- Home

- »

- Communications Infrastructure

- »

-

Innerduct Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Innerduct Market Size, Share & Trends Report]()

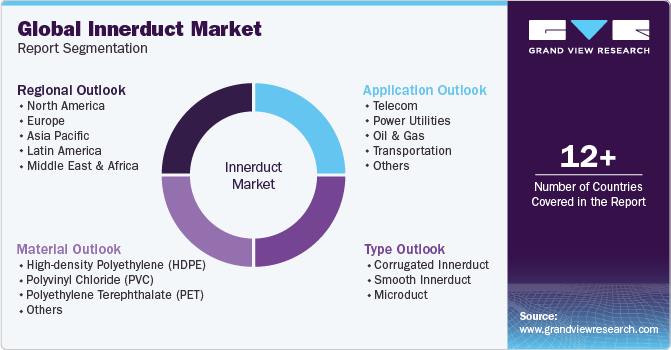

Innerduct Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (High-density Polyethylene (HDPE), Polyvinyl Chloride (PVC)), By Type (Corrugated Innerduct, Smooth Innerduct, Microduct), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-260-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Innerduct Market Size & Trends

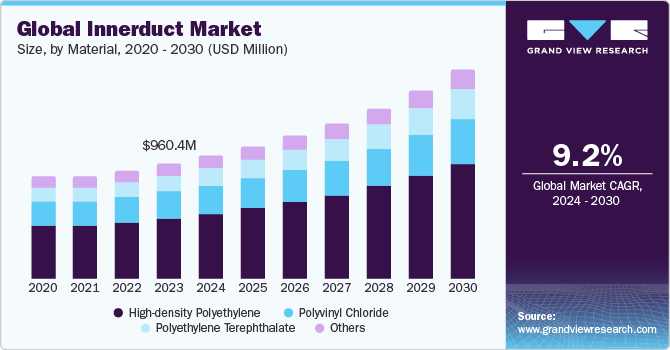

The global innerduct market size was estimated at USD 960.4 million in 2023 and is estimated to grow at a CAGR of 9.2% from 2024 to 2030. The increasing deployment of fiber optic cables for broadband internet, 5G networks, and other high-speed communication services is a major contributor to the growth of innerduct industry. Additionally, the significant growth of smart cities across the globe is attributed to propel the market growth in the coming years.

The continued rollout of telecommunications networks, power transmission networks, and power lines connecting renewable energy projects to power grids is driving the demand for cable protection solutions, such as innerducts. Growing awareness about cable damage stemming from weather hazards, rodent infestation, and physical impact is also driving the demand for innerducts.

Stringent regulations mandating cable protection for specific applications applicable in some regions also bode well for the growth of the market. Fiber network expansion projects are underway in several parts of the world as the rollout of 5G networks continues to gain traction. Operators of these projects are putting a strong emphasis on ensuring the safety of fiber optic cables, thereby driving the adoption of innerducts.

Innerducts provide the necessary shield for the fiber optic cables that form the foundation of internet highways. Additionally, as smart cities aim for resilient infrastructure, buried cables shielded by innerducts can significantly contribute to the transformation of urban areas into technology-centric hubs. As such, the smart city initiatives being pursued in different parts of the world are driving the rollout of massive fiber optic networks and subsequently driving the demand for innerducts.

For instance, Verizon is contemplating a multi-billion-dollar plan to expand its fiber optic network across North America. Such projects bode well for the growth of the innerduct market. Similarly, in July 2022, Verizon partnered with Corning Incorporated to leverage its 5G Edge service for the deployment of a private 5G network using AWS Outposts for data management and analytics. The rollout of 5G networks, particularly utilizing millimeter-wave spectrum, demands robust, high-speed infrastructure to facilitate high-speed data transmission. Innerducts are poised to play a niche role in safeguarding the fiber optic cables transmitting high-speed data.

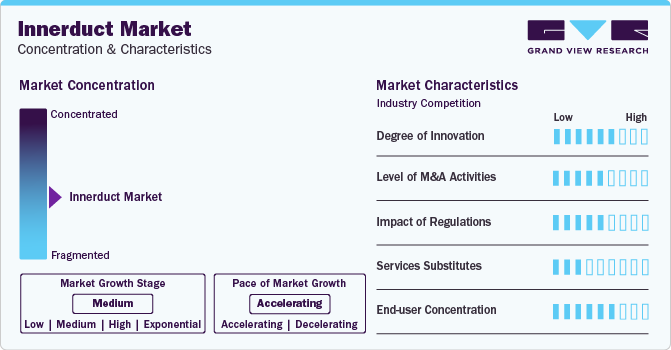

Market Concentration & Characteristics

Innovation in innerduct, the protective conduit used for housing fiber optic cables, lies in advancing its durability, flexibility, and efficiency. Integrating materials with enhanced tensile strength and resistance to environmental factors such as moisture, UV radiation, and temperature fluctuations can significantly prolong the lifespan of innerducts, ensuring the long-term reliability of fiber optic networks.

