- Home

- »

- Petrochemicals

- »

-

Middle East Methanol Market Size, Industry Report, 2033GVR Report cover

![Middle East Methanol Market Size, Share & Trends Report]()

Middle East Methanol Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Formaldehyde, Gasoline, Acetic Acid, MTBE, Dimethyl Ether, MTO/MTP, Biodiesel, Other Applications), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-715-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Methanol Market Summary

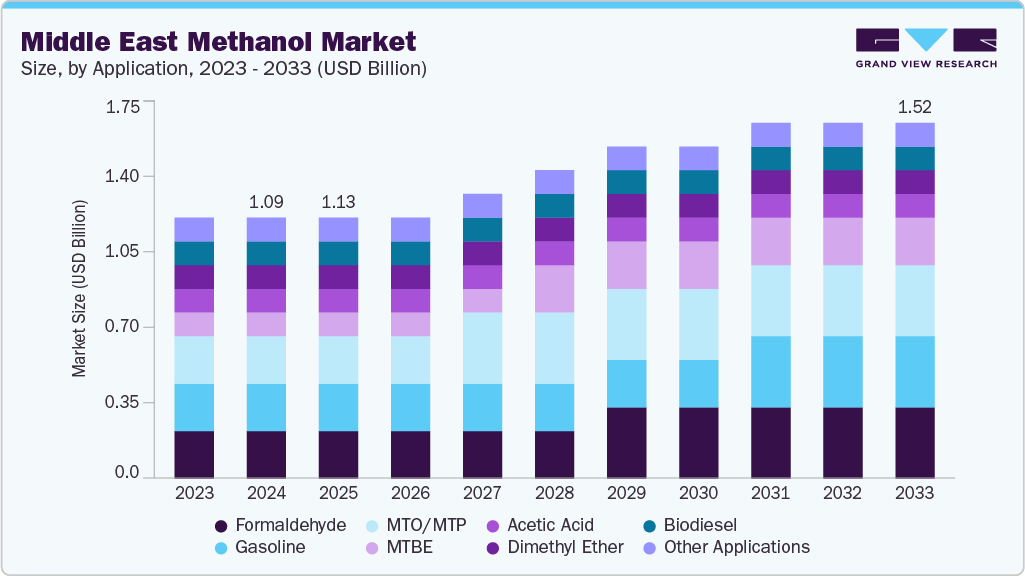

The Middle East methanol market size was estimated at USD 1.1 billion in 2024 and is projected to reach USD 1.52 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. Their critical role in formaldehyde production increasingly supports the market demand for Middle East methanol, as methanol is extensively used in industrial applications.

Key Market Trends & Insights

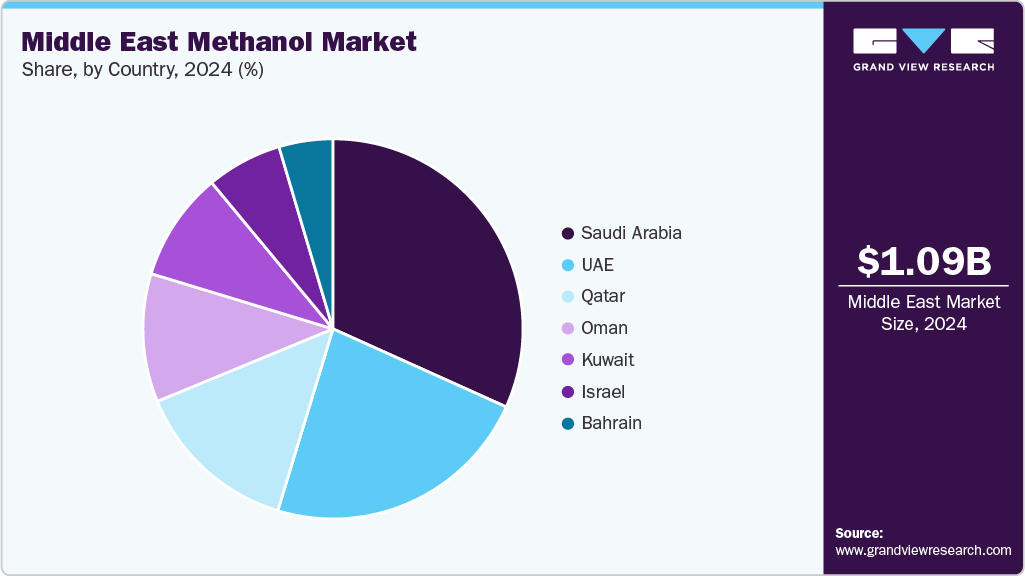

- Saudi Arabia dominated the Middle East methanol industry with the largest revenue share of 31.1% in 2024.

