- Home

- »

- Plastics, Polymers & Resins

- »

-

Middle East Folding Carton Packaging Market Report, 2033GVR Report cover

![Middle East Folding Carton Packaging Market Size, Share & Trends Report]()

Middle East Folding Carton Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By End-use (Food & Beverage, Electrical & Electronics, Household, Healthcare), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-751-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Folding Carton Packaging Market Summary

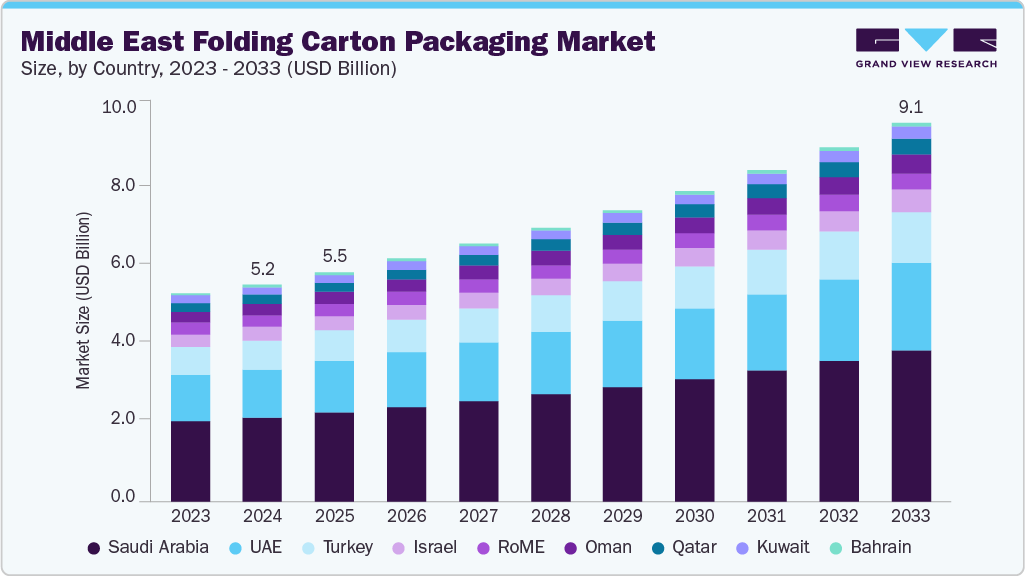

The Middle East folding carton packaging market size was estimated at USD 5.24 billion in 2024 and is projected to reach USD 9.16 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The market is driven by the rapid growth of the food & beverage and pharmaceutical industries, which demand sustainable, lightweight, and cost-effective packaging.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East folding carton packaging market with the largest revenue share of 38.6% in 2024 and is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033.

- By end use, the electrical & electronics segment is expected to grow at the fastest CAGR of 7.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.24 Billion

- 2033 Projected Market Size: USD 9.16 Billion

- CAGR (2025-2033): 6.5%

In addition, rising consumer preference for eco-friendly and recyclable packaging solutions is accelerating market adoption. With rising urbanization and increasing disposable incomes, there has been a significant surge in demand for packaged and processed foods, particularly ready-to-eat meals, dairy products, confectionery, and beverages. Folding cartons offer excellent printability, lightweight handling, and cost-effectiveness, making them a preferred choice for food manufacturers aiming to attract consumers through appealing packaging designs. For instance, leading regional food brands in Saudi Arabia and the UAE increasingly rely on folding cartons for breakfast cereals and confectionery to align with growing consumer preference for packaged convenience foods.

The region’s expanding e-commerce and retail sector is propelling the market growth. As online shopping accelerates, particularly in the UAE, Saudi Arabia, and Egypt, the need for reliable, lightweight, and eco-friendly packaging solutions has grown. Folding cartons meet these demands by providing sturdy protection for a wide range of products-from cosmetics and personal care items to pharmaceuticals and electronics-while being cost-effective for large-scale distribution. For example, the rise of e-commerce giants like Noon and Amazon in the Middle East has amplified the need for secondary packaging solutions, where folding cartons are increasingly utilized for both branding and product protection.

