- Home

- »

- IT Services & Applications

- »

-

Industrial Data Management Market, Industry Report, 2030GVR Report cover

![Industrial Data Management Market Size, Share & Trend Report]()

Industrial Data Management Market (2025 - 2030) Size, Share & Trend Analysis Report By Solution Type (Data Orchestration & Analytics, Data Storage & Integration, Data Sharing), By Data Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Data Management Market Summary

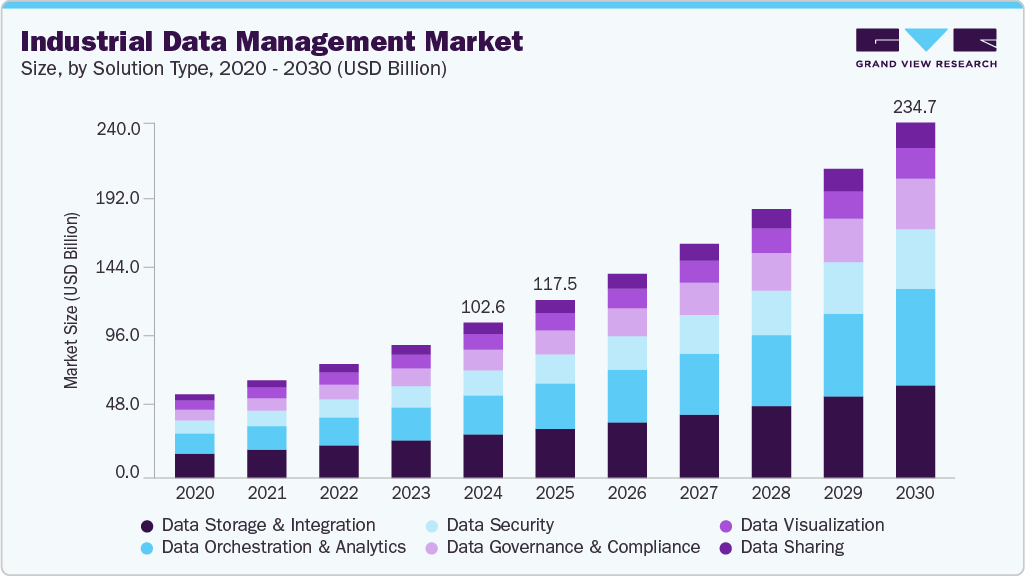

The global industrial data management market size was estimated at USD 102.58 billion in 2024 and is projected to reach USD 234.73 billion by 2030, growing at a CAGR of 14.8% from 2025 to 2030. Automation driven by AI is growing rapidly in industrial data management.

Key Market Trends & Insights

- North America dominates the global industrial data management market with the largest revenue share of 37.0% in 2024.

- The industrial data management market in the U.S. is driven by widespread adoption of advanced technologies.

- By solution types, the data storage & integration segment led the market with the largest revenue share of 28.01% in 2024.

- By data type, the unstructured data segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 102.58 Billion

- 2030 Projected Market Size: USD 234.73 Billion

- CAGR (2025-2030): 14.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Companies increasingly use AI to boost efficiency and streamline complex operations across various sectors. This shift reduces reliance on manual labor for repetitive and time-consuming tasks, allowing workers to focus on higher-value activities. As a result, decision-making processes become faster, more data-driven, and more accurate. Industries are steadily moving toward smarter, more autonomous systems that can adapt and respond in real-time, improving overall productivity and competitiveness. In October 2024, Honeywell International Inc., a U.S.-based technology and industrial solutions company, collaborated with Google LLC to integrate Google's advanced AI technology, Gemini, with the industrial data managed on Honeywell's Forge platform. The goal of this collaboration is to enable autonomous operations for Honeywell’s customers. These AI-driven tools are designed to automate tasks performed by warehouse workers, engineers, technicians, and others.

The industrial data management industry is growing rapidly due to the increasing adoption of cloud-based solutions and digital transformation. Integration of cloud technology with automation is driving demand for real-time data access, scalability, and advanced analytics. This growth is fueled by manufacturers seeking to optimize processes, minimize downtime, and enhance operational agility. As industries prioritize efficiency and responsiveness, the market continues to expand. The rise of smarter, more connected, and data-driven industrial systems is accelerating market development. The push for interoperability across systems and devices is also contributing to stronger adoption of industrial data platforms.

In addition, growing investment in AI and IoT technologies is further reinforcing the need for robust, scalable data management infrastructure. For example, in April 2025, Rockwell Automation, a U.S.-based automation company, partnered with Amazon Web Services, Inc. to advance manufacturing through cloud-enabled industrial automation solutions. The collaboration aims to accelerate digital transformation across the manufacturing sector by combining expertise in automation and cloud technology.

The integration of AI and robotics in predictive maintenance is fueling rapid growth in the industrial data management industry. As manufacturing facilities adopt these technologies, they generate vast amounts of sensor and machine data that must be processed, analyzed, and stored efficiently. This drives demand for scalable, cloud-based, and edge-enabled data platforms capable of handling real-time inputs. AI models require continuous data flow for training and optimization, pushing companies to invest in robust data architectures.

