- Home

- »

- Display Technologies

- »

-

Industrial Display Market Size, Trends, Industry Report, 2030GVR Report cover

![Industrial Display Market Size, Share & Trends Report]()

Industrial Display Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Rugged, Open Frame, Panel-mount, Video Walls), By Application (HMI, Remote Monitoring), By Technology (LCD, LED, OLED, E-paper), By Panel Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-575-5

- Number of Report Pages: 176

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Display Market Summary

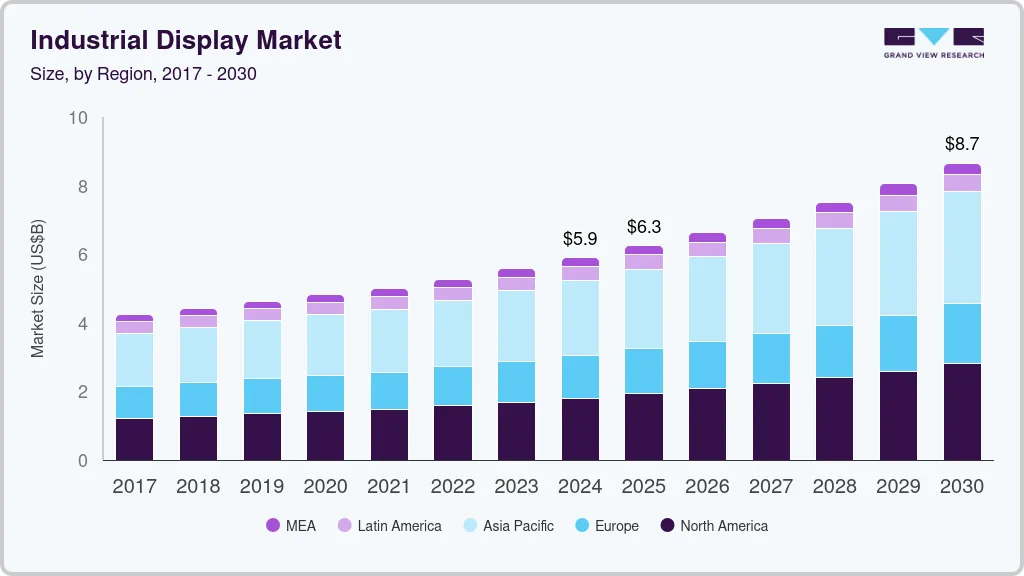

The global industrial display market size was estimated at USD 5,901.2 million in 2024 and is projected to reach USD 8,656.4 million by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The rising penetration of multi-featured human-machine interface (HMI) devices, increasing adoption of the Industrial Internet of Things (IIoT), and proliferation of smart industrial displays are some of the factors contributing to market growth.

