- Home

- »

- Advanced Interior Materials

- »

-

HVAC Rooftop Units Market Size, Industry Report, 2033GVR Report cover

![HVAC Rooftop Units Market Size, Share & Trends Report]()

HVAC Rooftop Units Market (2026 - 2033) Size, Share & Trends Analysis Report By Capacity, By Application (Residential, Commercial, Industrial), By Equipment, By Fuel (Electric, Fossil Fuel, Dual Fuel Systems), By Distribution Channel, By Installation, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-496-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HVAC Rooftop Units Market Summary

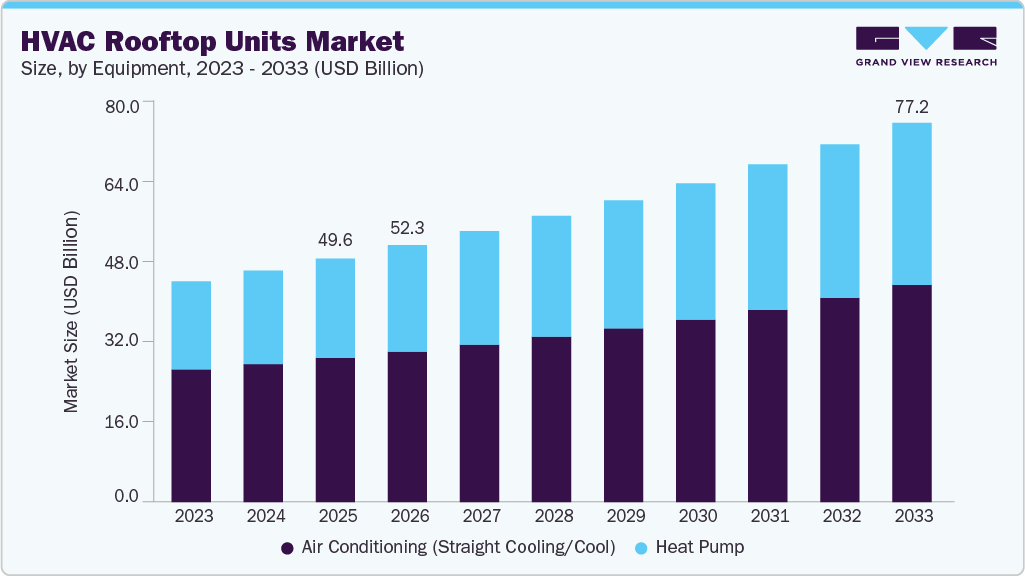

The global HVAC rooftop units market size was estimated at USD 49,550.8 million in 2025 and is expected to reach USD 77,200.9 million by 2033, growing at a CAGR of 5.7% from 2026 to 2033. The industry is increasingly driven by the growing demand for cost-effective and energy-efficient heating and cooling solutions across residential, commercial, and industrial sectors.

