- Home

- »

- Conventional Energy

- »

-

LGC And VLGC LPG Shipyard Carrier Market Report, 2040GVR Report cover

![LGC And VLGC LPG Shipyard Carrier Market Size, Share & Trends Report]()

LGC And VLGC LPG Shipyard Carrier Market Size, Share & Trends Analysis Report By Refrigeration & Pressurization (Ethylene, Full Refrigerated, Semi Refrigerated, Full Pressurized), By Region, And Segment Forecasts, 2024 - 2040

- Report ID: GVR-4-68040-266-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

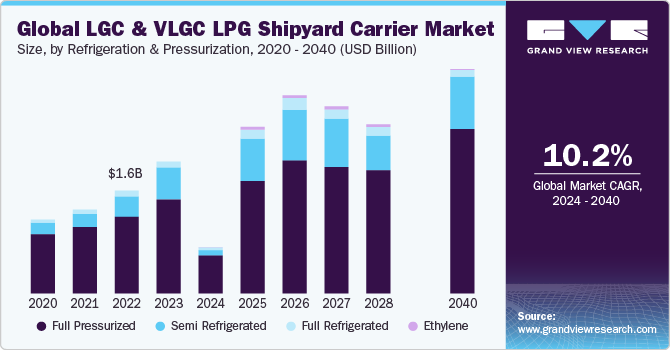

The global LGC and VLGC LPG shipyard carrier market size was estimated at USD 2,079.39 million in 2023 and is projected to register a CAGR of 10.2% from 2024 to 2040. Increasing shale gas production globally is likely to propel demand for liquefied petroleum gas (LPG) tankers over the coming years. The volatility in crude oil prices, coupled with advancements in hydraulic fracturing and horizontal drilling methods, has prompted major companies to shift their attention toward the production of oil and gas from shale rock. This shift in focus toward the production of shale gas is projected to further enhance market growth over the estimated period.

The production of shale gas is in a persistent phase worldwide, which is expected to drive market growth over the forecast period. With the high production of shale gas, there has been a simultaneous boom in the LPG trade business. Simultaneously, the demand for LPG for HVAC and cooking applications is on the rise, generating demand for transportation and safe storage of LPG, in turn leading to high demand for LPG tankers in the coming years.

The growing trade relationships between the U.S. and Asia Pacific region for shale gas, owing to reduced transportation costs, are likely to outgrow the demand for LPG tankers over the forecast period. Instability in crude oil prices, resulting in amplified LPG prices, is projected to hinder market growth over the projected period.

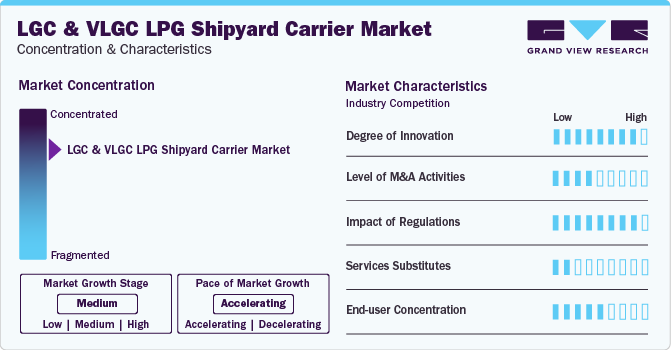

Market Concentration & Characteristics

The growth of the global oil and gas industry, along with rising shale gas production worldwide, is among the major factors contributing to the demand for LGC and VLGC LPG shipyard carriers. These carriers are generally utilized for the transportation and safe storage of LPG over long distances. The growing demand for LPG as a feedstock for producing fertilizers and petrochemicals is also expected to propel market growth for LGC and VLGC LPG shipyard carriers.

The large-scale application of LPG as a fuel in commercial and residential applications, refineries, and chemical manufacturing plants owing to its non-toxic, cost-efficient, clean, convenient, accessible, and portable nature contributes to a rise in its global demand. This increases the requirement for carriers used for transporting it, which in turn, leads to market growth.

