- Home

- »

- Petrochemicals

- »

-

India Lubricants Market Size & Share, Industry Report, 2030GVR Report cover

![India Lubricants Market Size, Share & Trends Report]()

India Lubricants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Industrial Lubricants, Automotive Lubricants, Marine Lubricants, Aerospace Lubricants), And Segment Forecasts

- Report ID: GVR-4-68040-290-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Lubricants Market Size & Trends

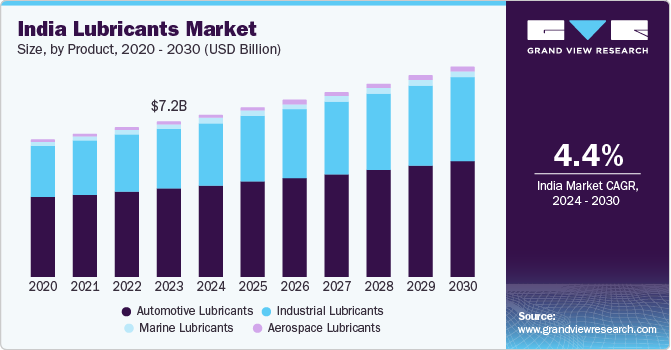

The India lubricants market size was estimated at USD 7.19 billion in 2023 and is expected to grow at a CAGR of 4.4% from 2024 to 2030. The growth is attributed to rapid expansion of Indian automotive industry and industrial growth in the country. Advances in lubricant technology, including the development of synthetic and bio-based lubricants, meet the demand for high-performance and environmentally friendly products. In Feb 2023, Valvoline launched a new line of engine oil for two-wheelers which claimed to increase fuel efficiency by up to 8%. The new generation of engine oil is compatible with the old and new generation of two-wheelers, 125CC onwards.

The rising demand from manufacturing industries is driving the market growth as lubricants are used in manufacturing industries in the form of transmission fluids, gear oils, compressor oils, metalworking fluids and greases for heavy machinery. Additionally, Lubricants have applications in marine and aerospace industries. Specialized lubricants required to sustain extreme temperatures are used in aerospace industries for lubrication of aircraft engines.

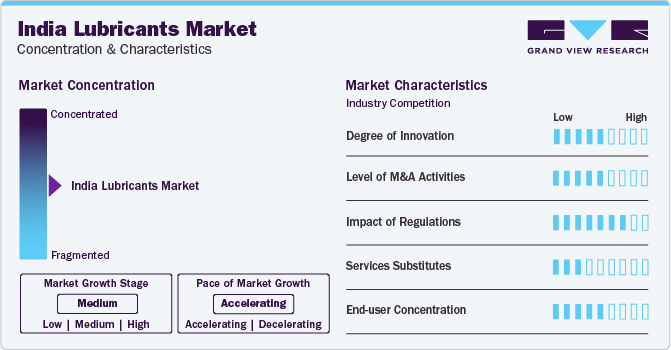

Market Concentration & Characteristics

The industry growth stage is medium and the pace of the industry is accelerating. The market encompasses a wide range of products, including mineral, synthetic, and semi-synthetic lubricants, catering to various automotive, industrial, marine, and aviation applications. This diversity meets the needs of a broad customer base with varying requirements.

The market is highly competitive, with the presence of both global giants and domestic players. Major international companies like Shell, ExxonMobil, and BP compete alongside prominent Indian companies such as Indian Oil Corporation, Bharat Petroleum, and Hindustan Petroleum. This competition fosters innovation and keeps prices competitive.

The growth of the automotive and industrial sectors is a significant driver for the lubricants market. Rising vehicle ownership and industrial activity increase the demand for lubricants for maintenance and operations. The emerging electric vehicle market presents opportunities for the lubricants industry. There's a growing demand for specialized lubricants for EV components, including battery coolants and greases for moving parts.

Product Insights

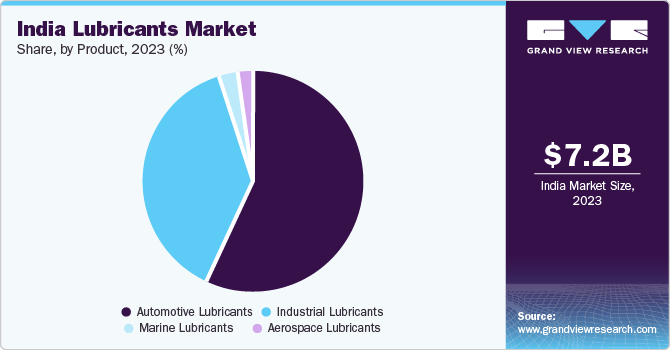

Automotive lubricants dominated the market with the largest revenue share of 57% in 2023. The automotive industry in India continues to grow, fueled by domestic demand and increasing export opportunities. As production and sales of vehicles increase, the demand for automotive lubricants is increasing. India's growing middle class and increasing disposable incomes are contributing to the growth of automobile market. The passenger vehicles segment in Indian automobile industry crossed units 4 million sales in 2023. This trend is expected to continue, driving demand for automotive lubricants for maintenance and performance enhancement.