Key Market Trends & Insights

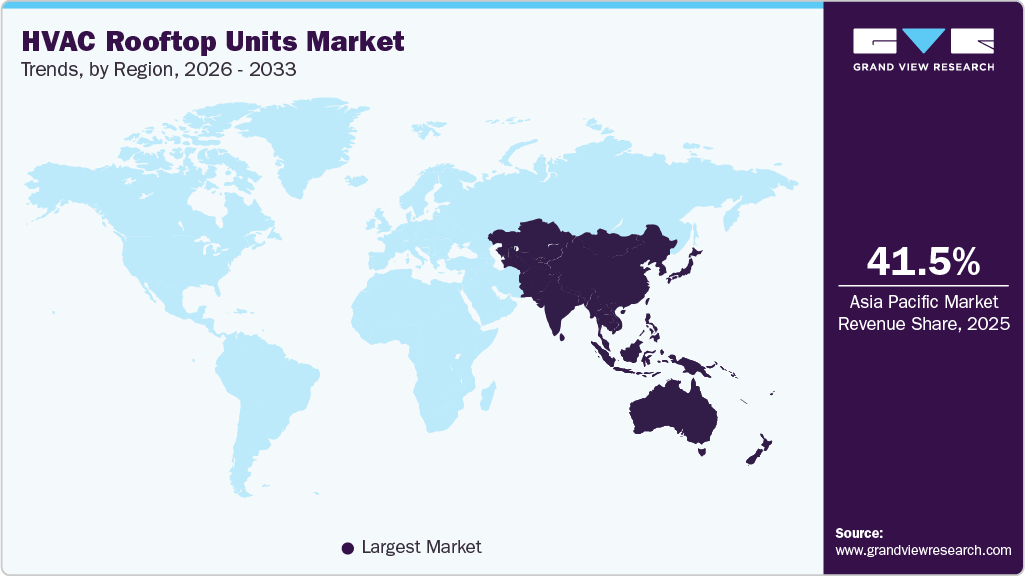

- Asia Pacific dominated the HVAC rooftop Units market with the largest revenue share of 41.5% in 2025.

- The market in China is projected to expand at a fast-paced CAGR of 6.8% from 2026 to 2033.

- By application, the industrial segment is projected to grow at a significant CAGR of 7.1% from 2026 to 2033 in terms of revenue.

- By equipment, the heat pump segment is expected to grow at a CAGR of 6.2% from 2026 to 2033 in terms of revenue.

- Based on capacity, the 3 to 7 tons segment is expected to grow at a CAGR of 6.3% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 49,550.8 Million

- 2033 Projected Market Size: USD 77,200.9 Million

- CAGR (2026-2033): 5.7%

- Asia Pacific: Largest market in 2025

As businesses and homeowners seek to reduce energy costs, the adoption of advanced rooftop units has become more appealing. Rooftop units, which provide centralized heating, ventilation, and air conditioning for commercial and industrial buildings, are increasingly preferred for their space-saving design and ease of maintenance.

The market is also influenced by regulatory frameworks promoting low-GWP refrigerants and sustainable building practices, encouraging the adoption of next-generation HVAC systems.

