- Home

- »

- Advanced Interior Materials

- »

-

Middle East Air Compressor Market, Industry Report, 2033GVR Report cover

![Middle East Air Compressor Market Size, Share & Trends Report]()

Middle East Air Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Product (Reciprocating, Rotary/Screw), By Lubrication, By Application, By Operating Mode, By Power Range, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-736-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Air Compressor Market Summary

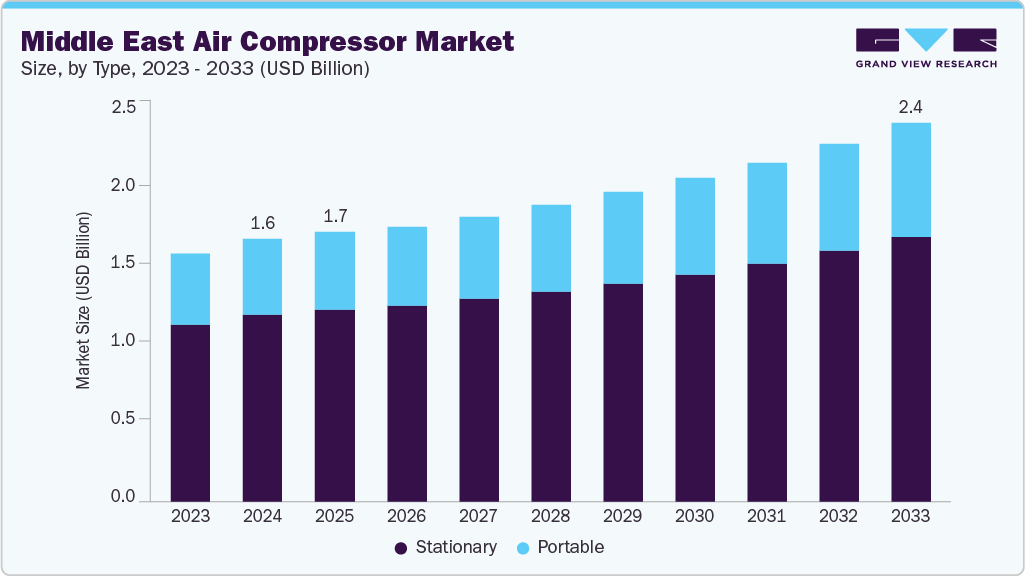

The Middle East air compressor market size was estimated at USD 1,692.9 million in 2024 and is projected to reach USD 2,443.3 million by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The Middle East air compressor industry is primarily driven by strong demand from the oil & gas and petrochemical industries, which are central to the region’s economy.

Key Market Trends & Insights

- The Saudi Arabia air compressor market is expected to grow at a CAGR of 4.7% from 2025 to 2033.

- By Type, the portable segment is expected to grow at a considerable CAGR of 5.0% from 2025 to 2033.

- By product, the centrifugal segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033.

- By application, the semiconductor & electronics segment is projected to expand at a significant CAGR of 6.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,692.9 Million

- 2033 Projected Market Size: USD 2,443.3 Million

- CAGR (2025-2033): 4.4%

These sectors rely heavily on compressed air for exploration, drilling, refining, and processing activities, creating consistent demand for both portable and stationary compressors. As regional governments invest in expanding downstream capacity and enhancing energy infrastructure, the need for reliable and efficient air compression systems continues to rise.

Another significant factor is the rapid growth of construction, manufacturing, and infrastructure development across the region. Large-scale projects under Saudi Arabia’s Vision 2030 and the UAE’s smart city initiatives are fueling demand for compressors in applications such as concrete spraying, powering pneumatic tools, and other industrial processes. In addition, the push toward energy efficiency and the adoption of oil-free and variable-speed compressors in sectors such as food & beverage, pharmaceuticals, and healthcare is broadening market demand beyond oil and gas.

