- Home

- »

- Next Generation Technologies

- »

-

Industrial Engine Market Size & Share, Industry Report, 2030GVR Report cover

![Industrial Engine Market Size, Share & Trends Report]()

Industrial Engine Market (2025 - 2030) Size, Share & Trends Analysis Report By Horsepower (201 - 500 HP, 501 - 1000 HP, Above 1000 HP), By Application (Power Generation, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Engine Market Summary

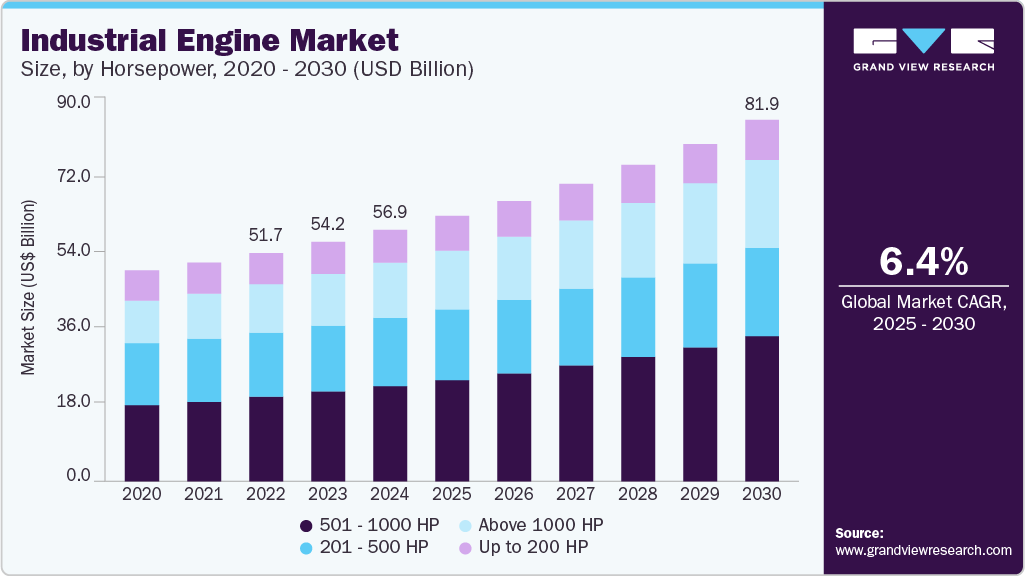

The global industrial engine market size was estimated at USD 56,954.4 million in 2024 and is projected to reach USD 81,880.7 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The rising demand for heavy-duty engines in construction, mining, agriculture, and marine sectors primarily drives market growth.