Market Concentration & Characteristics

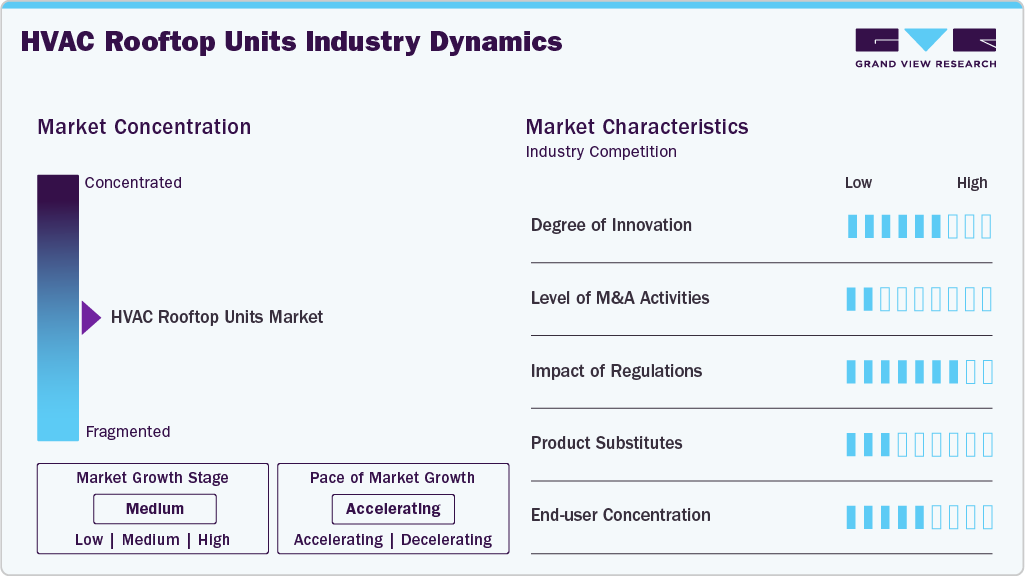

The HVAC rooftop units industry is moderately concentrated, with a few large multinational manufacturers holding a significant share of global revenues. These players benefit from strong distribution networks, established brands, and broad product portfolios across capacity ranges. However, the market also includes several regional and local manufacturers that compete on price, customization, and service support. This mix creates steady competitive pressure, especially in the replacement and mid-capacity segments, preventing any single company from achieving full market dominance.

Innovation in rooftop HVAC units is centered on energy efficiency, smart controls, and compact system design. Manufacturers are integrating IoT-enabled monitoring, variable-speed compressors, and advanced sensors to improve performance and reduce operating costs. There is also a growing focus on low-GWP refrigerants and hybrid systems that combine heating, cooling, and ventilation. These advancements help building owners meet efficiency targets while lowering long-term maintenance needs.

Regulations have a significant impact on product design and market adoption in the rooftop HVAC segment. Energy efficiency standards, building codes, and refrigerant phase-down policies are pushing manufacturers toward high-efficiency and environmentally compliant units. Mandatory compliance with standards such as minimum energy performance requirements increases R&D and certification costs. At the same time, regulations encourage replacement demand by accelerating the retirement of outdated systems.

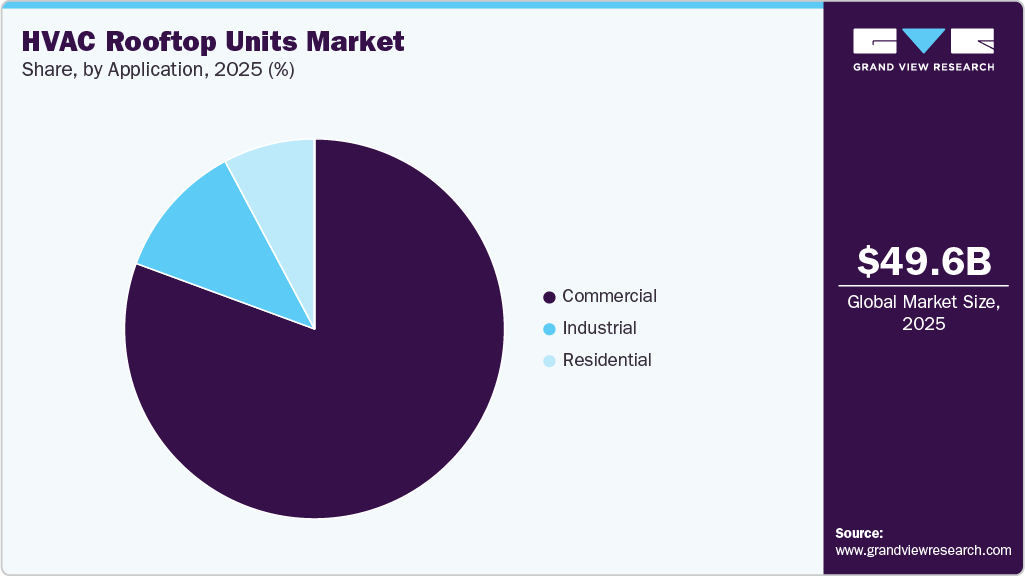

End-user demand is moderately concentrated, with commercial buildings accounting for the largest share of rooftop HVAC installations. Retail stores, offices, warehouses, and educational institutions rely heavily on these systems due to ease of installation and centralized control. Industrial users adopt rooftop units selectively, mainly for large single-story facilities. Replacement and retrofit demand remains strong, driven by aging building infrastructure and increasing energy costs.

