- Home

- »

- Automotive & Transportation

- »

-

Micro Electric Vehicle Market Size, Industry Report, 2030GVR Report cover

![Micro Electric Vehicle Market Size, Share & Trends Report]()

Micro Electric Vehicle Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Quadricycle, Golf Carts), By Battery Type (Lithium-ion, Lead Acid), By Application (Commercial Use, Personal Use, Public Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-571-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro Electric Vehicle Market Summary

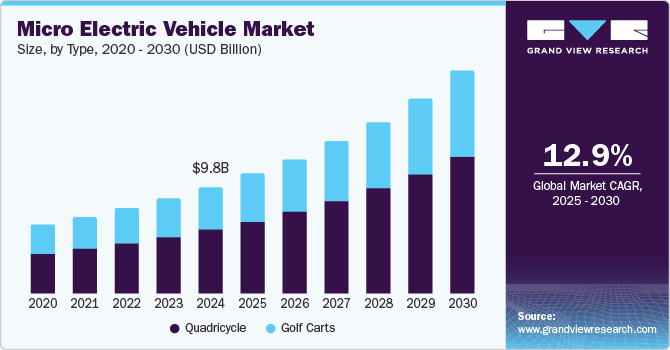

The global micro electric vehicle market size was estimated at USD 9.84 billion in 2024 and is projected to reach USD 20.26 billion by 2030, growing at a CAGR of 12.9% from 2025 to 2030. Micro electric vehicles (MEVs) are compact, battery-powered vehicles designed for urban environments. They offer a space-saving, zero-emission mobility option, often with features such as compact size, low speed, and good maneuverability.

Key Market Trends & Insights

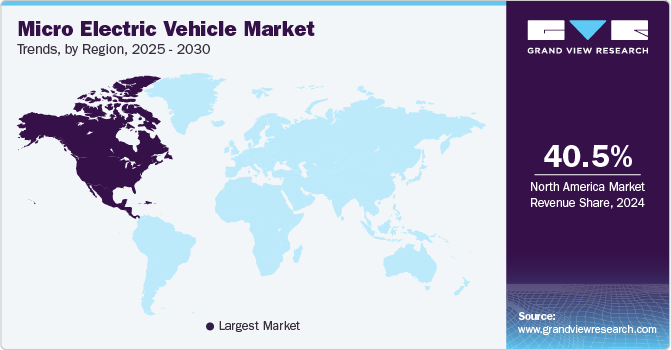

- The North America dominated the micro electric vehicle market with the largest revenue share of 40.54% in 2024.

- The U.S. accounted for the largest market revenue share in 2024.

- By battery type, the lithium-ion battery segment accounted for the largest revenue share in 2024.

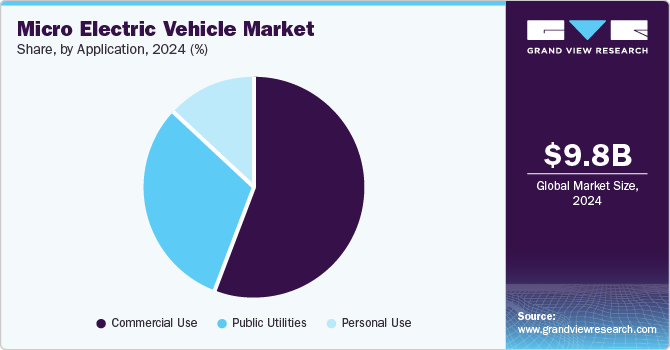

- By application, the commercial use segment accounted for the largest revenue share in 2024.

- By type, the quadricycle segment led the market with the largest revenue share of 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.84 Billion

- 2030 Projected Market Size: USD 20.26 Billion

- CAGR (2025-2030): 12.9%

- North America: Largest market in 2024

Factors such as increasing demand for urban mobility solutions, stringent emission policies and regulations aimed at reducing carbon footprints, and ongoing technological advancements in battery technology can be attributed to the growth of the micro electric vehicle industry.

Factors such as increasing demand for urban mobility solutions, stringent emission policies and regulations aimed at reducing carbon footprints, and ongoing technological advancements in battery technology can be attributed to the growth of the micro electric vehicle industry.

The surge in urban population density and traffic congestion is pushing cities worldwide to seek compact and efficient transport solutions. Micro electric vehicles, with their small footprint and low emissions, are emerging as ideal alternatives for last-mile connectivity and short-distance commuting. Cities are encouraging their use through low-emission zones, congestion charges, and restrictions on large vehicles in city centers. Urban planners prioritizing sustainable mobility are increasingly integrating MEVs into shared mobility fleets, campus shuttles, and delivery services, addressing environmental goals and practical urban challenges. Thus, increasing urban congestion and demand for last-mile mobility is propelling the growth of the micro electric vehicle industry.

Stringent emission regulations and generous government incentives are playing a critical role in accelerating MEV adoption globally. Many countries offer subsidies, tax rebates, and grants for electric vehicle purchases, including micro-EVs, making them more affordable for consumers. Regulatory frameworks such as the European Union’s CO₂ targets, China's NEV credits, and India’s FAME scheme are actively shaping market dynamics. These policies are encouraging both consumers to shift away from traditional combustion vehicles and manufacturers to expand their electric product portfolios, including micro-sized models designed for urban use.

