- Home

- »

- Clinical Diagnostics

- »

-

In-vitro Diagnostics Enzymes Market, Industry Report, 2030GVR Report cover

![In-vitro Diagnostics Enzymes Market Size, Share & Trends Report]()

In-vitro Diagnostics Enzymes Market (2025 - 2030) Size, Share & Trends Analysis Report By Enzyme (Polymerase & Transcriptase, Proteases), By Disease (Infectious Disease, Diabetes), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-246-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In-vitro Diagnostics Enzymes Market Trends

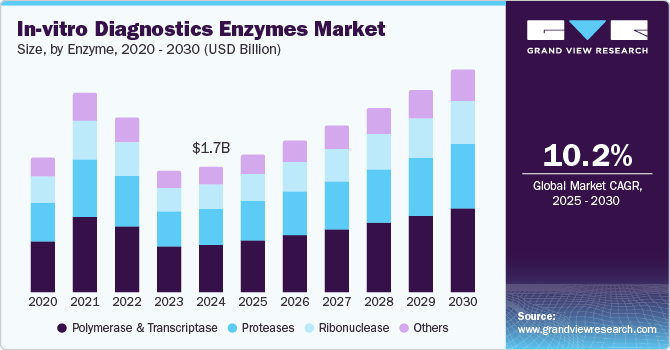

The global in-vitro diagnostics enzymes market size was estimated at USD 1.70 billion in 2024 and is projected to grow at a CAGR of 10.2% from 2025 to 2030. Enzymes are adopted in the diagnosis of various metabolic disorders owing to their remarkable catalytic properties. Several research studies have represented the clinical application of enzymes, such as alanine transaminase, acid phosphatase, creatine kinase, aspartate transaminase, lactate dehydrogenase, and gelatinase-B. These enzymes are preferred biomarkers in several disease conditions, including myocardial infarction, liver disease, schizophrenia, renal disease, rheumatoid arthritis, and cancer.

Various molecular biology techniques are continuously gaining popularity as in-vitro diagnostics (IVD) for the detection and prevention of several diseases. Among these techniques, the polymerase chain reaction (PCR) had a greater impact on the practices involved in the molecular biology field. PCR implements a thermostable polymerase to produce multiple copies of a specific nucleic acid region rapidly and exponentially. Taq polymerase, reverse transcriptase enzyme, and thermostable DNA polymerase are the commonly used enzymes during PCR amplification cycles.

The utility of enzymes for the diagnosis of COVID-19 has spurred market growth. A wide range of commercial COVID-19 tests were available in the marketplace. Some of the tests either detect the SARS-CoV-2 viral RNA using the nucleic acid hybridization-related strategies or PCR technique while others are serological and immunological assays that detect the antibodies produced in response to the virus.

The PCR method is highly accepted to test the presence of the SARS-CoV-2 virus. This method uses a DNA-copying enzyme, Taq DNA polymerase, which remains active at high temperatures. Along with this, reverse transcriptase is used to copy the RNA of the virus in the DNA for further amplification. Creative Enzymes and BioVendor are key companies that offer enzymes for the diagnosis of COVID-19.

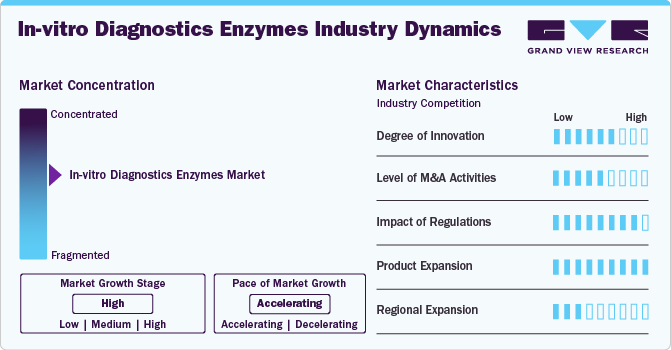

Market Concentration & Characteristics

The degree of innovation in the in-vitro diagnostics (IVD) enzymes industry is driven by advancements in molecular biology, genetic engineering, and automation technologies. Enzymes such as polymerases, reverse transcriptases, and ligases have been optimized for higher specificity, sensitivity, and stability, enabling breakthroughs in diagnostic accuracy and speed. Novel enzyme formulations tailored for point-of-care (POC) testing, multiplex assays, and next-generation sequencing (NGS) are expanding diagnostic capabilities across infectious diseases, oncology, and genetic disorders.

