- Home

- »

- Renewable Energy

- »

-

Middle East Energy Retrofit Systems Market Report, 2033GVR Report cover

![Middle East Energy Retrofit Systems Market Size, Share & Trends Report]()

Middle East Energy Retrofit Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Envelope, LED Retrofit Lighting, HVAC Retrofit, Appliances), By Application (Residential, Commercial, Institutional), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-747-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Energy Retrofit Systems Market Summary

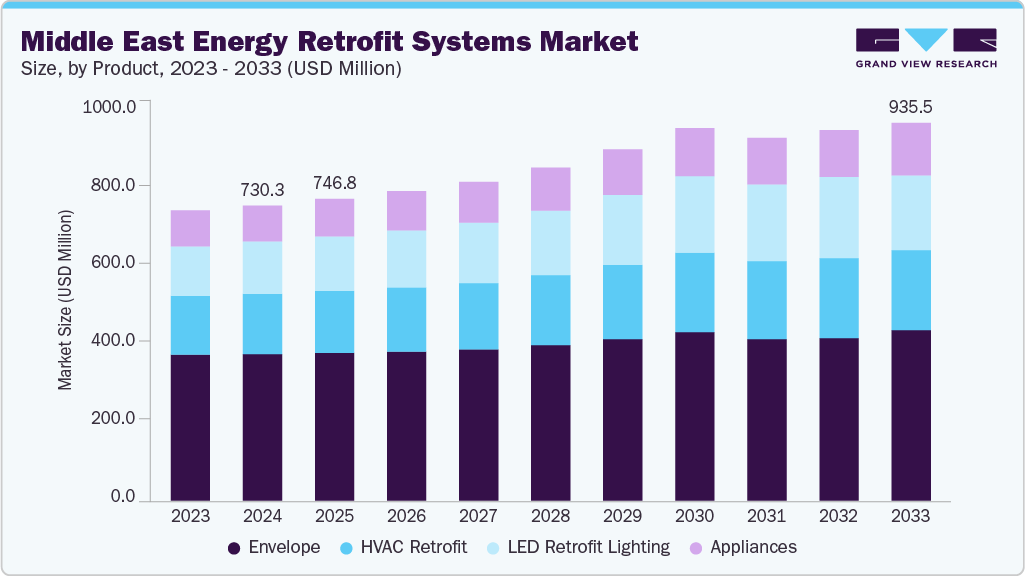

The Middle East energy retrofit systems market size was estimated at USD 730.35 million in 2024 and is projected to reach USD 935.50 million by 2033, growing at a CAGR of 2.9% from 2025 to 2033. Government-led sustainability programs, stringent energy efficiency regulations, and rising electricity consumption across residential, commercial, and institutional buildings are driving demand for retrofit solutions in the region.

Key Market Trends & Insights

- Saudi Arabia energy retrofit systems market held the largest share of 38.25% of the Middle East market in 2024.

- The energy retrofit systems market in the Middle East is expected to grow significantly over the forecast period.

- By product, the envelope held the largest market share of 49.68% in 2024.

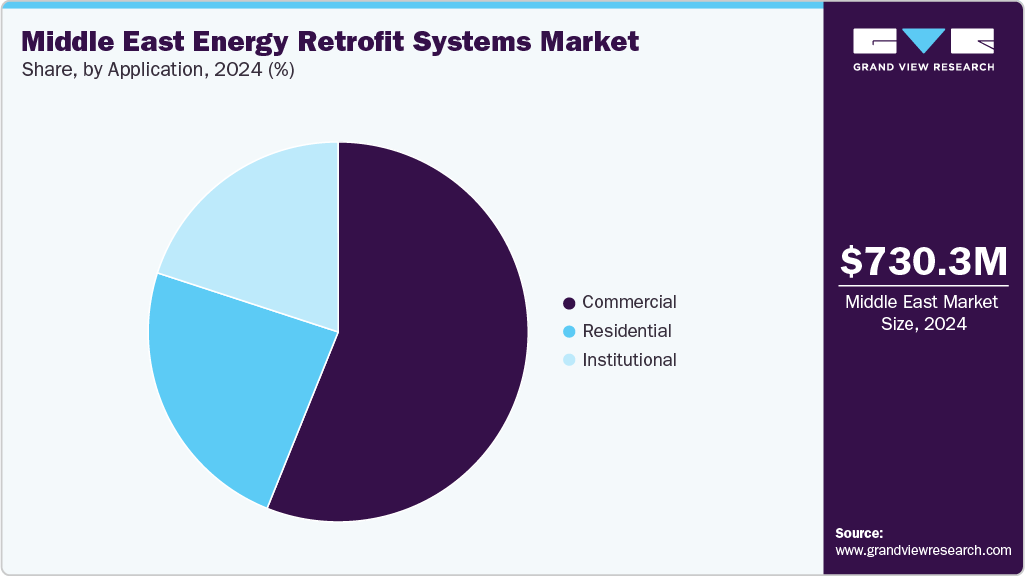

- By application, the commercial segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 730.35 Million