Significant innovation by key players in this industry is substantially propelling the market expansion. For instance, Antlink has risen as a prominent figure in the Fabric Innerduct manufacturing sector, establishing itself through a steadfast dedication to innovation, excellence, and client contentment. Employing state-of-the-art technology and leveraging strategic production facilities, the company consistently delivers high-quality products to meet the needs of its customers.

The innerduct industry is characterized by a high level of merger and acquisition (M&A) activity. For instance, in August 2022, Atkore announced the purchase of the assets of Elite Polymer Solutions, LLC, a company specializing in the production and distribution of high-density polyethylene (HDPE) conduits and specialized conduits designed for telecommunication, underground, and innerduct applications. The purchase, valued at USD 91.6 million, bolstered Atkore's HDPE conduit product portfolio, broadened its national presence, and helped it effectively meet the rising demand for underground protection within the utility, electrical, and telecom industries.

The market for innerduct faces a high threat from service substitutes. In this market, service substitutes encompass solutions that offer alternative means of protecting and managing fiber optic cables without relying on traditional physical conduits. One notable service substitute is micro-trenching, a technique that involves cutting narrow grooves in roads or pavements and then laying fiber optic cables directly into these trenches. Technologies such as 5G networks and satellite internet offer high-speed connectivity without the infrastructure requirements associated with innerducts. While these service substitutes offer alternatives to traditional innerduct solutions, they may not be suitable for all applications, particularly those requiring physical protection or where wireless connectivity is not feasible.

Innerduct end-user concentration refers to the distribution or clustering of consumers of innerduct products or services within a particular market or geographic area. Innerduct, often used in telecommunications and networking infrastructure, refers to the protective conduit used to house and safeguard fiber optic cables, copper cables, or other types of communication lines. Understanding the distribution of innerduct end-users is crucial for market analysis. Concentration levels can vary significantly from region to region, influenced by factors such as population density, urbanization, industrialization, and the level of technological infrastructure.

Material Insights

The High-Density Polyethylene (HDPE) segment led the market and accounted for 52.51% of the global revenue share in 2023. This is attributable to HDPE’s molecular structure, which shines brighter in applications where moisture resistance and cost-effectiveness are needed, such as the innerduct. HDPE innerducts exhibit outstanding resistance to Ultraviolet (UV) radiation, making it a crucial choice for innerducts used outdoors. This quality acts as a protective shield, preventing deterioration and ensuring that the innerducts perform reliably.

Even with extended exposure to sunlight, HDPE maintains its strength and durability, providing a long-lasting solution for outdoor cable protection. This resistance to UV radiation is a key factor in the overall performance and longevity of HDPE innerducts in outdoor environments. The lightweight nature of HDPE innerducts simplifies their transportation, handling, and installation. Low weight also contributes to overall project efficiency and reduces labor and transportation costs.

The Polyethylene Terephthalate (PET) segment is estimated to grow significantly over the forecast period. PET's resistance to a range of chemicals offers it great protection, particularly in environments prone to corrosive elements. This trait prevents the degradation of the material, helping maintain its integrity over time. Consequently, PET supports the long-term reliability of cable protection systems, ensuring durability and optimal performance in challenging conditions.

PET's recyclability offers the material an eco-friendly characteristic, which supports the sustainability objectives of a variety of applications. Recyclable PET-based innerducts also make for a promising environmentally conscious choice for cable management solutions. This aligns with the growing emphasis on sustainable practices across various industries.

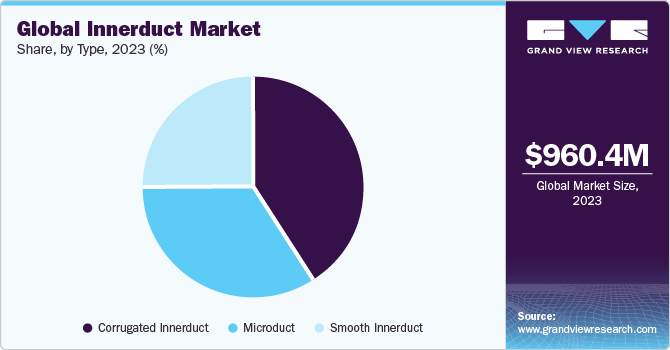

Type Insights

The corrugated innerduct segment accounted for the largest revenue share in 2023. Corrugated innerduct has superior all-weather flexibility. This lightweight innerduct offers maximum flexibility and enables installation in small or restricted areas. Corrugated innerducts are designed with a corrugated or ribbed exterior for added flexibility.

