- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Metallic Pigments Market Size, Share & Growth Report, 2030GVR Report cover

![Metallic Pigments Market Size, Share & Trends Report]()

Metallic Pigments Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Aluminum, Zinc, Copper), By Application (Paints & Coatings, Cosmetics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-770-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metallic Pigments Market Size & Trends

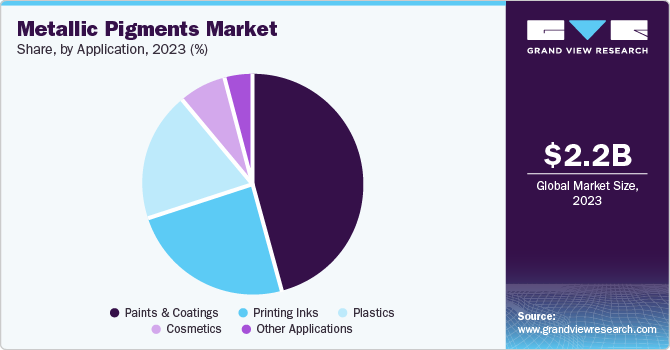

The global metallic pigments market size was valued at USD 2.16 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. Market growth driven by several key factors, including the increasing demand in automotive coatings, growing construction activities, expansion of the packaging industry, technological advancements, and trend towards eco-friendly products.

The automotive industry is a significant driver of market growth, as manufacturers utilize metallic pigments to enhance the durability and aesthetic appeal of vehicle coatings. Moreover, the rapid urbanization and infrastructure development in construction activities create demand for metallic pigments in architectural coatings. In addition, printing ink manufacturers are expected to contribute to market growth by developing a range of formulations that provide stylish, resilient, and enduring special effects for flexible packaging and other uses.

The packaging industry is another key driver of the market, as manufacturers seek to create eye-catching packaging solutions for consumer goods. The rise of e-commerce has further fueled the demand for metallic pigments, as companies aim to stand out in a crowded online marketplace. Technological advancements in metallic pigments have expanded their applications across various industries, including printing, textiles, and cosmetics. These innovations have enabled the development of unique visual effects and improved color intensity, making metallic pigments an attractive option for manufacturers.

The market is also driven by the trend towards eco-friendly products, as consumers increasingly prioritize sustainability. This shift has encouraged manufacturers to develop eco-friendly metallic pigments that comply with regulatory standards. As a result, the market is expected to see lucrative opportunities for growth, driven by the development of unique metal oxides with substrate layering and the increasing preference for green coatings among consumers and manufacturers.

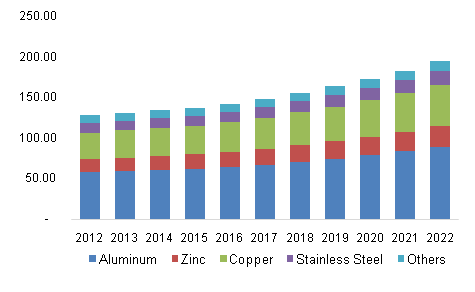

Product Insights

Aluminum accounted for the largest market revenue share of 39.7% in 2023. Aluminum products come in a variety of colors and possess high light reflectance to enhance the beauty, and enhance the anti-rust and anti-corrosion characteristics. The increasing demand of the product in automotive paints and coatings due to properties such as high metallic luster, high performance pigments and durability is the factor expected to drive segment growth further.

Zinc is expected to grow significantly with a CAGR of 6.5% during the forecast period. The zinc segment is experiencing growth in the metallic pigments market, driven by its ability to produce a desirable gold-bronze color effect in combination with copper. With a lower cost compared to other metals, zinc offers a budget-friendly option for manufacturers seeking to incorporate metallic appearances in their products.

Application Insights

The paints & coatings segment dominated the market and accounted for a share of 46.0% in 2023. The surge in infrastructure projects is driving demand for paint and coating, with emerging markets such as Indonesia, India, Bangladesh, and Vietnam expected to experience significant growth. As construction activities increase, the need for metallic pigments will also rise, benefiting from their ability to enhance visual attractiveness, flexibility, and protection against rust and corrosion.

The printing inks segment is projected to grow at the second-fastest CAGR of 6.4% over the forecast period. Metallic printing inks can significantly enhance the aesthetic appeal of packaging, captivating consumers’ attention on store shelves. Used in various applications such as banners, signs, posters, and apparel products, these inks provide a luxurious and vibrant effect. Continuous advancements in printing techniques and ink formulations enable metallic effects on a broader range of materials, opening opportunities for innovative applications.

Regional Insights

North America metallic pigments market was identified as a lucrative region in the global metallic pigments market in 2023 due to requirements for high performance but at the same time with appealing aesthetics keep the metallic pigment market in business. Consumers of North America are more and more engaging with premium products that give the feel of luxury and decoration. Metallic effects in packaging, cosmetics, and even home decors offer a living to this trend by perpetuating demand for metallic pigments across several applications.