Robotics adds another layer of complexity, producing operational data that needs structured management. The shift from reactive to predictive maintenance increases reliance on data accuracy and system interoperability. Advanced analytics, anomaly detection, and performance benchmarking tools are also gaining traction. Data security, compliance, and lifecycle management become critical as AI and robotics scale across industries. As a result, organizations are expanding their data infrastructure to support smarter, automated decision-making. This transformation positions data management as a central component of future-ready industrial operations.

Solution Types Insights

The data storage & integration segment led the market with the largest revenue share of 28.01% in 2024. The rising volume of machine-generated data across manufacturing operations drives this. Companies require robust infrastructure to collect, store, and consolidate data from diverse sources. Reliable storage and seamless integration are essential for supporting real-time applications. As industrial processes digitize, demand for scalable storage solutions continues to increase. Growing concerns over data security and compliance further boost investments in secure storage and integration technologies.

The data orchestration and analytics segment is anticipated to grow at the fastest CAGR during the forecast period. Organizations are prioritizing tools that help streamline data flows across systems and functions. Analytics solutions enable predictive insights, operational efficiency, and improved decision-making. The need to convert raw data into actionable intelligence is driving adoption. As AI and IoT expand, analytics and orchestration tools are becoming increasingly essential. Companies are focusing on enhancing automation and real-time analytics to gain a competitive advantage.

Data Type Insights

The unstructured data segment accounted for the largest market revenue share in 2024, due to its vast volume and variety. It includes formats such as images, videos, and text documents that are generated continuously by machines and sensors. Managing this data type poses challenges because it lacks a predefined model or organization. Companies invest heavily in technologies to store and analyze unstructured data to extract valuable insights. Despite its complexity, unstructured data holds critical information for predictive maintenance and operational efficiency. Its dominance reflects the growing reliance on diverse data sources in industrial environments, where companies continuously collect vast amounts of information from machines, sensors, and operational processes to improve efficiency, reduce downtime, and enhance decision-making.

The Semi-structured data segment is anticipated to grow at the fastest CAGR during the forecast period, because it offers more organization than unstructured data while retaining flexibility. It includes data formats such as JSON, XML, and sensor logs that carry tags or markers for easier parsing. Industries adopt semi-structured data management tools to improve integration and querying capabilities across diverse systems. This growth is driven by the increasing use of IoT devices that produce semi-structured outputs. Managing semi-structured data helps companies balance complexity with accessibility for better decision-making. The expansion of semi-structured data usage signals a shift toward more structured approaches in handling industrial information.

Application Insights

The predictive maintenance segment accounted for the largest market revenue share in 2024, because it helps companies reduce unexpected equipment failures and lower maintenance costs. Analyzing data from machines and sensors allows businesses to predict problems before they cause downtime. This approach improves operational efficiency and extends the lifespan of critical assets. Predictive maintenance relies heavily on real-time data processing and advanced analytics, making it a priority investment for many industrial firms. Its dominance shows the focus on minimizing disruptions and optimizing resource use in complex industrial settings. Companies continue to enhance these systems to achieve better accuracy and faster responses.

The supply chain and inventory management segment is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demands for transparency and efficiency. Managing data across multiple suppliers, warehouses, and distribution channels requires integrating diverse information sources. Advances in data analytics and IoT technologies enable better tracking of inventory levels and shipment statuses. This growth is driven by the need to reduce costs, improve delivery times, and respond quickly to market changes. As industries adopt more automated and connected supply chains, data management solutions for this area gain importance. The expansion of supply chain and inventory management reflects a broader shift toward smarter, more agile industrial operations.

End Use Insights

The manufacturing & processing segment accounted for the largest market revenue share in 2024. This sector has consistently prioritized data-driven operations to enhance efficiency and productivity. Real-time monitoring, predictive maintenance, and quality assurance heavily depend on structured data systems. The widespread adoption of IoT devices and automation technologies has increased the volume and complexity of data generated. To manage this, companies in the sector have invested in advanced industrial data platforms. Regulatory compliance and the need for operational transparency have further accelerated data integration. As a result, manufacturing & processing remain the most organized and established users of industrial data management solutions.

The BFSI segment is anticipated to grow at the fastest CAGR during the forecast period. Financial institutions are expanding their use of industrial-grade data systems to support secure and scalable operations. The sector is focusing on integrating disparate data sources for real-time analytics and regulatory compliance. Advanced data tools are being deployed to improve fraud detection, customer segmentation, and risk assessment. Digital transformation has driven greater adoption of cloud-based platforms and intelligent automation. This shift enables more agile and efficient decision-making across financial operations. While still developing, BFSI is emerging as a fast-growing adopter of industrial data management practices.

Regional Insights

North America dominates the global industrial data management market with the largest revenue share of 37.0% in 2024. North America leads the global market due to early digitalization and strong infrastructure. The region benefits from high adoption of IoT, AI, and cloud technologies across industries. Manufacturing, energy, and utilities have made significant investments in real-time data systems. Regulatory frameworks and data privacy laws have also pushed companies to adopt structured data platforms. Major players headquartered in the region continue to drive innovation and expansion globally.