Refrigeration & Pressurization Insights

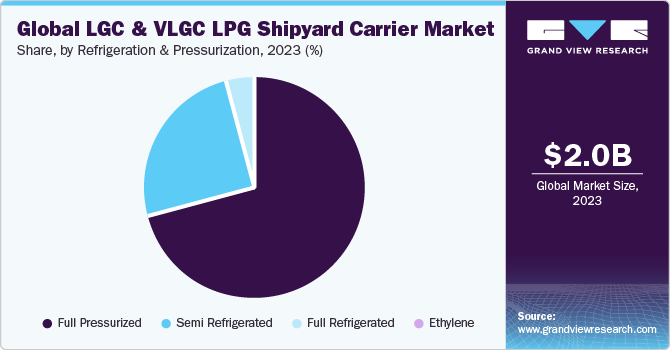

Based on refrigeration & pressurization, the market is segregated into ethylene, full refrigerated, semi-refrigerated, and full pressurized segments. In terms of revenue, the full pressurized segment accounted for the largest global share of 71.25% in 2023. Ships with less than 4000 m3 of cargo capacity are generally fully pressurized. These ships are the simplest of all gas carriers in terms of cargo-handling equipment and containment systems. Fully pressurized ships are small with maximum cargo capabilities of about 4,000 m3, and primarily used for transport of ammonia and LPG.

The semi-pressurized segment is anticipated to witness the fastest CAGR of 15.1% over the forecast period. The semi-pressurized vessels are similar to fully pressurized vessels as they have a type C tank. In this case, the pressure vessel is rated for a maximum working pressure of 57 bars. The ship size is up to 7,500 m3, and it is mainly used for transporting liquid gas. Decompression reduces the tank thickness compared to that of a fully pressurized container; however, it comes at the expense of additional freezing systems and tank insulation. The tanks of these ships are manufactured from steel that can withstand temperatures of up to 10°C, and they can be cylindrical, conical, or spherical in shape.

Regional Insights

North America LGC and VLGC LPG Shipyard Carrier market is expected to grow significantly over the forecast period owing to the increase in shipbuilding activities in the U.S. Original equipment manufacturers (OEM) in the U.S. provide components and systems to shipbuilding companies. This, in turn, is expected to drive the demand for LGC and VLGC LPG Shipyard carriers in the near future.

U.S. LGC And VLGC LPG Shipyard Carrier Market Trends

The LGC and VLGC LPG Shipyard Carrier Market in the U.S. is witnessing innovations in horizontal drilling and hydraulic fracturing processes for increasing oil & gas extraction, which have made oil & gas production a highlighting factor for the energy landscape of the country. According to the U.S. Energy Information Administration (EIA), propane exports from the country reached 1.7 million barrels per day (b/d) in March 2023, the highest level since 1973. This increase in propane exports from the U.S. was driven by the surged demand for solid heating and petrochemicals in Asia. Heating demand is a result of the temperature difference between indoor and outdoor air. As the U.S. experienced heating seasons in both the first and final months of 2020, it resulted in reduced domestic consumption and increased exports. Thus, the surging propane or LPG exports are expected to fuel the demand for LGC and VLGC LPG shipyard carriers in the U.S. as they are employed to ship large quantities of LPG.

Asia Pacific LGC And VLGC LPG Shipyard Carrier Market Trends

The LGC and VLGC LPG shipyard carrier market in Asia Pacific accounted for the largest revenue share of 42.41% globally in 2023. The market in this region is led by China, Japan, and India. There are no large gas pipelines in the Asia Pacific region similar to those in Europe. Instead, the countries in the Asia Pacific region rely on importing LPG via ship routes from countries across the world to meet their demand. As transportation by sea routes is much more accessible in this region, this is expected to foster the market demand in the region over the forecast period.

The China LGC and VLGC LPG shipyard carrier market accounted for the largest revenue share of 35.18% in Asia Pacific in 2023. China is among the most prominent countries in terms of growth of the market. The market in the country is projected to progress at a significant growth over the forecast period. In China, the need for LGC and VLGC shipyard carriers arises majorly from the oil & gas and petrochemical industries. The country is considered an important hub for both the production and consumption of LPG, which is expected to boost the market in a significant manner.

The LGC and VLGC LPG shipyard carrier market in India is also expected to grow at a significant CAGR of 10.8% over the forecast period. India is the third-largest oil and gas importing country in the world, and its imports of LPG have also witnessed a rise to fulfill its rising demand. Most of this LPG is transported through LGC and VLGC shipyard carriers, as it is the cheapest way of transportation. With increasing demand and low domestic production, the market is expected to witness an increase in demand in the coming years. The government has also implemented an initiative to provide LPG connections to 6 million households. With supportive government initiatives and the growth of the petrochemical industry, the demand for LPG is expected to continue to rise. Hence, the country’s LGC and VLGC shipyard carrier industry is expected to gain more momentum in the coming years.