U.S. Metallic Pigments Market Trends

The metallic pigments market in the U.S. is expected to grow rapidly in the coming years due to expansion of the automotive industry in the country. Rising innovations by key manufacturers to promote the use of various sustainable raw materials in the automotive industry are expected to the boost growth opportunities in the metallic pigments market.

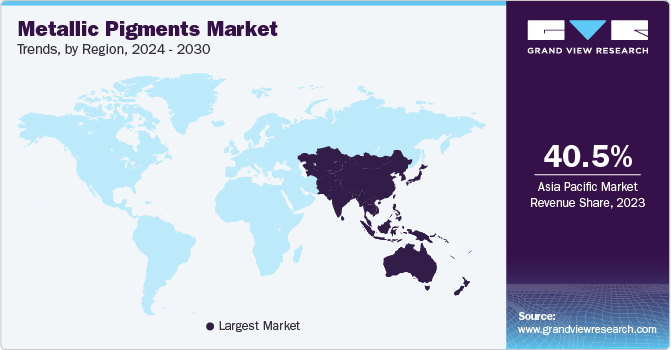

Asia Pacific Metallic Pigments Market Trends

Asia Pacific metallic pigments market led the global metallic pigments market with 40.5% of the total revenue share in 2023. The automotive sector, infrastructure projects, and industrial construction activities are driving the demand for metallic pigments. Growing demand in the automotive industry, particularly in commercial and passenger vehicles, and increased housing construction in Asia Pacific are expected to boost demand. Compliance with regulatory policies and the development of various printing inks and plastic products are also expected to increase the uptake of metallic pigments.

Metallic pigments market in China dominated the Asia Pacific market with a share of 41.0% in 2023. China has a booming manufacturing sector, particularly in construction, automotive, and packaging. These industries heavily rely on metallic pigments in paints and coatings for vehicles, buildings, and product packaging, driving market growth in the country.

Europe Metallic Pigments Market Trends

Europe metallic pigments market is anticipated to witness significant growth in the global market. European manufacturers lead the way in technological advancements for metallic pigments. This consists of colors with enhanced vibrancy, longevity, and features such as reflecting heat or light, resulting in new uses. Europe is a central location for high-end products, such as fashion, cars, beauty products, and household items. Metallic pigments are essential in achieving the luxurious and high-quality appearance that distinguishes these products, fueling demand within this category.

Germany metallic pigments market is expected to grow rapidly in the coming years. An increase in the demand for metallic pigments in Germany is coming from the paints and coatings industry. The growing consumer awareness about less toxic and sustainable coloring agents in expected to generate lucrative opportunities for market players. Moreover, rising demand for various cosmetic products such as haircare products, shower gel, eyeshadows, nail varnishes, and powders, which use metal pigments significantly, is also impacting market growth positively.

Key Metallic Pigments Company Insights

Some key companies in metallic pigments market include BASF SE; Sudarshan Chemical Industries Limited; ALTANA (Eckart Pigments); and SCHLENK SE; among others. Key initiatives undertaken in the industry include strategic developments, such as mergers and acquisitions, and product innovation, such as eco-friendly and high-performance formulations, to maintain competitiveness.

-

Sudarshan Chemical Industries Ltd is a manufacturer of pigments and colors, offering a diverse range of products including natural and synthetic pigments, high-performance pigments, and specialty pigments.

-

Carlfors Bruk AB is a producer and supplier of aluminum pigments and flakes. The company’s products are sold to construction companies, building materials retailers, and metal manufacturers in Sweden and internationally, catering to the global demand for high-quality aluminum pigments.

Key Metallic Pigments Companies:

The following are the leading companies in the metallic pigments market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Sudarshan Chemical Industries Limited

- ALTANA (Eckart Pigments)

- SCHLENK SE

- Comp5

- Sun Chemical

- Vibrantz (Ferro Corporation)

- CARLFORS BRUK

- Toyal America Inc

- Asahi Kasei Corporation

- Umicore

- SABIC

Recent Developments

-

In July 2024, Sun Chemical implemented a price increase on its European, Middle Eastern, and African ink products in response to supply chain disruptions, shortages, and tariffs, resulting from issues such as insolvencies, anti-dumping duties, and rising sea freight rates.

-

In March 2024, Sudarshan Chemical Industries Limited achieved near-term reductions in company-wide emissions by aligning with climate science through the Science-Based Targets initiative, a private sector initiative setting emission reduction goals based on science and promoting ambitious climate action.

-

In January 2024, ALTANA acquired Silberline, a leading aluminum effect pigments manufacturer, to expand its global presence and strengthen its ECKART division, particularly in North America and Asia.

Metallic Pigments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.30 billion

Revenue forecast in 2030

USD 3.34 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

BASF SE; Sudarshan Chemical Industries Limited; ALTANA (Eckart Pigments); SCHLENK SE; Sun Chemical; Vibrantz (Ferro Corporation); CARLFORS BRUK; Toyal America Inc; Asahi Kasei Corporation; Umicore; SABIC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metallic Pigments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metallic pigments market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Zinc

-

Copper

-

Stainless Steel

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Plastics

-

Printing Inks

-

Cosmetics

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.