The market is characterized by a high level of collaboration and partnership activities among key stakeholders, including biotechnology companies, diagnostic kit manufacturers, academic institutions, and contract research organizations (CROs). Strategic alliances are being formed to co-develop enzyme formulations optimized for specific diagnostic applications, such as molecular assays and next-generation sequencing (NGS).

Regulations play a critical role in the market, ensuring product safety, efficacy, and quality. Stringent guidelines from regulatory bodies like the FDA, EMA, and ISO drive the standardization of enzyme production and validation processes, fostering trust among healthcare providers and end users. Compliance with regulations such as the In Vitro Diagnostic Regulation (IVDR) in Europe has prompted manufacturers to invest in robust clinical evaluations and documentation, increasing transparency and accountability.

Product expansion in the market is driven by the increasing demand for specialized and versatile enzymes tailored to diverse diagnostic applications. Companies are broadening their portfolios by introducing recombinant enzymes with enhanced stability, specificity, and activity, suitable for advanced techniques like real-time PCR, next-generation sequencing (NGS), and isothermal amplification.

Companies are strategically entering high-growth regions such as Asia-Pacific, Latin America, and the Middle East, where rising healthcare investments, expanding diagnostic infrastructure, and increasing disease burden create significant opportunities. Local partnerships, distribution agreements, and the establishment of regional manufacturing and R&D centers are key strategies to penetrate these markets.

Enzyme insights

The polymerase and transcriptase segment accounted for the largest share of the market at 38.9% in 2024. This is attributed to their wide applications in molecular diagnostic assays. In addition, the presence of a substantial number of players that offer these enzymes is expected to enhance the segment growth. In June 2023, AIST and Asahi Kasei Pharma collaborated on the Smart Cell Project of NEDO to improve cholesterol esterase production efficiency, an enzyme utilized in in vitro diagnostic assays, enabling the manufacture of a commercial product called CEN II.

The proteases segment is likely to grow at a CAGR of 11.7% over the forecast period. Proteases are expected to gain traction in common molecular biology procedures. The application of heat-labile protease is used to digest the heat-stable molecular biology enzymes, such as PvuII and Taq Polymerase, which further inactivates due to a mild heat treatment. This indicates the major benefit of protease in instances where further chemical reactions can be completed without the requirement of an intermediate purification stage; therefore, it reduces product loss and saves time. This benefit of protease makes it an important diagnostic enzyme to be used in IVD procedures. The use of proteases in oncology disease is expected to witness significant growth throughout the forecast period with the rising cases of cancer globally and the expansion of IVD techniques, such as In Situ Hybridization (ISH) and Next-Generation Sequencing (NGS), in the field of oncology.

Disease Insights

The infectious disease segment captured the largest revenue share of 45.5% in 2024. The wide applicability of PCR technology in infectious disease diagnosis has led to early diagnosis and treatment. Organisms that are difficult to detect can now be identified with better precision and sensitivity. The application of PCR in infectious disease diagnosis includes the detection of tuberculosis, streptococcal pharyngitis, atypical pneumonia, ulcerative urogenital infections, and several persistent infections. The Thermus thermophilus DNA polymerase gene expressed in Escherichia coli allows an efficient reverse transcriptase activity for the detection of cellular mRNA expression in a single step. Moreover, an IgM antibody capture ELISA (MAC-ELISA) is a proven technology for dengue diagnosis during the early convalescent or late acute phase of the infection. Platelia Dengue NS1 antigen-capture ELISA kits and Panbio Dengue Duo IgG and IgM Rapid Cassette test kits are some of the enzyme-based kits for the diagnosis of infectious diseases.

The oncology segment is expected to expand at the fastest CAGR of 13.0% over the forecast period. Large-scale adoption of ISH methods as well as the development of high-throughput technologies, such as next-generation DNA sequencing and comparative genomic hybridization, for the diagnosis of human tumors, drive the usage of diagnostic enzymes in the oncology segment.

End-use Insights

The hospitals and diagnostic laboratories accounted for the largest share of 41.6% in 2024. The usage of IVD assays in hospitals has increased over the years. In several hospitals and clinics, physicians are switching to histopathology and molecular diagnostics from conventional testing procedures. The long turnover time associated with the conventional processes is boosting the adoption rate of histopathology-based tests as these aid in reducing the timelines.