- 2033 Projected Market Size: USD 935.50 Million

- CAGR (2025-2033): 2.9%

- Saudi Arabia: Largest market in 2024

- Oman: Fastest growing market

Countries such as Saudi Arabia, the UAE, Qatar, and Kuwait prioritize retrofitting initiatives as part of broader decarbonization targets, aiming to modernize existing infrastructure, curb energy wastage, and reduce operational costs. Programs under national visions such as Saudi Vision 2030 and the UAE Net Zero by 2050 strategy promote large-scale adoption of HVAC upgrades, LED lighting, envelope retrofits, and high-efficiency appliances to improve building performance and reduce carbon footprints.

The market’s growth is further accelerated by increasing urbanization, expanding commercial real estate, and the need for cost-effective energy management in both public and private sectors. Retrofit systems provide significant energy savings, enhance indoor comfort, and extend the lifespan of building assets, making them a strategic priority for utilities and facility owners. Integrating digital energy management systems, IoT-enabled monitoring, and performance contracting models is boosting adoption, while financing schemes and public-private partnerships are removing upfront investment barriers. Key players such as Johnson Controls, Honeywell, Schneider Electric, Siemens, and Trane are actively delivering retrofit projects across the region. With strong policy backing, rising awareness of sustainability, and accelerating investments in smart and efficient infrastructure, the Energy Retrofit Systems Market in Middle East is set for substantial expansion, which is likely to play a pivotal role in the region’s path toward energy efficiency and long-term decarbonization.

Drivers, Opportunities & Restraints

The Middle East energy retrofit systems market is driven by ambitious national sustainability agendas, rising electricity demand, and the urgent need to improve building energy efficiency across residential, commercial, and institutional sectors. Countries such as Saudi Arabia, the UAE, Qatar, and Kuwait align with long-term strategies such as Saudi Vision 2030 and the UAE Net Zero by 2050, emphasizing reducing carbon emissions, enhancing energy security, and lowering operational costs. Retrofitting initiatives, including HVAC upgrades, LED lighting, envelope improvements, and appliance replacements, are central to achieving energy savings in the region’s rapidly expanding urban infrastructure. Rapid population growth, industrial diversification, and high cooling loads in arid climates further accelerate the demand for retrofit solutions to cut consumption and extend the lifespan of existing building assets.

Opportunities in the Middle East energy retrofit market stem from increasing adoption of digital building management systems, IoT-enabled monitoring, and performance contracting models that allow energy savings to fund investments. Public-private partnerships, international collaborations, and government-backed financing schemes open pathways for large-scale retrofitting programs in commercial complexes, hospitals, universities, and residential developments. However, the market faces challenges such as high upfront costs, fragmented regulatory frameworks, and the slow modernization of older building stock that is not easily adaptable to retrofit technologies. Limited consumer awareness in certain countries and skill gaps in energy auditing and retrofit project implementation may also hinder adoption. In addition, financing constraints in non-GCC nations and varying enforcement of efficiency standards across the region could delay the pace of large-scale retrofitting.

Product Insights

The envelope segment dominated the Middle East energy retrofit market in 2024, capturing a revenue share of 49.68%. This leadership position is attributed to the region’s large-scale investments in improving building energy efficiency through enhanced insulation, advanced glazing systems, reflective roofing, and high-performance façade materials. With extreme climatic conditions and high cooling demand across Gulf countries, upgrading building envelopes significantly reduces energy consumption and operational costs, making it the cornerstone of retrofit strategies. Countries such as the UAE, Saudi Arabia, and Qatar are mandating stricter building codes and energy efficiency standards, further driving the adoption of envelope retrofits across residential, commercial, and institutional buildings.

Government-led sustainability programs such as the UAE’s Energy Strategy 2050 and Saudi Arabia’s Vision 2030 emphasize retrofitting existing infrastructure to meet energy reduction targets. Financial incentives, green building certifications, and public-private collaborations are accelerating investments in this segment. Integrating advanced envelope technologies with digital energy management systems and smart sensors enhances performance by reducing heat transfer and optimizing indoor comfort. While upfront retrofit costs and long payback periods remain challenging, the growing availability of energy service companies (ESCOs), innovative financing models, and rising demand for sustainable real estate development continue to reinforce the envelope segment’s dominant position in the Middle East energy retrofit market.