Key Market Trends & Insights

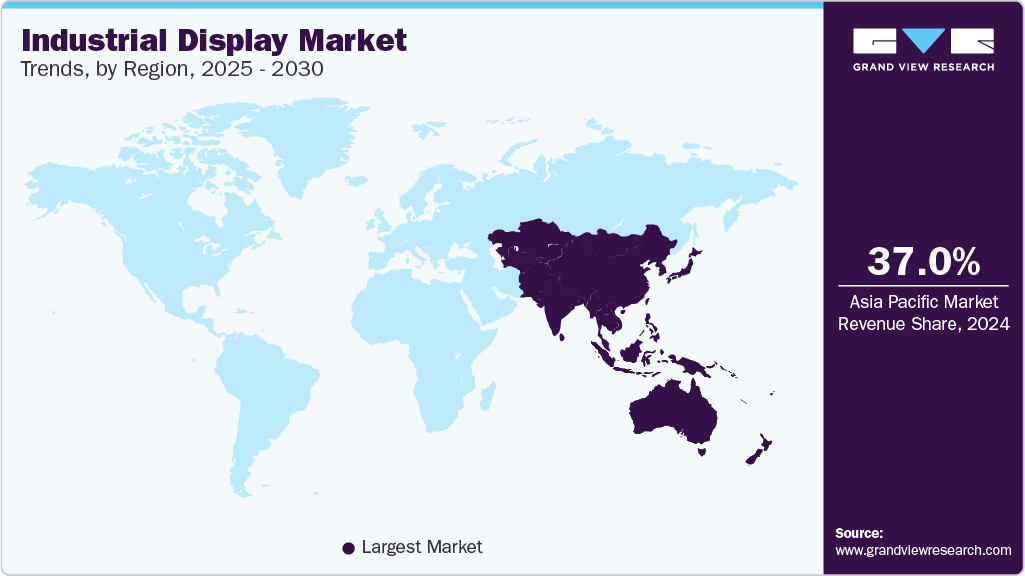

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Brazil is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, panel-mount monitors accounted for a revenue of USD 1,720.5 million in 2023.

- Open Frame Monitors is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,901.2 Million

- 2030 Projected Market Size: USD 8,656.4 Million

- CAGR (2025-2030): 6.7%

- Asia Pacific: Largest market in 2023

The industry is gaining prominence on account of innovative features offered by the displays, which include automatic touch detectors and touch screen panels; radio frequency identification (RFID); ethernet connectivity; and resistance to high temperature, shock, vibration, dust, scratch, and chemicals. The industry offers a huge investment opportunity as the displays are a suitable replacement for manual processes and outdated push-button technology.

The market has benefited from technological advancements in areas such as the Industrial Internet of Things (IIoT), which has improved the effectiveness of predictive analytics. For instance, displays equipped with IIoT sensors can provide real-time data on machine performance and other critical parameters, allowing operators to make data-driven decisions quickly. This helps identify potential issues and reduce downtime, thereby increasing production efficiency. Manufacturers leverage these capabilities to enhance productivity and remain competitive in the global market. Countries like the U.S. and China have adopted predictive analytics to improve their manufacturing processes on a large scale. This trend is expected to continue with the increasing use of predictive analytics solutions for predictive maintenance, asset management, and remote monitoring in the manufacturing industry.

The industrial sector is constantly evolving and adapting to changing needs, with technological advancements driving this progress. Some of the latest innovations in the industry include Thin-Film-Transistor (TFT), Liquid Crystal Display (LCD), Low-Temperature Poly-Silicon (LTPS), Digital Light Processing (DLP), and Color Filter (CF) technologies. For instance, Samsung introduced ultra-efficient Color E-Paper with near-zero power use and its AI-powered SmartThings Pro platform for smarter device management. It also includes a giant 115” 4K Smart Signage screen, setting new standards in sustainable, intelligent digital displays. The demand for multi-featured HMIs and smart touch screen displays is a key driver for technological advancement and innovation. However, regulations governing the manufacturing and sale of industrial displays can vary regionally or by country.

Type Insights

The panel-mount monitors segment held the largest revenue share of 30.5% in 2024. Panel-mount monitors are industrial displays made to be put directly into a control panel or enclosure. They are often manufactured with a rugged shell, bezel, and mounting brackets to survive harsh industrial conditions and offer a secure and sturdy installation. The sizes and resolutions of panel-mount monitors range from tiny displays for embedded systems to large panels for process control applications. They may additionally have touchscreen functionality, high brightness, and several interface options to support numerous industrial applications. Panel-mount monitors are frequently used in manufacturing, automation, and process control applications, where reliable and durable equipment is essential for the best performance and safety. They can also be found in transportation, defense, and aerospace applications where resistance to shock and vibration is essential.

The open frame monitors segment registered a CAGR of 8.1% from 2025 to 2030. Industrial displays without a bezel or casing are known as open-frame monitors. They comprise a metal frame, a display panel, electronics, and interface connectors. This frame is a popular option for industrial and commercial applications that demand flexibility and customization since it can be easily integrated into custom enclosures, kiosks, or other machinery. Widescreen formats are available on open frame displays, which typically have a sleek style and come in various sizes and resolutions. They also feature touchscreen capabilities and great brightness for the best visibility under varied lighting conditions. Gaming machines, self-service kiosks, ATMs, digital signage, and industrial automation equipment are examples of applications where open-frame monitors are frequently employed.