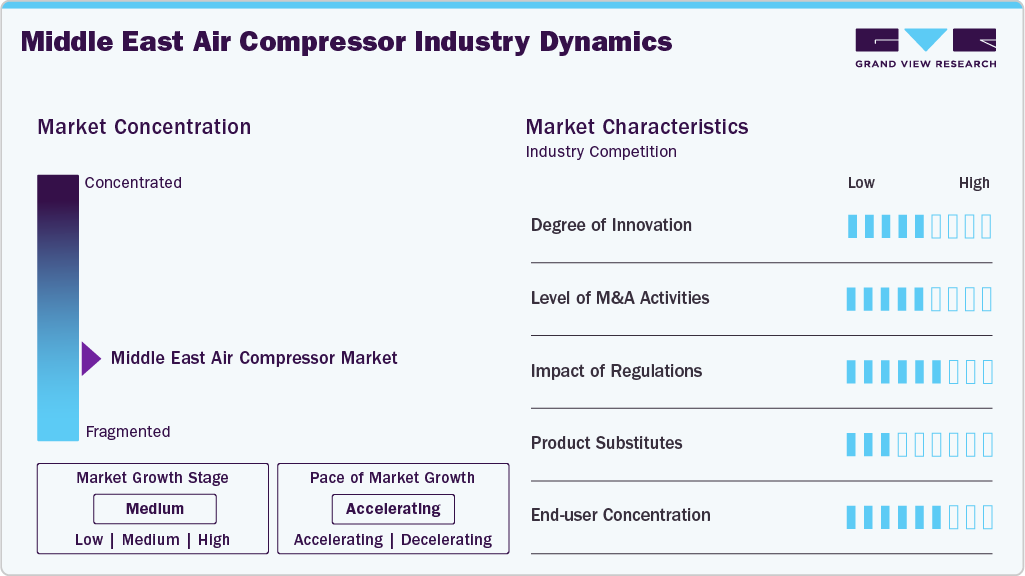

Market Concentration & Characteristics

The air compressor market in Middle East is moderately concentrated, with a mix of established international manufacturers and dynamic regional suppliers. Leading companies such as Atlas Copco, Ingersoll Rand, KAESER KOMPRESSOREN, and Hitachi Global Air Power command significant market presence by leveraging strong distribution networks, brand reputation, and continuous product innovation. Their ability to deliver advanced, energy-efficient solutions and comprehensive after-sales support secures their dominance across key end-user sectors including oil & gas, manufacturing, construction, and power generation.

At the same time, smaller regional players contribute meaningfully by catering to niche or customized requirements that international firms may not fully address. These local suppliers often focus on adapting equipment for harsh operating conditions, cost-sensitive applications, or unique project needs within domestic markets. Their role enriches the competitive environment by ensuring that end-users have access to a diverse range of solutions, keeping the market balanced between consolidation and fragmentation.

Regulatory frameworks also play a critical role in shaping the Middle East air compressor market. Governments and environmental authorities are increasingly emphasizing energy efficiency, carbon reduction, and sustainable industrial practices under national strategies such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 initiative. Efficiency standards, incentives for low-emission technologies, and sustainability-driven procurement policies are encouraging both manufacturers and end-users to adopt advanced, eco-friendly compressor systems. This regulatory push is accelerating the market’s shift toward innovation, cleaner technologies, and long-term sustainable growth.

Drivers, Opportunities & Restraints

The Middle East air compressor market is supported by a blend of energy-sector reliance and industrial diversification. While oil & gas ensures a strong base of demand, expanding non-oil industries, coupled with rising focus on sustainability and advanced compressor technologies, are creating long-term growth opportunities. This dual reliance positions the market for steady expansion across both traditional and emerging applications.

The market is presented with strong growth opportunities through the rising focus on energy efficiency and sustainable technologies. With governments pushing for carbon reduction and industrial modernization under programs such as Saudi Vision 2030 and UAE’s Net Zero 2050, there is growing demand for oil-free, variable-speed, and digitally integrated compressors. Expanding sectors such as food & beverage, pharmaceuticals, and renewable energy further create opportunities for manufacturers to diversify applications beyond oil & gas and tap into new, long-term growth avenues.