Application Insights

The commercial segment dominated the Middle East energy retrofit market in 2024, accounting for a revenue share of 56.10%, and is expected to maintain its lead throughout the forecast period. Rising energy consumption in office buildings, retail complexes, hotels, educational institutions, and healthcare facilities is driving the region's need for large-scale retrofit initiatives. Countries such as the UAE, Saudi Arabia, and Qatar are spearheading programs that mandate energy efficiency upgrades in commercial buildings to meet sustainability targets, reduce operational costs, and align with green building certification requirements. Retrofitting solutions, particularly in envelope improvements, LED lighting, and HVAC systems, are being widely deployed to tackle high cooling loads in the Gulf's extreme climate, where energy use is dominated by air conditioning demand.

The segment's growth is further supported by government-led policies, incentive schemes, and public-private partnerships encouraging energy efficiency projects across the commercial real estate sector. Increasing adoption of ESCO (Energy Service Company) models and innovative financing mechanisms enables building owners to implement retrofits without significant upfront costs, accelerating market penetration. Integrating smart technologies, including IoT-based monitoring systems and AI-driven energy management platforms, also enhances retrofit outcomes by enabling predictive maintenance, peak load management, and real-time energy optimization. While high installation costs and longer payback periods present challenges, the commercial segment remains the focal point of retrofit activity, driving sustainable transformation in the Middle East's built environment.

Country Insights

Saudi Arabia Energy Retrofit Systems Market Trends

Saudi Arabia held over 38.25% revenue share of the Middle East Energy Retrofit Systems market, driven by large-scale investments in energy efficiency under Vision 2030 and national decarbonization strategies. Retrofit initiatives in commercial and institutional sectors, such as hospitals, universities, and government buildings, are central to reducing high energy consumption caused by extreme cooling needs and rapid urbanization. Major projects in Riyadh, Jeddah, and NEOM incorporate HVAC upgrades, LED lighting retrofits, and advanced building envelope solutions to reduce operational costs and enhance sustainability. Performance contracting models, supported by the Saudi Energy Efficiency Center (SEEC), encourage private-sector participation in retrofit deployment. With sovereign-backed funding, clear policy frameworks, and mandatory building codes, the Kingdom remains the most attractive retrofit market in the region.

UAE Energy Retrofit Systems Market Trends

The UAE holds a significant share of the Middle East retrofit systems market in 2024, supported by ambitious sustainability policies under the UAE Net Zero by 2050 and the Dubai Clean Energy Strategy 2050. Retrofit programs led by entities such as Dubai Supreme Council of Energy and Abu Dhabi’s Estidama drive widespread adoption of LED lighting, efficient HVAC systems, and smart building controls in residential and commercial sectors. Large-scale developments such as the Mohammed bin Rashid Al Maktoum City and Expo City Dubai are positioned as benchmarks for green buildings, integrating retrofits into broader urban sustainability frameworks. A favorable regulatory environment, green financing initiatives, and strong government–private partnerships reinforce the UAE’s leadership as a regional hub for retrofit innovation.

Kuwait Energy Retrofit Systems Market Trends

Kuwait is steadily expanding its presence in the Middle East retrofit systems market as the government prioritizes energy efficiency to reduce reliance on oil-fired power generation and meet growing electricity demand. Under the Kuwait Vision 2035 framework, retrofit initiatives are deployed across public infrastructure, commercial complexes, and high-rise residential towers. The Ministry of Electricity, Water, and Renewable Energy (MEWRE) promotes large-scale adoption of efficient HVAC systems, LED retrofits, and insulation upgrades to address high per-capita energy consumption, particularly driven by air conditioning loads.

Energy performance contracting and partnerships with international service providers are gaining momentum, with several pilot projects demonstrating measurable savings in government and healthcare facilities. While regulatory enforcement is evolving, Kuwait’s high energy subsidies and rapid urban growth present challenges and opportunities for retrofit adoption. With ongoing investments in smart building technologies and stronger policy alignment with regional sustainability goals, Kuwait is expected to become an increasingly important in the Middle East retrofit systems market over the next decade.

