- Home

- »

- Catalysts & Enzymes

- »

-

Metal Carboxylates Market Size, Share, Industry Report 2030GVR Report cover

![Metal Carboxylates Market Size, Share & Trends Report]()

Metal Carboxylates Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Primary Drier Metals, Through Drier Metals, Auxiliary Drier Metals), By End-use (Catalyst, Lubricant Additives, Driers, Plastic Stabilizers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-522-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Carboxylates Market Summary

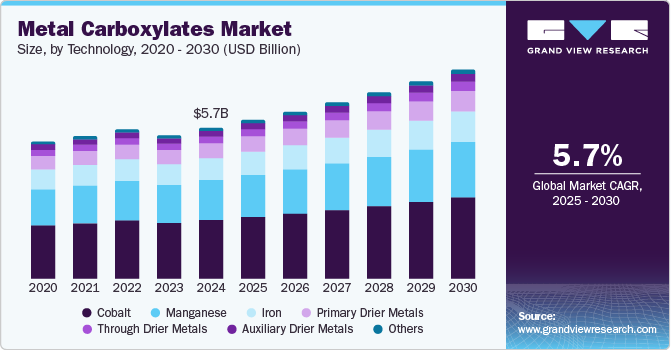

The global metal carboxylates market size was estimated at USD 5,717.0 million in 2024 and is projected to reach USD 7,910.6 million by 2030, growing at a CAGR of 5.7% from 2025 to 2030. Metal carboxylates have significant applications in the building and construction industry, where they protect structures from external damage.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Canada is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, cobalt accounted for a revenue of USD 2,360.5 million in 2024.

- Manganese is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,717.0 million

- 2030 Projected Market Size: USD 7,910.6 million

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

The demand for industrial coatings is experiencing the most substantial growth in China and India, with moderate growth in Europe. This surge in coating demand, in turn, enhances the need for metal carboxylates. Additionally, additives improve performance and address deficiencies in fuels or lubricants used across various applications. Manganese and iron metal carboxylates are commonly utilized as fuel additives.

Metal carboxylates are essential for various industrial processes, including producing plastics, coatings, lubricants, and catalysts. The rising demand for high-performance materials in sectors such as construction, automotive, and aerospace have significantly increased the need for these substances. Metal carboxylates offer distinctive advantages, such as improved performance in manufacturing processes, high-temperature resistance, and exceptional stability.

A significant market segment is utilizing metal carboxylates as catalysts in various processes. These compounds, particularly those based on zinc, copper, and cobalt, enhance the speed of chemical reactions, increasing their application in catalytic processes. One notable trend in this field is the growing use of metal carboxylates in Ozone Catalytic Oxidation Solutions, driving advancements in green chemistry. These catalysts support the industry's demand for economic and energy-efficient solutions due to their effectiveness at lower temperatures and reusability.

Drivers, Opportunities & Restraints

The growing demand for additives in lubricating oils and greases is boosting the market for metal carboxylates, which serve as essential driers, stabilizers, and anti-wear agents. Metal carboxylates, such as calcium, zinc, and barium carboxylates, enhance oxidation resistance, improve thermal stability, and extend lubricant life in automotive and industrial applications. The increasing need for high-performance lubricants in heavy machinery, automotive engines, and manufacturing processes is a key driver. Additionally, stringent environmental regulations are prompting the development of eco-friendly and low-toxicity metal carboxylate additives. As industries focus on efficiency and sustainability, demand for these additives is expected to rise.

High production costs in the metal carboxylates market are driven by the rising prices of raw materials, including metal salts and organic acids, which are essential for manufacturing. Energy-intensive production processes, along with stringent environmental regulations, further add to operational expenses. The need for advanced processing technologies to ensure product quality and compliance with safety standards also increases costs. Additionally, supply chain disruptions and fluctuations in metal prices impact overall profitability. As manufacturers seek cost-effective and sustainable alternatives, innovation in production techniques and material sourcing is expected to shape the market dynamics.

The industry presents significant opportunities driven by increasing demand in industries such as coatings, lubricants, and polymers. Growth in the automotive and construction sectors is fueling the need for high-performance driers and stabilizers, particularly in eco-friendly and water-based coatings. Rising industrial automation and machinery advancements are also boosting demand for metal carboxylates in lubricating oils and greases. Additionally, the shift toward sustainable and bio-based alternatives presents a key opportunity for innovation. Emerging markets in Asia-Pacific and Latin America offer further growth potential due to expanding manufacturing and infrastructure development.

