Lab Automation Market (2025 - 2033) Size, Share & Trends Analysis Report By Process (Continuous Flow, Discrete Processing), By Automation Type (Total Automation Systems, Modular Automation Systems), By End-use (Clinical Chemistry Analysis, Immunoassay Analysis), By Region, And Segment Forecasts

Lab Automation Market Summary

The global lab automation market size was estimated at USD 8.27 billion in 2024 and is projected to reach USD 18.39 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The market growth is driven by rising demand for advanced screening, laboratory efficiency, and the adoption of advanced automated solutions globally.

Key Market Trends & Insights

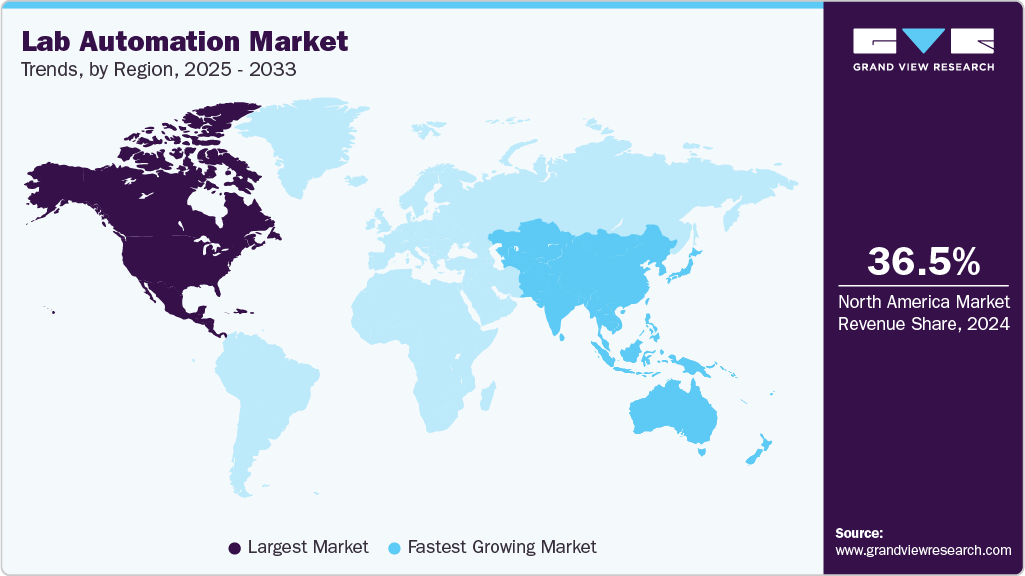

- The North America lab automation market held the largest share of 36.54% of the global market in 2024.

- The lab automation industry in the U.S. is expected to grow significantly over the forecast period.

- By process, the continuous flows segment held the largest market share of 55.35% in 2024.

- By automation type, the total automation segment held the largest market share in 2024.

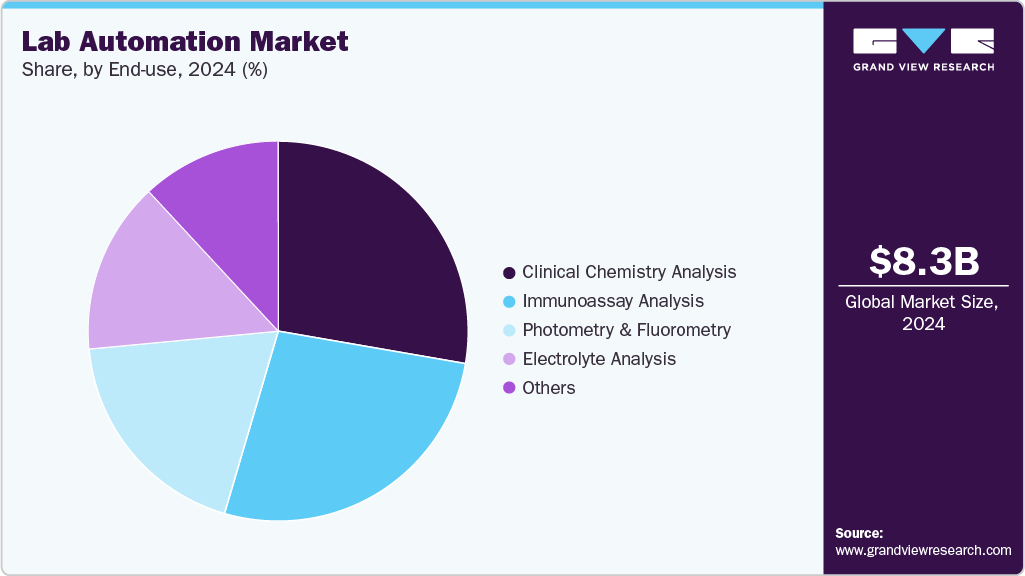

- By end-use, the clinical chemistry analysis segment captured the largest market share of 27.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.27 Billion