Sustainability concerns and government regulations are also shaping the demand for folding carton packaging. With many Middle Eastern nations investing in circular economy initiatives and sustainable practices, folding cartons, being recyclable and biodegradable, are gaining preference over plastic-based alternatives. The UAE’s "Single-Use Plastics Ban" implemented in 2024, for example, has accelerated the adoption of paperboard-based packaging formats such as folding cartons, particularly among foodservice operators and FMCG companies. This regulatory push is prompting manufacturers and retailers to adopt folding cartons as a more sustainable packaging option, aligning both government mandates and consumer expectations for eco-friendly solutions.

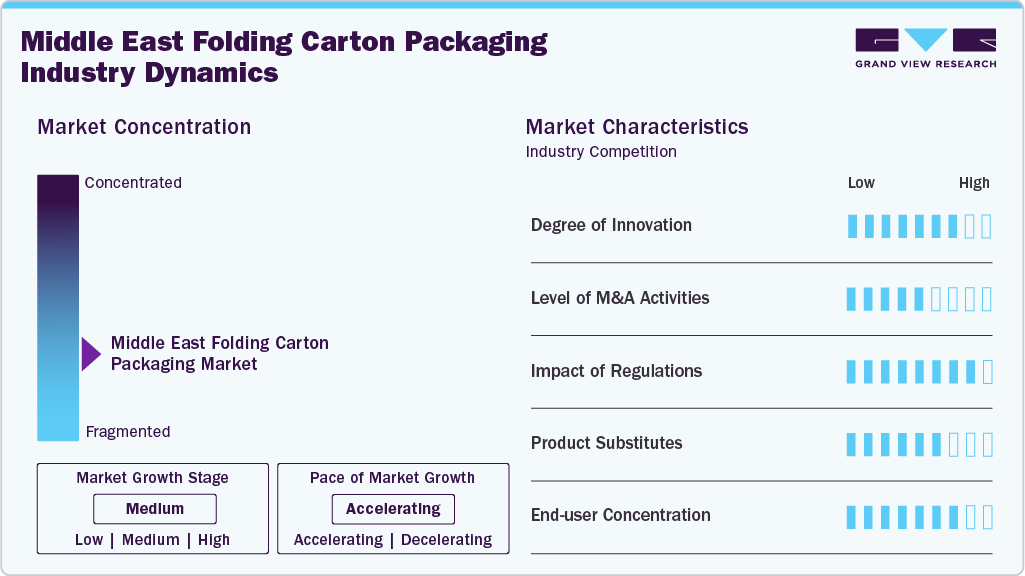

Market Concentration & Characteristics

A distinguishing characteristic of the Middle East folding carton industry is the growing focus on design innovation and premiumization. Cartons are increasingly viewed as a marketing tool rather than just a packaging medium. Advanced printing technologies, smart packaging features, and visually appealing designs are being widely adopted, especially in the premium food, cosmetics, and luxury goods sectors. This branding potential, coupled with ongoing digital transformation in packaging, is shaping the industry as one where aesthetics, functionality, and sustainability intersect to drive consumer choice.

The Middle East folding carton packaging industry is experiencing steady growth, driven by expanding consumer goods sectors such as food & beverages, personal care, pharmaceuticals, and retail. The rise of organized retail, supermarkets, and e-commerce platforms has created consistent demand for folding cartons as a cost-effective, lightweight, and versatile packaging solution. Countries such as the UAE and Saudi Arabia lead the adoption due to their strong FMCG consumption patterns, while emerging markets like Egypt are witnessing rapid uptake with growing urban populations.