However, a key restraint for the Middle East air compressor market is the high capital and maintenance costs associated with advanced compressor systems. Energy-efficient and oil-free compressors, while increasingly in demand, require significant upfront investment, which can limit adoption among small and mid-sized enterprises. In addition, fluctuating oil prices and economic uncertainties in the region can slow down large-scale industrial investments, directly impacting compressor demand.

Type Insights

The stationary segment held the largest market share, at 71.4% in 2024. Stationary air compressors are driven by their widespread use in large-scale industrial applications such as oil & gas, petrochemicals, manufacturing, and power generation. Their ability to deliver continuous, high-capacity air supply makes them indispensable for plants that operate around the clock. Growing industrialization in the Middle East, coupled with the establishment of new industrial hubs under initiatives like Saudi Arabia’s Vision 2030, is further boosting demand for these systems.

The portable segment is expected to grow at a significant CAGR of 5.0% from 2025 to 2033 in terms of revenue. The portable air compressor segment benefits from the expansion of construction, mining, and infrastructure projects across the region. Portable compressors are valued for their mobility, ease of use, and reliability in remote or temporary sites, making them essential for drilling, concrete spraying, and other heavy-duty tasks. With ongoing megaprojects such as NEOM and Expo City Dubai, the demand for rugged, portable compressors continues to grow.

Lubrication Insights

The oil filled segment represented the largest share of the market in 2024 at 69.1% due to their robust performance, cost-effectiveness, and efficiency in heavy-duty applications. They are extensively used in manufacturing and energy sectors where a steady air supply is required, and the presence of oil in compressed air does not pose a risk. Their durability and lower upfront cost compared to oil-free systems support continued adoption across industrial applications.

The oil free segment is expected to grow at a significant CAGR of 5.6% from 2025 to 2033 in terms of revenue. The oil-free air compressors segment is driven by the growing emphasis on clean, contamination-free air in industries such as food & beverage, pharmaceuticals, and electronics. Stringent regulatory standards for product safety and hygiene, along with the rising need for energy-efficient and environmentally friendly solutions, are propelling the adoption of oil-free compressors across the region..

Application Insights

The manufacturing segment remained the largest market segment in 2024, accounting for 40.0% of the market. The manufacturing sector drives compressor adoption due to their role in powering pneumatic tools, assembly lines, and automated systems. Regional efforts to diversify economies away from oil dependence are spurring investments in automotive, metalworking, and packaging industries, boosting the need for reliable compressed air solutions.

The semiconductor & electronics segment is expected to grow at a moderate CAGR of 6.3% from 2025 to 2033 in terms of revenue. The semiconductor and electronics segment is driven by the need for ultra-clean, oil-free compressed air in precision manufacturing processes. With Gulf countries investing in advanced technology and electronics assembly as part of economic diversification, this segment is becoming an important growth area for oil-free and high-purity compressors.

Operating Mode Insights

The electric segment held the largest market share in 2024, accounting for 57.6% of the market due to its energy efficiency, lower emissions, and alignment with sustainability goals. With increasing industry electrification and strong government support for cleaner technologies, electric compressors are becoming the preferred choice over fuel-based alternatives. The availability of stable power infrastructure in key Middle Eastern economies further supports this trend.

Internal combustion engine-driven compressors are driven by their independence from grid power, making them suitable for remote oil fields, construction sites, and mining operations. In regions where electricity access is limited or unreliable, these compressors ensure uninterrupted operation, particularly in large-scale infrastructure and energy projects.

Power Range Insights

The 51-250 kW segment held the largest revenue share in 2024, accounting for 34.3% of the market driven by demand from medium to large industrial facilities, including petrochemicals, food processing, and logistics. These compressors provide the right balance between capacity and efficiency, making them suitable for continuous use in a wide range of applications. Ongoing industrial diversification in the Gulf economies strengthens demand in this segment.

The Up to 20 kW segment is expected to grow at a moderate CAGR of 4.8% from 2025 to 2033 in terms of revenue. This Up to 20 kW segment is fueled by demand from small workshops, service centers, and light-duty applications. SMEs across the Middle East rely on compact, cost-effective compressors for daily operations in automotive, repair, and small-scale manufacturing. The affordability and versatility of these units make them highly attractive for businesses operating on tighter budgets.