Drivers, Opportunities & Restraints

The rapid expansion of commercial infrastructure globally is a major factor driving the HVAC rooftop units (RTU) market. Growth in the construction of office buildings, shopping centers, hospitals, and educational institutions has led to higher demand for efficient climate control systems that can be easily installed on rooftops, saving valuable indoor space. Moreover, the increasing emphasis on indoor air quality and occupant comfort in commercial spaces is reinforcing the adoption of advanced RTUs equipped with ventilation and filtration capabilities.

Emerging markets in the Asia Pacific, Latin America, and the Middle East present substantial growth opportunities for the HVAC rooftop units market. Rapid urbanization, rising disposable incomes, and increasing investments in commercial infrastructure are driving the growth of new installations. In addition, the shift toward sustainable building practices and government incentives for energy-efficient systems is expected to create favorable conditions for high-performance RTUs. Manufacturers focusing on hybrid systems, modular designs, and renewable-integrated rooftop units can capitalize on these trends to expand their presence in both developed and developing regions.

Despite strong growth prospects, the industry faces challenges due to high upfront installation and replacement costs. Advanced models with variable refrigerant flow (VRF) capabilities and smart control systems require a significant initial investment, which limits their adoption among small and mid-sized commercial establishments. Moreover, the presence of alternatives such as split systems, chilled water systems, and variable air volume (VAV) systems provides competition, particularly in retrofit applications. Maintenance complexity and limited access for rooftop installations can also increase lifecycle costs, restraining market expansion.

Capacity Insights

Rooftop units within the 3 to 7 tons segment held the largest revenue share in 2025, accounting for 27.2% of the global market, driven by their widespread use in commercial and institutional buildings. These units efficiently manage climate control for medium to large spaces, striking a balance between performance and cost-effectiveness. High SEER ratings and flexible installation options make them ideal for offices, schools, and healthcare facilities where comfort and operational cost savings are essential.

The 7 to 15 tons segment is expected to grow at a significant CAGR of 6.0% from 2026 to 2033 in terms of revenue, due to its relevance in large commercial applications needing powerful, energy-efficient solutions. These units offer scalable climate management for spaces up to 10,000 sq ft, serving retail, offices, and schools with advanced zoning and control capabilities that align with requirements for flexible, high-capacity performance.

Equipment Insights

Air conditioning straight cooling units led the equipment segment with a 59.2% market share in 2025, largely due to significant installations in warmer climates and across commercial and industrial environments. These systems are preferred for their dependable and cost-effective cooling capabilities, particularly in regions where cooling needs outweigh heating. Integrating advanced technologies and high SEER ratings helps these units to support compliance with strict energy standards, thus enhancing adoption rates.

The heat pump segment is expected to grow at a considerable CAGR of 6.2% from 2026 to 2033 in terms of revenue, propelled by the dual ability to provide both heating and cooling with enhanced energy efficiency. Growing sustainability goals and preference for all-season climate control are persuading businesses to upgrade to next-generation heat pump systems in both commercial and industrial environments.

Fuel Insights

The electric rooftop units segment dominated the market in 2025, accounting for 56.6% of the revenue share, shaped by the rising adoption of energy-efficient solutions in commercial and industrial buildings. These units are favored for their compatibility with advanced controls and renewable energy sources, offering reduced installation costs and easier maintenance compared to combustion-based systems. Increasing government incentives, stricter emissions regulations, and growth in clean electricity infrastructure further boosted the uptake of electric systems.

The fossil fuel (gas heat) segment is expected to grow at a significant CAGR of 5.4% from 2026 to 2033 in terms of revenue, due to their strong heating performance and reliability. They are widely used in cold regions where electric heating may struggle during peak demand periods. Stable natural gas availability and predictable fuel costs support the adoption of this technology in large commercial buildings. In addition, many facilities prefer gas heat for its rapid response time and ability to efficiently handle high heating loads.

