- Home

- »

- Next Generation Technologies

- »

-

Industrial Edge Market Size & Share, Industry Report, 2030GVR Report cover

![Industrial Edge Market Size, Share & Trends Report]()

Industrial Edge Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment Mode (On-premise, Cloud-based), By Organization Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-570-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Edge Market Summary

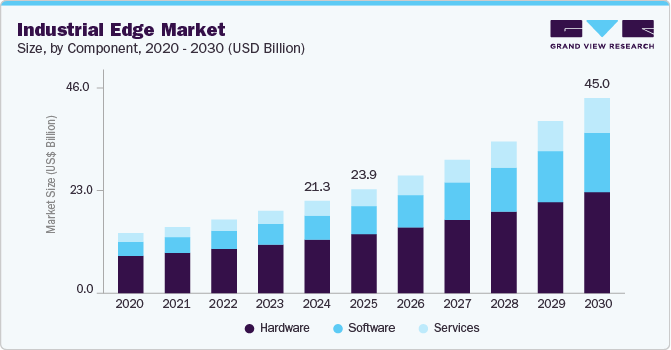

The global industrial edge market size was valued at USD 21.29 billion in 2024 and is projected to reach USD 45.03 billion by 2030, growing at a CAGR of 13.4% from 2025 to 2030. The market growth is primarily driven by the increasing demand for real-time data processing and low-latency decision-making in industrial environments.

Key Market Trends & Insights

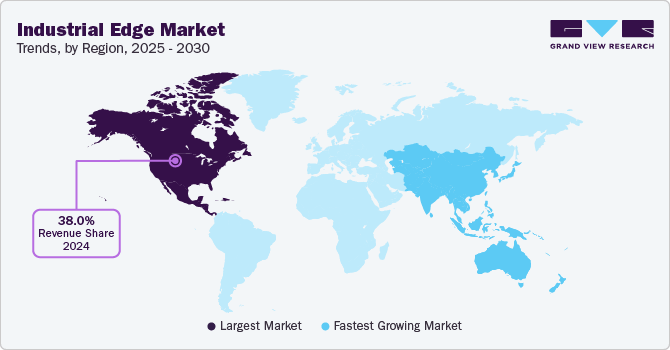

- The North America industrial edge market accounted for the largest share of over 38% in 2024.

- The U.S. industrial edge industry accounted for the largest revenue share of 71% in 2024.

- By component, the hardware segment dominated the market with a share of over 58% in 2024.

- By organization size, the large enterprises segment accounted for the largest market share in 2024.

- By application, the real-time monitoring and control segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.29 Billion

- 2030 Projected Market Size: USD 45.03 Billion

- CAGR (2025-2030): 13.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing emphasis on operational efficiency, predictive maintenance, and equipment automation is encouraging industries to deploy intelligent edge platforms. The shift toward decentralized infrastructure to improve security, reduce bandwidth costs, and enable faster response times is also contributing to the market's expansion. Additionally, the integration of advanced technologies such as AI, machine learning, and 5G connectivity into industrial operations is accelerating the adoption of industrial edge solutions across sectors, which is expected to drive the industrial edge industry expansion.

The rapid evolution of 5G and high-speed connectivity is revolutionizing industrial operations, enabling faster and more reliable data transfer between edge devices and central systems. Industrial edge solutions are capitalizing on these advancements to deliver real-time analytics, minimize latency, and support time-sensitive industrial applications. With enhanced bandwidth and reduced network congestion, 5G is empowering edge computing to support autonomous systems, robotics, and remote monitoring. This enhanced connectivity is significantly boosting the responsiveness and effectiveness of industrial edge.

Additionally, the growing focus on cybersecurity and data sovereignty is shaping the adoption of industrial edge solutions, as industries strive to protect sensitive data while complying with local data regulations. Industrial edge computing offers localized data processing, which limits exposure to external threats and reduces reliance on centralized cloud infrastructure. This decentralized approach enhances control over data flow and security protocols, making it highly attractive for critical sectors such as manufacturing, energy, and defense. As concerns over cyber threats and regulatory compliance intensify, the demand for secure industrial edge systems continues to rise, thereby driving market growth.

