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Higher Education Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global higher education technology market report based on component, solution, services, deployment, learning mode, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Student Information Management System

-

Content Collaboration

-

Data Security And Compliance

-

Campus Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Integration And Implementation

-

Support And Maintenance

-

Consulting Services

-

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Learning Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline Learning

-

Online Learning

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

State Universities

-

Government Colleges

-

Others

-

-

Private

-

Private Colleges

-

Community Colleges

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global higher education technology market size was estimated at USD 36.24 billion in 2022 and is expected to reach USD 42.60 billion in 2023.

b. The global higher education technology market is expected to grow at a compound annual growth rate of 18.6% from 2023 to 2030 to reach USD 140.40 billion by 2030.

b. North America dominated the global higher education technology market with a share of 30.0% in 2022, which is attributable to factors such as digital transformation, remote and hybrid learning, innovations in EdTech, improvements in data analytics, and online enrollment growth, among others.

b. Some key players operating in the global higher education technology market include Blackboard Inc., BYJUS, California Institute of Technology, CIVITAS LEARNING, Coursera Inc., Dell Inc., Harvard University, Imperial College London, Massachusetts Institute of Technology, Oracle, SAP SE, Stanford University, University of Cambridge, University of Oxford, and VMWare

b. Key factors driving the growth of the global higher education technology market include global demand for quality, increasing globalization and mobility, improving the Edtech ecosystem, global collaborations and research, use of blockchain technology, and integration of AR and VR, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.