Pharma & Biotech segment is likely to grow at a CAGR of 11.1% over the forecast period. Pharmaceutical and biotechnology companies are increasingly investing in research and development (R&D) to develop new diagnostic tools for precision medicine, personalized therapies, and the early detection of diseases. Enzymes, which play a crucial role in molecular diagnostics, are essential for applications such as PCR, next-generation sequencing (NGS), and immunoassays. As the demand for high-precision, fast, and accurate diagnostic solutions rises, especially in oncology, infectious diseases, and genetic testing, pharma and biotech companies are leveraging advanced enzyme technologies to meet these needs.

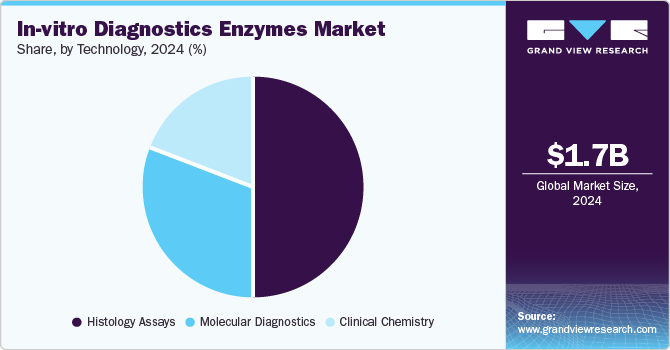

Technology Insights

The histology assay segment held the largest share of 50.3% in 2024. These assays leverage enzyme-based staining techniques, such as immunohistochemistry (IHC) and in situ hybridization (ISH), to visualize specific cellular components, enabling precise pathological evaluation. Enzymes like horseradish peroxidase (HRP) and alkaline phosphatase (AP) are integral to these assays, providing high sensitivity and specificity for detecting biomarkers in tissue samples. The rising prevalence of cancer globally has amplified the demand for histology-based diagnostics, as these assays are essential for tumor classification, staging, and treatment planning. Furthermore, advancements in enzyme engineering have enhanced the performance of histology assays, offering improved stability, faster reaction times, and compatibility with automated platforms. The integration of these assays into digital pathology systems has also expanded their utility, facilitating remote diagnostics and streamlined workflows. Regulatory approvals and the growing adoption of precision medicine further underscore their significance in personalized healthcare.

The molecular diagnostics segment is expected to expand at a CAGR of 10.7% by 2030. Molecular diagnostics is preferred over serology for the diagnosis of infectious diseases as this technique is highly sensitive and offers the detection of disease-causing agents, allowing early detection of several disorders. The molecular diagnostics segment is expected to witness the fastest growth over the forecast period. Moreover, enzymes are crucial to multiple steps in molecular diagnostic assays, such as NGS library and sample preparation. They provide shortcuts for difficult or slow reactions and enable the repair, modification, and amplification of nucleic acids for a wide range of applications.

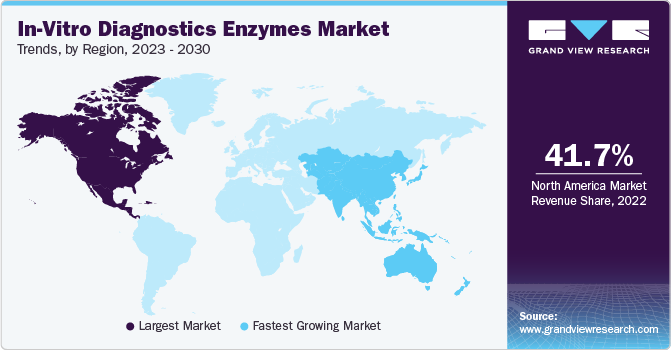

Regional Insights

The North America in-vitro diagnostics enzymes market dominated globally in 2024 and accounted for a 45.7% share in revenue. The market is growing due to a combination of factors, including advanced healthcare infrastructure, high demand for precision medicine, and significant investments in research and development. The U.S. and Canada are leaders in medical innovation, with robust healthcare systems and a strong focus on early disease detection, which drives the need for advanced diagnostic solutions. The growing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, has increased the demand for reliable and accurate diagnostic tools in which enzymes play a crucial role in. In addition, North America is home to major pharmaceutical, biotechnology, and diagnostic companies that are actively developing and commercializing enzyme-based diagnostic products. Regulatory support from agencies like the FDA ensures the safety and efficacy of these products, further boosting market growth.

