- Home

- »

- Plastics, Polymers & Resins

- »

-

Lignin-based Biopolymers Market Size, Industry Report, 2030GVR Report cover

![Lignin-based Biopolymers Market Size, Share & Trends Report]()

Lignin-based Biopolymers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Lignosulfonates, Kraft Lignin, Organosolv Lignin, Hydrolyzed Lignin), By End-use (Automotive, Construction, Packaging, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-555-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lignin-based Biopolymers Market Trends

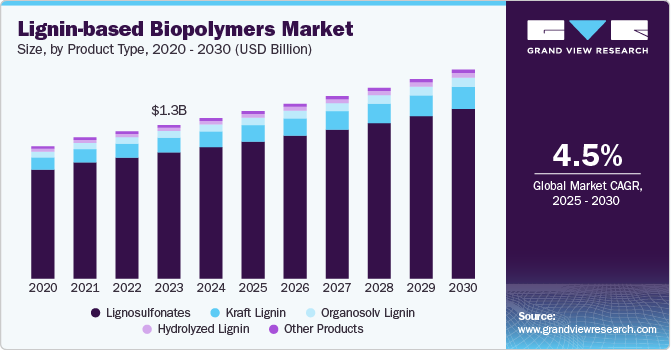

The global lignin-based biopolymers market size was estimated at USD 1.32 billion in 2024 and is expected to grow at a CAGR of 4.54% from 2025 to 2030. Growing demand for sustainable packaging is pushing companies to explore lignin-based biopolymers as an eco-friendly alternative to plastic. Additionally, regulatory bans on single-use plastics are accelerating the shift toward bio-based materials.

The increasing integration of lignin into circular economy models, especially in Europe and North America, is augmenting the lignin-based biopolymers market. With regulatory pressures escalating around carbon neutrality and fossil feedstock dependency, lignin-a major byproduct of the pulp and paper industry-is now being valorized into high-performance biopolymers. Governments, especially those aligned with the EU Green Deal and national bioeconomy strategies, are actively supporting lignin valorization through funding and policy incentives.

Major players in the packaging, automotive, and construction sectors are establishing internal sustainability mandates, creating long-term demand pathways for lignin-derived materials. As sustainability reporting becomes a financial metric in itself, companies are rapidly adopting bio-based feedstocks, making lignin a central pillar in R&D efforts focused on decarbonizing material science.

Drivers, Opportunities & Restraints

The cost-effective and scalable availability of lignin from the pulp and paper industry is driving the demand for the lignin-based biopolymers market. With over 50 million tons of lignin produced annually as a low-value byproduct, particularly in North America, Europe, and select Asian economies, the transition to high-value downstream applications presents a natural evolution for value chain optimization. By integrating lignin conversion technologies within existing industrial infrastructure, companies can significantly lower raw material costs, reduce waste, and improve profit margins.

Furthermore, advancements in fractionation technologies and lignin purification are allowing greater structural control, enhancing the polymerization potential and functional attributes of lignin for applications in composites, adhesives, coatings, and biodegradable plastics. This vertically integrated supply structure positions lignin as a strategic, sustainable, and commercially viable feedstock in the global biopolymer value chain.

With global OEMs pledging to cut lifecycle emissions and meet circularity benchmarks by 2030 and beyond, lignin-based thermoset and thermoplastic composites offer an environmentally superior alternative to petroleum-based materials. Their inherent stiffness, UV-resistance, and biodegradability make them highly compatible with dashboards, interior panels, and structural parts.

OEMs in Europe and Japan have initiated joint development agreements with bio-based material suppliers to co-engineer lignin-polymer composites, further accelerating commercialization. In parallel, innovations in lignin-based carbon fiber precursors are gaining traction, presenting a dual benefit of material performance enhancement and environmental compliance. This market window is further widened by regulatory tailwinds from initiatives like the U.S. BioPreferred Program and EU carbon taxation policies.

Despite its potential, the lignin-based biopolymers market faces a significant restraint in the form of structural heterogeneity and lack of end-product standardization. Lignin's molecular composition varies substantially depending on its botanical source (hardwood, softwood, or grasses) and extraction method (kraft, organosolv, soda process), creating inconsistency in polymer performance and compatibility with conventional processing equipment. These technical constraints complicate product reproducibility, scalability, and downstream integration, particularly in industries such as pharmaceuticals, electronics, or advanced packaging, where quality control is non-negotiable.

Additionally, limited industrial-grade purification and depolymerization technologies have slowed lignin’s transition from lab-scale validation to commercial-scale production. Without a harmonized regulatory framework or universally accepted technical benchmarks, lignin-derived polymers often struggle to compete with more mature bio-based alternatives like PLA or PHA, dampening investor confidence and impeding broader market adoption.