- 2033 Projected Market Size: USD 18.39 Billion

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cost & Time Efficiency

Cost and time efficiency are major factors influencing the global lab automation market. Automation technologies are increasingly being used by laboratories in the biotechnology, pharmaceutical, and clinical sectors to improve productivity, reduce manual intervention, and streamline processes. Automated instruments can more accurately and quickly complete repetitive and time-consuming tasks such as pipetting, sample preparation, and data analysis than manual methods. This helps to enhance the workflow effectiveness and scientific output by freeing researchers to concentrate on higher-value tasks such as experimental design and data interpretation.

Advantages and disadvantages of various options in implementation of total laboratory automation

|

Category |

Options |

Advantages |

Disadvantages |

|

Work cell configuration |

Attached work cell |

|

|

|

Modular work cell |

|

|

|

|

Culture reading shifts |

Limited culture reading hours |

|

|

|

24-h culture reading |

|

|

|

|

Culture reading organization |

By culture type |

|

|

|

By ready to read |

|

|

|

|

Implementation |

Staged implementation |

|

|

|

Complete implementation |

|

|

How has COVID19 impacted this market? To know more request a free sample copy

Source: Clinical Chemistry, Secondary Research, Grand View Research

Moreover, automation dramatically lowers labor costs by reducing reliance on trained technicians for routine tasks. It also reduces mistakes that result in expensive rework or experimental delays. Lab throughput is improved by processing large numbers of samples in shorter amounts of time, which is especially important in high-demand fields such as drug discovery, genomics, and diagnostics. Cost and time efficiency continue to drive the global adoption of automated laboratory systems as labs face increasing pressure to produce accurate results more quickly while effectively managing budgets.

High-Throughput Screening Needs

The need for high-throughput screening (HTS) has become a major factor in the expansion of the global lab automation market. To find possible drug candidates, improve formulations, and investigate biological interactions, laboratories in contemporary pharmaceutical and biotechnology research must simultaneously process and analyze thousands of samples. Handling so many samples by hand takes a lot of time, is prone to human error, and slows down the rate of discovery. The early phases of drug discovery and development can be accelerated by these technologies' ability to screen compounds, manage data, and streamline workflows quickly.

Robotics, liquid handling platforms, and sophisticated software are all integrated into automated systems that enable labs to conduct intricate tests and analyze large datasets with little assistance from humans. This improves the reliability of results in molecular biology research, toxicology testing, and diagnostics while also increasing operational efficiency. The market for lab automation is predicted to grow due to the significant increase in demand for high-throughput automated solutions brought about by pharmaceutical companies' and research institutions' continued investments in productivity and innovation.