Key Market Trends & Insights

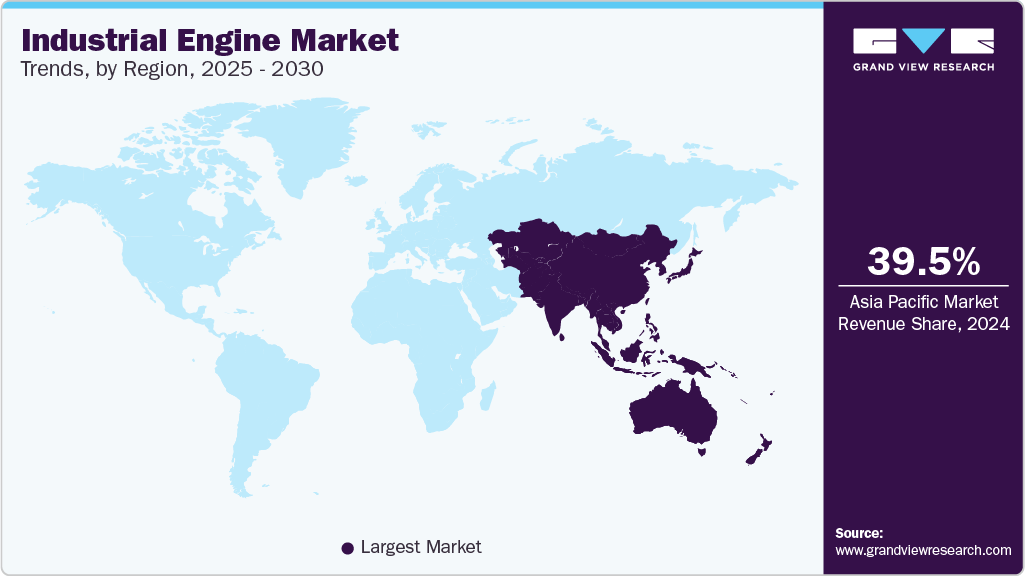

- Asia Pacific industrial engine market accounted for the largest share of over 39.54% in 2024.

- The industrial engine market in the U.S. is expected to grow at a CAGR of over 7% from 2025 to 2030.

- By horsepower, the 501 - 1000 HP segment dominated the market with a revenue share of over 37% in 2024.

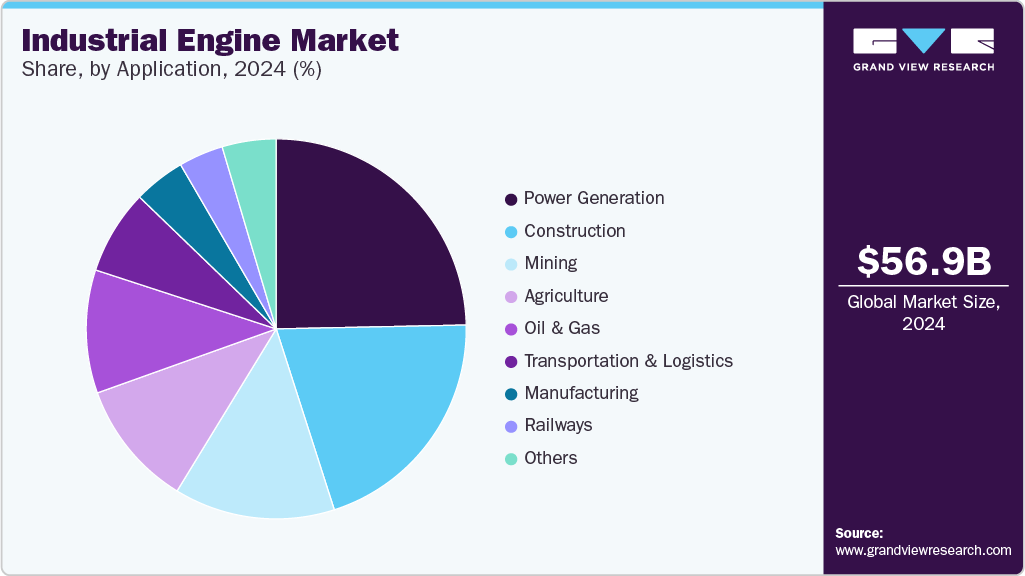

- By application, the power generation segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56,954.4 Million

- 2030 Projected Market Size: USD 81,880.7 Million

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

Infrastructure development accelerates globally, and in emerging economies, there is an increasing need for robust and efficient engines capable of delivering high performance in demanding environments. The growing focus on fuel efficiency and compliance with stringent emission regulations pushes manufacturers to innovate in engine design and integrate cleaner technologies.Adopting hybrid and alternative fuel-based engines is gaining momentum, further contributing to market growth. The increasing focus on energy efficiency and emissions reduction significantly influences the market, as governments and regulatory bodies globally tighten emissions standards. Manufacturers are investing in advanced combustion technologies, hybrid systems, and alternative fuel engines to meet these evolving regulations. This shift is encouraging innovation and pushing the development of next-generation engines that are cleaner and more efficient, thus driving growth in the industrial engine industry.

In addition, the marine and shipping industries are contributing to market growth. The increasing global trade and movement of goods by sea are driving demand for powerful, fuel-efficient marine engines. Stricter environmental regulations in the maritime sector are pushing the adoption of cleaner and more technologically advanced engine solutions, further fueling the industrial engine industry.