Environmental sustainability and energy efficiency are becoming vital considerations in industrial operations, fueling the adoption of industrial edge technologies. Edge computing reduces energy consumption by minimizing data transfer to centralized data centers, thus lowering the overall carbon footprint. Industrial edge devices also enable real-time energy monitoring and optimization, contributing to more sustainable and responsible manufacturing practices. As industries increasingly align their goals with environmental standards and green regulations, the integration of energy-efficient edge solutions is accelerating, thereby boosting the industrial edge industry growth.

The rise of decentralized and smart manufacturing ecosystems is significantly driving the adoption of industrial edge infrastructure. Industrial edge is evolving to support modular and distributed factory environments by enabling localized processing, real-time performance monitoring, and seamless machine-to-machine communication. This trend reflects the shift toward intelligent, flexible, and autonomous production lines and is accelerating the growth of the industrial edge market.

Component Insights

The hardware segment dominated the market with a share of over 58% in 2024, owing to the increasing need for high-performance edge devices capable of processing data locally in real time. These hardware components are essential for enabling low-latency processing, ensuring data security at the source, and supporting autonomous decision making. With the growing emphasis on Industry 4.0 and the integration of AI and IoT at the edge, the hardware segment continues to lead the market, offering scalable and robust solutions critical for next-generation industrial applications, thereby solidifying the dominance of this segment.

The software segment is expected to witness the fastest CAGR of over 16% from 2025 to 2030. This growth is fueled by the rising adoption of edge-based applications for real time control, predictive analytics, and remote asset management across sectors like manufacturing, energy, and logistics. As industrial environments become more complex, businesses are turning to advanced edge software to streamline operations, enhance system responsiveness, and reduce latency. The growing demand for interoperable and customizable edge platforms is also driving software innovation to support multi-vendor ecosystems and device compatibility. Additionally, the increasing emphasis on cybersecurity at the edge is prompting investment in robust software solutions that can secure distributed assets and maintain compliance in critical industrial operations.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024, driven by their substantial investments in digital transformation, automation, and edge computing infrastructure. These organizations often operate complex manufacturing and operational environments that demand real-time data processing, enhanced cybersecurity, and system-wide connectivity. Large enterprises are more likely to deploy industrial edge solutions to improve operational efficiency, reduce latency, and enable predictive maintenance across globally distributed facilities. Their strong financial capacity and strategic focus on integrating emerging technologies allow them to adopt advanced edge platforms at scale, thus contributing to the dominance of the large enterprises segment in the market.

The small & medium enterprise (SME’s) segment is expected to witness the fastest CAGR from 2025 to 2030. As SMEs strive to modernize operations and compete with larger corporations, they are increasingly adopting industrial edge solutions to gain real time insights, improve efficiency, and reduce latency in decision making. The proliferation of plug-and-play edge devices, along with simplified integration options, makes it easier for SMEs to deploy edge solutions tailored to their operational needs. Moreover, supportive government policies and digital transformation incentives are further encouraging SMEs to invest in industrial edge technologies, driving rapid adoption within this segment.

Application Insights

The real-time monitoring and control segment accounted for the largest market share in 2024, driven by the growing need for immediate data processing and decision making across industrial environments. This segment enables edge devices to process critical data at the source, reducing latency and ensuring instant responses to system changes. The rise of smart factories, predictive maintenance, and autonomous operations further amplifies the demand for real-time edge computing capabilities. Moreover, the push for greater agility and resilience in supply chains and production lines has made real-time control systems a cornerstone of digital transformation strategies, propelling segmental growth in the industrial edge market.

The automation and robotics segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the increasing demand for more intelligent, autonomous, and efficient robotic systems in industrial applications. Industrial Edge solutions empower robots with faster decision-making capabilities, enabling them to perform complex tasks like real-time quality control, adaptive manufacturing, and autonomous material handling. The rise in demand for flexible, scalable automation solutions to meet evolving production needs and the shift toward reducing human intervention in dangerous or high-precision tasks are key factors fueling this growth in the automation and robotics segment.