- The Middle East methanol industry is projected to grow at a CAGR of 3.8% from 2025 to 2033.

- By application, MTO/MTP dominated the market with a revenue share of 20.5% in 2024.

- By application, the gasoline segment is expected to witness the fastest growth of 4.3% from 2025 to 2033.

Market Size & Forecasts

- 2024 Market Size: USD 1.1 Billion

- 2033 Projected Market Size: USD 1.52 Billion

- CAGR (2025-2033): 3.8%

- Saudi Arabia: Largest market in 2024

- UAE: Fastest growing market

Methanol is often oxidized via catalytic processes to produce formaldehyde, a vital intermediate in manufacturing resins, plastics, adhesives, coatings, and wood products. The process is particularly important in the wood preservation industry, where formaldehyde enhances durability by strengthening the bonds between lignin and cellulose, improving resistance and structural integrity. Its low viscosity enables deep penetration into wood fibers, making it effective for high-performance engineered wood and construction materials.In addition, formaldehyde’s reactivity supports the synthesis of diverse derivatives such as phenol-formaldehyde and urea-formaldehyde resins, which are widely used in furniture, automotive, and building sectors. The Middle East benefits from abundant low-cost methanol feedstocks, strong downstream resin demand, and proximity to construction and manufacturing hubs, all of which reinforce formaldehyde production as a major growth driver in the regional methanol market.

In the Middle East, methyl tert-butyl ether (MTBE) production is a significant driver of methanol demand, as methanol reacts with isobutene in the liquid phase to form MTBE, an important high-octane gasoline additive. The process benefits from methanol’s high reactivity, the region’s abundant isobutene feedstock, and the strong demand for cleaner-burning fuels to meet stringent fuel quality standards. These factors position MTBE synthesis, enabled by efficient methanol conversion, as a key application supporting methanol market growth in the Middle East.

The methanol market in the Middle East for biodiesel applications is growing, driven by its strong methanol production capabilities and growing global demand for sustainable fuels. Methanol plays a crucial role in biodiesel production through the transesterification process, where it reacts with vegetable oils or animal fats to produce fatty acid methyl esters (FAME), the primary component of biodiesel. The region benefits from abundant and cost-competitive methanol supply, thanks to low-cost natural gas feedstock in key producing countries such as Qatar, Iran, and Saudi Arabia.

In addition, the Middle East’s strategic location positions it as an ideal hub for exporting methanol to biodiesel markets in the Middle East, Africa, and South Asia, where blending mandates and sustainability policies drive demand. Domestically, the region sees emerging biodiesel initiatives aligned with waste oil recycling, energy diversification, and sustainability goals, creating new avenues for methanol consumption.

Renewable methanol production in the Middle East is gaining strategic importance as the region seeks to diversify its energy portfolio and reduce greenhouse gas emissions in line with national net-zero targets. Renewable methanol can be produced through two primary pathways: bio-methanol, derived from sustainable biomass feedstocks such as agricultural residues, municipal solid waste (MSW), sewage sludge, biogas, and forestry by-products; and green e-methanol, synthesized using CO₂ captured from renewable sources (including bioenergy with carbon capture and storage [BECCS] and direct air capture [DAC]) combined with green hydrogen produced from renewable electricity.

However, in the Middle East methanol industry, rising environmental and health concerns act as a restraint, as conventional methanol production from fossil fuels generates CO₂ emissions, air and water pollution, and ecosystem damage. This is driving a gradual shift toward green methanol alternatives to mitigate sustainability challenges.