Application Insights

The human-machine interface (HMI) segment held the largest revenue share in 2024. A HMI display is a visual display employed in industrial automation systems to give users and operators real-time information. These displays frequently use cutting-edge technologies such as touchscreens, high-resolution graphics, and ruggedized designs to resist severe industrial conditions. Typically, HMI displays are used to monitor and manage various industrial operations, including production lines, assembly lines, and power generation facilities. They give operators access to real-time data on the condition of the monitored process, including temperature, pressure, flow rate, and other relevant aspects. HMI industrial displays can be used alone or with other industrial automation components like programmable logic controllers (PLC) or supervisory control and data acquisition (SCADA) systems to form a more comprehensive solution. They are designed simple with user-friendly interfaces and legible, easy-to-read visuals and displays.

The interactive display segment is projected to grow significantly over the forecast period. An interactive display lets viewers engage with digital content using touch, gestures, or other input techniques. It typically consists of a display screen, sensors, and software to allow users to interact with or traverse digital content on the screen. Users can engage with digital content on interactive displays by using several input devices, such as touchscreens, styluses, or motion sensors. They might also contain software programs that offer extra features, such as augmented reality applications, virtual whiteboards, and collaborative workplaces. Applications for interactive displays in industrial environments include monitoring and managing assembly lines, production operations, and power generation facilities. They provide operators with real-time information on the status of the monitored process, allowing them to adjust and control the process as needed. Interactive displays in industrial settings typically use touchscreens or other input methods to enable operators to interact with the system. They may also include software applications that provide additional functionality, such as real-time data visualization, remote monitoring, and diagnostic tools.

Technology Insights

The LCD segment held the largest revenue share in 2024. A liquid crystal display (LCD) is a flat panel display that generates images using liquid crystals. LCDs are widely utilized in various industrial applications, such as instrumentation and control panels, medical equipment, automobile displays, and many more. High brightness, a thin profile, and low power consumption are all characteristics of LCDs. They can be used in applications where numerous users must view the display simultaneously because they also have a broad viewing angle. These displays provide more dependability, toughness, and versatility in extreme environments.

The e-paper segment is projected to grow significantly over the forecast period. Electronic paper, often known as an e-ink or an e-paper display, is a display technology that resembles the look of ink on paper. E-readers, electronic shelf labels, and digital signage are just a few examples of industrial applications that frequently use e-paper displays. These displays are renowned for their great contrast, low power usage, and sunlight readability. E-paper displays have several benefits, one of which is their low power consumption, enabling them to run for extended periods on a single battery charge. They are appropriate for applications where battery life and power conservation are important considerations because they also offer a broad viewing angle and can retain an image without electricity. E-paper comes in various sizes and shapes, and it can also be flexible or even translucent, opening up new creative opportunities.

Panel Size Insights

The 14" - 21" segment held the largest revenue share in 2024. This category includes displays with a diagonal screen size between 14 and 21 inches. They are commonly used in industrial applications such as human-machine interfaces, point-of-sale systems, and kiosks. Rising demand for handheld devices, tablets, and touch screens with rugged capabilities has propelled the demand for the 14”-21” segment. Moreover, the 14”-21” panel size is ideal for daily industrial operations and factory applications and generally includes TFT, LCD, or plasma technologies. These displays are designed to protect computers and screens from physical impact, dust, grease, oil, water splashes, metal shavings and filings, and theft.

The 21" - 40" segment is projected to grow significantly over the forecast period. This category includes displays with a diagonal screen size between 21 and 40 inches. They are commonly used in industrial applications such as factory automation, digital signage, and control rooms. The demand for touch screen computer equipment in heavy-duty work environments is expected to propel the 21"-40" segment. The monitors and touch screen panels include anodized coatings with stainless-steel chassis and are designed to offer operators better durability and operation across wide temperature ranges. The tablets and monitors are built with multiple input and output options and advanced touch screen configurations.

