- Home

- »

- Next Generation Technologies

- »

-

Industrial Automation Services Market, Industry Report, 2030GVR Report cover

![Industrial Automation Services Market Size, Share & Trends Report]()

Industrial Automation Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Project Engineering & Installation, Maintenance & Support, Consulting, Operational), By Product Type (DCS, PLC, SCADA) By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-572-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Automation Services Market Trends

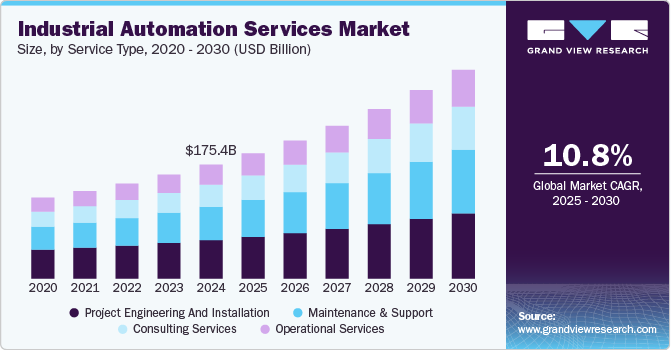

The global industrial automation services market size was estimated at USD 175.38 billion in 2024 and is expected to grow at a CAGR of 10.8% from 2025 to 2030. The growth is primarily driven by the increasing demand for enhanced operational efficiency. Companies across various industries are increasingly investing in automation to streamline processes, eliminate inefficiencies, optimize workflows, and improve overall productivity while reducing manual labor. This shift in industries toward higher precision and consistency is further fueled by the adoption of automation technologies such as robotics, AI, and machine learning, which is expected to further drive the industrial automation services industry expansion in the coming years.

The shift towards Industry 4.0 is a major driver within the industrial automation services industry. This revolution is characterized by the integration of IT with operational technology, enabling real-time monitoring, improved decision-making, and highly efficient production systems. As manufacturers adopt smart factory solutions, there is a growing demand for automation services to help businesses transition to fully connected and intelligent systems. This trend towards smart manufacturing continues to accelerate the growth of the industrial automation services industry.

Additionally, the integration of Artificial Intelligence (AI) and machine learning into industrial automation systems is emerging as another major trend. AI helps optimize processes by analyzing vast amounts of data to make intelligent decisions autonomously, while machine learning enables systems to improve based on real-time feedback and historical data continuously. These technologies are being applied to tasks such as quality control, predictive maintenance, and process optimization. As AI and machine learning continue to advance, their integration into automation is expected to become more impactful, enabling smarter and more efficient production environments, thereby further driving market growth.

Predictive maintenance is rapidly gaining traction as a trend within the industrial automation services industry. By utilizing sensors and IoT devices, companies can monitor the health of machinery in real-time and predict when equipment will require maintenance, thus preventing unplanned downtime. This trend is enabled by advanced data analytics, which can forecast potential failures before they occur, saving costs on repairs and extending the life of equipment. As industries aim to reduce maintenance-related disruptions and costs, predictive maintenance is increasingly becoming a crucial element of their automation strategies, playing a significant role in the growth of the industrial automation services industry.

Virtualization of control systems is a growing trend in industrial automation, where traditional hardware-based control systems are replaced with software-based solutions running on virtualized platforms. This allows for more flexible, scalable, and cost-effective management of industrial automation processes. Virtualization enables manufacturers to simulate, monitor, and control automation processes from a centralized location, without the need for extensive physical infrastructure. With the growing need for more efficient resource management and quicker adaptation to changing demands, virtualization is becoming an essential element of the modern industrial automation services industry, which is expected to fuel further the industrial automation services market in the coming years.

Service Type Insights

The product engineering & installation segment dominated the market with a share of over 33% in 2024, driven by the need for enhanced operational efficiency and productivity. Industries are increasingly adopting automation solutions to streamline processes, reduce downtime, and improve overall performance. The integration of advanced technologies such as AI, machine learning, and IoT is further propelling the demand for customized automation systems tailored to specific industry needs. Additionally, the growing shift towards cloud-based automation solutions, offering scalability, cost-efficiency, and remote monitoring capabilities, is expected to drive segmental growth in the coming years.