U.S. In-vitro Diagnostics Enzymes Market Trends

The U.S. in-vitro diagnostics enzymes market is projected to grow significantly during the forecast period. The country has a well-established healthcare infrastructure with a high demand for advanced diagnostic solutions, driven by the increasing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions. Enzyme-based diagnostics play a critical role in molecular diagnostics, including PCR, next-generation sequencing (NGS), and immunoassays, all of which are widely used in the U.S. The focus on precision medicine and personalized healthcare is further fueling the demand for specialized enzymes that can enable more accurate and tailored treatments.

Europe In-vitro Diagnostics Enzymes Market Trends

The Europe in-vitro diagnostics enzymes market is likely to emerge as a lucrative region, driven by a combination of factors such as strong healthcare infrastructure, high demand for advanced diagnostic technologies, and increasing investments in research and development. European countries, particularly Germany, France, and the UK, have well-established healthcare systems and are actively focusing on early disease detection, personalized medicine, and precision diagnostics, which rely heavily on enzyme-based technologies.

The UK in-vitro diagnostics enzymes market is projected to grow during the forecast period. The growing prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular conditions, is increasing the need for precise and rapid diagnostic solutions, where enzymes play a critical role in molecular diagnostics, PCR, and immunoassays. In addition, the UK's commitment to advancing precision medicine and genomic research is driving demand for specialized enzymes used in next-generation sequencing (NGS) and genetic testing.

The France in-vitro diagnostics enzymes market is expected to show steady growth over the forecast period, driven by a strong healthcare system, increasing demand for advanced diagnostic technologies, and significant investments in research and development.

The Germany in-vitro diagnostics enzymes market is projected to expand during the forecast period. Germany is a leader in the European healthcare market, with a well-established regulatory framework that ensures the safety and efficacy of enzyme-based diagnostic products, including adherence to the European Union's In Vitro Diagnostic Regulation (IVDR). The rising prevalence of chronic diseases such as cancer, cardiovascular conditions, and diabetes is increasing the demand for accurate and rapid diagnostic solutions, where enzymes are crucial for molecular diagnostics, PCR, and immunoassays.

Asia Pacific In-vitro Diagnostics Enzymes Market Trends

The Asia Pacific in-vitro diagnostics enzymes marketis projected to experience the fastest CAGR of 11.5% during the forecast period owing to expanding healthcare infrastructure, rising disease prevalence, and increasing adoption of advanced diagnostic technologies. Countries like China, Japan, India, and South Korea are at the forefront of this growth, with large populations and a rising burden of chronic diseases, including cancer, diabetes, and infectious diseases, fueling the demand for accurate and efficient diagnostic solutions.

The China in-vitro diagnostics enzymes market is projected to expand throughout the forecast period. China’s emphasis on improving healthcare access, particularly in rural and underserved areas, is contributing to the increased adoption of enzyme-based diagnostic technologies. In addition, the Chinese government’s support for the biotechnology and pharmaceutical industries, including investments in research and development, is fostering innovation in enzyme-based diagnostics.

The Japan in-vitro diagnostics enzymes market is anticipated to grow during the forecast period. Japan is known for its strong emphasis on early disease detection, where enzyme-based diagnostic technologies, including PCR, immunoassays, and next-generation sequencing (NGS), play a crucial role in improving diagnostic accuracy and speed. The growing focus on personalized medicine and genomic research is further boosting the demand for specialized enzymes used in genetic testing and companion diagnostics.

Latin America In-vitro Diagnostics Enzymes Market Trends

The Latin America in-vitro diagnostics enzymes market is expected to experience significant growth throughout the forecast period. Latin America is witnessing a shift towards personalized medicine, which is further boosting the demand for enzyme-based diagnostic solutions. In addition, the region is benefiting from government initiatives aimed at improving healthcare access and the expansion of diagnostic services, especially in underserved areas. Regulatory frameworks in countries like Brazil are evolving to ensure the safety and efficacy of enzyme-based diagnostic products, creating a favorable environment for market growth.

The Brazil in-vitro diagnostics enzymes market is anticipated to grow during the forecast period. Brazil’s regulatory framework, overseen by the National Health Surveillance Agency (ANVISA), ensures the safety and efficacy of enzyme-based diagnostic products, helping to foster confidence in the market.

MEA In-vitro Diagnostics Enzymes Market Trends

The in-vitro diagnostics enzymes market in MEA is anticipated to experience lucrative growth during the forecast period. The Saudi Arabia in-vitro diagnostics enzymes market is anticipated to experience healthy growth during the forecast period. The country is also seeing a shift towards personalized medicine, with enzyme-based diagnostic technologies being used for genetic testing and companion diagnostics. In addition, Saudi Arabia’s Vision 2030 initiative, which aims to diversify the economy and improve healthcare access, is driving investments in the healthcare sector, further supporting the growth of the IVD enzymes market.