Technology Insights

The cobalt segment accounted for the largest revenue share of 39.3% in 2024 and is expected to continue to dominate the industry over the forecast period. The cobalt technology segment in the metal carboxylates market is driven by its critical role as a drier in coatings, inks, and paints, enhancing oxidative curing and film formation. Cobalt-based carboxylates are widely used in alkyd resins for improved drying efficiency and durability. Growing demand for high-performance coatings in the automotive and construction industries is a key driver for this segment. However, increasing regulatory pressure on cobalt use is pushing manufacturers toward sustainable and low-toxicity alternatives.

The manganese technology segment in the metal carboxylates market is gaining traction due to its effectiveness as an eco-friendly alternative to cobalt-based driers in paints, coatings, and inks. Manganese carboxylates offer excellent oxidative curing properties while meeting stringent environmental regulations. The primary driver for this segment is the growing demand for sustainable and low-toxicity solutions in the coatings industry, particularly in Europe and North America.

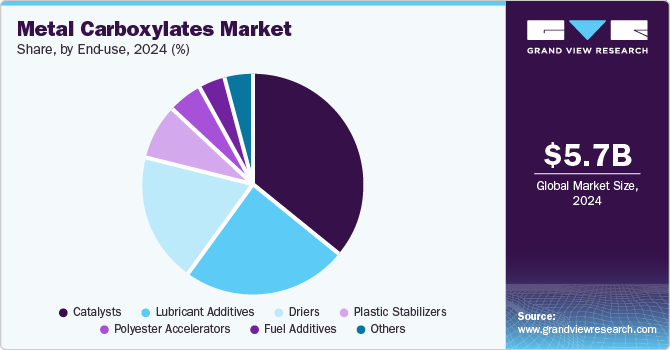

End-use Insights

The catalysts segment dominated the market with a share of 35.6% in 2024. The catalyst segment in the metal carboxylates market is driven by its critical role in polymerization, oxidation, and other chemical synthesis processes across various industries. Metal carboxylates, such as those based on cobalt, manganese, and zinc, enhance reaction efficiency and selectivity in industrial applications. The increasing demand for high-performance catalysts in petrochemicals, coatings, and pharmaceuticals is a key driver for this segment. Additionally, the push for sustainable and energy-efficient catalytic processes is further fueling market growth.

The lubricant additives segment in the metal carboxylates market is driven by the growing need for high-performance lubricants in automotive, industrial, and machinery applications. Metal carboxylates, such as calcium and barium-based compounds, enhance lubrication, reduce wear, and improve thermal stability. Rising industrial automation and stringent regulations on fuel efficiency and emissions are key drivers to boost demand. Additionally, advancements in lubricant formulations for electric vehicles and heavy-duty machinery further support market growth.

Regional Insights

North America metal carboxylates market is experiencing growth due to the rise in construction activity, increasing automotive production, and demand for products in the metal carboxylates market.

U.S. Metal Carboxylates Market Trends

The metal carboxylates market in the U.S. is expected to grow during the forecast period. This growth is attributed to the increasing automobile production, general industry, construction, and oil & gas industries this is expected to positively impact the metal carboxylates market.

Asia Pacific Metal Carboxylates Market Trends

The metal carboxylates market in Asia-Pacific region dominates the metal carboxylates market due to rapid industrialization, growing automotive production, and expanding construction activities. The rising demand for high-performance coatings, lubricants, and polymer stabilizers is a key driver fueling market growth. Additionally, increasing investments in manufacturing and infrastructure development further supports the region’s strong market expansion.

China metal carboxylates market is expected to grow during the forecast period. This growth is attributed to the increasing manufacturing activity in the region and has led to increased demand for products in the region.

Europe Metal Carboxylates Market Trends

The metal carboxylates market inEurope is expected to grow over the forecast period. This growth can be attributed to the increasing product demand from various end-use industries such as the general industry, power generation, aerospace, and automotive and vehicle refinishing. The regional market is also expected to grow due to the increasing automobile production, construction activity, and the growing aerospace sector.

Latin America Metal Carboxylates Market Trends

The metal carboxylates market inLatin America is expected to witness steady growth over the forecast period. The rising product demand from the general, automotive, aerospace, and marine industries is anticipated to positively influence market growth in the region. Furthermore, the presence of automotive production plants and oil & gas-producing countries in the region, including Brazil, Colombia, and Venezuela, is projected to fuel the demand for metal carboxylates over the forecast period.