Furthermore, the mining industry’s growth and rising adoption of autonomous and heavy-duty machinery drive demand for industrial engines. These engines are critical in powering haul trucks, loaders, and drilling rigs, especially in remote or rugged terrains. Global demand for minerals and metals increases, and engine manufacturers are innovating to offer durable, high-performance engines tailored for mining applications, thereby supporting overall market growth.

Moreover, the need for modern agriculture increasingly relies on mechanization to boost productivity and efficiency, and the use of tractors, harvesters, and other farming equipment powered by industrial engines is growing. This trend is particularly strong in emerging markets where governments promote agricultural modernization, thus contributing to market expansion.

Horsepower Insights

The 501 - 1000 HP segment dominated the market with a revenue share of over 37% in 2024, driven by its widespread use in heavy-duty industrial applications such as mining, construction, and large-scale agriculture. This horsepower range offers an ideal balance of power, durability, and fuel efficiency, making it well-suited for operations that require continuous and reliable performance. The segment also gained momentum due to infrastructure expansion in developing regions and rising demand for high-capacity equipment. Moreover, manufacturers are increasingly introducing engines in this category that comply with stringent emission standards, further enhancing their adoption. These factors collectively contributed to the segment’s strong market position and continued preference across various industrial sectors.

The Above 1000 HP segment is expected to witness the highest CAGR of over 8% from 2025 to 2030. This growth is fueled by the increasing adoption of high-range industrial engines in sectors such as marine, oil & gas, and large-scale material handling, where high torque and reliability are essential. The segment benefits from a surge in demand for engines supporting hybrid power systems, enabling better energy efficiency and environmental compliance. The growth of rental equipment markets, particularly in developing regions, drives demand for versatile, medium-horsepower engines that offer ease of maintenance and adaptability across multiple applications. Advancements in engine cooling systems, electronic control units (ECUs), and extended service intervals are also contributing to the growing preference for this segment.

Application Insights

The power generation segment accounted for the largest market share in 2024, owing to the increasing demand for reliable and efficient power solutions across diverse industries and remote infrastructures. The increasing adoption of backup and prime power systems in manufacturing plants, data centers, hospitals, and construction sites drives demand for robust industrial engines. Growing investments in renewable energy integration and hybrid power systems have led to a surge in demand for engines that can complement intermittent power sources. These trends, coupled with the need for energy security and the expansion of off-grid energy projects in developing regions, are thereby fueling the dominance of the power generation segment in the industrial engine industry.

The oil & gas segment is expected to witness the highest CAGR from 2025 to 2030. The increasing demand for robust, high-performance engines in offshore and remote drilling operations drives the need for reliable industrial power solutions. As exploration activities expand into harsher environments, the industry is turning to advanced engines that offer durability, fuel efficiency, and compliance with strict emission standards. Rising investments in oil & gas infrastructure and a global push for energy security and operational efficiency are further propelling this segment's rapid expansion.

Regional Insights

North America accounted for the significant market share of over 27% in 2024, primarily driven by the region’s strong presence of manufacturing and construction industries, coupled with significant investments in infrastructure modernization and energy projects. The demand for high-performance, fuel-efficient industrial engines is rising due to stringent emission regulations and the push for sustainability. The resurgence of the oil & gas sector and ongoing technological advancements in engine design and hybrid powertrains are further accelerating the adoption of the industrial engine industry.

U.S. Industrial Engine Market Trends

The industrial engine market in the U.S. is expected to grow at a CAGR of over 7% from 2025 to 2030, driven by the rising automation in agriculture and the increasing use of industrial engines in equipment such as tractors, harvesters, and irrigation pumps. The ongoing expansion of data centers and logistics hubs across the Midwest and Southern states is spurring demand for backup power systems powered by industrial engines. The growth of the defense and aerospace manufacturing sectors, which require robust and reliable engine solutions for auxiliary and ground support equipment, also adds momentum to the industrial engine industry growth.