End-use Insights

The manufacturing segment accounted for the largest market share in 2024, driven by the increasing demand for real-time data processing and the need for enhanced automation. As manufacturers adopt smart factory solutions and embrace Industry 4.0, industrial edge technologies allow for faster, localized decision-making at the machine level, reducing latency and optimizing production efficiency. Manufacturers respond more quickly to market demands, optimize supply chains, and ensure the agility needed in a rapidly evolving market. As a result, the manufacturing sector is experiencing significant growth in the adoption of industrial edge.

The healthcare segment accounted for the highest CAGR from 2025 to 2030. The adoption of industrial edge solutions in healthcare enables faster analysis of patient data, remote monitoring, and predictive analytics at the point of care. Edge computing helps reduce latency and enhances the accuracy of diagnoses by processing sensitive health data locally, thereby improving patient outcomes. Additionally, the integration of AI and IoT technologies in healthcare devices and systems at the edge is empowering healthcare providers to offer more personalized treatments, improve operational efficiency, and enhance the overall quality of care. As the demand for faster, more secure, and scalable healthcare solutions grows, the market in the healthcare segment is expanding rapidly.

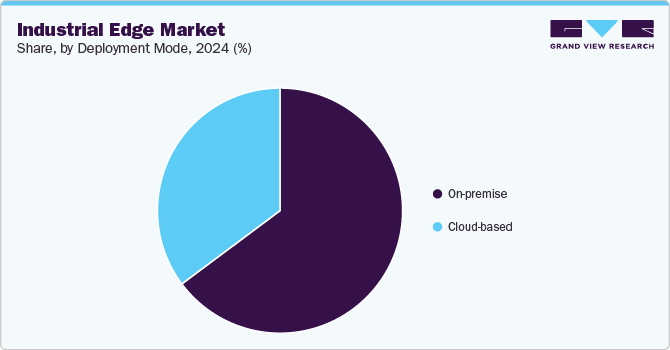

Deployment Mode Insights

The on-premises segment dominated the market in 2024, owing to the growing need for real-time data processing, enhanced data security, and low latency performance in industrial operations. As industries adopt Industry 4.0 technologies, the reliance on edge computing infrastructure deployed directly on the factory floor or within localized facilities has increased significantly. On-premises deployment enables greater control over sensitive data, reduces dependency on constant internet connectivity, and ensures rapid response times for mission-critical applications. This operational reliability and control are solidifying the on-premises segment’s dominance within the industrial edge industry.

The cloud-based segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the increasing need for scalable, flexible, and cost-efficient edge solutions that can be deployed across diverse industrial environments. Cloud-based edge deployments enable seamless data integration, remote monitoring, and real-time analytics, making them ideal for industries such as manufacturing, energy, and transportation. Additionally, the integration of AI, IoT, and machine learning technologies in cloud platforms allows for enhanced decision making, predictive maintenance, and improved asset performance. As companies prioritize digital transformation and operational efficiency, the adoption of cloud-based industrial edge solutions continues to accelerate the market growth.

Regional Insights

The North America industrial edge market accounted for the largest share of over 38% in 2024, primarily driven by the strong emphasis on advanced manufacturing technologies and digital infrastructure. The presence of leading technology firms and industrial automation players in the U.S. and Canada is accelerating the adoption of edge computing across sectors such as automotive, aerospace, energy, and healthcare. Growing investments in smart factories, real-time data processing, and Industry 4.0 initiatives are fueling demand for localized, low-latency computing solutions. Additionally, favorable government policies supporting innovation and cybersecurity standards are further contributing to the expansion of the regional market.

U.S. Industrial Edge Market Trends

The U.S. industrial edge industry accounted for the largest revenue share of 71% in 2024, driven by the rising emphasis on data security, regulatory compliance, and real-time operational control. Industrial edge in the U.S. is evolving as businesses prioritize localized data processing to reduce latency, enhance cybersecurity, and meet sector-specific compliance standards. The growing integration of edge computing in critical industries such as healthcare, energy, and manufacturing is fueling demand for secure and responsive edge solutions. This increased focus on data governance and operational resilience is accelerating the market growth.