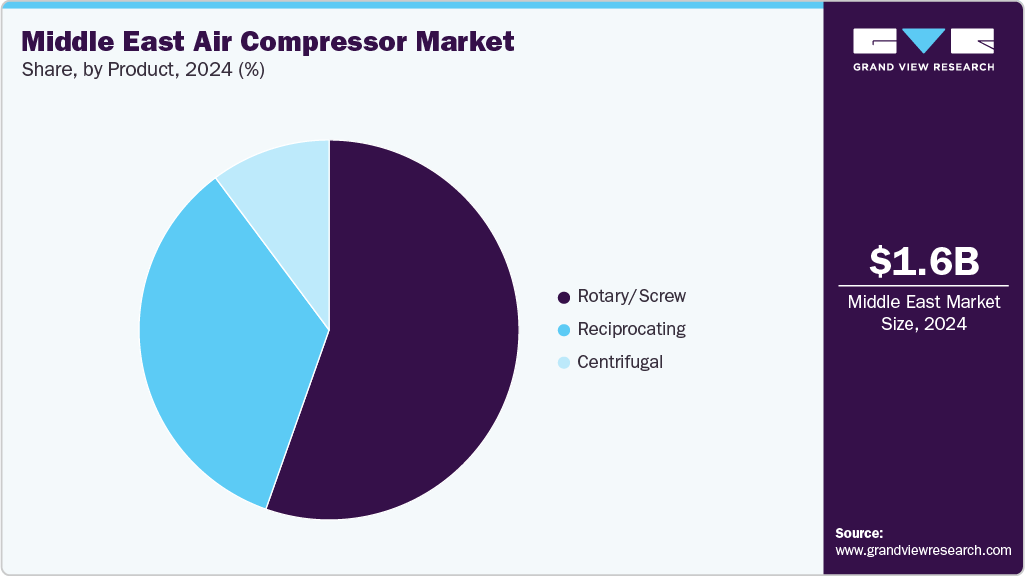

Product Insights

The rotary/screw segment is the largest by market share, accounting for 46.5% in 2024. Growth is propelled by industries such as food processing, chemicals, and manufacturing, all seeking to decarbonize operations and manage rising energy costs. Industrial facilities are switching to biomass boilers for steady, high-volume steam and process heat. High and consistent thermal demand, together with access to on-site or local biomass resources, makes these systems especially attractive.

The centrifugal segment is expected to grow at a moderate CAGR of 5.7% from 2025 to 2033 in terms of revenue. Centrifugal compressors are gaining traction due to their suitability for large-scale, high-capacity applications, particularly in oil & gas and power generation. Their ability to handle large volumes of compressed air with relatively lower operating costs makes them a preferred choice for refineries and petrochemical complexes. Rising investments in downstream oil & gas projects across the Middle East are a key driver for this segment.

Country Insights

Saudi Arabia Air Compressor Market Trends

The air compressor market in Saudi Arabia is expanding steadily, and accounted for 50.5% of the market share in 2024 supported by the country’s large-scale oil & gas, petrochemical, and industrial development projects. Vision 2030 is fueling diversification into manufacturing, mining, and infrastructure, all of which depend heavily on compressed air technologies. Investments in megaprojects such as NEOM, The Red Sea Project, and industrial zones are creating sustained demand for both stationary and portable compressors. In addition, a strong focus on energy efficiency and the adoption of advanced, oil-free systems in healthcare, food, and pharmaceuticals are opening new growth avenues.

UAE Air Compressor Market Trends

The UAE air compressor market is projected grow at a CAGR of 4.4% over the forecast period driven by construction, infrastructure modernization, and diversification into non-oil sectors. Dubai and Abu Dhabi continue to lead with investments in smart cities, logistics hubs, and renewable energy projects, requiring advanced air compressor solutions. The country’s thriving aviation, healthcare, and electronics industries further push demand for oil-free and high-efficiency compressors. Moreover, the UAE’s Net Zero 2050 strategy is encouraging adoption of electric and energy-efficient compressors, reinforcing long-term market growth.

