- Home

- »

- Plastics, Polymers & Resins

- »

-

Light-activated Polymers Market Size, Industry Report, 2033GVR Report cover

![Light-activated Polymers Market Size, Share & Trends Report]()

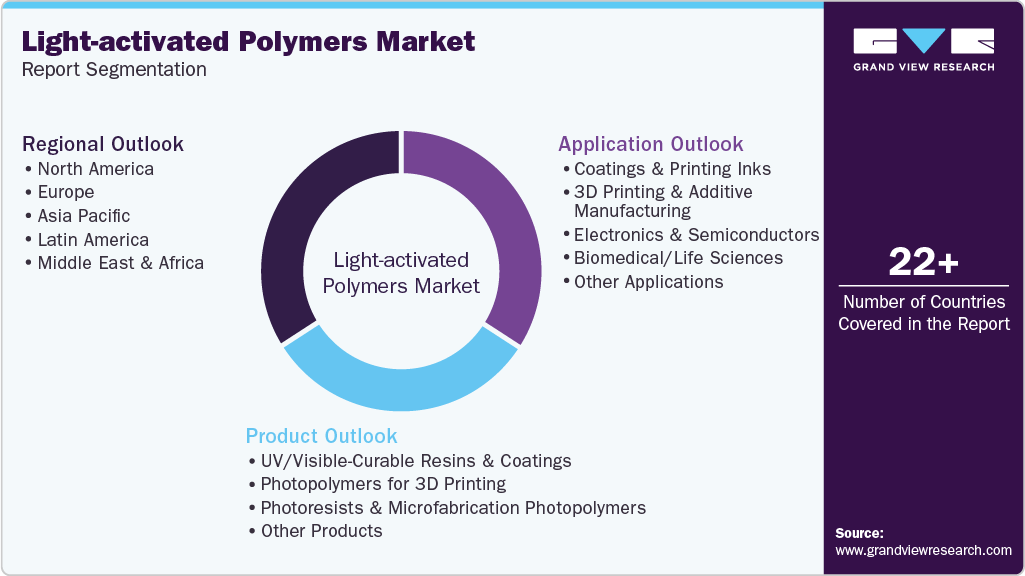

Light-activated Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Photopolymers For 3D Printing, UV/Visible-Curable Resins & Coatings ), By Application (Coatings & Printing Inks, Biomedical/Life Sciences), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-791-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Light-activated Polymers Market Summary

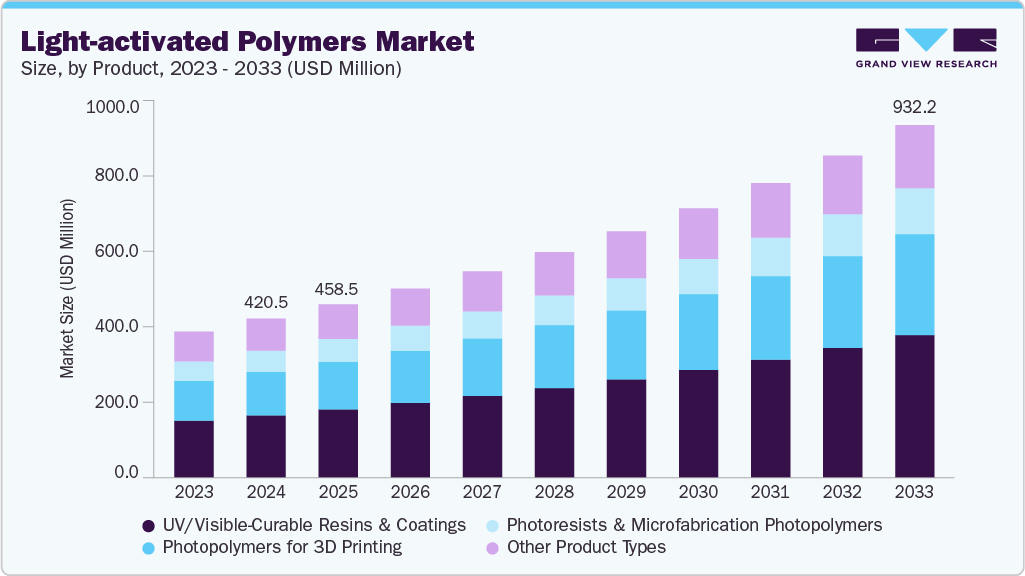

The global light-activated polymers market size was estimated at USD 420.5 million in 2024 and is projected to reach USD 932.2 million by 2033, growing at a CAGR of 9.3% from 2025 to 2033. Rising adoption of automation and advanced manufacturing technologies is driving demand for light-activated polymers, as they enable precise, energy-efficient, and responsive material performance. This is particularly relevant in electronics, automotive, and healthcare applications.

