- Home

- »

- Next Generation Technologies

- »

-

Mobile Artificial Intelligence Market Size, Industry Report 2030GVR Report cover

![Mobile Artificial Intelligence Market Size, Share & Trends Report]()

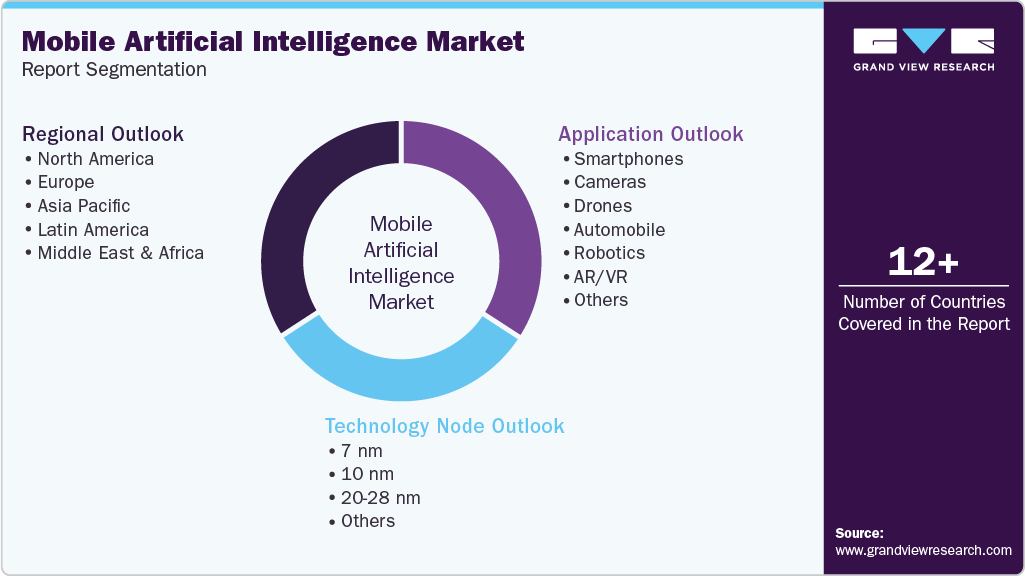

Mobile Artificial Intelligence Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology Node (7 nm, 10 nm, 20-28 nm), By Application (Smartphones, Cameras, Drones, Automobile, Robotics, AR/VR), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-081-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Artificial Intelligence Market Summary

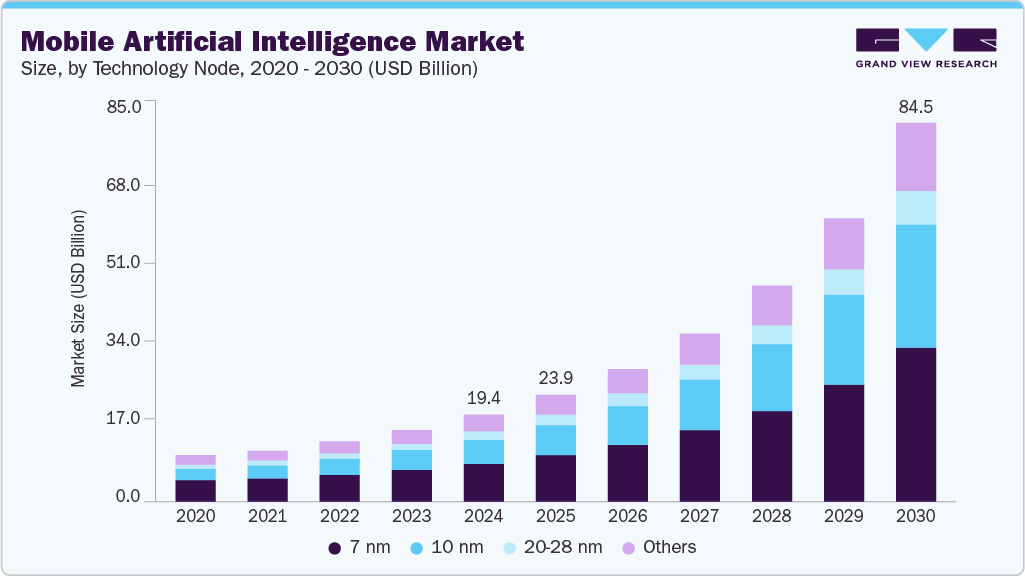

The global mobile artificial intelligence market size was estimated at USD 19.42 billion in 2024 and is projected to reach USD 84.97 billion by 2030, growing at a CAGR of 28.9% from 2025 to 2030. The vast expansion in connectivity with the rollout of 5G and the IoT enables organizations and individuals to collect more real-world data in real-time.