Product Type Insights

Lignosulfonates dominated the lignin-based biopolymers market across the product type segmentation in terms of revenue, accounting for a revenue share of 82.00% in 2024. This is due to their superior dispersing capabilities and wide-scale adoption in industrial applications such as concrete admixtures, animal feed binders, and agrochemicals. As construction activities intensify across Asia and infrastructure projects receive renewed focus post-COVID, lignosulfonates are being favored for their water-reducing properties in cement and their ability to enhance flow characteristics in fertilizer and pesticide formulations. Moreover, their compatibility with circular economy goals has positioned them as preferred additives in sustainable agriculture and low-carbon building materials.

Kraft lignin is emerging as a strategic raw material for the production of high-value bio-based chemicals and engineered polymers and is anticipated to grow at the fastest CAGR of 5.82% over the forecast period. With global interest intensifying around fossil-free performance materials, especially in Europe and North America, kraft lignin’s thermoplastic characteristics and high carbon content make it ideal for value-added applications such as carbon fiber precursors, phenolic resins, and energy storage devices. Companies are increasingly integrating Kraft lignin into their R&D pipelines to meet performance benchmarks in composite manufacturing and functional coatings, opening new commercialization avenues.

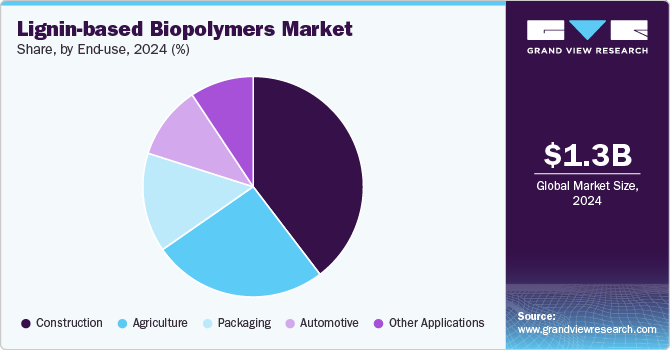

End-use Insights

Automotive dominated the lignin-based biopolymers market across the end use segmentation in terms of revenue, accounting for a revenue share of 39.63% in 2024. In the automotive sector, the pressure to reduce vehicle weight and carbon emissions is driving OEMs to incorporate lignin-based biopolymers into interior components, under-the-hood structures, and composites.

With electric vehicle production accelerating, the need for sustainable lightweighting materials has become central to both cost-efficiency and regulatory compliance. Lignin’s ability to enhance mechanical performance while reducing dependency on petroleum-based resins is being actively explored through global collaborations between automotive manufacturers and bio-material innovators.

The construction segment is projected to witness a substantial CAGR of 4.35% through the forecast period. The construction industry is increasingly turning to lignin-derived products in response to tightening green building standards and a push toward carbon-neutral materials. Lignin-based adhesives, insulation foams, and concrete plasticizers are being adopted for their lower environmental footprint and cost-effectiveness. With green certification programs such as LEED and BREEAM influencing procurement decisions, lignin biopolymers are gaining commercial relevance as sustainable alternatives that align with both policy targets and material performance requirements in modern infrastructure projects.

Regional Insights

In North America, the lignin-based biopolymers market is being driven by a surge in public-private partnerships focused on developing next-generation bio-refineries. The U.S. Department of Energy's Bioenergy Technologies Office and Canada’s Clean Fuels Fund are channeling investments into lignin valorization for use in high-performance polymers and energy applications. This institutional backing is accelerating commercialization timelines and fostering a robust ecosystem of start-ups, academia, and corporates focused on lignin upscaling.

U.S. Lignin-based Biopolymers Market Trends

In the U.S., demand is specifically advancing due to the federal government’s emphasis on strengthening domestic supply chains for sustainable materials. With policy momentum building through initiatives like the Inflation Reduction Act and the BioPreferred Program, U.S. manufacturers are incentivized to reduce reliance on petroleum-derived resins and adopt bio-based alternatives. Lignin’s potential to serve as a carbon-rich feedstock for multiple industrial sectors is being actively explored under these frameworks.

