- Home

- »

- Plastics, Polymers & Resins

- »

-

Global Lamination Adhesives Market Size Report, 2020-2027GVR Report cover

![Lamination Adhesives Market Size, Share & Trends Report]()

Lamination Adhesives Market (2020 - 2027) Size, Share & Trends Analysis Report By Resin (Acrylic, Polyurethane), By Technology, By End-use (Packaging, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-895-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lamination Adhesives Market Summary

The global lamination adhesives market size was valued at USD 2.53 billion in 2019 and is projected to reach USD 4.55 billion by 2027, growing at a CAGR of 7.6% from 2020 to 2027. Increasing pharmaceutical demand for tablets, pouches, and medical devices is projected to assist the market growth over the long term.

Key Market Trends & Insights

- Asia Pacific emerged as the largest regional market and accounted for a revenue share of over 38.0% in 2019.

- Europe is likely to register a revenue-based CAGR of 7.2% from 2020 to 2027.

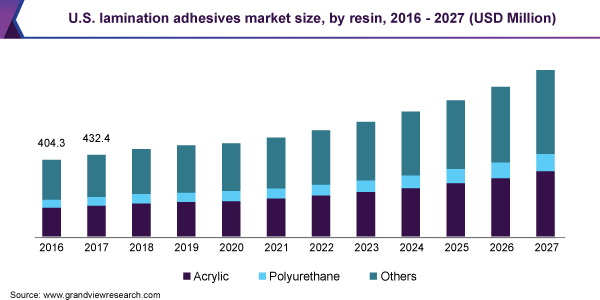

- By resin, the other segment held the largest revenue share of 50.7% in 2019.

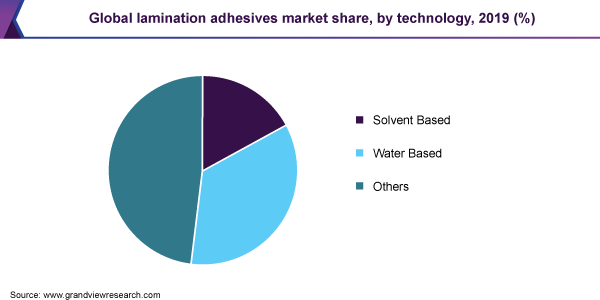

- By technology, water-based segment was the largest and accounted for a volume share of more than 50.0% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 2.53 Billion

- 2027 Projected Market Size: USD 4.55 Billion

- CAGR (2020-2027): 7.6%

- Asia Pacific: Largest market in 2019

With a growing population and increasing share of the geriatric population in some countries, healthcare needs are increasing at a rapid pace. Lamination adhesive products find a wide application in healthcare packaging in the bonding of paper, plastics, and aluminum. Innovation in plastic packaging and focus on increasing the productivity of machines through the use of advanced packaging materials are likely to assist in market growth.The U.S. is one of the leading countries in the global lamination adhesives market and it accounted for a significant revenue share in 2019. Key factors driving the market include increasing healthcare expenditure through private and government investment and a positive sales trend for consumer goods.

The restructuring of the pharmaceutical industry in the U.S. is projected to offer numerous opportunities for market vendors. In order to restructure themselves, pharmaceutical companies are focused on the development of cost-effective products and diversified strategies. This is likely to create a favorable impact on lamination adhesive products over the long term.

High expenditure on the biopharmaceutical R&D and growing demand for medical devices are a promising area for the market players. As per the Pharmaceutical Research and Manufacturers Association, the U.S. companies spend nearly USD 75 billion on new medicines annually. These companies also hold intellectual property rights on most of the new medicines.

Resin Insights

The other segment held the largest revenue share of 50.7% in 2019. Acrylic was the second largest segment in 2019 and is expected to witness the fastest growth over the forecast period. Increasing demand for hospital equipment, respirators, wound dressings, and medical devices are projected to assist in the penetration of acrylic-based adhesives. Pressure-sensitive adhesives are also likely to gain traction in various applications, including blood glucose monitoring strips.

Demand for structural adhesive products made using cyanoacrylates is projected to increase over the coming years. Cyanoacrylates are used to bond various types of substrates, such as plastics, rubbers, and metals. They can be used in needle bonding, IV tube sets or plastic tubing applications.