Europe LGC And VLGC LPG Shipyard Carrier Market Trends

The LGC and VLGC LPG shipyard carrier market in Europe has a strong foothold. The European Union (EU) has undertaken several initiatives to support the progress of the energy sector. The market is expanding through mergers and acquisitions by mainstay industry players as well as the establishment of new startups. Germany, France, and the UK have been identified as major contributors to the growth of the market in the region owing to the large consumer base and rising number of manufacturers & suppliers of LPG and LGC and VLGC LPG shipyard carriers.

The Greece LGC and VLGC LPG shipyard carrier market held the largest revenue share of 40.10% in Europe. Greece has emerged as one of the fastest-growing regions in the European market. The maritime industry in Greece has demonstrated resilience and adaptability, with a focus on modernizing the LPG carrier fleet to meet international standards and environmental regulations.

On November 29th, 2023, Benelux Overseas announced the expansion of its current fleet and inked a deal with China’s Huangpu Wenchong, its first export LPG new building contract. The presence of prominent market players like StealthGas Inc. has played a major role in the growth of this market in the region. The market growth is also expected to be driven by the country’s strategic location and growing consumption of LPG over the forecast period.

The LGC and VLGC LPG shipyard carrier market in Germany is anticipated to grow at a CAGR of 12.7%. Germany has been promoting LPG as a motor fuel and has implemented incentive policies for it instead of diesel or gasoline. Due to the continued focus of the government on the use of LPG as an alternative fuel, the demand for LGC and VLGC LPG shipyard carriers is expected to increase in the coming years. Moreover, the positivity surrounding the manufacturing sector and the support from the government to promote manufacturing companies by introducing subsidies, tax breaks, and incentives are expected to drive the country’s energy sector, thereby propelling the market demand in the country. Many research & development organizations and oil & gas companies are working on the development and commercialization of LPG, which is expected to create enormous opportunities for the market players.

Central & South America LGC And VLGC LPG Shipyard Carrier Market Trends

The rising adoption of LPG is expected to positively impact LPG exports from Central & South America, thereby driving the growth of the market for LGC and VLGC LPG Shipyard Carriers in the region over the forecast period.

The Brazil LGC and VLGC LPG shipyard carrier market held a significant share in 2023 in Central & South America. Brazil is geographically closer to the U.S. and Argentina than other LPG-producing countries such as Saudi Arabia, Russia, and Algeria. This has resulted in LPG distribution companies based in the U.S. and Argentina signing supply contracts. For instance, in April 2021, Copagaz signed an agreement with Argentina-based Transportadora de Gas del Sur (TGS). Under this agreement, Copagaz is expected to import 7,600 tons of LPG in three cargos at the Tergasul terminal in Rio Grande do Sul.

Middle East & Africa LGC And VLGC LPG Shipyard Carrier Market Trends

The Middle East has surplus reserves of crude oil and natural gas; hence, the usage of gasoline for automobiles is predominant in the region. However, high carbon emissions resulting from the burning of gasoline are expected to boost the demand for clean energy sources, such as LPG, in the Middle East.

The Saudi Arabia LGC and VLGC LPG shipyard carrier market held the largest revenue share of 50.35% in 2023 in the Middle East and Africa. The presence of companies like Saudi Aramco, the largest producer of LPG in the world, is expected to fuel the requirement for LGC and VLGC LPG shipyard carriers in the region.

Key LGC And VLGC LPG Shipyard Carrier Company Insights

The market players continuously adopt various organic and inorganic growth strategies to expand their global footprint. Key players in this industry include Dorian LPG Ltd., BW Group, Hyundai Heavy Industries Co., Ltd, and Kawasaki Heavy Industries, Ltd.

-

In August 2023, Astomos Tankers announced a contract with Maersk Tankers for the management of five VLGC carriers with potential additions.

-

In July 2023, NYK ordered the sixth LPG dual-fuel VLGC, which is supported for LPG and ammonia gas, from Kawasaki Heavy Industries Ltd. (KHI).

-

In April 2023, ADNOC Logistics & Services added five VLGC carriers to its fleet. The carriers were manufactured in Jiangnan shipyard in Shanghai, China. The VLGC carriers are owned and managed by AW Shipping, a joint venture between ADNOC L&S and Wanhua Chemical Group.

Key LGC And VLGC LPG Shipyard Carrier Companies:

The following are the leading companies in the LGC and VLGC LPG shipyard carrier market. These companies collectively hold the largest market share and dictate industry trends.