Key Middle East Air Compressor Company Insights

Some of the key players operating in the market include Atlas Copco and Ingersoll Rand.

-

Atlas Copco, headquartered in Sweden, is a prominent global provider of industrial productivity solutions. Founded in 1873, the company specializes in air compressors, vacuum solutions, industrial tools, and construction equipment. Its products are widely used across industries such as oil & gas, manufacturing, mining, and power generation. Atlas Copco is known for its focus on energy-efficient technologies, digital solutions, and sustainability initiatives, maintaining a strong presence in the Middle East and worldwide.

-

Ingersoll Rand, based in the U.S., is a diversified industrial manufacturer with a broad portfolio of mission-critical flow creation and industrial solutions, including air compressors, pumps, blowers, and power tools. It serves sectors such as manufacturing, transportation, energy, and healthcare networks.

Key Middle East Air Compressor Companies:

- Atlas Copco

- Ingersoll Rand

- KAESER KOMPRESSOREN

- Hitachi Global Air Power US, LLC

- BOGE KOMPRESSOREN

- ELGi

- BAUER COMPRESSORS, INC

- Kaishan Group

- SEIZE AIR

- Burckhardt Compression

Recent Developments

-

In March 2025, Azizi Developments, a private developer in the UAE, announced its collaboration with Atlas Copco, to provide advanced air compressors for its major Dubai projects Riviera and Azizi Venice. These developments emphasize energy efficiency, large-scale infrastructure, and innovative lifestyle features, highlighting Azizi’s commitment to quality and sustainability.

-

In April 2024, Atlas Copco launched the GA 11-30 FLX, its first dual-speed air compressor, which reduces energy use by up to 20% compared to previous fixed-speed models. The GA FLX offers compact design, optimal airflow at all pressures, and software-based upgradability to Variable Speed Drive for further energy savings, addressing growing market demand for efficiency and flexibility.

Middle East Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,737.1 million

Revenue forecast in 2033

USD 2,443.3 million

Growth rate

CAGR of 4.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, lubrication, application, operation mode, power range, country

Country scope

Saudi Arabia; UAE; Oman; Qatar

Key companies profiled

Atlas Copco; Ingersoll Rand; KAESER KOMPRESSOREN; Hitachi Global Air Power US, LLC; BOGE KOMPRESSOREN; ELGi; BAUER COMPRESSORS, INC; Kaishan Group; SEIZE AIR; Burckhardt Compression

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Air Compressor Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East air compressor market report based on type, product, lubrication, operating mode, power range, and country.

-

Type Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Stationary

-

Electric

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Internal Combustion Engine

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

-

Portable

-

Electric

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Internal Combustion Engine

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

Over 500 kW

-

-

-

Product Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Oil Free

-

Oil Filled

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Operating Mode Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Electric

-

Internal Combustion Engine

-

-

Power Range Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Country Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

Oman

-

UAE

-

Qatar

-

Frequently Asked Questions About This Report

b. The Middle East air compressor market size was estimated at USD 1,692.9 million in 2024 and is expected to be USD 1,737.1 million in 2025.

b. The Middle East air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033 to reach USD 2,443.3 million by 2033.

b. The UAE air compressor market held the largest regional share of the market accounting for 44.0% in 2024 driven by the government’s push for renewable energy adoption and reduced reliance on fossil fuels. Increasing demand for sustainable heating solutions in industrial and commercial sectors is also supporting uptake. Technological advancements in biomass combustion and fuel efficiency are further encouraging market expansion.

b. Some of the key players operating in the Middle East air compressor market include Atlas Copco, Ingersoll Rand, KAESER KOMPRESSOREN, Hitachi Global Air Power US, LLC, BOGE KOMPRESSOREN, ELGi, BAUER COMPRESSORS, INC, Kaishan Group, SEIZE AIR, and Burckhardt Compression.

b. The Middle East air compressor market is driven by strong demand from oil & gas, petrochemicals, and manufacturing industries that require reliable compressed air solutions. Additionally, infrastructure growth and rising investments in energy-efficient, low-maintenance compressors are fueling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.