Key In-vitro Diagnostics Enzymes Company Insights

Key companies are making continuous efforts to fulfill the demand for enzymes utilized during diagnostic procedures for clinical disorders, especially COVID-19. For instance, in May 2020, Richcore Lifesciences, an Indian company, along with the Indian Institute of Science Education and Research at Pune and Chandigarh and the Indian Institute of Science, Bengaluru, produced and optimized Reverse Transcriptase and Taq Polymerase, two key enzymes, for the RT-PCR diagnostic kits. The company is currently offering these enzyme samples to test kit manufacturers to approve the consistency and stability of enzymes. Once approved, the company would be able to mass-produce these enzymes for millions of certified testing kits in India. Such initiatives undertaken by the companies drive large-scale production of enzymes to address the urgent need for testing kits for COVID-19 diagnosis. In January 2023, Thermo Fisher Scientific acquired The Binding Site Group, a global specialty diagnostics leader, in an all-cash transaction valued at £2.3 billion. The acquisition expands Thermo Fisher's specialty diagnostics portfolio with pioneering innovation in multiple myeloma diagnostics and monitoring. It aims to enable further advancements in patient outcomes.

Key In-vitro Diagnostics Enzymes Companies:

The following are the leading companies in the in-vitro diagnostics enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Codexis, Inc.

- F. Hoffmann-La Roche Ltd.

- Amano Enzyme Inc.

- Advanced Enzymes Technologies Ltd.

- Biocatalysts Ltd.

- Amicogen

- Dyadic International

- BBI Solutions

- Affymetrix

- American Laboratories

Recent Developments

-

In September 2024, Alphazyme and TriLink BioTechnologies announced the launch of CleanScribe RNA Polymerase, which reduces dsRNA during mRNA synthesis. This launch is likely to benefit the companies involved in mRNA therapeutics production.

-

In May 2023, QIAGEN announced the expansion of its enzymes business to cater to emerging life science research laboratories across the globe. This initiative is likely to bring more business to the company, improving its market position among its competitors.

-

In June 2023, AIST and Asahi Kasei Pharma collaborated on the Smart Cell Project of NEDO to improve cholesterol esterase production efficiency, an enzyme utilized in in-vitro diagnostic assays enabling the manufacture of a commercial product called CEN II

In-vitro Diagnostics Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.88 billion

Revenue forecast in 2030

USD 3.05 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Enzyme, disease, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Merck KGaA; Codexis, Inc.; F. Hoffmann-La Roche Ltd.; Amano Enzyme Inc.; Advanced Enzymes Technologies Ltd.; Biocatalysts Ltd.; Amicogen; Dyadic International; BBI Solutions; Affymetrix; American Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global In-vitro Diagnostics Enzymes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global in-vitro diagnostics enzymes market based on enzyme, disease, technology, end-use, and region:

-

Enzyme Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteases

-

Polymerase & Transcriptase

-

Ribonuclease

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious disease

-

COVID-19 Testing

-

Hepatitis

-

HIV

-

Others

-

-

Diabetes

-

Oncology

-

Cardiology

-

Nephrology

-

Autoimmune diseases

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Histology Assays

-

Molecular Diagnostics

-

PCR Assays

-

NGS Assays

-

Others

-

-

Clinical Chemistry

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & Biotech

-

Hospital & Diagnostic Labs

-

Contract Research Organizations (CROs)

-

Academic Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in-vitro diagnostics enzymes market size was estimated at USD 1.70 billion in 2024 and is expected to reach USD 1.88 billion in 2025.

b. The global in-vitro diagnostics enzymes market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 3.05 billion by 2030.

b. North America dominated the IVD enzymes market with a share of 45.7% in 2024. This is attributable to the high demand for IVD enzymes and the increasing prevalence of infectious disorders in the region.

b. Some of the key players in the IVD enzymes market include Merck KGaA, Codexis, Inc., F. Hoffmann-La Roche Ltd., Amano Enzyme Inc., Advanced Enzymes Technologies Ltd., Biocatalysts Ltd., Amicogen, Dyadic International, BBI Solutions, Affymetrix, American Laboratories

b. Key factors driving the IVD enzymes market growth include a rise in the adoption of IVD in clinical diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.