- Home

- »

- Advanced Interior Materials

- »

-

Middle East Bromine Market Size, Industry Report, 2033GVR Report cover

![Middle East Bromine Market Size, Share & Trends Report]()

Middle East Bromine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Elemental Bromine, Calcium Bromide, Sodium Bromide), By Country (Israel, Saudi Arabia, Qatar, UAE), And Segment Forecasts

- Report ID: GVR-4-68040-749-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Bromine Market Summary

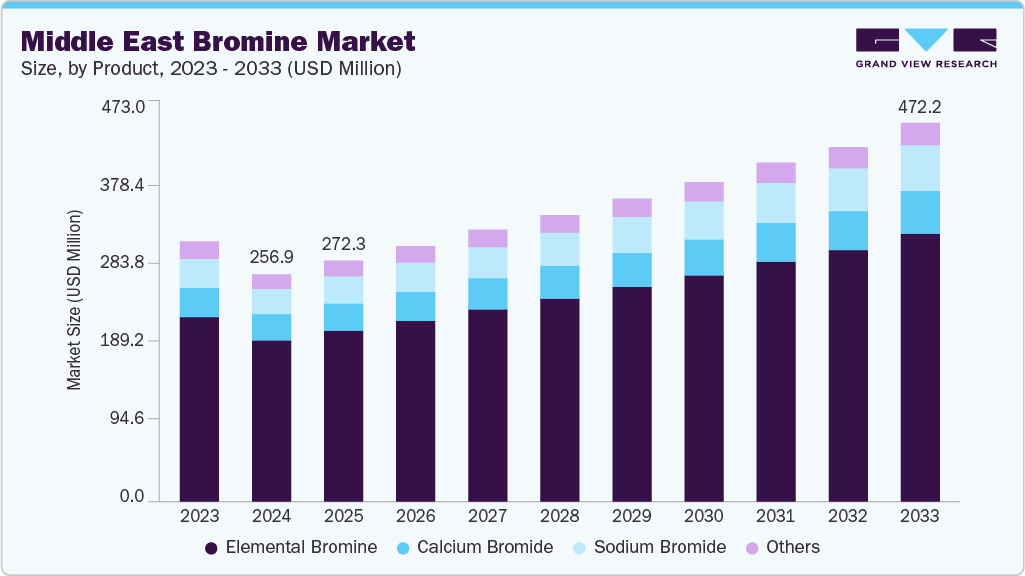

The Middle East bromine market size was valued at USD 256.9 million in 2024 and is projected to reach USD 427.2 million by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The industry is witnessing steady growth as industrial applications of bromine and its derivatives expand across multiple sectors.

Key Market Trends & Insights

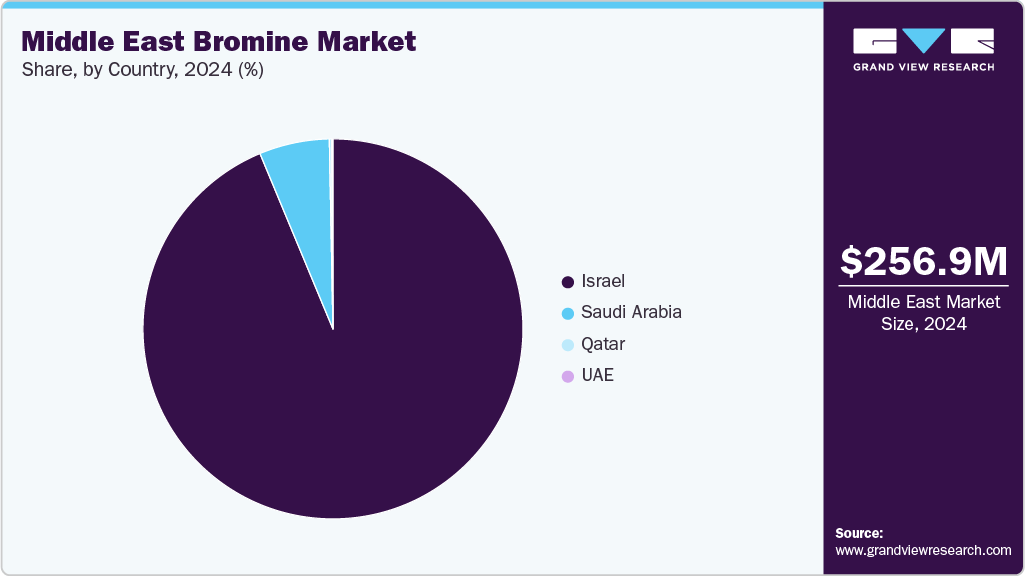

- Israel dominated the Middle East bromine market with the largest revenue share of 92.5% in 2024.