The global boom in e-commerce has created demand for efficient, cost-effective last-mile delivery solutions, which is fueling the uptake of MEVs. These vehicles are increasingly used by logistics providers and retailers for delivering packages in densely populated urban areas where larger vehicles face access restrictions. Their lower operating costs, ease of maneuverability, and compatibility with green delivery initiatives make them attractive for companies looking to reduce carbon footprints and improve delivery efficiency. The growth of same-day and quick commerce services is making MEVs crucial tools in urban logistics networks, thereby driving the market growth.

Advancements in battery technology and the rapid expansion of charging infrastructure are further driving the MEV adoption. Improvements in battery density, charging speed, and durability have enhanced the range and performance of micro EVs, making them more practical for daily use. In addition, investments in public and private charging stations, especially in urban centers, are addressing range anxiety and improving convenience for users. The continued decline in battery costs enables manufacturers to offer better-equipped, more affordable micro EVs, expanding their appeal in both developed and emerging markets.

Type Insights

The quadricycle segment led the market with the largest revenue share of 60.0% in 2024. Quadricycles are small, lightweight vehicles designed for short commutes and city driving. Their compact size makes them ideal for navigating narrow streets and crowded urban areas. They offer low operating costs and are easy to park, adding to their practicality. With zero emissions, they appeal to environmentally conscious consumers and cities aiming to cut congestion and pollution. Such factors are expected to contribute to the segment’s growth.

The golf carts segment is expected to grow at the fastest CAGR during the forecast period. These vehicles are increasingly being utilized for short-distance travel within gated communities, large campuses, and recreational areas, where their compact size and zero emissions make them ideal. The rising demand for clean and efficient transport solutions in eco-conscious communities is fueling the growth of electric golf carts. Moreover, the commercial sector is adopting golf carts for last-mile delivery and maintenance operations in resorts, airports, and large shopping centers, thereby driving the segment’s growth.

Battery Type Insights

The lithium-ion battery segment accounted for the largest revenue share in 2024. The increasing adoption of lithium-ion batteries in MEVs due to their longer lifespan, superior energy density, and faster charging capabilities compared to traditional battery types can be attributed to the segment’s growth. With battery costs declining, manufacturers are turning to lithium-ion technology to equip micro EVs with longer range and enhanced performance, increasing their appeal for daily commuting and commercial applications. The growing emphasis on lightweight, efficient, and eco-friendly vehicles is also supporting the shift towards lithium-ion, especially in urban centers where range and charging convenience are critical.

The lead acid battery segment is expected to register at the fastest CAGR during the forecast period. Lead-acid batteries maintain a solid presence in the micro electric vehicle industry, especially in cost-sensitive regions and entry-level models. Their lower upfront cost makes them attractive for budget-conscious consumers and for applications where short-distance travel is sufficient, such as golf carts, campus shuttles, and neighborhood electric vehicles (NEVs). Despite their heavier weight and shorter lifespan compared to lithium-ion, lead-acid batteries continue to serve markets where affordability takes priority over performance. However, as environmental regulations tighten and demand for higher efficiency grows, the segment is seeing a gradual shift, though it remains relevant for low-cost, utility-focused MEVs in developing economies.

Application Insights

The commercial use segment accounted for the largest revenue share in 2024. The segment’s growth is driven by the rapid expansion of e-commerce, last-mile delivery services, and urban logistics. Companies are increasingly adopting MEVs to reduce operating costs, meet sustainability goals, and navigate congested city streets where larger vehicles face restrictions. Their compact size, lower emissions, and affordability make them ideal for tasks such as food delivery, parcel distribution, and small-scale freight transport in urban centers. Thus, increasing adoption of MEVs for commercial transportation applications is propelling the growth of the segment.

The public utilities segment is anticipated to grow at the fastest CAGR during the forecast period. Public utilities are adopting micro electric vehicles as part of their efforts to modernize fleets and support sustainable urban infrastructure. MEVs are being deployed by municipalities and government agencies for applications such as street cleaning, park maintenance, security patrols, and waste collection in areas where noise and emissions need to be minimized. Their low operating costs, ease of maneuverability, and suitability for short-distance, repetitive tasks make them an efficient solution for public sector use. With cities worldwide focusing on green mobility and zero-emission targets, the integration of MEVs into public utility operations is expected to grow, further boosting the segment’s market growth.

Regional Insights

North America dominated the micro electric vehicle market with the largest revenue share of 40.54% in 2024, primarily due to the widespread use of golf carts and quadricycles, especially in the U.S. and Canada. The region's advanced infrastructure and consumer preferences for eco-friendly transport contribute to its significant market share.

U.S. Micro Electric Vehicle Market Trends

The micro electric vehicle market in the U.S. accounted for the largest market revenue share in 2024, driven by the rising urban congestion, increasing environmental awareness, and strong demand for low-speed electric vehicles (LSEVs) such as neighborhood electric vehicles (NEVs) and golf carts.