The consulting services segment is expected to witness the fastest CAGR of over 11% from 2025 to 2030. The increasing complexity of industrial operations and the need for digital transformation are driving the demand for consulting services in the automation sector. Consulting services are increasingly adopting advanced technologies such as digital twins, augmented reality (AR), and blockchain to provide deeper insights and value-driven solutions. AR-driven advisory services enable remote training and operational support, enhancing workforce readiness while minimizing disruptions.

End-use Insights

The manufacturing segment accounted for the largest market share in 2024, driven by the increasing need for automation across industries such as oil & gas, chemicals, and power generation. Industries are adopting DCS solutions for more precise control over complex processes, improving efficiency, and reducing operational costs. The need for enhanced safety standards and regulatory compliance also fuels the demand for DCS, particularly in hazardous environments where precise control is crucial. Advances in technology, including integration with IoT and AI, have made DCS systems more efficient, scalable, and cost-effective, driving widespread adoption across industries.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2030. The increasing need for real-time monitoring and control of industrial operations, particularly in industries such as utilities, manufacturing, and infrastructure, is driving the growth of SCADA systems. With the rise of smart cities, smart grids, and connected devices, SCADA systems play a critical role in enabling seamless monitoring and management of complex systems. The increasing focus on safety, process optimization, and efficiency across industries also contributes to the growth of SCADA systems, as they provide enhanced control and visibility into operational data. The adoption of SCADA is further driven by the move toward remote monitoring and maintenance, particularly in areas that are difficult to access or are critical.

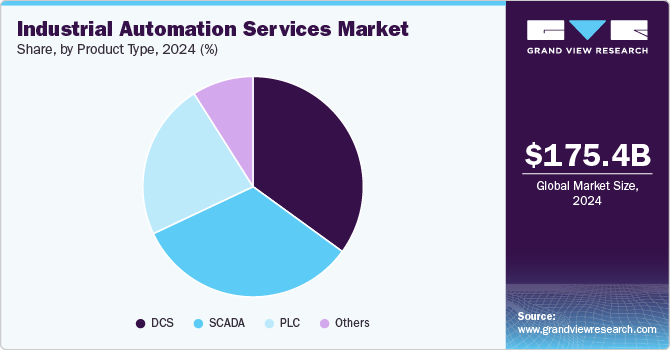

Product Type Insights

The DCS segment accounted for the largest market share in 2024, driven by the increasing need for automation across industries such as oil & gas, chemicals, and power generation. Industries are adopting DCS solutions for more precise control over complex processes, improving efficiency, and reducing operational costs. The need for enhanced safety standards and regulatory compliance also fuels the demand for DCS, particularly in hazardous environments where precise control is crucial. Advances in technology, including integration with IoT and AI, have made DCS systems more efficient, scalable, and cost-effective, driving widespread adoption across industries.

The SCADA segment is expected to witness the highest CAGR from 2025 to 2030. The increasing need for real-time monitoring and control of industrial operations, particularly in industries such as utilities, manufacturing, and infrastructure, is driving the growth of SCADA systems. With the rise of smart cities, smart grids, and connected devices, SCADA systems play a critical role in enabling seamless monitoring and management of complex systems. The increasing focus on safety, process optimization, and efficiency across industries also contributes to the growth of SCADA systems, as they provide enhanced control and visibility into operational data. The adoption of SCADA is further driven by the move toward remote monitoring and maintenance, particularly in areas that are difficult to access or are critical.

Regional Insights

North America accounted for a significant share of over 28% in 2024, driven by a strong focus on technological innovation, with industries increasingly adopting automation solutions to improve operational efficiency and reduce costs. Additionally, the need for enhanced productivity, reduced downtime, and improved safety in industries such as automotive, aerospace, and food processing fuels the adoption of industrial automation services. Moreover, government initiatives and substantial investments in smart manufacturing and Industry 4.0 further boosts the market in this region.

U.S. Industrial Automation Services Market Trends

The U.S. industrial automation services industry dominated the market with a share of over 81% in 2024, driven by rapid technological advancements and a large manufacturing base. The U.S. also sees a strong emphasis on predictive maintenance and smart factory solutions, which enhance productivity and reduce unplanned downtime. The growing trend toward digitalization in industries such as automotive, electronics, and chemicals is driving the demand for automation services, and further driving the market growth.