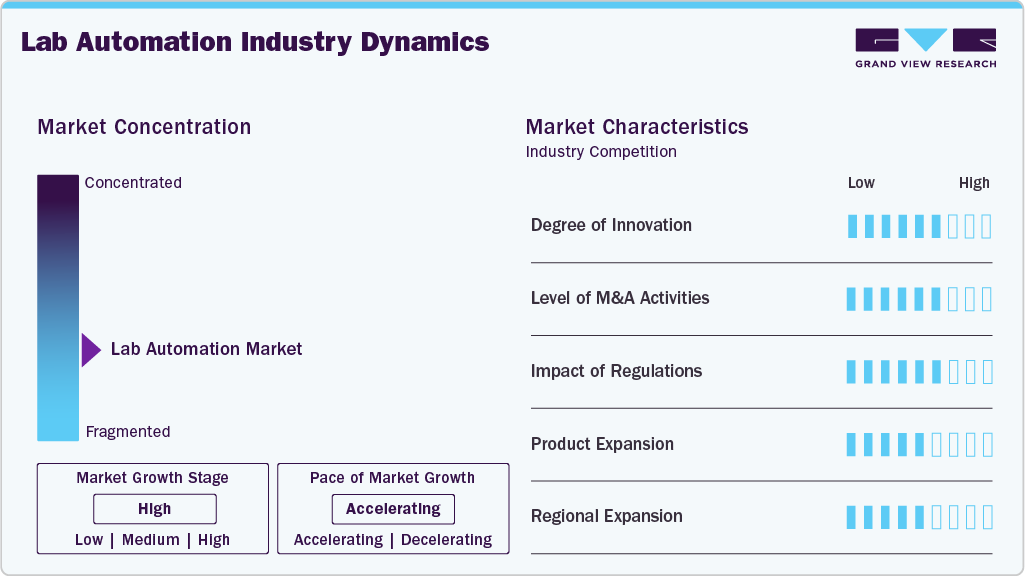

Market Concentration & Characteristics

The degree of innovation in the global lab automation industry is high, driven by continuous advancements in robotics, artificial intelligence (AI), and data analytics. Accuracy and efficiency are greatly increased by the increasing integration of smart automation technologies in modern laboratory systems that can perform predictive maintenance, adaptive learning, and real-time monitoring. These innovations highlight the market's strong potential for innovation by lowering operational costs and human intervention while speeding up research and discovery procedures in biotechnology, clinical diagnostics, and pharmaceutical industries.

The global lab automation industry has seen a high volume of M&A activity, which indicates the industry's strategic significance and expansion prospects. Businesses are pursuing mergers, acquisitions, and strategic alliances more frequently to broaden their product offerings, penetrate new markets, and improve their technological prowess. For instance, in December 2023, in the United States, Hudson Robotics and Art Robbins Instruments acquired Tomtec Inc., expanding liquid-handling capabilities and entering the bioanalytical sample-preparation segment for life sciences R&D.

Regulations greatly impact the global lab automation industry because automated systems are adopted to guarantee accuracy, reproducibility, and data integrity due to stringent standards in biotechnology, pharmaceuticals, and diagnostics. Automation technologies are well-suited to help laboratories maintain standardized, traceable, and auditable workflows to comply with regulations set forth by organizations such as the FDA, EMA, and ISO. While regulatory requirements may increase initial costs, they create strong demand for advanced automated solutions that help labs operate efficiently and remain compliant, making regulations a key growth driver for the market.

Product expansion is one of the main factors propelling the growth of the lab automation industry worldwide. Businesses are constantly creating and introducing new robotics platforms, software programs, and automated instruments to satisfy the changing demands of industrial, clinical, and research labs. Cloud-based laboratory management tools, AI-integrated analytics, modular systems, and high-throughput screening platforms are innovations that improve workflow flexibility, accuracy, and efficiency. This continuous product diversification improves competitive positioning and encourages market adoption by providing labs with more complete, customized, and cutting-edge automation solutions.

Regional expansion is a key growth driver for the global lab automation industry, as companies seek to tap into emerging markets with rising demand for advanced laboratory technologies. Manufacturers are setting up distribution networks, partnerships, and subsidiaries in the Middle East, Asia-Pacific, and Latin America to take advantage of the expanding pharmaceutical, biotechnology, and clinical research industries. Geographical expansion enables businesses to reach new clientele, handle regional legal requirements better, and deliver prompt service and support. In high-potential markets across the globe, this strategic emphasis on regional presence increases market penetration, brand recognition, and long-term growth opportunities.

Process Insights

The continuous flow segment held the largest revenue share of 55.35% in 2024, owing to the higher demand for continuous flow systems in industries and the surging adoption of continuous flow in laboratories for offering high-quality services. Moreover, continuous flow is among the widely preferred techniques and is also suitable when analyzing many samples. For instance, in October 2020, Sakura Finetek of Europe launched Tissue-Tek SmartConnect, which allows automated continuous flow by connecting, processing, and embedding in the histology laboratory.

The discrete processing segment is projected to register the fastest growth rate throughout the forecast period. Several advantages of discrete processing over continuous flow are projected to bolster its adoption during the forecast period. Moreover, in this kind of sample processing, much space is provided for sample analysis, thereby minimizing the chances of reagent wastage. Thus, owing to several advantages of the discrete process, it is projected to exhibit lucrative growth opportunities during the forecast period.