The inherent flexibility of corrugated innerducts enables effortless bending and curving, making them well-suited for applications where the duct must navigate a non-linear path. This characteristic is particularly beneficial in situations where traditional rigid innerducts may be challenging to install. The corrugated construction also enhances the innerduct's ability to withstand external pressures, offering them extra strength and rigidity.

The microduct segment is projected to grow significantly over the forecast period. ModelOps or Microducts offer a scalable solution to cater to the rising requirement for enhanced data capacity, especially in the telecommunications and broadband sectors. The high fiber capacity and adaptability of microducts make them ideal for future network growth.

As data needs increase, microducts allow for the easy addition of more fibers without requiring major infrastructure changes. This adaptability makes microducts a smart and efficient choice for addressing the evolving data capacity demands of a range of applications. The compact design of microducts offers a space-efficient solution ideal for installations with limited space availability. This attribute becomes critical in urban environments or areas where underground conduit space is a premium commodity. For instance, the small footprint of microducts is apt for space optimization in bustling urban settings.

Application Insights

The telecom segment accounted for the largest revenue share in 2023. The growing need for broadband services and high-speed internet has significantly increased the adoption of fiber optic networks globally. Innerducts play a critical role in ensuring the efficient and reliable transmission of data, shielding the cables from environmental factors and physical stresses. Innerducts also offer essential protection and organization for the intricate network of fiber optic cables typical of telecom operations. Consequently, innerducts are important in the smooth operation and longevity of the fiber optic infrastructure of a telecom business.

The oil & gas segment is predicted to foresee significant CAGR during the forecast period. Oil & gas operations often expose communication cables to harsh conditions, including extreme temperatures, moisture, and chemical exposure. Innerducts act as a protective layer, ensuring the protection and prolonged durability of communication cables under such challenging environmental factors.

Fiber optic communication is crucial for real-time monitoring and control in oil & gas facilities. Innerducts provide a protective conduit for fiber optic cables, safeguarding them against harsh environmental conditions, temperature variations, and potential physical damage. The oil & gas industry relies on extensive pipeline networks. Innerducts support the deployment of fiber optics for monitoring and automating pipeline operations, enhancing the efficiency and safety of transportation and distribution systems.

Regional Insights

North America dominated the market with a revenue share of 29.09% share in 2023. This can be attributed to prominent development of fiber optic network infrastructure in the region. Fiber optic cables require protective conduits to preserve their integrity and endurance. The increasing deployment of innerducts in fiber optic cables for broadband internet, 5G networks, and other high-speed communication services in North America are contributing to the regional market growth. Furthermore, considerable initiatives by leading companies are driving market expansion. For instance, in March 2023, CommScope, a network connectivity solutions provider, revealed plans to enhance its fiber-optic cable production. The objective was to expedite the deployment of broadband services across the U.S., fostering connectivity in additional communities and addressing underserved areas.

U.S. Innerduct Market Trends

The innerduct market in the U.S. is expected to grow significantly over the forecast period. The significant investment in semiconductors is augmenting this growth. The U.S. hosts several major semiconductor players, such as Intel and Texas Instruments, boasting a strong presence in the upstream value chain that encompasses core IP, Electronic Design Automation (EDA), and chip design. However, a notable gap, and thus a significant opportunity, lies in semiconductor manufacturing, as fabrication is predominantly outsourced to Eastern nations such as Taiwan, South Korea, and Japan. In response, U.S. policymakers are focusing on narrowing this gap by attracting investments in both semiconductor production and innovation.

Europe Innerduct Market Trends

Clean technology projects and smart city initiatives are augmenting the market expansion in Europe. In December 2023, the European Commission revealed that around USD 71.73 million in funding from the Europe Innovation Fund will be allocated to support small-scale innovative clean technology projects. This investment is intended to help European businesses, particularly small businesses, introduce breakthrough technologies to the market in renewable energy, energy-intensive industries, and energy storage.