Europe Industrial Automation Services Market Trends

Europe industrial automation services industry is expected to grow at a CAGR of 7% from 2025 to 2030, primarily driven by stringent regulatory standards and the push for sustainability in manufacturing. European industries, particularly in sectors such as automotive, pharmaceuticals, and energy, are adopting automation technologies to improve efficiency, reduce waste, and meet environmental targets. The EU's commitment to digital transformation, supported by initiatives such as the European Digital Strategy, is accelerating the integration of AI, IoT, and robotics. Furthermore, the region's strong focus on workforce safety and precision is fueling the growth of automation solutions that improve operational consistency.

The UK industrial automation services market is expected to grow at a significant rate in the coming years. The UK's focus on high-tech industries, including automotive, aerospace, and pharmaceuticals, has led to increased adoption of automation to improve productivity, safety, and product quality. Additionally, government policies aimed at supporting technological innovation and digital transformation are contributing to the market's expansion.

The industrial automation services market in Germany is driven by the country’s strong emphasis on digital transformation, coupled with government support for smart manufacturing. Furthermore, the trend toward energy-efficient and sustainable production practices is pushing the demand for advanced automation solutions, thereby boosting market expansion.

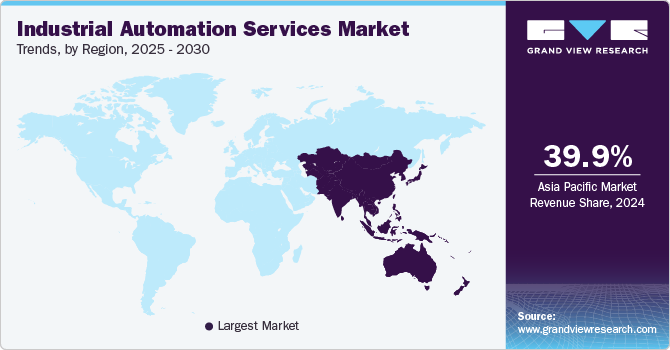

Asia Pacific Industrial Automation Services Market Trends

The Asia Pacific industrial automation services industry is expected to grow at the fastest CAGR of over 13% from 2025 to 2030, driven by the region's expanding manufacturing sectors, particularly in China, Japan, and India. The need for greater efficiency, reduced labor costs, and improved product quality is pushing industries in APAC to adopt automation solutions, thereby boosting market growth.

The Japan industrial automation services market is gaining traction, driven by the country’s strong emphasis on innovation and technological advancement. Japan has been a pioneer in robotics, particularly in the automotive and electronics sectors, where automation is crucial for improving efficiency, precision, and productivity.

The industrial automation services market in China is rapidly expanding, driven by the country’s rapid industrial growth and the expansion of its manufacturing and power generation sectors. The government’s ongoing initiatives to improve energy efficiency and reduce carbon emissions are pushing the adoption of advanced cooling technologies. The demand for cooling systems in industries such as chemicals, steel, and electronics is growing significantly.

Key Industrial Automation Services Company Insights

Some of the key players operating in the market are Siemens AG and Rockwell Automation, Inc.

-

Siemens AG is a global player in industrial automation services, with a long-established presence in the market. The company offers a comprehensive range of automation solutions, including digitalization, control systems, robotics, and IoT technologies. The company’s flagship platform, Siemens Digital Industries, integrates automation and software to optimize production efficiency and sustainability. Its services span across industries such as manufacturing, energy, automotive, and infrastructure, positioning the company as a key player driving digital transformation and smart factory solutions worldwide.

-

Rockwell Automation Inc. is renowned for its control systems, automation software, and industrial IoT solutions. The company is focused on enabling smart manufacturing, optimizing production efficiency, and improving safety across a wide range of industries, including automotive, food and beverage, and energy. Rockwell’s FactoryTalk platform helps businesses automate and monitor operations with advanced data analytics and AI, empowering industries to maximize performance and minimize downtime.

Yokogawa Electric Corporation and Omron Corporation are some of the emerging participants in the industrial automation services market.