U.S. Industrial Data Management Market Trends

The industrial data management market in the U.S. is driven by widespread adoption of advanced technologies. Sectors such as manufacturing, oil & gas, and aerospace rely on real-time data analytics for operational efficiency. Investments in IIoT, edge computing, and cybersecurity are expanding rapidly. Regulatory compliance requirements have pushed organizations to strengthen data governance and integration. Cloud-based solutions are seeing strong uptake among both large enterprises and mid-sized firms.

Europe Industrial Data Management Market Trends

The industrial data management market in Europe is shaped by strict data privacy regulations and sustainability goals. Countries across the region are investing in smart manufacturing and green technologies. Industrial players are adopting platforms that enable cross-border data flow under GDPR compliance. Legacy infrastructure is being upgraded to support real-time and predictive data applications. Public-private initiatives are also driving digital transformation in industrial sectors.

Asia Pacific Industrial Data Management Market Trends

The industrial data management market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, due to expanding manufacturing activity. Countries such as China, Japan, and South Korea are investing heavily in smart factories and digital infrastructure. The rise of domestic industrial automation vendors is boosting regional competition. Data integration and analytics tools are gaining traction as companies aim for productivity and cost control. Government-backed digital initiatives are supporting technology upgrades in key sectors. Despite fragmentation, the region is emerging as a strong contender in the global sector.

Key Industrial Data ManagementCompany Insights

Some of the key companies in the industrial data management industry include Amazon Web Services, Inc., Emerson Electric Co., GE Vernova Inc., Honeywell International Inc., IBM Corporation, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Honeywell International Inc. is advancing industrial data management through its Forge platform, which integrates real-time data for better decision-making. It partnered with Google to incorporate AI tools that automate tasks and boost productivity across operations. Honeywell’s cloud historian platform improves plant analytics and provides secure global data access. These innovations address labor shortages and enhance operational efficiency.

-

BM Corporation is enhancing industrial data management with its Watsonx platform, which brings together AI, data, and governance in a unified solution. It supports enterprises at various stages of AI adoption by providing tools for data ingestion, model creation, and lifecycle management. IBM is expanding its hybrid cloud and automation capabilities in this area. The Watsonx platform emphasizes governance, collaboration, and monitoring to ensure responsible AI use.

Key Industrial Data Management Companies:

The following are the leading companies in the global industrial data management market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Emerson Electric Co.

- GE Vernova Inc.

- Honeywell International Inc.

- IBM Corporation

- Microsoft

- Oracle

- Rockwell Automation, Inc.

- SAP SE

- Siemens AG

Recent Developments

-

In September 2024, Honeywell International Inc. and Microsoft strengthened their partnership by integrating Microsoft Azure with Honeywell's Forge platform. This collaboration aims to enhance industrial operations, improve asset reliability, and accelerate the energy transition across various industries. The partnership focuses on optimizing operations and driving sustainability efforts.

-

In May 2024, Siemens AG and Microsoft expanded their longstanding partnership by making Siemens' Xcelerator as a Service portfolio available on Microsoft Azure. This involves combining Siemens' Teamcenter X software for Product Lifecycle Management (PLM) with Microsoft Azure OpenAI Service and Microsoft 365 Copilot. This partnership aims to increase productivity and help organizations bring products to market faster.

Industrial Data Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 117.53 billion

Revenue forecast in 2030

USD 234.73 billion

Growth rate

CAGR of 14.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Solution type, data type, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Emerson Electric Co.; GE Vernova Inc.; Honeywell International Inc.; IBM Corporation; Microsoft; Oracle, Rockwell Automation, Inc.; SAP SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Data Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial data management market report based on the solution type, data type, application, end use, and region.

-

Solution Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Data Orchestration & Analytics

-

Data Storage & Integration

-

Data Sharing

-

Data Security

-

Data Visualization

-

Data Governance & Compliance

-

-

Data Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Structured

-

Unstructured

-

Semi-Structured

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Predictive Maintenance

-

Asset Monitoring & Optimization

-

Real-Time Operational Analytics

-

Manufacturing Process Optimization

-

Supply Chain & Inventory Management

-

Regulatory Reporting & Compliance

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing & Processing

-

BFSI

-

Energy & Utilities

-

Logistics & Supply Chain

-

Healthcare & Life Sciences

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial data management market size was estimated at USD 102.58 billion in 2024 and is expected to reach USD 117.53 billion in 2025.

b. The global industrial data management market is expected to grow at a compound annual growth rate of 14.8% from 2025 to 2030 to reach USD 234.73 billion by 2030.

b. North America dominated the industrial data management market with a share of 37.0% in 2024. This is attributable to widespread digitalization, strong industrial infrastructure, and high adoption of advanced analytics.

b. Some key players operating in the industrial data management market include Amazon Web Services, Inc., Emerson Electric Co., GE Vernova Inc., Honeywell International Inc., IBM Corporation, Microsoft, Oracle, Rockwell Automation, Inc., SAP SE, and Siemens AG.

b. Key factors driving the market growth include rising demand for real-time data insights, increasing adoption of Industrial IoT, and the growing need for predictive maintenance and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.