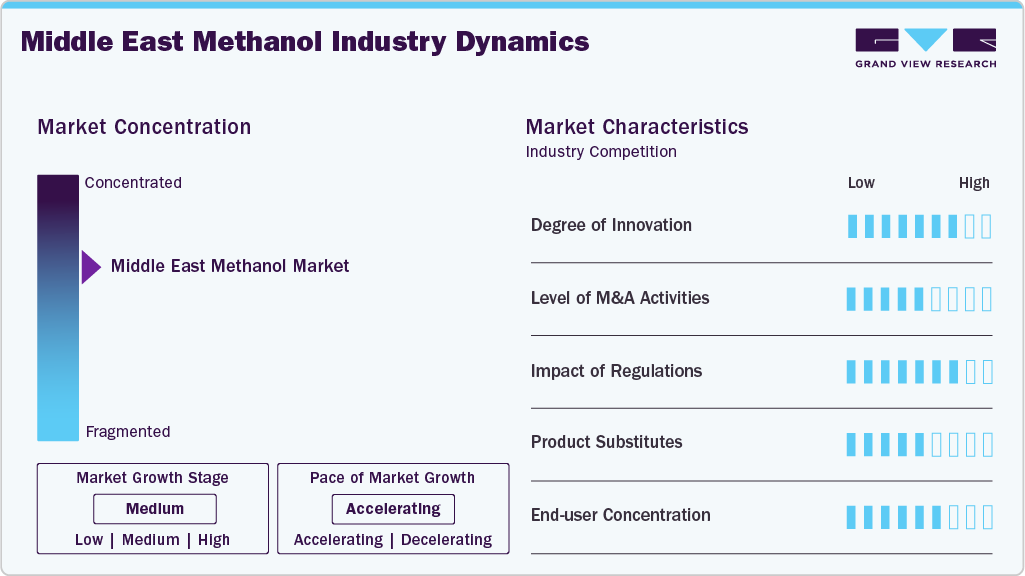

Market Concentration & Characteristics

The Middle East methanol industry is moderately consolidated, dominated by a mix of global chemical giants and large regional producers. These leading companies benefit from vertical integration, securing cost advantages through in-house natural gas feedstock sourcing, large-scale production facilities, and well-established global distribution networks. Their integration across the methanol value chain, from processing to derivative chemical manufacturing, ensures cost efficiency, consistent product quality, and reliable supply to high-demand end-use sectors such as formaldehyde resins, acetic acid, olefins, fuels, and specialty chemicals.

At the same time, emerging players in the Middle East are gradually expanding their presence by leveraging abundant natural gas reserves, low energy costs, and rising domestic demand. Supported by government-backed industrial development initiatives and investments in world-scale methanol and derivative plants within petrochemical hubs, these manufacturers target competitive pricing and high-volume downstream applications, including formaldehyde, MTBE, biodiesel, and methanol-to-olefins (MTO) production.

However, the Middle East market faces notable challenges, with one key restraint being increasing global environmental and regulatory pressures on methanol and its derivatives. Stricter safety, emissions, and product handling regulations in major importing regions such as North America and the Middle East, particularly concerning toxicological risks, formaldehyde emissions, and greenhouse gas footprints, are pushing producers to invest in cleaner technologies, carbon capture, and sustainable production practices to maintain market access and competitiveness.

Application Insights

The MTO/MTP application segment dominated the market with a market share of 20.5% in 2024, due to their role in producing high-value petrochemical derivatives such as polypropylene, polyethylene, and other light olefins. These processes offer a viable alternative to conventional crude oil-based propylene production, aligning with regional ambitions to diversify feedstocks and reduce reliance on imported naphtha. MTO technology, typically using SAPO-34 catalysts, prioritizes ethylene production, while Lurgi’s MTP process employs H-ZSM-5 zeolite catalysts to achieve higher propylene selectivity at operating temperatures of 350-500°C. In both cases, predominantly from natural gas, methanol produced in the Middle East is dehydrated to dimethyl ether and converted into olefins, which can be further processed into commodity polymers. For instance, in 2024, Saudi Arabia’s SABIC announced an expansion study to integrate MTP technology at its Jubail complex to convert surplus methanol into propylene, feeding its polypropylene units. This move aims to capture rising demand in packaging, automotive, and construction sectors across Asia and the Middle East while optimizing value from the Kingdom’s abundant natural gas feedstock.