Europe Industrial Edge Market Trends

Europe industrial edge industry is expected to grow at a CAGR of over 12% from 2025 to 2030. In Europe, the industrial edge services market is being propelled by increasing investments in digital infrastructure and government-backed initiatives aimed at strengthening technological sovereignty. Additionally, the rising demand for real-time analytics and low-latency solutions in sectors like energy, logistics, and pharmaceuticals is accelerating the adoption of industrial edge technologies across the region.

The UK industrial edge market is expected to grow at a significant rate in the coming years. Industrial Edge is evolving to support the U.K.'s strategic initiatives in areas such as smart infrastructure, energy transition, and advanced manufacturing. This trend reflects the country’s push for resilient and technology-driven industrial ecosystems, supported by government-backed programs, 5G expansion, and growing investments in AI and IoT. These developments are accelerating the adoption of industrial edge solutions and fueling market growth.

The growth of the industrial edge market in Germany is fueled by the country’s leadership in Industry 4.0 and its commitment to smart factory initiatives. Industrial Edge is evolving in Germany to support highly automated and data-driven manufacturing processes, enabling real-time analytics, predictive maintenance, and seamless equipment integration. This trend reflects the nation’s push toward digital transformation in manufacturing and is significantly accelerating the growth of Germany industrial edge industry.

Asia Pacific Industrial Edge Market Trends

Asia Pacific industrial edge industry is expected to grow at the fastest CAGR of over 18% from 2025 to 2030, driven by expanding smart city initiatives, rising investments in 5G infrastructure, and increasing adoption of Industry 4.0 practices across manufacturing hubs. Government-led digital transformation programs and strong public-private partnerships are creating favorable conditions for edge technology deployment. This regional push toward technological modernization and digital infrastructure is significantly propelling the market growth.

The Japan industrial edge services market is gaining traction, fueled by the country’s focus on advanced robotics and automation in manufacturing. With robotics being pivotal in sectors like automotive manufacturing and precision engineering, the demand for low-latency edge computing solutions is on the rise. Additionally, Japan’s strong emphasis on high-quality product standards and continuous innovation is pushing companies to adopt cutting-edge industrial edge services to maintain a competitive advantage. These factors combined are contributing to the rapid growth of the market in Japan.

The industrial edge services market in China is rapidly expanding. Investments in advanced manufacturing technologies are driving the adoption of industrial edge solutions for enhanced automation and real-time decision making. The government's development of 5G networks is enabling faster, more reliable communication and accelerating edge computing use. Additionally, China's focus on sustainability and energy efficiency in manufacturing pushes demand for edge technologies to optimize resource usage.

Key Industrial Edge Company Insights

Some of the key players operating in the market include Amazon Web Services, Inc. and NVIDIA Corporation.

-

Amazon Web Services, Inc. (AWS) is a cloud computing subsidiary of Amazon.com, Inc., providing scalable infrastructure and platform services that play a critical role in enabling industrial edge applications. AWS offers a robust edge computing portfolio, including AWS IoT Greengrass and AWS Snow Family, which allow industries to deploy AI, machine learning, and analytics at the edge for real-time data processing. By facilitating low-latency operations, localized computing, and seamless integration with cloud environments, AWS supports digital transformation in sectors such as manufacturing, energy, and logistics. The company's expansive cloud ecosystem, global reach, and strong edge capabilities make it a significant player in the industrial edge services market.

-

NVIDIA Corporation is a global technology company specializing in graphics processing units (GPUs), AI computing, and edge computing solutions. In the industrial edge services market, NVIDIA provides powerful edge AI platforms like NVIDIA Jetson and NVIDIA EGX, enabling real-time processing and inference at the edge for industrial applications such as predictive maintenance, robotics, and quality inspection. The company’s focus on accelerated computing, combined with its strong partnerships with industrial automation and software providers, positions it at the forefront of enabling smart factories and autonomous systems.

Advantech Co., Ltd. and Kontron AG are some of the emerging participants in the industrial edge market.