Distribution Channel Insights

Direct to distributor channels led the market in 2025, holding 48.8% of the share, as distributors offer effective logistics, rapid product availability, and access to extensive HVAC portfolios for contractors and end-users. Their expertise in warehousing, regional compliance, and tailored technical support enables smooth delivery and installation, making this channel essential for scaling in both mature and emerging markets.

The direct to contractor segment is expected to grow at a significant CAGR of 5.3% from 2026 to 2033 in terms of revenue, driven by manufacturers’ focus on quick installations and optimized after-sales service for commercial clients. Contractors ensure high-quality installation and system calibration, responding to complex site requirements and compliance needs. This direct engagement reduces procurement timelines and aligns with growing demand for turnkey HVAC solutions.

Installation Insights

Replacement installations dominated the rooftop HVAC units market, accounting for 61.5% share in 2025, due to the large base of aging commercial systems. Many buildings are upgrading older units to meet stricter energy efficiency and emission standards. Rising maintenance costs of legacy equipment also encourage timely replacement. This segment benefits from shorter decision cycles and predictable demand from retrofit projects.

New installation segment is expected to grow at the fastest CAGR of 6.2% from 2026 to 2033 in terms of revenue, driven by expanding commercial construction and infrastructure development. Warehouses, retail spaces, and logistics centers are increasingly opting for rooftop units due to their quick deployment and space efficiency. Growth in smart buildings is also supporting demand for advanced rooftop systems. Urban expansion and investment in new facilities continue to accelerate this segment.

Application Insights

The commercial segment dominated the market in 2025, accounting for 78.5% of the share, due to the high demand for reliable, energy-efficient heating and cooling in large spaces such as offices, malls, retail stores, and hotels. As businesses expand and establish new locations, the demand for advanced HVAC rooftop units increases. Regulatory compliance, operational efficiency, and occupant comfort remain priority drivers, backed by investments in new construction and facility upgrades.

The industrial segment is expected to grow at the fastest CAGR of 7.1% from 2026 to 2033 in terms of revenue, supported by the rising adoption of high-efficiency compressors and advanced control systems in manufacturing, logistics, and data centers. The expansion of industrial infrastructure, increased energy management needs, and a focus on employee safety and equipment performance drive demand for robust HVAC rooftop solutions.

Regional Insights

The North America HVAC rooftop units market is witnessing steady growth driven by the region’s mature commercial infrastructure and a strong focus on energy-efficient retrofits. The rising implementation of green building standards and federal incentives for sustainable technologies is encouraging the adoption of advanced RTUs with smart controls and low-emission refrigerants.

U.S. HVAC Rooftop Units Market Trends

The U.S. HVAC rooftop units industry accounted for the largest market share in North America due to robust commercial construction, stringent energy codes, and aggressive federal/state incentives to upgrade to high-efficiency rooftop systems. The expansion of office, retail, and institutional real estate, coupled with the demand for advanced, environmentally compliant HVAC solutions, continues to drive replacements and new installations across the region.

The rooftop HVAC units industry in Canada is growing steadily due to rising demand from commercial buildings such as retail centers, warehouses, and offices. Cold climatic conditions increase the need for reliable heating-focused rooftop systems, especially gas-based and hybrid units. Stricter energy efficiency regulations are also driving upgrades and replacement of older equipment. In addition, expansion of urban infrastructure and refurbishment of aging buildings are supporting continued market growth.

Europe HVAC Rooftop Units Market Trends

The HVAC rooftop units industry in Europe is supported by stringent environmental regulations and the region’s commitment to carbon neutrality. Building owners are increasingly upgrading to modern rooftop systems that comply with the EU’s energy efficiency directives and F-Gas regulations. Demand is being propelled by a surge in renovation and retrofit projects, particularly in Western and Northern Europe.

The Germany HVAC rooftop units industry led the European market, propelled by strong investments in energy-efficient building retrofits, tough decarbonization rules, and widespread adoption of building automation. The country's robust industrial sector and comprehensive regulatory framework for indoor environment standards further stimulate demand for rooftop units that support sustainability and operational excellence.