The gasoline-based application segment is expected to grow fastest with a CAGR of 4.3% from 2025 to 2033 due to its strategic driver for energy security and emissions reduction. Produced from abundant regional resources such as natural gas and, in some cases, coal or biomass, methanol offers a clean-burning, high-octane alternative to petroleum-based gasoline components without the need for government subsidies or blending mandates. Methanol’s high blending octane, absence of sulfur, and favorable hydrogen-to-carbon ratio contribute to lower carbon intensity and cleaner combustion, reducing vehicle emissions of CO, hydrocarbons, particulate matter, and air toxics. This is especially relevant in the Middle East, where major urban centers target air quality improvements while maintaining mobility demand growth. Its oxygen content allows refiners to replace toxic aromatic compounds traditionally used for octane enhancement, enabling compliance with stricter environmental specifications. The economics are also compelling: methanol blending enables refiners to expand gasoline output, upgrade lower-grade fuel to premium quality, and delay costly refinery expansion investments, an important consideration in a region with growing transport fuel demand. Moreover, blending methanol into gasoline can quickly displace costly petroleum imports in certain markets while leveraging existing distribution infrastructure, with methanol-gasoline blends being transportable via pipelines, barges, and tanker trucks. For instance, in November 2023, Zagros Petrochemical Company (ZPC), a major methanol producer in Iran, began constructing its oxygen production facility to secure a stable oxygen supply, reduce operating costs, and enhance production sustainability. The plant, to be completed in 36 months on a 1.5-hectare site, will feature two air separation lines producing 86,000 Nm³/h of oxygen and nitrogen, and argon outputs. This investment supports ZPC’s broader efficiency initiatives, such as flare gas recovery and steam reuse for power generation, to increase methanol output and improve cost competitiveness in the global methanol market.

Country Insights

Saudi Arabia Methanol Market Trends

Saudi Arabia methanol market held a 31.1% share of the regional revenue in 2024, driven by its application in chemical manufacturing sectors, primarily driven by its role as a key feedstock for formaldehyde production. Formaldehyde, produced via the catalytic oxidation of methanol, serves as a critical building block in the creation of resins, adhesives, plastics, and preservatives. Its versatility in forming durable materials, such as formaldehyde urea resin for furniture, construction, and textiles, underpins the consistent industrial requirement for methanol. In addition, formaldehyde’s applications in healthcare, agriculture, and chemical synthesis, ranging from disinfectants and vaccine production to slow-release fertilizers, further amplify methanol consumption. The efficiency, scalability, and cost-effectiveness of converting methanol into formaldehyde make it an essential raw material, ensuring steady demand in industries seeking durability, high-performance, and versatile chemical intermediates.

UAE Methanol Market Trends

The methanol industry in UAE is expected to grow fastest with a CAGR of 4.2% from 2025 to 2033 due to its use as a feedstock in Methanol-to-Olefins (MTO) and Methanol-to-Propylene (MTP) processes, which produce ethylene, propylene, and other key chemicals for plastics, resins, and synthetic rubbers. The country’s abundant natural gas makes methanol a cost-effective raw material, supporting the expansion of domestic petrochemical and polymer industries. Growing regional demand for plastics in packaging, construction, and consumer goods further fuels methanol consumption. In addition, integration of methanol production with downstream chemical facilities ensures a stable supply, while environmentally efficient MTO processes align with UAE’s sustainability goals.

Key Middle East Methanol Company Insights

Some of the key players operating in the Middle East methanol industry include SABIC and LyondellBasell Industries Holdings B.V.

-

SABIC, headquartered in Riyadh, Saudi Arabia, is globally diversified chemicals company, mature player in the Middle East methanol industry. Leveraging decades of petrochemical manufacturing expertise, SABIC offers a comprehensive portfolio of methanol and methanol-derived products tailored for a broad range of industrial and specialty applications. Its Middle East methanol products deliver critical performance characteristics such as high purity, consistent reactivity, and compatibility with downstream processes, serving end-use sectors including maritime fuel, resins for laminate flooring and furniture panels, acrylic sheets, formaldehyde production, and various chemical intermediates. With fully integrated upstream feedstock access and world-scale joint venture methanol facilities in the region, SABIC ensures exceptional supply reliability, cost competitiveness, and operational efficiency. The company’s advanced R&D and application centers, located in Saudi Arabia, Middle East, Asia, and the U.S., focus on process optimization, carbon footprint reduction, and next-generation low carbon solutions. In line with its 2050 carbon neutrality pledge, SABIC is pioneering carbon capture and utilization (CCU) technologies to produce certified low carbon methanol, enabling customers to achieve significant Product Carbon Footprint (PCF) savings. By combining technological innovation, sustainable production methods, and strong value chain partnerships, SABIC continues to set industry benchmarks in the Middle East market.