-

Yokogawa Electric Corporation is a well-established company in industrial automation, recognized for its focus on providing innovative solutions for processing industries. By integrating advanced technologies such as AI, IoT, and sophisticated control systems, the company enhances efficiency and reduces operational costs. The company’s OpreX automation suite is designed to help industries such as oil and gas, chemicals, and energy optimize their operations and stay competitive in a rapidly evolving digital landscape.

-

Omron Corporation is a global provider of industrial automation solutions, known for its expertise in robotics, control systems, and sensors. The company focuses on improving operational efficiency, safety, and quality through automation products that serve industries such as automotive, electronics, and manufacturing. The company’s ongoing advancements in smart automation and AI integration allow it to meet the evolving needs of businesses continuously.

Key Industrial Automation Services Companies:

The following are the leading companies in the industrial automation services market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- Rockwell Automation, Inc.

- Schneider Electric

- Honeywell International Inc.

- ABB Ltd.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Fuji Electric Co., Ltd.

- Omron Corporation

Recent Developments

-

In March 2025, Siemens AG expanded its Industrial Copilot offering by introducing a new generative AI-powered maintenance solution. This enhancement integrates Siemens' Senseye Predictive Maintenance platform with advanced AI capabilities to support all stages of the maintenance cycle—from repair and prevention to prediction and optimization.

-

In January 2024, Honeywell International, Inc. announced a collaboration with Hai Robotics to enhance distribution center efficiency through advanced automation. The partnership integrates Hai Robotics' Autonomous Case-handling Mobile Robots (ACRs) with Honeywell's Momentum Warehouse Execution Software and cybersecurity capabilities.

-

In January 2024, ABB Ltd. announced its acquisition of Canadian company Real Tech, a leader in optical sensor technology for real-time water quality monitoring. This acquisition enhances ABB's presence in the water segment and complements its portfolio with critical optical technology for smart water management. Real Tech's solutions provide real-time measurements, enabling better process control and continuous water quality assurance.

Industrial Automation Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 192.75 billion

Revenue forecast in 2030

USD 321.78 billion

Growth rate

CAGR of 10.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, product type, end-use, region

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Siemens AG; Rockwell Automation, Inc.; Schneider Electric; Honeywell International Inc.; ABB Ltd.; Mitsubishi Electric Corporation; Emerson Electric Co.; Yokogawa Electric Corporation; Fuji Electric Co., Ltd.; Omron Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Automation Services Market Report Segmentation

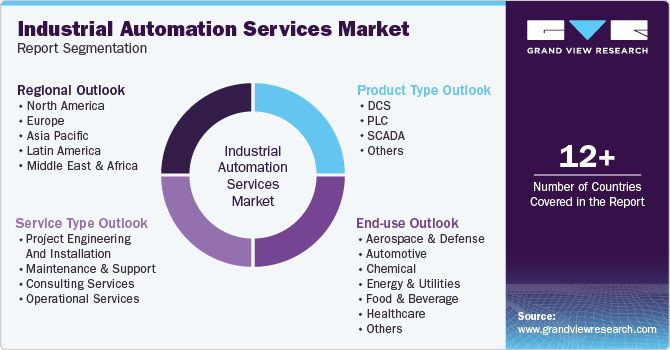

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial automation services market report based on service type, product type, end-use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Project Engineering and Installation

-

Maintenance & Support

-

Consulting Services

-

Operational Services

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial automation services market size was estimated at USD 175.38 billion in 2024 and is expected to reach USD 192.75 billion in 2025.

b. The global industrial automation services market is expected to grow at a compound annual growth rate of 10.8% from 2025 to 2030 to reach USD 321.78 billion by 2030.

b. North America accounted for a significant share of over 28% in 2024, driven by a strong focus on technological innovation, with industries increasingly adopting automation solutions to improve operational efficiency and reduce costs.

b. Some key players operating in the industrial automation services market include Siemens AG, Rockwell Automation, Inc., Schneider Electric, Honeywell International Inc., ABB Ltd., Mitsubishi Electric Corporation, Emerson Electric Co., Yokogawa Electric Corporation, Fuji Electric Co., Ltd., and Omron Corporation

b. The key factors driving the market growth include the increasing demand for enhanced operational efficiency, shift towards Industry 4.0, and the integration of Artificial Intelligence (AI) and machine learning into industrial automation systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.