-

Advantech Co., Ltd. is a provider of industrial IoT and embedded computing solutions, specializing in edge computing platforms for intelligent manufacturing and automation. The company delivers a wide range of Industrial Edge solutions, including edge servers, IoT gateways, and AI-enabled devices that facilitate real-time data processing, machine control, and predictive analytics. Advantech's focus on smart factory integration, 5G connectivity, and modular system design enables industries to enhance efficiency, reduce latency, and improve operational visibility.

-

Kontron AG is a provider of embedded computing technology and Industrial Edge solutions tailored for sectors such as manufacturing, transportation, and energy. The company offers rugged edge devices, scalable edge servers, and intelligent control systems designed to operate in harsh industrial environments. With a strong focus on cybersecurity, open standards, and long-term system reliability, Kontron is helping enterprises digitize their operations while optimizing performance and compliance in edge-enabled infrastructures.

Key Industrial Edge Companies:

The following are the leading companies in the industrial edge market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Google LLC

- NVIDIA Corporation

- Siemens AG

- Rockwell Automation

- Hewlett-Packard Enterprise Development LP

- Intel Corporation

- International Business Machines Corporation (IBM)

- ZEDEDA

- Advantech Co., Ltd.

- Kontron AG

Recent Developments

-

In April 2025, Rockwell Automation announced a strategic collaboration with Amazon Web Services (AWS) to accelerate the transformation of manufacturing through advanced industrial automation solutions. This partnership directly enhances the Industrial Edge market by integrating edge computing with cloud technologies, enabling real-time data processing and operational efficiency. By combining Rockwell’s expertise in automation with AWS's cloud services, the initiative is designed to optimize manufacturing processes, support autonomous operations, and improve scalability, aligning with the growing demand for edge-driven innovation in the industrial sector.

-

In March 2025, NVIDIA introduces AI query agents that utilize NVIDIA’s computing, networking, and software capabilities to enable rapid and accurate responses to complex queries. By integrating AI technologies at the edge of storage systems, this advancement enhances industrial edge services by optimizing real-time data processing, enabling faster decision-making, and supporting more efficient, intelligent systems in industrial environments.

-

In March 2025, ZEDEDA announced enhancements to its enterprise edge AI capabilities through improved integrations with NVIDIA technologies. This development aims to streamline the deployment and management of edge computing solutions, catering to the growing demand for real-time data processing in industrial applications.

Industrial Edge Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.97 billion

Revenue forecast in 2030

USD 45.03 billion

Growth rate

CAGR of 13.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization size, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Amazon Web Services, Inc.; Google LLC; NVIDIA Corporation; Siemens AG; Rockwell Automation; Hewlett Packard Enterprise Development LP; Intel Corporation; International Business Machines Corporation (IBM); ZEDEDA; Advantech Co., Ltd.; Kontron AG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Edge Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial edge market report based on component, deployment mode, organization size, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Predictive Maintenance

-

Real-Time Monitoring and Control

-

Asset Tracking and Management

-

Remote Monitoring and Management

-

Automation and Robotics

-

Quality Control and Inspection

-

Process Optimization

-

Security and Compliance

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Energy & Utilities

-

Transportation & Logistics

-

Healthcare

-

Oil & Gas

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The North America industrial edge market accounted for the largest share of over 38% in 2024, primarily driven by strong emphasis on advanced manufacturing technologies and digital infrastructure. The presence of leading technology firms and industrial automation players in the U.S. and Canada is accelerating the adoption of edge computing across sectors such as automotive, aerospace, energy, and healthcare

b. Some key players operating in the industrial edge market include Amazon Web Services, Inc.; Google LLC; NVIDIA Corporation; Siemens AG; Rockwell Automation; Hewlett Packard Enterprise Development LP; Intel Corporation; International Business Machines Corporation (IBM); ZEDEDA; Advantech Co., Ltd.; Kontron AG

b. The key factors driving the industrial edge market include increasing demand for real-time data processing and low-latency decision-making in industrial environments, the integration of advanced technologies such as AI, machine learning, and 5G connectivity, and the growing focus on cybersecurity and data sovereignty.

b. The global industrial edge market size was estimated at USD 21.29 billion in 2024 and is expected to reach USD 23.97 billion in 2025.

b. The global industrial edge market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2030 to reach USD 45.03 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.