Key Market Trends & Insights

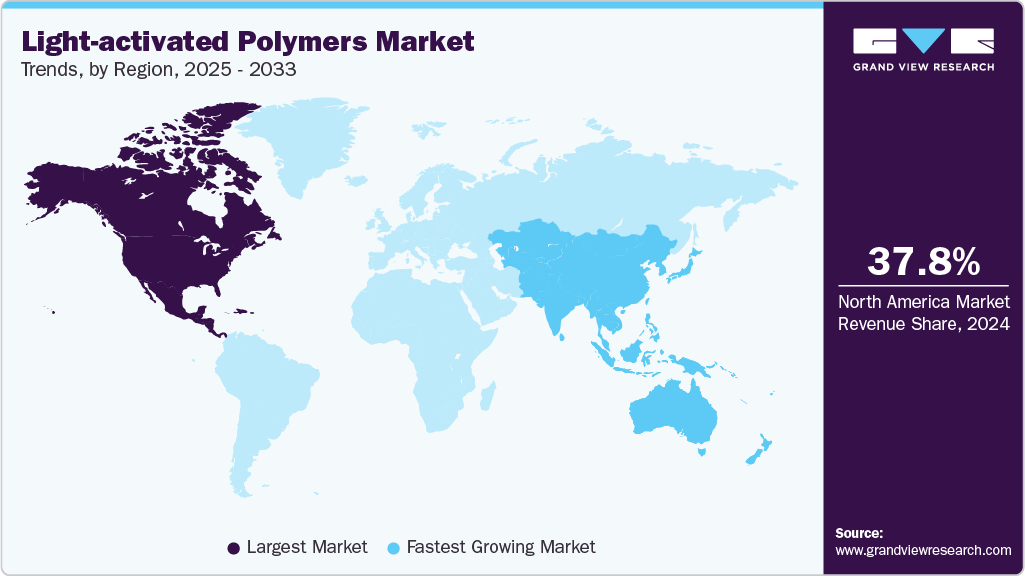

- North America dominated the light-activated polymers market with the largest revenue share of 37.82% in 2024.

- The U.S. led the North American market and captured around 75% of the revenue market share in 2024.

- By product, the UV/visible-curable resins & coatings dominated the market across the product segmentation in terms of revenue, accounting for a market share of 39.28% in 2024.

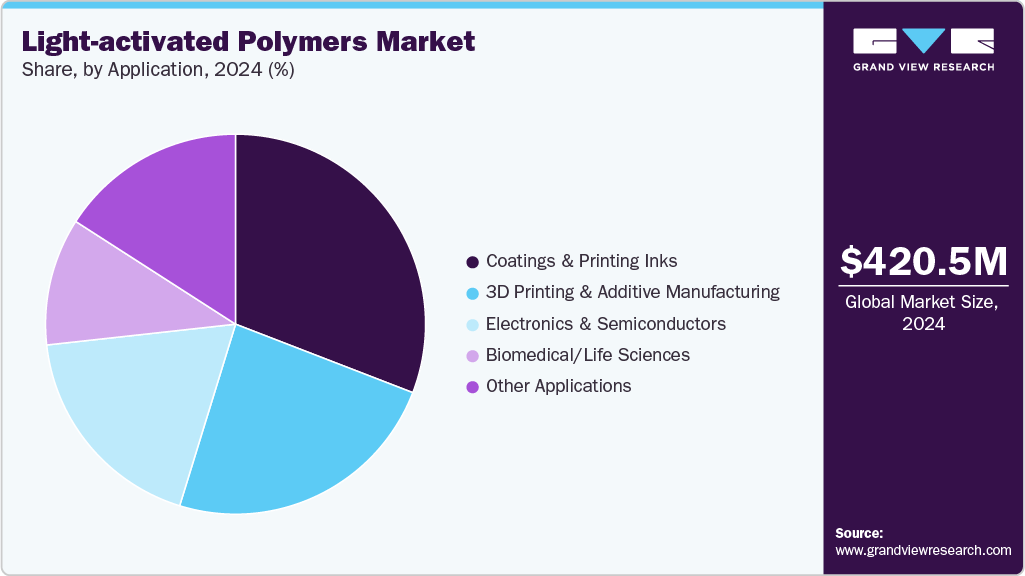

- By application, the coatings & printing inks dominated the application segmentation in revenue, accounting for a market share of 30.87% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 420.5 Million

- 2033 Projected Market Size: USD 932.2 Million

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is experiencing a significant trend towards integration with smart materials, driven by advancements in material science and increasing demand for adaptive solutions. These polymers, which respond to external stimuli such as light, are incorporated into various applications, including drug delivery systems, self-healing materials, and responsive coatings.