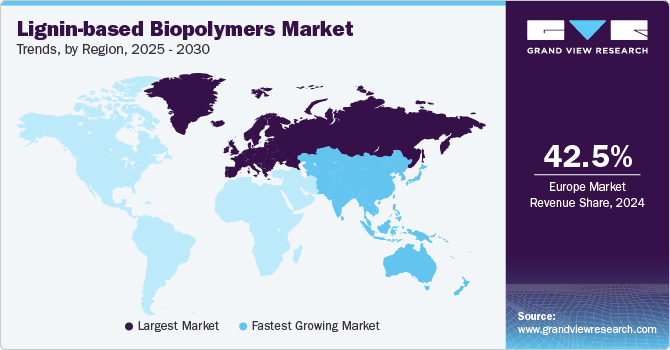

Europe Lignin-based Biopolymers Market Trends

Europe lignin-based biopolymers market dominated the global market and accounted for the largest revenue share of 42.45% in 2024 due to the European Green Deal, which mandates a full transition toward climate neutrality by 2050. The region’s leadership in circular economy adoption is pushing industries to replace fossil-based inputs with renewable, traceable feedstocks such as lignin. Additionally, funding through Horizon Europe and national bioeconomy strategies is boosting lignin R&D and enabling scalable applications in packaging, electronics, and construction materials.

Germany lignin-based biopolymers market is witnessing accelerated lignin integration in its industrial base as part of its national bioeconomy roadmap. The country’s advanced pulp and paper industry provides a stable lignin supply, while strong collaboration between technical universities and corporates is driving innovation in lignin-based thermosets and composite materials. With Germany’s engineering-intensive sectors such as automotive and chemicals demanding sustainable performance materials, lignin is emerging as a competitive, low-carbon solution.

Asia Pacific Lignin-based Biopolymers Market Trends

The Asia Pacific lignin-based biopolymers market is expected to expand at a rapid CAGR of 5.34% from 2025 to 2030, which can be attributed to the expanding industrial output and rising environmental concerns, particularly in China, India, and Japan. Regional governments are investing in bio-based industrial parks and encouraging lignin valorization as a means to reduce air and water pollution associated with agro-industrial waste. Moreover, increasing collaboration between global bio-material innovators and Asian conglomerates is facilitating lignin’s adoption in high-volume sectors like packaging, textiles, and construction.

Key Lignin-based Biopolymers Company Insights

The lignin-based biopolymers market is highly competitive, with several key players dominating the landscape. Major companies include Borregaard, Stora Enso, UPM Biochemicals, MetGen, Ingevity, Lignolix, and West Fraser. The lignin-based biopolymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Lignin-based Biopolymers Companies:

The following are the leading companies in the lignin-based biopolymers market. These companies collectively hold the largest market share and dictate industry trends.

- Borregaard

- Stora Enso

- UPM Biochemicals

- MetGen

- Ingevity

- Lignolix

- West Fraser

Recent Developments

-

In December 2024, Lignin Industries signed a partnership agreement with Hellyar Plastics, the UK’s leading independent compounder and polymer distributor, to expand the market reach of their innovative bio-based plastic, Renol. After collaborating for 18 months and testing the product with customers, they prepared to launch the first products commercially, aiming to scale the commercialization of Lignin’s patented technology. The agreement focused on introducing Renol to new markets in the UK and beyond. Currency conversion was not applicable as no financial figures were disclosed in the announcement.

-

In September 2024, Södra, a Swedish forestry cooperative, signed an agreement to supply UPM with kraft lignin from its new plant in Mönsterås, Sweden, which is expected to be operational by 2027. The plant is projected to be the world's largest commercial kraft lignin production facility. UPM intends to use the lignin to create sustainable products, such as resins and binders. The investment was supported by the Swedish Energy Agency, the EU Recovery and Resilience Facility (RRF), and Next Generation EU. Södra has the potential to produce up to 250,000 tpy of kraft lignin.

Lignin-based Biopolymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.38 billion

Revenue forecast in 2030

USD 1.72 billion

Growth rate

CAGR of 4.54% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Borregaard; Stora Enso; UPM Biochemicals; MetGen; Ingevity; Lignolix; West Fraser

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lignin-based Biopolymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lignin-based biopolymers market report based on product type, end-use, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Lignosulfonates

-

Kraft Lignin

-

Organosolv Lignin

-

Hydrolyzed Lignin

-

Others Product

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Construction

-

Agriculture

-

Packaging

-

Automotive

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global lignin-based biopolymers market was estimated at USD 1.32 billion in the year 2024 and is expected to reach around USD 1.38 billion in 2025.

b. The global lignin-based biopolymers market is expected to grow at a compound annual growth rate of 4.54% from 2025 to 2030, reaching around USD 1.72 billion by 2030.

b. Lignosulfonates dominated the product type segment of the lignin-based biopolymers market in 2024 with more than 82.0% revenue share due to their superior dispersing capabilities and wide-scale adoption in industrial applications such as concrete admixtures, animal feed binders, and agrochemicals.

b. The key players in the lignin-based biopolymers market include Borregaard, Stora Enso, UPM Biochemicals, MetGen, Ingevity, Lignolix, and West Fraser.

b. The lignin-based biopolymers market is driven by the growing demand for sustainable packaging, which is pushing companies to explore lignin-based biopolymers as an eco-friendly alternative to plastic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.