Automation Type Insights

Total automation segment dominated the market and accounted for the largest revenue share in 2024 and is expected to grow with the fastest CAGR throughout the forecast period. The rising demand for novel automation systems and their ability to offer customization services according to laboratory needs are projected to support segment growth. These systems are well-suited for labs with high volumes and stringent quality control requirements.

The modular automation systems segment is anticipated to grow significantly over the forecast period. This segment's largest revenue share is attributed to the mix-and-match and flexibility capabilities offered by modular automation systems. In addition, the rising application of modular systems across end-users is another factor supporting market expansion. These systems are suitable for labs that need automation for specific processes. For instance, in July 2025, in the United States, Ginkgo Bioworks deployed modular Reconfigurable Automation Carts (RACs) at the Environmental Molecular Sciences Laboratory (EMSL) at PNNL, enabling automated anaerobic phenotyping to accelerate microbial research for the bioeconomy.

End-use Insights

The clinical chemistry analysis segment captured the largest market share of 27.72% in 2024, driven by technological advancements, rising preference for automated laboratory instruments, and higher demand for automation in clinical chemistry labs for sample handling, storage, and labeling. For instance, in May 2021, Beckman Coulter launched DxA 5000 Fit, a workflow automation system for medium-sized labs.

Immunoassay analysis segment is projected to exhibit the fastest CAGR over the forecast period. Various advantages, including accuracy, time and cost savings, easy data management and integration, and high efficiency, are projected to bolster the demand for lab automation for immunoassay analysis.

Regional Insights

North America lab automation market dominated the respective global market with a revenue share of 36.54% in 2024. The region's market leadership has been further strengthened by its well-established life sciences and healthcare industries, early adoption of state-of-the-art automation technologies, high-throughput screening, and AI-integrated laboratory systems. The adoption of automated solutions in North American academic, clinical, and industrial laboratories has also been accelerated by encouraging government initiatives, strict regulatory standards, and an emphasis on increasing laboratory accuracy and efficiency.

U.S.Lab Automation Market Trends

The U.S. lab automation market is highly competitive, characterized by numerous global and domestic players striving to innovate and expand their market share. Ongoing R&D expenditure further increases competition, with the launch of AI-enabled systems, high-throughput platforms, and modular automation solutions. For instance, in May 2025, in the United States, Siemens Healthineers invested USD 150 million to expand production, relocate Varian manufacturing to California, open mega supply depots, and construct an Experience Center, enhancing healthcare delivery and supply-chain resilience.

Europe Lab Automation Market Trends

The Europe lab automation industry is witnessing steady growth. Robust government initiatives and funding for genomics, personalized medicine, and diagnostics research drive the need for effective, precise, standardized laboratory workflows. The adoption of lab automation has also accelerated throughout Europe due to the presence of well-established market players and technological advancements such as robotics, AI-integrated systems, and cloud-based laboratory management solutions.

The UK lab automation industry is experiencing considerable growth as academic institutions, research facilities, and pharmaceutical businesses increasingly use automated systems to improve laboratory workflows' precision, effectiveness, and reproducibility. Government funding and policies that support life sciences research have further accelerated the demand in the lab automation market.

The lab automation industry in Germany is growing, driven by strong investments in clinical research, biotechnology, and pharmaceuticals, along with the nation's emphasis on Industry 4.0 and smart laboratory solutions. Increasing demand for advance screening, precise diagnostics, and efficient laboratory workflows drives the adoption of automated systems.

Asia Pacific Lab Automation Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 10.9% during the forecast period. Factors such as the rising number of small and medium-sized laboratories in the region and the increasing investments by market leaders to launch novel systems are projected to fuel regional market growth. The regional market's growth is also aided by favorable government regulations that make lab automation easier. For instance, in May 2025, Asian Hospital in Faridabad, India, introduced Total Lab Automation in collaboration with QuidelOrtho, utilizing the Vitros Automation Solution to provide patients with quicker, more accurate, and more sustainable diagnostic testing.

The lab automation market in China is witnessing rapid growth, propelled by the country's increasing emphasis on biotechnology, the development of pharmaceuticals, and clinical research. For instance, in October 2024, SPT Labtech and ICE Bioscience launched a joint automated drug screening laboratory in China, integrating SPT Labtech's firefly liquid-handling platform to advance high-throughput drug discovery and assay development. Government policies also encouraging improvement to the healthcare infrastructure and innovation within life sciences, which further supports growth within the market.