Key Market Trends & Insights

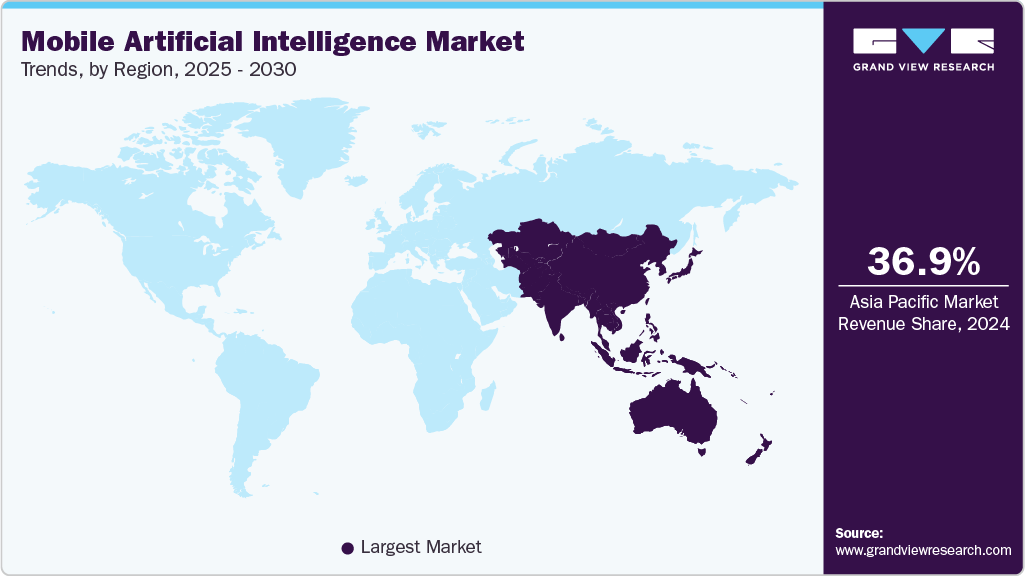

- Asia Pacific dominated the mobile artificial intelligence (AI) industry with a revenue share of over 36% in 2024.

- The U.S. mobile artificial intelligence (AI) industry is expected to grow significantly in 2024.

- By technology node, the 10 nm segment led the mobile AI industry in 2024, accounting for over 42% of global revenue.

- By application, the smartphones segment accounted for the largest revenue share of the mobile AI market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.42 Billion

- 2030 Projected Market Size: USD 84.97 Billion

- CAGR (2025-2030): 28.9%

- Asia Pacific: Largest market in 2024

This data can be used to improve AI systems further so that they become increasingly sophisticated and capable. These technologies can produce a powerful virtuous circle to generate massive socio-economic benefits. The emerging use of drones is rising quickly for several reasons, including more venture capital financing, demand for drone-generated data for commercial uses, and quickening technology development. Artificial intelligence (AI) is projected to fuel the next generation of drones, enabling them to function autonomously and make choices without human supervision. Drones are cameras and sensors that send information to tiny circuits in vision processing units (VPUs). A drone's VPU processor and sophisticated algorithms are applied.Moreover, the mobile Artificial Intelligence (AI) industry growth is driven by ongoing advancements in semiconductor technologies and innovations in AI chip architectures that improve processing speeds, energy efficiency, and scalability. The rising adoption of edge computing accelerates demand for compact, low-power AI hardware capable of real-time data processing closer to data sources, such as in autonomous vehicles, smart devices, and industrial automation. In addition, increasing cloud adoption and expanding AI-as-a-service platforms require powerful AI hardware infrastructure to support large-scale training and inference workloads.

Furthermore, growing internet penetration, smart city initiatives, and the proliferation of IoT devices generating vast amounts of data requiring AI-driven analytics are influencing future market expansion. Major technology players continue to invest heavily in research and development to create energy-efficient AI 7 nm and neuromorphic chips that mimic brain functions for cognitive tasks. With regulatory support and increasing AI adoption across sectors, these developments sustain the AI hardware market’s growth.

Technology Node Insights

The 10 nm segment led the mobile AI industry in 2024, accounting for over 42% of global revenue. This can be attributed to the technology’s optimal balance between performance, power efficiency, and cost-effectiveness. Semiconductor manufacturers have refined 10 nm fabrication processes, enabling the production of AI chips that deliver substantial computational power while maintaining manageable thermal output and battery consumption. This makes 10 nm chips highly suitable for a wide range of mobile devices, including smartphones and tablets, which require efficient on-device AI processing for applications such as voice recognition, image processing, and real-time data analytics. The maturity of this node size also ensures higher yields and lower production costs, encouraging widespread adoption by device manufacturers.