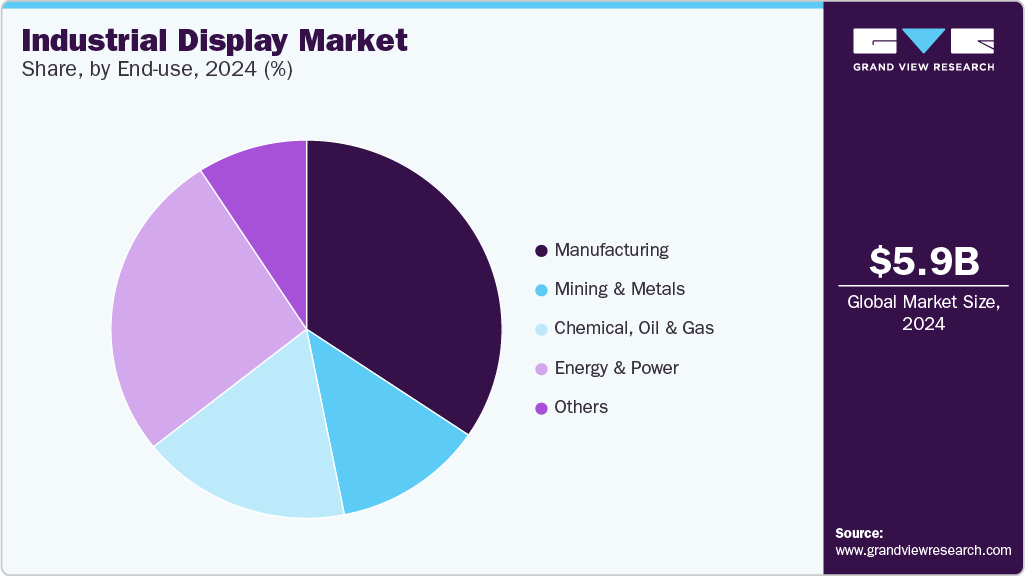

End-use Insights

The manufacturing segment held the largest revenue share in 2024. It provides industrial displays to show real-time statistics on production rates, machine status, and quality control information. In addition, they can manage automated equipment like robotics and production lines. Industrial displays can also be used in production for communication, safety, and employee training. They can provide safety instructions, training videos, and other pertinent data to assist staff in performing their duties more proficiently and safely.

The energy & power segment is projected to grow significantly over the forecast period. Industrial displays show real-time statistics on energy use and production, including electrical output, temperature, and pressure. They can also be used to operate and keep an eye on automated equipment, like power distribution systems, turbines, and generators. Industrial displays can be utilized in the energy and power sector for safety, communication, process management, and monitoring. To assist workers to stay safe in potentially dangerous energy and power conditions, they can display safety regulations, emergency procedures, and other crucial information.

Regional Insights

North America industrial display industry held a significant share in 2024, driven by rising demand for automation, IoT integration, and advanced human-machine interfaces (HMIs) across sectors like manufacturing and oil & gas. The push for remote monitoring, increased use of digital signage, and regional manufacturing capabilities are further boosting market growth. Technological innovations, including LED-backlit LCDs, are also enhancing product appeal and adoption. There is a wide demand for industrial displays in the U.S. and Canada in this region. Furthermore, the rising preference for using industrial displays can be attributed to rising automation, the increasing demand for safer and more effective workplaces, and rising expenditures on cutting-edge technology. Due to the growing adoption of automation and improved driver assistance systems, the demand for rugged and dependable displays is anticipated to increase, notably in the automotive and transportation sectors.

U.S. Industrial Display Market trends

The industrial display industry in the U.S. is experiencing rapid growth, driven by the rise of automation, smart manufacturing, and the need for durable, high-performance displays across key industries. Demand is fueled by the integration of Industrial IoT for real-time data visualization, increasing use of touchscreen interfaces, and ongoing technological advancements. Industries such as manufacturing, healthcare, and logistics are key contributors to this expansion.