- By product, elemental bromine accounted for the largest revenue share in 2024.

- The bromine market in the UAE is shaped by the country’s strong industrial and trade-driven economy.

Market Size & Forecast

- 2024 Market Size: USD 256.9 Million

- 2033 Projected Market Size: USD 472.2 Million

- CAGR (2025-2033): 5.8%

One of the primary drivers is the rising demand for flame retardants, which are widely used in construction materials, electronics, and automotive components to enhance fire safety. With stricter safety regulations being adopted across the region, especially in infrastructure development and consumer electronics, using brominated flame retardants is becoming increasingly essential. This has created a strong and sustained demand for bromine in the market. Bromine-based compounds, such as clear brine fluids, are widely utilized in drilling and completion activities for oil and gas extraction. As regional governments continue to invest in upstream exploration and production activities, demand for clear brine fluids has increased. Middle Eastern economies' reliance on oil and gas production makes bromine an important element in sustaining these operations.

Bromine derivatives are used in the production of various pharmaceutical formulations, including sedatives and antiseptics. The rising population and increasing healthcare spending in countries like Saudi Arabia, the UAE, and Qatar boost pharmaceutical manufacturing capacity, thereby expanding opportunities for bromine utilization. This trend is expected to remain strong as healthcare infrastructure continues to develop.

With water scarcity being a persistent challenge in the Middle East, governments and industries increasingly turn to advanced water treatment solutions. Bromine-based biocides are used in industrial and municipal water treatment systems to control microbial growth and maintain water quality. As demand for clean water grows, especially in desalination and power generation plants, the role of bromine in water treatment applications will expand further.

Lastly, the increasing diversification of economies in the Middle East creates fresh opportunities for bromine demand. Countries invest in chemical manufacturing, industrial expansion, and export-oriented industries as part of their economic diversification strategies. Bromine and its compounds are key in specialty chemicals, agrochemicals, and advanced material development. This diversification is broadening the scope of bromine applications beyond traditional uses, strengthening its growth outlook in the region.

Drivers, Opportunities & Restraints

The rising demand from end-use industries such as oil and gas, construction, pharmaceuticals, and water treatment primarily drives the growth of the industry. The use of bromine in flame retardants has grown significantly due to the rapid expansion of infrastructure and stricter fire safety standards across the region. Additionally, clear brine fluids derived from bromine are vital for drilling and well completion in oil and gas operations, which remain central to the Middle East economy. Increasing investments in healthcare and water treatment facilities support steady demand for bromine and its derivatives.

Opportunities for the bromine market in the Middle East are expanding as countries diversify their economies and invest in downstream chemical production. Growing industrialization and the push toward developing specialty chemicals, agrochemicals, and advanced materials open new avenues for bromine applications. Moreover, the region’s strategic focus on water management through desalination and advanced water treatment creates additional prospects for bromine-based biocides. Export opportunities are also strengthening, with the Middle East well-positioned to supply bromine and its derivatives to Asia and Europe due to its rich reserves and growing production capacities.

Despite these drivers and opportunities, the market faces certain restraints that could limit its growth potential. Environmental and health concerns related to bromine and its derivatives are leading to regulatory scrutiny, particularly in applications such as flame retardants. Price volatility of raw materials and fluctuations in oil and gas activity can also affect the stability of demand for bromine in drilling fluids. In addition, competition from alternative chemicals and the need for sustainable substitutes in some applications may pose challenges for long-term growth.

Product Insights

The elemental bromine segment is experiencing strong growth due to its critical role as a base material for producing a wide range of bromine derivatives. Given the region's dependence on hydrocarbon production and continuous investments in exploration and well development, its use in clear brine fluids for oil and gas drilling remains one of the most significant drivers. The demand for flame retardants in construction and electronics is another factor boosting elemental bromine consumption, as the compound serves as the foundation for brominated flame retardant manufacturing. With rising infrastructure projects and stricter safety regulations, the market for elemental bromine continues to expand steadily.