The 7 nm segment is predicted to experience the fastest CAGR during the forecast period, due to the increasing demand for enhanced AI capabilities in mobile devices. This technology node supports higher transistor density, which translates into greater processing power and improved energy efficiency, two important factors for AI workloads on mobile platforms. The transition toward 7 nm chips aligns with the evolving requirements of next-generation smartphones, AR/VR devices, and edge computing applications, where real-time AI inference and low latency are essential. Additionally, the adoption of 7 nm technology enables manufacturers to integrate more sophisticated neural processing units (NPUs) and AI 7 nm, facilitating advanced functionalities such as natural language processing, augmented reality enhancements, and intelligent camera systems.

Application Insights

The smartphones segment accounted for the largest revenue share of the mobile AI market in 2024. This dominance is driven by the ubiquity of smartphones as primary computing devices and their increasing reliance on AI to enhance user experiences. AI integration in smartphones supports various functionalities, including voice assistants, facial recognition, computational photography, and personalized content delivery. The constant evolution of AI chipsets tailored for mobile platforms enables manufacturers to embed powerful AI capabilities without compromising battery life or device form factor. Moreover, the global proliferation of smartphones, particularly in emerging markets, sustains strong demand for AI-enabled devices.

The AR/VR segment is anticipated to grow at the fastest CAGR during the forecast period, reflecting the rising interest in immersive technologies across various sectors. AI plays a pivotal role in AR/VR devices by enabling real-time environment mapping, object recognition, gesture tracking, and adaptive content rendering. These capabilities are essential for delivering seamless and interactive user experiences in gaming, education, healthcare, and enterprise applications. The ongoing advancements in AI algorithms and hardware, 7 nm optimized for AR/VR, contribute to enhanced device performance and reduced latency. Additionally, increasing investments from technology companies and startups in AR/VR innovation, coupled with expanding consumer adoption, support the rapid growth trajectory of this segment.

Regional Insights

North America mobile artificial intelligence (AI) industry held a revenue share of over 28% in 2024. This can be attributed to the region’s well-established technology ecosystem, presence of major semiconductor and software companies, and substantial investments in AI research and development. The United States, in particular, benefits from a robust innovation infrastructure, including world-class universities, government funding programs, and a vibrant startup culture focused on AI advancements. Additionally, high consumer awareness and early adoption of AI-powered mobile devices contribute to strong market demand.

U.S. Mobile Artificial Intelligence (AI) Market Trends

The U.S. mobile artificial intelligence (AI) industry is expected to grow significantly in 2024, driven by extensive investments in AI chip design, expansion of data center capacity, and widespread AI adoption across finance, defense, and healthcare industries. Leading technology firms focus on developing energy-efficient 10 nm and 7 nm chips tailored to AI workloads, enhancing performance and reducing operational costs. Federal funding programs and strategic collaborations between academia and industry foster innovation and accelerate deployment.

Europe Mobile Artificial Intelligence (AI) Market Trends

The mobile artificial intelligence (AI) industry in Europe is expected to grow significantly over the forecast period, supported by a combination of regulatory emphasis on data privacy, investments in AI startups, and growing adoption of AI-enabled mobile technologies. The European Union’s focus on ethical AI development and stringent data protection regulations drives innovation that balances technological advancement with user trust. Key industries such as automotive, telecommunications, and healthcare are integrating mobile AI solutions to enhance connectivity, safety, and service delivery.

Asia Pacific Mobile Artificial Intelligence (AI) Market Trends

The mobile artificial intelligence (AI) industry in Asia Pacific is anticipated to register the fastest CAGR over the forecast period, driven by rapid smartphone adoption, expanding digital infrastructure, and supportive government policies. Countries like China, India, Japan, and South Korea lead in both manufacturing and consumption of AI-enabled mobile devices.

The region’s large and tech-savvy population drives demand for AI-powered applications such as voice assistants, mobile payments, and personalized content. Additionally, government initiatives promoting AI innovation, smart cities, and digital transformation create a conducive environment for market expansion.

Key Mobile Artificial Intelligence Company Insights

Some key companies in the mobile artificial intelligence (AI) industry are IBM Corporation, Intel Corporation, NVIDIA Corporation, and Microsoft.