This integration enhances the functionality and versatility of products, aligning with the growing consumer preference for intelligent and sustainable materials. As industries seek to develop more efficient and adaptable solutions, the convergence of light-activated polymers with smart materials is expected to accelerate, opening new avenues for innovation and application.

Drivers, Opportunities & Restraints

The increasing demand for sustainable and adaptive solutions across various industries is a primary market driver. Consumers and manufacturers seek materials that perform efficiently and contribute to environmental sustainability. Light-activated polymers offer the advantage of being responsive to external stimuli, reducing the need for additional energy sources and enabling more efficient resource use. This demand is particularly evident in sectors such as healthcare, automotive, and electronics, with a push towards developing high-performing and environmentally friendly products.

The light-activated polymers industry presents significant opportunities for expansion into emerging applications, particularly in fields that require responsive and adaptive materials. For instance, in the medical sector, these polymers can be utilized to develop smart drug delivery systems that release therapeutic agents in response to light stimuli. Similarly, light-activated polymers can be employed in the automotive industry's self-healing coatings and adaptive lighting systems. These emerging applications broaden the scope of light-activated polymers and align with the industry's trend towards multifunctional and intelligent materials.

These advanced materials' high development and manufacturing costs significantly restrain the light-activated polymers industry. The synthesis of light-responsive polymers often involves complex processes and specialized equipment, increasing production expenses. In addition, the need for rigorous testing and quality control to ensure the reliability and safety of these materials further adds to the cost burden. These financial constraints can limit the widespread adoption of light-activated polymers, particularly among small and medium-sized enterprises, and may hinder the market's growth potential.

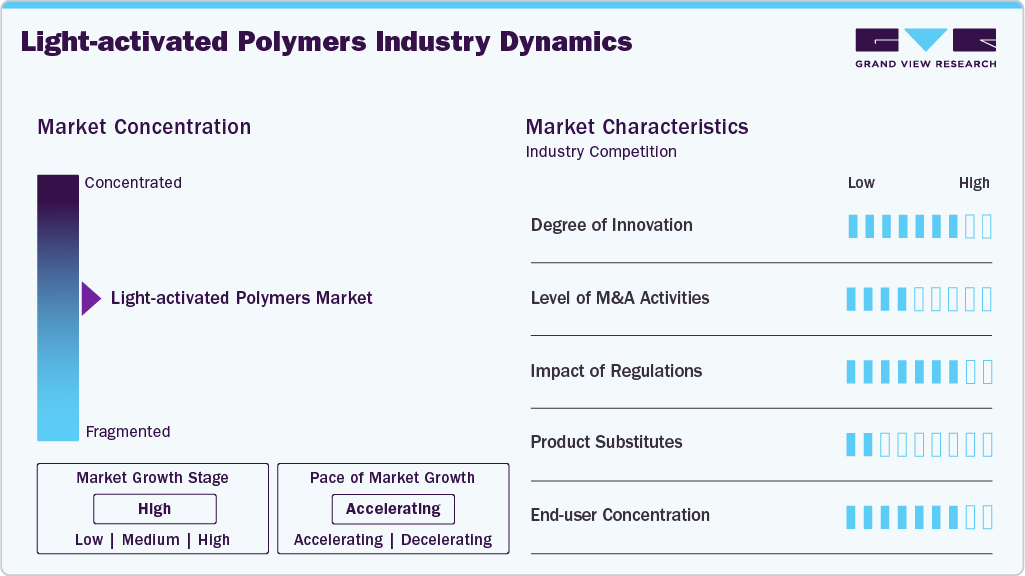

Market Concentration & Characteristics

The market is in a medium growth stage, and the pace is accelerating, exhibiting consolidation, with key players dominating the industry landscape. Major companies like 3M, Arkema, BASF SE, Celanese Corporation, Covestro AG, Dow Inc., Evonik, Heraeus, Parker Hannifin, RTP Company, Solvay S.A., and others play a significant role in shaping the market dynamics. These leading players often drive innovation, introducing new products, technologies, and applications to meet evolving industry demands.