Europe Industrial Display Market Trends

The industrial display industry in Europe is experiencing fast growth, driven by the adoption of Industry 4.0, IoT, and digital transformation across sectors like manufacturing, energy, and healthcare. Demand is rising for rugged, high-resolution displays capable of real-time data visualization and integration with smart factory systems. Key trends include the use of touchscreen interfaces, 4K displays, and panel-mount designs that ensure durability and reliable performance in harsh environments.

Asia Pacific Industrial Display Market Trends

The Industrial display market in Asia Pacific is undergoing significant growth,driven by the fact that Asia Pacific is home to some of the biggest and fastest-growing economies in the world, including China, Japan, and India. China is the largest market for industrial displays in the Asia Pacific due to the rising need for automation and digitalization across various industries, including manufacturing, healthcare, and the automobile industry. Japan also witnesses significant growth in the market due to the demand for high-quality displays in the automobile industry and other application areas.

Key Industrial Display Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

Key Industrial Display Companies:

The following are the leading companies in the industrial display market. These companies collectively hold the largest market share and dictate industry trends

- SAMSUNG DISPLAY

- LG Electronics India Limited

- AUO Corporation

- Innolux Corporation

- SHARP CORPORATION

- HannStar.

- BOE Technology Group Co., Ltd.

- TCL

- UNIVERSAL DISPLAY 2022

- Maple Systems Inc.

Recent Developments

-

In April 2025, AUO introduced its latest display innovations, including the Smart Cockpit 2025 featuring Micro LED technology that delivers transparency, scalability, and flexibility for next-gen automotive HMI systems. The company also showcased energy-saving Field Sequential Color LCDs and a 16-inch Security Protection Display with an invisible watermark for enhanced data security in public environments. In collaboration with its subsidiary BHTC, AUO presented advanced Haptifold Displays with foldable, force-sensitive features and high-brightness Holographic Head-Up Displays, emphasizing its vision for smart, sustainable, and secure display technologies shaping the future of mobility and user interaction.

-

In February 2025, Samsung Display and Intel have entered into a Memorandum of Understanding (MoU) to jointly develop next-generation IT display solutions, reshape for Intel’s cutting-edge processors, focusing on high-performance AI PCs and premium laptops. The collaboration merges Samsung’s OLED expertise with Intel’s system-on-a-chip technology to boost visual quality and energy efficiency. Both companies also plan to co-promote their innovations at major global events, including the AI Media Art Exhibition in Korea, aiming to drive advancement in the evolving AI PC market.

Industrial Display Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6,252.1 million

Revenue forecast in 2030

USD 8,656.3 million

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, panel size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

SAMSUNG DISPLAY; LG Electronics India Limited; AUO Corporation; Innolux Corporation; SHARP CORPORATION; HannStar.; BOE Technology Group Co., Ltd.; TCL; UNIVERSAL DISPLAY 2022; Maple Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Display Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial display market report based on type, application, technology, panel size, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rugged Displays

-

Open Frame Monitors

-

Panel-Mount Monitors

-

Marine Displays

-

Video Walls

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

HMI

-

Remote Monitoring

-

Interactive Display

-

Digital Signage

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LCD

-

LED

-

OLED

-

E-paper

-

-

Panel Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 14"

-

14"-21"

-

21"-40"

-

40" and Above

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Mining & Metals

-

Chemical, oil & gas

-

Energy & power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Others

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Others

-

-

Latin America

-

Brazil

-

Others

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial display market size was projected at USD 5,901.1 million in 2024 and is expected to reach USD 6,252.1 million in 2024.

b. The global industrial display market is anticipated to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 8,656.3 million by 2030.

b. Asia Pacific dominated the industrial display market with a share of 37.03% in 2024. This is attributable to increased investments in IIoT applications and multi-featured HMI devices.

b. Some key players operating in the industrial display market include Samsung Display, LG Display Co., Ltd., Japan Display, Inc., Advantech Co., Ltd., and Innolux Corporation.

b. Key factors that are driving the industrial display market growth include increasing adoption of the Industrial Internet of Things (IIoT), rising demand for multi-featured Human Machine Interface (HMI) devices, and growing adoption of smart industrial displays.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.