The innerduct market in the UK has been actively investing in upgrading its broadband networks with a focus on deploying fiber-optic cables to enhance internet speeds and connectivity. Significant developments in optics cables are propelling the innerduct market in the UK Moreover, several telecommunications companies, such as Openreach, BT, and Virgin Media, are involved in deploying and expanding fiber-optic networks. The developments and innovations in innerduct products are supporting statewide gigabit-capable coverage to increase broadband speed, resilience, and dependability for households and businesses across the UK

The France innerduct market is expected to grow significantly over the forecast period. The increasing number of data centers, driven by the growing demand for cloud services and data storage, contributes to the demand for innerducts. Data centers rely on extensive cabling infrastructure, and innerduct protects these cables.

Asia Pacific Innerduct Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Various government initiatives are propelling the demand for innerducts in Asia Pacific. Further, the development of smart cities and the increasing prevalence of Internet of Things (IoT) are contributing to the demand for innerducts in Asia Pacific. As cities deploy more sensors, cameras, and other IoT devices, the need for robust and secure innerducts to house the necessary cables is increasing.

The China innerduct market is expected to grow significantly over the forecast period. Fiber optic network deployment in China has witnessed major advancements in recent years. An extensive fiber optic infrastructure connects the nation's major cities and regions. Moreover, various initiatives are pursued to expand fiber optic coverage to rural and remote areas, bridge the digital divide, and provide broadband access to underserved communities in China.

Key Innerduct Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2023, Lummus Technology, a process tech giant, collaborated with Texplore to leverage Texplore's advanced EXCENE technology. This collaboration was aimed at enhancing the efficiency, quality, and sustainability of High-Density Polyethylene (HDPE) production, revolutionizing the manufacturing process and minimizing negative environmental impact.

Key Innerduct Companies:

The following are the leading companies in the innerduct market. These companies collectively hold the largest market share and dictate industry trends.

- Corning Incorporated

- Dura-Line

- Endot Industries, LLC

- Equinix, Inc.

- InnerDuct.com

- MaxCell Innerduct

- National Conduit Supply Inc.

- National Pipe and Plastics, Inc

- Premier Conduit

- WL Plastics

Recent Developments

-

In September 2022, Blue Diamond Industries formalized the initiation of its operations in Laurens County. Situated at 877 Torrington Road in Clinton, the newly established facility marks Blue Diamond Industries’ inaugural manufacturing operation on the East Coast. The company's range of conduit solutions, including duct, inner duct, and micro duct products, is intended to meet customer demands, particularly within the rapidly expanding fiber-to-the-home (FTTH) systems market in the U.S.

-

In August 2022, Atkore announced the purchase of the assets of Elite Polymer Solutions, LLC, a company specializing in the production and distribution of high-density polyethylene (HDPE) conduits and specialized conduits designed for telecommunication, underground, and innerduct applications. The purchase, valued at USD 91.6 million, bolstered Atkore's HDPE conduit product portfolio, broadened its national presence, and helped it effectively meet the rising demand for underground protection within the utility, electrical, and telecom industries.

-

In November 2022, Corning Incorporated collaborated with Wesco and Nokia Corporation to enhance broadband deployment in rural and urban areas. The collaboration involved utilizing Corning’s fiber cables, conduits, and innerduct solutions, such as SmartGuide Microducts, Corning Optical Cable, and FlexNAP. These products helped simplify fiber optic cable installation, decrease deployment time, and reduce costs, contributing to the expansion of broadband access in underserved communities.

Innerduct Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.02 billion

Revenue forecast in 2030

USD 1.74 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Corning Incorporated; Dura-Line; Endot Industries, LLC; Equinix, Inc.; InnerDuct.com; MaxCell Innerduct; National; Conduit Supply Inc.; National Pipe and Plastics, Inc; Premier Conduit; WL Plastics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Innerduct Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global innerduct market report based on material, type, application, and region:

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

High-density Polyethylene (HDPE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Corrugated Innerduct

-

Smooth Innerduct

-

Microduct

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Power Utilities

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global innerduct market size was estimated at USD 960.4 million in 2023 and is expected to reach USD 1.02 billion in 2024.

b. The global innerduct market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 1.74 billion by 2030.

b. North America dominated the innerduct market with a share of 29.1% in 2023. This is attributable to prominent development of fiber optic network infrastructure in the region and considerable initiatives by leading companies fueling market expansion

b. Some key players operating in the innerduct market include Corning Incorporated; Dura-Line; Endot Industries, LLC; Equinix, Inc.; InnerDuct.com; MaxCell Innerduct; National; Conduit Supply Inc.; National Pipe and Plastics, Inc; Premier Conduit; WL Plastics

b. Key factors that are driving the market growth include continued rollout of telecommunications infrastructure, growing urbanization and construction activities, and focus on safety and reliability in cable management

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.