Sodium bromideis anticipated to register the fastest CAGR over the forecast period. As one of the most active oil-producing regions in the world, the Middle East continues to invest heavily in upstream operations, which directly drives demand for sodium bromide as a vital completion and drilling fluid. Its effectiveness in stabilizing wells and preventing blowouts makes it indispensable for safe and efficient drilling, aligning with the region’s focus on boosting crude oil output and maintaining global energy supply.

Country Insights

Israel Bromine Market Trends

Israel bromine market benefits strongly from its natural resource base. The Dead Sea has one of the world’s richest bromine-containing brine deposits, providing producers with a cost-effective and reliable feedstock. This unique advantage allows Israel to maintain large-scale production capacity, ensuring a steady supply for both domestic consumption and international exports.

Saudi Arabia Bromine Market Trends

Saudi Arabia bromine market is supported by the country’s broader petrochemical and chemical industry expansion. With a strong government focus on diversifying the economy under Vision 2030, specialty chemicals and derivatives investments provide momentum for the demand for bromine. The kingdom’s growing industrial base in construction, automotive, and manufacturing also stimulates the use of bromine-based flame retardants, water treatment solutions, and drilling fluids.

UAE Bromine Market Trends

The bromine market in the UAE is shaped by the country’s strong industrial and trade-driven economy. As the UAE continues investing in petrochemicals, specialty chemicals, and advanced materials, bromine and its derivatives are important as part of these expanding value chains. The nation’s role as a regional trade hub also allows bromine-based products to be imported, processed, and re-exported efficiently to markets across Asia, Africa, and Europe.

Key Middle East Bromine Companies Insights

Key players operating in the Middle East bromine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Middle East Bromine Companies:

- Arab Potash Company

- ICL Group Ltd.

- Intech Organics Limited

- Jordan Bromine Company

- Muscat and Barka Business Trading Chemical Company

- Rhapsodic FZE

- Saline Water Conversion Corporation (SWCC)

- Specialty Industrial Chemistry Company (SICCo)

Recent Development

-

In June 2024, QatarEnergy announced plans to construct a major salt production facility in the Um Al Houl area, in partnership with Mesaieed Petrochemical Holding Company (MPHC), Qatar Industrial Manufacturing Company (QIMC), and additional strategic partners. Backed by the TAWTEEN localization programme, the plant aims to boost Qatar’s self-sufficiency by producing both industrial and table salt, reducing annual salt imports of approximately 850,000 tonnes, and targeting both local consumption and regional exports.

Middle East Bromine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 272.3 million

Revenue forecast in 2033

USD 427.2 million

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, country

Regional scope

Middle East

Country scope

Israel; Saudi Arabia; UAE; Qatar

Key companies profiled

Jordan Bromine Company; Arab Potash Company; ICL; Specialty Industrial Chemistry Company (SICCo); Saline Water Conversion Corporation (SWCC); Intech Organics Limited; Rhapsodic FZE; Muscat and Barka Business Trading Chemical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Bromine Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East bromine market report on the basis of product and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Elemental Bromine

-

Calcium Bromide

-

Sodium Bromide

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Israel

-

Saudi Arabia

-

Qatar

-

UAE

-

-

Frequently Asked Questions About This Report

b. The Middle East bromine market size was estimated at USD 256.9 million in 2024 and is expected to reach USD 272.3 million in 2025.

b. The Middle East bromine market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 427.2 million by 2033.

b. The elemental bromine segment dominated the market with a revenue share of 70.9% in 2024.

b. Some of the key players of the Middle East bromine market are Jordan Bromine Company, Arab Potash Company, Israel Chemicals Ltd (ICL), Specialty Industrial Chemistry Company (SICCo), Saline Water Conversion Corporation (SWCC), Intech Organics Limited, Rhapsodic FZE, Muscat and Barka Business Trading Chemical Company, and others.

b. The key factor that is driving the growth of the Middle East bromine market is driven by the rising demand for bromine-based flame retardants, particularly in electronics, automotive, and construction industries, along with increasing use in water treatment, oil & gas drilling fluids, and pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.