The light-activated polymers industry is characterized by a high degree of innovation, driven by advancements in material science and nanotechnology. Researchers are developing polymers with enhanced responsiveness to light stimuli, enabling applications in smart coatings, drug delivery systems, and self-healing materials. This continuous innovation is expanding the functional capabilities of these polymers, allowing for more precise control and integration into complex systems. As industries seek materials that offer adaptive and intelligent behaviors, the emphasis on innovation in light-activated polymers is expected to intensify, fostering the development of next-generation materials with tailored functionalities.

In the light-activated polymers industry, traditional materials such as thermoplastics and thermosets are increasingly substituted by stimuli-responsive polymers. These conventional materials lack the dynamic responsiveness to external stimuli that light-activated polymers offer. The shift towards stimuli-responsive polymers is driven by their ability to enable adaptive behaviors in various applications, including drug delivery, smart textiles, and responsive coatings. While traditional materials dominate certain sectors, the growing demand for intelligent and adaptive materials is accelerating the adoption of light-activated polymers, positioning them as viable substitutes in numerous applications.

Product Insights

UV/visible-curable resins & coatings dominated the market across the product segmentation in terms of revenue, accounting for a market share of 39.28% in 2024, and is forecasted to grow at a 9.6% CAGR from 2025 to 2033. It is driven by their widespread use in industrial coatings, adhesives, inks, and electronics assembly. These polymers undergo rapid curing upon exposure to ultraviolet or visible light, offering high throughput, low energy consumption, and solvent-free processing features increasingly aligned with sustainability regulations and energy-efficiency mandates.

Growth is further supported by their expanding use in automotive clearcoats, packaging coatings, and optical films, particularly in Europe and Asia, where environmental restrictions on VOCs are tightening. As manufacturing shifts toward faster and cleaner curing technologies, UV-curable systems capture share from thermal and solvent-based alternatives.

The photopolymers for 3D printing is anticipated to grow at the fastest CAGR of 9.8% through the forecast period. The segment is driven by the accelerating adoption of vat photopolymerization technologies (SLA, DLP, LCD) and hybrid digital manufacturing systems. These materials enable the creation of highly detailed, smooth-surface components in sectors such as dental, medical devices, consumer electronics, and customized industrial parts. Market expansion is propelled by the increasing availability of functional photopolymers that exhibit higher thermal stability, toughness, and biocompatibility, addressing traditional mechanical strength and UV aging weaknesses.

Photoresists and microfabrication photopolymers form a specialized yet high-value segment within the light-activated polymers industry. They primarily serve the semiconductor, display, MEMS, and printed circuit board (PCB) manufacturing chains. These materials are critical for pattern transfer processes that define nanoscale features in integrated circuits and advanced packaging applications.

Application Insights

Coatings & printing inks dominated the application segmentation in revenue, accounting for a market share of 30.87% in 2024, and are forecasted to grow at an 8.9% CAGR from 2025 to 2033. These materials, primarily UV- and visible-curable resins, enable instant curing, high gloss, abrasion resistance, and solvent-free processing, aligning with the rising sustainability standards in industrial and consumer product manufacturing. Adoption is strongest in automotive clearcoats, wood finishes, packaging, and commercial printing, where fast curing translates directly into higher throughput and reduced VOC emissions.

The biomedical/life sciences segment is expected to expand at a substantial CAGR of 10.0% through the forecast period. In biomedical and life-science applications, light-activated polymers are increasingly used for tissue engineering, drug delivery, dental resins, and surgical device fabrication. Their ability to polymerize under controlled light allows precise spatial patterning, ideal for creating complex 3D scaffolds, hydrogels, and biointerfaces that mimic natural tissue structures.

In additive manufacturing, light-activated polymers are the cornerstone for vat photopolymerization processes such as stereolithography (SLA), digital light processing (DLP), and masked LCD printing. These resins enable exceptional surface resolution and fine geometric accuracy, making them ideal for producing complex parts across dental, medical, jewelry, consumer electronics, and automotive prototyping applications.

Light-activated polymers play a pivotal role in microelectronics, semiconductors, and display manufacturing, where they function as photoresists, encapsulants, dielectric layers, and optical adhesives. Their capacity to be patterned with nanoscale precision under light exposure is fundamental to photolithography processes in integrated circuit and printed circuit board fabrication. As global chip production capacity expands, particularly across East Asia, the U.S., and Europe, the demand for high-performance photoresists with superior etch resistance and resolution is rising sharply.