Japan lab automation market is developing steadily due to an aging population, rising demand for clinical diagnostics, and a commitment to higher-quality medical research. Labs are increasingly investing in automation to gain efficiencies, lessen human error, and increase precision when processing high volumes of samples. Technological advancements such as robotics, AI-powered analysis, and integrated laboratory management systems have increased uptake.

MEA Lab Automation Market Trends

The Middle East and Africa (MEA) lab automation market is developing quickly, driven by increasing investment in healthcare infrastructure, growth in clinical diagnostics, and increases in pharmaceutical and biotechnology research activities. Moreover, government initiatives to modernize healthcare services and local laboratories and firms partnering with their global lab automation technology provider are helping to implement next-generation automation solutions in the region, indicating that MEA is a developing but attractive market in the global lab automation space.

The Kuwait laboratory automation market is experiencing sporadic growth due to increasing investments in healthcare infrastructure and the drive to modernize clinical laboratories. Hospitals and diagnostic centers use automated systems for greater efficiency, improved accuracy, and laboratory workflows. Government initiatives supporting healthcare development and collaborative arrangements with international automation technology providers support the introduction of new automation technology, including robotic analyzers, high-throughput platforms, and laboratory information management systems (LIMS), further supporting the market expansion.

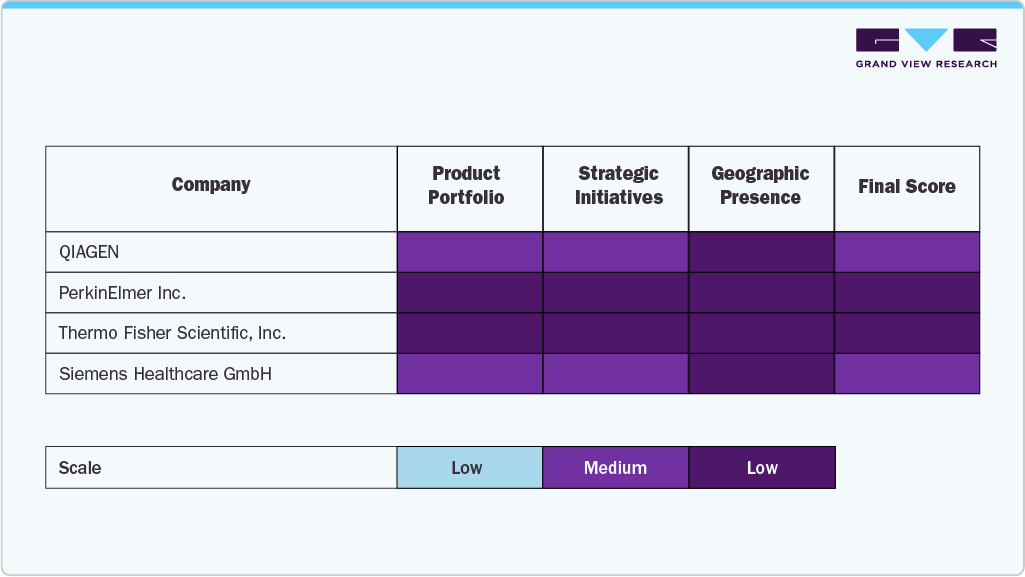

Key Lab Automation Company Insights

The lab automation industry is represented by several major players who continue to lead by offering a wide product range, developing strategic partnerships, and investing in research and development. Companies including QIAGEN, PerkinElmer Inc., Thermo Fisher Scientific, Siemens Healthcare GmbH, Danaher, and Agilent Technologies, Inc. have gained considerable share in the market by providing advanced automation solutions, such as liquid handling systems, robotic instrumentation and platforms, laboratory information management systems (LIMS), and high-throughput screening technologies across pharmaceutical, biotechnology, and clinical laboratory sectors.

Moreover, companies such as Eppendorf SE, Hudson Robotics, Aurora Biomed Inc., BMG LABTECH GmbH, Tecan Trading AG, Hamilton Company, and F. Hoffmann-La Roche Ltd, among others, are broadening their reach by implementing specialized, innovative automation solutions providing customization to address the specific needs of research institutions, diagnostic labs, and biopharmaceutical companies. These organizations continue to enhance workflow efficiency, accuracy, and reproducibility to meet the growing demand for faster, high-throughput laboratory workflows.