Europe Micro Electric Vehicle Market Trends

The micro electric vehicle market in Europe is expected to register at a moderate CAGR from 2025 to 2030. Europe is witnessing growth fueled by strict environmental regulations and the European Union’s ambitious climate goals. Numerous countries have introduced policies that promote electric mobility, offering subsidies for EV purchases and investing heavily in charging infrastructure.

The UK micro electric vehicle market is expected to register at a notable CAGR from 2025 to 2030.In the UK, the micro electric vehicle industry is benefiting from the government's aggressive push towards zero-emission transport, including the planned ban on new petrol and diesel vehicles by 2035. The rising cost of fuel and growing popularity of car-sharing and subscription models are also driving demand for micro electric vehicles.

The micro electric vehicle market in Germany held a substantial market share in 2024, owing to the stringent CO₂ emission targets, generous subsidies for electric vehicles, and a strong domestic automotive industry that's shifting toward sustainable mobility solutions.

Asia Pacific Micro Electric Vehicle Market Trends

The micro electric vehicle market in Asia Pacific is anticipated to grow at a significant CAGR of 15.2% during the forecast period. Asia Pacific is rapidly growing, with countries such as China and India investing heavily in electric mobility initiatives to combat pollution and reduce reliance on fossil fuels. The development of extensive charging networks and the proliferation of electric vehicle manufacturing support the growth of MEVs in this region.

The India micro electric vehicle market is expected to grow at the fastest CAGR during the forecast period. The market is expected to be driven by severe urban congestion, high pollution levels, and strong government support through initiatives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme.

The micro electric vehicle market in China held a substantial market share in 2024. The country's aggressive electric mobility policies, urban air quality concerns, and government subsidies have created an environment highly favorable to MEVs. Moreover, China's massive urbanization and densely populated cities make micro EVs a logical solution for personal mobility, thereby driving the market’s growth.

Key Micro Electric Vehicle Company Insights

Some of the key companies in the micro electric vehicle industry include Citroen, Toyota Motor Corporation, and Toyota Motor Corporation, among others. These players are taking several strategic initiatives, such as new product launches, business expansions, partnerships, collaborations, and agreements, among others.

-

Toyota Motor Corporation is a Japanese multinational automotive manufacturer. The company designs, manufactures, and sells a full range of vehicles, including sedans, SUVs, trucks, and electrified models. It also develops micro electric vehicles (MEVs). In March 2025, Toyota Motor Europe (TME) introduced the FT-Me concept, a compact battery electric vehicle developed to address the demands of changing urban landscapes.

-

Citroën is a French automobile brand. The brand is known for its unique styling, comfort, and innovative vehicles and services, aiming to make mobility accessible to everyone. The company offers a micro electric vehicle called the Ami. The Ami is a 100% electric quadricycle, designed for urban use and short trips, offering easy maneuverability and parking in tight spaces.

Key Micro Electric Vehicle Companies:

The following are the leading companies in the micro electric vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Citroen

- Club Car

- Micro Mobility System AG (Microlino)

- Nissan Motor

- Polaris

- Toyota Motor Corporation

- Yamaha Motor

- Eli Electric Vehicles

- GEM (Waev Inc.)

- ICON Electric Vehicles

Recent Developments

-

In March 2025, Rivian launched a micromobility startup called “Also,” with the goal of reshaping the electric micromobility landscape through the development of affordable, scalable electric vehicles tailored for urban and short-distance travel.

-

In May 2024, Eli Electric Vehicles expanded into the U.S. market with the launch of the Eli ZERO, a micro electric vehicle designed to reduce urban congestion and improve daily commutes.

Micro Electric Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.04 billion

Revenue forecast in 2030

USD 20.26 billion

Growth rate

CAGR of 12.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, battery type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Citroen; Club Car; Micro Mobility System AG (Microlino); Nissan Motor; Polaris; Toyota Motor Corporation; Yamaha Motor; Eli Electric Vehicles; GEM (Waev Inc.); ICON Electric Vehicles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro Electric Vehicle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro electric vehicle market report based on type, battery type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Quadricycle

-

Golf Carts

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium-ion Battery

-

Lead Acid Battery

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Use

-

Public Utilities

-

Personal Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micro electric vehicle market size was estimated at USD 9.84 billion in 2024 and is expected to reach USD 11.04 billion in 2025.

b. The global micro electric vehicle market is expected to grow at a compound annual growth rate of 12.9% from 2025 to 2030 to reach USD 20.26 billion by 2030.

b. The commercial use segment dominated the market in 2024. The segment’s growth is driven by the rapid expansion of e-commerce, last-mile delivery services, and urban logistics.

b. Some key players operating in the micro electric vehicle market include Citroen, Club Car, Micro Mobility System AG (Microlino), Nissan Motor, Polaris, Toyota Motor Corporation, Yamaha Motor, Eli Electric Vehicles, GEM (Waev Inc.), and ICON Electric Vehicles.

b. Factors such as increasing demand for urban mobility solutions, stringent emission policies and regulations aimed at reducing carbon footprints, and ongoing technological advancements in battery technology can be attributed to the growth of the micro electric vehicle market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.