Middle East & Africa Metal Carboxylates Market Trends

The metal carboxylates market in the Middle East and Africa is expected to witness steady growth over the forecast period due to increasing oil production in the region. The region is the global leader in terms of oil production. The presence of major oil-producing countries such as Saudi Arabia, Kuwait, Oman, Bahrain, Libya, Iraq, Angola, and Iran in the Middle East & Africa is expected to create high demand for metal carboxylates in the region

Key Metal Carboxylates Company Insights

Some of the key players operating in the market include BASF SE and Arkema Group

-

BASF SE is a globally recognized German chemical company and the largest chemical producer in the world. The company operates through six primary business segments: industrial solutions, chemicals, materials, surface technologies, agricultural solutions, and nutrition and care. Its diverse portfolio encompasses various chemical products, such as performance, plastics, and functional solutions. One of the company’s key areas of expertise is the production of carotenoids, including beta-carotene and related products, which are utilized in the food and beverages, pharmaceuticals, and animal feed industries.

-

Arkema manufactures specialty chemicals and advanced materials. It operates through three segments: high-performance materials, coating solutions, and industrial specialties. The company sells its products to end-use industries, including construction, electrical and electronics, food and agrochemicals, health, hygiene, beauty, oil and gas, paper and packaging, renewable energies, sports, and transportation. The company has 151 production plants in 55 countries.

Key Metal Carboxylates Companies:

The following are the leading companies in the metal carboxylates market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- Elementis plc

- Organometals

- Arkema Group

- PMC Group, Inc.

- Valtris Specialty Chemicals

- Penta Manufacturing Company

- DIC Corporation

- Ege Kimya San. ve Tic. A.S

Recent Developments

-

In October 2023, Arkema announced a significant capacity expansion at its Nansha site in China. The expansion will aim to increase the production capacity for high-performance materials, specifically for high-temperature-resistant polymers and advanced coatings. This move also aimed to meet the growing demand for coatings in various sectors, including automotive, electronics, and renewable energy. The company planned to invest in new facilities and upgrade the existing ones to enhance production efficiency and support its strategic growth objectives in the Asian market. The expansion aligns with Arkema’s broader strategy to strengthen its global presence and cater to the regional market needs.

-

In September 2022, Eastman acquired Taminco, a leading producer of alkylamines and metal carboxylates, for USD 2.8 billion. This acquisition aims to enhance Eastman's position in the specialty chemicals market, particularly in high-performance metal carboxylates for industrial and agricultural applications.

Metal Carboxylates Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.0 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume, kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa.

Key companies profiled

BASF SE, Ege Kimya San. ve Tic. A.S, Elementis plc, Organometals, Arkema Group, PMC Group, Inc., Valtris Specialty Chemicals, Penta Manufacturing Company, Dow, DIC Corporation.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Carboxylates Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal carboxylates market report on the basis of technology, end-use and region.

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Primary Drier Metals

-

Through Drier Metals

-

Auxiliary Drier Metals

-

Cobalt

-

Manganese

-

Iron

-

Other Technology

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Catalysts

-

Lubricant Additives

-

Driers

-

Plastic Stabilizers

-

Polyester Accelerators

-

Fuel Additives

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal carboxylates market size was estimated at USD 5.71 billion in 2024 and is expected to reach USD 6.0 billion in 2025.

b. The global metal carboxylates market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 7.91 billion in 2030.

b. Asia Pacific dominated the metal carboxylates market in the food & beverages market with a share of 48.1% in 2024. The Asia Pacific region is dominant in the metal carboxylates market, Rapid industrialization in the region is anticipated to increase the demand for metal carboxylates market.

b. Some key players operating in the metal carboxylates market include BASF SE, Ege Kimya San. ve Tic. A.S, Elementis plc, BASF SE, Arkema Group, PMC Group, Inc., Valtris Specialty Chemicals, Penta Manufacturing Company, Dow, Ege Kimya San. ve Tic. A.S, Oriental International (Pvt) Ltd., and CarboTech.

b. This growth is attributed to the expansion of the transportation sector, especially in automotive and aerospace, is fueling market growth. The increasing preference for eco-friendly waterborne metal carboxylates is another reason for the growth of the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.