Europe Industrial Engine Market Trends

The industrial engine market in Europe is expected to grow at a CAGR of over 4% from 2025 to 2030. In Europe, the market is influenced by the region's emphasis on energy efficiency, low emissions, and adherence to Euro VI and Stage V emission standards. The accelerated shift toward hybrid and alternative fuel-powered engines increases as companies strive to reduce their carbon footprint and meet sustainability goals. The region’s investment in decentralized energy systems and the resurgence of manufacturing activity, especially in Eastern and Central Europe, contribute to the increased adoption of versatile and durable industrial engines suited for a wide range of heavy-duty applications.

The UK industrial engine market is expected to grow steadily in the coming years. The country benefits from ongoing infrastructure development and the resurgence of domestic manufacturing activities. The rising demand for backup power solutions in critical sectors such as healthcare, data centers, and utilities is fueling the need for reliable industrial engines.

The industrial engine market in Germany is driven by the country’s robust manufacturing and heavy machinery sectors, which demand high-performance and reliable engine solutions to support operations across construction, mining, and logistics industries. Furthermore, Germany’s strong focus on decarbonization and emissions reduction prompts increased investment in next-generation industrial engines that comply with stringent EU environmental regulations. This push towards cleaner and more energy-efficient engines creates opportunities for technological innovation and the development of hybrid and alternative fuel-powered industrial engines.

Asia Pacific Industrial Engine Market Trends

Asia Pacific industrial engine market accounted for the largest share of over 39.54% in 2024. The industrial engine market in Asia Pacific is expected to grow at the highest CAGR of over 7% from 2025 to 2030, driven by the region’s expanding construction and infrastructure development activities, rising energy demand, and increasing investments in mining and agriculture sectors. The shift towards cleaner energy sources pushes manufacturers to develop fuel-efficient and hybrid engine solutions. The rise of smart manufacturing practices and the adoption of Industry 4.0 technologies also play a crucial role in modernizing industrial equipment, thereby enhancing the market potential for industrial engines in the region.

Japan industrial engine market is gaining traction, fueled by rising demand for low-emission, fuel-efficient industrial engines across various sectors such as construction, agriculture, and marine. The growth of renewable energy projects and the integration of combined heat and power (CHP) systems have fueled the need for advanced industrial engines that can support decentralized power generation. Japan’s vulnerability to natural disasters has also encouraged investment in emergency power systems and disaster-resilient infrastructure, further propelling the industrial engine industry.

The industrial engine market in China is experiencing rapid growth, driven by the country’s ongoing industrialization and focus on technological advancement. China’s emphasis on upgrading manufacturing capabilities, particularly in sectors like automotive, construction, and energy, significantly boosts demand for industrial engines. China’s push for sustainability in manufacturing, focusing on reducing emissions and enhancing energy efficiency, is creating opportunities for developing and adopting environmentally friendly industrial engines.

Key Industrial Engine Company Insights

Some of the key players operating in the market include Caterpillar. and Cummins Inc., among others

-

Caterpillar is a global manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company provides a wide range of industrial engine solutions designed to meet the needs of various sectors such as construction, agriculture, mining, and energy. The company’s commitment to reducing environmental impact through cleaner engine technologies, such as advanced emissions control and fuel efficiency solutions, further strengthens its position as a major player in the market.

-

Cummins Inc. is a global power solutions provider specializing in the design, manufacturing, and distribution of diesel and natural gas engines, as well as power generation systems. A strong emphasis on sustainability and technological advancement, Cummins delivers innovative industrial engines that are highly efficient, durable, and capable of meeting stringent environmental standards. Cummins is also at the forefront of developing alternative fuel engines, such as those powered by natural gas and hydrogen, to support the transition to greener and more sustainable power solutions across global markets.

YANMAR HOLDINGS CO., LTD. and KUBOTA Corporation are some of the emerging market participants.