Regional Insights

North America held the largest revenue share of 37.82% in the light-activated polymers market in 2024. North America, particularly the U.S., benefits from a robust research and development infrastructure that fosters innovation in light-activated polymers. With substantial investments in academic research, government-funded initiatives, and a strong presence of leading polymer manufacturers, the region is at the forefront of developing advanced materials. This environment accelerates the commercialization of novel light-responsive polymers, catering to diverse healthcare, electronics, and environmental applications. The synergy between research institutions and industry players propels North America's leadership in the market.

U.S. Light-activated Polymers Market Trends

The U.S. led the North American market and captured around 75% of the revenue market share in 2024. The light-activated polymers market in the U.S. market for light-activated polymers is strongly driven by the healthcare and medical sectors, where precision and responsive materials are in high demand. Light-activated polymers are increasingly used in smart drug delivery systems, photodynamic therapies, and medical devices that require controlled activation. The presence of leading pharmaceutical companies and a well-established healthcare infrastructure enables rapid adoption and commercialization of these advanced polymers. This focus on improving patient outcomes through innovative materials significantly propels the U.S. market growth.

Europe Light-activated Polymers Market Trends

The light-activated polymers market in Europe is driven by stringent environmental regulations, which drive the demand for sustainable materials, including light-activated polymers. The European Union's commitment to reducing carbon footprints and promoting circular economies encourages industries to adopt materials that are not only efficient but also environmentally friendly. Light-activated polymers, with their potential for recyclability and reduced environmental impact, align well with these regulatory objectives. This regulatory push accelerates the adoption of such materials in sectors like packaging, automotive, and construction.

Asia Pacific Light-activated Polymers Market Trends

Asia Pacific is anticipated to register the fastest CAGR of 10.3% over the forecast period. The light-activated polymers market in the Asia Pacific is driven by rapid industrialization and urbanization. Countries like China and India are experiencing swift infrastructure development, leading to increased demand for advanced materials in construction, electronics, and automotive industries. Light-activated polymers offer advantages such as durability, adaptability, and energy efficiency, making them attractive choices for these growing sectors. The region's expanding industrial base and urban landscape create a conducive environment for the widespread adoption of these innovative materials.

Key Light-activated Polymers Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include 3M, Arkema, BASF SE, Celanese Corporation, Covestro AG, Dow Inc., Evonik, Heraeus, Parker Hannifin, RTP Company, and Solvay S.A. The market is characterized by a competitive landscape, with several key players driving innovation and growth. Major companies in this sector invest heavily in research and development to enhance their products' performance, cost-effectiveness, and sustainability.

Key Light-activated Polymers Companies:

The following are the leading companies in the light-activated polymers market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Arkema

- BASF SE

- Celanese Corporation

- Covestro AG

- Dow Inc.

- Evonik

- Heraeus

- Parker Hannifin

- RTP Company

- Solvay S.A.

Recent Developments

-

In July 2025, the U.S. Food and Drug Administration approved a novel nerve repair system utilizing light-activated polymers, developed by Tissium. This approval marks a significant advancement in medical technology, offering a non-surgical alternative for nerve repair that enhances patient recovery times and reduces complications. The system's flexibility and precision in application underscore the growing potential of light-responsive materials in healthcare.

-

In July 2025, Nova Chemicals was acquired in a USD 13.4 billion deal, marking a significant consolidation in the resin manufacturing sector. By integrating Nova's expertise and resources, this acquisition will enhance the company's capabilities in producing advanced polymers, including light-activated variants. The merger aims to strengthen market position and drive innovation in polymer technologies.

Light-activated Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 458.5 million

Revenue forecast in 2033

USD 932.2 million

Growth rate

CAGR of 9.3% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; Arkema; BASF SE; Celanese Corporation; Covestro AG; Dow Inc.; Evonik; Heraeus; Parker Hannifin; RTP Company; Solvay S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light-activated Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global light-activated polymers market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

UV/Visible-Curable Resins & Coatings

-

Photopolymers for 3D Printing

-

Photoresists & Microfabrication Photopolymers

-

Other Products

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Coatings & Printing Inks

-

3D Printing & Additive Manufacturing

-

Electronics & Semiconductors

-

Biomedical/Life Sciences

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.