Celanese Corporation and HELM AG are emerging market participants in the Middle East methanol industry.

-

Celanese Corporation, headquartered in Irving, Texas, USA, is an emerging and dynamic player in the Middle East methanol industry, progressively strengthening its footprint across strategic regions including North America, Middle East, and Asia. Renowned globally for its leadership in acetyl intermediates and engineered materials, Celanese leverages its methanol capabilities as a critical feedstock for its integrated acetyl chain and downstream specialty chemical production. In the Middle East, Celanese methanol is utilized extensively in applications such as formaldehyde, acetic acid, solvents, adhesives, coatings, and engineered polymers, serving diverse industries including construction, automotive, packaging, and consumer goods. Through a combination of global supply chain integration, strategic partnerships, and technology-driven production processes, Celanese ensures high-purity methanol supply with consistent quality and operational efficiency. The company emphasizes innovation and sustainability, incorporating energy-efficient manufacturing methods and exploring low-carbon pathways to reduce its environmental footprint. By offering tailored technical support, application expertise, and dependable delivery, Celanese positions itself as a flexible and trusted partner for Middle East customers seeking high-performance methanol solutions within competitive and evolving markets.

Key Middle East Methanol Companies:

- BASF

- ZPCIR

- MITSUI & CO., LTD.

- Celanese Corporation

- Petroliam Nasional Berhad (PETRONAS)

- SABIC

- LyondellBasell Industries Holdings B.V.

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Industries Qatar

- HELM AG

Recent Developments

-

In September 2024, SABIC launched its new certified low carbon product portfolio as part of its 2050 carbon neutrality pledge, beginning with low carbon methanol from its Chemicals business. The product achieves a reduced carbon footprint through carbon capture and utilization (CCU), using by-product CO₂ from upstream processes as an alternative feedstock while maintaining existing quality specifications. Certified low carbon methanol is produced at SABIC joint venture sites and is used in applications such as maritime fuel, laminate flooring resins, furniture panels, and acrylic sheets.

-

In March 2025, Mitsubishi Gas Chemical (MGC) has begun building a methanol production demonstration facility at its Mizushima Plant, designed to use CO₂ and industrial by-product gases as raw materials. Scheduled to start operations in FY2026, the plant will have an annual capacity of 100 tons and is supported by Japan’s Subsidy for Petroleum Supply Structure Improvement Projects. The initiative, developed in partnership with JFE Steel and Mitsubishi Chemical, aims to validate technologies for producing methanol from diverse gas sources, including direct reaction of steel plant by-product gases with hydrogen.

Middle East Methanol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.13 billion

Revenue forecast in 2033

USD 1.52 billion

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in million tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Regional scope

Middle East

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel

Key companies profiled

BASF; ZPCIR; MITSUI & CO. LTD.; Celanese Corporation; Petroliam Nasional Berhad (PETRONAS); SABIC; LyondellBasell Industries Holdings B.V.; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Industries Qatar; HELM AG

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Methanol Market Report Segmentation

This report forecasts revenue & volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East methanol market report based on application, and region:

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2033)

-

Formaldehyde

-

Gasoline

-

Acetic Acid

-

MTBE

-

Dimethyl Ether

-

MTO/MTP

-

Biodiesel

-

Other Applications

-

-

Country Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2033)

-

Middle East

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

-

Frequently Asked Questions About This Report

b. The Middle East methanol market size was estimated at USD 1.1 billion in 2024 and is expected to reach USD 1.13 billion in 2025.

b. The Middle East methanol market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2033 to reach USD 1.52 billion by 2033.

b. The Saudi Arabia Middle East methanol segment led the market and accounted for the largest revenue share of 31.1 % in 2024, due to their strategic driver for energy security and emissions reduction.

b. Some of the key players operating in the Middle East methanol Market include BASF, ZPCIR, MITSUI & CO., LTD., Celanese Corporation, Petroliam Nasional Berhad (PETRONAS), SABIC, LyondellBasell Industries Holdings B.V., MITSUBISHI GAS CHEMICAL COMPANY, INC., Industries Qatar and HELM AG.

b. The growth in Middle East methanol, is attributed to its critical role in formaldehyde production. Methanol is a key driver for its extensive industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.