The HVAC rooftop units industry in Italy recorded the fastest CAGR in Europe, led by mandatory building efficiency upgrades driven by strict EU directives and national policies targeting energy transition and decarbonization. The replacement of aging, inefficient commercial building stock with high-efficiency rooftop systems is propelled by government incentives, such as Ecobonus and Superbonus, which prioritize heat pump-based solutions that maximize renewable energy usage and comply with new standards.

Asia Pacific HVAC Rooftop Units Market Trends

The HVAC rooftop units industry in the Asia Pacific represents the fastest-growing and the most dominant regional market, accounting for a 41.5% share in 2025, driven by rapid urbanization, commercial construction, and expanding retail and hospitality sectors. Governments in countries such as China, India, and Japan are promoting energy-efficient HVAC solutions through policy reforms and smart city initiatives. Rising disposable incomes and increasing awareness of indoor air quality are further driving adoption among private and institutional developers.

The China HVAC rooftop units industry held the largest market share in Asia Pacific in 2025, as large-scale urbanization and infrastructure projects fuel demand for modern HVAC systems in commercial and industrial construction. A focus on green building codes, government-backed energy efficiency mandates, and rapid growth of the service sector all reinforce investments in high-capacity rooftop equipment.

The HVAC rooftop units industry in India is projected to grow at the fastest CAGR in the Asia Pacific, fueled by swift urbanization, growth of organized commercial real estate, and rising middle-class consumption. National energy efficiency mandates, the adoption of green building certifications, and an increase in retrofit activity for older urban properties are driving widespread upgrades to advanced rooftop systems. A surge in new retail, office, and hospitality projects, combined with government programs aimed at accelerating sustainable infrastructure, consistently boosts demand for rooftop HVAC solutions tailored to diverse climatic zones.

Middle East & Africa HVAC Rooftop Units Market Trends

The HVAC rooftop units industry in the Middle East and Africa is advancing rapidly due to large-scale infrastructure projects, extreme climatic conditions, and the need for efficient cooling solutions. Countries in the Gulf region are investing heavily in smart and sustainable urban developments, which rely on modern HVAC systems for optimal temperature and humidity control.

The Saudi Arabia HVAC rooftop units industry contributed the largest share in the Middle East and Africa, shaped by a booming construction sector, extreme ambient temperatures, and sustained investments in commercial and public infrastructure. Stringent requirements for cooling performance, growing adoption of green building certifications, and emphasis on large mixed-use developments are primary demand drivers.

Latin America HVAC Rooftop Units Market Trends

The HVAC rooftop units industry in Latin America is expanding due to the modernization of commercial infrastructure and the growing adoption of sustainable building practices. Economic recovery and renewed investment in office, retail, and hospitality developments are creating a favorable environment for energy-efficient HVAC technologies.

The Brazil HVAC rooftop units industry dominated the Latin America market, underpinned by increasing urbanization, major commercial developments in cities, and efforts to modernize aging HVAC infrastructure. Climate extremes, coupled with rising expectations for indoor comfort and the proliferation of large shopping centers, have made advanced rooftop systems indispensable.

Key HVAC Rooftop Units Company Insights

Some of the key players operating in the market include Carrier and DAIKIN INDUSTRIES, LTD:

-

Carrier is a provider of safe, sustainable, intelligent building and cold chain solutions. The company provides refrigeration, heating, ventilation, and air conditioning (HVAC), as well as building automation technologies. The company owns various brands, including Kidde, Automated Logic, Carrier Global Corporation, Edwards, and LenelS2. It operates through 51 manufacturing facilities and 39 research & design centers worldwide.