Oman Energy Retrofit Systems Market Trends

Oman is emerging as a promising retrofit systems market, aligning with Oman Vision 2040 and its focus on sustainable urban and industrial development. The government is prioritizing building energy efficiency upgrades to reduce reliance on fossil fuels and to manage rising electricity demand. Pilot retrofit programs in Muscat and Sohar are introducing LED retrofits, high-performance insulation, and efficient HVAC systems across government and institutional facilities. Although challenges remain with limited financing and regulatory support, international collaborations and incentives for private-sector retrofits are laying the groundwork for future growth. The increasing adoption of performance-based contracting is expected to attract global energy service companies to Oman’s developing retrofit landscape.

Qatar Energy Retrofit Systems Market Trends

Qatar’s retrofit market is gaining traction under Qatar National Vision 2030, emphasizing energy efficiency and carbon reduction in commercial and residential infrastructure. Government-backed initiatives focus on retrofitting public buildings, stadiums, and hospitality projects built for the FIFA World Cup 2022 to enhance energy performance. Programs promote advanced HVAC retrofits, envelope upgrades, and smart lighting systems to optimize energy usage. The country’s strong financial position enables direct investments in sustainable building technologies, while growing awareness in the private sector encourages adoption in high-rise residential and retail facilities. With increasing urbanization and regulatory support, Qatar is set to expand its role in the Middle East retrofit systems market.

Key Middle East Energy Retrofit Systems Company Insights

Some of the key players operating in the Middle East Energy Retrofit Systems market include Johnson Controls, Honeywell International Inc., Schneider Electric, Siemens AG, Trane Technologies, ENGIE Solutions Middle East, Etihad Energy Services (Etihad ESCO), Abu Dhabi Energy Services (ADES), Voltas Limited, and Emrill Services LLC, among others. These companies are delivering retrofit solutions such as HVAC upgrades, LED lighting, building envelope improvements, and smart building management systems to improve energy efficiency across residential, commercial, and institutional sectors in the region.

Key Middle East Energy Retrofit System Companies:

- Johnson Controls

- Honeywell International Inc.

- Schneider Electric

- Siemens AG

- Trane Technologies

- ENGIE Solutions Middle East

- Etihad Energy Services (Etihad ESCO)

- Abu Dhabi Energy Services (ADES)

- Voltas Limited

- Emrill Services LLC

Recent Developments

-

In February 2025, Johnson Controls collaborated with the Saudi Energy Efficiency Center (SEEC) to launch a large-scale retrofit program targeting government and commercial buildings across Riyadh and Jeddah. The initiative focuses on upgrading HVAC systems, deploying advanced building management platforms, and replacing outdated lighting with high-efficiency LED solutions.

Middle East Energy Retrofit Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 746.82 million

Revenue forecast in 2033

USD 935.50 million

Growth rate

CAGR of 2.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Country scope

UAE; Saudi Arabia; Oman; Qatar; Kuwait

Key companies profiled

Johnson Controls; Honeywell International Inc.; Schneider Electric; Siemens AG; Trane Technologies; ENGIE Solutions Middle East; Etihad Energy Services (Etihad ESCO); Abu Dhabi Energy Services (ADES); Voltas Limited; Emrill Services LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Energy Retrofit Systems Market Report Segmentation

This report forecasts revenue growth at regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East Energy retrofit systems market report based on product, application, and country.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Envelope

-

LED Retrofit Lighting

-

HVAC Retrofit

-

Appliances

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Single-family

-

Apartments/ Condominium

-

-

Commercial

-

Food Sales & Service

-

Mercantile

-

Office Buildings

-

Warehouse

-

Others

-

-

Institutional

-

Education

-

Healthcare

-

Worship Buildings

-

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East

-

UAE

-

Saudi Arabia

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The Middle energy retrofit systems market size was estimated at USD 730.35 million in 2024 and is expected to reach USD 746.82 million in 2025.

b. The Middle Energy Retrofit Systems market is expected to grow at a compound annual growth rate of 2.9% from 2025 to 2033 to reach USD 935.50 million by 2033.

b. Based on the application segment, Commercial held the largest revenue share of 56.10% in the Middle East Energy Retrofit Systems Market in 2024, driven by the region’s strategic focus on improving energy efficiency and reducing operational costs in commercial buildings.

b. Some of the key vendors operating in the Middle East energy retrofit systems market include Johnson Controls, Honeywell International Inc., Schneider Electric, Siemens AG, Trane Technologies, ENGIE Solutions Middle East, Etihad Energy Services (Etihad ESCO), Abu Dhabi Energy Services (ADES), Voltas Limited, and Emrill Services LLC, among others.

b. The key factors driving the Middle East Energy Retrofit Systems Market include ambitious national energy efficiency strategies, rising electricity demand, and the urgent need to modernize existing building infrastructure to reduce energy consumption and emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.