-

YANMAR HOLDINGS CO., LTD., is a player in the market, specializing in developing and manufacturing high-performance, efficient, and environmentally friendly engines for various industrial applications. The company produces compact diesel engines for agriculture, construction, and power generation industries. Yanmar’s commitment to sustainability drives the development of engines that meet stringent global emission standards, offering advanced fuel-efficient technologies. With a strong emphasis on innovation, Yanmar continues to enhance the performance and reliability of its industrial engines, ensuring they meet the diverse needs of industries worldwide.

-

Kubota Corporation produces industrial engines, primarily for agricultural machinery, construction equipment, and other off-road applications. The company is renowned for its durable and fuel-efficient engines, which power a wide range of heavy-duty equipment. Kubota focuses on developing compact and high-performance engines that provide reliable power while reducing emissions and ensuring compliance with international environmental standards. Kubota’s engines are recognized for their superior quality and performance, catering to both emerging and established markets.

Key Industrial Engine Companies:

The following are the leading companies in the industrial engine market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar.

- Cummins Inc.,

- General Electric Company

- Deere & Company.

- AB Volvo Penta

- MAN Energy Solutions

- Honda Motor Co.,

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- YANMAR HOLDINGS CO., LTD.

- KUBOTA Corporation.

Recent Developments

-

In April 2025, Caterpillar Industrial Power Systems showcased a range of optimized, fuel-flexible engines and advanced power technologies at Bauma Munich. The company also introduced its series hybrid powertrain, part of its growing electrification ecosystem, and highlighted ongoing hydrogen engine testing to support future fuel development, showcasing its continued innovation in the industrial engine market.

-

In April 2025, General Electric Company secured multiple engine supply agreements, strengthening its position in the industrial and aerospace engine markets. The company finalized engine commitments with ANA Holdings for LEAP and GEnx engines, Malaysia Aviation Group for LEAP engines, and Korean Air for both GEnx and GE9X engines. These developments reflect GE’s growing influence in high-performance engine technology across both commercial & defense sectors.

-

In April 2025, AB Volvo Penta highlighted its advancements in the industrial engine market at Bauma 2025 by showcasing its battery-electric platform tailored for construction and mining applications. The company emphasized its integrated battery energy storage subsystem (BESS), which complements its lineup of proven combustion engines and purpose-built electric drivelines. This strategic focus on electrification and hybrid power solutions underlines Volvo Penta’s commitment to supporting the energy transition in industrial operations through dependable power systems, connected technologies, and a robust global service network.

Industrial Engine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59,997.1 million

Revenue forecast in 2030

USD 81,880.7 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Horsepower, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Caterpillar.; Cummins Inc.; General Electric Company; Deere & Company.; AB Volvo Penta; MAN Energy Solutions; Honda Motor Co.; MITSUBISHI HEAVY INDUSTRIES, LTD.; YANMAR HOLDINGS CO., LTD.; KUBOTA Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Engine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial engine market report based on horsepower, application, and region:

-

Horsepower Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 200 HP

-

201 - 500 HP

-

501 - 1000 HP

-

Above 1000 HP

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Construction

-

Mining

-

Agriculture

-

Railways

-

Oil & Gas

-

Transportation & Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial engine market size was estimated at USD 56,954.4 million in 2024 and is expected to reach USD 59,997.1 million in 2025.

b. The global industrial engine market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 81,880.7 million by 2030.

b. The Asia Pacific industrial engine market is expected to grow at the highest CAGR of over 7% from 2025 to 2030, driven by the region’s expanding construction and infrastructure development activities, rising energy demand, and increasing investments in mining and agriculture sectors

b. Some key players operating in the industrial engine market include Caterpillar.; Cummins Inc.; General Electric Company; Deere & Company.; AB Volvo Penta; MAN Energy Solutions; Honda Motor Co.; MITSUBISHI HEAVY INDUSTRIES, LTD.; YANMAR HOLDINGS CO., LTD.; KUBOTA Corporation.

b. The key factors driving the industrial engine market include the increasing demand for heavy machinery across sectors; growth in infrastructure development projects; rising adoption of fuel-efficient and emission-compliant engines; expansion of manufacturing activities in emerging economies; and technological advancements in engine design and performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.