Other resins used in the manufacturing of lamination adhesive include epoxy, polyester, polyvinyl acetate, among others. Advantages such as uniform bonding, lack of leakage, improved durability, design flexibility, and cost-effectiveness are likely to contribute to increased penetration over the coming years.

Technology Insights

Water-based was the largest technology segment and accounted for a volume share of more than 50.0% in 2019. These adhesives are used in hard to bond films in flexible packaging applications in the food and medical sectors. It offers several advantages such as green strength, excellent food safety, and reduction in operational time.

Solvent-based adhesives are projected to expand at a CAGR of 7.1% from 2020 to 2027 in terms of revenue. In these adhesive products, the solvent acts as a carrier during the dry bolding laminating process. These laminations have multiple layers of adhesive layers and are widely used in snack food packaging, fabric laminations, and window films.

Other technologies include hot melt, solvent-less, and electron beam curing (EB). Food packaging application is projected to open new avenues for EB products. Factors such as quick turnaround time laminated products, ultra-fast cure speeds, and instantaneous bonds are some of the key factors driving the demand.

End-use Insights

The packaging was the largest segment and accounted for a revenue share of over 65.0% in 2019. Demand from the medical sector is a key factor contributing to the growth of the packaging end-use segment. Manufacturing firms including medical devices, implant, contract packaging, and pharmaceutical are the key consumers of products.

Innovation in medical devices, new product development, and increasing healthcare expenditure are some of the key factors driving the healthcare industry. Packaging of healthcare products in order to improve shelf life is expected to grow rapidly over the forecast period.

Other industrial end uses include protection and industrial wear, fashion textiles, sportswear, intimate apparel, upholstery textiles, electrical laminates, photovoltaic laminates, sailcloth, window film architecture, automotive, lamination resin for x-wrap films, and plastic wrap.

Regional Insights

Asia Pacific emerged as the largest regional market and accounted for a revenue share of over 38.0% in 2019. Increasing end-use industry growth is projected to attract demand for lamination adhesives in the long run. Investments in new production facilities and thereby growing production capacities in the consumer goods, medical, and automotive sectors are likely to provide a boost to the market growth.

Over the last few decades, countries including India and China are doing well in the pharmaceutical contract manufacturing. Lower cost of operation including various resources, such as manpower, has assisted in the expansion of the sector. This sector attracts significant demand for medical products, including labels, lids, bags, and pouches.

In terms of revenue, Europe is likely to register a revenue-based CAGR of 7.2% from 2020 to 2027. Increased health awareness among the population and increased consumer spending on food and beverage and other consumer goods products are the key factors contributing to the long term growth of the market.

Key Companies & Market Share Insights

Regional expansion through investment in production capacities and other inorganic growth strategies adopted by manufacturers are projected to boost the competition over the coming years. Developing countries are likely to attract the establishment of new facilities owing to the low labor costs. Some of the prominent players in the lamination adhesives market include:

-

3M

-

Dowdupont Inc.

-

Ashland Inc.

-

H.B. Fuller

-

Coim Group

-

Arkema

-

Henkel AG

-

DIC Corporation

-

Flint Group

Lamination Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.59 billion

Revenue forecast in 2027

USD 4.55 billion

Growth Rate

CAGR of 7.6% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative Units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue and volume forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Resin, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil; Saudi Arabia

Key companies profiled

H.B. Fuller; Henkel AG; 3M; Dowdupont Inc.; DIC Corporation; Ashland Inc.; Arkema; Flint Group; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global lamination adhesives market report based on resin, technology, end-use, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Acrylic

-

Polyurethane

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Solvent-based

-

Water-based

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Packaging

-

Automotive & Transportation

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lamination adhesives market size was estimated at USD 2.53 billion in 2019 and is expected to reach USD 2.59 billion in 2020.

b. The lamination adhesives market is expected to grow at a compound annual growth rate of 7.6% from 2020 to 2027 to reach USD 4.55 billion by 2027.

b. Packaging dominated the lamination adhesives market with a share of 65.7% in 2019, owing to its extensive demand from medical and food flexible packaging.

b. Some of the key players operating in the lamination adhesives market include H.B. Fuller, Henkel AG, 3M, Dowdupont Inc., Ashland Inc., Arkema, DIC Corporation, and Coim Group.

b. The key factors that are driving the lamination adhesives market include growing healthcare awareness among the population, and increasing demand for medical devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.