The aerospace lubricants segment is expected to grow at the fastest CAGR over the forecast period. The development of India's Maintenance, Repairs, and Operations (MRO) industry, supported by policy reforms aimed at making India a global MRO hub, presents significant opportunities for the aerospace lubricants market. The need for regular maintenance and servicing of aircraft engines and components boosts the demand for high-quality lubricants.

The global aviation industry's emphasis on improving fuel efficiency and reducing emissions influences the development and adoption of advanced aerospace lubricants. These lubricants play a vital role in enhancing engine efficiency and reducing friction, thereby contributing to fuel savings and lower emissions.

Key India Lubricants Company Insights

Some of the key players operating in the market include HP Lubricants.; Indian Oil Corporation Ltd; CASTROL LIMITED

-

Servo is the brand name under which Indian Oil Corporation Ltd. (IOCL) markets its lubricants. Servo is a prominent player in the Indian lubricants market, offering an extensive range of products catering to various sectors including automotive, industrial, marine, and more. It provides a wide range of engine oils for petrol, diesel, and CNG/LPG vehicles, catering to both passenger and commercial vehicles.

-

Hindustan Petroleum Corporation Limited (HPCL) markets its lubricants under the brand name HP Lubricants. HP Lubricants is a significant player in the Indian lubricants market, offering a comprehensive range of products tailored to various applications in the automotive, industrial, and specialty segments. The company leverages HPCL's extensive experience in the oil and gas sector to develop high-quality lubricants that meet the evolving needs of consumers and industries in India.

Key India Lubricants Companies:

- CASTROL LIMITED

- HP Lubricants

- Indian Oil Corporation Ltd

- Shell

- Gulf Oil International Ltd

- Valvoline

- TotalEnergies

- Exxon Mobil Corporation.

Recent Developments

-

In October 2023, Gulf Oil and S-Oil announced partnership to expand its footprint in India. Through this partnership Gulf Oil aims to expand its product offerings and market presence in the country while S-Oil has entered a strategic alliance to bolster its global supply chain and product offerings

-

In October 2023, BPCL announced launch of two new premium synthetic engine oils for high end cars and bikes. The company announced launch of Mak TitaniumCK4, ultra-low emission diesel engine oil and Mak Blaze Synth for high end bikes

-

In October 2023, Chevron announced re-entry in the Indian market after 12 years. The company announced partnership with Hindustan Petroleum, the strategic partnership will allow HPCL to market the company latest Caltex lubricants in India. Chevron is expected to be able to expand its product offering in the growing lubricant market using HPCL vast distribution channel

-

In March 2023, ExxonMobil announced investment of USD 110 million to setup lubricant manufacturing plant in Raigad, Maharashtra, India. The new plant is expected to produce 159,000 kiloliters of lubricants annually to meet country’s growing lubricant demand. The strategic move allows company to make Indian market specific lubricants and establish market presence as provider of high-performance lubricants in the country

-

In April 2023, Breaks India announced entry in lubricants under Revia brand name. The company is expected to produce lubricants via third party and sell via its distributors. Revia will be available in 5 grades and 4 grades of engine oil for passenger cars and commercial vehicles respectively.

-

In January 2023, Goodyear lubricants announce new BS VI and Euro VI engine oils for Southeast, Southeast Asia and New Zeeland market. The new engine oils will be manufactured in Haryana, India with compliance to BS VI and Euro VI emission norms for both passenger and commercial vehicles with goal of reducing carbon emissions

India Lubricants Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9.70 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume, kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

India

Key companies profiled

CASTROL LIMITED; HP Lubricants; Indian Oil Corporation Ltd. Shell; Gulf Oil International Ltd. Valvoline; TotalEnergies; Exxon Mobil Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Lubricants Market Report Segmentation

This report forecasts volume and revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the India lubricants market report based on products:

-

India Lubricants Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial Lubricants

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Automotive Lubricants

-

Engine Oil

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Marine Lubricants

-

Engine Oil

-

Hydraulic Oil

-

Gear Oil

-

Turbine Oil

-

Greases

-

Others

-

-

Aerospace Lubricants

-

Gas Turbine Oils

-

Piston Engine Oils

-

Hydraulic Fluids

-

Others

-

-

Frequently Asked Questions About This Report

b. The India lubricants market size was estimated at USD 7.19 billion in 2023 and is expected to reach USD 7491.71 million in 2024

b. The Indian lubricants market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 9.70 billion by 2030

b. The automotive lubricants segment held the highest market share of 56.9% in 2023. Growing demand for automobiles and automobile service shops are contributing to the segment's growth.

b. Some key players operating in the India lubricants market include CASTROL LIMITED, HP Lubricants, Indian Oil Corporation Ltd, Shell, Gulf Oil International Ltd, Valvoline, TotalEnergies, Exxon Mobil Corporation.

b. Factors such as the rising growth of automobile and manufacturing industries in the country have increased the demand for lubricants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.