End Use Insights

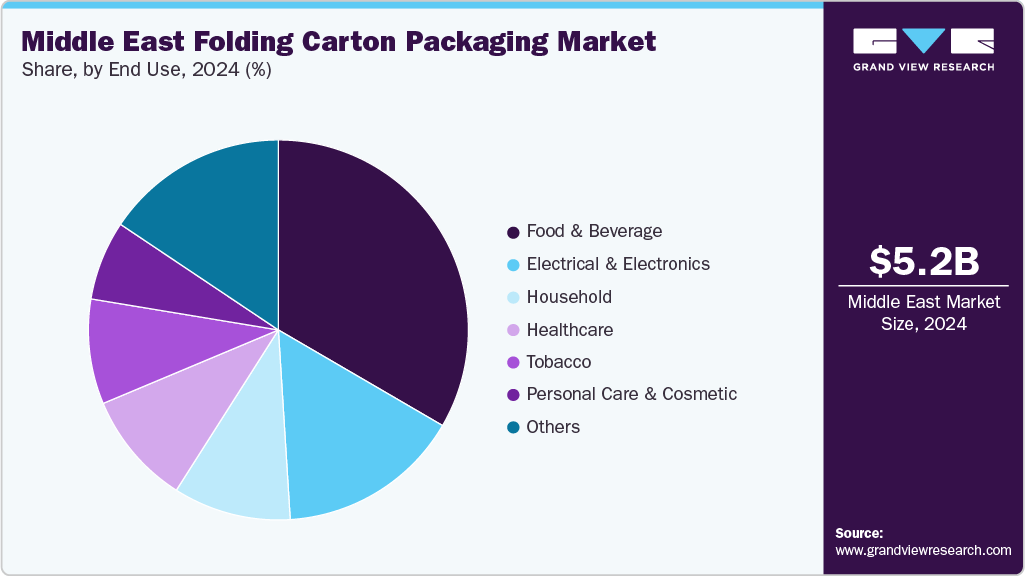

The food & beverage segment led the market with the largest revenue share of 37.0% in 2024. Folding cartons are widely used for bakery items, dairy products, ready-to-eat meals, frozen foods, confectionery, and beverages such as juices and dairy-based drinks. In the Middle East, where urbanization and Westernized lifestyles are influencing consumption habits, demand for convenience-driven and attractive packaging is rising sharply. The segment is driven by the rising demand for packaged and convenience foods, the booming quick-service restaurant (QSR) sector, and increasing food exports.

The electrical & electronics segment is projected to grow at the fastest CAGR of 7.3% during the forecast period. Folding carton packaging is increasingly used in the electrical & electronics industry for items such as smartphones, consumer electronics, accessories, and household appliances. Lightweight cartons provide both protective cushioning and branding opportunities. Electronics retailing in Middle Eastern hubs like Dubai has fueled demand for sleek and high-quality folding cartons to reflect brand value, especially for premium electronics and small appliances. The growth is propelled by the region’s strong consumer electronics market, fueled by high purchasing power and tech-savvy demographics.

Country Insights

Saudi Arabia Folding Carton Packaging Market Trends

Saudi Arabia dominated the Middle East folding carton packaging market with the largest revenue share of 38.6% in 2024, and is projected to register at the fastest CAGR of 6.9% during the forecast period. This positive outlook is due to its strong consumer base and expanding manufacturing sector. The food and beverage (F&B) industry, supported by the country’s Vision 2030 plan, is heavily investing in packaged goods, ready meals, and convenience foods, which are driving demand for folding cartons. The government’s focus on localization of manufacturing also pushes domestic packaging production. The growth in foodservice outlets, especially quick-service restaurants (QSRs) such as McDonald’s, Herfy, and Al Baik, is fueling folding carton adoption.

UAE Folding Carton Packaging Market Trends

The folding carton packaging market in the UAE is thriving due to its status as a regional trade hub and a global tourism destination. With Dubai and Abu Dhabi hosting a large expatriate population, there is a steady demand for packaged foods, beverages, and pharmaceuticals. Luxury goods and cosmetics, where premium folding cartons are widely used, also see significant consumption in the UAE. The country’s logistics and re-export activities further enhance demand for robust and eco-friendly packaging solutions. Growth in the hospitality and retail industries, fueled by international tourism and global events like Expo 2020, has boosted packaged goods consumption.