- Dorian LPG Ltd.

- BW Group

- Hyundai Heavy Industries Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Heavy Industries, Ltd.

- PT Pertamina (Persero)

- Kuwait Oil Tanker Co. S.A.K.

- Teekay Corporation

- StealthGas Inc.

- Kuwait Oil Tanker Co. S.A.K.

- Namura Shipbuilding Co., Ltd

- EXMAR

- STX Corporation

- The Great Eastern Shipping Co. Ltd.

LGC And VLGC LPG Shipyard Carrier Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 745.66 million

Revenue forecast in 2040

USD 3,542.90 million

Growth rate

CAGR of 10.2% from 2024 to 2040

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2040

Quantitative units

Revenue in USD million/billion, volume in units, capacity in thousand CBM, CAGR from 2024 to 2040

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Refrigeration & pressurization, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; UK; Denmark; Turkey; Greece; Netherlands; Belgium; China; India; Japan; South Korea; Australia; Indonesia; Taiwan; Brazil; Saudi Arabia

Key companies profiled

StealthGas Inc.; Dorian LPG Ltd.; BW Group; Hyundai Heavy Industries Co., Ltd; Kawasaki Heavy Industries, Ltd; Mitsubishi Heavy Industries, Ltd.; The Great Eastern Shipping Co. Ltd.; Kuwait Oil Tanker Co. S.A.K.; Dae Sun Shipbuilding & Engineering Co., Ltd; Namura Shipbuilding Co., Ltd.; EXMAR; STX Corporation; PT Pertamina (Persero); Teekay Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LGC And VLGC LPG Shipyard Carrier Market Report Segmentation

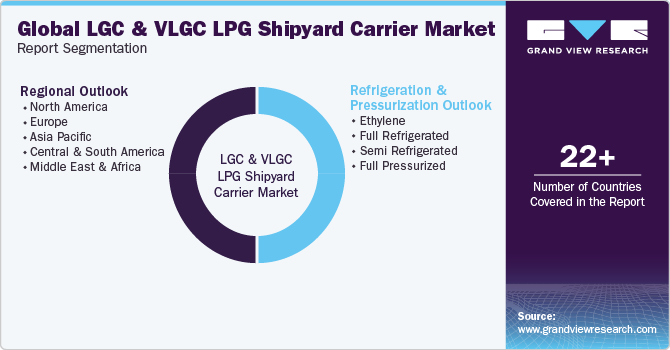

This report forecasts capacity, revenue, & volume growth at global, regional, and country levels. It provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2040. For this study, Grand View Research has segmented the global LGC and VLGC LPG shipyard carrier market report based on refrigeration & pressurization and region:

-

Refrigeration & Pressurization Outlook (Volume, Units; Capacity, Billion cu m; Revenue, USD Million, 2018 - 2040)

-

Ethylene

-

Full Refrigerated

-

Semi Refrigerated

-

Full Pressurized

-

-

Regional Outlook (Volume, Units; Capacity, Billion cu m; Revenue, USD Million, 2018 - 2040)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Spain

-

UK

-

Denmark

-

Turkey

-

Greece

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Taiwan

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

How big is the global Large Gas Carrier (LGC) and Very Large Gas Carrier (VLGC) LPG Shipyard Market?b. The global Large Gas Carrier (LGC) and Very Large Gas Carrier (VLGC) LPG Shipyard Market size was estimated at USD 2,079.39 million in 2023 and is expected to reach USD 745.66 million in 2024.

b. The the global LGC and VLGC LPG shipyard carrier market is expected to witness a compound annual growth rate of 10.2% from 2024 to 2040 to reach USD 3,542.90 million by 2040

b. Full Pressurized accounted for a revenue share of 71.25% in the global market in 2023. the full pressurized segment dominated the market owing to the wide-scale adoption of full pressurized LPG carrier sets in the global market.

b. Some key players operating in the LGC and VLGC LPG shipyard carrier market include StealthGas Inc., Dorian LPG Ltd., BW Group, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., The Great Eastern Shipping Co. Ltd., Kuwait Oil Tanker Co. S.A.K., Dae Sun Shipbuilding & Engineering Co., Ltd, Namura Shipbuilding Co., Ltd., EXMAR, STX Corporation, PT Pertamina (Persero), Teekay Corporation

b. Key factors driving the LGC and VLGC LPG shipyard carrier market growth include growing global trade relations and increasing shale gas extraction activities

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."