The convergence of advanced technology capabilities, integrated service offerings, and strategic growth activities increasingly characterizes market leadership in lab automation. As laboratories globally adopt systems that incorporate AI, robotics, and cloud-based management solutions to produce laboratory assets and tools, increased competition in the market emerges through mergers and acquisitions, alliances, and continuous product innovation. Organizations that find the intersection of scientific innovation and customer-centric solutions are expected to generate long-term value and help steer momentum for the lab automation industry, alongside global trends in precision medicine, diagnostics, and life sciences research.

Key Lab Automation Companies:

The following are the leading companies in the lab automation market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- PerkinElmer Inc.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Danaher

- Agilent Technologies, Inc.

- Eppendorf SE

- Hudson Robotics

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- Tecan Trading AG

- Hamilton Company

- F. Hoffmann-La Roche Ltd

Recent Developments

-

In September 2025, Eppendorf launched the VisioNize box 2, a next-generation digital connectivity hub enabling laboratories to monitor, manage, and integrate multiple devices remotely, enhancing efficiency, safety, and digital lab operations globally.

-

In July 2025, in Darmstadt, Germany, Merck launched the AAW Automated Assay Workstation, powered by Opentrons, offering a plug-and-play lab automation platform for academia, biotech, and pharmaceutical laboratories to accelerate scientific discovery.

-

In April 2025, in Venlo, Netherlands, QIAGEN announced plans to launch three new sample preparation instruments: QIAmini, QIAsprint Connect, and QIAsymphony Connect between 2025 and 2026. These instruments likely to enhance lab automation for low-to high-throughput workflows in oncology, genomics, and clinical research.

Lab Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.05 billion |

|

Revenue forecast in 2033 |

USD 18.39 billion |

|

Growth rate |

CAGR of 9.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 - 2023 |

|

Forecast period |

2025 - 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Process, automation type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

F. Hoffmann-La Roche Ltd; QIAGEN; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Danaher; Agilent Technologies, Inc.; Eppendorf SE; Hudson Robotics; Aurora Biomed Inc.; BMG LABTECH GmbH; Tecan Trading AG.; Hamilton Company |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Lab Automation Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global lab automation market based on process, automation type, end-use, and region:

-

Process Outlook (Revenue, USD Million, 2021 - 2033)

-

Continuous Flow

-

By Workflow

-

Sequential Processing

-

Parallel Processing

-

-

By Components

-

Consumables

-

Equipment

-

-

-

Discrete Processing

-

By Method

-

Centrifugal Discrete Processing

-

Random Access Discrete Processing

-

-

By Components

-

Consumables

-

Equipment

-

-

By Workflow

-

Dependent Analysis

-

Independent Analysis

-

-

-

-

Automation Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Total Automation

-

By Steps

-

Pre-analysis

-

Centrifugation

-

Sample Preparation

-

Sample Sorting

-

-

Transport Mechanisms

-

Liquid Handling

-

Sample Storage

-

Sample Analysis

-

-

-

Modular Automation Systems

-

By Steps

-

Specimen Acquisition & Identification & Labelling

-

Transport Mechanisms

-

Sample Preparation

-

Sample Loading & Aspiration

-

Reagent Handling & Storage

-

Sample Analysis & Measurements

-

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Chemistry Analysis

-

Photometry & Fluorometry

-

Immunoassay Analysis

-

Electrolyte Analysis

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lab automation market size was estimated at USD 8.27 billion in 2024 and is expected to reach USD 9.05 billion in 2025.

b. The global lab automation market is expected to grow at a compound annual growth rate of 9.27% from 2025 to 2033 to reach USD 18.39 billion by 2033.

b. North America dominated the lab automation market with a share of 36.54% in 2024. The growth is attributed to the presence of a well-established healthcare infrastructure, which has led to an increase in the adoption of lab automation systems in the region.

b. Some key players operating in the lab automation market include F. Hoffmann-La Roche Ltd; QIAGEN.; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthineers; Danaher Corporation; Agilent Technologies, Inc.; Eppendorf SE; Hudson Robotics; Aurora Biomed Inc.; BMG LABTECH GMBH; Tecan Group Ltd.; and Hamilton Company.

b. Key factors that are driving the market growth include a rise in the gap between the availability of trained laboratory personnel and the demand for laboratory procedures and high reproducibility and accuracy obtained through lab automation.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.