Turkey Folding Carton Packaging Market Trends

Turkeyfolding carton packaging market is one of the largest packaging producers in the Middle East, supplying to both domestic and international markets. Its well-established printing and paperboard industries make it a strong player in folding carton packaging. The food and beverage sector, including confectionery, dairy, and bakery products, heavily utilizes folding cartons. Turkey’s strategic geographic position as a bridge between Europe and Asia boosts its packaging exports. Growth in domestic urbanization and modern retail formats such as supermarkets is driving demand for consumer-oriented packaging.

Key Middle East Folding Carton Packaging Company Insights

The competitive environment of the Middle East folding carton packaging industry is characterized by a mix of global packaging giants and regional converters, with competition largely driven by cost efficiency, sustainability, and innovation in design. Multinational players such as Tetra Pak, WestRock, and Huhtamaki maintain a strong presence through advanced technologies and diversified product portfolios, while regional companies such as Takamul Industries and Napco National leverage proximity to end-use sectors such as food, beverages, pharmaceuticals, and personal care to offer cost-effective, customized solutions.

Rising consumer demand for eco-friendly and recyclable packaging, coupled with government initiatives promoting sustainable materials, is intensifying competition and pushing companies toward lightweight paperboard and advanced printing solutions. In addition, the fast-growing e-commerce and food delivery sectors in countries like the UAE and Saudi Arabia are expanding opportunities, making market rivalry increasingly centered on innovation, supply chain agility, and the ability to meet rapidly shifting consumer preferences.

Key Middle East Folding Carton Packaging Companies:

- Tetra Pak

- Huhtamaki

- International Paper

- Stora Enso

- Napco National

- Takamul Industries

- Hotpack Packaging Industries LLC

- Spectrum Converting Industry

- Bony Packaging

- ZamZam Packaging Mat. Ind. LLC

- Universal Carton Industries LLC

Recent Development

-

In December 2024, ZamZam Packaging Mat. Ind. LLC opened a new state-of-the-art plant in Umm Al Quwain, UAE. The new facility is equipped with the latest machinery, including fully automated corrugation, printing, folding, and stitching equipment.

-

In November 2024, Tetra Pak, in partnership with Union Paper Mills (UPM), launched the UAE’s first-of-its-kind recycling line for carton packages, backed by a joint investment of AED 2.5 million (approx. USD 0.68 million). This innovative recycling facility can process up to 10,000 tonnes of post-consumer carton packaging annually, diverting waste from landfills and enabling the recovery of high-quality virgin paper fibers for paperboard production and recycled polymers and aluminum. The initiative aligns with Tetra Pak’s sustainability goals and the UAE’s Green Agenda 2030.

Middle East Folding Carton Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.54 billion

Revenue forecast in 2033

USD 9.16 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, country

Regional scope

Middle East

Country scope

UAE; Saudi Arabia; Oman; Kuwait; Qatar, Bahrain; Israel; Turkey

Key companies profiled

Tetra Pak; Huhtamaki; International Paper; Stora Enso; Napco National; Takamul Industries; Hotpack Packaging Industries LLC; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Universal Carton Industries LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Folding Carton Packaging Market Report Segmentation

This report forecasts revenue growth at a regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East folding carton packaging market report based on end use, and country:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Electrical & Electronics

-

Household

-

Healthcare

-

Tobacco

-

Personal Care & Cosmetic

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Kuwait

-

Qatar

-

Bahrain

-

Israel

-

Turkey

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East folding carton packaging market was estimated at around USD 5.24 billion in the year 2024 and is expected to reach around USD 5.54 billion in 2025.

b. The Middle East folding carton packaging market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach around USD 9.16 billion by 2033.

b. Food & beverage segment emerged as the dominating application segment in the Middle East folding carton packaging market due to rising demand for convenient, sustainable, and visually appealing packaging that ensures product safety and shelf-life.

b. The key players in the Middle East folding carton packaging market include Tetra Pak; Huhtamaki; International Paper; Stora Enso; Napco National; Takamul Industries; Hotpack Packaging Industries LLC; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; and Universal Carton Industries LLC.

b. The market is driven by the rapid growth of the food & beverage and pharmaceutical industries, which demand sustainable, lightweight, and cost-effective packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.