-

NVIDIA Corporation develops advanced GPUs and AI solutions to accelerate machine learning, deep learning, and data analytics workloads. Its technology node portfolio includes architectures such as the Blackwell series, which focus on improving computational efficiency and energy performance for AI training and inference. NVIDIA supports a comprehensive ecosystem that combines hardware, software frameworks, and collaborations with cloud providers and enterprises to facilitate AI deployment across sectors, including healthcare, finance, and autonomous systems.

-

Intel Corporation offers diverse AI solutions, including CPUs, GPUs, and specialized AI accelerators tailored for various workloads from edge devices to large-scale data centers. Recent technology nodes such as the Intel Arc Pro GPUs and Gaudi 3 AI accelerators emphasize energy efficiency and scalability for AI inference and training tasks. Intel integrates hardware development with open software platforms and ecosystem partnerships, enabling efficient AI application deployment. The company focuses on advancing AI-optimized processors and new architectures that support applications across cloud services, professional computing, and edge environments.

Key Mobile Artificial Intelligence Companies:

The following are the leading companies in the mobile artificial intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Qualcomm Inc

- Nvidia Corporation

- Intel Corporation

- IBM Corporation

- Microsoft

- Apple Inc

- Huawei (Hisilicon)

- Google LLC

- Mediatek

- Samsung

- Cerebras Systems

- Graphcore

- Cambricon Technology

- Shanghai Thinkforce Electronic Technology Co., Ltd (Thinkforce)

- Deephi Tech

- Sambanova Systems

- Rockchip (Fuzhou Rockchip Electronics Co., Ltd.)

- Thinci

- Kneron

Recent Developments

-

In May 2025, Anthropic announced the rollout of a voice interaction mode for Claude, its widely used AI chatbot, to all mobile app users. Currently in beta, this new feature supports English voice input and is available across all subscription tiers, including the free plan. The introduction of voice mode aims to enhance user accessibility and engagement by enabling more natural, conversational interactions with the AI, reflecting ongoing advancements in conversational AI technologies.

-

In March 2025, Samsung articulated its strategic vision to deliver an integrated AI companion across the Galaxy ecosystem, emphasizing the launch of the Galaxy S25 series and the expansion of AI-driven functionalities to the new A series, as well as to health and smart home applications. The company showcased significant advancements in Galaxy AI and comprehensive software solutions designed to empower network operators, enabling them to fully leverage AI technologies for enhanced connectivity, user experience, and operational efficiency.

-

In February 2025, Mistral, a French startup recognized for its pioneering role in European AI development, launched Le Chat, an AI chatbot application available on both iOS and Android platforms. The app leverages advanced natural language processing technologies to provide users with interactive and intelligent conversational experiences. This release underscores Mistral’s commitment to expanding accessible AI tools and strengthening its position within the competitive AI landscape in Europe.

Mobile Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.85 billion

Revenue forecast in 2030

USD 84.97 billion

Growth rate

CAGR of 28.9% from 2025 to 2030

Actual data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology node, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Qualcomm Inc; Nvidia Corporation; Intel Corporation; IBM Corporation; Microsoft; Apple Inc; Huawei (Hisilicon); Google LLC; Mediatek; Samsung; Cerebras Systems; Graphcore; Cambricon Technology; Shanghai Thinkforce Electronic Technology Co., Ltd (Thinkforce); Deephi Tech; Sambanova Systems; Rockchip (Fuzhou Rockchip Electronics Co., Ltd.); Thinci; Kneron

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile Artificial Intelligence (AI) market report based on technology node, application, and region:

-

Technology Node Outlook (Revenue, USD Million, 2017 - 2030)

-

7 nm

-

10 nm

-

20-28 nm

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Cameras

-

Drones

-

Automobile

-

Robotics

-

AR/VR

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile artificial intelligence market size was estimated at USD 19.42 billion in 2024 and is expected to reach USD 23.85 billion in 2025.

b. The global mobile artificial intelligence market is expected to grow at a compound annual growth rate of 28.9% from 2025 to 2030 to reach USD 84.97 billion by 2030.

b. North America dominated the mobile artificial intelligence (AI) market with a share of over 28% in 2024. This is attributable to the prevalence of large number of market players in the countries from the region.

b. Some key players operating in the mobile artificial intelligence market include Qualcomm, Nvidia, Intel, IBM, Microsoft, Apple, Huawei (Hisilicon), Alphabet (Google), Mediatek, Samsung, Shanghai Thinkforce Electronic Technology Co., Ltd (Thinkforce), Sambanova Systems, Rockchip (Fuzhou Rockchip Electronics Co., Ltd.)

b. Key factors that are driving the market growth include prominent innovation of AI in smartphones, increase in demand for AI-capable processors, and substantial investments in AI technology

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.