-

DAIKIN INDUSTRIES Ltd. sells and manufactures air conditioning systems and chemical products. It owns 313 consolidated subsidiaries worldwide and offers a range of products, including air-conditioning systems, room heating and heat pumps, hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key HVAC Rooftop Units Companies:

The following are the leading companies in the HVAC rooftop units market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier

- DAIKIN INDUSTRIES Ltd.

- Johnson Controls

- LG Electronics

- Danfoss

- Lennox International Inc.

- Rheem Manufacturing Company

- Trane

- SAMSUNG

- Mitsubishi Electric Corporation

- Fujitsu

- AAON

- Captive Aire

- Addison HVAC

- Greenheck Fan Corporation

Recent Developments

-

In September 2025, Carrier introduced the first 10-14-ton commercial rooftop heat pump validated by the U.S. DOE. The unit maintained full heating output at 5 °F and strong efficiency at -10 °F. Testing by DOE and national labs confirmed its performance. This marks a key step toward cost-efficient, energy-saving HVAC solutions for commercial buildings.

-

In August 2025, Lennox International announced that the company is acquiring NSI Industries’ HVAC division, including brands like Duro Dyne and Supco, for about USD 550 million. The deal, expected to close in Q4 2025, will expand Lennox’s HVAC components and accessories portfolio. This acquisition strengthens Lennox’s product range and distribution network, enhancing its market presence.

HVAC Rooftop Units Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 52,295.9 million

Revenue forecast in 2033

USD 77,200.9 million

Growth rate

CAGR of 5.7% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, equipment, application, fuel, distribution channel, Installation, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Carrier; DAIKIN INDUSTRIES Ltd.; Johnson Controls; LG Electronics; Danfoss; Lennox International Inc.; Rheem Manufacturing Company; Trane; SAMSUNG; Mitsubishi Electric Corporation; Fujitsu; AAON; Captive Aire; Addison HVAC; Greenheck Fan Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVAC Rooftop Units Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global HVAC rooftop Units market report based on capacity, equipment, application, fuel, distribution channel, Installation, and region:

-

Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 3 Tons

-

3 to 7 Tons

-

7 to 15 Tons

-

15 to 25 Tons

-

25 to 45 Tons

-

Above 45 Tons

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Supermarkets & Hypermarkets

-

Retail Stores

-

Restaurants

-

Workspaces/Office

-

Shopping Malls

-

Education

-

Healthcare

-

Warehousing

-

Other Commercial Applications

-

-

Industrial

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Conditioning (Straight Cooling/Cool)

-

Heat Pump

-

-

Fuel Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Fossil Fuel (Gas Heat)

-

Dual Fuel Systems (Hybrid)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct to Customer

-

Direct to Distributor

-

Direct to Contractor

-

-

Installation Outlook (Revenue, USD Million, 2021 - 2033)

-

New Installation

-

Replacement

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HVAC rooftop Units market size was estimated at USD 49,550.8 million in 2025 and is expected to be USD 52,295.9 million in 2026

b. The global HVAC rooftop Units market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2026 to 2033 to reach USD 77,200.9 million by 2033.

b. The Asia Pacific market dominated the market in 2025, accounting for a 41.5% share by rapid urbanization, expanding commercial construction, and government initiatives promoting energy-efficient infrastructure. Rising awareness of indoor air quality and increasing adoption of smart, sustainable HVAC technologies further support market expansion across the region.

b. Some of the key players operating in the global HVAC rooftop Units market include Carrier, DAIKIN INDUSTRIES Ltd., Johnson Controls, LG Electronics, Danfoss, Lennox International Inc., Rheem Manufacturing Company, Trane, SAMSUNG, Mitsubishi Electric Corporation, Fujitsu, AAON, Captive Aire, Addison HVAC, and Greenheck Fan Corporation.

b. Key factors driving the global HVAC rooftop units market include rising demand for energy-efficient climate control systems, increasing commercial construction, and stricter environmental regulations. Technological advancements such as IoT integration and the adoption of low-GWP refrigerants are further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.